Veterinary Reference Laboratory Market Size by Service Type (Clinical Chemistry, Immunodiagnostics (ELISA), Molecular Diagnostics (PCR, Microarray)), Application (Pathology, Virology), Animal (Companion, Livestock), & Region - Global Forecast to 2029

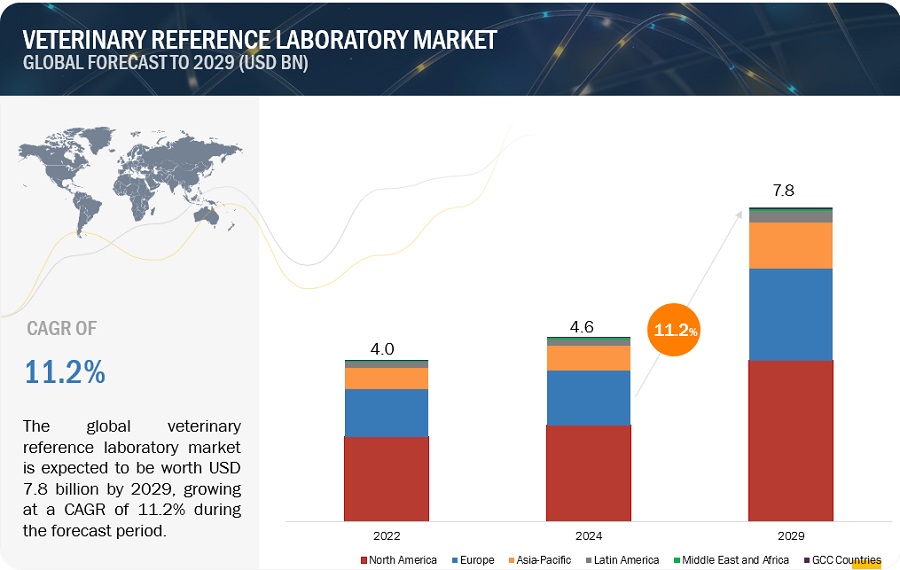

The size of global veterinary reference laboratory market in terms of revenue was estimated to be worth $4.6 billion in 2024 and is poised to reach $7.8 billion by 2029, growing at a CAGR of 11.2% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

A veterinary reference laboratory is a specialized facility that provides diagnostic testing and expertise for veterinarians and animal healthcare professionals. These labs offer a wide range of services including pathology, microbiology, serology, and molecular diagnostics to help diagnose diseases, monitor health, and ensure the well-being of animals. They play a crucial role in supporting veterinary medicine by offering accurate and timely analysis of samples from various animal species.

The veterinary reference laboratory market is experiencing significant growth due to increase in pet ownership, greater investment in animal healthcare, and an expanding focus on preventive measures. Consequently, there is a notable rise in demand for the specialized diagnostic services provided by these facilities, empowering veterinarians to make better treatment choices. Furthermore, advancements in technology are streamlining processes and increasing testing accuracy, solidifying the role of veterinary reference laboratories in the future of animal health.

In this report, the veterinary reference laboratory market is segmented into – service type, application, animal type, and region

Attractive Opportunities in the Veterinary Reference Laboratory Industry

To know about the assumptions considered for the study, Request for Free Sample Report

Veterinary Reference Laboratory Market Dynamics

Driver: Rising awareness of animal health

As awareness about the importance of animal health continues to rise among both pet owners and livestock producers, there's a growing recognition of the benefits of early disease detection and prevention. Pet owners increasingly understand that regular check-ups and diagnostic tests can help identify health issues in their pets. Similarly, livestock producers recognize that proactive monitoring of animal health can prevent disease outbreaks and minimize economic losses. This increasing awareness drives the demand for diagnostic tests offered by veterinary reference laboratories, as they provide specialized expertise and advanced technology for accurate and timely disease detection. Ultimately, the emphasis on early detection and prevention contributes to the overall well-being of animals and supports the sustainability of both companion animal and livestock industries.

Restraint: Cost of advanced testing equipment

The veterinary reference laboratory market demands cutting-edge equipment and technology to ensure precise test results across a spectrum of diagnostic procedures. However, acquiring and maintaining such sophisticated equipment entails substantial initial investments. These costs can act as a barrier, deterring new entrants from establishing laboratories and restricting the expansion efforts of existing ones. Consequently, the market landscape may remain dominated by established players with the financial resources to sustain these technological demands, potentially limiting competition and innovation within the sector.

Opportunity: Expansion of livestock industries

The expansion of the livestock industry presents a significant opportunity for veterinary reference laboratories. As global demand for meat, milk, and eggs rises, livestock production is increasing worldwide. This translates to a growing need for veterinary services to ensure the health and productivity of animal herds. Veterinary reference laboratories can support livestock producers by providing advanced diagnostic testing. This helps identify and address diseases early on, preventing outbreaks, improving animal welfare, and ultimately increasing farm profitability.

Challenge: Low Awareness in Emerging Markets

While pet ownership is booming in developing countries like India and China, many pet owners and even veterinarians might not be fully aware of the advanced diagnostic capabilities offered by reference laboratories. Moreover, veterinarians, pet owners, and livestock farmers, may have limited understanding of the importance and availability of veterinary reference laboratory services. They may not be aware of the range of tests and diagnostics offered, as well as the benefits of using these services for animal health management. Additionally, in many emerging markets, there is limited access to veterinary reference laboratories due to factors such as geographic isolation, insufficient transportation networks, and a shortage of healthcare facilities. This lack of accessibility makes it challenging for individuals and organizations to utilize these services even if they are aware of their existence. This lack of understanding hinders the growth of this market in these regions, as potential users aren't utilizing the full range of veterinary healthcare available.

VETERINARY REFERENCE LABORATORY INDUSTRY ECOSYSTEM

The veterinary reference laboratory market ecosystem comprises various interconnected components that collectively support the functioning of veterinary diagnostic services. At its core are the reference laboratories themselves, which conduct specialized tests and analyses on samples collected from animals. These labs collaborate closely with veterinary clinics, hospitals, and practitioners who collect and submit samples for analysis. Additionally, they rely on manufacturers and suppliers of diagnostic equipment and reagents to maintain their testing capabilities. Regulatory bodies ensure compliance with standards and guidelines, while academic institutions contribute to research and development in veterinary diagnostics. Finally, pet owners and livestock producers form the end-users, seeking accurate and timely diagnostic information to support animal health and management decisions. This dynamic ecosystem relies on collaboration and innovation to advance veterinary diagnostics and improve animal healthcare outcomes.

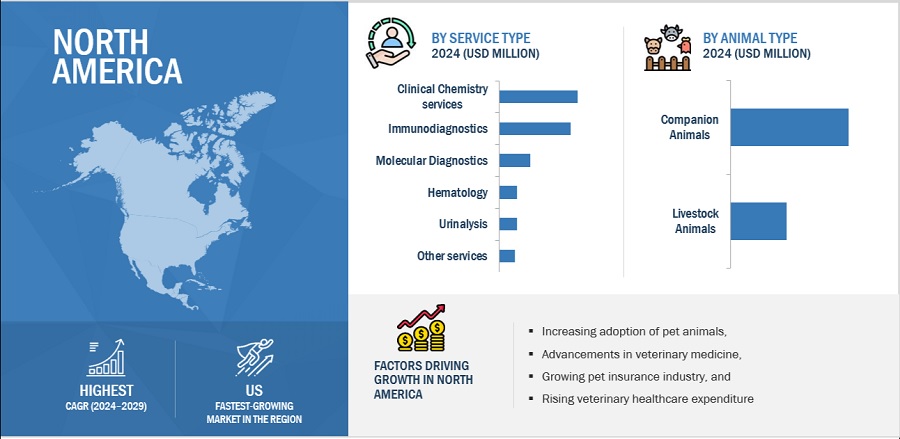

By service type, clinical chemistry services segment of the veterinary reference laboratory industry is expected to show highest CAGR from 2024 to 2029

Clinical chemistry services in veterinary reference laboratories are experiencing a surge in growth, with the highest CAGR. This uptrend can be attributed to several factors, such as an increasing awareness among pet owners about the importance of preventive healthcare for their animal companions, leading to more frequent check-ups and diagnostic testing. Moreover, advancements in technology have made these services more accessible and efficient, allowing for quicker and more accurate diagnoses.

Based on application, the clinical pathology segment is expected to have the largest market share in the veterinary reference laboratory industry.

The Clinical pathology segment holds the largest share in the veterinary reference laboratory market due to its vital role in diagnosing and monitoring various health conditions in animals. Through advanced techniques like blood chemistry analysis, hematology, and urinalysis, clinical pathologists can detect abnormalities, assess organ function, and monitor the effectiveness of treatments. Given the increasing demand for accurate and timely diagnosis in veterinary care, clinical pathology remains a cornerstone of veterinary reference laboratories, driving its dominance in the market.

Based on animal type, companion animals’ segment of the veterinary reference laboratory industry is expected to show highest CAGR from 2024 to 2029

Companion animals’ segment are anticipated to undergo the highest CAGR within the veterinary reference laboratory market. This growth projection is primarily attributed to an increasing trend towards pet ownership worldwide, leading to greater demand for veterinary services and diagnostics for companion animals. Moreover, the emotional attachment people have towards their pets often translates into a willingness to invest in their healthcare, contributing to the growth of this segment within the veterinary reference laboratory market.

North America accounted for the largest market share of the global veterinary reference laboratory industry, by region in the forecast period.

North America dominated the veterinary reference laboratory market due to several factors. North America boasts a highly developed veterinary healthcare infrastructure, with advanced diagnostic capabilities and a strong emphasis on animal welfare. Additionally, the region comprises of veterinary diagnostic laboratories equipped with cutting-edge technology and staffed by skilled professionals. The presence of leading market players, substantial investments in research and development, and a proactive regulatory framework further contribute to the dominance of North America in the veterinary reference laboratory market.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the veterinary reference laboratory market include IDEXX Laboratories, Inc. (US), Mars, Incorprated (US), GD Animal Health (Netherlands), Zoetis (US), NEOGEN Corporation (US), LABOKLIN GMBH & CO. KG (Germany), VETLAB (Veterinary Diagnostic Laboratory) (India), Mira Vista Labs (US), Virbac (US), Thermo Fisher Scientific (US), Vaxxinova (Netherlands), Texas A&M Veterinary Medical Diagnostic Laboratory (US), University of Minnesota (Veterinary Diagnostic Laboratory) (US), Iowa State University (Veterinary Diagnostic Laboratory) (US), QML Vetnostics (Australia), Greencross Vets (Australia), ProtaTek International, Inc. (US), Animal and Plant Health Agency (UK), Animal Health Diagnostic Center (Cornell University) (US), National Veterinary Services Laboratory USDA-APHIS (US), Washington Animal Disease Diagnostic Laboratory (US), Colorado State University (Veterinary Diagnostic Laboratories) (US), The Pirbright Institute (UK), (Australia), Friedrich-Loeffler-Institute (FLI) (Germany), and Kansas State Veterinary Diagnostic Laboratory (US).

Scope of the Veterinary Reference Laboratory Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$4.6 billion |

|

Projected Revenue by 2029 |

$7.8 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 11.2% |

|

Market Driver |

Rising awareness of animal health |

|

Market Opportunity |

Expansion of livestock industries |

The research report categorizes veterinary reference laboratory market to forecast revenue and analyze trends in each of the following submarkets:

By Service Type

- Clinical Chemistry

-

Immunodiagnostics

- ELISA

- Lateral Flow Assays

- Other Immunodiagnostics Services

-

Molecular Diagnostics

- PCR Tests

- Microarrays

- Other Molecular Diagnostics Services

- Hematology

- Urinalysis

- Other Services

By Application

- Clinical Pathology

- Bacteriology

- Parasitology

- Virology

- Productivity Testing

- Pregnancy Testing

- Toxicology Testing

By Animal Type

-

Companion Animals

- Dogs

- Cats

- Horses

- Other Companion Animals

-

Livestock Animals

- Cattle

- Swine

- Poultry

- Other Livestock Animals

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- GCC Countries

Recent Developments of The Veterinary Reference Laboratory Industry:

- In November 2023, IDEXX Laboratories, Inc. (US) launched a comprehensive screening test for vector-borne diseases, including canine leishmaniosis. SNAP Leish 4Dx Test uses trusted SNAP 4Dx Plus texting platform to detect Lyme disease, and anaplasmosis.

- In November 2023, Antech Diagnostics, Inc. (US), started with veterinary diagnostics services through its laboratory in UK with complete portfolio including, in-house diagnostics, imaging and technology solutions, and rapid diagnostics.

- In January 2024, GD Animal Health (Netherlands) acquired PathoSense diagnostics with the aim of identifying all viruses and bacteria with the use of nanopore sequencing technology.

- In November 2023, Zoetis Inc. (US) partnered with Adopt a Pet to improve access to care for pets and to deploy educational resources for veterinary healthcare teams and pet owners across the country.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global veterinary reference laboratory market?

The global veterinary reference laboratory market boasts a total revenue value of $7.8 billion by 2029.

What is the estimated growth rate (CAGR) of the global veterinary reference laboratory market?

The global veterinary reference laboratory market has an estimated compound annual growth rate (CAGR) of 11.2% and a revenue size in the region of $4.6 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved four major activities in estimating the current veterinary reference laboratory market size. Exhaustive secondary research was done to collect information on the market, peer market and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the veterinary reference laboratory market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

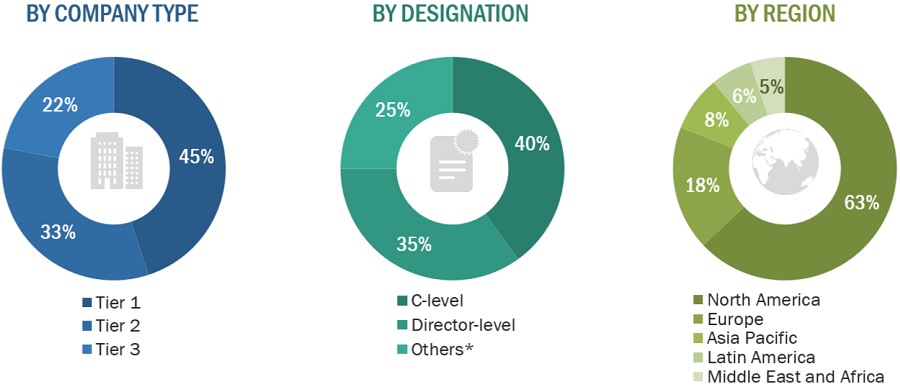

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the veterinary reference laboratory market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents for the veterinary reference laboratory market is provided below:

Note 1: C-level primaries include CEOs, COOs, and CTOs.

Note 2: Others include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

The research methodology used to estimate the size of the market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the veterinary reference laboratory market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall veterinary reference laboratory market was obtained from secondary data and validated by primary participants to arrive at the total veterinary reference laboratory market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by reference laboratories and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall veterinary reference laboratory market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Veterinary Reference Laboratory Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Veterinary Reference Laboratory Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Veterinary reference laboratories offer various routine and specialty testing facilities to veterinarians, pet owners, livestock producers, and research institutes for the early diagnosis, evaluation, and monitoring of diseases and disorders in both livestock and companion animals.

Key Stakeholders

- Veterinary Diagnostic Manufacturers

- Veterinary Diagnostic Distributors

- Animal Health R&D Companies

- Government Associations

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Objectives of the Study

- To define, describe, and forecast the veterinary reference laboratory market based on service type, application, animal type, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall veterinary reference laboratory market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the veterinary reference laboratory market in five regions, namely, North America (US and Canada), Europe (Germany, UK, France, Spain, Italy, and Rest of Europe), the Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), Middle East and Africa, and the GCC countries.

- To analyze the impact of the economic recession on the growth of the veterinary reference laboratory market

- To strategically profile the key players in the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments, such as service launches, expansions, acquisitions, partnerships, collaborations, and agreements, of the leading players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe veterinary reference laboratory market into Belgium, Russia, the Netherlands, Switzerland, and other countries.

- Further breakdown of the Rest of Asia Pacific veterinary reference laboratory market into Indonesia, Philippines, Vietnam, Hong Kong, and other countries

- Further breakdown of the Rest of Latin America veterinary reference laboratory market into colombia, Peru, and other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Reference Laboratory Market