Synthetic Latex Polymers Market by Type (Styrene Acrylic, Acrylic, Styrene Butadiene, Vinyl Acetate Ethylene, Polyvinyl Acetate, Vinyl Acetate Copolymer), Application (Paints & Coatings, Adhesives & Sealants, Nonwovens), & Region - Global Forecast to 2029

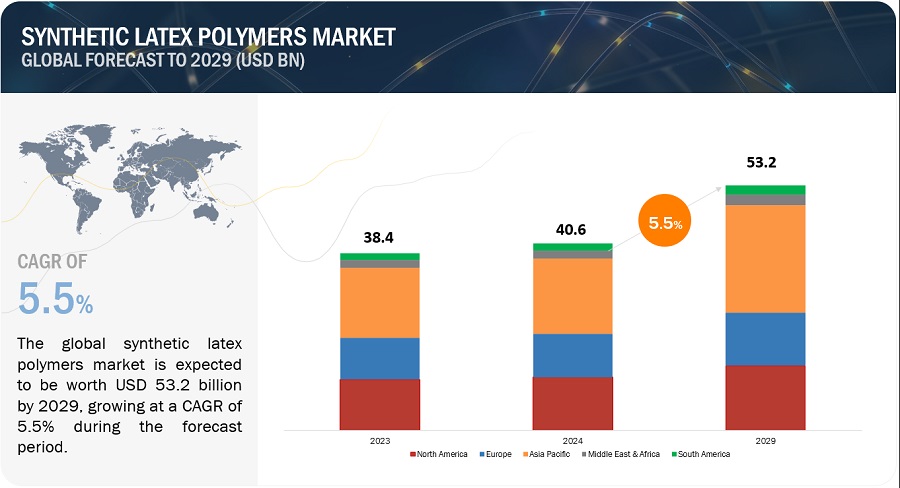

The global synthetic latex polymers market size is projected to reach USD 53.2 billion by 2029 from USD 40.6 billion in 2024, at a CAGR of 5.5% during the forecast period. The synthetic latex polymers market is projected to grow significantly in the coming years. Synthetic latex polymers, often referred to as simply synthetic latex, are artificially produced materials composed of polymer particles dispersed in water. These polymers are created through a process called emulsion polymerization, where monomers such as styrene, butadiene, acrylic acid, vinyl acetate, or ethylene undergo polymerization in an aqueous medium with the aid of surfactants or colloids. This process results in the formation of stable latex emulsions containing polymer particles suspended in water.

Global Synthetic Latex Polymers Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Synthetic Latex Polymers Market Dynamics

Driver: Increasing demand in the paints and coatings industry

The increasing demand for synthetic latex polymers in the paints and coatings industry is driven by their outstanding performance, environmental advantages, cost efficiency, and compliance with evolving market trends and regulatory standards. These polymers provide excellent durability, flexibility, and adhesion, resulting in long-lasting, high-quality finishes suitable for both interior and exterior uses. Their superior water resistance and low emissions of volatile organic compounds (VOCs) make them ideal for healthier indoor environments and adhering to strict environmental regulations. Furthermore, their non-toxic nature ensures safer options for both applicators and occupants.

Restraint: Volatility in raw materials prices

Volatility in raw material prices presents a significant restraint for the synthetic latex polymers market, impacting both producers and consumers across the supply chain. Petrochemicals serve as the primary raw materials for synthetic latex polymer production, and their prices are highly susceptible to fluctuations influenced by diverse factors including supply-demand dynamics, geopolitical tensions, and macroeconomic conditions. Sudden spikes or declines in raw material prices disrupt the cost structures of synthetic latex polymer manufacturers, introducing uncertainty into production planning and profitability projections. This unpredictability poses challenges for producers in passing on increased costs to consumers, particularly in fiercely competitive markets where price sensitivity is high, potentially compressing profit margins and hindering financial stability. Furthermore, the volatility in raw material prices can act as a deterrent to investments in capacity expansion or new product development initiatives, restraining industry growth and innovation.

Opportunity: Growing demand in the electronics industry

The growing demand in the electronic industries presents significant opportunities for the synthetic latex polymers market due to their versatile applications in electronic components, manufacturing processes, and device protection. Synthetic latex polymers offer several key advantages that align with the evolving needs of the electronics sector, including superior adhesion, insulation properties, and moisture resistance. These polymers are commonly used in the production of coatings, adhesives, and encapsulants for electronic devices, providing protection against moisture, dust, and mechanical stress. With the increasing complexity and miniaturization of electronic components, there is a rising demand for advanced materials that can offer precise control over properties such as thermal conductivity, dielectric strength, and chemical resistance.

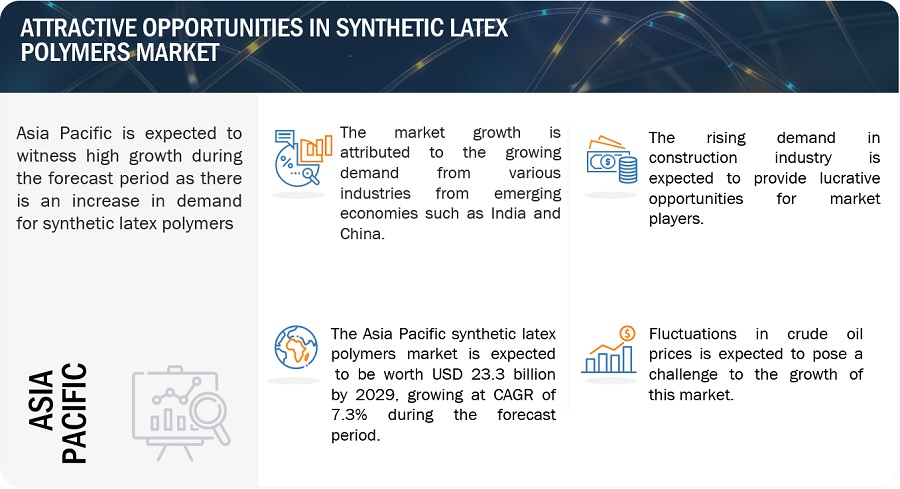

Challenges: Fluctuating Crude Oil Prices

Fluctuating crude oil prices pose a significant challenge for the synthetic latex polymers market due to their reliance on petrochemical-derived raw materials. Synthetic latex polymers are primarily manufactured using petroleum-based feedstocks such as styrene, butadiene, and acrylate monomers, which are directly impacted by changes in crude oil prices. When crude oil prices experience sudden spikes or declines, it directly affects the cost structure of synthetic latex polymer production, creating uncertainty for manufacturers. Abrupt increases in crude oil prices lead to higher production costs for synthetic latex polymers, which can be challenging for producers to absorb or pass on to consumers, particularly in competitive markets where price sensitivity is high. On the other hand, sharp declines in crude oil prices may initially reduce raw material costs, but this may not translate into proportional savings for synthetic latex polymer manufacturers due to factors such as inventory management, contractual obligations, and market dynamics.

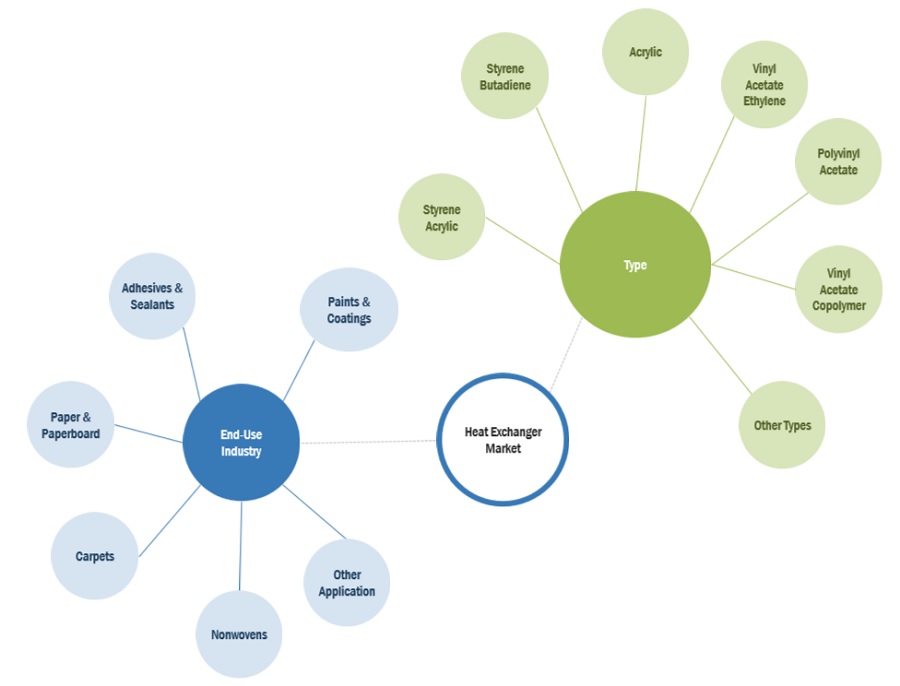

Market Ecosystem

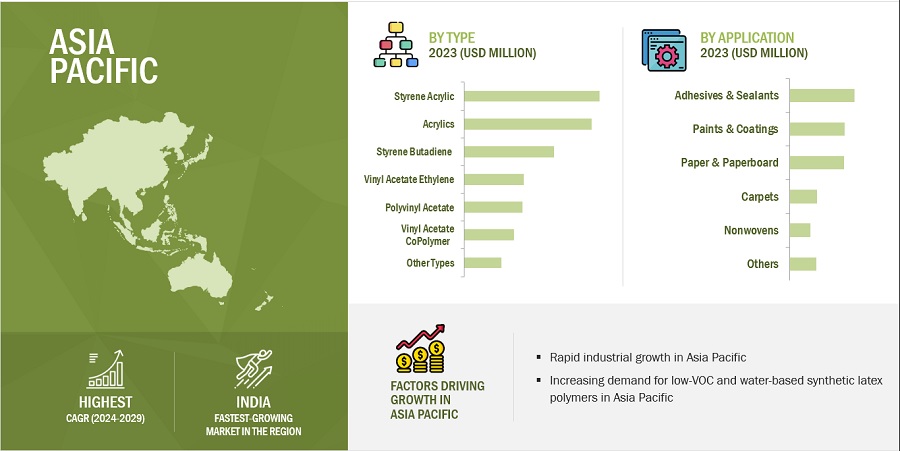

By type, styrene acrylic is the second fastest in the synthetic latex polymers market, in 2023.

Styrene acrylic synthetic latex polymers offer improved adhesion, durability, and resistance to water in coatings and adhesives, making them well-suited for the construction industry. Particularly in the paints & coatings sector, styrene acrylic latex is gaining prominence in building construction and roof coatings due to its versatility, heat sealability, salt stability, and water resistance. The styrene acrylic segment is projected to dominate the market in the coming years owing to the growing demand for weatherproof coatings.

By application, adhesives & sealants segment is the second fastest growing application in the synthetic latex polymers market, in 2023.

Synthetic latex polymers are primarily utilized in adhesives and sealants owing to their exceptional properties. Within the construction sector, synthetic latex polymers assume a pivotal role in enhancing the efficacy of adhesives and sealants by boosting adhesion, water resistance, and flexibility in cements and asphalts. This ensures the formation of sturdier and longer-lasting bonds. Moreover, the adaptability of synthetic latex polymers permits one- or two-sided application, in contrast to natural latex, which necessitates two-sided application consistently. This renders synthetic latex polymers more convenient and effective for adhesive and sealant applications.

Asia Pacific accounted for the largest market share in the synthetic latex polymers market, in terms of value.

The Asia-Pacific region, encompassing countries such as China, India, and Japan, is witnessing notable urbanization and construction advancement, driving substantial demand for synthetic latex polymers across diverse applications including paints & coatings, textiles, adhesives & sealants, and non-woven fabrics. Notably, key synthetic latex polymer producers such as BASF SE, Dow, Arkema Group, LG Chem, and KUMHO PETROCHEMICAL are concentrated in the Asia-Pacific, underscoring the region's prominence in the market. In Southeast Asia, countries such as Thailand, Malaysia, and Indonesia hold significant shares of synthetic latex polymers consumption, with specific variants such as acrylonitrile-butadiene (AB nitrile) and styrene acrylics commanding the market, affirming the region's robust position in the synthetic latex polymers sector.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the key players operating in the synthetic latex polymers market include Arkema (France), Wacker Chemie AG (Germany), Synthomer PLC (UK), LG Chem (South Korea), Celanese (US), Trinseo (US), Dow (US), BASF SE (Germany), Apcotex (India), ARLANXEO (The Netherlands), H.B. Fuller (US), Asahi Kasei Corporation (Japan), The Lubrizol Corporation (US), and ZEON CORPORATION (Japan) among others.

These companies have adopted various organic as well as inorganic growth strategies between 2019 and 2024 to strengthen their positions in the market. The new product launch is the key growth strategy adopted by these leading players to enhance regional presence and develop product portfolios to meet the growing demand for synthetic latex polymers from emerging economies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2020-2029 |

|

Base Year |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Units; Value (USD Million) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Arkema (France), Wacker Chemie AG (Germany), Synthomer PLC (UK), LG Chem (South Korea), Celanese (US), Trinseo (US), Dow (US), BASF SE (Germany), Apcotex (India), ARLANXEO (The Netherlands), H.B. Fuller (US), Asahi Kasei Corporation (Japan), The Lubrizol Corporation (US), and ZEON CORPORATION (Japan). |

This report categorizes the global synthetic latex polymers market based on material, type, end-use industry, and region.

Based on the type:

- Styrene Acrylic

- Acrylic

- Styrene Butadiene

- Vinyl Acetate Ethylene

- Polvinyl Acetate

- Vinyl Acetate Copolymer

- Other Types

Based on the application:

- Paints & Coatings

- Adhesives & Sealants

- Nonwovens

- Paper & Paperboard

- Carpet

- Other Application

Based on the region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In March 2024, Trinseo launched LIGOS C 9484, a vinyl acrylic latex binder designed for architectural coatings. The product helped the company to deliver a strong hiding performance, leveling properties, and excellent washability. It makes coating applications extremely durable.

- In July 2022, Arkema acquired Polimeros Especiales, a Mexico-based producer of waterborne resins for various applications. This acquisition is part of Arkema's strategy to expand its coating solutions segment in growing markets and low-volatile organic compound solutions.

- In April 2024, Celanese has expanded its business by starting a new vinyl acetate ethylene (VAE) unit in Nanjing, China. The newly established VAE unit enhanced the capacity by 70 kt, empowering the acetyl chain segment to effectively meet the rising regional demand for both VAE and downstream RDP products in Asia.

Frequently Asked Questions (FAQ):

What is the current market size of the global synthetic latex polymers market?

Global synthetic latex polymers market size is estimated to reach USD 53.2 billion by 2029 from USD 40.6 billion in 2023, at a CAGR of 5.5% during the forecast period.

Who are the winners in the global synthetic latex polymers market?

Companies such as include Arkema (France), Wacker Chemie AG (Germany), Synthomer PLC (UK), LG Chem (South Korea), Celanese (US), Trinseo (US), Dow (US), BASF SE (Germany), Apcotex (India), ARLANXEO (The Netherlands), H.B. Fuller (US), Asahi Kasei Corporation (Japan), The Lubrizol Corporation (US), and ZEON CORPORATION (Japan) among others. They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Increasing demand in the paints and coatings industry, rapid urbanization and infrastructure projects in emerging economies, stringent environmental regulations regarding VOC emissions, rising demand for biobased, eco-friendly, and biodegradable synthetic latex polymers are some drivers of synthetic latex polymers market.

What are the various types of synthetic latex polymers?

Styrene acrylic, styrene butadiene, acrylic, vinyl acetate ethylene, polyvinyl acetate, and vinyl acetate copolymer are various types of synthetic latex polymers.

What are the application of synthetic latex polymers?

Paints & coatings, adhesives & sealants, paper & paperboard, carpets, and nonwovens are the main applications of synthetic latex polymers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the synthetic latex polymers market. Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The synthetic latex polymers market comprises several stakeholders in the value chain, which include manufacturers, and end users. Various primary sources from the supply and demand sides of the synthetic latex polymers market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in synthetic latex sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the synthetic latex polymers industry. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of synthetic latex polymers and outlook of their business, which will affect the overall market.

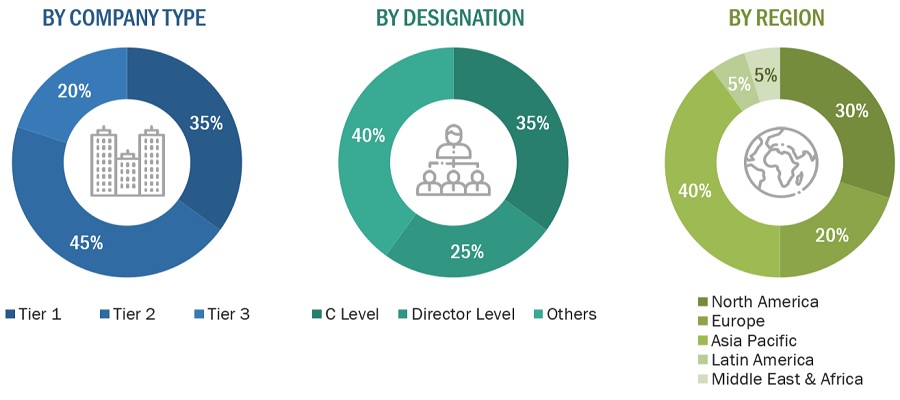

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the synthetic latex polymers market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

TOP - DOWN Approach-

To know about the assumptions considered for the study, Request for Free Sample Report

BOTTOM - UP Approach-

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Synthetic latex polymers are artificially created substances containing polymer particles dispersed in water. These polymers undergo emulsion polymerization, where monomers such as styrene, butadiene, acrylic acid, vinyl acetate, or ethylene are polymerized to form chains of polymers suspended in water. They are widely employed in various industries due to their adaptability, effectiveness, and ease of application. These polymers function as binding agents, adhesives, coatings, and sealants in a wide array of applications, spanning from paints and coatings to textiles, paper, carpet backing, and specialized latex products. Their notable attributes include robust adhesion, longevity, malleability, and eco-friendliness, rendering them highly sought-after in numerous industrial and commercial contexts.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the synthetic latex polymers market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and Impact on Synthetic latex polymers market

Growth opportunities and latent adjacency in Synthetic Latex Polymers Market