Electrosurgery Market Size, Share & Trends by Product (Instruments, Accessories, Generators, Smoke Evacuation Systems), Surgery (Cardiovascular, Orthopedic, Cosmetic, Oncology, Urology, Neurosurgery), End User (Hospitals, Ambulatory Surgical Centers) - Global Forecast to 2029

Electrosurgery Market Size, Share & Trends

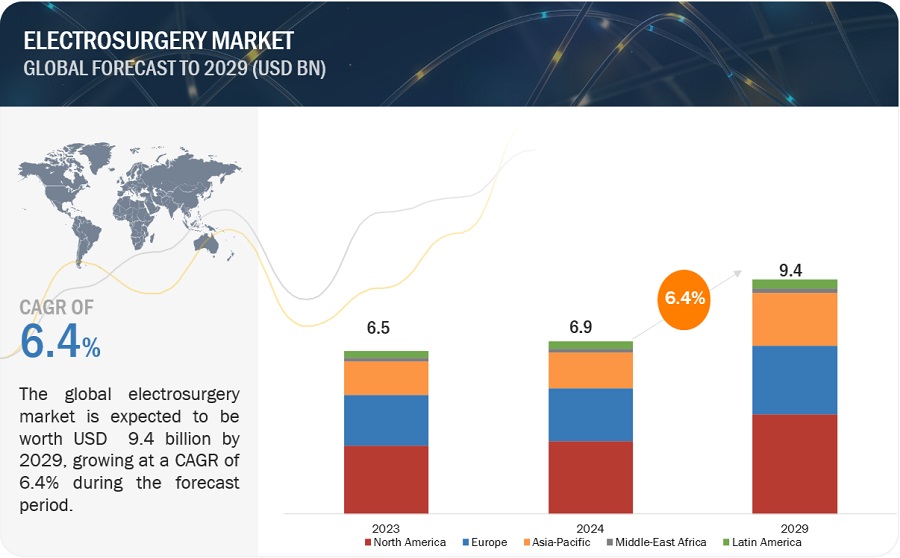

The global electrosurgery market in terms of revenue was estimated to be worth $6.9 billion in 2024 and is poised to reach $9.4 billion by 2029, growing at a CAGR of 6.4% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Investments in healthcare infrastructure, particularly in developing regions, are creating opportunities for market expansion in the electrosurgery sector. As the demand for healthcare services grows globally, there's a need to upgrade facilities to accommodate this demand. Electrosurgical devices play a vital role in modernizing healthcare infrastructure, enabling efficient and minimally invasive surgical procedures. By investing in these technologies, policymakers and stakeholders can enhance access to advanced medical treatments while stimulating market growth in the electrosurgery sector. Some healthcare providers and patients may prefer alternative technologies or surgical techniques over electrosurgery due to factors such as perceived safety concerns, efficacy, or patient preference, which could limit market expansion.

Electrosurgery Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Electrosurgery Market Dynamics

DRIVER: Increasing demand for minimally invasive surgery

Over the past decade, there has been a notable surge in the preference for minimally invasive and non-invasive surgical techniques over traditional methods. These advanced procedures offer numerous advantages including reduced hospitalization duration, lower post-operative complications, quicker recovery, enhanced effectiveness, and decreased discomfort. Additionally, they tend to be more cost-effective than conventional surgeries. Laser and electrosurgical technologies are increasingly favored for treating various conditions such as liver cancer, cardiac valve disorders, ophthalmic issues, and spine surgeries due to their procedural benefits. Laparoscopic surgeries, in particular, are gaining traction among patients due to their reduced surgical risks, minimal pain and blood loss, decreased infection rates, and shorter recovery periods, leading to reduced healthcare costs. Electrosurgery devices like generators and active electrodes streamline precision-demanding and time-sensitive surgeries such as cosmetic, cardiovascular, and gynecological procedures, thereby boosting their demand in the market.

RESTRAINT: Risks associated with electrosurgical procedures

In electrosurgical procedures, the application of high-frequency electrical currents serves the dual purpose of tissue cutting and coagulation. However, the resultant heat from electrosurgical generators poses significant risks, including electric shocks, thermal burns, emission of toxic gases, smoke inhalation, and potential infection transmission to both patients and operators. Notably, Encision Inc. (US) highlights that, on average, a patient in the US sustains burns during laparoscopic surgery every 90 minutes. Additionally, the utilization of electrosurgical instruments on patients with implanted cardiac devices can lead to device malfunction. Moreover, inadequate precautions during the procedure elevate the risk of contamination. These factors represent substantial challenges likely to hinder the growth trajectory of the electrosurgery market.

OPPORTUNITY: Rising government funding to develop advanced medical treatments

Government bodies worldwide are increasingly focusing on enhancing healthcare infrastructures, particularly critical care facilities, within their respective healthcare systems. This strategic emphasis is anticipated to bolster various allied markets, including the electrosurgery sector.

Numerous developed nations are initiating efforts to strengthen their healthcare systems by augmenting investments in healthcare infrastructure and improving affordability of healthcare services. Noteworthy examples of such governmental initiatives include:

- The German medical device market stands as a lucrative sector, generating approximately USD 42 billion annually, constituting a significant portion of Europe's market. In 2022, the healthcare industry contributed EUR 439.6 billion to Germany's economy, accounting for 12.7 percent of the nation's total economic output. Foreign sales from the healthcare sector in 2022 amounted to EUR 186 billion, representing 9.8 percent of Germany's total exports, with imports totaling EUR 154 billion. The German medical equipment market is projected to witness robust growth, with anticipated compound annual growth rates (CAGR) of 5.1 percent in Euro terms and 6.8 percent in USD terms from 2020 to 2025.

- According to the Gov. UK, commitments totaling up to USD 213 million have been allocated to support NHS-led health research into diagnostics and treatment via new privacy-preserving platforms and clinical research services. Furthermore, an additional USD 63 million is designated to facilitate the expansion of life sciences manufacturing in the UK.

CHALLENGE: Concerns regarding toxic fumes produced during surgical procedures

Surgical smoke emerges from the thermal breakdown of tissue due to laser or electrosurgical device usage. It poses multiple concerns, such as emitting unpleasant odors, obstructing the surgeon's view, and containing harmful elements like toxic gases, vapors, and various cellular materials including viable and non-viable substances, viruses, and bacteria. There have been documented cases of human papillomavirus (HPV) transmission through surgical smoke from laser procedures. Annually, over half a million healthcare professionals, including surgeons, nurses, and surgical technologists, are exposed to surgical smoke. Acute health effects resulting from exposure include irritation of the eyes, nose, and throat, headaches, coughing, nasal congestion, asthma, and asthma-like symptoms. However, innovations such as smoke evacuation pencils and systems are anticipated to mitigate this challenge.

Electrosurgery Industry Ecosystem:

Leading players in this market include well-established and financially stable service providers of electrosurgery products. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in this market include Medtronic plc (Ireland), Johnson & Johnson (Ethicon) (US), Olympus Corporation (Japan), B. Braun Melsungen (Germany), CONMED Corporation (US).

Electrosurgical Instruments segment holds largest share in the electrosurgery industry in 2023

Compliance with regulatory approvals and standards is paramount for the acceptance and growth of the electrosurgical instrument market. Manufacturers must adhere to stringent regulations and standards set forth by regulatory bodies to ensure the safety, efficacy, and quality of their products. Investing in research and development (R&D) to meet these requirements is crucial for manufacturers to remain competitive and capture a larger market share. Through R&D investments, manufacturers can innovate and develop electrosurgical instruments that not only meet regulatory requirements but also address emerging market needs and technological advancements. This includes enhancing product design, functionality, and performance to improve surgical outcomes and patient safety. Furthermore, investing in R&D allows manufacturers to stay ahead of regulatory changes and evolving industry standards, ensuring continuous compliance and market relevance. By prioritizing regulatory compliance and investing in R&D, electrosurgical instrument manufacturers can establish themselves as trusted industry leaders, gain market acceptance, and drive sustainable growth in the competitive healthcare landscape.

General Surgery segment holds the largest share of by surgery type of electrosurgery industry

Electrosurgery stands out as a cost-effective alternative to traditional surgical techniques, primarily due to its ability to streamline procedures and enhance patient outcomes. The efficiency of electrosurgical procedures translates into reduced operating times, minimizing the resources and personnel required for each surgery. Consequently, this leads to cost savings for healthcare providers, making electrosurgery an attractive option in terms of resource utilization and overall efficiency. Moreover, electrosurgery's minimally invasive nature contributes to shorter hospital stays for patients, further reducing healthcare costs associated with prolonged hospitalization. Additionally, the precision and control offered by electrosurgical devices result in fewer post-operative complications, lowering the need for follow-up care and reducing healthcare expenditures in the long run. As healthcare providers seek to optimize resource allocation and improve patient outcomes, the cost-effectiveness of electrosurgery makes it a preferred choice in the general surgery segment. This trend is expected to drive market growth as the demand for efficient and economically viable surgical techniques continues to rise in healthcare settings globally.

The hospitals, clinics, and ablation centers holds the largest share of electrosurgery industry in 2023

The growing preference among patients for minimally invasive treatment options has fueled the demand for electrosurgical procedures across various healthcare settings, including hospitals, clinics, and ablation centers, thereby propelling market growth. Patients are increasingly prioritizing treatments that offer faster recovery times, reduced pain, and shorter hospital stays, prompting healthcare providers to adopt electrosurgical techniques to meet these evolving preferences. Electrosurgery, known for its minimally invasive nature and precise tissue control, aligns perfectly with these patient demands. By utilizing specialized electrosurgical devices, healthcare professionals can perform a wide range of procedures with minimal trauma to surrounding tissues, resulting in quicker recovery times and enhanced patient comfort. Additionally, the reduced post-operative pain associated with electrosurgical procedures contributes to improved patient satisfaction and overall healthcare outcomes. As the trend towards minimally invasive treatment options continues to gain momentum, the demand for electrosurgical procedures is expected to grow exponentially, further driving market expansion in hospitals, clinics, and ablation centers worldwide.

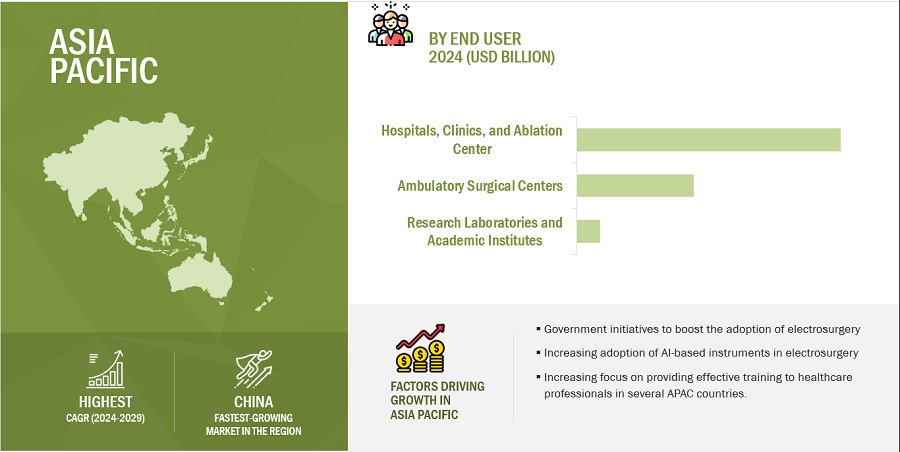

APAC is estimated to be the fastest-growing regional of electrosurgery industry for electrosurgery instruments

The electrosurgery market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa based on the region type. North America accounted for the largest share of the global electrosurgery market. In 2023, APAC is estimated to be the fastest-growing regional market for electrosurgery market. The Asia Pacific region has emerged as a prominent hub for medical tourism, attracting patients globally to countries like India, China, and Japan for a wide array of medical procedures, including surgeries utilizing electrosurgical devices. This trend significantly contributes to the demand for electrosurgery and drives market growth within the region. The popularity of medical tourism in Asia Pacific is fueled by several factors, including the availability of high-quality healthcare services at competitive prices, well-established medical infrastructure, and skilled medical professionals. Electrosurgery, renowned for its precision, minimally invasive nature, and effectiveness, aligns seamlessly with the preferences of medical tourists seeking advanced surgical treatments. Additionally, the affordability and accessibility of electrosurgical procedures in Asia Pacific countries make them particularly attractive to international patients seeking cost-effective healthcare solutions. As medical tourism continues to thrive in the region, with a growing number of patients opting for elective surgeries and specialized medical treatments, the demand for electrosurgery is expected to escalate further, driving market growth and reinforcing the position of the Asia Pacific region as a leading destination for medical travelers seeking innovative healthcare solutions.

Geographic Snapshot: Electrosurgery Market

To know about the assumptions considered for the study, download the pdf brochure

Key players in this market are adopting several organic and inorganic growth strategies (such as product launches, agreements, collaborations, acquisitions, and expansions). Prominent players in this market include Medtronic plc (Ireland), Johnson & Johnson (Ethicon) (US), Olympus Corporation (Japan), B. Braun Melsungen (Germany), CONMED Corporation (US), Boston Scientific Corporation (US), Smith and Nephew Plc (UK), Erbe Elektromedizin GmbH (Germany), KLS Martin Group (Germany), BOWA-electronic GmbH & Co. KG (Germany), The Cooper Companies, Inc. (US), Kirwan Surgical Products LLC (US), Zimmer Biomet (US), Utah Medical Products Inc. (US), Encision Inc. (US), Stryker Corporation (US), Meyer-Haake GmbH Medical Innovations (Germany), Surgical Holdings (UK), I. C. Medical, Inc. (US), Aspen Surgical (US), Applied Medical Resources Corporation (US), Apyx Medical (US), EPMD Group (India) and Directa Dental Group (US).

Scope of the Electrosurgery Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$6.9 billion |

|

Projected Revenue by 2029 |

$9.4 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.4% |

|

Market Driver |

Increasing demand for minimally invasive surgery |

|

Market Opportunity |

Rising government funding to develop advanced medical treatments |

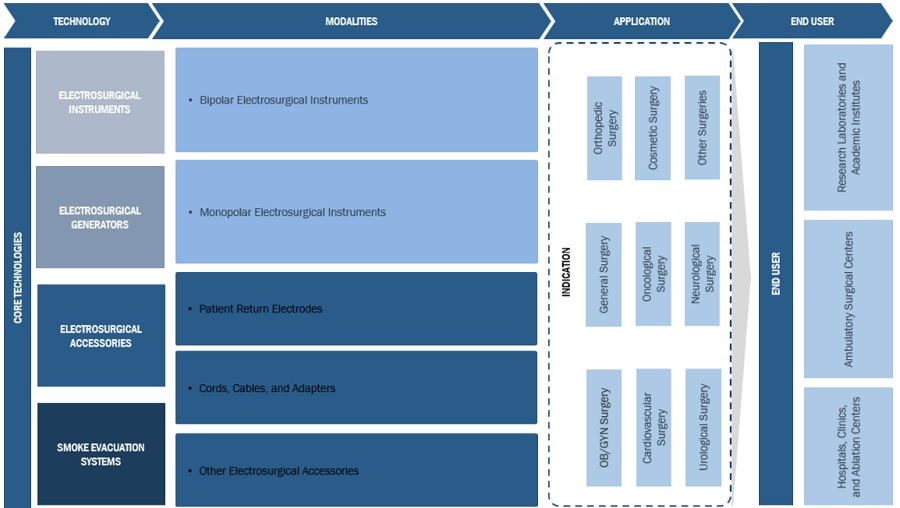

The research report electrosurgery market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Electrosurgical Instruments

- Electrosurgical Generators

- Electrosurgical Accessories

- Smoke Evacuation Systems

By Surgery

- General Surgery

- Obstetric/Gynecological Surgery

- Orthopedic Surgery

- Cardiovascular Surgery

- Oncological Surgery

- Cosmetic Surgery

- Urological Surgery

- NeuroSurgery

- Other Surgeries

By End User

- Hospitals, Clinics, and Ablation Centers

- Ambulatory Surgical Centers

- Research Laboratories and Academic Institutes

By Country

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of LATAM

-

Middle East & Africa

- GCC Countries

- Rest of MEA

Recent Developments of Electrosurgery Industry:

- In April 2024, Integra LifeSciences Holdings Corporation (US) has acquired Acclarent, Inc. (US), one of the leading companies in ENT surgical solutions. This strategic move broadens Integra's product range, enhances market presence, and unlocks a USD 1 billion growth opportunity in the ENT device sector.

- In March 2024, Medical Device Business Services a subsidiary of Johnson & Johnson (US) collaborated with NVIDIA Corporation (US). This collaboration aims to enhance real-time analysis and make AI algorithms more widely accessible in operating rooms at global level. By leveraging AI, surgeons can make informed decisions, improve education, and foster collaboration within connected ORs, ultimately enhancing patient outcomes.

- In November 2023, Erbe Elektromedizin GmbH (Germany) launched TriSect rapide tool designed for bipolar coagulation, division, and sealing of vessels and tissue bundles, as well as grasping, dissecting, and cutting tissue. Suitable for open, minimally invasive, and endoscopically assisted procedures across various medical fields including general visceral surgery, gynecology, urology, pediatrics, and thoracic surgery.

- In August 2023, Erbe Elektromedizin GmbH (Germany) launched HYBRIDknife flex. This innovative device combines needle-free, high-pressure hydrodissection and novel electrosurgical waveforms, streamlining procedures. Physicians can perform all four essential steps of Endoscopic Submucosal Dissection (ESD) without the need to switch instruments, enhancing efficiency and precision in gastrointestinal procedures.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global electrosurgery market?

The global electrosurgery market boasts a total revenue value of $9.4 billion by 2029.

What is the estimated growth rate (CAGR) of the global electrosurgery market?

The global electrosurgery market has an estimated compound annual growth rate (CAGR) of 6.4% and a revenue size in the region of $6.9 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

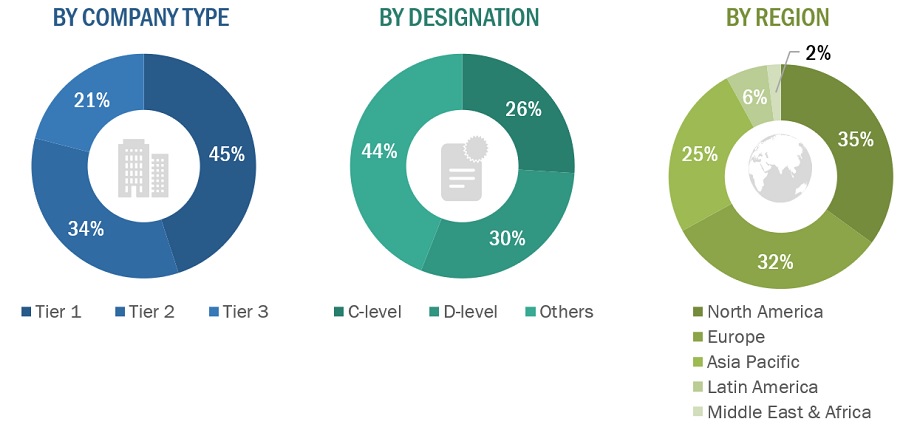

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the electrosurgery market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the electrosurgery market. Primary sources from the demand side included hospitals, clinics, researchers, lab technicians, purchase managers etc, and stakeholders in corporate & government bodies.

Breakdown of Primary Interviews

A breakdown of the primary respondents for electrosurgery market (supply side) market is provided below:

Note 1: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Other primaries include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

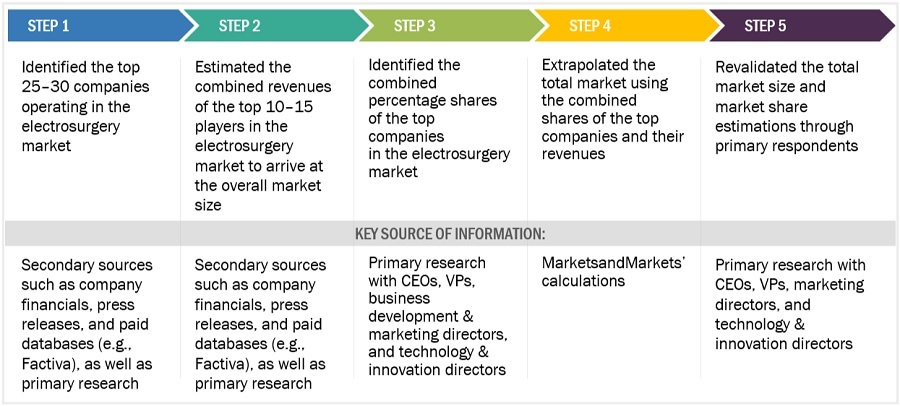

Market Size Estimation

The market size for electrosurgery market was calculated using data from four different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for electrosurgery market was calculated using data from four distinct sources, as will be discussed below:

Approach 1: Supply-Side Analysis - Revenue Share Analysis

Electrosurgery Market: Revenue Share Analysis

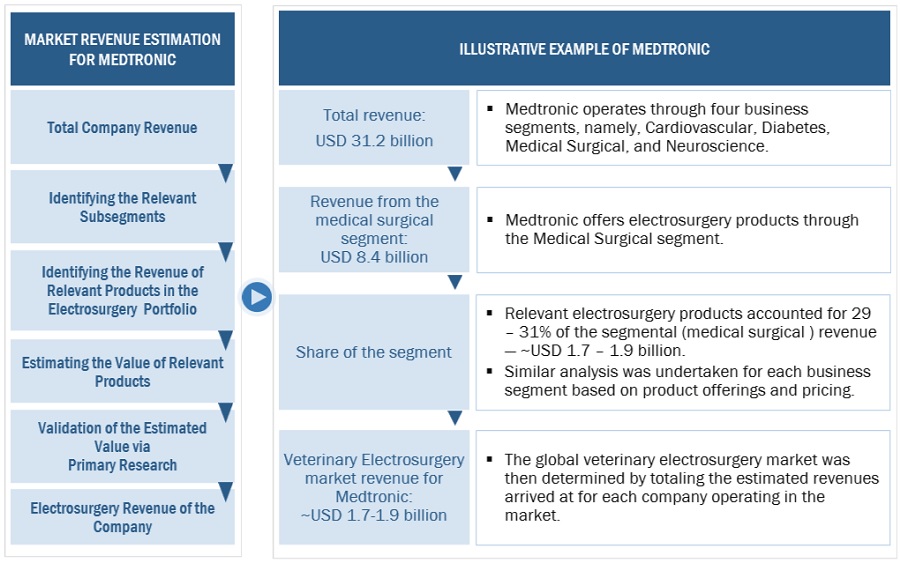

Electrosurgery Market: Revenue Share Analysis Illustration of Medtronic

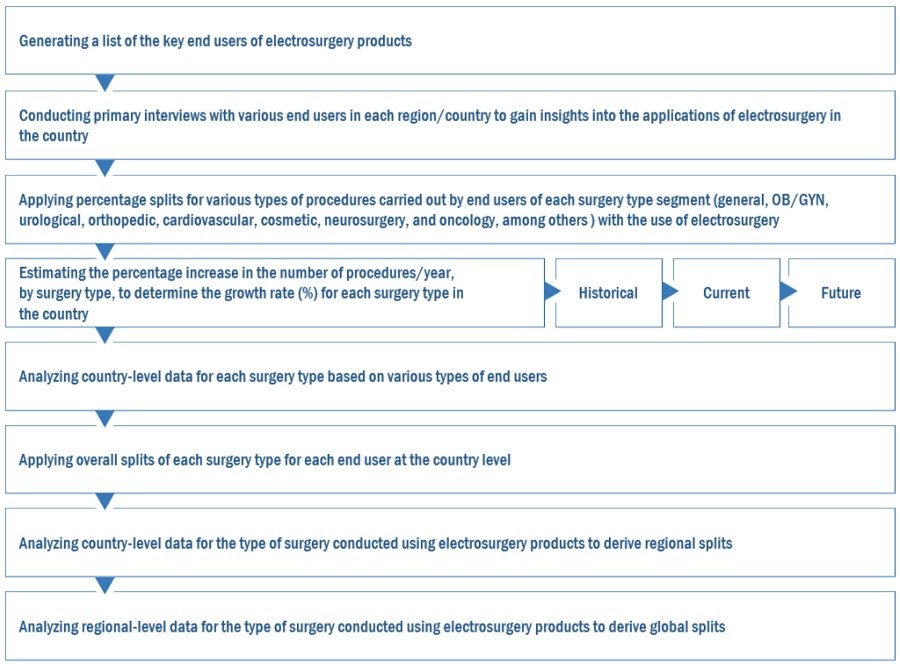

Approach 2: Electrosurgery Market: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Approach 3: Electrosurgery Market: Surgery Type-Based Estimation

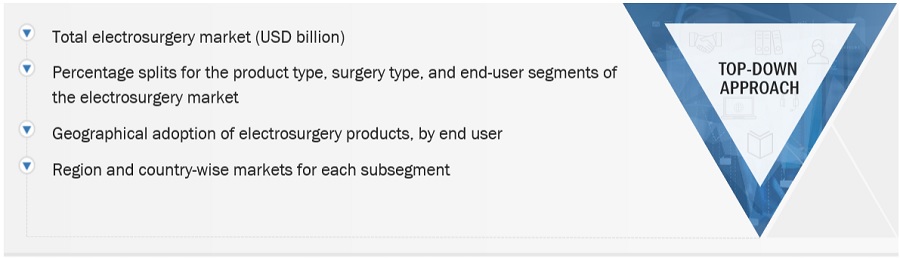

Approach 4: Electrosurgery Market: Top-Down Approach

Data Triangulation

The entire market was split up into several segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of electrosurgery. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Electrosurgery is a surgical technique that uses high-frequency electrical currents to cut, coagulate, or remove tissue during procedures. It offers precise tissue control, reduced blood loss, and shorter recovery times, making it widely used across medical specialties for minimally invasive surgeries.

Key Stakeholders

- Electrosurgical product manufacturing companies

- Distributors, suppliers, and commercial service providers

- Healthcare service providers

- Contract research organizations (CROs)

- Medical research laboratories

- Academic medical centers and universities

- Market research and consulting firms

- Hospitals and clinics

- Cancer care and ablation centers

- Ambulatory surgery centers (ASCs)

- Research laboratories

Objectives of the Study

- To define, describe, and forecast the electrosurgery market based on by product, surgery type, end user, and region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall electrosurgery market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the electrosurgery market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies in the electrosurgery market

- To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, service launches, agreements, and other developments in the electrosurgery market

- To benchmark players within the electrosurgery market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and service offerings

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Electrosurgery Market into Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific Electrosurgery Market into Vietnam, New Zealand, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electrosurgery Market