Acoustic Insulation Market by Type (Glass Wool, Rock Wool, Foamed Plastics, Elastomeric Foam), End-Use Industry (Building & Construction, Transportation, Oil & Gas, Energy & Utilities, Industrial & Oem), and Region - Global Forecast to 2026

Acoustic Insulation Market Analysis

The global acoustic insulation market was valued at USD 14.08 billion in 2021 and is projected to reach USD 17.07 billion by 2026, growing at a cagr 3.9% from 2021 to 2026. Increasing demand for acoustic insulation from various end-use segments, stringent regulatory & sustainability mandates and growing concerns for the environment is driving the market for acoustic insulation.

Attractive Opportunities in the Acoustic Insulation Market

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on Global Acoustic Insulation Market

Acoustic insulation is used in various industries, such as building & construction, oil & gas, petrochemical, energy & utilities, transportation and industrial & OEM. Power is one of the important market due to the requirements of energy conservation, energy efficiency, and environmental regulations governing the industry. In Q1 of 2020, the sector witnessed a decline of about 2.5% in demand, as compared to the same period in 2019. Overall, the electricity demand is expected to decline by about 2.0% in 2020, according to IEA. Majority of the electricity is consumed in industrial sector followed by residential and commercial & services sectors. The electricity demand was impacted from the industrial and commercial sectors as establishments were forced to close due to government initiated lockdowns, social distancing measures, and a restricted supply chain. The global oil & gas demand also suffered heavily due to the pandemic. The oil & gas industry had already been weakened in last few years by the steep decline in oil prices that had started mid-2014 and accelerated price decline. The sector faced a new vicious shock in 2020 with a sudden and massive drop in global demand coupled with the COVID-19 outbreak. However, in 2021, demand is expected to grow driven mainly by the recovery of economic activities in countries, such as China, India, Indonesia, Malaysia, and Thailand.

Building & construction, oil & gas, petrochemical, energy & utilities, transportation and industrial & OEM are the major end-use industries of acoustic insulation.

Acoustic Insulation Market Dynamics

Driver: Rising health issue associated with noise pollution

Noise pollution is affecting people since the start of industrialization in the late 18th century. It is proved that long-term noise exposure can cause various health effects including sleep disturbance, hearing loss, annoyance, risks of stress, negative effects on the cardiovascular and metabolic system, as well as cognitive impairment in children. According to European Environment Agengy (EEA) around 20% of Europe’s population is exposed to harmful and unhealthy long-term noise levels. Moreover, as per current data, from EEA, environmental noise contributes to 48,000 new cases of ischemic heart disease every year, along with 12,000 premature deaths. In addition, approximately, 22 million people suffer from chronic high annoyance and 6.5 million people suffer high sleep disturbance.

Furthermore, it is estimated that 12,500 school children are suffering from reading impairment in school in 2020 as a result of aircraft noise. According to a European Union (EU) publication: about 40% of the population in EU countries is exposed to road traffic noise at levels exceeding 55 db(A); 20% is exposed to levels exceeding 65 dB(A) during the daytime; and more than 30% is exposed to levels exceeding 55 dB(A) at night. Thus, in order to overcome this issue, regulations limiting noise are being imposed by the governments of different countries.

Therefore, consumption of acoustic insulation materials, such as glass wool, stone wool, and foamed plastics, by different industry players has increased in order to decrease the ill effects of noise pollution among workers. Moreover, the regulatory norms to reduce noise pollution boosts the demand for acoustic insulation materials in major regions and is expected to grow globally during the forecast period..

Restraint: Fluctuating raw material prices due to volatility in crude oil prices

Fluctuation in raw material prices of plastic foams is a major restraint in the growth of the acoustic insulation market. Plastic foams are derivatives of fossil fuels and these, including polyurethane foams, and polystyrene foams, are crude oil-based products. Thus, fluctuations in pricing and availability of crude oil are major limitations in their production and further use. Volatility in supply and demand of crude oil hamper the production of these materials, which further hamper the demand for end-products. The availability of crude oil-based products, such as polymers and elastomers, depend on the import and production scenario of various countries. According to the US EIA (Energy Information Administration), Brent crude oil spot prices averaged USD 40 per barrel in June 2020, from USD 11 per barrel in May 2020 and USD 22 per barrel in April 2020. The oversupply of crude oil provided opportunities for various countries to build up their strategic reserves. Prices rose as OPEC+ producers agreed to extend the production cuts through July 2020, and due to these indications, many locations previously under lockdown were increasing their liquid fuel storage. Given the supply reductions and rising demand, the EIA estimated that global oil inventories declined in June 2020 for the first time since December 2019. The global oil inventory averaged at 8.4 million barrels per day, which caused a sharp drop in crude oil prices. However, in the future, crude oil prices are expected to rise again, owing to renewed demand from China, India, and other emerging economies. Owing to these fluctuations in crude oil prices, the prices of raw materials for acoustic insulation have also been affected. Manufacturers need to cope with these fluctuations in raw material costs, which reduce their profit margins. This scenario has compelled market players to enhance the efficiency and productivity of their operations to sustain growth.

Opportunity: Increased infrastructure spending in emerging economies

Infrastructural development in economies, such as China, India, Brazil, and South Korea, is expected to boost industrial activities and increase the consumption of insulation materials during the forecast period. In 2018, countries, such as China, the US, Australia, the UK, and France spent 5.57%, 0.52%, 1.69%, 0.92%, and 0.84% of their GDP in construction and maintenance of infrastructure, according to Statista. In 2020, China had scheduled USD 1.07 trillion as infrastructure spending, according to China Banking News. India has also launched various infrastructure projects, such as the smart city initiative, urban transformation schemes, new industrial estates, and business parks, which are expected to boost sector growth during the forecast period. According to the World Bank, emerging economies need to spend about 4.5% of GDP to achieve sustainable development. Infrastructural growth related to electricity demand, clean water demand, fuel demand, transportation demand, and construction demand are expected to boost the market for acoustic insulation in the next five years. The global spending on infrastructure is expected to reach USD 94 trillion by 2040, and an additional USD 3.4 trillion would be required to attain United Nations’ Sustainable Development Goals for electricity and water, according to Oxford Economics. Countries in APAC, including as China, India, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam, will be the fastest-growing and account for nearly 50% of the global infrastructure spending by 2040, according to an Oxford Economics study. An increase in spending and industrial activities are thus expected to provide major opportunities for the growth of the acoustic insulation market as well..

Challenge: Low Awareness and high capital cost of acoustic insulation developing countries

Energy conservation is a major focal point for all industries, including power, food & beverage, and petrochemical. Insulation materials are simple yet significant requirement in any industry dealing with various heat transfer operations. A lack of awareness about the benefits of acoustic insulation is a major challenge for the market. In the developing countries like India, South Africa, and other southeast Asian countries, acoustic insulation is considered luxury and costly. The customers are not aware of the significant benefits of acoustic insulation, they rather consider it as a sound proofing technique and thus, it is only limited to entertainment rooms in the residential buildings. Thus, increasing the awareness about acoustic insulation could boost the demand in developing countries in the future. In the industries, the capital cost for the installation of insulation materials is quite high, owing to the requirement of separate clearances, regulation citing, and skilled labor. Knowledge and experience both are required to achieve proper insulation in pipes, tanks, equipment, and boilers. Inadequate insulation of fittings, tanks, boilers, and other machinery can result in very high energy losses and may cost hundreds of thousands of US dollars to the facility, annually. The R-value or maximum thermal performance of any insulation is dependent on proper installation. Proper installation is required for preventing damage to pipes, machinery, and boilers due to temperature fluctuations; reducing mechanical equipment cycling, and maintaining designed operating conditions. Various regulations and codes, such as the Building Code, the American Society of Heating, Refrigerating and Air-Conditioning Engineers Standards (ASHRAE), the Quality Standards for Mechanical Insulation, and others guide contractors on proper installation of insulation materials, which enable efficient operation and longer lifespan of machinery and fittings.

In terms of value Transportation is projected second largest share of the acoustic insulation market, by end-use industry, during the forecast period.

Transportation is the second-largest end-use industry of the acoustic insulation market worldwide, which accounted for a 29.4% share of the overall market in 2020 in terms of volume. Acoustic insulation are used in the transportation industry to reduce interior noise and vibration and improve the sensation of ride comfort for the passengers and surrounding of the vehicle. Interior noise is currently a competitive quality characteristic of every mode of transport facility automobiles. Although interior noise lowers the comfort feeling inside a vehicle, it also induces fatigue and may reduce driving safety. A variety of sources contribute to the interior and exterior noise of a vehicle which can be structureborne or airborne sound. Acoustic insulation used to control noise in vehicles must provide airborne transmission reduction, damping and sound absorption. However, the use of acoustic textiles in vehicles is not only dependent on their acoustic properties but also on additional characteristics. Various key players provide acoustic solutions in transportation segment such as Knauf insulation, BASF, Soprema and Huntsman. The transportation industry uses acoustic insulation for soundproofing against sound systems installed, engines and other machinery sounds, and external noise. In the automotive industry, acoustic insulation mainly refers to noise, vibration, and harshness (NVH) control. Materials, such as rock wool and glass wool are used in vehicle exhausts, while plastics and foams are used to encase engine parts to reduce engine noise from entering the cabin. Acoustic insulation materials, such as mineral wool and foam-based products are used in marine for bulkhead, overhead, duct, piping, and other industries. They are also used in business jets, military aircrafts, and helicopters in the aviation industry. In Airbus, Boeing, Canadair, Embraer, business jets, military aircrafts, and helicopters, acoustic and thermal insulation is used to reduce their weight.

Foamed Plastics is projected second fastest to grow at a CAGR of 4.3%, in terms of value during the forecast period.

Foamed Plastics is projected second fastest to grow at a CAGR of 4.3%, in terms of value during the forecast period. These plastics are innovative, energy-efficient materials used for insulation. They can effectively seal gaps and stop air leaks. Foamed plastics are further segmented into polyethylene, polyurethane, polystyrene, phenolic foam, etc. In addition, glass wool is the second-largest material type in demand, because of its superior sound absorption, low cost, and its increasing use in the building and construction sector. It is thus used in various applications, such as piping, gymnasiums, cinemas, air conditioner duct warming/cooling, machine rooms, ships, office partition walls, and ceiling sound absorption.

APAC is estimated to be the fastest-growing market for acoustic insulation.

APAC is estimated to be the fastest-growing market for acoustic insulation between 2021 and 2026. Growth in APAC is primarily attributed to the fast-paced expansion of the economies such as China, India, and Indonesia. The region has become an attractive location for chemical & petrochemical, power, oil & gas, and cement industries. Growing population, increased consumer spending, and rapid industrial expansion are the major factors responsible for high growth rate of the region. The rapid urbanization and increasing disposable income are the key factors driving the demand for acoustic insulation in India. The manufacturers focus on the high-growth Indian market to gain market share and increase their profitability

To know about the assumptions considered for the study, download the pdf brochure

Key Players in Acoustic Insulation Market

Major players operating in the global acoustic insulation market include Saint-Gobain (France), Knauf Insulation (US), Armacell International (Germany), Soprema (France), Rockwool International (Denmark), Huntsman (US), Owens Corning (US), Kingspan Group (Ireland), BASF SE (Germany), and Johns Manville (US)

Acoustic Insulation Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 14.1 billion |

|

Revenue Forecast in 2026 |

USD 17.1 billion |

|

CAGR |

3.9% |

|

Years considered for the study |

2019-2026 |

|

Base year |

2020 |

|

Forecast period |

2021-2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Type, End-use Industry, Region |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

Saint Gobain (France), Knauf Insulation (US), Armacell International (Germany), Soprema (France), Rockwool International (Denmark), Huntsman (US), Owens Corning (US), Kingspan Group (Ireland), BASF SE (Germany), and Johns Manville (US) |

This research report categorizes the Acoustic insulationmarket based on type, end-use industry, and region.

Based on the type:

- Mineral Wool

- Foamed Plastic

- Elastomeric Foam

- Others

Based on the end-use industry:

- Building and Construction

- Transportation

- Oil & Gas and Petrochemical

- Energy and Utilities

- Industrial and OEM

Based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments in Acoustic Insulation Market

- In August 2020, Armacell launched ArmaGel DT. ArmaGel product delivers good thermal and acoustic solutions to customers around the globe with an excellent quality/cost ratio.

- In January 2020, Saint-Gobain acquired Sonex in Brazil, a company specialized in the manufacture and supply of acoustic ceiling systems, marketed in particular under the Sonex, Nexacustic, and Fiberwood brands. This acquisition strengthened the group’s position in Brazil.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the acoustic insulation market?

The growth of this market can be attributed to rising demand in the developing countries undergoing industrialization and increasing awareness towards noise pollution.

Which are the key sectors driving the acoustic insulation market?

The sectors driving the demand for acoustic insulation are building & construction, transportation, energy & utilities and industrial & OEM among others.

Who are the major manufacturers?

Major manufactures include Saint-Gobain (France), Knauf Insulation (US), Armacell International (Germany), Soprema (France), Rockwool International (Denmark), Huntsman (US), Owens Corning (US), Kingspan Group (Ireland), BASF SE (Germany), and Johns Manville (US), among others.

What is the biggest restraint for acoustic insulation?

The slowdown in the construction industry of Europe, which is the biggest region consuming acoustic insulation.

How is COVID-19 affecting the overall acoustic insulation market?

Due to the ongoing pandemic, the chemical industry has been severely affected throughout the world. Manpower shortage, logistical restrictions, material unavailability, and other restrictions have slowed the growth of the industry in a considerable manner.

What will be the growth prospects of the acoustic insulation market?

Rising population, rapid urbanization and improving industrial infrastructure in emerging economies coupled with an increase in demand for acoustic comfort are expected to offer significant growth opportunities to manufacturers of acoustic insulation. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 ACOUSTIC INSULATION: MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 ACOUSTIC INSULATION MARKET: RESEARCH DESIGN

2.2 SECONDARY DATA

2.2.1 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 KEY DATA FROM PRIMARY SOURCES

2.3.1.1 Primary interviews – demand and supply side

2.3.1.2 Key industry insights

2.3.1.3 Breakdown of primary interviews

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 ACOUSTIC INSULATION MARKET: BOTTOM-UP APPROACH

FIGURE 3 ACOUSTIC INSULATION MARKET ESTIMATION, BY TYPE

FIGURE 4 MARKET SIZE ESTIMATION: ACOUSTIC INSULATION MARKET, SUPPLY-SIDE APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 ACOUSTIC INSULATION MARKET: TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: ACOUSTIC INSULATION MARKET: TOP-DOWN APPROACH

2.5 MARKET FORECAST APPROACH

2.5.1 SUPPLY-SIDE FORECAST PROJECTION:

2.5.2 DEMAND-SIDE FORECAST PROJECTION:

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 ACOUSTIC INSULATION MARKET: DATA TRIANGULATION

2.7 FACTOR ANALYSIS

2.8 ASSUMPTIONS AND LIMITATIONS

2.8.1 ASSUMPTIONS

2.8.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 BUILDING & CONSTRUCTION ACCOUNTED FOR THE LARGEST SHARE IN 2020

FIGURE 9 FOAMED PLASTICS ACCOUNTED FOR THE LARGEST SHARE IN THE ACOUSTIC INSULATION MARKET

FIGURE 10 APAC TO BE THE FASTEST-GROWING ACOUSTIC INSULATION MARKET

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 ATTRACTIVE OPPORTUNITIES IN THE ACOUSTIC INSULATION MARKET

FIGURE 11 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 EUROPE: ACOUSTIC INSULATION MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 12 GERMANY IS THE LARGEST MARKET FOR ACOUSTIC INSULATION IN EUROPE IN 2021

4.3 ACOUSTIC INSULATION MARKET, BY TYPE

FIGURE 13 GLASS WOOL ACCOUNTED FOR THE LARGEST MARKET IN TERMS OF VOLUME, DURING THE FORECASTED PERIOD

4.4 ACOUSTIC INSULATION MARKET, BY END-USE INDUSTRY

FIGURE 14 BUILDING & CONSTRUCTION INDUSTRY WAS THE LARGEST SEGMENT DURING THE FORECAST PERIOD

4.5 ACOUSTIC INSULATION MARKET: REGIONAL GROWTH RATES

FIGURE 15 APAC TO REGISTER THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ACOUSTIC INSULATION MARKET

5.2.1 DRIVERS

5.2.1.1 Rising health issues associated with noise pollution

5.2.1.2 Stringent regulations for insulation

5.2.1.3 Rising demand from developing nations

5.2.1.4 Surging demand for acoustic insulation from industrial sectors

5.2.2 RESTRAINTS

5.2.2.1 Slowdown in the European construction industry

5.2.2.2 Fluctuating raw material prices due to volatility in crude oil prices

FIGURE 17 YEARLY GRAPH OF CRUDE OIL PRICES

5.2.3 OPPORTUNITIES

5.2.3.1 Aerogel is the potential high-performance substitute for glass wool

5.2.3.2 Increasing focus on sustainability and favorable government regulations on energy efficiency

5.2.3.3 Increased infrastructural spending in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Proper disposable and recycling techniques required

5.2.4.2 Low awareness and high capital cost of acoustic insulation in developing countries

5.3 PATENT ANALYSIS

5.3.1 METHODOLOGY

5.3.2 DOCUMENT TYPE

FIGURE 18 PATENT APPLICATION ACCOUNT FOR THE LARGEST SHARE

5.3.3 PUBLICATION TRENDS - LAST 10 YEARS

5.3.4 INSIGHT

5.3.5 JURISDICTION ANALYSIS

5.3.6 TOP 10 COMPANIES/APPLICANTS

FIGURE 19 TOP 10 COMPANIES

TABLE 1 LIST OF PATENTS BY SAINT-GOBAIN

TABLE 2 LIST OF PATENTS BY DUPONT

TABLE 3 LIST OF PATENTS BY AIRBUS OPERATIONS GMBH

TABLE 4 LIST OF PATENTS BY HILTI AG

TABLE 5 LIST OF PATENTS BY ASPEN AEROGELS INC.

TABLE 6 LIST OF PATENTS BY BOEING CO.

TABLE 7 TOP 10 PATENT OWNERS (US) IN THE LAST 10 YEARS

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 8 ACOUSTIC INSULATION: PORTER’S FIVE FORCES ANALYSIS

5.5 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS

5.5.1 RAW MATERIAL SUPPLIERS

5.5.2 MANUFACTURERS

5.5.3 DISTRIBUTORS

5.5.4 END-CONSUMERS

5.6 RAW MATERIAL ANALYSIS

5.6.1 MINERAL WOOL

5.6.2 CALCIUM SILICATE

5.6.3 PLASTIC FOAMS

TABLE 9 COMMON INSULATING MATERIALS PROPERTIES

5.7 TARIFF AND REGULATIONS

5.7.1 EUROPE

5.7.2 NORTH AMERICA

TABLE 10 MINIMUM PERMISSIBLE AIR BORNE SOUND INSULATION INDICES

5.8 TECHNOLOGY ANALYSIS

5.8.1 NEW TECHNOLOGIES – ACOUSTIC INSULATION

5.9 COVID-19 IMPACT ANALYSIS

5.9.1 COVID-19 ECONOMIC ASSESSMENT

5.9.2 MAJOR ECONOMIC EFFECTS OF COVID-19

5.9.3 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 22 PACE OF GLOBAL PROPAGATION OF COVID-19 IS UNPRECEDENTED

5.9.4 IMPACT ON END-USE INDUSTRIES

TABLE 11 COVID IMPACT ON PERCENTAGE OF TOTAL GDP FROM CONSTRUCTION BY KEY COUNTRIES

5.9.4.1 Impact on customers’ output and strategies to improve production

5.9.4.2 Short-term strategies to manage cost structure and supply chains

5.10 MACROECONOMIC INDICATOR

TABLE 12 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018–2025

TABLE 13 PRODUCTION OF PASSENGER CARS, COMMERCIAL VEHICLES, TRUCKS, AND BUSES, BY COUNTRY, 2018–2019 (UNITS)

TABLE 14 PRODUCTION OF PASSENGER CARS, COMMERCIAL VEHICLES, TRUCKS, AND BUSES, BY REGION, 2018–2019 (UNITS)

5.11 OPERATIONAL DATA

FIGURE 23 INFRASTRUCTURE INVESTMENT AS PART OF GDP, 2019

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 24 REVENUE SHIFT FOR ACOUSTIC INSULATION MARKET

5.13 CASE STUDY ANALYSIS

5.13.1 KNAUF INSULATION

5.13.2 BASF

5.13.3 SOPREMA

5.14 TRADE ANALYSIS

5.14.1 IMPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

5.14.2 EXPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

5.14.3 EPDM IMPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

5.14.4 EPDM EXPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

5.15 ECOSYSTEM MAPPING

FIGURE 25 ECOSYSTEM

TABLE 15 ACOUSTIC INSULATION: ECOSYSTEM

5.16 AVERAGE PRICING ANALYSIS

FIGURE 26 ACOUSTIC INSULATION AVERAGE REGIONAL PRICE

FIGURE 27 AVERAGE YEARLY PRICING, BY TYPE

6 ACOUSTIC INSULATION MARKET, BY TYPE (Page No. - 87)

6.1 INTRODUCTION

FIGURE 28 FOAMED PLASTICS TO BE THE LARGEST TYPE OF ACOUSTIC INSULATION

TABLE 16 ACOUSTIC INSULATION MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 17 MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

TABLE 18 MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 19 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

6.2 GLASS WOOL

6.2.1 EASY INSTALLATION AND TRANSPORT MAKES IT A FAVORABLE INSULATION SOLUTION

6.3 ROCK WOOL

6.3.1 ABUNDANT AND EASY AVAILABILITY OF RAW MATERIALS TO DRIVE THE ROCK WOOL MARKET

6.4 FOAMED PLASTICS

6.4.1 PLASTIC FOAMS ARE ENERGY-EFFICIENT MATERIALS

6.4.2 POLYETHYLENE

6.4.3 POLYURETHANE

6.4.4 POLYSTYRENE

6.4.5 POLYISOCYANURATE

6.4.6 PHENOLIC FOAM

6.4.7 OTHER FOAMED PLASTICS

6.5 ELASTOMERIC FOAM

6.5.1 FIBER-FREE AND LOW-VOC FOR CHEMICAL EMISSIONS

6.5.2 NITRILE-BUTADIENE RUBBER (NR) FOAM

6.5.3 ETHYLENE PROPYLENE DIENE MONOMER (EPDM) FOAM

6.5.4 CHLOROPRENE FOAM

6.5.5 OTHER ELASTOMERIC FOAMS

6.6 OTHERS

6.6.1 AEROGEL

6.6.2 CELLULOSE ACETATE

7 ACOUSTIC INSULATION, BY END-USE INDUSTRY (Page No. - 94)

7.1 INTRODUCTION

FIGURE 29 BUILDING & CONSTRUCTION TO BE LARGEST END-USE INDUSTRY OF THE ACOUSTIC INSULATION MARKET

TABLE 20 ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 21 MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 22 MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 23 MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

7.2 BUILDING & CONSTRUCTION

7.2.1 LARGEST END-USE INDUSTRY IN THE ACOUSTIC INSULATION MARKET

7.2.2 RESIDENTIAL BUILDINGS

7.2.2.1 Residential buildings envelope

7.2.2.2 Residential buildings equipment

7.2.3 COMMERCIAL BUILDINGS

7.2.3.1 Commercial buildings envelope

7.2.3.2 Commercial buildings equipment

7.3 TRANSPORTATION

7.3.1 SECOND-LARGEST END-USE INDUSTRY OF THE MARKET WITH EXPECTED RAPID GROWTH IN THE FUTURE

7.3.2 AUTOMOTIVE

7.3.3 MARINE

7.3.4 AEROSPACE

7.3.5 RAILWAYS

7.3.6 EARTH MOVING EQUIPMENT

7.4 OIL & GAS AND PETROCHEMICAL

7.4.1 GROWING POPULATION AND ENERGY DEMAND WILL IMPACT THE MARKET

7.4.2 COMPRESSORS

7.4.3 HIGH-PRESSURE PIPES

7.4.4 VESSELS

7.4.5 EQUIPMENT ENCAPSULATION

7.5 ENERGY AND UTILITIES

7.5.1 GROWING ENRGY DEMAND FROM DEVELOPING COUNTRIES IS DRIVING THE MARKET

7.5.2 COMPRESSORS

7.5.3 HIGH-PRESSURE PIPES

7.5.4 PUMP

7.5.5 POWER GENERATION

7.5.6 TURBINE ROOM

7.6 INDUSTRIAL AND OEM

7.6.1 INCREASING DEMAND FOR ELECTRONICS AND TELECOM WILL DRIVE THE MARKET

7.6.2 GENERAL MANUFACTURING

7.6.3 TELECOM

7.6.4 SEMICONDUCTORS

8 ACOUSTIC INSULATION MARKET, BY REGION (Page No. - 103)

8.1 INTRODUCTION

FIGURE 30 ACOUSTIC INSULATION MARKET IN INDIA TO REGISTER THE HIGHEST CAGR

TABLE 24 MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 25 MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

8.2 EUROPE

FIGURE 31 EUROPE: ACOUSTIC INSULATION MARKET SNAPSHOT

TABLE 26 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 27 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 28 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 29 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 30 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 31 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 32 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 33 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.1 GERMANY

8.2.1.1 Vast industrial base to support the acoustic insulation market

TABLE 34 GERMANY: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 35 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 36 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 37 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.2 FRANCE

8.2.2.1 Investments from international companies to drive the industrial growth

TABLE 38 FRANCE: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 39 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 40 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 41 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.3 UK

8.2.3.1 Continuous innovations and technological advancements support the acoustic insulation market

TABLE 42 UK: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 43 UK: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 44 UK: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 45 UK: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.4 ITALY

8.2.4.1 Advanced automotive sector supports the growth of the acoustic insulation market

TABLE 46 ITALY: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 47 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 48 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 49 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.5 SPAIN

8.2.5.1 Infrastructural investments to drive the acoustic insulation market

TABLE 50 SPAIN: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 51 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 52 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 53 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.6 NORDIC COUNTRIES

8.2.6.1 New developments in green technologies to drive the automotive industry

TABLE 54 NORDIC COUNTRIES: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 55 NORDIC COUNTRIES: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 56 NORDIC COUNTRIES: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 57 NORDIC COUNTRIES: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.7 BENELUX

8.2.7.1 The upcoming construction projects to support the market growth in the Netherlands

TABLE 58 BENELUX: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 59 BENELUX: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 60 BENELUX: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 61 BENELUX: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.8 POLAND

8.2.8.1 Energy shift and environmental consciousness to support the growth of acoustic insulation

TABLE 62 POLAND: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 63 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 64 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 65 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.9 SWITZERLAND

8.2.9.1 Improving consumer and investor support in the construction industry to support the economy

TABLE 66 SWITZERLAND: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 67 SWITZERLAND: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 68 SWITZERLAND: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 69 SWITZERLAND: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.2.10 REST OF EUROPE

TABLE 70 REST OF EUROPE: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 71 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 72 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 73 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3 NORTH AMERICA

FIGURE 32 NORTH AMERICA: ACOUSTIC INSULATION MARKET SNAPSHOT

TABLE 74 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3.1 US

8.3.1.1 The US leads the demand for acoustic insulation in North America

TABLE 82 US: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 83 US: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 84 US: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 85 US: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3.2 MEXICO

8.3.2.1 Government policies impacted in market growth

TABLE 86 MEXICO: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 87 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 88 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 89 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.3.3 CANADA

8.3.3.1 Increase in the demand due to measures taken by the government

TABLE 90 CANADA: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 91 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 92 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 93 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4 APAC

FIGURE 33 APAC: ACOUSTIC INSULATION MARKET SNAPSHOT

TABLE 94 APAC: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 95 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 96 APAC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 97 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 98 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 99 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 100 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 101 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.1 CHINA

8.4.1.1 Government’s policies to impact market growth

TABLE 102 CHINA: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 103 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 104 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 105 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.2 JAPAN

8.4.2.1 Upgradation of infrastructure to drive the acoustic insulation market

TABLE 106 JAPAN: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 107 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 108 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 109 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.3 SOUTH KOREA

8.4.3.1 Recovering automotive sector and government support to propel market growth

TABLE 110 SOUTH KOREA: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 111 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 112 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 113 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.4 INDIA

8.4.4.1 Government policies for infrastructure to impact market growth

TABLE 114 INDIA: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 115 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 116 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 117 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.5 AUSTRALIA

8.4.5.1 Construction industry is an important driver of the market

TABLE 118 AUSTRALIA: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 119 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 120 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 121 AUSTRALIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.6 ASEAN COUNTRIES

8.4.6.1 Growing building and construction industry to drive the market

TABLE 122 ASEAN COUNTRIES: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 123 ASEAN COUNTRIES: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 124 ASEAN COUNTRIES: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 125 ASEAN COUNTRIES: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.4.7 REST OF APAC

TABLE 126 REST OF APAC: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 127 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 128 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 129 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 130 MIDDLE EAST & AFRICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 131 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 132 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 135 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 136 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.5.1 SAUDI ARABIA

8.5.1.1 Saudi Vision 2030 to contribute a significant rise in demand

TABLE 138 SAUDI ARABIA: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 139 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 140 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 141 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.5.2 UAE

8.5.2.1 Measures taken by the government to boost the economy and the market

TABLE 142 UAE: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 143 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 144 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 145 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.5.3 TURKEY

8.5.3.1 Growth in construction activities to boost the demand for acoustic insulation

TABLE 146 TURKEY: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 147 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 148 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 149 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.5.4 REST OF MIDDLE EAST AND AFRICA

TABLE 150 REST OF MIDDLE EAST & AFRICA: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 151 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 152 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 153 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.6 SOUTH AMERICA

TABLE 154 SOUTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 155 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 156 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 157 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 158 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 159 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 160 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 161 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 Largest construction market in South America

TABLE 162 BRAZIL: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 163 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 164 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 165 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.6.2 ARGENTINA

8.6.2.1 Infrastructure development to drive the demand

TABLE 166 ARGENTINA: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 167 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 168 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 169 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

8.6.3 REST OF SOUTH AMERICA

TABLE 170 REST OF SOUTH AMERICA: ACOUSTIC INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 171 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

TABLE 172 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 173 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 171)

9.1 INTRODUCTION

TABLE 174 COMPANIES ADOPTED INVESTMENT & EXPANSION AND NEW PRODUCT DEVELOPMENT AS KEY GROWTH STRATEGIES BETWEEN 2017 AND 2021

9.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2019

FIGURE 34 RANKING OF TOP 5 PLAYERS IN THE ACOUSTIC INSULATION MARKET, 2019

9.3 MARKET SHARE ANALYSIS

FIGURE 35 ACOUSTIC INSULATION MARKET SHARE, BY COMPANY (2020)

TABLE 175 ACOUSTIC INSULATION MARKET: DEGREE OF COMPETITION

9.4 REVENUE ANALYSIS OF TOP 3 MARKET PLAYERS

FIGURE 36 TOP 3 PLAYERS DOMINATED THE MARKET OVER THE LAST 5 YEARS

9.5 MARKET EVALUATION MATRIX

TABLE 176 MARKET EVALUATION MATRIX

9.6 COMPANY EVALUATION MATRIX, 2019 (TIER 1)

9.6.1 STARS

9.6.2 EMERGING LEADERS

FIGURE 37 ACOUSTIC INSULATION MARKET: COMPANY EVALUATION MATRIX, 2020

9.7 COMPANY TYPE FOOTPRINT

9.8 COMPANY INDUSTRY FOOTPRINT

9.9 COMPANY REGION FOOTPRINT

9.10 STRENGTH OF STRATEGY EXCELLENCE

FIGURE 38 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ACOUSTIC INSULATION MARKET

9.11 BUSINESS PRODUCT FOOTPRINT

FIGURE 39 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ACOUSTIC INSULATION MARKET

9.12 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

9.12.1 PROGRESSIVE COMPANIES

9.12.2 RESPONSIVE COMPANIES

9.12.3 STARTING BLOCKS

9.12.4 DYNAMIC COMPANIES

FIGURE 40 ACOUSTIC INSULATION MARKET: START-UPS AND SMES MATRIX, 2020

9.13 COMPETITIVE SCENARIO

9.13.1 NEW PRODUCT LAUNCH

TABLE 177 NEW PRODUCT LAUNCH, 2017–2021

9.13.2 ACOUSTIC INSULATION: DEALS

TABLE 178 ACOUSTIC INSULATION: DEALS, 2017–2021

9.13.3 OTHER DEVELOPMENTS

TABLE 179 OTHER DEVELOPMENTS, 2017–2021

10 COMPANY PROFILES (Page No. - 191)

(Business overview, Products offered, Deals, Other developments & MnM View)*

10.1 MAJOR PLAYERS

10.1.1 SAINT-GOBAIN

TABLE 180 SAINT-GOBAIN: COMPANY OVERVIEW

FIGURE 41 SAINT-GOBAIN: COMPANY SNAPSHOT

10.1.2 KNAUF INSULATION

TABLE 181 KNAUF INSULATION: COMPANY OVERVIEW

10.1.3 ARMACELL INTERNATIONAL

TABLE 182 ARMACELL INTERNATIONAL: COMPANY OVERVIEW

FIGURE 42 ARMACELL INTERNATIONAL: COMPANY SNAPSHOT

10.1.4 SOPREMA

TABLE 183 SOPREMA: COMPANY OVERVIEW

10.1.5 ROCKWOOL INTERNATIONAL

TABLE 184 ROCKWOOL INTERNATIONAL: COMPANY OVERVIEW

FIGURE 43 ROCKWOOL INTERNATIONAL: COMPANY SNAPSHOT

10.1.6 HUNTSMAN

TABLE 185 HUNTSMAN: COMPANY OVERVIEW

FIGURE 44 HUNTSMAN: COMPANY SNAPSHOT

10.1.7 OWENS CORNING

TABLE 186 OWENS CORNING: COMPANY OVERVIEW

FIGURE 45 OWENS CORNING: COMPANY SNAPSHOT

10.1.8 KINGSPAN GROUP

TABLE 187 KINGSPAN GROUP: COMPANY OVERVIEW

FIGURE 46 KINGSPAN GROUP: COMPANY SNAPSHOT

10.1.9 BASF

TABLE 188 BASF: COMPANY OVERVIEW

FIGURE 47 BASF: COMPANY SNAPSHOT

10.1.10 JOHNS MANVILLE

TABLE 189 JOHNS MANVILLE: COMPANY OVERVIEW

10.1.11 GETZNER WERKSTOFFE GMBH

TABLE 190 GETZNER WERKSTOFFE: COMPANY OVERVIEW

10.1.12 CELLOFOAM GMBH

TABLE 191 CELLOFOAM: COMPANY OVERVIEW

10.1.13 REGUPOL BSW GMBH

TABLE 192 REGUPOL BSW GMBH: COMPANY OVERVIEW

*Details on Business overview, Products offered, Deals, Other developments & MnM View might not be captured in case of unlisted companies.

10.2 OTHER PLAYERS

10.2.1 3M

10.2.2 TRELLEBORG

10.2.3 L'ISOLANTE K-FLEX S.P.A

10.2.4 DOW

10.2.5 SIDERISE

10.2.6 CABOT

10.2.7 FLETCHER INSULATION

10.2.8 HUSH ACOUSTIC

10.2.9 PRIMACOUSTIC

10.2.10 TROCELLEN

10.2.11 CELLECTA LTD.

10.2.12 RECTICEL INSULATION

10.2.13 INTERNATIONAL CELLULOSE CORPORATION

10.2.14 ARABIAN FIBERGLASS INSULATION CO. LTD.

10.2.15 LANXESS

11 ADJACENT/RELATED MARKET (Page No. - 232)

11.1 INTRODUCTION

11.2 LIMITATIONS

11.3 INDUSTRIAL INSULATION MARKET

11.4 INDUSTRIAL INSULATION MARKET OVERVIEW

11.5 INDUSTRIAL INSULATION MARKET, BY FORM

TABLE 193 INDUSTRIAL INSULATION MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

11.6 INDUSTRIAL INSULATION MARKET, BY MATERIAL

TABLE 194 INDUSTRIAL INSULATION MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

11.7 INDUSTRIAL INSULATION MARKET, BY END-USE INDUSTRY

TABLE 195 INDUSTRIAL INSULATION MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

11.8 INDUSTRIAL INSULATION MARKET, BY REGION

TABLE 196 INDUSTRIAL INSULATION MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.8.1 NORTH AMERICA

11.8.2 APAC

11.8.3 EUROPE

11.8.4 SOUTH AMERICA

11.8.5 MIDDLE EAST & AFRICA

12 APPENDIX (Page No. - 237)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

Overview on Soundproofing Materials Market

Soundproofing materials are designed to reduce or eliminate unwanted sound and noise. The soundproofing materials market includes a wide range of products such as acoustic insulation, soundproofing foams, barriers, and panels, among others. These products are used in various end-use industries such as construction, transportation, and industrial to control noise pollution.

Acoustic insulation is a subset of the soundproofing materials market. Acoustic insulation materials are designed to absorb and dampen sound waves, preventing the transfer of sound from one area to another. Soundproofing materials, on the other hand, include a broader range of products that are designed to block or reduce sound transmission.

The soundproofing materials market is expected to have a positive impact on the acoustic insulation market. As noise pollution continues to be a major concern in various industries, the demand for acoustic insulation materials is expected to increase. The use of soundproofing materials in construction and industrial applications is also expected to drive the demand for acoustic insulation materials.

Futuristic Growth Use-Cases

The soundproofing materials market is expected to grow significantly in the coming years, driven by increasing demand from the construction, transportation, and industrial sectors. One of the key growth areas is expected to be the use of soundproofing materials in electric vehicles to reduce noise pollution. Additionally, the development of new and innovative soundproofing materials with advanced properties is expected to create new opportunities in the market.

Top Players

Some of the top players in the soundproofing materials market include Saint-Gobain S.A., Owens Corning, ROCKWOOL International A/S, BASF SE, and Johns Manville, among others.

Impact on Other Industries

The soundproofing materials market is expected to impact various other industries, including construction, automotive, and aerospace. As noise pollution continues to be a major concern, the demand for soundproofing materials is expected to increase in these industries. Additionally, the use of soundproofing materials in residential and commercial buildings is expected to drive the growth of the construction industry.

Speak to our Analyst today to know more about Soundproofing Materials Market!

The study involved four major activities in estimating the current size of the acoustic insulation market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Acoustic Insulation Market Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the acoustic insulations market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, National Insulation Association, International Monetary fund (IMF)and articles from recognized authors, authenticated directories, and databases.

Acoustic Insulation Market Primary Research

The Acoustic insulation market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing the end-use industry, such as residential, commercial, and industrial. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

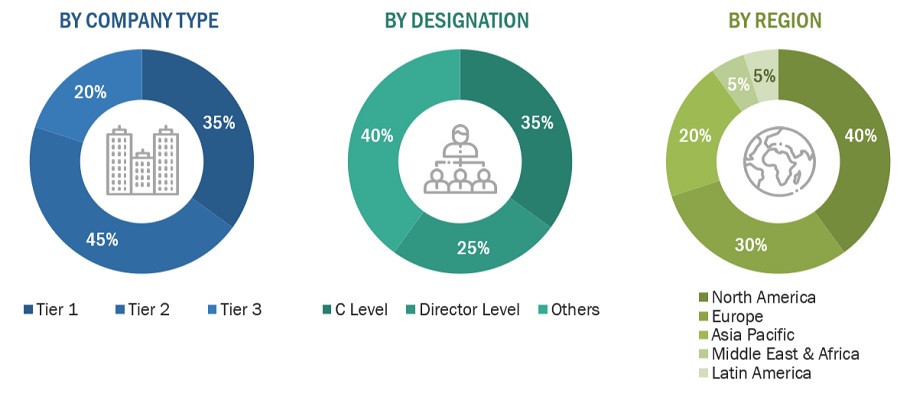

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Acoustic Insulation Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Acoustic insulation market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Acoustic Insulation Market Data Triangulation

After arriving at the overall market size-using the estimation processes explained above-the Acoustic insulation market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Acoustic Insulation Market Report Objectives

- To analyze and forecast the acoustic insulation market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market based on compound, type, application, and end-use industry

- To forecast the market size of different segments based on regions: Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape of market leaders

- To analyze competitive developments: investment & expansion, new product development, and merger & acquisitions in the market

- To strategically profile the key players and comprehensively analyze their core competencies2

Acoustic Insulation Market Report Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the Acoustic insulation market report:

Acoustic Insulation Market Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Acoustic Insulation Market Regional Analysis

- A further breakdown of the acoustic insulations market, by segments

Acoustic Insulation Market Company Information

- Detailed analysis and profiling of additional market players (up to ten)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Acoustic Insulation Market