Savory Ingredients Market by Ingredient Type (Monosodium Glutamate, Yeast Extracts, HVPS, HAPs, Nucleotides), Form (Powder, Liquid), Origin (Natural, & Synthetic), Application (Food, Feed) and Region - Global Forecast to 2029

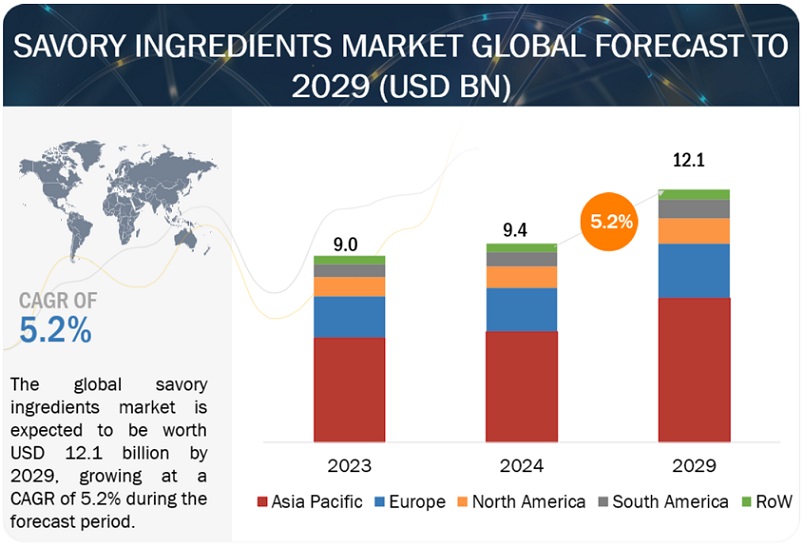

[350 Pages Report] The global savory ingredients market is on a trajectory of significant expansion, with an estimated value projected to reach USD 12.1 billion by 2029 from the 2024 valuation of USD 9.4 billion, displaying a promising Compound Annual Growth Rate (CAGR) of 5.2%. The demand for savory ingredient demand is rising sharply due to several important variables that are reshaping the industry. The demand for savory ingredients is being driven by a shift in consumer preferences towards rich, delicious foods. A wide variety of savory ingredients are required for a variety of food categories as consumers seek out items with rich taste profiles, fragrant flavors, and pleasant textures.

Furthermore, the growing demand for savory ingredients is being fueled by the growing acceptance of snacking culture, especially in cities. As hectic lifestyles become the norm, customers are choosing portable, easy-to-carry snacks that are satisfying and tasty. The demand for savory flavorings, and seasonings has surged as a result of this trend in the consumption of savory snacks such as chips, crackers, and nuts.

Moreover, consumers' culinary horizons are being broadened by globalization and cultural exchange, which is fostering a rising appreciation for a variety of foreign flavors. Savory ingredients that can develop real flavors from throughout the world are in higher demand as customers get increasingly creative with their culinary selections. This comprises ingredients that give foods influenced by different cultures depth and complexity, such as marinades, sauces, and spices.

In addition, the need for savory ingredients is being fueled by the food service sector's expansion, which includes QSR (quick-service restaurants), cafes, and restaurants. A broad range of savory ingredients is required to make dishes that are tempting and delectable since food service operations are continuously coming up with new menu items and innovations to meet the changing preferences of their guests.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Drivers:Increasing popularity of convenience food products

The market for savory ingredients is expanding due to the growing demand for convenience food products. Consumers are increasingly choosing ready-to-eat meals that are handy as their lives become more hectic and time-constrained. Demand for packaged foods, ready-to-eat meals, and snacks has increased as a result of this change in consumer behavior. These products mainly rely on savory ingredients to enhance flavor. Because they enhance the flavor profiles of convenience food products with depth, richness, and complexity, savory ingredients are essential to their creation. Savory components including seasonings, condiments, flavor enhancers, and chips and crackers are crucial elements that contribute to the flavor of a variety of foods, including frozen dinners, frozen snacks, and instant noodles.

Moreover, the convenience food sector continues to innovate and diversify, introducing new product offerings and flavor variations to cater to changing consumer preferences. This constant innovation drives the demand for a wide range of savory ingredients, as manufacturers seek to differentiate their products and capture market share in this competitive landscape.

Restraints: Stringent regulations on international quality standards

One of the primary obstacles resulting from strict rules is the load of compliance that savory ingredient suppliers and manufacturers bear. It is frequently necessary to make large investments in testing, paperwork, and research to comply with complex regulatory requirements and show that the product meets international quality standards. This may lead to higher manufacturing costs and administrative hassles, especially for smaller market participants who might not have the means and know-how to successfully negotiate the regulatory environment.

Furthermore, stringent regulations act as a barrier to entry for new market entrants, limiting competition and innovation within the savory ingredients market. Small-scale producers may find it challenging to meet the rigorous requirements for quality assurance and certification, thereby hindering their ability to penetrate new markets or expand their product offerings.

Opportunities: Rising demand for natural and healthy flavor ingredients

The market for savory ingredients has a lot of potential due to the growing desire for natural and healthful flavor ingredients. There is a growing demand for food products created with clean-label ingredients, devoid of artificial additives, preservatives, and flavorings, as people place a higher priority on their health and wellness.

Herbs, spices, fruits, and vegetables are examples of natural, savory items that are well-positioned to benefit from this trend. These natural flavor enhancers offer food goods nutritional advantages, a clean label appeal, and depth and complexity. Herbs like basil, thyme, and rosemary, for instance, are valued not only for their aromatic qualities but also for their health benefits like antioxidant activities.

Savory substances that can replace conventional salt-based flavorings are in greater demand as a result of growing awareness of the health hazards linked to excessive sodium intake. Seaweed-based spices, soy sauce, and yeast extracts are examples of umami-rich ingredients that can improve taste perception while lowering the overall sodium level of food products, making them desirable choices for health-conscious consumers.

Challenges: Consumer awareness about the ill effects of flavor enhancers

Savory ingredients pose a big challenge to consumer awareness of the negative consequences of flavor enhancers. Customers are paying more attention to the ingredients listed in food goods as worries about the possible health dangers linked to some artificial flavorings and chemicals grow.

A primary obstacle arising from consumer consciousness is the belief that savory products that incorporate artificial flavor enhancers are unhealthy or may be hazardous. Certain ingredients, including monosodium glutamate (MSG), have come under fire and unfavorable press since some people have reported experiencing allergic responses, nausea, and headaches. The market for savory ingredients that rely on artificial flavor enhancers has been impacted by customers' unwillingness to purchase products containing these chemicals as a result of their increased awareness.

Market Ecosystem

Powder, By Form, Accounted For The Highest Market Share Among Form Segment In 2023.

The powder form segment's popularity can be attributed to its versatility and convenience. Savory ingredients in powder form are easier to handle, store, and transport than in liquid or paste form. Because of this, they are excellent choices for a broad variety of uses in many cuisine categories, such as seasonings, snacks, soups, sauces, and prepared meals. Additionally, the powdered form ensures uniform flavor distribution and improves the finished product's overall sensory experience by enabling exact measurement and constant dispersion. Moreover, powdered savory ingredients frequently have better stability and longer shelf life, which makes them perfect for long-term preservation and storage.

Additionally, businesses can build individual flavor profiles and modify products to fit market trends and specific consumer preferences by using the powdered form, which enables flexibility in formulation. Powdered savory ingredients offer a flexible canvas for culinary creativity and product uniqueness, whether it's enhancing the umami taste of snacks or adding richness to culinary creations. Thus, as consumer demand for flavorful and convenient food products continues to rise, powdered savory ingredients are poised to maintain their leading position within the market, driving innovation and growth in the years to come.

Synthetic, By Origin, Accounted For The Highest Market Share Among Origin Segment In 2023.

When compared to natural alternatives, synthetic savory ingredients frequently show improved stability and shelf life. Because of the exact control over production processes, toxins, and impurities may be eliminated, giving ingredients a longer shelf life and a lower chance of spoiling. This increased stability is especially useful for producers of shelf-stable goods including seasonings, snacks, and packaged foods.

Furthermore, producers can benefit from lower costs and more efficient production with synthetic savory ingredients. Synthetic flavor ingredients are a more affordable option for large-scale production since they can be obtained in bulk at a lower cost than natural components. Furthermore, synthetic ingredients enable more flexibility and customization in product development by being adapted to certain flavor profiles and uses. Thus, from savory snacks and convenience foods to sauces, seasonings, and ready-to-eat meals, synthetic ingredients play a vital role in enhancing flavor and texture across diverse food categories.

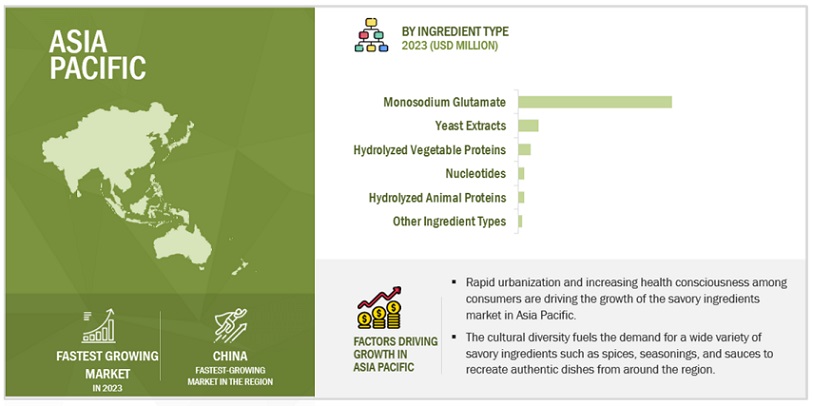

Asia Pacific Is The Fastest-Growing Market For Savory Ingredients Among The Regions.

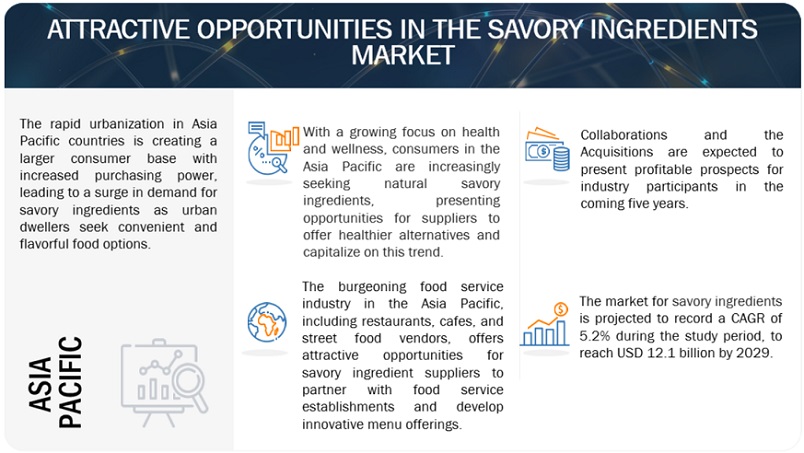

Due to the region's fast population growth, rising rates of urbanization, and rising disposable incomes, a growing consumer base with shifting tastes and preferences is produced. The desire for quick and tasty food options, such as savory snacks, ready-to-eat meals, and packaged goods that use savory ingredients to enhance flavor, is rising as urbanization and fast-paced lives increase.

Savory ingredients are in high demand due to Asia Pacific's diverse cultures and rich culinary legacy. East Asian cuisines are subtle and savory, whereas Southeast Asian cuisines are robust and spicy. The region offers a wide variety of cuisines, flavors, and ingredients. Due to consumer curiosity and experimentation sparked by this diversity, there is a growing demand for a broad range of savory ingredients, including sauces, seasonings, and spices, to make dishes that are authentic and full of flavor.

In addition, the market for savory ingredients is developing in Asia Pacific due to the growing popularity of international cuisines and the adoption of Western eating habits. Savory ingredients used in Western-style entrees, snacks, and convenience foods are in greater demand as global culinary trends impact consumer preferences. This presents chances for suppliers and manufacturers to launch products catering to regional tastes.

Key Market Players

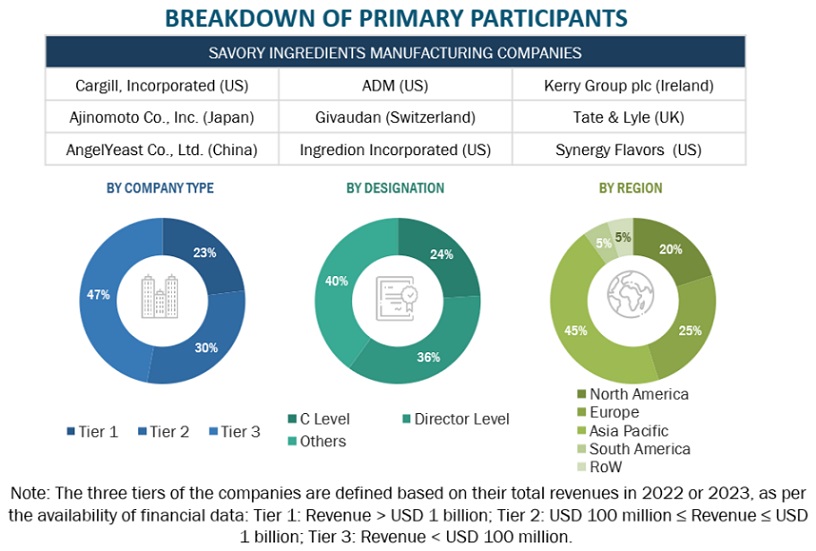

The key players in this market include Kerry Group plc. (Ireland), Ajinomoto Co., Inc. (Japan), Givaudan (Switzerland), Ingredion (US), Sensient Technologies Corporation (US), Symrise (Germany), Associated British Foods Plc (UK), ADM (US), DSM (Netherlands), Tate & Lyle (UK), Cargill, Incorporated (US), Novozymes (Denmark) and Corbion (Netherlands)

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments Covered |

By Ingredient Type, Origin, Form, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies studied |

|

This research report categorizes the savory ingredients market, based on ingredient type, form, origin, application, and region.

Target Audience

- Savory Ingredients Manufacturers

- Meat Producers

- Processed Meat Manufacturers

- Government Agencies (related to food safety and regulations such as FDA, EFSA, and FSSAI)

Savory Ingredients Market:

By Ingredient type

- Yeast Extracts

- Hydrolyzed Vegetable Proteins

- Hydrolyzed Animal Proteins

- Monosodium Glutamate

- Nucleotides

- Other Ingredient Types

By Origin

- Natural

- Synthetic

By Form

- Powder

- Liquid

- Other Forms

By Application

-

Food & Beverages

- Snacks

- Soups & Sauces

- Prepared Meals

- Processed Meats

- Convenience Foods

- Other Food & Beverages

- Pharmaceuticals

- Feed

- Other Applications

By Region

- North America

- Europex

- Asia-Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In January 2024, Ohly revealed ambitious modernization and expansion strategies for its production facilities, showcasing a strong dedication to sustainability and expansion. This strategic initiative not only boosts Ohly's competitive edge but also establishes the company as a frontrunner in sustainable innovation within the savory ingredients sector.

- In August 2023, Kerry Group plc completed the acquisition of Orchard Food for a sum exceeding $100 million, with the possibility of additional payments totaling up to $100 million over the next three years, subject to meeting predefined performance benchmarks. This purchase is in line with Kerry's continued strategy to strengthen its foothold in China and enhance its standing in the worldwide savory taste markets.

- In July 2021, Sensient Technologies Corporation announced the acquisition of Flavor Solutions, Inc., poised to substantially influence Sensient's standing in the savory ingredients market. Through the integration of Flavor Solutions' assets into its portfolio, Sensient is now positioned to provide an expanded array of flavors and flavor technologies to the food, beverage, and nutraceutical industries.

Frequently Asked Questions (FAQ):

What is the current size of the savory ingredients market?

The savory ingredients market is estimated at USD 9.4 billion in 2024 and is projected to reach USD 12.1 billion by 2029, at a CAGR of 5.2% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

The key players in the savory ingredients market include Kerry Group plc. (Ireland), Ajinomoto Co., Inc. (Japan), Givaudan (Switzerland), Ingredion (US), Sensient Technologies Corporation (US), Symrise (Germany), Associated British Foods Plc (UK), ADM (US), DSM (Netherlands), Tate & Lyle (UK), Cargill, Incorporated (US), Novozymes (Denmark) and Corbion (Netherlands).

The savory ingredients market witnesses increased scope for growth. The market is seeing an increase in the number of joint ventures, acquisitions, and new expansions. Moreover, the companies involved in manufacturing savory ingredients products are investing a considerable proportion of their revenues in research and development activities.

Which region is projected to account for the largest share of the savory ingredients market?

The Asia Pacific market is expected to dominate during the forecast period. Asia Pacific’s dominance in the savory ingredients market stems from a robust consumer awareness regarding health and wellness that has driven demand for savory ingredients. Additionally, the region boasts advanced food technology and research infrastructure, facilitating innovation in ingredient development. Moreover, stringent regulations ensure quality and safety standards, enhancing consumer trust. Unlike other regions, Asia Pacific’s affluent population and dietary preferences favor premium savory ingredients, further solidifying its market leadership.

What kind of information is provided in the company profile section?

The company profiles mentioned above offer valuable information such as a comprehensive business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Additionally, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What are the factors driving the savory ingredients market?

The demand for savory ingredients is surging globally due to evolving consumer tastes and preferences towards flavorful and indulgent food experiences. Consumers seek products that offer rich taste profiles, aromatic flavors, and satisfying textures, fueling the need for a diverse range of savory ingredients across various food categories. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

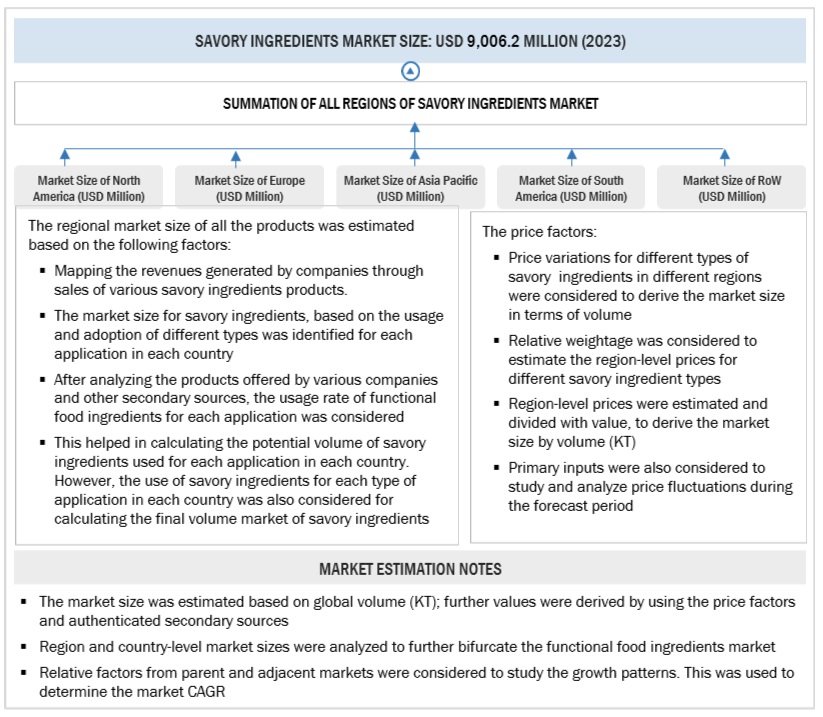

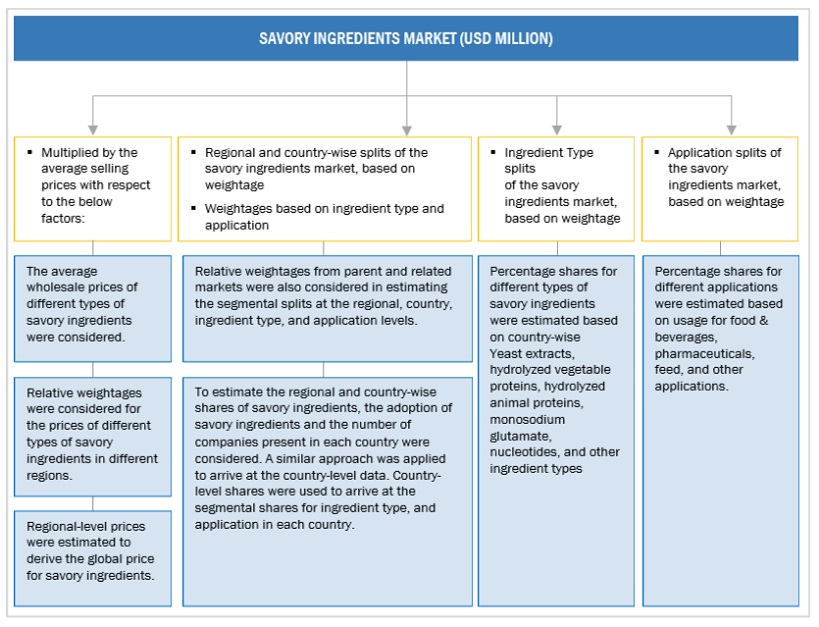

The study involved two major segments in estimating the current size of the savory ingredients market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the savory ingredients market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the savory ingredients market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, research, and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to savory ingredients type, form, origin, application, and region. Stakeholders from the demand side, such as meat products manufacturers who use the savory ingredients were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of savory ingredients and the outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

designation |

|

Ajinomoto Co., Inc. (Japan) |

Regional Sales Manager |

|

Kerry Group plc. (Ireland) |

Marketing Manager |

|

ADM (US) |

General Manager |

|

Tate & Lyle (UK) |

Head of Export Department |

|

AngelYeast Co., Ltd. (China) |

Sales Manager |

|

Cargill, Incorporated (US) |

Sales Executive |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total market size. These approaches were also used to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Savory Ingredients Market: Bottom-Up Approach.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Savory Ingredients Market: Top-Down Approach.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall savory ingredients market and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Savory ingredients are flavoring agents that do not have an individual flavor of their own but enhance the overall taste of food or feed products. Savory, also known as umami flavor, ingredients used in the form of powders, liquids, pastes, or sprays, are neither sour, bitter, sweet, or salty. Still, they have a significant impact on improving the flavor and aroma of the food products.

Savory ingredients are derived from natural or synthetic sources, which provide taste and appetizing fragrances to food or other food products influenced by aromatic spices, which enhance the flavor. Some major types of savory ingredients that find applications in food and feed sectors include monosodium glutamate, yeast extracts, nucleotides, hydrolyzed vegetable proteins, and hydrolyzed animal proteins.

Key Stakeholders

- Raw material suppliers

- Savory ingredients manufacturers and suppliers

- Foodservice and restaurant operators

- Retailers & Distributors

- Commercial research & development (R&D) institutions and financial institutions

- Importers and exporters of savory ingredients

- Food & beverage traders, distributors, and suppliers

- Government organizations, research organizations, consulting firms, trade associations, and industry bodies

-

Associations, regulatory bodies, and other industry-related bodies:

- United States Department of Agriculture (USDA)

- The European Food Information Council (EUFIC)

- International Association of Food Industry Suppliers

- International Foodservice Manufacturers Association

- European Food Safety Authority (EFSA)

- Food and Drug Administration (FDA)

- American Spice Trade Association (ASTA)

- European Spice Association (ESA)

- Flavor and Extract Manufacturers Association (FEMA)

- Intermediary suppliers such as traders, distributors, and suppliers of ingredients and end products

Report Objectives

- To define, segment, and forecast the global savory ingredients market based on ingredient type, origin, form, application, and region over a historical period ranging from 2019 to 2023 and a forecast period ranging from 2024 to 2029.

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across the regions.

- Analyzing the demand-side factors based on the following:

- Impact of macro and microeconomic factors on the market.

- Shifts in demand patterns across different subsegments and regions.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments, such as partnerships, mergers & acquisitions, product developments, and expansions & investments in the savory ingredients market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of European market for savory ingredients into Denmark, Poland, and Norway.

- Further breakdown of the Rest of Asia Pacific market for savory ingredients into Singapore, Indonesia, Thailand, Vietnam, Malaysia, and the Philippines.

- Further breakdown of the Rest of South American market for savory ingredients into Chile, Peru, and Colombia.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Savory Ingredients Market