Power Transformer Market by Power Rating (Small Power Transformer (Up To 60 MVA), Medium Power Transformer (61- 600 MVA), Large Power Transformer (Above 600 MVA)), Cooling Type (Oil-cooled, Air-cooled), Phase (Single, Three) - Global Forecast to 2029

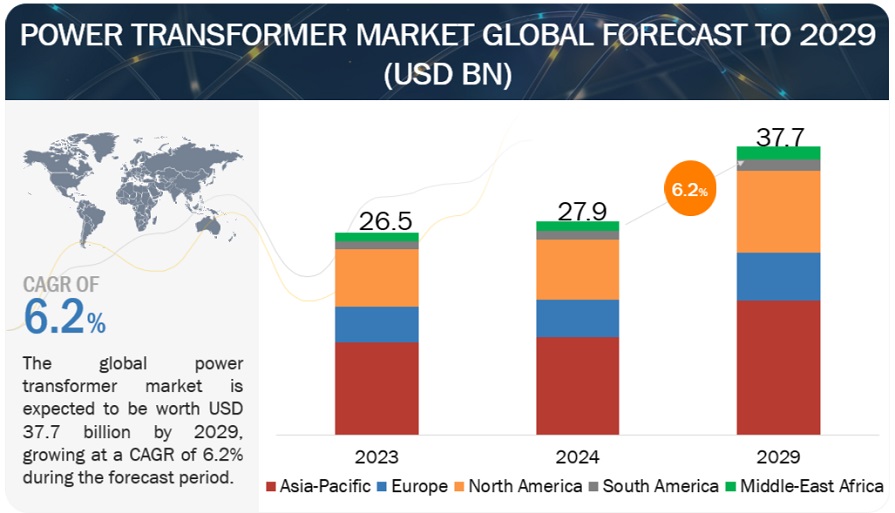

[278 Pages Report] The power transformer market is poised for significant growth, projected to expand at a compound annual growth rate (CAGR) of 6.2% from an estimated USD 27.9 billion in 2024 to USD 37.7 billion by 2029. This growth is largely driven by the increasing integration of IoT technology in home and building automation, which has heightened the demand for more sophisticated energy management systems. As IoT technologies become more prevalent, there is an enhanced need for power transformers that can effectively monitor and optimize energy usage, ensuring more efficient operation of automated and smart systems. These transformers play a pivotal role in adapting to fluctuating energy demands and integrating renewable energy sources, thereby supporting a transition to smarter, greener energy infrastructures. Collectively, these developments underscore the vital role of power transformers in today's increasingly automated and energy-conscious market landscape.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Power transformer Market Dynamics

Driver: Growing Demand for Electricity.

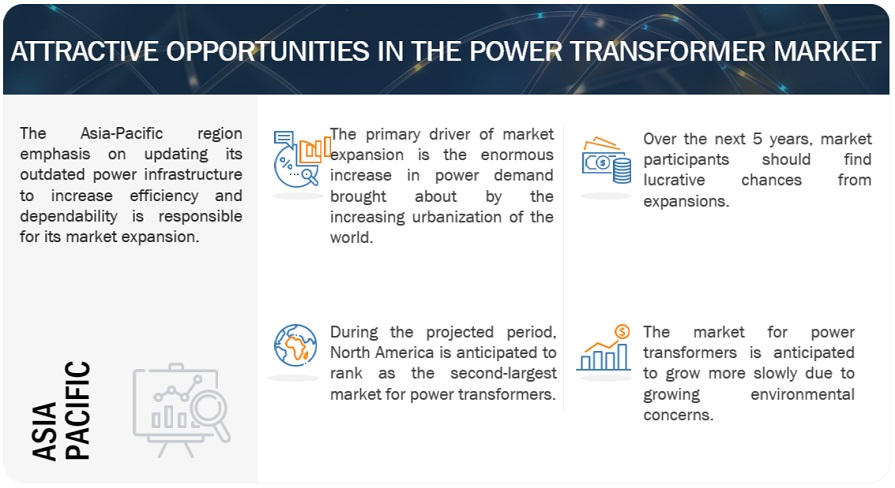

The increasing demand for electricity is a primary driver of the power transformer market, propelled by two key factors. Firstly, the need for grid expansion and upgradation arises to meet the growing electricity demand, which necessitates expanding existing grids to reach new consumers and reinforcing transmission lines for higher capacity. This surge in demand directly correlates with a heightened requirement for more transformers at substations and along transmission lines. Moreover, the upgrading of aging grids with modern infrastructure amplifies the demand for transformers equipped with enhanced functionalities, such as higher voltage and current handling capabilities to accommodate increased power flow, and smart grid features for efficient load management and two-way communication. Secondly, the global shift towards renewable energy sources like solar and wind power presents unique challenges for grid integration. These sources, being variable and non-dispatchable, rely on weather conditions for generation. Power transformers play a critical role in integrating renewable energy sources into the grid by stepping up the voltage generated by solar and wind farms to match the transmission grid voltage and providing grid stability by managing fluctuations in power generation from these renewable sources. This demand for transformers is observed across regions, with developed economies focusing on grid modernization to improve efficiency and reliability, developing economies undertaking massive grid expansion projects to accommodate urbanization, and remote areas requiring transformers for rural electrification programs.

Restraints : Cost Pressures and Lead Times Hinders the Power Transformer Growth.

The power transformer market, though promising, encounters several market-specific restraints, primarily driven by cost pressures and extended lead times. One notable restraint is the high initial investment required, particularly for high-capacity transformers, which poses a significant challenge, especially in developing economies. Limited budgets in these regions restrict investments in grid expansion and modernization projects, hindering market growth potential. Another restraint stems from the impact of fluctuations in raw material prices, notably copper and steel. Price volatility in these key raw materials can significantly affect the market, eroding profit margins for manufacturers and potentially leading to price hikes. Such uncertainties make planning and budgeting difficult for both manufacturers and utilities, impacting overall market efficiency. Moreover, long lead times associated with manufacturing large power transformers present a barrier to market growth. Extended lead times can pose challenges during periods of high demand, causing project delays and stalling grid expansion initiatives. Unforeseen delays in transformer delivery further disrupt project timelines and budgets, undermining the market's efficiency. Combined, these cost pressures and lead time challenges constrain the full potential of the market, particularly in developing economies and grid expansion projects. To overcome these restraints, manufacturers should focus on cost optimization strategies, while governments can implement initiatives to encourage investment in grid projects despite the challenges. By mitigating these restraints, the market can flourish and make significant contributions to global energy infrastructure development.

Opportunities: Rise of decentralized generation represents a significant transformation for the power transformer market.

The emergence of decentralized generation (DG), particularly through rooftop solar and microgrids, is reshaping the landscape of the power transformer market. This transformation offers a distinctive opportunity for growth and innovation. Traditionally, electricity flowed from large power plants through extensive high-voltage transmission lines before reaching homes and businesses via substation transformers. However, DG reverses this model by situating smaller-scale renewable energy sources closer to end-users, directly injecting power into the distribution grid. This shift towards DG necessitates a different type of transformer - distribution transformers. These transformers, though lower in capacity compared to substation transformers, play a critical role in integrating DG into the grid and managing bidirectional power flow. The International Renewable Energy Agency (IRENA) predicts a substantial increase in DG capacity, as outlined in its 2023 report. This forecast translates into a growing demand for distribution transformers, presenting a significant market opportunity for manufacturers. Furthermore, it also anticipates a steady rise in global electricity demand, with renewables expected to contribute significantly. Given this scenario and the aging infrastructure in many regions, investment in distribution transformers becomes imperative.

Challenges: Cybersecurity threats pose a significant challenge for the power transformer market as power grids become increasingly digitalized.

The increasing digitalization of power grids introduces a significant challenge for the market: cybersecurity threats. As grid infrastructure becomes more interconnected and reliant on digital technologies, the risk of cyberattacks targeting transformers and the broader grid infrastructure rises. These cyber threats pose serious risks to the reliability, safety, and resilience of the power grid, necessitating robust security measures to mitigate potential risks. Cyberattacks on transformers and grid infrastructure can take various forms, including malware infections, ransomware attacks, denial-of-service (DoS) attacks, and unauthorized access to control systems. These attacks can disrupt normal grid operations, manipulate grid parameters, or even cause physical damage to transformers, leading to widespread power outages, equipment failures, and potential safety hazards. One of the primary challenges in addressing cybersecurity threats in the market is the complexity of grid systems and the multitude of interconnected devices and systems. Transformers, substations, control systems, communication networks, and other grid components all represent potential targets for cyber threats. Securing these diverse elements requires a holistic approach that encompasses both technical solutions and organizational practices. Technical solutions for enhancing cybersecurity in the power transformer market may include implementing robust encryption protocols, deploying intrusion detection and prevention systems, segmenting network infrastructure to minimize the spread of cyber threats, and regularly updating software and firmware to patch known vulnerabilities. Additionally, the adoption of advanced authentication mechanisms, such as multi-factor authentication and biometric authentication, can help prevent unauthorized access to critical grid assets.

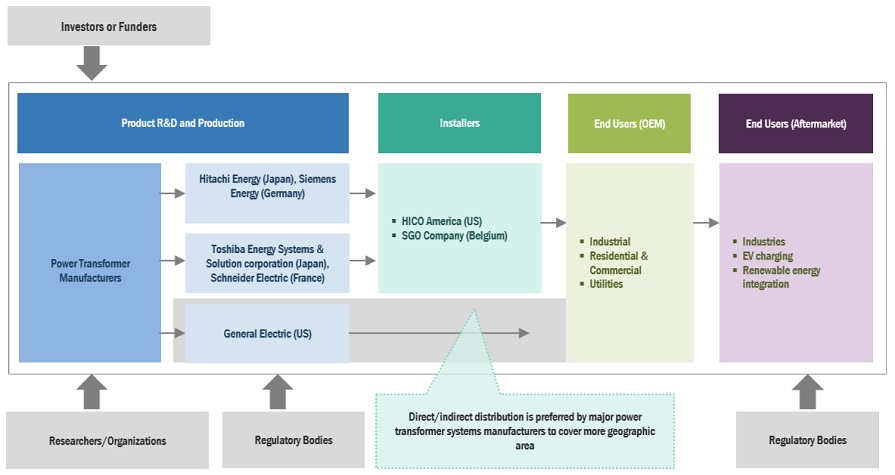

Power transformer Market Ecosystem

The market is characterised by the presence of well-established, financially stable companies with significant experience in producing power transformers and related components. These companies are well-established in the market and offer a diverse range of products. Utilizing cutting-edge technologies, they uphold vast international networks for sales and marketing. Some of the leading companies in this market are Hitachi Energy (Japan), Siemens Energy (Germany), Schneider Electric (France), Toshiba Energy System & Solution Corporation (Japan), and General Electric (US).

Power transformer Small Power Transformer (Up to 60 MVA) segment, by power rating, to grow at highest CAGR from 2024 to 2029.

The Small Power Transformer segment (Up to 60 MVA) in the power transformer market is projected to grow at the highest CAGR from 2024 to 2029, driven largely by the increasing demand for electricity in rural areas and the expansion of distributed generation systems, including renewable energy sources like solar and wind power. These transformers are ideally suited for applications requiring a smaller, more flexible power capacity, such as supporting local substations or industrial facilities, and they play a critical role in the integration of renewables into the grid by stepping down high-voltage electricity to usable levels. Additionally, their relatively lower cost and ease of installation make them attractive options for utility companies looking to expand or upgrade their networks without the extensive capital outlays required for larger transformers. The push towards electrification in developing regions, coupled with the growing trend towards decentralized power systems, further fuels the demand for small power transformers.

Three phase segment, by phase, to emerge as largest segment of power transformer market.

The three-phase segment is projected to be the largest in the power transformer market, showing strong growth throughout the forecast period. This growth is driven by the widespread use of three-phase transformers in power transmission and distribution systems worldwide. Three-phase transformers are favored for their ability to efficiently handle large power loads and their effectiveness in transmitting power over long distances with minimal energy losses. With ongoing industrialization, urbanization, and infrastructure enhancements fueling the demand for electricity, the necessity for dependable and scalable power distribution solutions is more crucial than ever. The inherent benefits of three-phase transformers, such as balanced power transmission and streamlined grid design, make them essential for meeting these increasing energy requirements. Therefore, the three-phase segment is expected to be a key player in the market, underscoring its importance in ensuring efficient and stable power distribution across various applications and sectors.

Utilities segment, by end user, to have highest market share from 2024 to 2029.

The utilities segment is projected to retain the highest market share in the power transformer market from 2024 to 2029 due to its critical role in the generation, transmission, and distribution of electricity. Utilities are the backbone of electrical infrastructure, required to meet the increasing energy demands of both growing urban populations and expanding industrial activities. Furthermore, this segment is heavily involved in upgrading aging infrastructure to ensure grid reliability and to comply with modern efficiency and environmental standards. With the ongoing global shift towards renewable energy sources, utilities need to integrate these variable energy sources into the grid, necessitating extensive use of power transformers for voltage regulation and stabilization. Government policies and investments in infrastructure projects to enhance national grids and to increase renewable energy penetration also significantly contribute to the sustained demand in the utilities sector for power transformers.

Asia Pacific to account for largest market size during forecast period.

Asia Pacific is projected to account for the largest market size in the power transformer market during the forecast period, primarily due to the region's rapid economic growth, urbanization, and industrialization. Countries like China, India, Japan, and South Korea are significantly investing in upgrading their electrical infrastructure to support increasing urban and rural electricity demand. Additionally, these nations are heavily investing in renewable energy projects as part of their commitments to reduce carbon emissions, which require extensive grid enhancements to integrate such sources effectively. This involves significant deployment of power transformers for efficient energy transmission and distribution. Furthermore, governmental initiatives across the region aiming to enhance energy efficiency and ensure reliable electricity supply are fostering the development of smart grids and the replacement of aging infrastructure, further driving the demand for power transformers. This confluence of factors makes Asia Pacific the largest and a dynamically expanding market for power transformers.

Key Market Players

Hitachi Energy (Japan), Siemens Energy (Germany), Schneider Electric (France), Toshiba Energy System & Solution Corporation (Japan), and General Electric (US), Mitsubishi Electric (Japan), Hyundai Electric (South Korea), CG power & Industrial Solutions (India), and Fuji Electric (Japan).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Power Rating, By Phase, By Cooling Type and By End User |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East and Africa, and South America |

|

Companies covered |

Hitachi Energy (Japan), General Electric (US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric (Japan), Eaton Corporation (Ireland), Hyundai Electric (South Korea), Fuji Electric (Japan), Toshiba corporation (Japan), MGM Transformer Company (California), CG Power and Industrial Solutions (India), Ningbo Ironcube Works International Co., Ltd. (China), Chint Group (China), EFACEC (Portugal), CG power & Industrial Solutions (India), Hyosung Heavy Industries (South Korea), Bharat Heavy Electricals Limited (India), SBG SMIT (Germany), WEG (South Korea), Transformer & Rectifier India Ltd. (India), Niagara Power Transformer Corp. (US), LS Electric Co., Ltd (South Korea), Hammond Power Solutions (Canada), Wilson Power Solutions (UK), ABC Transformer (India), Vijay Power (India) and JSHP (China). |

The market is classified in this research report based on power rating, phase, cooling type, end user, and region.

Based on power rating, the power transformer market has been segmented as follows:

- Small Power Transformer (Up to 60MVA)

- Medium Power Transformer (61- 600MVA)

- Large Power Transformer (Above 600MVA)

Based on phase, the market has been segmented as follows:

- Single

- Three

Based on cooling type, the power transformer market has been segmented as follows:

- Oil-cooled

- Air-cooled

Based on end user, the market has been segmented as follows:

- Utilities

- Residential & Commercial

- Industrial

Based on regions, the market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East and Africa

Recent Developments

- In February 2024, Hitachi Energy's substantial investment of USD 32 million in expanding and modernizing its power transformer manufacturing facility in Bad Honnef, Germany, is a strategic move that aligns well with the broader objectives of Europe's energy transition.

- In June 2023, HD Hyundai Electric Co. Ltd's deal worth USD 164 million with US energy firm Xcel Energy to provide electric power transformers is a significant development in the power infrastructure sector. This contract not only represents a substantial commercial transaction but also highlights several key aspects of the evolving energy landscape and the strategic moves within it.

- In April 2023, This agreement between Siemens Energy, Dragados Offshore, and TenneT signifies a significant step forward in the development and expansion of renewable energy infrastructure in Europe. The focus on high-voltage direct current (HVDC) transmission technology is crucial for several reasons.

Frequently Asked Questions (FAQ):

What is the current size of the global power transformer market?

The global power transformer market is estimated to be USD 37.7 billion in 2029.

What are the major drivers for power transformer market?

The major drivers of the power transformer market include the global increase in electricity demand, aging infrastructure requiring upgrades or replacements, and the rapid expansion of renewable energy sources that necessitate advanced grid integration technologies. Furthermore, urbanization and industrialization, particularly in emerging economies, are accelerating the need for robust electricity distribution systems. Additionally, government regulations and initiatives aimed at improving energy efficiency and reducing carbon footprints are pushing utilities and industries to invest in modern, high-efficiency transformers. Lastly, technological advancements such as smart transformers that facilitate more reliable, efficient, and automated power distribution systems are also significant drivers in the market growth.

Which End user has the largest market share in the power transformer market?

The utilities segment holds the largest market share in the power transformer market primarily because utilities are the main providers of electricity to both residential and commercial users, necessitating robust, extensive, and reliable grid infrastructures. Power transformers are crucial in these infrastructures for stepping up and stepping down voltage to ensure safe electricity transmission and distribution across vast networks. As utilities continuously work to expand, upgrade, and maintain their grids to meet increasing electricity demand, comply with regulatory standards, and integrate renewable energy sources, their demand for power transformers remains consistently high. Additionally, aging electrical infrastructure in many developed countries requires significant investment in replacing old transformers with more efficient, modern ones to ensure grid reliability and adapt to the changing energy landscape, further driving demand in this segment.

Which is the largest-growing region during the forecast period in the power transformer market?

Asia Pacific is projected to be the fastest-growing region in the power transformer market during the forecast period due to several converging factors. Rapid urbanization and industrialization across major economies such as China, India, and Southeast Asian countries are significantly increasing the demand for electricity. This surge necessitates extensive development of power infrastructure, including substations and transmission lines, where power transformers play a critical role. Furthermore, governments in the region are heavily investing in renewable energy projects to meet climate goals, which require grid enhancements to integrate and manage fluctuating renewable energy sources effectively. Additionally, the push towards improving rural electrification and modernizing aging electrical infrastructure to reduce energy losses and enhance system reliability also drives the demand for advanced power transformers in the region.

Which is the fastest-growing segment by phase in the power transformer market during the forecast period?

The fastest-growing segment by phase in the power transformer market during the forecast period is expected to be the three-phase transformer segment. This growth can be attributed to their widespread application in industrial and commercial settings, where large amounts of power distribution are necessary. Three-phase transformers are more efficient, have a higher power capacity, and offer greater stability compared to single-phase transformers, making them ideal for applications in larger facilities that demand a constant, reliable power supply. Additionally, as industries expand and new industrial projects are initiated, particularly in developing countries, the demand for three-phase transformers increases due to their ability to handle higher loads and distribute power more evenly. This makes them essential for supporting the infrastructure needed in manufacturing, data centers, large commercial complexes, and utility applications, all of which contribute to their rapid growth in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

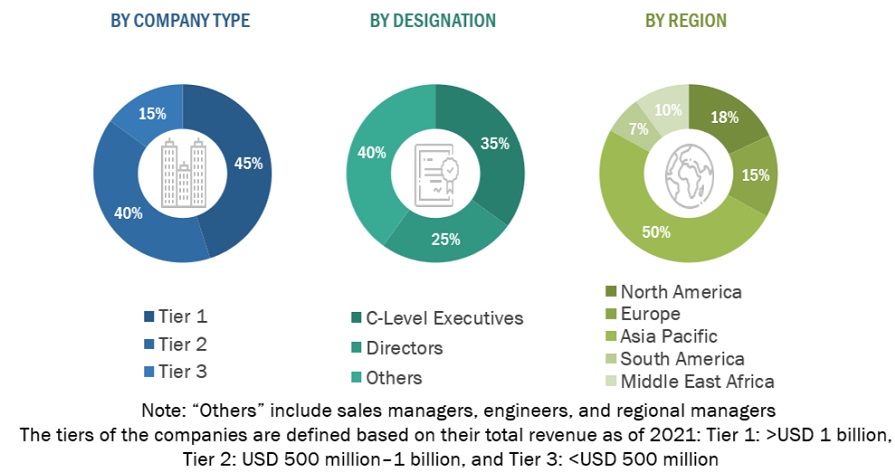

This study undertook an extensive process to determine the current dimensions of the power transformers market, beginning with an in-depth secondary research phase focused on gathering data from the market, related markets, and the overall industry context. This initial data collection was followed by a thorough validation using primary research, which included discussions with industry experts across the value chain. Market size evaluations were then conducted for each country through a tailored analysis, leading to a detailed breakdown of the market. Data from these analyses were cross-checked to estimate the sizes of different segments and sub-segments. By integrating both secondary and primary research methods, the study ensures the findings are both accurate and reliable.

Secondary Research

In this research study, a comprehensive range of secondary sources was utilized, including directories, databases, and trusted references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, the US Department of Energy (DOE), and the International Energy Agency (IEA). These sources were crucial in gathering essential data needed for a detailed analysis of the global power transformer market. Covering technical, market-oriented, and commercial facets, these secondary sources greatly enriched the study's depth and scope. Additional resources included annual reports, press releases, investor presentations, white papers, authoritative publications, articles by respected experts, information from industry associations, trade directories, and various database resources. The extensive and varied secondary sources employed provide a solid and well-rounded basis for this research study.

Primary Research

The power transformers market includes a diverse array of stakeholders throughout its supply chain, ranging from component manufacturers and product assemblers to service providers, distributors, and end-users. The primary demand drivers in this market are industrial end-users, with the growing needs of transmission and distribution utilities also playing a crucial role in market expansion. On the supply side, there is a clear trend toward increased demand for contracts within the industrial sector, complemented by a significant number of mergers and acquisitions among leading industry participants.

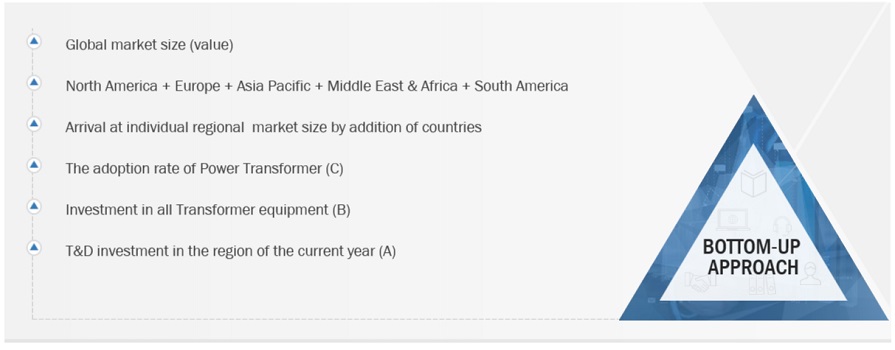

The calculation and verification of the power transformer market size were carefully performed using a bottom-up approach. This technique was rigorously applied to determine the sizes of various subsegments within the market. The research process included several critical stages.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

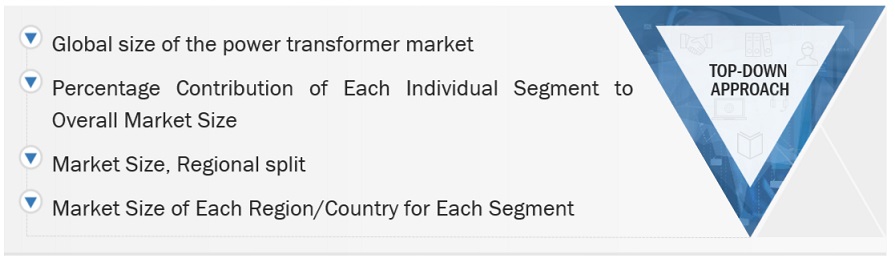

Using a bottom-up & top-down methodology, the power transformer market size has been carefully estimated and validated. This approach was used extensively to determine the size of several market subsegments. The following crucial phases are included in the research process.

This method has examined national and regional manufacturing statistics for all types of power transformers.

A significant amount of primary and secondary research has been conducted in order to fully understand the global market situation for various transformer types.

Prominent power transformer system development specialists, including major OEMs and Tier I suppliers, have been interviewed in several primary interviews.

When evaluating and projecting the market size, qualitative factors such as market drivers, restraints, opportunities, and challenges have been taken into account.

Global Power Transformer Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Power Transformer Market Size: Top-Down Approach

Data Triangulation

The determination of the overall market size was conducted using the outlined methodologies, which involved dividing the market into various segments and subsegments. To finalize the comprehensive market analysis and obtain accurate statistics for each segment and subsegment, techniques such as data triangulation and market segmentation were employed as needed. Data triangulation included a detailed analysis of different factors and trends from both demand and supply sides within the power transformers market ecosystem.

Market Definition

A power transformer is an essential device used in the transmission and distribution of electrical energy, designed to modify voltage levels between circuits in the power grid. Its primary function is to step up (increase) or step down (decrease) voltage as electricity travels from power plants to end users, ensuring that electrical power is transmitted efficiently over long distances with minimal loss. Power transformers are critical for connecting different power networks and for maintaining the stability and reliability of the electricity supply system. Power transformers consist of a core made from magnetic materials such as silicon steel, and coils or windings of insulated wire. These components work together through electromagnetic induction. When alternating current flows through the primary winding, it creates a magnetic field that induces a voltage in the secondary winding. The voltage level of the induced current depends on the ratio of turns between the primary and secondary windings. For instance, if the secondary winding has fewer turns than the primary, the output voltage will be lower, and the transformer will function as a step-down unit.

Key Stakeholders

- Government Utility Providers

- Independent Power Producers

- Transformer manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Transformer manufacturers, distributors, and suppliers

- Transformers original equipment manufacturers (OEMs)

Objectives of the Study

- Based on variables including power rating, phase, cooling type, and end user, the power transformer market will be defined, categorized, segmented, and projected.

- To project market sizes for the major countries in each of these five regions, as well as those for North America, South America, Europe, Asia Pacific, the Middle East, and Africa.

- To provide in-depth analyses of the elements driving market dynamics, industry-specific opportunities, constraints, and difficulties.

- To systematically assess the market share, growth trends, and prospects of each subsegment.

- To evaluate the competitive landscape for leaders in the industry and the market prospects for interested parties.

- To create strategic profiles of the top players by closely examining their market shares and essential strengths.

- To monitor and assess competitive changes in the oil-immersed market, such as alliances, contracts, sales contracts, new product introductions, contracts, joint ventures, expansions, and investments.

- This research gives an evaluation of the power transformers market.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Power Transformer Market