Downhole Tools Market Location of deployment (Onshore, Offshore), Tool type (Drilling tools, Flow and Pressure Control tools, Impurity Control tools, Logging tools, Handling tools), Application and Region - Global Forecast to 2029

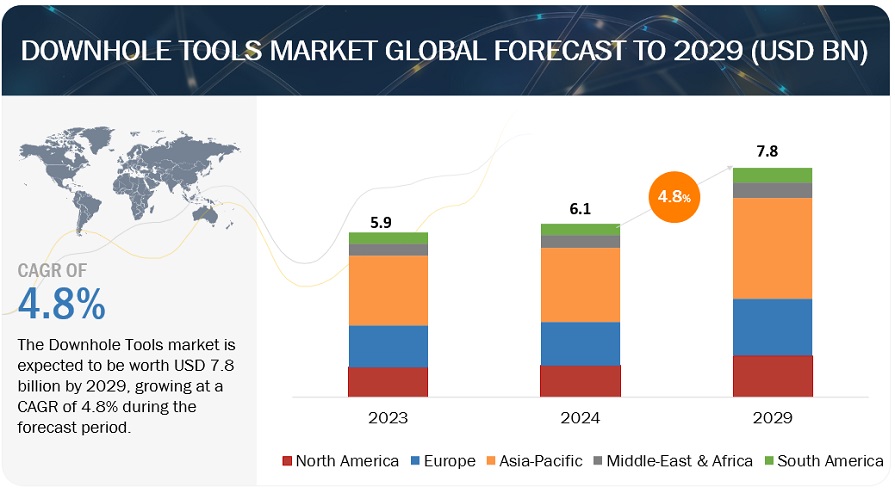

[280 Pages Report] The global downhole tools market is forecast to reach USD 7.8 billion by 2029 from an estimated USD 6.1 billion in 2024, at a CAGR of 4.8% during the forecast period (2024-2029). As the world population grows and economies expand, the demand for energy, particularly oil and gas, continues to rise. This drives investment in exploration and production activities, leading to higher demand for downhole tools. Moreover, innovations in drilling techniques, materials, and equipment enhance efficiency and productivity. Downhole tools play a crucial role in optimizing drilling processes, making them indispensable for modern oil and gas operations. These are some of the factors that are expected to boost the market worldwide.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Downhole Tools Market Dynamics

Driver: Increased drilling activity and investments

Increasing drilling activities and investments in the oil and gas sector have been a notable trend in recent years. In 2022, drilling activity in the United States rose by approximately 30% from the levels seen in 2021. This surge in drilling reflects a remarkable recovery for oil and gas operators, driven by record cash flows that restored confidence and repaired balance sheets. The recovery in drilling activity signifies a renewed commitment to exploration and production activities within the industry. As governmental authorities recognize the limitations of renewable energy as a near-term solution, there has been a shift towards acknowledging carbon capture, utilization, and storage (CCUS) as a more feasible path forward. This recognition is expected to drive further activity in 2023, enabling the accelerated development of low-carbon technologies. The emphasis on CCUS and low-carbon technologies suggests that while the industry is rebounding, there is also a growing awareness of the need to address environmental concerns and transition towards cleaner energy sources.

The global upturn in exploration and production spending, both in North America and internationally, indicates a positive outlook for the oil and gas industry. Despite some fluctuations in spending growth rates, there is overall momentum towards increased investment in drilling and production activities. This trend is driven by factors such as energy security, supply reliability, and the need to expand production capacity. The rising drilling activity and investments in the oil and gas sector are expected to have significant implications for the downhole tools market.

Restraint: Rapidly growing renewable energy technologies

The current landscape in the energy sector reveals a cautious approach from oil companies towards significant drilling investments, largely due to the impending energy transition. As governments globally implement policies aimed at combating climate change, oil firms find themselves disincentivized to heavily allocate resources towards new production endeavors despite reaping record profits. This cautious stance could potentially lead to a scenario of tight supply and heightened prices, particularly as renewable energy alternatives strive to fill the gap left by traditional fossil fuels. Amidst a backdrop of soaring crude oil prices surpassing $90 per barrel, many oil companies are opting to prioritize rewarding investors through avenues such as boosting dividends or executing share buybacks, rather than embarking on extensive production expansion initiatives. While environmental groups perceive a deceleration in production growth as a positive driver towards accelerating the transition to renewable energy and mitigating carbon emissions, industry executives caution against the potential repercussions, including exacerbating energy shortages in economically disadvantaged regions and contributing to inflationary pressures. The sentiments expressed by key figures in the oil industry underscore the delicate balance between meeting current energy demands and navigating towards a more sustainable future. CEOs such as Darren Woods of Exxon Mobil emphasize the criticality of maintaining investment levels within the industry to counteract the natural depletion of oil and gas reserves, which occurs at a rate of 5-7% annually. However, uncertainties surrounding government policies, particularly regarding subsidies for emission-capture projects and emissions caps, pose significant hurdles for companies contemplating substantial investment in large-scale projects.

Opportunities: Increasing oil and gas discoveries

In 2022, the global oil and gas exploration sector witnessed its most robust performance in over a decade, driven by significant discoveries in key regions such as Namibia, Brazil, and Algeria. According to a report from Wood Mackenzie, exploration activities resulted in the creation of over USD 33 billion in value, achieving full cycle returns of 22% at a base price of USD 60 per barrel of Brent crude. Despite exploration well numbers being lower than pre-pandemic levels, the total volume of discovered resources, totaling 20 billion barrels of oil equivalent, matched the average annual volumes recorded between 2013 and 2019. This success was attributed to strategic selection and focus on high-potential prospects, leading to the identification of higher-quality hydrocarbons and significant resource additions to companies' portfolios. The discoveries in 2022 were characterized by their substantial size, with the average discovery exceeding 150 million barrels of oil equivalent, more than double the average of the previous decade. Liquids accounted for 60% of the new resources discovered, marking only the third instance in 20 years where liquids comprised the majority of new discoveries.

Looking ahead, fast-tracked development of these new discoveries could potentially contribute to a significant increase in oil and gas production by 2030, with estimates suggesting up to 1 million barrels per day of oil and 0.5 million barrels of equivalent per day of gas production, generating approximately USD 15 billion in free cash flow. In terms of market dynamics, the exploration boom presents an opportunity for the down hole tools market. As oil and gas companies accelerate their exploration and appraisal activities to capitalize on newfound resources, there will likely be an increased demand for equipment and services related to drilling and extraction processes. This surge in demand could drive growth in the down hole tools market as companies seek to optimize their operations and maximize the potential of these newly discovered reserves.

Challenges: Complex well intervention operations in harsh high-pressure and high temperature (HPHT) environmental conditions

The development of a new heat transfer model and the proposed heat extraction systems to regulate high temperatures in wellbores during drilling have significant implications for downhole tools used in the oil, gas, and geothermal industries. Firstly, the downhole tools themselves must be capable of withstanding high temperatures encountered during drilling operations. The implementation of heat extraction systems to reduce bottom-hole temperatures addresses the challenge of thermal degradation of downhole tools. High temperatures can adversely affect the stability and lifespan of drilling tools, including drill bits, logging while drilling systems, and downhole power tools. By reducing the temperature within the wellbore, these heat extraction systems help mitigate the risk of premature tool failure, thereby enhancing the efficiency and safety of drilling operations. Secondly, the proposed heat extraction systems may require modifications or adaptations to existing downhole tools and equipment. For example, insulated pipe strings and phase-change heat storage drilling liquids may need to be integrated into the design of downhole tools to facilitate heat extraction while drilling. This could involve changes in material selection, design configurations, and manufacturing processes to ensure compatibility and effectiveness in high-temperature environments.

Furthermore, the development of a new heat transfer model that considers various factors impacting wellbore temperature distribution provides valuable insights for optimizing the design and performance of downhole tools. By incorporating parameters such as fluid composition, casing programs, and heat sources into the model, researchers and engineers can better understand the thermal dynamics within the wellbore and identify areas where improvements can be made to enhance downhole tool functionality and reliability.

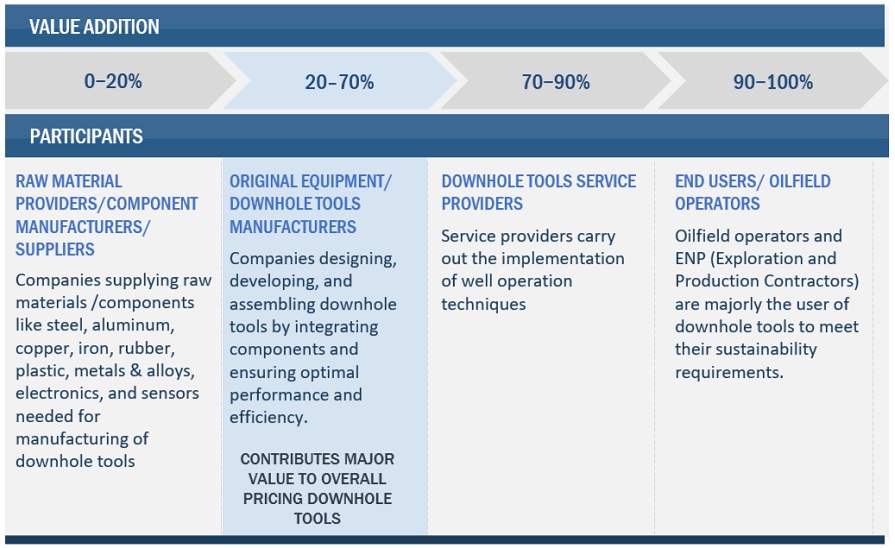

Downhole Tools Market Ecosystem

Leading companies in this market include well-established, financially secure producers of downhole tools. These corporations have been long operating in the market and have a differentiated product portfolio, modern manufacturing technologies, and robust sales and marketing networks. Some of the major companies in this market include SLB (US), Baker Hughes Company (US), Halliburton Co (US), Tenaris (Luxembourg), TechnipFMC (France).

The flow & pressure control tools segment is expected to be the second fastest market by tool type during the forecast period.

By tool type, the downhole tools market is divided into drilling tools, flow & pressure control tools, impurity control tools, logging tools, and handling tools. The flow & pressure control tools segment is expected to be the second fastest in the downhole tools market since the depletion of conventional oil and gas reserves is driving the exploration and production of unconventional resources like shale gas and tight oil. These resources require specialized techniques for extraction, and flow & pressure control tools are crucial for managing the high pressures and flow rates encountered in these wells.

By location of deployment, offshore is expected to be the fastest segment during the forecast period.

The offshore segment is expected to be the fastest in the downhole tools market due to rising global demand for oil and gas, exploration of new reserves in regions like Asia Pacific and South America. Moreover, offshore wells tend to be more productive than onshore wells, requiring downhole tools that can handle the higher flow rates and pressure associated with extracting larger volumes of oil and gas. The focus on production of oil from offshore locations particularly in North America along with usage of advanced technical equipment is also expected to further boost the market in future.

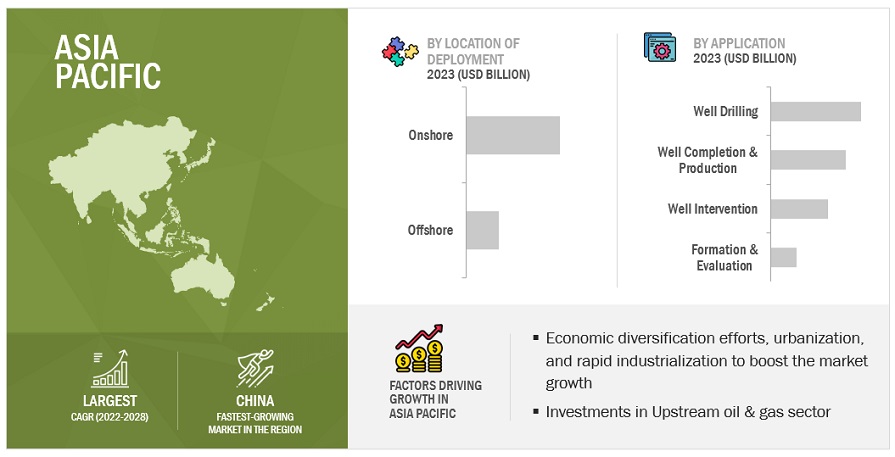

“Asia pacific”: The fastest region in the downhole tools market.

Asia Pacific is the fastest region in the downhole tools market owing to the region experiencing significant population growth and economic development, leading to a corresponding increase in energy demand. The region has vast untapped offshore reserves, particularly in Southeast Asia. Exploring and extracting these resources necessitates advanced downhole tools that can handle deepwater environments and complex geology. Furthermore, the region is witnessing a rise in domestic manufacturing of downhole tools. This reduces dependence on foreign suppliers and caters to the specific needs of the regional drilling projects. There's a strong push for innovation in the Asia Pacific downhole tools market. Manufacturers are developing more efficient, cost-effective, and reliable tools to meet the demands of the region's drilling activities. These are some of the factors that are augmenting the market growth in the region.

Key Market Players

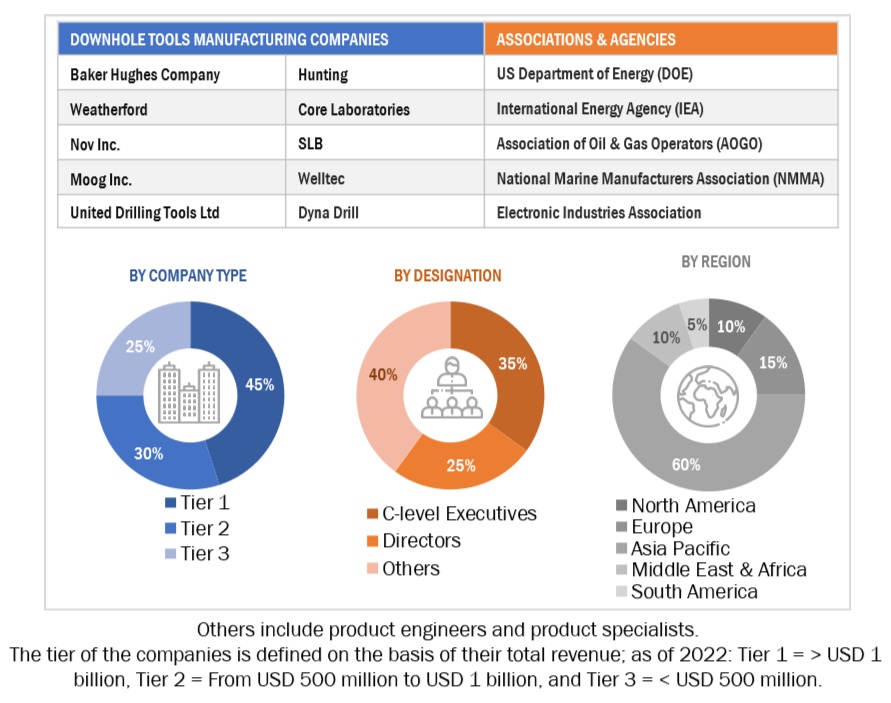

The downhole tools market is dominated by a few major players that have a wide regional presence. The major players in the downhole tools market are SLB (US), Baker Hughes Company (US), Halliburton Co (US), Tenaris (Luxembourg), TechnipFMC (France). Between 2020 and 2024, strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the downhole tools market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2021–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

Tool type, Application, Location of deployment |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

SLB (US), Halliburton Co (US), Baker Hughes Company (US), Weatherford (US), Tenaris (LUXEMBOURG), Nov Inc (US), TechnipFMC Plc (FRANCE), Oil states International, Inc. (US), Moog Inc. (US), Schoeller Bleckmann Oilfield Equipment AG (AUSTRIA), Anton Oilfield Services Group (CHINA), United Drilling Tools Ltd (INDIA), Excalibre Downhole Tools Ltd. (CANADA), Bilco (US), Hunting (UK), Vallourec (NFRANCE), Nabors Industries Ltd (US), Core Laboratories (US), Herrenknecht AG (GERMANY), Dril-Quip, Inc. (US), Jereh Energy Services Corporation (CHINA), Expro Group (US), Welltec (Denmark), Tam International, Inc (US), Dyna Drill (US) |

This research report categorizes the downhole tools market by Tool type, Application, Location of deployment, and region.

On the basis of Tool type, the downhole tools market has been segmented as follows:

- Drilling Tools

- Flow & Pressure Control Tools

- Impurity Control Tools

- Logging Tools

- Handling Tools

On the basis of location of deployment, the downhole tools market has been segmented as follows:

- Onshore

- Offshore

On the basis of application, the downhole tools market has been segmented as follows:

- Well Drilling

- Well Intervention

- Well Completion & Production

- Formation & Evaluation

On the basis of region, the downhole tools market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In April 2024, SLB and ChampionX Corporation announced a definitive agreement for SLB to purchase ChampionX in an all-stock transaction. ChampionX Corporation is a global leader in chemistry solutions, artificial lift systems, and highly engineered equipment and technologies that help companies drill for and produce oil and gas safely, efficiently, and sustainably around the world. This acquisition would allow SLB to enhance its product portfolio.

- In February 2024, KCF Technologies, a leader in predictive maintenance and machine health solutions, today announced an integration with Nabors Industries, pioneer of the RigCLOUD® digital drilling platform, enabling customers to bring data from their wireless machine sensors into the open cloud system.

- In November 2023, Halliburton Co and Sekal AS announced an agreement to jointly provide leading well construction automation solutions as part of a longer-term strategy to deliver fully automated drilling operations. Under the agreement, Halliburton and Sekal are collaborating on several technologies and services that incorporate Halliburton digitally integrated well construction solutions and the Sekal DrillTronics automation platform. In addition, both parties’ remote operations centers will provide expertise and support to these offerings.

- In November 2021, Expro Group, a leading provider of energy services, launched Galea, a fully autonomous well intervention system which is used to maximize production while reducing intervention costs, HSE risks and environmental impact. Galea replaces larger, conventional, and more labour-intensive wireline rig-ups for a range of slickline operations such as solids removal, plug setting/pulling and logging surveys.

Frequently Asked Questions (FAQ):

What is the current size of the downhole tools market?

The current market size of the downhole tools market is USD 6.1 billion in 2024.

What are the major drivers for the downhole tools market?

The major driver of the downhole tools market is the increased drilling activity and investments in the upstream oil & gas sector.

Which is the largest region during the forecasted period in the downhole tools market?

North America is expected to dominate the downhole tools market between 2024–2029.

Which is the second fastest segment, by location of deployment, during the forecasted period in the downhole tools market?

The onshore segment is expected to be the second fastest market during the forecast period. There's a resurgence of onshore drilling activity globally, particularly in shale oil and gas sector. This is due to advancements in horizontal drilling techniques and the development of unconventional resources that are more abundant onshore. These activities require a significant number of downhole tools, thus driving the market growth.

Which is the third largest segment, by tool type during the forecasted period in the downhole tools market?

The handling tools segment is expected to be the third largest growing market during the forecast period due to the critical demand for optimized drilling and optimized exploration activities in challenging and remote environments. Also, since handling tools are involved throughout the entire well lifecycle across wide range of applications, that makes handling tools a constant requirement in downhole operations. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

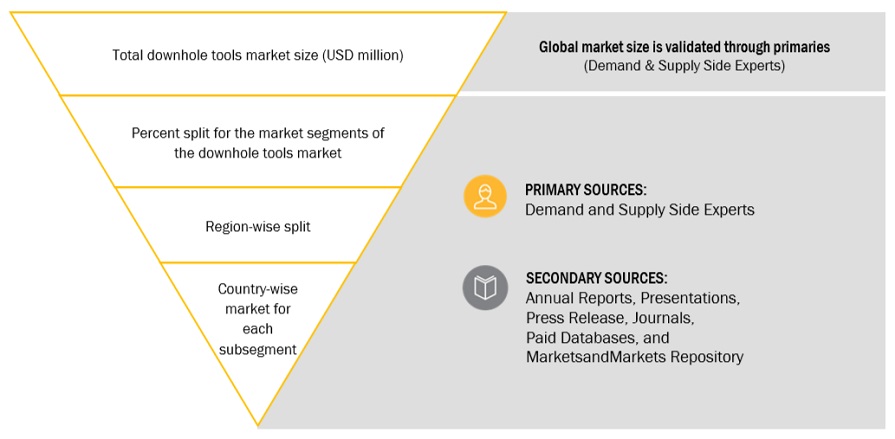

The study involved major activities in estimating the current size of the downhole tools market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the downhole tools market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and United States Energy Association, to identify and collect information useful for a technical, market-oriented, and commercial study of the global downhole tools market. The other secondary sources included annual reports of the companies involved in the market, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The downhole tools market comprises several stakeholders such as downhole tools manufacturers, downhole tools service companies, suppliers and distributors of downhole tools in the supply chain. The demand side of this market is characterized by the increasing oil & gas exploration activities. The supply side is characterized by rising demand for contracts from the oil & gas sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

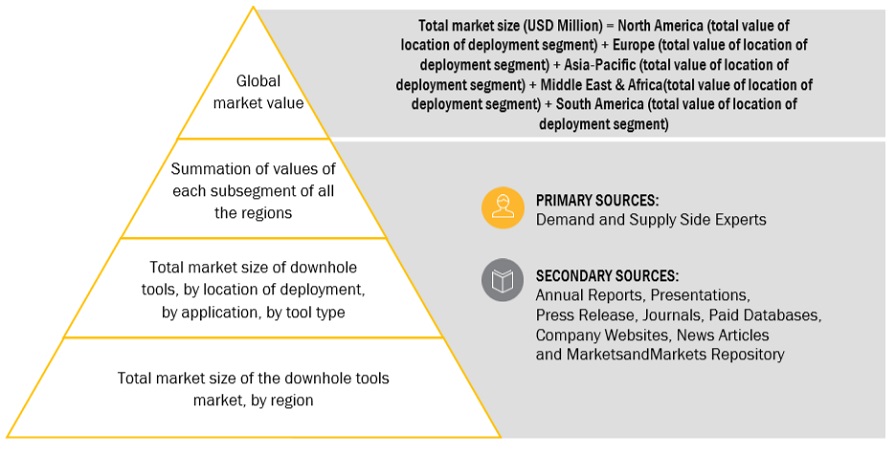

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the downhole tools market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions has been determined through both secondary and primary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primaries.

Global Downhole tools Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Downhole tools Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. The complete market engineering process is done to arrive at the exact statistics for all the segments and subsegments, also data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by examining various factors and trends from both the demand- and supply sides. Along with this, the market has been validated through both the top-down and bottom-up approaches.

Market Definition

Downhole tools are employed for work-over and completion activities of well in the Bottom Hole Assembly (BHA). The selection of downhole tools depends on the formation characteristics of the reservoir and the rate of penetration to be achieved. These tools are used for various operations like fishing, casing, cementing, and fracturing.

Key Stakeholders

- Downhole tools manufacturers and providers

- Industrial gas supplying companies

- Manufacturing industries

- R&D laboratories

- Consulting companies from the energy & power sector

- Distributors of downhole tools

- Government and research organizations

- State and national regulatory authorities

Objectives of the Study

- To define, describe, segment, and forecast the downhole tools market by application, by location of deployment, and by tool type in terms of value.

- To describe and forecast the market for six key regions: North America, Europe, Asia Pacific, South America, the Middle East, and Africa, along with their country-level market sizes, in terms of value.

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide supply chain analysis, trends/disruptions impacting customer business, ecosystem/market map, pricing analysis, Porter’s five forces analysis, case study analysis, and regulatory standards pertaining to downhole tools

- To analyze opportunities for stakeholders in the downhole tools and draw a competitive landscape of the market.

- To strategically analyze the ecosystem, tariffs and regulations, patents, and trading scenarios pertaining to downhole tools

- To compare key market players based on product specifications and applications.

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts and agreements, investments and expansions, mergers and acquisitions, partnerships, joint ventures, and collaborations, in downhole tools

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Downhole Tools Market