Oxygen-Free Copper Market by Grade (Cu-OF, Cu-OFE), Product Form (Wires, Strips, Busbar & Rods), End-use Industry (Electronics & Electrical, Automotive), and Region( North America, Europe, APAC, MEA, South America) - Global Forecast to 2029

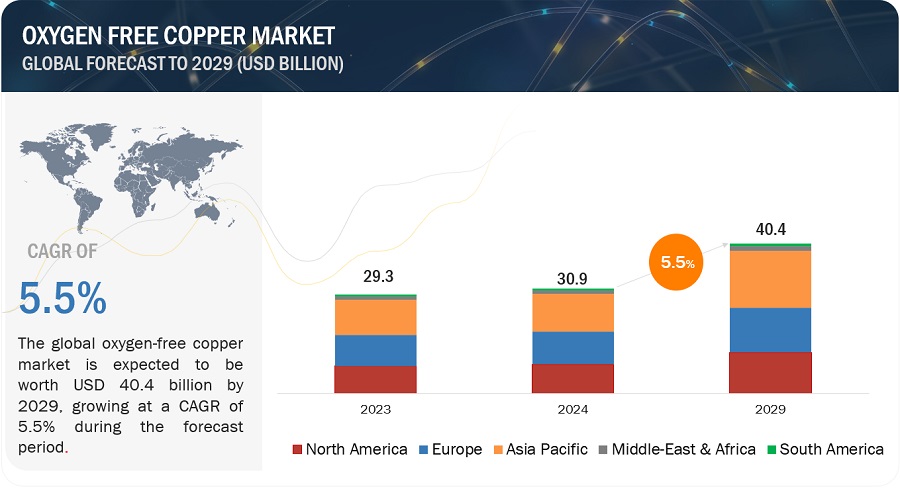

The global oxygen free copper market size is projected to grow from USD 30.9 billion in 2024 to USD 40.4 billion by 2029, at a CAGR of 5.5% during the forecast period.

The oxygen-free copper market revolves around the production, distribution, and utilization of a specialized grade of copper known for its high conductivity and low impurities. With minimal oxygen content, typically less than 0.001%, oxygen-free copper offers superior electrical and thermal conductivity, making it essential for various high-performance applications. This high-purity copper is widely used in industries such as electronics, telecommunications, automotive, and renewable energy, where reliable and efficient electrical conductivity is crucial. The market is driven by the increasing demand from these industries, coupled with technological advancements and innovations requiring high-quality materials. However, challenges like volatile prices and high processing costs can impact market growth. Overall, the oxygen-free copper market continues to expand, fuelled by its indispensable role in advancing technologies and industries worldwide.

Attractive Opportunities in the Oxygen-Free Copper Market

To know about the assumptions considered for the study, Request for Free Sample Report

Oxygen free copper Market Dynamics

Driver: Increasing demand from electronics and electrical end-use industries

The increasing demand for oxygen-free copper in the electronics and electrical end-use industries is a major driver for the oxygen-free copper market. As these industries continue to advance and innovate, there's a growing need for high-conductivity and reliable materials like oxygen-free copper. It is extensively used in applications such as printed circuit boards, semiconductors, wiring, and electrical components due to its superior electrical conductivity and low impurity levels. With the rapid technological advancements and expanding electronic product market, the demand for oxygen-free copper is expected to rise significantly, driving the growth of the market.

Restraint: High cost of oxygen free copper processing

The high cost of processing oxygen-free copper serves as a significant restraint in the market. Producing oxygen-free copper requires specialized refining processes, such as vacuum melting and casting, to achieve the desired purity levels. These processes are more complex and energy-intensive compared to conventional copper production methods, leading to higher production costs. As a result, the price of oxygen-free copper is often higher than standard copper grades, making it less accessible for some industries and applications. The elevated production costs can limit its adoption and competitiveness in the market, posing a challenge for both producers and consumers.

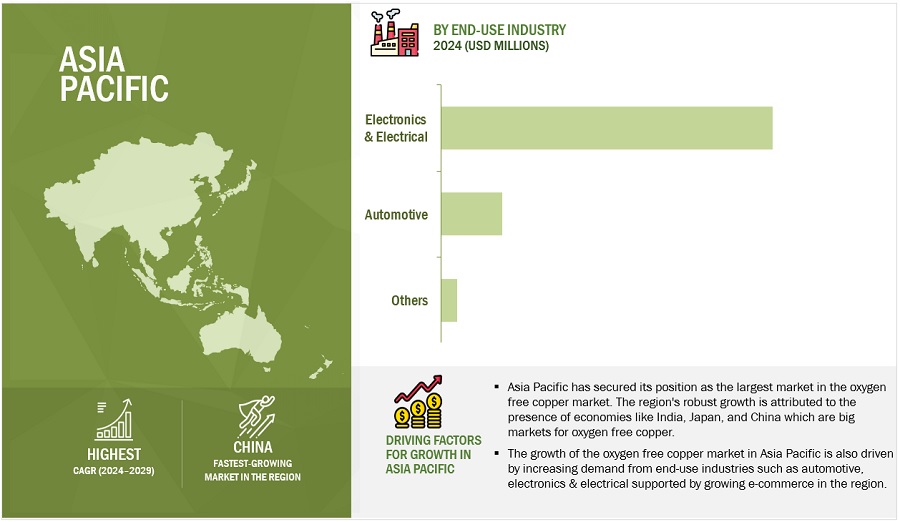

Opportunity: Strong demand from APAC region

The strong demand for oxygen-free copper in the Asia-Pacific (APAC) region presents a significant market opportunity. APAC, with countries like China, India, Japan, and South Korea at its forefront, has emerged as a major hub for electronics, electrical, and automotive industries. As these sectors continue to grow and innovate, the need for high-quality materials like oxygen-free copper is escalating. Additionally, the region's shift towards Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) further boosts the demand for oxygen-free copper in battery and electrical components. With its expanding manufacturing capabilities, skilled workforce, and abundant raw materials, APAC offers a lucrative market for oxygen-free copper producers and suppliers looking to capitalize on the region's growth and demand.

Challenge: Volatile prices of copper

Volatile prices of oxygen-free copper present a significant challenge in the market. The pricing of oxygen-free copper is susceptible to fluctuations influenced by factors such as raw material costs, energy prices, global demand, and economic conditions. These unpredictable price movements can create uncertainty for both producers and consumers, impacting profit margins and overall market stability. The volatility in prices makes it challenging for businesses to plan and budget effectively, leading to potential supply chain disruptions and investment hesitations. Managing these price fluctuations requires market participants to adopt effective risk management strategies and closely monitor market trends to mitigate their impact on operations and profitability.

ECOSYSTEM

By Grade, Cu-OF has the highest market share in the forecast period.

The Cu-OF (Copper Oxygen-Free) segment holds the largest share among Cu-OF and Cu-OFE in the oxygen-free copper market due to its versatile applications. Cu-OF, with its 99.95% purity and 0.001% oxygen content, offers superior electrical conductivity comparable to standard copper, making it suitable for a wide range of high-performance applications. It is widely used in critical industries such as electronics, telecommunications, and automotive, where reliable and efficient electrical conductivity is crucial. Additionally, its high thermal conductivity and resistance to hydrogen embrittlement further enhance its appeal for various industrial uses.

By Product Form, wires segment has the highest market share in the forecast period.

The wires segment dominates the oxygen-free copper market among wires, strips, busbars & rods, and others due to its versatile applications and widespread use across industries. Oxygen-free copper wires are crucial components in various sectors, including electronics, telecommunications, automotive, and power transmission. Their high electrical conductivity, reliability, and efficiency make them essential for transmitting electrical signals and power effectively. Whether used in high-end audio systems, telecommunications infrastructure, or automotive wiring, oxygen-free copper wires offer superior performance compared to other materials. As a result, the wires segment commands the largest share in the oxygen-free copper market, driven by its indispensable role in diverse industries.

By end-use industry, the electronics & electrical segment is projected to dominate the market in the forecast period.

The electronics & electrical segment holds the largest share in the oxygen-free copper market due to its extensive use across various electronic and electrical applications. Oxygen-free copper's superior conductivity and low impurity levels make it indispensable for industries requiring high-performance materials. In electronics, it's used in printed circuit boards, semiconductors, and wiring, while in electrical applications, it's utilized in power transmission, transformers, and electrical components. The growing demand for advanced electronic devices, telecommunications equipment, and renewable energy systems further drives the need for oxygen-free copper in this segment, solidifying its position as the largest segment in the market.

Asia Pacific dominated the market in 2023.

The Asia-Pacific (APAC) region has emerged as the dominant force in the oxygen free copper market among APAC, North America, Europe, South America, and the Middle East and Africa due to several key factors. Firstly, APAC countries, such as China, Japan, and India, are experiencing rapid urbanization and population growth. These are primary centers for manufacturing and sale of electrical & electronic goods, which are the major end users of oxygen-free copper. The Asia Pacific region is an attractive market for automobiles and is witnessing a shift toward EVs, such as Hybrid Electric Vehicles (HEVs).

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Oxygen free copper market comprises key manufacturers such as KGHM Polska Miedz SA (Poland), Proterial Metals, Ltd. (Japan), Mitsubishi Materials Corporation (Japan), Metrod Holdings Berhad (Malaysia), Aviva Metals (US), Aurubis AG (Germany), Copper Braid Products (UK), KME Germany GmbH (Germany), Sam Dong (South Korea), and others. Expansions, collaborations, and deals were some of the major strategies adopted by these key players to enhance their positions in the oxygen free copper market. A major focus was given to deals.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2022–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD million/USD Billion) and Volume (Kilo Ton) |

|

Segments Covered |

Grade, Product Form, End-Use Industry, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

KGHM Polska Miedz SA (Poland), Proterial Metals, Ltd. (Japan), Mitsubishi Materials Corporation (Japan), Metrod Holdings Berhad (Malaysia), Aviva Metals (US), Aurubis AG (Germany), Copper Braid Products (UK), KME Germany GmbH (Germany), and Sam Dong (South Korea) |

This research report categorizes the oxygen-free copper market based on grade, product form, end-use industry, and region

Oxygen-free copper Market, Based on Grade:

- Cu-OF

- Cu-OFE

Oxygen free copper Market, Based on the Product Form :

- Wire

- Strips

- Busbar & Rod

- Others

Oxygen free copper Market, Based on the End-Use Industry :

- Electronics & Electrical

- Automotive

- Others

Oxygen free copper Market, Based on the Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In November 2023, KGHM Polska Miedz S.A. extended its agreement with China Minmetals, spanning from 2024 to 2028. Under this, KGHM will supply copper to China Minmetals over the five-year period.

- In August 2023, KGHM Polska Miedz S.A. entered into a significant long-term agreement with NKT. Under this arrangement, KGHM will supply copper wire rods to entities within NKT over the period spanning from 2023 to 2027.

- In February 2022, KGHM Polska Miedz S.A. officially registered its primary product, copper cathodes, on the Shanghai International Energy Exchange (INE).

- In October 2023, Mitsubishi Materials Corporation and Anglo-American plc, a multinational mining company based in London, UK signed a memorandum of understanding to establish a sustainable and responsible supply chain for copper-related products.

- In December 2023, The Indonesian subsidiary PT. Smelting ("PTS"), under Mitsubishi Materials Corporation, undertook an expansion project to increase the processing capacity of copper concentrate at its Gresik Smelter & Refinery in Indonesia.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the oxygen free copper market?

The major drivers influencing the growth of the oxygen free copper market are increasing demand for oxygen-free copper in the electronics & electrical end-use industry and increasing sales of electric vehicles (EVs).

What are the major challenges in the oxygen free copper market?

The major challenge is the volatile prices of copper.

What are the restraining factors in the oxygen free copper market?

The major restraint in the oxygen free copper market is high cost of oxygen-free copper processing.

What is the key opportunity in the oxygen free copper market?

Strong demand for oxygen-free copper from the Asia Pacific region is a major opportunity in the oxygen free copper market.

Who are the key players in the global oxygen free copper market?

The key players operating in the oxygen-free copper market are KGHM Polska Miedz SA (Poland), Proterial Metals, Ltd. (Japan), Mitsubishi Materials Corporation (Japan), Metrod Holdings Berhad (Malaysia), Aviva Metals (US), Aurubis AG (Germany), Copper Braid Products (UK), KME Germany GmbH (Germany), and Sam Dong (South Korea) amongst others.

How is the oxygen-free copper market aligned?

The oxygen-free copper market is relatively fragmented. It has many global, regional, and domestic players who have a strong presence in the market. These players have well-established procurement and distribution networks, which help in cost-efficient production. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities for estimating the current global size of the oxygen-free copper market. Exhaustive secondary research was conducted to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of oxygen-free copper through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the oxygen-free copper market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the oxygen free copper market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

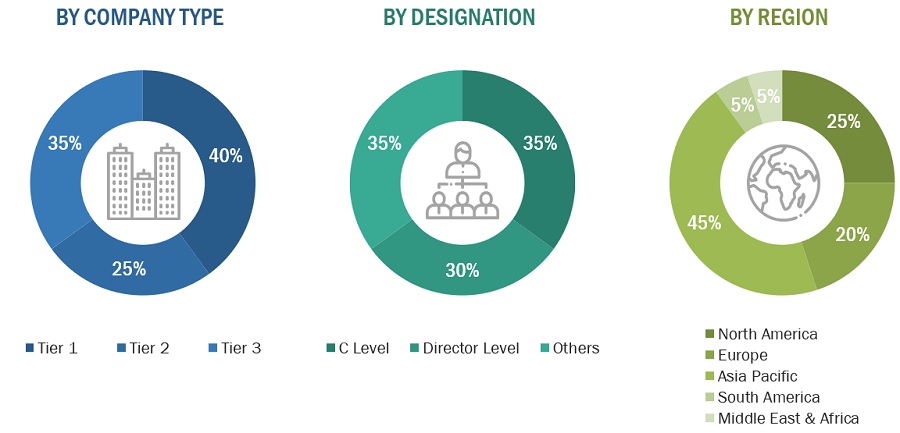

Various primary sources from both the supply and demand sides of the oxygen free copper market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the oxygen free copper industry. The breakdown of the profiles of primary respondents is as follows:

Breakdown of Primary Interviews

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 = <USD 500 million.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

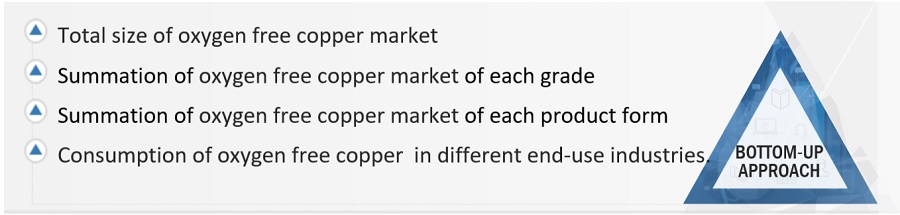

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the oxygen-free copper market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the oxygen-free copper market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Oxygen-free copper (OFC) is a specialized grade of copper characterized by extremely low oxygen content, typically less than 0.001%. This high-purity copper is produced through a vacuum melting and casting process to eliminate oxygen, resulting in a material with superior electrical conductivity and minimal impurities. Oxygen-free copper is distinguished by its high thermal conductivity, resistance to hydrogen embrittlement, and excellent electrical properties, making it ideal for applications requiring high-performance copper, such as advanced electronics, telecommunications, automotive components, and renewable energy systems. The oxygen-free copper market encompasses the production, distribution, and consumption of this specialized copper grade, serving various industries that demand high-quality materials for critical applications.

Key Stakeholders

- Raw material suppliers

- Oxygen-free copper manufacturers

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- End-use industries

- Traders and distributors

Research Objectives

- To estimate and forecast the oxygen-free copper market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market size, based on grade, product form, end-use industry, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as merger & acquisition, expansion & investment, and agreements in the oxygen free copper market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the oxygen free copper report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the oxygen free copper market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Oxygen-Free Copper Market