Agriculture Robots Market by Type (Unmanned Aerial Vehicles/Drones, Milking Robots, Driverless Tractors, Automated Harvesting Systems), Farming Environment (Indoor and Outdoor), End-use Application and Region - Global Forecast to 2028

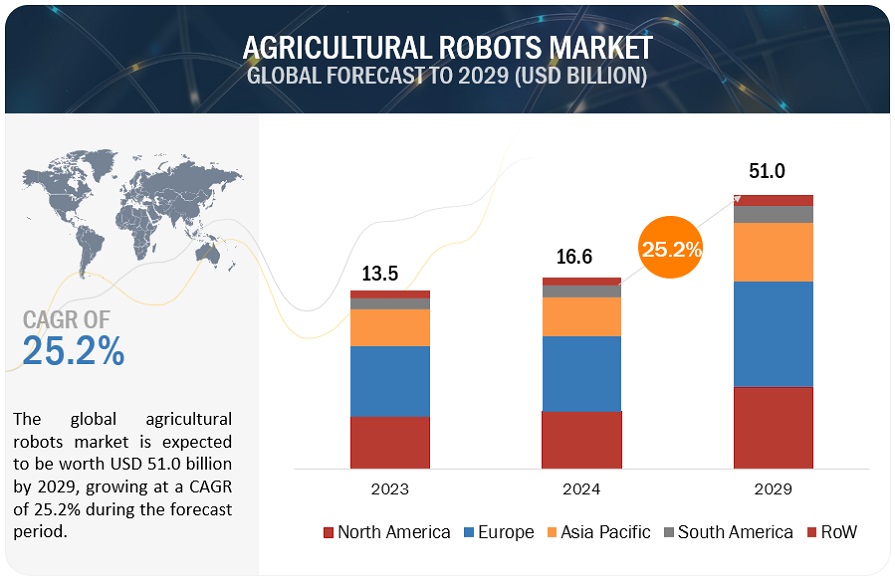

The agriculture robots market is estimated at USD 13.5 billion in 2023; it is projected to grow at a CAGR of 24.3 % to reach USD 40.1 billion by 2028.

The agriculture robots market represents a dynamic landscape filled with immense potential, poised to redefine and revolutionize the agricultural industry. Equipped with cutting-edge technologies and AI capabilities, these sophisticated machines offer unprecedented opportunities for precision agriculture, resource optimization, and sustainable farming practices. With their capacity to automate labor-intensive tasks, enhance productivity, and deliver real-time data insights, agriculture robots are reshaping the future of farming. Envision a world where crops are nurtured with unparalleled precision, scarce resources are utilized efficiently, and data-driven decision-making empowers farmers for bountiful harvests. From autonomous planting and harvesting to crop monitoring and soil analysis, agriculture robots are spearheading a paradigm shift in the agricultural landscape.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Agriculture Robots Market Dynamics

Driver: Growing cost of labor encouraging automation

The growing global population and increasing labor charges are driving the market for agriculture robots. As the demand for food rises, farmers face the challenge of producing more with limited labor availability and rising labor costs. Agriculture robots offer a solution by automating tasks such as planting, harvesting, and monitoring, reducing the dependency on human labor. These robots enable increased productivity, efficiency, and precision, leading to higher yields and reduced production costs. With the potential to address labor shortages and optimize resource utilization, the adoption of agriculture robots becomes increasingly attractive, fueling the growth of the market and supporting sustainable agricultural practices.. Even in agricultural hubs, for instance, California, where farm wages can sometimes top USD 20 per hour, high wages are not encouraging people to perform physically demanding and repetitive tasks, for instance, berry picking. Robotic automation will not only perform unwanted jobs, but also attract skilled workers toward other non-repetitive tasks. For example, in dairy farms, tasks, such as cleaning and feeding can be automated through robots, making it easier for farmers to focus more on decision-making. Large farming companies are helping startups engaging in agricultural robotic solutions by investing in their technology. For instance, two-thirds of the investors in Harvest CROO (US) are affiliated with the strawberry industry.

Restraint: High cost of digitisation for small farms

The high cost of agriculture robots is posing significant challenges to the digitalization of the agricultural sector. While these robots offer numerous benefits, including increased efficiency, precision, and reduced labor requirements, their prohibitive prices hinder widespread adoption among farmers, especially small and medium-sized ones. The initial investment and maintenance costs of agricultural robots create financial barriers, limiting access to advanced technology for many farmers.

As a result, the digital divide in agriculture widens, with larger and wealthier farms benefitting from technology-driven advancements, while smaller and resource-constrained farms struggle to keep pace. Moreover, the high costs also deter agricultural technology companies from developing affordable solutions, further limiting options for cost-conscious farmers. Addressing the cost issue requires concerted efforts from governments, industry stakeholders, and research institutions to promote research and development in affordable robot technology. Increased funding, subsidies, and incentives for adopting agricultural robots can help bridge the digital divide and unlock the full potential of digitalization in agriculture, ensuring a sustainable and inclusive transformation of the sector.

Opportunity: Untapped market potential and scope for automation in agriculture

Robots are being used extensively in the food processing industry; however, they are not used to the same extent in agriculture. In addition, the use of robotics for livestock management is an opportunity for the deployment of autonomous platforms, for instance, IoT tags. The introduction of remote sensing for tracking raw materials or livestock for industrial production through different identification tags to optimize the quantity and quality of crops or livestock produced can further enhance automation in the agricultural ifndustry. The development and adoption of various drone and robotic technologies have helped farmers tackle the rigorous nature of their profession with greater ease. Agricultural technologies combined with GPS navigation and vision systems help farmers plow and spray crops with greater precision. Fleets of small, lightweight robots are now seen as a replacement for traditional high-mass tractors in the future.

According to a white paper published in 2018 by the UK-Robotics and Autonomous Systems (UK-RAS) Network, about 50% of all herds in Europe will be milked by robots by 2025. Robotic systems are also starting to perform other tasks around the farm, such as removing waste from animal cubicle pens or carrying and moving feed. Advanced automation and big data analytics are penetrating farming robot technology to enable larger benefits. IoT, big data, and artificial intelligence are some of the technologies that are adopted by the manufacturers of agricultural robots.

Stringent government regulations, especially in the EU, that favor the use of targeted pesticide application in limited quantities using robots, have led to a reduced number of new pesticides entering the agricultural market. Robots that apply fertilizers and pesticides will help in reducing the resulting environmental impact. In-built sensors can help reduce the use of pesticides by precisely targeting the application area. On the other hand, robotic weeding is an active area of current research, which involves investigating alternative methods to kill or remove unwanted plants without damaging the crop.

The relative lack of regulations on autonomous driving on agricultural fields is a boon to the deployment of farming robots and other new agricultural technologies. Compared to the safety rules required for self-driving cars, there are lesser limitations for agricultural robots since they do not operate in the vicinity of humans. The self-driving technology being developed in the automotive industry is also expected to be adopted in various agricultural equipment and vehicles.

Challenge: High cost and complexity of fully autonomous robots

While some robotic technologies such as auto-steering and aerial mapping have already achieved or are approaching the robustness and cost-effectiveness required for real-world use, other technologies are not yet at that stage for field deployment. For example, prototypes of fully autonomous tractors and driverless tractors by John Deere (US), Autonomous Tractor Corporation (US), Case IH (US), Kubota (Japan), and Yanmar (Japan) have started emerging recently. For example, in April 2021, ANYbotics launched a new canine robot for inspection work. ANYbotics fully autonomous four-legged robot ANYmal provides a scalable solution to automate routine condition monitoring of equipment and infrastructure. On the other hand, fruit picking robots still require development in sensing, manipulation, and soft robotics. A typical fruit picking harvesting robot costs between USD 250,000 and USD 750,000, making it unaffordable for most farmers. Owing to such high prices, many companies are considering leasing their robots to customers instead of asking for full payment. Except for drones, many industry experts predict that fully autonomous robots in agriculture, such as driverless tractors or weeding robots, will become commonplace and operational only after 2025.

Agriculture Robots Market Ecosystem

The market ecosystem of agriculture robots consists of various interconnected components. At its core are the agriculture robots themselves, including drones, autonomous vehicles, and specialized robotic systems designed for farming tasks. These robots are supported by key technology providers offering advanced sensors, imaging, AI, and data analytics solutions. Farm equipment manufacturers integrate robotics into their machinery, enhancing their capabilities. The ecosystem also includes farm operators, large-scale agribusinesses, and small-scale farmers who adopt and utilize the robots. Additionally, research institutions, governments, and agricultural organizations play a crucial role by driving innovation, providing funding, and creating regulations that shape the development and deployment of agriculture robots.

Based on type, milking robots is estimated to account for the second largest market share of the agriculture robots.

Milking robots, also known as robotic milking systems (RMS), have revolutionized the dairy industry by automating the milking process. These advanced machines are designed to milk cows without human intervention, offering numerous benefits to dairy farmers. Milking robots eliminate the need for manual milking by automatically attaching and detaching milking cups to a cow's udders. The cows are trained to visit the robotic milking station voluntarily, and the process is non-stressful and comfortable for them. Milking robots are equipped with sensors that gather data on milk yield, milk quality, and cow health. This data is continuously monitored and analyzed, providing valuable insights to farmers regarding each cow's productivity and well-being. The automation provided by milking robots reduces the need for manual labor in the milking process, saving time and labor costs for farmers. Moreover, the increased milking frequency facilitated by milking robots enhances milk production and improves udder health. Farmers can also provide individualized care for each cow based on the data collected, identifying cows with health issues or those not producing optimal milk yield and providing them with targeted attention and treatment. With the integration of farm management software, milking robots enable farmers to track and manage milk production, cow health, and overall farm performance. As the technology continues to evolve, milking robots are expected to play an increasingly significant role in modern dairy farming practices worldwide, contributing to improved efficiency, cow welfare, and farm profitability.

Based on end application, Harvesst Management is expected to grow at second fastest CAGR.

Harvest management by agriculture robots has revolutionized the traditional farming practices by offering more efficient, precise, and data-driven methods to optimize crop yields and minimize losses. These robots, equipped with advanced technologies such as AI, sensors, and imaging capabilities, play a vital role throughout the harvest season. They provide real-time crop monitoring and assessment using drones with multispectral cameras, enabling farmers to plan their harvest schedule effectively and prioritize areas needing immediate attention. Moreover, agriculture robots can autonomously perform harvesting operations, identifying and delicately picking ripe fruits or using precise cutting mechanisms for crops like rice and wheat. The data collected during the harvest, such as crop yield and quality metrics, is analyzed using AI algorithms, providing valuable insights for future crop planning and resource allocation. Additionally, agriculture robots contribute to sustainability by reducing crop wastage, conserving resources, and promoting environmentally-friendly practices.

The Europe market is projected to contribute the second largest share of the agricultural robots market.

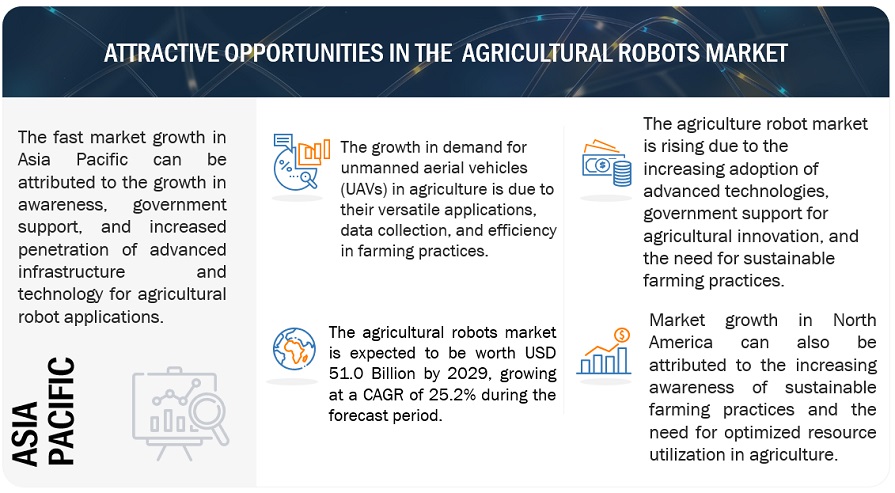

Agriculture robots in Europe has been experiencing significant growth and development, driven by various factors and trends that are reshaping the agricultural landscape across the continent. Europe's agriculture sector has embraced digital transformation and sustainable farming practices, creating a conducive environment for the adoption of agriculture robots. Precision agriculture practices are gaining traction in Europe, and agriculture robots are at the forefront of this movement. Farmers are increasingly looking for solutions to optimize resource usage, reduce environmental impact, and increase productivity. Agriculture robots equipped with advanced sensors, GPS technology, and AI capabilities enable precise and targeted applications of resources like water, fertilizers, and pesticides, leading to improved efficiency and sustainable farming practices. European governments and agricultural organizations have recognized the potential of agriculture robots in modernizing the farming sector and promoting sustainable practices. They are providing financial support, subsidies, and incentives to encourage the adoption of robotics technology in agriculture, further fueling market growth.

Key Market Players

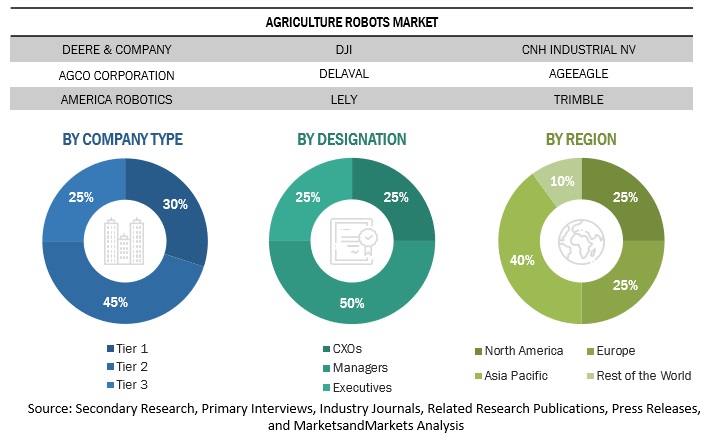

The key players in this include Deere & Company (US), CNH Industrial NV (UK), AGCO Corporation (US), Lely (the Netherlands), AgJunction (US), DeLaval (Sweden), Deepfield Robotics (Germany), Naïo Technologies (France), KUBOTA Corporation (Japan), Monarch Tractor (US), and Clearpath Robotics (Canada)

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

Type, Application, End Use, Farming environment, and Application |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

Deere & Company (US), CNH Industrial NV (UK), AGCO Corporation (US), Lely (the Netherlands), AgJunction (US), DeLaval (Sweden), Deepfield Robotics (Germany), Naïo Technologies (France), KUBOTA Corporation (Japan), Monarch Tractor (US), and Clearpath Robotics (Canada) |

This research report categorizes the agriculture robots market based on type, application, farming environment, farm produce, and region.

Based on type, the agriculture robots market has been segmented as follows:

-

Unmanned Aerial Vehicles/Drones by Type

- Fixed Wing Drones

- Rotary Drone Blades

- Hybrid Drones

-

Unmanned Aerial Vehicles/Drones by Components

-

Hardware

- Frames

- Controller

- Propulsion System

- Camera systems

- Navigation systems

- Batteries

- Others

-

Software

- Software used for data management, imaging, and data analytics applications

- Milking Robots

-

Hardware

-

Milking Robots by Component

-

Hardware

-

Automation and control devices

- Robotic Arm devices

- Control & Display units

- Milk meters & analyzers

- Cleaning & Detection systems

-

Sensing and Monitoring Devices

- Sensors

- Camera Systems

- Others

-

Automation and control devices

-

Software

- Driverless Tractors

- Automated Harvesting System

- Others

-

Hardware

Based on the farming environment, the agriculture robots market has been segmented as follows:

- Indoor

- Outdoor

Based on the end use, the agriculture robots market has been segmented as follows:

-

Farm Produce (Area)

-

Cereals and Grains

- Corn

- Wheat

- Rice

- Other cereals and grains

-

Oilseeds and Pulses

- Soybean

- Sunflower

- Other oilseeds and pulses

-

Fruits and Vegetables

- Pome Fruits

- Citrus Fruits

- Berries

- Root and Tuber Vegetables

- Leafy Vegetables

- Other fruits and vegetables

-

Cereals and Grains

- Other Crop Types (turf & ornamentals, plantation crops, fiber crops, and silage & forage crops)

- Dairy & Livestock

Based on the application, the agriculture robots market has been segmented as follows:

-

Harvest Management

-

Field Farming

- Plowing & Seeding

- Crop Monitoring & Weed Detection

-

Plant Scouting

- Weather Tracking & Monitoring

- Others

-

Field Farming

-

Dairy & Livestock Management

- Dairy FarmManagement

- Livestock Monitoring

- Precision Fish Farming

- Soil & Irrigation Management

- Inventory Management

- Others

Based on the region, the agriculture robots market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East & South Africa)

Recent Developments

- In 2021, AGCO Corporation launched the pilot of its Precision Ag Line (PAL) program, a tool designed to streamline support services for farming customers using AGCO solutions with mixed-fleet operations. PAL makes precision farming expertise available to farmers using products from widely-used AGCO brands such as Challenger, Fendt, Gleaner, Massey Ferguson, and Precision Planting.

- .'Advanced' route planning technology was presented by Trimble in 2023.With the help of this software-based technology, Trimble end users and equipment producers may automate and optimise the trajectory, speed, and general route design of industrial equipment to boost productivity.

- In 2022,Precision spraying solution integration was announced by CNH Industrial and ONE SMART SPRAY . The integration of ONE SMART SPRAY is a crucial solution that will hasten the development of CNH Industrial's automated and precise spraying capabilities. It will achieve this using several cameras that are mounted on the boom of a sprayer. Customers will receive selective spraying and weed identification using the green-on-green (plant on plant) and green-on-brown (plant on soil) methods.

Frequently Asked Questions (FAQ):

What are the drivers for the growth of the Agriculture Robots market?

The drivers of the agriculture robots market include increasing labor shortages and rising labor costs, the need for precision farming and sustainable practices, advancements in AI and robotics technologies, and the potential to increase productivity and yield. Additionally, the demand for efficient and automated solutions to address challenges in crop monitoring, harvesting, and weed control also contributes to the market growth. Furthermore, government support for adopting modern agricultural practices and the growing awareness of the benefits of robotics in agriculture fuel the adoption of agricultural robots across the globe.

Which are the major companies in the Agriculture Robots market? What are their major strategies to strengthen their market presence?

The key players in this include Deere & Company (US), DJI(China), PrecisionHawk (US), Trimble Inc. (US), Parrot Drones (France), AeroVironment, Inc. (US), Yamaha Motor Co., Ltd. (Japan), and AgEagle Aerial Systems, Inc. (US). The companies operating in the agriculture robots market are strategically expanding their presence through agreements and collaborations. They have established a strong foothold in North America, Asia Pacific, and Europe, with manufacturing facilities and robust distribution networks across these regions.

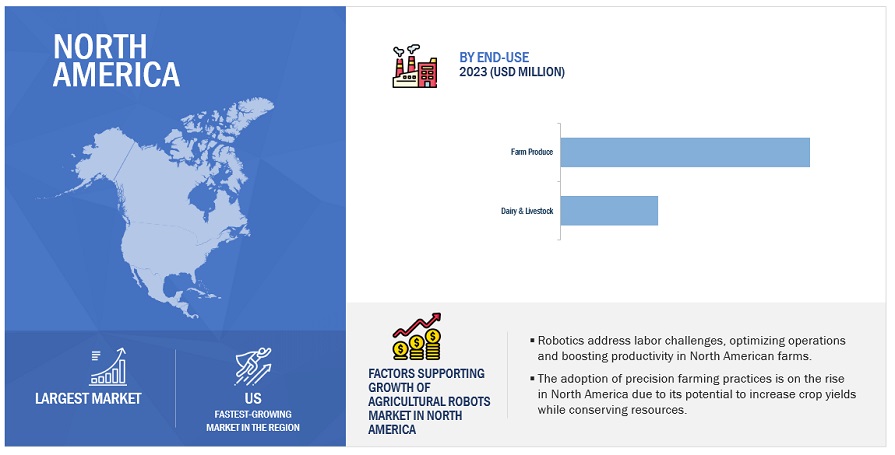

Which region is expected to hold the highest market share?

The market in North America will dominate the market share in 2022, displaying strong demand from the agricultural robots’ market in the region.

Which are the key technology trends prevailing in the agriculture robots market?

Key trends and technology in the agriculture robots market include the increasing adoption of autonomous robots for tasks like planting and harvesting, integration of AI and machine learning for data-driven decision-making, and the emergence of swarm robotics for collaborative farming. Precision agriculture practices, enabled by advanced sensors and imaging technologies on agriculture drones, are on the rise. Robots with AI algorithms analyze data for crop monitoring and resource optimization. Additionally, the market is witnessing advancements in modular and scalable robotics solutions, aiding various crop types and farm sizes. Governments and organizations continue to support the growth of agriculture robots through subsidies and incentives.

What is the total CAGR expected to be recorded for the agriculture robots market during 2023-2028?

The CAGR is expected to record a CAGR of 24.3% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

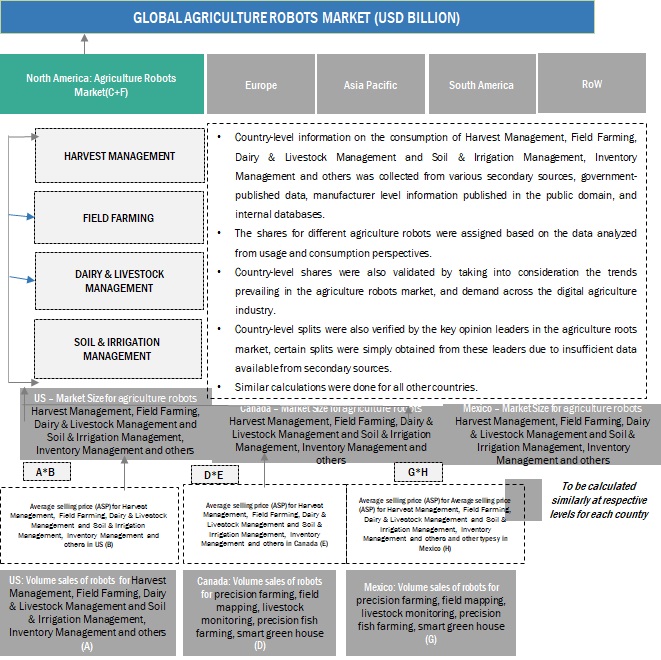

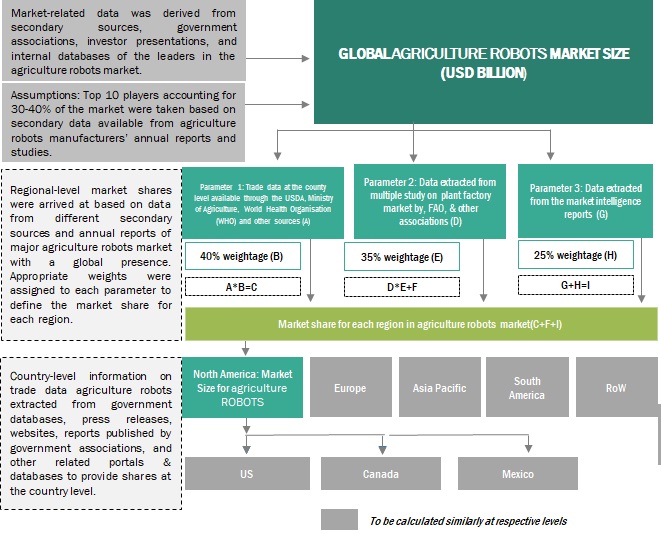

The study involved four major activities in estimating the current size of the agriculture robots market. Exhaustive secondary research was done to collect information on the Market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from regulatory bodies, trade directories by recognized authors, and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both Market- and technology-oriented perspectives.

Primary Research

The agriculture robots market includes several stakeholders in the supply chain, including raw material suppliers, technology and service providers, and regulatory organizations. The demand side of the Market is characterized by manufacturing companies and startups. Key technology and service providers and suppliers of raw materials characterize the supply side.

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the insect repellents sectors. The primary sources from the supply side include key opinion leaders and key manufacturers in the agriculture robots Market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the agriculture robots market. These approaches were also used extensively to estimate the size of various subsegments in the Market. The research methodology used to estimate the market size includes the following details.

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent markets—the smart agriculture market and precision farming market—were considered to validate further the market details of the agriculture robots Market.

-

Bottom-up approach:

- The market size was analyzed based on the share of each offering of agriculture robots and growing systems at regional and country levels. Thus, the global Market was estimated with a bottom-up approach at the country level.

- Other factors include demand for agriculture robots produced through different growing systems across various facility types; pricing trends; adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the agriculture robots market were considered while estimating the market size.

- All possible parameters that affect the Market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global agriculture robots Size: Bottom-Up Approach

The bottom-up approach used the data extracted from secondary research to validate the market segment sizes obtained. This approach was employed to determine the overall size of the agriculture robots market in particular regions. Its share in the agriculture robots market at the country and regional levels was validated through primary interviews conducted with suppliers, dealers, and distributors.

To know about the assumptions considered for the study, Request for Free Sample Report

Global agriculture robots market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the segmentation) through percentage splits from secondary and primary research.

The top-down approach used to triangulate the data obtained through this study is explained in the next section:

- In the agriculture robots market, related secondary sources such as the US Department of Agriculture (USDA), the Ministry of Agriculture, Forestry and Fisheries (MAFF), and the World Health Organisation (WHO) Annual Reports of all major players were considered to arrive at the global market size.

- The global number of agriculture robots arrived after giving certain weightage factors for the data obtained from these secondary and primary sources.

- With the data triangulation procedure and data validation through primaries (from both supply and demand sides), the shares and sizes of the regional markets and individual markets were determined and confirmed.

- Data on company revenues, area harvested, product launches, and global regulations for the agriculture robots Market in the last four years was used to arrive at the country-wise market size. CAGR estimation of offering and application segments was used and then validated from primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total Market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to estimate the overall insect-repellent active ingredients market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

“According to The Association for Advancing Automation (A3), Agricultural robots are autonomous or semi-autonomous machines equipped with advanced technologies such as sensors, computer vision, and artificial intelligence, designed to assist farmers in various tasks, including planting, harvesting, monitoring crops, and managing livestock.”Agricultural robots automate slow, repetitive, and dull tasks for farmers, allowing them to focus more on improving overall production yield. Agricultural robots include unmanned aerial vehicles (UAVs) or drones, milking robots, automated harvesting systems, driverless tractors, and other robots, such as unmanned ground vehicles (UGVs) robots used in nurseries or greenhouses, sorting and packing robots, and weed control robots. According to The International Federation of Robotics (IFR): Agricultural robots, also known as agribots, are specialized robots used in agriculture to perform tasks such as seeding, spraying, harvesting, and monitoring crops. These robots are equipped with sensors, navigation systems, and robotic arms, enabling them to operate autonomously or with minimal human intervention.

Key Stakeholders

- Agriculture Equipment Component Suppliers

- Electronics Component and Device Manufacturers

- Original Equipment Manufacturers (OEMs)

- Product Manufacturers

- Agriculture Component and Device Suppliers and Distributors

- Software, Service, and Technology Providers

- Standardization and Testing Firms

- Government Bodies such as Regulatory Authorities and Policymakers

- Associations, Organizations, Forums, and Alliances Related to Semiconductor and Automotive Industries

- Research Institutes and Organizations

- Market Research and Consulting Firms

- Agri-food Buyers

Report Objectives

Market Intelligence

- Determining and projecting the size of the Agriculture Robots Market based on type, application, farm produce, farming environment, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the Market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the Market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the Market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the Market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the Agriculture Robots Market

Competitive Intelligence

- Identifying and profiling the key market players in the Agriculture Robots Market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations, and technology in the Agriculture Robots Market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe's agriculture robots market, by key country

- Further breakdown of the Rest of Asia Pacific agriculture robots market, by key country

Segmentation Analysis

- Market segmentation analysis of other types of Agriculture Robots Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agriculture Robots Market

Does your report includes these equipment and system like Driverless Tractors, Food Processing systems, Pulverizer and capsules Filing machines, Green Leave Dryers, and Softwares .

Хочу посмотреть что происходит на рынке робототехники и самое главное перспективы

Would be interested in knowing penetration level of drones and its adoption in agriculture industry across all continents.

Looking for agriculture robots market historical data and future trends for camera technology. Specially for polarisation, hyperspectral, tof, video in uhd, FHD...

I am doing Research on Robotic Agriculture and Artificial Intelligence use cases for agriculture industry and in need of major companies operating in this space. So please could you provide the related information for my research work. I will be happy to refer your sample data for this study.

We are planning to establish a centre of Excellence for Agribots,Drones ,AGVs smart portable sensing devices in Agriculture. We are intrested to collaborate with your Organization. Please guide me with further details.

I am looking for major analysis you have provided for different agriculture robots and their adoption trends in major agriculture country.

You do not speak about VITIROVER, their solution of swarm robotics have great success in europe for management of vegetation in agricultural (vineyard, orchards,...) and industrial plots (railways, highways, airports, photovoltaic farms, etc...)