Agricultural Dyes & Pigments Market by Type (Dyes and Pigments), Application (Seed Treatment, Fertilizers, Crop Protection Products, Turf & Ornamental, Pond/Lake Color & Others), and by Region - Global Forecasts to 2020

The agricultural dyes & pigments market is estimated to be valued at USD 1.51 Billion in 2015. The market is projected to grow at a CAGR of 4.3% from 2015 to 2020. The agricultural dyes & pigments market is segmented on the basis of its types and applications. It is further segmented on the basis of regions, such as North America, Europe, Asia-Pacific, Latin America, and Rest of the World (RoW). The years considered for the study are:

- Base Year 2014

- Estimated Year 2015

- Projected Year 2020

- Forecast Period 2015 to 2020

Research Methodology:

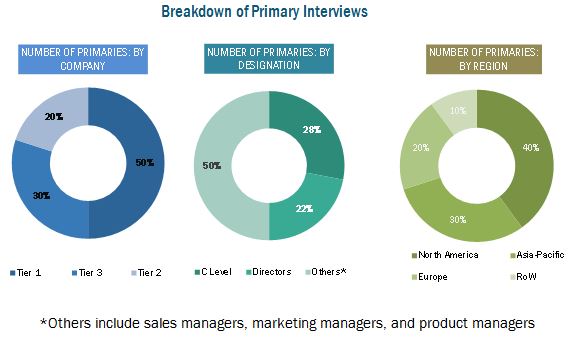

This report includes estimations of market sizes for value (USD million) and volume (KT). Both top-down and bottom-up approaches have been used to estimate and validate the size of the global agricultural dyes & pigments market and to estimate the size of various other submarkets. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

includes qualitative and quantitative analyses of the agricultural dyes & pigments market, competitive landscape, and the preferred development strategies of key players. The report also analyzes the market dynamics and issues faced by leading players.

Market Ecosystem:

The upstream players such as the raw material suppliers of the agricultural dyes & pigments and the downstream stakeholders such as the manufacturers and end-user industries of the agricultural dyes & pigments influence the global agricultural dyes & pigments market.

Target Audience:

The report is targeted toward the existing players in the industry, which include fertilizer & agrochemical manufacturers, turf & ornamental manufacturers, seed treatment & crop protection manufacturers, pond/lake color manufacturers, and research institutions. Key participants in the supply chain of agricultural dyes & pigments are raw material suppliers, government bodies, distributors, and end users.

Companies who offer agricultural dyes & pigments to end users have been included such as Bayer CropScience AG (Germany) and BASF SE (Germany).

The study answers several questions for stakeholders, primarily which market segments to focus on in next two to five years for prioritizing efforts and investments.

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

On the basis of type, the market is segmented as follows:

- Dyes

- Pigments

On the basis of application, the market is segmented as follows:

- Seed Treatment

- Fertilizers

- Crop Protection Products

- Turf & Ornamental

- Pond/Lake Color

- Others including bio-stimulants & plant growth regulators

On the basis of region, the market is segmented as follows:

- North America

- Europe

- Asia-Pacific

- Latin America

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The agricultural dyes & pigments market is projected to grow at a CAGR of 4.3% from 2015 to reach a projected value of USD 1.86 Billion by 2020. The market growth is driven by increasing demand from end-user industries such as fertilizer industry, turf & ornamental industry & pond/lake color management industry. Further, the increasing number of applications such as use of dyes & pigments in seed treatment, seed coating, seed dressing and crop protection products. The market is further driven by factors such as advanced farming technologies and its multi-functional uses.

Depending upon the applications, the agricultural dyes & pigments market is led by the turf & ornamentals segment, followed by pond/lake color. Pond/lakes and turf & ornamental are the major applications for the agricultural dyes & pigments market. Pond water is generally cloudy, dull, and dirty brown in appearance. Thus, dyes and pigments are added to the lakes and ponds, which has special UV filtering properties that protect the ponds and lakes and maintains its natural color shading by limiting algae growth. Further, turf paint is preferred by most number of people for imparting lawns and gardens with color. Among the types of agricultural dyes & pigments, i.e., dyes and pigments, pigments accounted for the largest market share in 2014, followed by dyes.

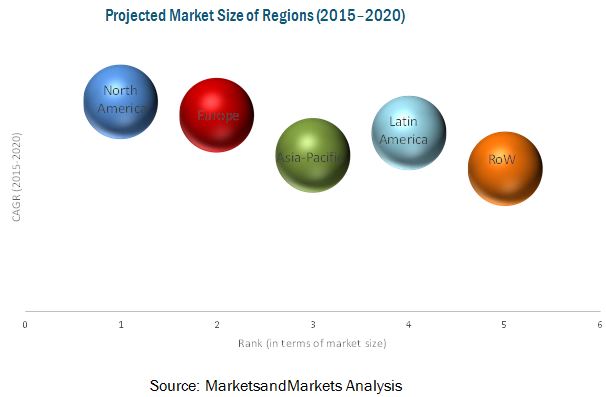

North America accounted for the largest share in the agricultural dyes & pigments market, followed Europe and Latin America. Adoption of agriculture dyes & pigments in emerging countries such as Brazil, South Africa, and Argentina is increasing, which is promoted by agronomic benefits in terms of yield and protection. The North American region is projected to be the fastest-growing market with investments from several multinational manufacturers, especially in countries such as the U.S., Canada, and Mexico.

The different government regulations in different countries related to the usage of agricultural dyes & pigments and growing environmental concerns such as contamination of groundwater and soil pollution may hinder the growth of the agricultural dyes & pigments market.

The key market players that dominated the agricultural dyes & pigments market include Bayer CropScience AG (Germany), BASF SE (Germany), Clariant International AG (Switzerland), Chromatech Incorporated (U.S.), and INCOTEC Group BV (The Netherlands). Most key participants have been exploring new regions through new product launches across the globe, to avail a competitive advantage through combined synergies.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Farm Expenditure

2.2.3 Supply-Side Analysis

2.2.3.1 Fluctuations in Raw Material Prices

2.2.3.2 Research & Development

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.4.1 Data Triangulation

2.5 Research Assumptions & Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 31)

3.1 Overview

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in Agricultural Dyes & Pigments Market

4.2 Agricultural Dyes & Pigments Market Across Different Regions

4.3 Agricultural Dyes & Pigments Market Potential

4.4 Agricultural Dyes & Pigments Life Cycle Analysis, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Agricultural Dyes & Pigments Market, By Type

5.2.2 Agricultural Dyes & Pigments Market, By Application

5.3 Market Dynamics

5.3.1 Market Drivers

5.3.1.1 Increasing Demand From End-User Industries

5.3.1.2 Advanced Farming Technologies

5.3.1.3 Multi-Functional Benefits

5.3.2 Market Restraints

5.3.2.1 Avoidance By Fertilizer Manufacturers

5.3.2.2 Stringent Government Regulations

5.3.2.3 Growing Environmental Considerations

5.3.3 Market Opportunities

5.3.3.1 Green-Field Investments

5.3.3.2 Development of Environment-Friendly Agricultural Dyes & Pigments

5.3.4 Challenge

5.3.4.1 Colored Mulches: an Environmental Concern

5.4 Porters Analysis

5.4.1 Bargaining Power of Suppliers

5.4.2 Bargaining Power of Buyers

5.4.3 Threat of New Entrants

5.4.4 Threat of Substitutes

5.4.5 Intensity of Competetive Rivalry

6 Industry Trends (Page No. - 55)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Value Chain Analysis

6.4 Industry Insights

6.4.1 Prominent Companies

6.4.2 Small & Medium Enterprises

7 Regulations in Agricultural Dyes & Pigments Market (Page No. - 58)

7.1 Introduction

7.2 Electronic Code of Federal Regulations, U.S.

7.3 Environmental Protection Agency (EPA), U.S.

7.4 Japan External Trade Organization, Japan

7.5 Philippines National Standard of Organic Farming

8 Agricultural Dyes & Pigments Market, By Brand (Page No. - 60)

8.1 Introduction

8.2 Stressgard

8.3 ProIzed Seed Colorant

8.4 Color Coat Colorants

8.5 Starburst Mulch Colorant

8.6 Impact Mulch Colorant

8.7 Poly Tree Rubber Colorant

8.8 Mulch Magic Mulch Colorant

8.9 Sensipro

8.10 Agrocer

8.11 PV Fast

8.12 Chromatint

9 Agricultural Dyes & Pigments Market, By Type (Page No. - 68)

9.1 Introduction

9.2 Dyes

9.2.1 Types of Dyes

9.2.1.1 Water-Soluble Dyes

9.2.1.2 Solvent-Soluble Dyes

9.3 Pigments

9.3.1 Types of Pigments

9.3.1.1 Organic Pigments

9.3.1.2 Inorganic Pigments

10 Agricultural Dyes & Pigments Market, By Application (Page No. - 74)

10.1 Introduction

10.2 Seed Treatment

10.2.1 Crop (Agriculture) Seed

10.2.1.1 Insecticides

10.2.1.2 Fungicides

10.2.1.3 Inoculants

10.2.1.4 Others

10.2.2 Grass (TURF) Seeds

10.2.2.1 Insecticides

10.2.2.2 Fungicides

10.2.2.3 Inoculants

10.2.2.4 Others

10.3 Fertilizers

10.3.1 By Type

10.3.1.1 Nitrogen

10.3.1.2 Phosphorus

10.3.1.3 Potassium

10.3.1.4 Micronutrients

10.3.1.5 Others

10.3.2 By End-Use Form

10.3.2.1 Water-Soluble Fertilizers (Granules)

10.3.2.2 Liquid Fertilizers

10.3.2.3 Controlled-Release Fertilizers

10.3.2.4 Slow-Release Fertilizers

10.3.2.5 Others

10.3.3 Crop Protection Products

10.3.3.1 Insecticides

10.3.3.2 Fungicides

10.3.3.3 Inoculants

10.3.3.4 Others

10.3.4 TURF & Ornamentals

10.3.5 Pond Color/Lake Color

10.3.6 Others

11 Agricultural Dyes & Pigments Market, By Region (Page No. - 98)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Russia

11.3.4 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Australia

11.4.4 Rest of Asia-Pacific

11.5 Latin America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of Latin America

11.6 RoW

11.6.1 South Africa

11.6.2 Other Countries in RoW

12 Competitive Landscape (Page No. - 132)

12.1 Overview

12.2 Competitive Situation & Trends

12.2.1 Expansions

12.2.2 New Product Launches

12.2.3 Acquisitions

12.2.4 Partnerships, Collaborations, Agreements & Joint Ventures

12.2.5 Investments

13 Company Profiles (Page No. - 138)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 BASF SE Company

13.3 Bayer Cropscience AG

13.4 Clariant International AG

13.5 Croda International PLC

13.6 Incotec Group Bv

13.7 Sun Chemical Corporation

13.8 Brettyoung

13.9 Germains Seed Technology Inc.

13.10 Organic Dyes & Pigments

13.11 Keystone Aniline Corporation

13.12 Chromatech Incorporated

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 169)

14.1 Discussion Guide

14.2 Company Developments

14.2.1 Expansions

14.2.2 New Product Launches

14.2.3 Acquisitions

14.2.4 Partnerships, Collaborations, Agreements & Joint Ventures

14.3 Introducing RT: Real Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

List of Tables (97 Tables)

Table 1 Stressgard: Product Range

Table 2 ProIzed Seed Colorant: Product Range

Table 3 Color Coat Colorants: Product Range

Table 4 Starburst Mulch Colorant: Product Range

Table 5 Impact Mulch Colorant: Product Range

Table 6 Poly Tree Rubber Colorant: Product Range

Table 7 Mulch Magic Mulch Colorant: Product Range

Table 8 Sensipro: Product Range

Table 9 Agrocer: Product Range

Table 10 PV Fast: Product Range

Table 11 Chromatint: Product Range

Table 12 Agricultural Dyes & Pigments Market Size, By Type, 20132020 (USD Million)

Table 13 Agricultural Dyes & Pigments Market Size, By Type, 20132020 (KT)

Table 14 Agricultural Dyes & Pigments Market Size, By Dye Type, 20132020 (USD Million)

Table 15 Agricultural Dyes & Pigments Market Size, By Dye Type, 20132020 (KT)

Table 16 Agricultural Dyes & Pigments Market Size, By Pigment Type, 20132020 (USD Million)

Table 17 Agricultural Dyes & Pigments Market Size, By Pigment Type, 20132020 (KT)

Table 18 Agricultural Dyes & Pigments Market Size, By Application, 20132020 (USD Million)

Table 19 Agricultural Dyes & Pigments Market Size, By Application, 20132020 (KT)

Table 20 EPA Approved Dyes for Seed Treatment Materials

Table 21 Seed Treatment Market Size, By Type, 20132020 (USD Million)

Table 22 Seed Treatment Market Size, By Type, 20132020 (KT)

Table 23 Crop (Agriculture) Seed Market Size, By Type, 20132020 (USD Million)

Table 24 Crop (Agriculture) Seed Market Size, By Type, 20132020 (KT)

Table 25 Grass (TURF) Seed Market Size, By Type, 20132020 (USD Million)

Table 26 Grass (TURF) Seed Market Size, By Type, 20132020 (KT)

Table 27 Agricultural Dyes & Pigments for Fertilizers & Pesticides

Table 28 Fertilizers Market Size, By Type, 20132020 (USD Million)

Table 29 Fertilizers Market Size, By Type, 20132020 (KT)

Table 30 Agricultural Dyes & Pigments By Chromatech Europe B.V. (Europe) Designed for Application in Water Soluble Fertilizers

Table 31 Fertilizers Market Size, By End-Use Form, 20132020 (USD Million)

Table 32 Fertilizers Market Size, By End-Use Form, 20132020 (KT)

Table 33 Crop Protection Products & Protection Against Specific Crops

Table 34 Crop Protection Products Market Size, By Type, 20132020 (USD Million)

Table 35 Crop Protection Products Market Size, By Type, 20132020 (KT)

Table 36 Agricultural Dyes & Pigments Market Size, By Region, 2013-2020 (USD Million)

Table 37 North America: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 38 North America: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 39 North America: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (USD Million)

Table 40 North America: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (KT)

Table 41 U.S.: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 42 U.S.: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 43 Canada: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 44 Canada: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 45 Mexico: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 46 Mexico: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 47 Europe: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 48 Europe: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 49 Europe: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (USD Million)

Table 50 Europe: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (KT)

Table 51 France: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 52 France: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 53 Germany: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 54 Germany: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 55 Russia: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 56 Russia: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 57 Rest of Europe: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 58 Rest of Europe: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 59 Asia-Pacific: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 60 Asia-Pacific: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 61 Asia-Pacific: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (USD Million)

Table 62 Asia-Pacific: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (KT)

Table 63 China: Agricultural Dyes & Pigments Market Size for Environmental Management, By Type, 20132020 (USD Million)

Table 64 China: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (KT)

Table 65 India: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (USD Million)

Table 66 India: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (KT)

Table 67 Australia: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (USD Million)

Table 68 Australia: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (KT)

Table 69 Rest of Asia-Pacific: Agricultural Dyes & Pigments Market, By Type, 20132020 (USD Million)

Table 70 Rest of Asia-Pacific: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (KT)

Table 71 Latin America: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 72 Latin America: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 73 Latin America: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (USD Million)

Table 74 Latin America: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (KT)

Table 75 Brazil: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (USD Million)

Table 76 Brazil: Agricultural Dyes & Pigments Market Size By Type, 20132020 (KT)

Table 77 Argentina: Agricultural Dyes & Pigments Market, By Type, 20132020 (USD Million)

Table 78 Argentina: Agricultural Dyes & Pigments Market, By Type, 20132020 (KT)

Table 79 Rest of Latin America: Agricultural Dyes & Pigments Market, By Type, 20132020 (USD Million)

Table 80 Rest of Latin America: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (KT)

Table 81 RoW: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (USD Million)

Table 82 RoW: Agricultural Dyes & Pigments Market Size, By Type, 2013-2020 (KT)

Table 83 RoW: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (USD Million)

Table 84 RoW: Agricultural Dyes & Pigments Market Size, By Application, 2013-2020 (KT)

Table 85 South Africa: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (USD Million)

Table 86 South Africa: Agricultural Dyes & Pigments Market Size For, By Type, 20132020 (KT)

Table 87 Other Countries in RoW: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (USD Million)

Table 88 Other Countries in RoW: Agricultural Dyes & Pigments Market Size, By Type, 20132020 (KT)

Table 89 Expansions, 2015

Table 90 New Product Launches, 2015

Table 91 Acquisitions, 20132015

Table 92 Partnerships, Collaborations, Agreements & Joint Ventures, 20142015

Table 93 Investments, 20122013

Table 94 Expansions, 20102015

Table 95 New Product Launches, 20102015

Table 96 Acquisitions, 20102015

Table 97 Partnerships, Collaborations, Agreements & Joint Ventures, 20102015

List of Figures (53 Figures)

Figure 1 Agricultural Dyes & Pigments Market Segmentation

Figure 2 Research Design

Figure 3 U.S. Agricultural Farm Expenditure, 2013 vs 2014 (USD Million)

Figure 4 Fluctuations in Raw Material Prices, 2000 to 2014 (USD Per Mt/BBL)

Figure 5 Public Expenditure on Agricultural Research & Development, By Region

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Agricultural Dyes & Pigments Market, By Type (2015 vs 2020)

Figure 9 Agricultural Dyes & Pigments Market, By Application (2015 vs 2020)

Figure 10 Agricultural Dyes & Pigments Market Trend, By Region, 2014

Figure 11 North America is Projected to Be the Fastest-Growing Market By 2020

Figure 12 Agricultural Dyes & Pigments Market Value is Estimated to Reach USD 1,863.5 Million By 2020

Figure 13 North America Accounted for Major Share in Agricultural Dyes & Pigments Market in 2015

Figure 14 North America is Projected to Grow at the Highest CAGR During the Period 2015-2020

Figure 15 North American Market is Expected to Continue to Grow at an Exponential Rate During the Forecast Period

Figure 16 By Type

Figure 17 By Application

Figure 18 Agricultural Dyes & Pigments: Drivers, Restraints, Opportunities & Challenge

Figure 19 Annual Crop Protection Market Size Analysis, 20112016 (USD Million)

Figure 20 Annual Seed Treatment Market Size Analysis, 20112016 (USD Million)

Figure 21 Porters Five Force Analysis: Agricultural Dyes & Pigments Market

Figure 22 Distribution Channel Plays A Vital Role in the Supply Chain for Agricultural Dyes & Pigments

Figure 23 Value Chain of Agricultural Dyes & Pigments

Figure 24 Agricultural Dyes & Pigments Market, 2015 vs 2020 (USD Million)

Figure 25 Agricultural Dyes Market

Figure 26 Agricultural Pigments Market, 2015 vs 2020 (USD Million)

Figure 27 Agricultural Dyes & Pigments Market Segmentation, By Application

Figure 28 TURF & Ornamental Segment is Projected to Grow at A Highest CAGR for the Period Between 2015-2020

Figure 29 Seed Treatment Market Size, By Type, 2015 vs 2020 (USD Million)

Figure 30 Global Sales of Seed Treatment Applications (% Market Share)

Figure 31 Crop (Agriculture) Seed Market Size, By Type, 2015 vs 2020 (USD Million)

Figure 32 Grass (TURF) Seed Market Size, By Type, 2015 vs 2020 (USD Million)

Figure 33 Fertilizers Market Size, By Type, 2015 vs 2020 (USD Million)

Figure 34 Fertilizers Market Size, By End Use, 2015 vs 2020 (USD Million)

Figure 35 Crop Protection Products Market Size, By Type, 2015 vs 2020 (USD Million)

Figure 36 Geographic Snapshot (2015-2020): Rapidly Growing Markets are Emerging as New Hot Spots

Figure 37 North American Agricultural Dyes & Pigments Market: A Snapshot

Figure 38 European Agricultural Dyes & Pigments Market: A Snapshot

Figure 39 Asia-Pacific Agricultural Dyes & Pigments Market: A Snapshot

Figure 40 Expansions and New Product Launches Were Preferred By Key Agricultural Dyes & Pigments Companies From 2010 to 2015

Figure 41 Expansions Fueled Growth of Agricultural Dyes & Pigments Between 2010 to 2015

Figure 42 Expansions & New Product Launches: the Key Strategies, 2010-2015

Figure 43 Geographic Revenue Mix of Top Five Market Players

Figure 44 BASF SE : Company Snapshot

Figure 45 BASF SE Company: SWOT Analysis

Figure 46 Bayer Cropscience AG Company: Company Snapshot

Figure 47 Bayer Cropscience AG: SWOT Analysis

Figure 48 Clariant International AG : Company Snapshot

Figure 49 Clariant International AG : SWOT Analysis

Figure 50 Croda International PLC: Company Snapshot

Figure 51 Croda International PLC : SWOT Analysis

Figure 52 Incotec Group BV: Company Snapshot

Figure 53 Sun Chemical Corporation: SWOT Analysis

Growth opportunities and latent adjacency in Agricultural Dyes & Pigments Market