Aircraft Seating Market by Seat Type (Passenger Seat, Pilot, & Crew Seat), Platform (Narrow Body, Wide Body Aircraft, Business Jet, Commercial Helicopter, Light Aircraft, UAM), End-User, Seat Material, Standard and Region - Global Forecast to 2029

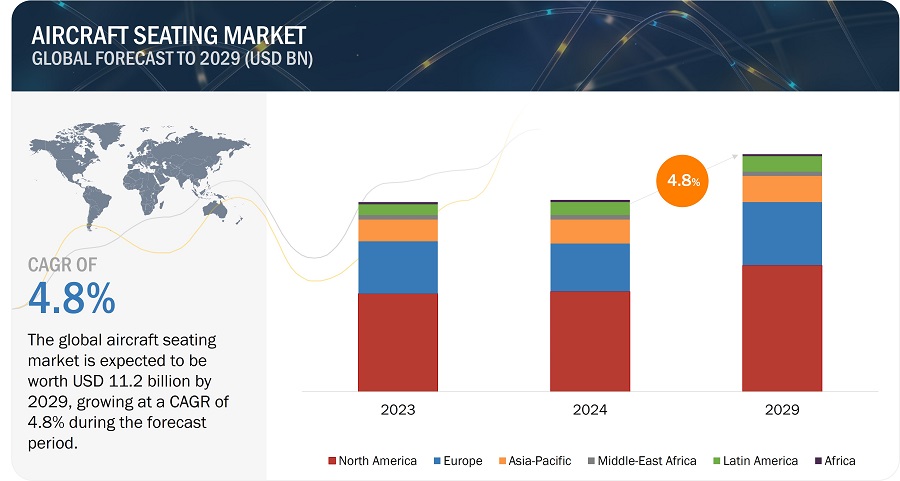

[400 Pages Report] The Aircraft seating market is estimated to be USD 8.9 billion in 2024 and is projected to reach USD 11.2 billion by 2029, at a CAGR of 4.8% from 2024 to 2029. Also, the aircraft seats volume is projected to grow from 883,745 units in 2024 to 1,083,558 units in 2029. The market is driven by factors such as demand for modern connected aircraft and need of more comfortable seating solutions. Technological advancements, the growing trend towards autonomous and electric aircraft contributes to innovation in elegant safer seating solutions, fostering a dynamic industry landscape.

Aircraft Seating Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Aircraft Seating Market Dynamics

Driver: Rising Aircraft Deliveries and Air Travel Demand

The aircraft seating market is experiencing a significant boost, subject to a rise in aircraft deliveries and air travel demand. With airlines worldwide adding new aircraft to their operations, the demand for seating configurations tailored to different aircraft models is rising. This surge in aircraft deliveries presents a lucrative opportunity for seating manufacturers to offer innovative and customizable seating options that enhance passenger comfort and experience.

Airlines are actively replacing older aircraft with newer, technologically advanced models to comply with stringent regulations and achieve competitive operational cost advantages. The uptick in air travel further underscores the importance of optimizing cabin space and maximizing seating capacity without compromising passenger comfort or safety. Many new airlines have also been launched recently, which shows the growth of air travel. For instance, Australia-based Bonza started its operations in January 2023. Airlines are keen on investing in seating solutions that balance efficiency, aesthetics, and functionality to cater to diverse passenger preferences and market segments. In 2023, Boeing and Airbus collectively delivered 528 and 735 aircraft, surpassing their respective 2022 figures of 480 and 661 deliveries. The International Air Transport Association (IATA) predicts that the number of air passengers will reach 4.7 billion in 2024, surpassing the 4.5 billion passengers who traveled in 2019, indicating a demand for new aircraft in the upcoming years.

Restraints: Stringent Regulatory and Certification Requirements

Stringent regulatory and certification requirements represent a potential restraint in the aircraft seating market, impacting both the pace of innovation and the market entry of new products. Aircraft components, including seats, must adhere to rigorous safety and performance standards set by aviation authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These regulations ensure the reliability and safety of aviation components but also introduce complex compliance challenges for manufacturers.

The process of obtaining certification is lengthy and resource-intensive, requiring extensive testing, documentation, and validation of each component’s adherence to the specified standards. For new and innovative seats, this can mean significant delays in product development and increased costs, as the certification process may necessitate multiple design iterations and exhaustive testing protocols. Further, the global nature of the aviation industry means that manufacturers must navigate a diverse regulatory landscape, complying with different standards and certification processes in various jurisdictions. This complicates the certification process and increases the time and expense involved in bringing new aircraft seats to the international market.

Opportunity: Rapidly Expanding Global Economy

Economic growth creates lucrative opportunities for the aircraft seating market, driven by expanding air travel demand in emerging economies and the subsequent need for new aircraft. The global aviation industry is expected to witness substantial growth, with the International Air Transport Association (IATA) projecting a doubling of air passengers to 8.2 billion by 2037. This growth is particularly pronounced in regions such as Asia-Pacific, which is forecasted to lead the world in passenger growth, offering a significant opportunity for the aircraft seating market.

As economies expand, there is a marked increase in disposable income and middle class, particularly in emerging markets, fueling the demand for air travel. This economic prosperity translates into increased investments in fleet expansion and modernization by airlines to cater to the growing passenger traffic. Consequently, there is a heightened demand for advanced aircraft seat solutions, which are essential for the operation of airlines, passenger comfort, and safety in modern aircraft.

Challenges: Complex Design and Integration of New Materials

The aircraft seating market is confronting a significant challenge with the complex design and integration of new materials. Advanced materials such as high-strength alloys, ceramics, and composite materials offer the potential for lighter, stronger, and more durable seats. However, their integration into aircraft seat manufacturing presents several challenges. These materials often require novel manufacturing techniques, such as additive manufacturing or specialized machining processes, which can substantially increase production complexity and costs.

Moreover, the unique properties of these materials, while beneficial in terms of performance, necessitate extensive research and development to fully understand their behavior under the extreme conditions of aircraft operation. This includes rigorous testing for fatigue resistance, thermal stability, and compatibility with other materials used in the seat assembly. The transition to these advanced materials also involves overcoming certification barriers. Given the critical role of seats in passenger safety, any new material or design must undergo a comprehensive certification process with aviation regulatory bodies, which can be time-consuming and costly.

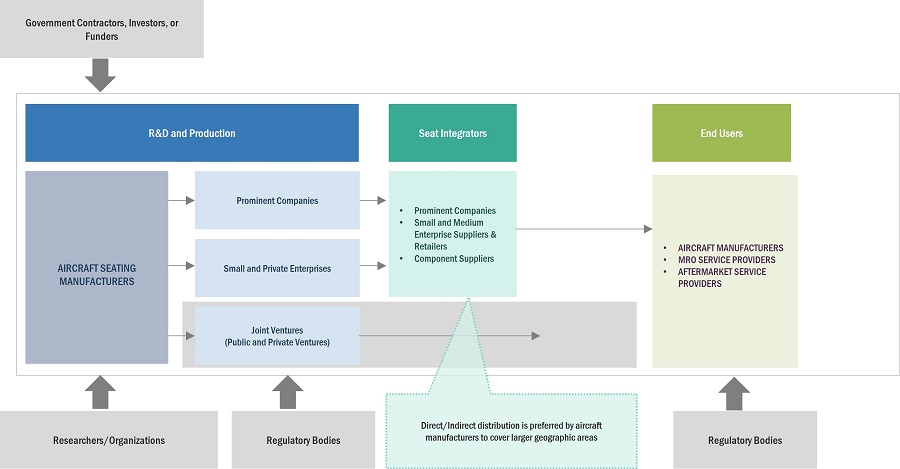

Aircraft Seating Market Ecosystem

In the aircraft seating market ecosystem, key stakeholders range from major aircraft seat providers to private enterprises, distributors, suppliers, retailers, and end customers like airlines and aircraft manufacturers. Influential forces shaping the industry include investors, funders, academic researchers, distributors, service providers, and defense procurement authorities. This intricate network of participants collaboratively drives market dynamics, innovation, and strategic decisions, highlighting the complexity and vitality of the aircraft seating sector.

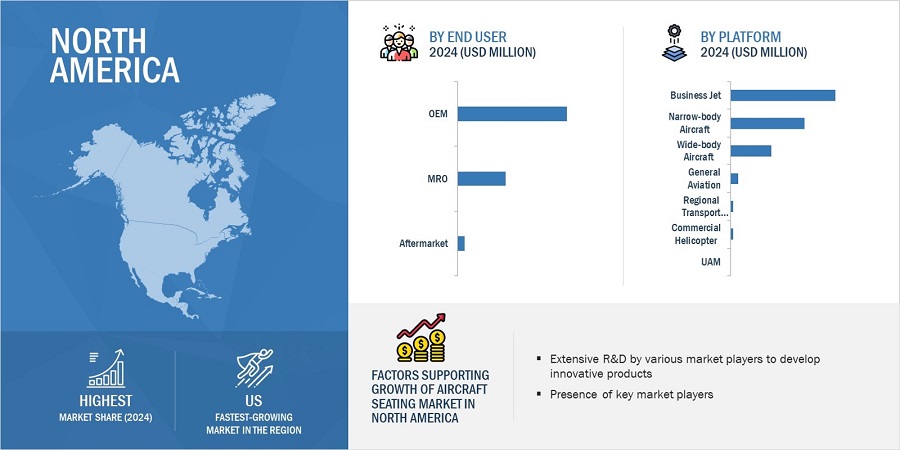

Based on the platform, the Narrow-body aircraft segment is estimated to lead the aircraft seating market in 2024.

Based on the platform, the aircraft seating market has been segmented broadly into narrow-body aircraft, wide-body aircraft, regional transport aircraft, business jet, general aviation, commercial helicopter, and UAM. Here narrow-body aircraft is leading this segment in 2024. The narrow-body aircraft segment in aircraft seating is experiencing robust growth driven by technological innovations, heightened safety standards, and a surge in air travel demand. Modern aircraft seats, incorporating state-of-the-art sensors, cushion materials, and lightweight materials, are pivotal in enhancing operational efficiency and passenger safety.

Based on the end user, the OEM segment is estimated to lead the aircraft seating market in 2024.

Based on the end user, the aircraft seating market has been segmented broadly into OEM, MRO, and aftermarket. Here OEM is leading this segment in 2024. The OEM segment in aircraft seating is thriving due to a growing demand for aircraft equipped with integrated and advanced aircraft seats straight from the manufacturing line. Airlines are increasingly prioritizing efficiency, safety, and compliance with evolving industry standards. Manufacturers are responding by offering cutting-edge seating solutions during the initial assembly process, streamlining operations and reducing retrofitting costs.

Based on the seat type, the passenger seats segment is estimated to lead the aircraft seating market in 2024.

Based on the seat type, the aircraft seating market has been segmented broadly into passenger seats and pilot & crew seats. Here passenger seats is leading this segment in 2024. Passenger seats are further segmented into economy, premium economy, business class, and first class. The continuous growth in air travel demand, particularly in emerging markets, propels the need for efficient and comfortable seating solutions to accommodate increasing passenger volumes. Airlines' focus on enhancing passenger experience and loyalty drives investments in innovative seat designs, amenities, and comfort features. Additionally, regulatory mandates emphasizing safety standards and ergonomic considerations influence seat design and procurement decisions.

Based on the seat materials, the cushion materials segment is estimated to lead the aircraft seating market in 2024.

Based on the seat materials, the aircraft seating market has been segmented broadly into cushion materials, structure materials, and upholsteries and seat cover materials. Here cushion materials is leading this segment in 2024. The cushion materials segment in the aircraft seating market is primarily driven by factors focusing on passenger comfort, safety, and operational efficiency. Airlines prioritize materials that offer durability, lightweight properties, and enhanced comfort for passengers during flights. Innovations in cushion materials, such as advanced foam compositions and ergonomic designs, cater to evolving passenger preferences while meeting stringent regulatory requirements. Moreover, the emphasis on fuel efficiency and aircraft performance encourages the adoption of lightweight cushion materials, contributing to operational cost savings for airlines.

The North America market is projected to have the largest share in 2024 in the aircraft seating market

Aircraft Seating Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Based on region, the aircraft seating market has been segmented into North America, Europe, Asia Pacific the Middle East, Latin America, and Africa. North America's aircraft seating sector is thriving due to a combination of factors. The region's robust aviation industry, marked by major players and a high concentration of airlines, drives consistent demand for advanced seating technologies. The region's emphasis on modernizing aging fleets, coupled with a growing trend toward automation and safety, further propels the aircraft seating market. The market is characterized by a surge in investments in research and development, fostering the evolution of state-of-the-art seating solutions tailored to meet the specific technical requirements of diverse platforms.

Key Market Players

Major players in the aircraft seating companies include Raytheon Technologies Corporation (US), Safran (France), RECARO Aircraft Seating GmbH & Co. KG (Germany), ZIM Aircraft Seating GmbH (Germany), Stelia Aerospace (France) to enhance their presence in the market. The report covers various industry trends and new technological innovations in the aircraft seating market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By End User, Platform, Seat Type, Standard, and Seat Material |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America |

|

Companies covered |

Raytheon Technologies Corporation (US), Safran (France), RECARO Aircraft Seating GmbH & Co. KG (Germany), ZIM Aircraft Seating GmbH (Germany), Stelia Aerospace (France), Jamco Corporation (Japan), ST Engineering (Singapore), Acro Aircraft Seating (UK), Expliseat (UK), Adient Aerospace LLC (US), Mirus Aircraft Seating (England), Martin Baker Aircraft Co. Ltd (UK), Geven S.P.A. (Italy), Ipeco Holdings Ltd (UK), UNUM (UK). |

Aircraft Seating Market Highlights

This research report categorizes the aircraft seating markets based on Platform, End User, Seat Type, Standard, and Seat Material.

|

Segment |

Subsegment |

|

By End User |

|

|

By Platform |

|

|

By Seat Type |

|

|

By Standard |

|

|

By Seat Materials |

|

|

By Region |

|

Recent Developments

- In February 2024, RECARO Aircraft Seating (RECARO) was selected by Southwest Airlines to equip new aircraft deliveries with the BL3710 economy class seat. The Dallas-based airline will begin taking deliveries in 2025. Its lightweight, flexible open system architecture seamlessly integrates with BETA's flight control, propulsion, and battery management systems.

- In October 2023, Safran has secured a contract with Japan Airlines for the fully customized Premium Economy, Business Class, and First-Class seats for 13 Airbus A350s. These seats will be tailored to meet the specific requirements of Japan Airlines, ensuring optimal comfort and functionality for passengers. This deal underscores Safran Seats' commitment to delivering high-quality and innovative seating solutions to its aviation clients.

Frequently Asked Questions (FAQs) Addressed by the Report:

What are your views on the growth prospect of the aircraft seating market?

Response: The aircraft seating market exhibits promising growth prospects driven by technological innovations, rising air travel demand, and increased focus on safety and efficiency. Advancements such as lightweight materials, enhanced safety, and sustainable aviation solutions contribute to market expansion.

What are the key sustainability strategies adopted by leading players operating in the aircraft seating market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the aircraft seating market. Major players Raytheon Technologies Corporation (US), Safran (France), and RECARO Aircraft Seating GmbH & Co. KG (Germany) have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the aircraft seating market?

Response: Some of the major emerging technologies are additive manufacturing and smart cabin solutions that will disrupt the aircraft seating market.

Who are the key players and innovators in the ecosystem of the aircraft seating market?

Response: Major players in the aircraft seating market include Raytheon Technologies Corporation (US), Safran (France), RECARO Aircraft Seating GmbH & Co. KG (Germany), ZIM Aircraft Seating GmbH (Germany), Stelia Aerospace (France).

Which region is expected to hold the highest market share in the aircraft seating market?

Response: Aircraft seating market in the North America region is estimated to account for the largest share of 52.0% of the market in 2024.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

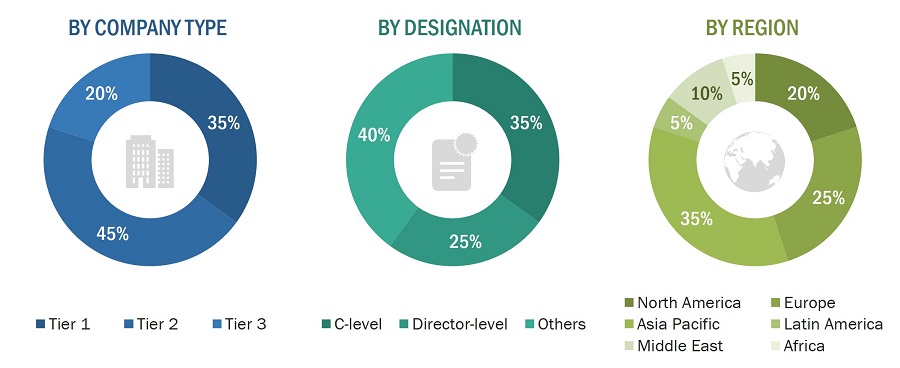

This research study on the aircraft seating market involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the aircraft seating market and assess the market's growth prospects.

Secondary Research

The market share of companies in the aircraft seating market was determined using the secondary data acquired through paid and unpaid sources and analyzing the product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. Primary sources further validated these data points.

Secondary sources referred to for this research study on the aircraft seating market included government sources, such as GAMA (General Aviation Manufacturer Association), International Air Transport Association (IATA), Boeing Outlook 2023, Airbus Outlook 2023, and federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to determine the overall size of the aircraft seating market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the aircraft seating market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- Both top-down and bottom-up approaches were used to estimate and validate the size of the aircraft seating market.

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market Size Estimation Methodology: Bottom-up Approach

Market Size Estimation Methodology: Top-Down Approach

Data triangulation

After arriving at the overall size of the aircraft seating market from the market size estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, data triangulation and market breakdown procedures explained below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Aircraft seats are specialized passenger and pilot & crew seating solutions designed for use within the interior of an aircraft. These seats are engineered for safety, comfort, ergonomics, and efficient space utilization, aligning with aviation standards and regulatory requirements. Manufacturers focus on incorporating lightweight materials, advanced technology for personalization, and features that enhance passenger experience, including adjustable recline, personal entertainment systems, and connectivity options. Aircraft seats include components such as structure, foam, actuators, electrical fittings, and others. The design and configuration of aircraft seats are critical for airlines to optimize cabin space, differentiate service offerings, improve passenger satisfaction, and pilot & crew safety, ultimately influencing airline branding and revenue generation.

The market is driven by the constant evolution of technology, leading to the development of advanced seating solutions that contribute to fuel efficiency, increased comfort, and enhanced safety. Growing demand for modernized aircraft, increased air travel, and the imperative for regulatory compliance further propel the aircraft seating market.

Stakeholders

Various stakeholders of the market are listed below:

- Manufacturers of Aircraft Seats

- Suppliers of Aircraft Seating Parts

- Manufacturers of Subcomponents

- Retailers, Distributors, and Wholesalers of Aircraft Seating

- Airline Associations

- Private and Public Aircraft Seating Companies

- Regulators

- Technology Support Providers

Report Objectives

- To define, describe, segment, and forecast the size of the aircraft seating market based on platform, end-user, seat type, standard, seat material, and region.

- To forecast the market size of various segments of the aircraft seating market with respect to major regions, namely, North America, Europe, Asia Pacific, Middle East, Latin America, and Africa along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the aircraft seating market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze competitive developments such as contracts, partnerships, agreements, collaborations, acquisitions, funding, and new product launches & developments of key players in the market

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the aircraft seating market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies2

1 Micromarkets are referred to as the segments and subsegments of the Aircraft Seating market considered in the scope of the report.

2 Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aircraft Seating Market

I'd like to know the market size and growth of 9G seats compared to 16G seats, the market data for the last 20 years, and an estimate in future growth and size for these 2 segments.

Hi. I'm investigating an investment in an aircraft seating company and was just keen to know the relative size, the players, the split of the market in to First/Business/Premium Economy/Economy, and the split into OEM, Aftermarket, MRO. If there's any snippets you could provide that would be much appreciated. Thanks, Michael.

We are manufacturing and developing polymer material products which are used in the production of aircraft seats. As a wider business we have 8 manufacturing sites around Europe producing different polymer sheet products for many diverse markets.