Refractories Market by Form (Shaped Refractories, Unshaped Refractories), Alkalinity (Acidic & Neutral. Basic), End-Use Industry (Iron & Steel, Non-Ferrous Metals, Cement, Power Generation, Glass), and Region - Global Forecast to 2029

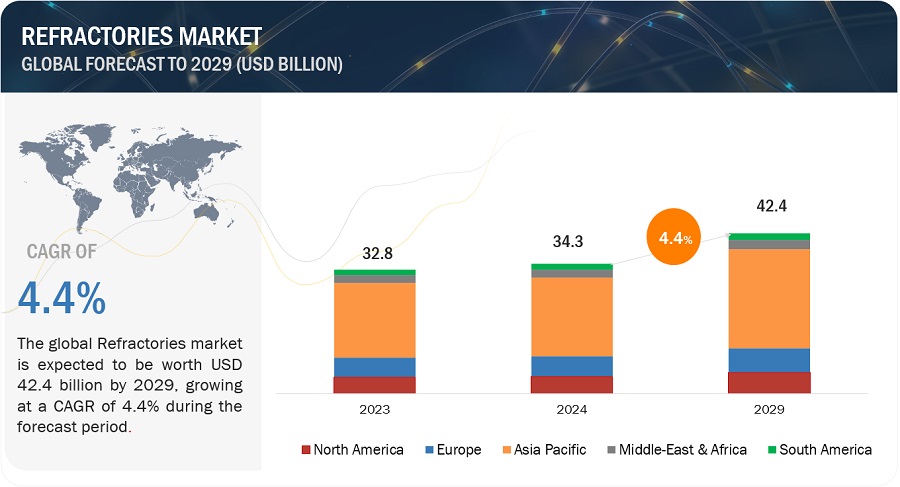

The global refractories market size is projected to grow from USD 34.3 billion in 2024 to USD 42.4 billion by 2029, at a CAGR of 4.4% during the forecast period.

The refractories market encompasses a diverse range of materials crucial for withstanding high temperatures and harsh operating conditions in various industrial processes. These specialized materials find widespread applications in industries such as steelmaking, cement manufacturing, glass production, petrochemicals, and more. With the global industrial sector continuously evolving and expanding, the demand for refractories remains strong. Factors driving this demand include infrastructure development projects, increasing urbanization, technological advancements, and growing emphasis on energy efficiency and sustainability. However, the market also faces challenges such as raw material price volatility, supply chain disruptions, and environmental regulations. To navigate these challenges and capitalize on opportunities, refractories manufacturers are investing in research and development to innovate new products, optimize manufacturing processes, and expand their global presence. Overall, the refractories market plays a vital role in supporting industrial operations worldwide, ensuring the efficiency, reliability, and longevity of critical equipment and processes.

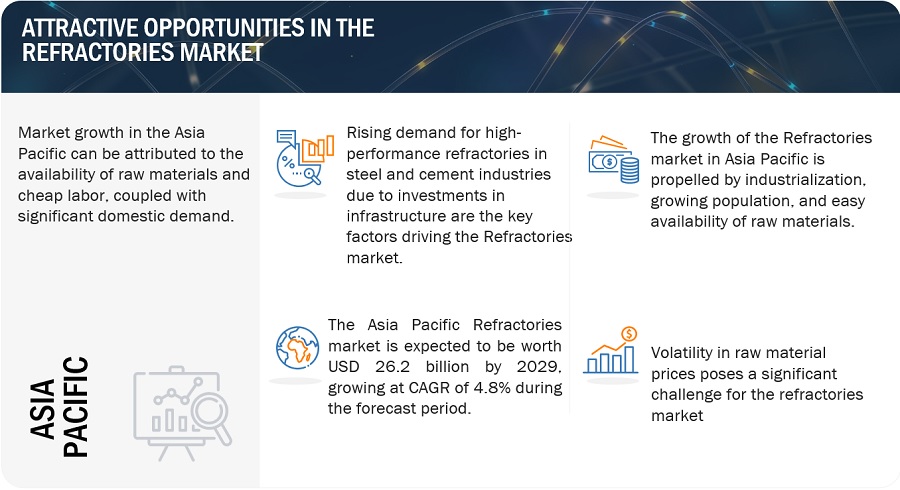

Attractive Opportunities in the Refractories Market

To know about the assumptions considered for the study, Request for Free Sample Report

Refractories Market Dynamics

Driver: Increasing infrastructure investments worldwide

Increasing infrastructure investments worldwide are catalysts for driving demand in key end-use industries of refractories such as iron and steel, glass, and cement. As governments and private sectors allocate funds towards infrastructure projects like roads, bridges, and buildings, there's a subsequent surge in the need for iron and steel for structural frameworks, glass for facades and windows, and cement for construction materials. These industries heavily rely on refractories to withstand the high temperatures and harsh conditions involved in their manufacturing processes. Consequently, the robust growth in infrastructure investments directly translates into heightened demand for refractories, as these materials play a critical role in ensuring the efficiency and longevity of industrial equipment. This symbiotic relationship between infrastructure investment and refractories market growth underscores the pivotal role played by the construction sector in driving demand for refractory products and driving the expansion of the market.

Restraint: China's monopoly over raw materials

A significant restraint in the refractories market is the dominance of China in the supply of key raw materials. China holds a significant share of global production and reserves for minerals, oxides, and metals essential in refractory manufacturing. This dominance can lead to market distortions, monopolistic pricing, and supply chain vulnerabilities. As a result, refractory manufacturers outside of China may face challenges in accessing raw materials at competitive prices and securing a stable supply. Dependence on China for critical raw materials also increases the risk of supply disruptions, particularly in times of geopolitical tensions or trade disputes.

Opportunity: Recycling of refractories

Recycling refractories emerges as a promising market avenue driven by environmental consciousness and economic advantages. As these materials reach the end of their lifespan in industrial settings, traditional disposal methods entail significant costs and environmental burdens. However, recycling offers a sustainable solution by repurposing spent refractories, curbing waste, and conserving raw materials. Moreover, recycling initiatives can yield valuable secondary resources, promoting a circular economy model. With increasing emphasis on sustainability across industries, refractories recycling presents a compelling opportunity for market growth and innovation within the sector.

Challenge: Fluctuations in raw material prices

A key challenge in the refractories market is the instability of raw material prices. The production of refractories relies heavily on minerals, oxides, and metals, whose prices can fluctuate due to factors like supply chain disruptions and changes in global demand. These fluctuations pose challenges for manufacturers, impacting production costs and pricing for customers. To address this, companies implement strategies such as strategic sourcing and price hedging. However, the unpredictability of raw material costs remains a persistent challenge requiring ongoing management and adaptation within the industry.

ECOSYSTEM

By Alkalinity, Acidic & Neutral segment have the highest market share in the forecast period.

The dominance of the Acidic & Neutral refractories segment in the market can be attributed to several key factors. Acidic & Neutral refractories, comprising materials such as silica (SiO2) and alumina (Al2O3), offer excellent resistance to acidic and basic slags, making them versatile options for various industrial applications. These refractories are widely utilized in industries such as glassmaking, ceramics, and cement manufacturing, where they encounter harsh chemical environments.

By Form, Shaped refractories have the highest market share in the forecast period.

Shaped refractories maintain a dominant position in the market compared to their unshaped counterparts due to their versatility and suitability for a wide range of industrial applications. These pre-formed refractory products, including bricks, tiles, and special shapes, offer structural integrity and precise fitting, making them ideal for lining furnaces, kilns, and other equipment with standardized shapes. Shaped refractories provide ease of installation, consistency in performance, and durability in high-temperature environments.

By end-use industry, the Iron & Steel segment projected to dominate the market in the forecast period.

The Iron & Steel segment asserts dominance in the refractories market due to its sheer scale of operations and intensive reliance on refractory materials. This industry accounts for a substantial portion of global refractory demand owing to its critical role in steelmaking processes. Refractories are indispensable in furnaces, converters, ladles, and other equipment involved in steel production. Moreover, the iron and steel sector's continuous pursuit of operational efficiency and product quality drives the adoption of advanced refractory solutions. While other segments such as cement, glass, and power generation also require refractories, the sheer magnitude of demand from the iron and steel industry solidifies its dominance in the refractories market.

Asia Pacific dominated the market in 2023.

In 2023, Asia-Pacific (APAC) region emerged as the dominant force in the refractories market among APAC, North America, Europe, South America, and the Middle East and Africa due to several key factors. There are several factors contributing to its supremacy. Foremost among these was China's status as the world's largest steel producer, driving substantial demand for refractory materials in the steelmaking industry. Additionally, rapid urbanization and industrialization across the region, particularly in countries like India and Japan, fuelled demand for refractories in infrastructure development projects and manufacturing activities. Favourable government policies, technological advancements, and a skilled labour force further supported the growth of the refractories sector in Asia Pacific. Moreover, the region's strategic location and strong presence of key refractories manufacturers enhanced its competitive advantage in the global market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Refractories market comprises key manufacturers such as RHI Magnesita (Austria), Vesuvius (UK), Krosaki Harima Corporation (Japan), Imerys (France), Shinagawa Refractories Co., Ltd. (Japan), Saint-Gobain (France), and Calderys (France), and others. Expansions, collaborations, and deals were some of the major strategies adopted by these key players to enhance their positions in the refractories market. A major focus was given to deals.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2022–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD million/USD Billion) and Volume (Kilo Ton) |

|

Segments Covered |

Alkalinity, Form, End-Use Industry, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

RHI Magnesita (Austria), Vesuvius (UK), Krosaki Harima Corporation (Japan), Imerys (France), Shinagawa Refractories Co., Ltd. (Japan), Saint-Gobain (France), Calderys (France), and others. |

This research report categorizes the refractories market based on alkalinity, form, product, manufacturing process, end-use industry and region

Refractories Market, By Alkalinity:

- Acidic & Neutral Refractories

- Basic Refractories

Refractories Market, By Form:

- Shaped Refractories

- Unshaped Refractories

Refractories Market, By End-Use Industry:

- Iron & Steel

- Non-Ferrous Metal

- Cement

- Power Generation

- Glass

- Other Industries

Refractories Market, By Product:

- Castables & Mortars

- Ceramic Fibers & Firebricks

- Graphite Blocks

- Insulation Fire Brick

Refractories Market, By Manufacturing Process:

- Dry Press Process

- Fused Cast

- Hand Molded

- Formed

- Unformed

Refractories Market, Based on the Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In December 2021, Vesuvius acquired the trade and assets of Universal Refractories Inc. (URI), a specialty refractory producer headquartered in Pennsylvania, USA.

- In April 2024, Vesuvius fortified its presence in India by inaugurating a state-of-the-art flux manufacturing facility.

- In May 2021, Krosaki Harima Corporation signed a partnership agreement with ArcelorMittal Refractories, based in Kraków, Poland, and part of the ArcelorMittal Group. This collaboration was done with the aim of optimizing production capacities and enhancing ArcelorMittal Refractories' product portfolio.

- In January 2023, RHI Magnesita completed the acquisition of the Indian refractory business of Dalmia Bharat Refractories Limited (DBRL).

- In March 2022, RHI Magnesita and the Horn & Co. Group signed a mutual agreement to merge their recycling endeavors in Europe, aiming to enhance the production, utilization, and availability of secondary raw materials for the European refractory industry.

- In October 20232, Vesuvius acquired Bayuquan Magnesium Co (BMC), a top-tier basic monolithic refractory plant in China.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the refractories market?

The major drivers influencing the growth of the refractories market are increasing demand for refractories in the iron and steel end-use industry and increasing infrastructure investments worldwide.

What are the major challenges in the refractories market?

The major challenge is the volatile prices of raw materials.

What are the restraining factors in the refractories market?

The major restraint in the refractories market is monopoly of some countries over refractory raw materials.

What is the key opportunity in the refractories market?

Strong demand for refractories from the Asia Pacific region is a major opportunity in the refractories market.

Who are the key players in the global refractories market?

The key players operating in the refractories market are RHI Magnesita (Austria), Vesuvius (UK), Krosaki Harima Corporation (Japan), Imerys (France), Shinagawa Refractories Co., Ltd. (Japan), Saint-Gobain (France), and Calderys (France), amongst others.

How is the refractories market aligned?

The refractories market is competitive. It has many global, regional, and domestic players who have a strong presence in the market. These players have well-established procurement and distribution networks, which help in cost-efficient production. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities for estimating the current global size of the refractories market. Exhaustive secondary research was conducted to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of refractories through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the refractories market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the refractories market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

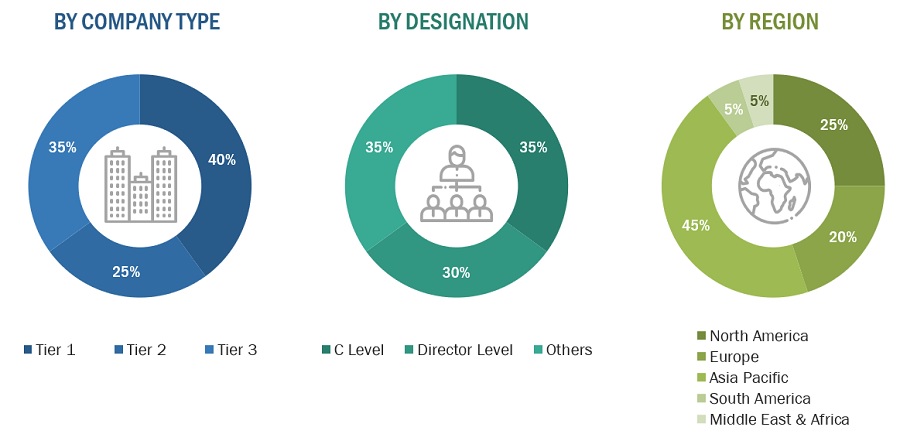

Primary Research

Various primary sources from both the supply and demand sides of the refractories market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the refractories industry. The breakdown of the profiles of primary respondents is as follows:

Breakdown of Primary Interviews

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 = <USD 500 million.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the refractories market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analysed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the refractories market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

The refractories market refers to the economic domain encompassing the production, distribution, and consumption of specialized materials designed to withstand extremely high temperatures and harsh operating conditions in industrial processes. These materials, known as refractories, are essential components in industries such as steelmaking, glass production, cement manufacturing, and chemical processing. The market involves manufacturers producing refractory products, end-users purchasing these materials for their industrial operations, distributors facilitating the supply chain, and maintenance services ensuring the longevity and efficiency of refractory linings in industrial equipment.

Key Stakeholders

- Raw material suppliers

- Refractories manufacturers

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- End use industries

- Traders and distributors

Research Objectives

- To estimate and forecast the refractories market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market size, based on form, alkalinity, end-use industry, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and South America along with their key countries

- To strategically analyze micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as merger & acquisition, expansion & investment, and agreements in the refractories market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the refractories report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the refractories market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Refractories Market