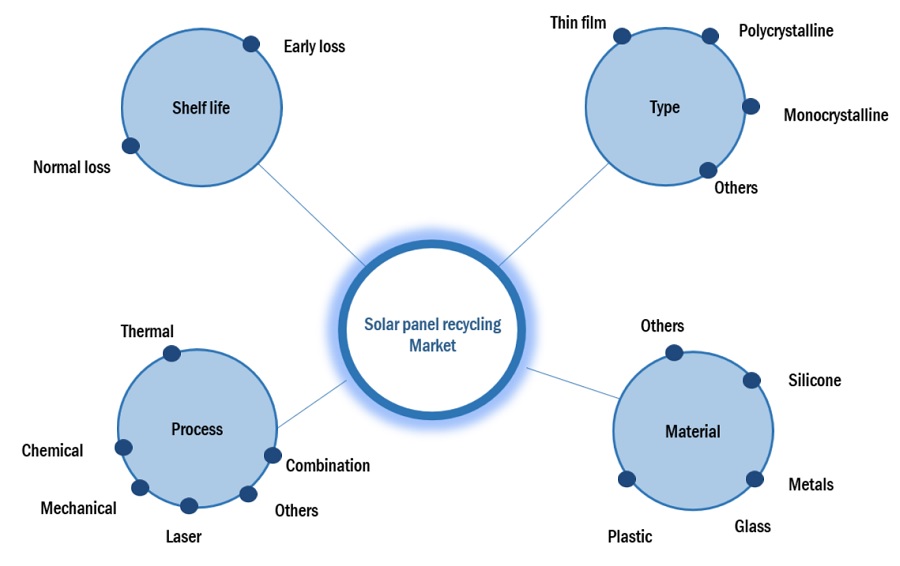

Solar Panel Recycling Market by Type (Monocrystalline, Polycrystalline, Thin Film), Process (Thermal, Chemical, Mechanical, Laser, Combination), Shelf Life (Early Loss, Normal Loss), Material (Metal, Glass, Plastic, Silicone) - Global Forecast to 2029

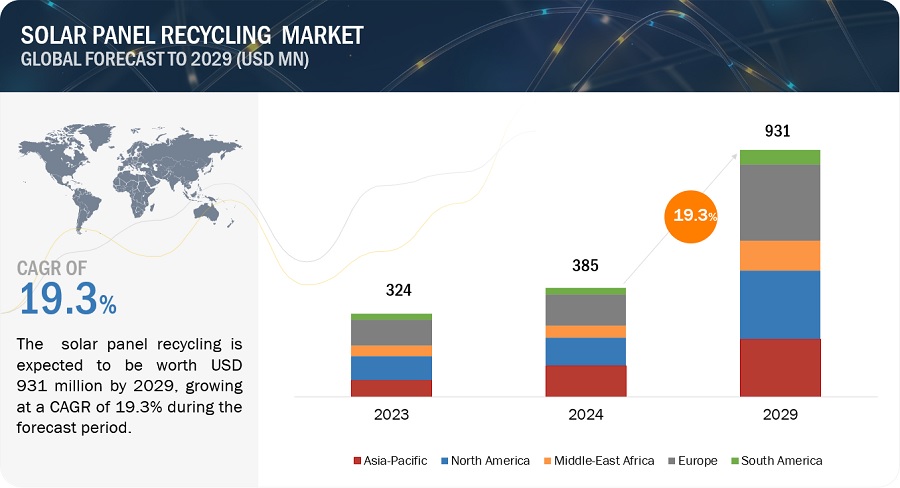

The solar panel recycling market is projected to reach USD 931 million by 2029, at a CAGR of 19.3% from USD 385 million in 2024. The global solar panel recycling market is primarily driven primarily by the surge in solar panel installations worldwide and the consequent increase in waste panels due to their limited lifespan. As environmental regulations tighten and governments become increasingly committed to sustainable disposal practices, the need for efficient recycling solutions becomes critical. This regulatory push, coupled with the scarcity of raw materials like silicon and precious metals used in photovoltaic cells, is a major driving factor for the industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Solar Panel Recycling Market

Market Dynamics

Driver: the demand for recovery and reuse of materials from the solar panel recycling

The burgeoning demand for the solar panel recycling market is primarily driven by the substantial increase in solar panel waste anticipated as the first generations of photovoltaic (PV) installations approach the end of their operational life, typically around 25 to 30 years. Since the early 2000s, there has been a significant global surge in solar installations, fueled by the push for renewable energy sources to combat climate change. Consequently, as these early installations begin to age out, the volume of decommissioned solar panels is set to rise dramatically, creating an urgent need for effective recycling solutions. This situation is further exacerbated by the inherent material composition of solar panels, which includes valuable but hazardous materials such as silicon, silver, and lead. The recycling of these materials is not only economically beneficial—recovering precious metals and high-quality silicon—but it is also critical for environmental protection, as improper disposal can lead to toxic chemical leaching and other forms of environmental degradation.

Moreover, the regulatory landscape is increasingly favoring the recycling industry. Governments around the world are implementing stricter waste management regulations and setting ambitious sustainability targets, which include mandates for the recycling of renewable energy installations. This regulatory framework compels manufacturers and installers to consider the end-of-life phase of solar panels more seriously, thereby bolstering the market for solar panel recycling. For instance, the European Union's Waste Electrical and Electronic Equipment Directive (WEEE Directive) requires the collection and recycling of e-waste, which includes used solar panels. As technology in the recycling sector advances, the processes are becoming more cost-effective and efficient, improving the recovery rates of valuable materials and reducing the overall environmental footprint of solar energy. These advancements present significant opportunities for growth in the solar panel recycling sector, offering a sustainable solution to manage the impending influx of solar waste while supporting the circular economy in the renewable energy industry.

Restraint: Economic Viability Challenges in the Global Solar Panel Recycling Market

One major restraint impacting the global solar panel recycling market is the economic viability and cost-effectiveness of the recycling process. Despite the growing necessity to recycle aging solar panels, the economic hurdles associated with the recycling operations can significantly impede market growth. Solar panels are primarily composed of glass, which accounts for about 75% of their weight, and the remaining materials include precious metals like silver and rare materials such as indium, as well as plastics and aluminum. The cost of extracting and refining these materials, especially the smaller quantities of precious and rare metals, often surpasses the potential revenue from selling the reclaimed materials. This discrepancy can lead to financial losses unless supported by additional funding or subsidies. Additionally, the initial investment required for establishing recycling facilities that can safely and effectively process solar panels is substantial. Advanced machinery and technology are needed to disassemble and recover high-value materials without releasing toxic substances into the environment. This high capital expenditure can deter new entrants into the market and limit the expansion of existing operations, particularly in regions where regulatory incentives or financial support mechanisms are lacking.

Opportunity: Emerging Technologies in Solar Panel Recycling: Enhancing Efficiency and Sustainability

One significant opportunity in the solar panel recycling market is the advancement and integration of new recycling technologies that enhance the efficiency and effectiveness of material recovery. As solar panels reach the end of their lifecycle, the demand for methods to reclaim and repurpose valuable components such as silicon, silver, and aluminum increases. Current recycling technologies face challenges such as low recovery rates of these valuable materials and high operational costs. However, emerging technologies promise to revolutionize this landscape by increasing the purity and amount of recovered materials while reducing energy consumption and operational costs associated with recycling.

Innovative processes like mechanical-hybrid recycling techniques, which combine mechanical processing with advanced chemical treatments, are being developed to improve the separation and purification of materials. For example, new methods that use chemical leaching to dissolve and recover precious metals at a higher purity level are being explored. These technological advancements not only enhance the economic viability of recycling operations by maximizing the resale value of recovered materials but also reduce the environmental impact associated with traditional recycling methods, which often involve intensive energy consumption and potentially harmful emissions.

Furthermore, such technologies present a lucrative opportunity for companies in the recycling industry to differentiate themselves in a competitive market. By adopting advanced recycling technologies, companies can offer more efficient and environmentally friendly services, appealing to both consumers and regulators focusing on sustainable practices. This adoption also opens up new revenue streams; recycled materials can potentially be sold at a premium due to their lower environmental footprint compared to virgin materials. As the volume of end-of-life solar panels increases globally, the opportunity to capitalize on advanced recycling technologies will play a crucial role in shaping the future of the solar panel recycling market. This not only aligns with global sustainability goals but also meets the growing consumer and regulatory demand for greener recycling processes.

Challenge: Regulatory Fragmentation: A Barrier to Sustainable Growth in Solar Panel Recycling

One of the key challenges facing the solar panel recycling market is the lack of standardized regulations across different regions. This inconsistency can create significant hurdles for recycling companies, who must navigate a complex landscape of varying compliance requirements, which can differ widely from one country to another. In some regions, stringent regulations may mandate the recycling of solar panels and other electronic waste, providing clear guidelines and sometimes financial incentives for recycling. However, in other parts of the world, such regulations may be lax or non-existent, offering little motivation for solar panel manufacturers and owners to recycle, thus limiting the development of a robust recycling infrastructure.

This regulatory fragmentation can lead to several issues. First, it complicates the ability of recycling companies to operate on a global scale, as they must adapt their operations and strategies to meet the specific legal demands of each market. This can increase operational costs, reduce efficiencies, and potentially deter investment in recycling technology advancements. Furthermore, the lack of uniformity can lead to "recycling deserts," areas where recycling facilities are sparse due to unfavorable regulatory environments. This not only makes it more difficult and expensive to recycle panels but can also lead to higher rates of illegal dumping or improper disposal of solar waste, exacerbating environmental impacts.

Moreover, the absence of harmonized regulations can stifle innovation within the recycling industry. Without consistent standards, there may be less incentive for companies to invest in developing new recycling technologies or improving existing processes that could make recycling more cost-effective and efficient. This lack of innovation further compounds the difficulties of recycling solar panels, making it challenging to keep pace with the increasing quantity of solar waste as installations continue to grow worldwide.

Addressing this challenge will require concerted efforts from policymakers, industry leaders, and international organizations to advocate for and implement standardized, enforceable regulations that promote responsible and efficient recycling practices globally. Such efforts are crucial to ensure that the solar panel recycling market can fully develop and contribute to the sustainability of the solar energy industry.

MARKET ECOSYSTEM

The market ecosystem for solar panel recycling is composed of a diverse array of entities and stakeholders that collectively contribute to the development, implementation, and advancement of solar panel recycling materials. At the core of this ecosystem are material providers who focus on research, development, and manufacturing of electronic wet chemicals. They continuously innovate and produce novel materials and their applications to meet the evolving demands of the market.

The key players in this market are First Solar, Inc. (US), ReilingGmbh & Co.Kg (Germany), THE RETROFIT COMPANIES, INC. (US), Rinovasol Group (Netherlands), we recycle solar (US), ROSI SOLAR (France), SILCONTEL LTD (Israel), Etavolt Pte. Ltd. (Singapore), PV Industries Pty Ltd (Australia), Solarcycle Inc. (US), etc.

Solar Panel Recycling Market: Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Polycrystalline is the largest sub-segment amongst the type segment in the solar panel recycling market in 2024, in terms of value."

Polycrystalline silicon solar panels have been a staple in the solar energy industry due to their cost-effectiveness and broad accessibility, which naturally positions them as a substantial component of the solar panel recycling market. Historically more affordable than monocrystalline panels, polycrystalline solar panels have been widely adopted for both residential and large-scale solar projects, particularly in cost-sensitive markets. This widespread deployment has led to a significant accumulation of polycrystalline panels that are now reaching the end of their typical lifespan of 25 to 30 years, thereby entering the waste stream in large volumes and underscoring their prominence in the recycling sector.

The structure of polycrystalline panels, made from multiple silicon crystals melted together, not only makes them less efficient at converting sunlight into energy compared to monocrystalline panels but also presents unique challenges in recycling. The process of breaking down these panels to recover valuable materials such as silicon, silver, and aluminum involves complex mechanical and chemical treatment methods. These materials, particularly silicon, can be repurposed for new solar panels or other products, making the recycling process economically and environmentally significant.

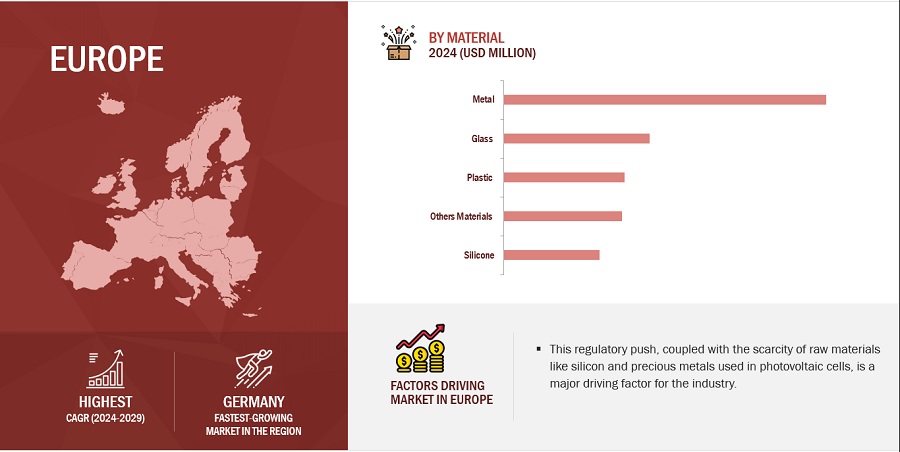

“Metals accounted for the largest by material share of the solar panel recycling market in 2024” in terms of value.

Metals, especially aluminum, are prominently recovered from solar panel recycling, constituting a significant segment of the market due to various pivotal factors. Aluminum, widely used in the frames of solar panels for its excellent strength-to-weight ratio, corrosion resistance, and durability, is prevalent in solar panel construction. This prevalence ensures that a large volume of aluminum is available for recovery when panels are decommissioned. Recycling metals like aluminum from solar panels is relatively straightforward compared to other materials such as silicon or glass. Processes like shredding, magnetic separation, and other sorting technologies efficiently separate and purify these metals, making the recycling process economically viable and technically feasible.

The economic incentives for recycling metals are robust. Metals retain high resale values, and materials like aluminum and copper are in demand across various industries, including automotive, construction, and electronics. This broad market applicability enhances the economic attractiveness of metal recovery, driving investments and technological advancements in this recycling sector. Additionally, the environmental benefits of metal recycling are substantial. For instance, producing aluminum from recycled materials consumes about 95% less energy than manufacturing it from raw bauxite, which not only saves energy but also significantly reduces greenhouse gas emissions. This efficiency supports the sustainability goals of the renewable energy sector by conserving natural resources and minimizing environmental footprints.

Furthermore, regulatory frameworks in many regions advocate for or mandate the recycling of electronic waste, including metals from solar panels. These regulations often prioritize the recovery of valuable materials due to their economic and environmental advantages, promoting the development of specialized recycling infrastructures focused on metals. This regulatory support, combined with the inherent economic and environmental benefits of metal recovery, ensures that this segment remains the largest and most profitable within the solar panel recycling market, emphasizing its crucial role in the sustainability of solar energy implementation.

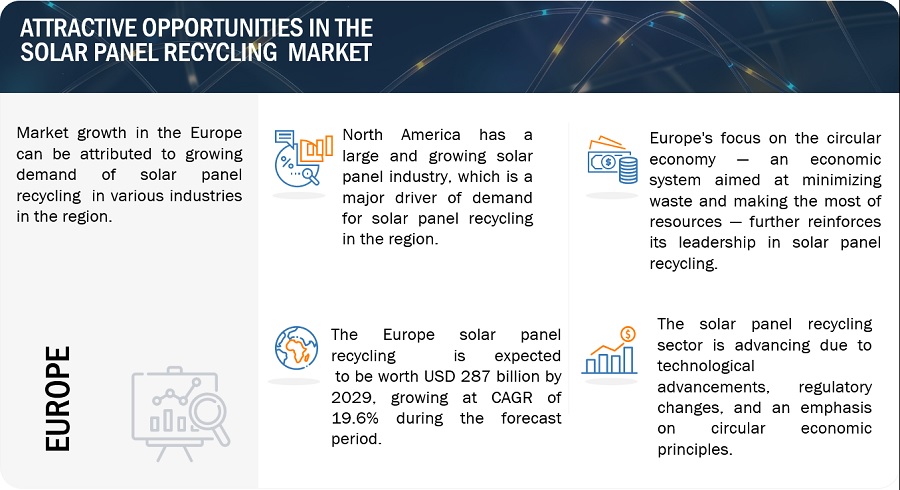

"Europe is the largest market for solar panel recycling Market in 2024, in terms of value."

Europe stands as the largest market for solar panel recycling, a status driven by a combination of advanced environmental regulations, high adoption rates of solar energy, and a proactive approach to the circular economy. The European Union has been a pioneer in implementing stringent environmental policies which mandate the responsible disposal and recycling of electronic waste, including solar panels. Legislation such as the Waste Electrical and Electronic Equipment Directive (WEEE Directive) requires the collection and recycling of electronic items, setting high recovery targets that foster a robust recycling infrastructure across member states. Furthermore, Europe’s commitment to sustainability and renewable energy has led to widespread installation of solar panels over the past few decades. As these installations age and reach the end of their operational life, the volume of solar panels needing disposal has surged, creating a significant demand for recycling services. This demand is well-supported by the continent's advanced recycling technology and facilities, which are capable of efficiently processing large quantities of solar waste. Additionally, Europe's focus on the circular economy — an economic system aimed at minimizing waste and making the most of resources — further reinforces its leadership in solar panel recycling. The European Commission has actively promoted circular economy principles, which encourage not just recycling but also the reuse of materials to reduce the environmental impact of raw material extraction and waste. This holistic approach enhances the viability and necessity of solar panel recycling within the European market.

The combination of forward-thinking policies, high solar adoption rates, sophisticated recycling technologies, and a strong emphasis on sustainability positions Europe as a leader in the global solar panel recycling market. This leadership not only helps reduce landfill waste and conserve resources but also sets a standard for other regions aiming to integrate similar environmentally responsible practices in their solar energy sectors.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market are First Solar, Inc. (US), Reiling Gmbh & Co.Kg (Germany), THE RETROFIT COMPANIES, INC. (US), Rinovasol Group (Netherlands), we recycle solar (US), ROSI SOLAR (France), SILCONTEL LTD (Israel), Etavolt Pte. Ltd. (Singapore), PV Industries Pty Ltd (Australia), Solarcycle Inc. (US), etc. Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of solar panel recycling have opted for new product launches to sustain their market position.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2020-2029 |

|

Base Year |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Value (USD Billion/Million), Volume (Million Panels) |

|

Segments |

Type, Process, Material, Shelf life and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

First Solar (US), Reiling GmbH & Co.KG (Germany), The Retrofit Companies, Inc. (US), Rinovasol Global Services B. V. (Netherlands), We Recycle Solar (US), ROSI (France), SILCONTEL LTD (Israel), Etavolt Pte. Ltd. (Singapore), PV Industries Pty Ltd (Australia), SOLARCYCLE, Inc. (US) |

Segmentation

This report categorizes the global Solar panel recycling market based on type, process, material, shelf life and region.

On the basis of type, the market has been segmented as follows:

- Monocrystalline

- Polycrystalline

- Thin Film

- Others

On the basis of process, the market has been segmented as follows:

- Thermal

- Chemical

- Mechanical

- Laser

- Combination

- Others

On the basis of material, the market has been segmented as follows:

- Silicon

- Metal

- Plastic

- Glass

- Others

On the basis of shelf life, the market has been segmented as follows:

- Early Loss

- Normal Loss

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- First solar in April 2023, with support from a $1.3 million grant from the U.S. Department of Energy’s Solar Energy Technologies Office, scientists at the University of Kansas are on the brink of tackling the impending waste crisis in the solar industry. Partnering with the Idaho National Laboratory and First Solar Inc., researchers at KU’s Center for Environmentally Beneficial Catalysis are working on a cost-effective approach to extract and repurpose components from decommissioned solar panels for recycling purposes.

- First solar in April 2023, has recently entered into a master supply agreement (MSA) with Silicon Ranch, a prominent independent power producer, to provide 4 gigawatts (GW)DC of advanced, responsibly-produced thin film photovoltaic (PV) solar modules. It's responsibly produced advanced thin film PV modules engineered and crafted at First Solar's research and development (R&D) hubs in California and Ohio, are renowned for setting industry standards in quality, durability, reliability, design, and environmental performance. As part of the agreement, First Solar's advanced high value recycling program will handle end-of-life CadTel modules from Silicon Ranch projects, recovering approximately 90 percent of CadTel material. This material is then repurposed to manufacture new modules, alongside other materials like aluminum, glass, and laminates. Moreover, the recycled glass can be transformed into useful glass products, while laminates can be processed into rubber products such as shoe soles and bicycle handles. First Solar presently operates commercial recycling facilities in the US, Germany, Malaysia, and Vietnam.

- The U.S. International Development Finance Corporation (DFC) announced a $500 million loan to facilitate the construction of First Solar's latest facility. This investment aims to enhance supply chain diversity within a vital sector and stimulate economic development in India.

- First Solar has successfully secured a revolving credit facility worth $1 billion, valid for a period of five years.

- Reiling GmbH & Co. KG in march 2022, In Germany, approximately ten thousand tonnes of silicon from outdated photovoltaic modules are recycled annually, with projections indicating this figure will rise to several hundred thousand tonnes per year by 2029. Presently, only the aluminum, glass, and copper components of old modules undergo recycling, while the silicon solar cells remain unprocessed.

- REILING GMBH & CO.KG In collaboration with its Swiss partner, KWB Planreal AG in the Swiss PV Circle project. This initiative, spearheaded by SENS eRecycling, Swissolar, and the Bern University of Applied Sciences, alongside other stakeholders from the solar and energy sectors, aims to identify the most effective recycling approach for photovoltaic modules at the conclusion of their initial life cycle, utilizing data-driven insights. The project seeks to reintroduce efficient photovoltaic modules back into the market as second-hand units.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the solar panel recycling market?

This study's forecast period for the solar panel recycling market is 2023-2028. The market is expected to grow at a CAGR of 19.3% in terms of value, during the forecast period.

Who are the major key players in the solar panel recycling market?

The key players in this market are First Solar (US), Reiling GmbH & Co.KG (Germany), The Retrofit Companies, Inc. (US), Rinovasol Global Services B. V. (Netherlands), We Recycle Solar (US), ROSI (France), SILCONTEL LTD (Israel), Etavolt Pte. Ltd. (Singapore), PV Industries Pty Ltd (Australia), Solarcycle, Inc. (US), etc. are the leading manufacturers and service provider of solar panel recycling market.

What are the emerging trends in the Solar panel recycling market?

The solar panel recycling market is evolving, driven by technological innovations, regulatory developments, and a focus on the circular economy. Improved recycling technologies, stricter regulations, and repurposing materials for new products indicate a robust future, with the industry becoming more sustainable and efficient, aligned with global environmental goals and resource conservation.

What are the drivers and opportunities for the solar panel recycling market?

The solar panel recycling market is driven by the increasing number of end-of-life panels from global installations and tightening environmental regulations. Opportunities lie in developing efficient recycling technologies, expanding infrastructure in growing solar markets, and aligning with consumer demand for sustainability, fostering a circular economy within the industry.

What are the restraining factors in the solar panel recycling market?

Challenges facing the solar panel recycling market include the lack of standardized regulations globally, hindering operational consistency and increasing costs. Insufficient investment in recycling infrastructure and technology, along with logistical complexities in transporting bulky panels, also pose barriers to market growth, impeding efficient and widespread recycling practices. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the Solar panel recycling market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The solar panel recycling market comprises several stakeholders in the value chain, which include solar panel recyclers, research & development, recycling facilities, and end users. Various primary sources from the supply and demand sides of the Solar panel recycling market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include recyclers, associations, and institutions involved in the solar panel recycling industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to material, type, shelf-life, process and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, fabricators, and their current usage of solar panel recycling material and the outlook of their business, which will affect the overall market.

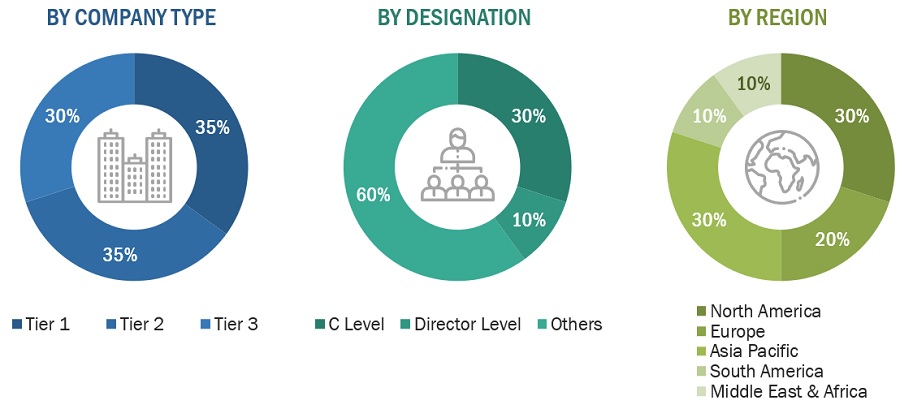

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company name |

Designation |

|

ROSI (France) |

Manager |

|

PV Industries Pty Ltd (Australia) |

Senior Engineer |

|

Reiling Gmbh & Co.KG. (Germany) |

Director of Product Marketing |

|

First Solar (US) |

Senior Plant Manager |

|

We Recycle Solar (US) |

R&D Manager |

MARKET SIZE ESTIMATION

The top-down and bottom-up approaches have been used to estimate and validate the size of the Solar panel recycling market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Solar Panel Recycling Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Solar Panel Recycling Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Solar panel recycling refers to the process of collecting, dismantling, and recovering valuable materials from end-of-life solar panels to minimize waste and maximize resource utilization. It involves the extraction and separation of materials such as glass, aluminum, silicon, and other metals from decommissioned solar panels, which can then be reused in manufacturing new panels or other products.

The market for solar panel recycling encompasses a range of activities and services aimed at managing the growing volume of retired solar panels sustainably. This includes the development of recycling technologies, establishment of collection and processing facilities, implementation of regulatory frameworks, and provision of recycling services by specialized companies. As the adoption of solar energy continues to increase globally, driven by environmental concerns and renewable energy targets, the need for effective and efficient solar panel recycling solutions becomes paramount.

Key Stakeholders

- Solar panel recyclers

- Recycling Facilities

- Waste Management Companies

- Research organizations

- Governments and research organizations

- Regulatory bodies

- Environment support agencies

- End-users

Report Objectives

- To define, describe, and forecast the size of the solar panel recycling market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on product type, process, shelf-life, material and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Solar Panel Recycling Market