Agricultural Colorants Market by Type (Dyes and Pigments), Application (Seed Treatment, Fertilizers, Crop Protection Products, Turf & Ornamentals, and Ponds/Lakes), and Region - Global Forecast to 2022

The agricultural colorants market is estimated at USD 1.63 Billion in 2017, and is projected to reach USD 2.03 Billion by 2022, during the forecast period. The objectives of the report are to define, segment, and estimate the global agricultural colorants market, in both quantitative and qualitative terms. The market is segmented by type, application, and region. It aims to provide detailed information about the crucial factors influencing the growth of the market, strategical analysis of micromarkets, opportunities for stakeholders, details of competitive landscape, and profiles of the key players with respect to their market share and competencies.

The years considered for the study are as follows:

- Base year: 2016

- Projection period: 2017 to 2022

Research Methodology:

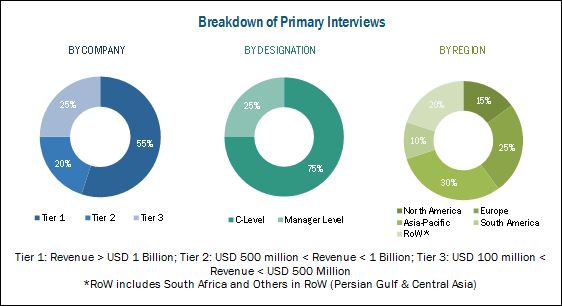

The top-down and bottom-up approaches were used to arrive at the market size and obtain the market forecast. Data triangulation methods were used to perform market estimation and market forecasting for the entire segmentation listed in this report. Extensive secondary research was conducted through databases such as FAOSTAT and World Bank data to understand the market insights and trends, which was further validated through primary interviews. The report provides both qualitative and quantitative analysis of the agricultural colorants market, the competitive landscape, and the preferred development strategies of key players.

To know about the assumptions considered for the study, download the pdf brochure

The value chain of agricultural colorants market begins with research & development, which comprises extraction, trials, and safety testing. Considerable efforts have been made in research & development to meet the growing demand for the market. After this, the manufacturing of the product is done; this phase comprises production and packaging of the agricultural colorants.

The formulation/manufacturing phase is required to maintain stringent quality standards. Further value addition is done in the distribution and marketing & sales. The maximum value addition of a product in the agricultural colorants industry is observed in the stages of registration & formulation/manufacturing, as the maximum cost is associated with the formulation of the dyes and pigments.

The key manufacturers in the value chain include BASF SE (Germany), DIC Corporation (Japan), Sensient Technology (U.S.), Clariant International AG (Switzerland), Lanxess Aktiengesellschaft (Germany), DyStar Singapore Pte. Ltd. (Singapore), Organic Dyes & Pigments (U.S.), Chromatech Inc. (U.S.), Keystone Aniline Corporation (U.S.), Croda International Plc (U.K.), Retort Chemicals Pvt. Ltd. (India), Globachem NV (Belgium), T.H. Glennon Company Inc. (U.S.), Aakash Chemicals & Dye Stuffs (U.S.), Germains Seed Technology Inc. (U.K.), BrettYoung (Canada), FirstSource Worldwide LLC (U.S.), Milliken Chemical (U.S.), Pylam Products Company Inc.(U.S.), Hocking International Laboratories (U.S.), Precision Laboratories, LLC (U.S.), and Geophonics Corp. (U.S.).

The stakeholders for insect growth regulators market are mentioned below:

- Agrochemical importers/exporters

- Pesticide manufacturers/suppliers

- Crop growers and warehouse owners

- Intermediary suppliers

- Wholesalers

- Traders

- Research institutes and organizations

- Regulatory bodies

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

:

This research report categorizes the global agricultural colorants market based on type, application, and region.

On the basis of Type, the market has been segmented into the following:

- Dyes

- Pigments

On the basis of Application, the market has been segmented into the following:

- Seed treatment

- Fertilizers

- Crop protection

- Turf & ornamentals

- Pond/lake colors

- Others (bio-stimulants and plant growth regulators)

On the basis of Region, the market has been segmented into the following:

- North America

- Europe

- Asia-Pacific

- South America

- Rest of the World (South Africa and Rest of RoW (Persian Gulf & Central Asia)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia-Pacific agricultural colorants market into Indonesia & Malaysia

- Further breakdown of the Rest of South America agricultural colorants market into Central American countries such as Honduras and Costa Rica

- Further breakdown of the RoW agricultural colorants market into South Africa and Others in RoW, which includes Persian Gulf countries and Central Asia

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The agricultural colorants market is estimated at USD 1.63 Billion in 2017, and is projected to reach USD 2.03 Billion by 2022. The primary factors influencing the agricultural colorants market are increased usage of advanced agricultural techniques, increase in awareness among farmers, multifunctionality of the agricultural colorants market, and rise in demand from the end-use industries, due to adoption of better farming techniques.

The agricultural colorants market is segmented by type, application, and region. On the basis of type, the pigments was the largest market in 2016. The pigment is a type of insoluble material that is suspended in a medium for its usage as colorant agents. Increase in turf & ornamental management across the globe is driving the demand for pigments, which increases the demand for agricultural colorants in the global market.

The agricultural colorants in the global l market, by application, is segmented into seed treatment, fertilizers, crop protection, turf & ornamentals, pond/lake colors, and others (bio-stimulants and plant growth regulators). The turf & ornamental segment accounted for the largest market share in 2016. This is due to the increasing number of applications of turf colorants in recreational areas, parks, golf courses, athletic fields, and lawns to enhance the aesthetic appeal.

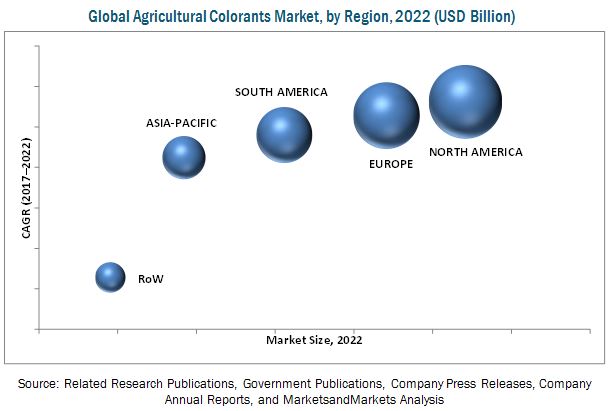

The North American market for agricultural colorants accounted for the largest share, followed by the European region in 2016. This is due to the increase in the consumption of dyes and pigments in various end-use agricultural products such as seed treatment, crop protection chemicals, fertilizers, and turf & ornamentals. The demand for healthy seeds to increase crop yield also pushes the demand for seed coating (colorants) with major usage as a turf colorants in the North American region.

The major restraining factors for agricultural colorants market are avoidance in use of colorants by fertilizer manufacturers, as colorants do not change the composition and content of the fertilizers, but increase the price with limited value addition; many manufacturers are avoiding colorants as a strategy to reduce the overall price of their product. Stringent and inconsistent regulations against usage of synthetic chemicals, especially in the European and North American region has somewhat affected the agricultural colorants market.

The agricultural colorants market is fragmented and not many big players hold the majority of market share. The companies profiled for this report are BASF SE (Germany), Lanxess Aktiengesellschaft (Germany), DIC Corporation (Japan), Clariant International AG (Switzerland), Sensient Technology (U.S.), Croda International PLC (U.K.), Organic Dyes & Pigments (U.S.), Keystone Aniline Corporation (U.S.), Chromatech Inc. (U.S.), BrettYoung (Canada), Germains Seed Technology Inc. (U.K.), Aakash Chemicals & Dye Stuffs (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Unit Considered

1.7 Stakeholders

1.8 Limitations

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Macro Indicators

2.2.1 Reducing Arable Land

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 Attractive Opportunities in the Agricultural Colorants Market

4.2 Agricultural Colorants Market, By Type

4.3 Agricultural Colorants Market, By Region & Application

4.4 Agricultural Colorants Market: Major Countries

4.5 Agricultural Colorants Market, By Application

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Multifuntionality of Colorants in Agriculture

5.2.1.2 Rise in Demand From End-User Industries Due to Adoption of Better Farming Techniques

5.2.2 Restraints

5.2.2.1 Stringent and Inconsistent Regulations on Synthetic Chemicals and Seed Treatment

5.2.2.2 Avoidance in Use of Colorants By Fertilizer Manufacturers

5.2.3 Opportunities

5.2.3.1 Development of Bio-Based Agricultural Colorants

5.2.3.2 Increase in the Greenfield Investments in Rapidly Emerging Markets of Asia-Pacific

5.2.4 Challenges

5.2.4.1 Drawbacks of Using Dyed Mulch on Crops

5.3 Value Chain

5.4 Supply Chain

6 Agricultural Colorants Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Dyes

6.2.1 Types of Dyes

6.2.1.1 Water-Soluble Dyes

6.2.1.2 Solvent-Soluble Dyes

6.3 Pigments

6.3.1 Types of Pigments

6.3.1.1 Organic Pigments

6.3.1.2 Inorganic Pigments

7 Agricultural Colorants Market, By Application (Page No. - 41)

7.1 Introduction

7.2 Seed Treatment

7.3 Fertilizers

7.3.1 Crop Protection

7.3.2 Turf & Ornamentals

7.3.3 Pond/Lake Colors

7.3.4 Others

8 Agricultural Colorants Market, By Region (Page No. - 51)

8.1 Introduction

8.2 North America

8.2.1 U.S.

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 France

8.3.2 Germany

8.3.3 Russia

8.3.4 Rest of Europe

8.4 Asia-Pacific

8.4.1 China

8.4.2 India

8.4.3 Australia

8.4.4 Rest of Asia-Pacific

8.5 South America

8.5.1 Brazil

8.5.2 Argentina

8.5.3 Rest of South America

8.6 Rest of the World (RoW)

8.6.1 South Africa

8.6.2 Rest of RoW

9 Competitive Landscape (Page No. - 79)

9.1 Introduction

9.2 Vendor Dive

9.2.1 Vanguards

9.2.2 Dynamic

9.2.3 Innovator

9.2.4 Emerging

9.3 Competitive Benchmarking

9.3.1 Product Offerings

9.3.2 Business Strategy

*Top Companies Analyzed for This Study are Aakash Chemicals & Dye Stuffs (U.S.); Germains Seed Technology, Inc. (Uk); BASF SE (Germany); DIC Corporation (Japan); Clariant International AG (Switzerland); Lanxess Aktiengesellschaft (Germany); Sensient Technologies (U.S.); Dystar Singapore Pte. Ltd. (Singapore); Organic Dyes & Pigments (U.S.); Chromatech Inc. (U.S.); Keystone Aniline Corporation (U.S.); Brettyoung (Canada); Firstsource Worldwide LLC (U.S.); Milliken Chemical (U.S.); Pylam Products Company Inc.(U.S.); Hocking International Laboratories (U.S.); Precision Laboratories, LLC (U.S.); Geophonics Corp. (U.S.); Croda International PLC (U.K.); Retort Chemicals Pvt. Ltd. (India); Globachem Nv (Belgium); T.H. Glennon Company Inc. (U.S.)

10 Company Profiles (Page No. - 83)

(Business Overview, Products & Services, Key Insights, Recent Developments, MnM View)*

10.1 BASF SE

10.2 Lanxess Aktiengesellschaft (Lanxess)

10.3 DIC Corporation

10.4 Clariant International AG

10.5 Sensient Technologies

10.6 Croda International PLC

10.7 Organic Dyes and Pigments

10.8 Keystone Aniline Corporation

10.9 Chromatech Incorporated

10.10 Brettyoung

10.11 Germains Seed Technology Inc.

10.12 Aakash Chemicals & Dye Stuffs

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 117)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Introducing RT: Real-Time Market Intelligence

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (63 Tables)

Table 1 Agricultural Colorants Market Size, By Type, 2015-2022 (USD Million)

Table 2 Market Size, By Type, 2015-2022 (KT)

Table 3 Dyes: Agricultural Colorants Market Size, By Subsegment, 2015-2022 (USD Million)

Table 4 Dyes: Market Size, By Subsegment, 2015-2022 (KT)

Table 5 Pigments: Agricultural Colorants Market Size, By Subsegment, 2015-2022 (USD Million)

Table 6 Pigments: Market Size, By Subsegment, 2015-2022 (KT)

Table 7 Agricultural Colorants Market Size, By Application, 20152022 (USD Million)

Table 8 Market Size, By Application, 20152022 (KT)

Table 9 Seed Treatment Market Size, By Region, 20152022 (USD Million)

Table 10 Seed Treatment Market Size, By Region, 20152022 (KT)

Table 11 Fertilizers Market Size, By Region, 20152022 (USD Million)

Table 12 Fertilizers Market Size, By Region, 20152022 (KT)

Table 13 Crop Protection Market Size, By Region, 20152022 (USD Million)

Table 14 Crop Protection Market Size, By Region, 20152022 (KT)

Table 15 Turf & Ornamentals Market Size, By Region, 20152022 (USD Million)

Table 16 Turf & Ornamentals Market Size, By Region, 20152022 (KT)

Table 17 Pond/Lake Colors Market Size, By Region, 20152022 (USD Million)

Table 18 Pond/Lake Colors Market Size, By Region, 20152022 (KT)

Table 19 Others Market Size, By Region ,20152022 (USD Million)

Table 20 Others Market Size, By Region, 20152022 (KT)

Table 21 Agricultural Colorants Market Size, By Region, 2015-2022 (USD Million)

Table 22 Market Size, By Region, 2015-2022 (KT)

Table 23 North America: Agricultural Colorants Market Size, By Country, 20152022 (USD Million)

Table 24 North America: Market Size, By Application, 2015-2022 (USD Million)

Table 25 North America: Market Size, By Type, 2015-2022 (USD Million)

Table 26 North America: Agricultural Colorants in Dyes Market Size, By Subsegment, 2015-2022 (USD Million)

Table 27 North America: Agricultural Colorants in Pigments Market Size, By Subsegment, 2015-2022 (USD Million)

Table 28 U.S.: Agricultural Colorants Market Size, By Type, 2015-2022 (USD Million)

Table 29 Canada: Market Size, By Type, 2015-2022 (USD Million)

Table 30 Mexico: Market Size, By Type, 2015-2022 (USD Million)

Table 31 Europe: Agricultural Colorants Market Size, By Country, 20152022 (USD Million)

Table 32 Europe: Market Size, By Application, 2015-2022 (USD Million)

Table 33 Europe: Market Size, By Type, 2015-2022 (USD Million)

Table 34 Europe: Agricultural Colorants in Dyes Market Size, By Subsegment, 2015-2022 (USD Million)

Table 35 Europe: Agricultural Colorants in Pigments Market Size, By Subsegment, 2015-2022 (USD Million)

Table 36 France: Agricultural Colorants Market Size, By Type, 2015-2022 (USD Million)

Table 37 Germany: Agricultural Colorants Market Size, By Type, 2015-2022 (USD Million)

Table 38 Russia: Market Size, By Type, 2015-2022 (USD Million)

Table 39 Rest of Europe: Market Size, By Type, 2015-2022 (USD Million)

Table 40 Asia-Pacific: Agricultural Colorants Market Size, By Country, 20152022 (USD Million)

Table 41 Asia-Pacific: Market Size, By Application, 2015-2022 (USD Million)

Table 42 Asia-Pacific: Market Size, By Type, 2015-2022 (USD Million)

Table 43 Asia-Pacific: Agricultural Colorants in Dyes Market Size, By Subsegment, 2015-2022 (USD Million)

Table 44 Asia-Pacific: Agricultural Colorants in Pigments Market Size, By Subsegment, 2015-2022 (USD Million)

Table 45 China: Agricultural Colorants Market Size, By Type, 2015-2022 (USD Million)

Table 46 India: Market Size, By Type, 2015-2022 (USD Million)

Table 47 Australia: Agricultural Colorants Market Size, By Type, 2015-2022 (USD Million)

Table 48 Rest of Asia-Pacific: Agricultural Colorants Market Size, By Type, 2015-2022 (USD Million)

Table 49 South America: Agricultural Colorants Market Size, By Country, 20152022 (USD Million)

Table 50 South America: Market Size, By Application, 2015-2022 (USD Million)

Table 51 South America: Market Size, By Type, 2015-2022 (USD Million)

Table 52 South America: Agricultural Colorants in Dyes Market Size, By Subsegment, 2015-2022 (USD Million)

Table 53 South America: Agricultural Colorants in Pigments Market Size, By Subsegment, 2015-2022 (USD Million)

Table 54 Brazil: Agricultural Colorants Market Size, By Type, 2015-2022 (USD Million)

Table 55 Argentina: Market Size, By Type, 2015-2022 (USD Million)

Table 56 Rest of South America: Market Size, By Type, 2015-2022 (USD Million)

Table 57 RoW: Agricultural Colorants Market Size, By Country, 20152022 (USD Million)

Table 58 RoW: Market Size, By Application, 2015-2022 (USD Million)

Table 59 RoW: Market Size, By Type, 2015-2022 (USD Million)

Table 60 RoW: Agricultural Colorants in Dyes Market Size, By Subsegment, 2015-2022 (USD Million)

Table 61 RoW: Agricultural Colorants in Pigments Market Size, By Subsegment, 2015-2022 (USD Million)

Table 62 South Africa: Agricultural Colorants Market Size, By Type, 2015-2022 (USD Million)

Table 63 Rest of RoW: Market Size, By Type, 2015-2022 (USD Million)

List of Figures (29 Figures)

Figure 1 Research Design

Figure 2 Arable Land, 20102050 (Hactares Per Person)

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Agricultural Colorants Market: Data Triangulation

Figure 6 North America is Expected to Dominate the Market From 2017 to 2022

Figure 7 Agricultural Colorants Market Size, By Type, 2017 vs 2022

Figure 8 Turf & Ornamentals is Projected to Hold the Largest Market Share By 2022

Figure 9 Attractive Opportunities in Agricultural Colorants Market, 20172022

Figure 10 The Pigments Segment is Projected to Be the Largest During the Forecast Period

Figure 11 The North American Region Was the Largest Market for Agricultural Colorants in 2016

Figure 12 The U.S. is Projected to Be the Fastest-Growing Country-Level Market for Agricultural Colorants, From 2017 to 2022

Figure 13 The North American Region Dominated the Market in 2016

Figure 14 Agricultural Colorants: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Greenfield FDI Inflows in the Asia-Pacific Region From 2010 to 2015

Figure 16 Value Chain Analysis for Market: Most of the Value Added is During Registration and Formulation

Figure 17 Supply Chain for Market

Figure 18 Pigments Segment is Expected to Dominate the Market,2017-2022 (USD Million)

Figure 19 Turf & Ornamentals Segment is Expected to Dominate the Market Throughout the Forecast Period

Figure 20 Regional Snapshot: North American Market is Projected to Grow at the Highest Rate From 2017 to 2022

Figure 21 North America: Market Snapshot (20152022)

Figure 22 Asia-Pacific: Market Snapshot (20152022)

Figure 23 Dive Chart

Figure 24 BASF SE: Company Snapshot

Figure 25 Lanxess Aktiengesellschaft (Lanxess): Company Snapshot

Figure 26 DIC Corporation: Company Snapshot

Figure 27 Clariant International AG: Company Snapshot

Figure 28 Sensient Technologies: Company Snapshot

Figure 29 Croda International PLC: Company Snapshot

Growth opportunities and latent adjacency in Agricultural Colorants Market