Amphoteric Surfactants Market by Type (Betaine, Amine Oxide, Amphoacetates, Amphopropionates, Sultaines), Application (Personal Care, Home Care & I&I Cleaning, Oil Field Chemicals, Agrochemicals), and Region - Global Forecast to 2023

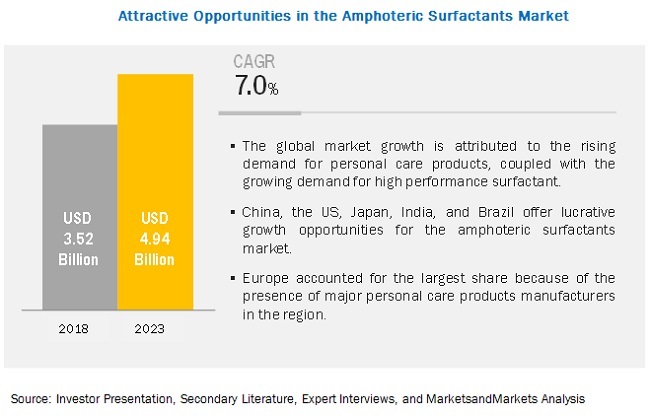

[119 Pages Repoert] MarketsandMarkets forecasts the Amphoteric Surfactants Market to grow from USD 3.53 billion in 2018 to USD 4.95 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 7.0% during the forecast period. The rising demand for personal care products, coupled with the growing demand for high performance surfactants is driving the market for amphoteric surfactants. However, stringent regulations are expected to restrain their demand during the forecast period.

By application personal care accounted for the largest market of amphoteric surfactants market during the forecast period

Personal care was the largest application of the amphoteric surfactants market, in terms of value and volume, in 2018. Amphoteric surfactants are the mildest among all the surfactants, hence it is most commonly used in the formulation of various personal care products. The mildness these surfactants possess by their zwitterion nature. The use of these surfactants in the personal care products results in low irritation to the skin compared to other surfactants.

By type, amine oxide segment to record the highest CAGR during the forecast period

The demand for amine oxide is very high in the home care & I&I cleaning application mainly due to its excellent foaming, cleansing and ability to decrease skin irritation. Moreover, due to its inherent stability in presence of hydrogen peroxide it is used in the oxygen breaching and cleansing products.

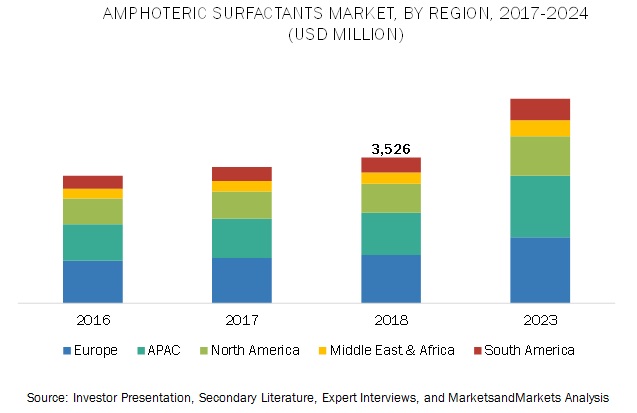

APAC to grow at the highest CAGR during the forecast period.

The amphoteric surfactants market in APAC is projected to grow at the highest CAGR between 2018 and 2023. Economic growth of emerging countries and increasing disposable income of the middle-class population of the region are making APAC an attractive market for amphoteric surfactants manufacturers. Rise in awareness towards skin, hair & oral care, changing lifestyle supported by increasing disposable income and urbanization, and the increasing popularity of organic skin care products are some of the major factors boosting the amphoteric surfactants market in APAC.

Market Dynamics

Drivers: Rising demand for personal care products

Personal care is the largest application of amphoteric surfactants, as they are one of the important ingredients required for skin care, hair care, and other personal care products. The industry is growing rapidly as personal care products have high demand among customers. Growing urbanization, increasing number of working women, changing lifestyle, and rising awareness regarding hygiene and skin care are some of the key drivers of the amphoteric surfactants market in the personal care application. The awareness regarding hygiene and personal health has propelled the need for personal care products. This change has led to an increase in the manufacturing of skin care and hair care products, thus driving the demand for amphoteric surfactants.

The increase in spending on better personal care products is driving the amphoteric surfactants market. Also, the retail sector is getting organized in emerging economies such as China, India, and Brazil, which is also helping the personal care industry to flourish. The industry is continuously evolving to comply with changing consumer preferences.

Restraints: Stringent regulations

Amphoteric surfactants produced from petrochemicals undergo various chemical processes that release toxic wastes and gases. These chemicals can cause environmental and health concerns. Therefore, various regulations are imposed by government agencies such as the United States Environmental Protection Agency (USEPA) and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) to address them. These agencies map and monitor the toxicity levels to keep them within the permissible level. The stringent regulations restrict the growth of the overall market, as petroleum-based amphoteric surfactants account for the major share of the market.

Opportunity: Increasing demand from niche applications

Personal care and home care & I&I are the major applications of amphoteric surfactants. However, there are other applications of amphoteric surfactants such as oil field chemicals and agrochemicals that capture minor share in the amphoteric surfactants market. These surfactants provide desired foaming, corrosion inhibition, and emulsification in the formulations of oil field chemicals. Similarly, in agrochemicals application they are used in the formulation of herbicides, pesticides, and insecticides, mainly to optimize crop protection and improve performance. However, there are only a few manufacturers that are primarily targeting these segments, leaving space for new players. Although the amphoteric surfactants market in personal care and home care & I&I cleaning is growing, these are developed markets and may arrive at the stage of maturity. The manufacturers should, therefore, target the applications that are in the growth stage, mainly to capture an additional market share.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

20172023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Product Type (Betaine, Amine Oxide, Amphoacetate, Amphopropionates, Sultaines), Application (personal care, home care & industrial & cleaning, oil field chemicals, agrochemicals) |

|

Geographies covered |

APAC, North America, Europe, MEA, and South America |

|

Companies covered |

Akzonobel N.V. (Netherlands), BASF SE (Germany), Clariant AG (Switzerland), Croda (UK), Evonik Industries AG (Germany), Lonza (Switzerland), The Lubrizol Corporation (US), Oxiteno SA (Brazil), Solvay (Belgium), and Stepan Company (US). |

The research report categorizes the amphoteric surfactants market to forecast the revenues and analyze the trends in each of the following sub-segments:

Amphoteric Surfactants Market, By Product Type

- Betaine

- Amine Oxide

- Amphoacetate

- Amphopropionates

- Sultaines

Amphoteric Surfactants Market, By Application

- personal care

- home care & Industrial & Institutional (I&I) cleaning

- oil field chemicals

- agrochemicals

Amphoteric Surfactants Market, By Region

- Asia Pacific (APAC)

- North America

- Europe

- Middle East and Africa (MEA)

- South America

Key Market Players

Akzonobel N.V. (Netherlands), BASF SE (Germany), Clariant AG (Switzerland), Croda (UK), Evonik Industries AG (Germany), Lonza (Switzerland), The Lubrizol Corporation (US), Oxiteno SA (Brazil), Solvay (Belgium), and Stepan Company (US).

Recent Developments

- In July 2015, BASF SE and its partner Solazyme (US) launched a new amphoteric surfactant product under the brand name of Dehyton AO 45. This new product is mainly used in home and personal care applications.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the amphoteric surfactants market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Significant Opportunities in the Amphoteric Surfactants Market

4.2 Amphoteric Surfactants Market, By Region

4.3 Europe: Amphoteric Surfactants Market, By Type and Country

4.4 Amphoteric Surfactants Market, By Type

4.5 Amphoteric Surfactants Market Attractiveness

4.6 Amphoteric Surfactants Market, By Application and Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Personal Care Products

5.2.1.2 Growing Demand for High-Performance Surfactants

5.2.2 Restraints

5.2.2.1 Stringent Regulations

5.2.3 Opportunities

5.2.3.1 Increasing Demand From Niche Applications

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Amphoteric Surfactants Market, By Type (Page No. - 38)

6.1 Introduction

6.1.1 Amphoteric Surfactants Market Estimates and Forecasts, By Type 2016 - 2023 (Kilo Tons)

6.1.2 Amphoteric Surfactants Market Estimates and Forecasts, By Type 2016 - 2023 (USD Million)

6.2 Betaine

6.2.1 Europe is Projected to Drive the Market for Betaine

6.2.2 Betaine Market Estimates and Forecasts, By Region, 2016 - 2023 (Kilo Tons)

6.2.3 Betaine Market Estimates and Forecasts, By Region, 2016 - 2023 (USD Million)

6.2.4 Betaine Market Estimates and Forecasts, By Sub-Type, 2016 - 2023 (Kilo Tons)

6.2.5 Betaine Market Estimates and Forecasts, , By Sub-Type 2016 - 2023 (USD Million)

6.3 Amine Oxide

6.3.1 Increased Awareness for Hygiene and Homecare Products to Drive the Market

6.3.2 Amine Oxide Market Estimates and Forecasts, By Region, 2016 2023 (Kilo Tons)

6.3.3 Amine Oxide Market Estimates and Forecasts, By Region, 2016 2023 (USD Million)

6.4 Amphoacetates

6.4.1 Increased Demand for Baby Care Products to Drive the Matket

6.4.2 Amphoacetates Market Estimates and Forecasts, By Region,2016 2023 (Kilo Tons)

6.4.3 Amphoacetates Market Estimates and Forecasts, By Region,2016 2023 (USD Million)

6.5 Amphopropionates

6.5.1 Increasing Demand for High Performance Surfactants to Drive the Market

6.5.2 Amphopropionates Market Estimates and Forecasts, By Region, 2016 - 2023 (Kilo Tons)

6.5.3 Amphopropionates Market Estimates and Forecasts, By Region, 2016 - 2023 (USD Million)

6.6 Sultaines

6.6.1 Unique Properties of Sultaines to Drive the Market

6.6.2 Sultaines Market Estimates and Forecasts, By Region, 2016 - 2023 (Kilo Tons)

6.6.3 Sultaines Market Estimates and Forecasts, By Region, 2016 2023 (USD Million)

7 Amphoteric Surfactants Market, By Application (Page No. - 49)

7.1 Introduction

7.1.1 Amphoteric Surfactants Market Estimates and Forecasts,By Application, 2016 - 2023 (Kilo Tons)

7.1.2 Amphoteric Surfactants Market Estimates and Forecasts,By Application, 2016 - 2023 (USD Million)

7.2 Personal Care

7.2.1 Regulations for Use of Skin-Friendly Formulations to Drive the Market in Personal Care Application

7.2.2 Amphoteric Surfactants Market Estimates and Forecasts in Personal Care, By Region, 2016 - 2023 (Kilo Tons)

7.2.3 Amphoteric Surfactants Market Estimates and Forecasts in Personal Care, By Region, 2016 2023 (USD Million)

7.3 Home Care and I&I Cleaning

7.3.1 Demand for High Performance Dish Wash to Drive the Market

7.3.2 Amphoteric Surfactants Market Estimates and Forecasts in Home Care and I&I Cleaning, By Region, 2016 - 2023 (Kilo Tons)

7.3.3 Amphoteric Surfactants Market Estimates and Forecasts in Home Care and I&I Cleaning, By Region, 2016 2023 (USD Million)

7.4 Oil Field Chemicals

7.4.1 Presence of Oil Reserves in Middle East & Africa to Drive the Market for Oil Field Chemical Application

7.4.2 Amphoteric Surfactants Market Estimates and Forecasts in Oil Field Chemicals, By Region, 2016 - 2023 (Kilo Tons)

7.4.3 Amphoteric Surfactants Market Estimates and Forecasts in Oil Field Chemicals, By Region, 2016 2023 (USD Million)

7.5 Agrochemicals

7.5.1 Demand for Better Crop Yield to Drive the Market in Agrochemicals Application

7.5.2 Amphoteric Surfactants Market Estimates and Forecasts in Agrochemicals, By Region, 2016 - 2023 (Kilo Tons)

7.5.3 Amphoteric Surfactants Market Estimates and Forecasts in Agrochemicals, By Region, 2016 2023 (USD Million)

7.6 Others

7.6.1 Amphoteric Surfactants Market Estimates and Forecasts in Other Applications, By Region, 2016 - 2023 (Kilo Tons)

7.6.2 Amphoteric Surfactants Market Estimates and Forecasts in Other Applications, By Region, 2016 2023 (USD Million)

8 Amphoteric Surfactants Market, By Region (Page No. - 61)

8.1 Introduction

8.1.1 Amphoteric Surfactants Market Estimates and Forecasts,By Region, 2016 - 2023 (Kilo Tons)

8.1.2 Amphoteric Surfactants Market Estimates and Forecasts,By Region, 2016 2023 (USD Million)

8.2 Europe

8.2.1 Europe Amphoteric Surfactants Market Estimates and Forecasts,By Country, 2016 - 2023 (Kilo Tons)

8.2.2 Europe Amphoteric Surfactants Market Estimates and Forecasts,By Country, 2016 - 2023 (USD Million)

8.2.3 Europe Amphoteric Surfactants Market Estimates and Forecasts,By Type, 2016 - 2023 (Kilo Tons)

8.2.4 Europe Amphoteric Surfactants Market Estimates and Forecasts,By Type, 2016 - 2023 (USD Million)

8.2.5 Europe Amphoteric Surfactants Market Estimates and Forecasts,By Application, 2016 - 2023 (Kilo Tons)

8.2.6 Europe Amphoteric Surfactants Market Estimates and Forecasts,By Application, 2016 - 2023 (USD Million)

8.2.7 France

8.2.7.1 France Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.2.7.2 France Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.2.8 Germany

8.2.8.1 Germany Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.2.8.2 Germany Amphoteric Surfactants Market, By Application,2016 - 2023 (USD Million)

8.2.9 Italy

8.2.9.1 Italy Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.2.9.2 Italy Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.2.10 Russia

8.2.10.1 Russia Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.2.10.2 Russia Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.3 APAC

8.3.1 APAC Amphoteric Surfactants Market Estimates and Forecasts,By Country, 2016 - 2023 (Kilo Tons)

8.3.2 APAC Amphoteric Surfactants Market Estimates and Forecasts,By Country, 2016 - 2023 (USD Million)

8.3.3 APAC Amphoteric Surfactants Market Estimates and Forecasts,By Type, 2016 - 2023 (Kilo Tons)

8.3.4 APAC Amphoteric Surfactants Market Estimates and Forecasts,By Type, 2016 - 2023 (USD Million)

8.3.5 APAC Amphoteric Surfactants Market Estimates and Forecasts,By Application, 2016 - 2023 (Kilo Tons)

8.3.6 APAC Amphoteric Surfactants Market Estimates and Forecasts,By Application, 2016 - 2023 (USD Million)

8.3.7 China

8.3.7.1 China Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.3.7.2 China Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.3.8 Japan

8.3.8.1 Japan Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.3.8.2 Japan Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.3.9 India

8.3.9.1 India Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.3.9.2 India Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.4 North America

8.4.1 North America Amphoteric Surfactants Market Estimates and Forecasts, By Country, 2016 - 2023 (Kilo Tons)

8.4.2 North America Amphoteric Surfactants Market Estimates and Forecasts, By Country, 2016 - 2023 (USD Million)

8.4.3 North America Amphoteric Surfactants Market Estimates and Forecasts, By Type, 2016 - 2023 (Kilo Tons)

8.4.4 North America Amphoteric Surfactants Market Estimates and Forecasts, By Type, 2016 - 2023 (USD Million)

8.4.5 North America Amphoteric Surfactants Market Estimates and Forecasts, By Application, 2016 - 2023 (Kilo Tons)

8.4.6 North America Amphoteric Surfactants Market Estimates and Forecasts, By Application, 2016 - 2023 (USD Million)

8.4.7 US

8.4.7.1 US Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.4.7.2 US Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.4.8 Canada

8.4.8.1 Canada Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.4.8.2 Canada Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.4.9 Mexico

8.4.9.1 Mexico Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.4.9.2 Mexico Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.5 Middle East & Africa

8.5.1 Middle East & Africa Amphoteric Surfactants Market Estimates and Forecasts, By Country, 2016 - 2023 (Kilo Tons)

8.5.2 Middle East & Africa Amphoteric Surfactants Market Estimates and Forecasts, By Country, 2016 - 2023 (USD Million)

8.5.3 Middle East & Africa Amphoteric Surfactants Market Estimates and Forecasts, By Type, 2016 - 2023 (Kilo Tons)

8.5.4 Middle East & Africa Amphoteric Surfactants Market Estimates and Forecasts, By Type, 2016 - 2023 (USD Million)

8.5.5 Middle East & Africa Amphoteric Surfactants Market Estimates and Forecasts, By Application, 2016 - 2023 (Kilo Tons)

8.5.6 Middle East & Africa Amphoteric Surfactants Market Estimates and Forecasts, By Application, 2016 - 2023 (USD Million)

8.5.7 Iran

8.5.7.1 Iran Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.5.7.2 Iran Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.5.8 Turkey

8.5.8.1 Turkey Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.5.8.2 Turkey Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.6 South America

8.6.1 South America Amphoteric Surfactants Market Estimates and Forecasts, By Country, 2016 - 2023 (Kilo Tons)

8.6.2 South America Amphoteric Surfactants Market Estimates and Forecasts, By Country, 2016 - 2023 (USD Million)

8.6.3 South America Amphoteric Surfactants Market Estimates and Forecasts, By Type, 2016 - 2023 (Kilo Tons)

8.6.4 South America Amphoteric Surfactants Market Estimates and Forecasts, By Type, 2016 - 2023 (USD Million)

8.6.5 South America Amphoteric Surfactants Market Estimates and Forecasts, By Application, 2016 - 2023 (Kilo Tons)

8.6.6 South America Amphoteric Surfactants Market Estimates and Forecasts, By Application, 2016 - 2023 (USD Million)

8.6.7 Brazil

8.6.7.1 Brazil Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.6.7.2 Brazil Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

8.6.8 Argentina

8.6.8.1 Argentina Amphoteric Surfactants Market, By Application, 2016 - 2023 (Kilo Ton)

8.6.8.2 Argentina Amphoteric Surfactants Market, By Application, 2016 - 2023 (USD Million)

9 Competitive Landscape (Page No. - 95)

9.1 Introduction

9.2 Market Share

9.3 Competitive Situation & Trends

9.3.1 New Product Launch

10 Company Profiles (Page No. - 97)

(Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

10.1 Evonik Industries Ag

10.1.1 Business Overview

10.1.2 Product Offered

10.1.3 SWOT Analysis

10.1.4 MnM View

10.2 Solvay

10.2.1 Business Overview

10.2.2 Product Offered

10.2.3 SWOT Analysis

10.2.4 MnM View

10.3 Stepan Company

10.3.1 Business Overview

10.3.2 Product Offered

10.4 Akzo Nobel N.V.

10.4.1 Business Overview

10.4.2 Product Offered

10.4.3 SWOT Analysis

10.4.4 MnM View

10.5 BASF SE

10.5.1 Business Overview

10.5.2 Product Offered

10.5.3 Recent Developments

10.5.4 SWOT Analysis

10.5.5 MnM View

10.6 Clariant AG

10.6.1 Business Overview

10.6.2 Product Offered

10.6.3 SWOT Analysis

10.6.4 MnM View

10.7 Croda

10.7.1 Business Overview

10.7.2 Product Offered

10.8 Lonza

10.8.1 Business Overview

10.8.2 Product Offered

10.9 The Lubrizol Corporation

10.9.1 Business Overview

10.9.2 Product Offered

10.1 Oxiteno SA

10.10.1 Business Overview

10.10.2 Product Offered

10.11 Other Players

10.11.1 KAO Corporation

10.11.2 Enaspol A.S.

10.11.3 Galaxy Surfactants

10.11.4 EOC Group

10.11.5 Klk Oleo

*Details on Business Overview, Products, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 113)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (90 Tables)

Table 1 GDP Per Capita (PPP), By Key Country, 20162020 (USD Million)

Table 2 Amphoteric Surfactants Market Size, By Type, 20162023 (Kiloton)

Table 3 Amphoteric Surfactants Market Size, By Type, 20162023 (USD Million)

Table 4 Market Size of Betaine Amphoteric Surfactants , By Region, 20162023 (Kiloton)

Table 5 Market Size of Betaine Amphoteric Surfactants , By Region, 20162023 (USD Million)

Table 6 Market Size of Betaine Amphoteric Surfactants , By Sub-Type, 20162023 (Kiloton)

Table 7 Market Size of Betaine Amphoteric Surfactants , By Sub-Type, 20162023 (USD Million)

Table 8 Market Size of Amine Oxide Amphoteric Surfactants, By Region, 20162023 (Kiloton)

Table 9 Market Size of Amine Oxide Amphoteric Surfactants, By Region, 20162023 (USD Million)

Table 10 Market Size of Amphoacetates Amphoteric Surfactants, By Region, 20162023 (Kiloton)

Table 11 Market Size of Amphoacetates Amphoteric Surfactants, By Region, 20162023 (USD Million)

Table 12 Market Size of Amphopropionates Amphoteric Surfactants, By Region, 20162023 (Kiloton)

Table 13 Market Size of Amphopropionates Amphoteric Surfactants, By Region, 20162023 (USD Million)

Table 14 Market Size of Sultaines Amphoteric Surfactants, By Region, 20162023 (Kiloton)

Table 15 Market Size of Sultaines Amphoteric Surfactants, By Region, 20162023 (USD Million)

Table 16 Amphoteric Surfactants Market Size, By Application, 20162023 (Kiloton)

Table 17 By Market Size, By Application, 20162023 (USD Million)

Table 18 By Market Size in Personal Care Application, By Region, 20162023 (Kiloton)

Table 19 By Market Size in Personal Care Application, By Region, 20162023 (USD Million)

Table 20 By Market Size in Personal Care Application, By Sub-Application, 20162023 (Kiloton)

Table 21 By Market Size in Personal Care Application, By Sub-Application, 20162023 (USD Million)

Table 22 By Market Size in Home Care and I&I Cleaning Application, By Region, 20162023 (Kiloton)

Table 23 By Market Size in Home Care & I&I Cleaning Application, By Region, 20162023 (USD Million)

Table 24 By Market Size in Oil Field Chemicals Application, By Region, 20162023 (Kiloton)

Table 25 By Market Size in Oil Field Chemicals Application, By Region, 20162023 (USD Million)

Table 26 By Market Size in Agrochemicals Application, By Region, 20162023 (Kiloton)

Table 27 By Market Size in Agrochemicals Application, By Region, 20162023 (USD Million)

Table 28 By Market Size in Other Applications, By Region, 20162023 (Kiloton)

Table 29 By Market Size in Other Applications, By Region, 20162023 (USD Million)

Table 30 By Market Size, By Region, 20162023 (Kiloton)

Table 31 By Market Size, By Region, 20162023 (USD Million)

Table 32 Europe: By Market Size, By Country, 20162023 (Kiloton)

Table 33 Europe: By Market Size, By Country, 20162023 (USD Million)

Table 34 Europe: By Market Size, By Type, 20162023 (Kiloton)

Table 35 Europe: By Market Size, By Type, 20162023 (USD Million)

Table 36 Europe: By Market Size, By Application, 20162023 (Kiloton)

Table 37 Europe: By Market Size, By Application, 20162023 (USD Million)

Table 38 France: By Market Size, By Application, 20162023 (Kiloton)

Table 39 France: By Market Size, By Application, 20162023 (USD Million)

Table 40 Germany: By Market Size, By Application, 20162023 (Kiloton)

Table 41 Germany: By Market Size, By Application, 20162023 (USD Million)

Table 42 Italy: By Market Size, By Application, 20162023 (Kiloton)

Table 43 Italy: By Market Size, By Application, 20162023 (USD Million)

Table 44 Russia: By Market Size, By Application, 20162023 (Kiloton)

Table 45 Russia: By Market Size, By Application, 20162023 (USD Million)

Table 46 APAC: By Market Size, By Country, 20162023 (Kiloton)

Table 47 APAC: By Market Size, By Country, 20162023 (USD Million)

Table 48 APAC: By Market Size, By Type, 20162023 (Kiloton)

Table 49 APAC: By Market Size, By Type, 20162023 (USD Million)

Table 50 APAC: By Market Size, By Application, 20162023 (Kiloton)

Table 51 APAC: By Market Size, By Application, 20162023 (USD Million)

Table 52 China: By Market Size, By Application, 20162023 (Kiloton)

Table 53 China: By Market Size, By Application, 20162023 (USD Million)

Table 54 Japan: By Market Size, By Application, 20162023 (Kiloton)

Table 55 Japan: By Market Size, By Application, 20162023 (USD Million)

Table 56 India: By Market Size, By Application, 20162023 (Kiloton)

Table 57 India: By Market Size, By Application, 20162023 (USD Million)

Table 58 North America: By Market Size, By Country, 20162023 (Kiloton)

Table 59 North America: By Market Size, By Country, 20162023 (USD Million)

Table 60 North America: By Market Size, By Type, 20162023 (Kiloton)

Table 61 North America: By Market Size, By Type, 20162023 (USD Million)

Table 62 North America: By Market Size, By Application, 20162023 (Kiloton)

Table 63 North America: By Market Size, By Application, 20162023 (USD Million)

Table 64 US: By Market Size, By Application, 20162023 (Kiloton)

Table 65 US: By Market Size, By Application, 20162023 (USD Million)

Table 66 Canada: By Market Size, By Application, 20162023 (Kiloton)

Table 67 Canada: By Market Size, By Application, 20162023 (USD Million)

Table 68 Mexico: By Market Size, By Application, 20162023 (Kiloton)

Table 69 Mexico: By Market Size, By Application, 20162023 (USD Million)

Table 70 Middle East & Africa: By Market Size, By Country, 20162023 (Kiloton)

Table 71 Middle East & Africa: By Market Size, By Country, 20162023 (USD Million)

Table 72 Middle East & Africa: By Market Size, By Type, 20162023 (Kiloton)

Table 73 Middle East & Africa: By Market Size, By Type, 20162023 (USD Million)

Table 74 Middle East & Africa: By Market Size, By Application, 20162023 (Kiloton)

Table 75 Middle East & Africa: By Market Size, By Application, 20162023 (USD Million)

Table 76 Iran: By Market Size, By Application, 20162023 (Kiloton)

Table 77 Iran: By Market Size, By Application, 20162023 (USD Million)

Table 78 Turkey: By Market Size, By Application, 20162023 (Kiloton)

Table 79 Turkey: By Market Size, By Application, 20162023 (USD Million)

Table 80 South America: By Market Size, By Country, 20162023 (Kiloton)

Table 81 South America: By Market Size, By Country, 20162023 (USD Million)

Table 82 South America: By Market Size, By Type, 20162023 (Kiloton)

Table 83 South America: By Market Size, By Type, 20162023 (USD Million)

Table 84 South America: By Market Size, By Application, 20162023 (Kiloton)

Table 85 South America: By Market Size, By Application, 20162023 (USD Million)

Table 86 Brazil: By Market Size, By Application, 20162023 (Kiloton)

Table 87 Brazil: By Market Size, By Application, 20162023 (USD Million)

Table 88 Argentina: By Market Size, By Application, 20162023 (Kiloton)

Table 89 Argentina: By Market Size, By Application, 20162023 (USD Million)

Table 90 New Product Launch, 2015

List of Figures (44 Figures)

Figure 1 Amphoteric Surfactants Market Segmentation

Figure 2 Amphoteric Surfactants Market: Research Design

Figure 3 Amphoteric Surfactants Market: Data Triangulation

Figure 4 Betaine to Be the Largest Type of Amphoteric Surfactant During the Forecast Period

Figure 5 Personal Care to Be the Largest Application of Amphoteric Surfactants

Figure 6 Europe to Account for the Largest Market Share

Figure 7 High Market Growth is Expected During the Forecast Period

Figure 8 Europe to Be the Largest Market of Amphoteric Surfactants

Figure 9 France Accounted for the Largest Share of the European Amphoteric Surfactants Market in 2017

Figure 10 Betaine to Account for the Largest Market Share

Figure 11 Rising Consumption of Personal Care Products is Expected to Drive the APAC Market During the Forecast Period

Figure 12 Personal Care Was the Largest Application of Amphoteric Surfactants in 2017

Figure 13 Overview of Factors Governing the Amphoteric Surfactants Market

Figure 14 Amphoteric Surfactants Market: Porters Five Forces Analysis

Figure 15 Betaine to Be the Largest Type of Amphoteric Surfactant

Figure 16 Europe to Be the Largest Market of Betaine Amphoteric Surfactants

Figure 17 Europe to Be the Largest Market of Amine Oxide Amphoteric Surfactants

Figure 18 Europe to Be the Largest Market of Amphoacetates Amphoteric Surfactants

Figure 19 Europe to Be the Largest Market of Amphopropionates Amphoteric Surfactants

Figure 20 Europe to Be the Largest Market of Sultaines Amphoteric Surfactants

Figure 21 Personal Care to Be the Largest Application of Amphoteric Surfactants

Figure 22 Europe to Be the Largest Market of Amphoteric Surfactants in Personal Care Application

Figure 23 Europe to Be the Largest Market of Amphoteric Surfactants in Home Care and I&I Cleaning Application

Figure 24 Middle East & Africa to Be the Largest Market of Amphoteric Surfactants in Oil Field Chemicals Application

Figure 25 APAC to Be the Largest Market for Amphoteric Surfactants in Agrochemicals Application

Figure 26 APAC to Be the Largest Market of Amphoteric Surfactants in Other Applications

Figure 27 India to Be the Fastest-Growing Market of Amphoteric Surfactants

Figure 28 Europe: Market Snapshot

Figure 29 APAC: Market Snapshot

Figure 30 North America: Market Snapshot

Figure 31 Market Share of Key Players, 2017

Figure 32 Evonik Industries AG: Company Snapshot

Figure 33 Evonik Industries AG: SWOT Analysis

Figure 34 Solvay: Company Snapshot

Figure 35 Solvay: SWOT Analysis

Figure 36 Stepan Company: Company Snapshot

Figure 37 Akzo Nobel N.V.: Company Snapshot

Figure 38 Akzo Nobel N.V.: SWOT Analysis

Figure 39 BASF SE: Company Snapshot

Figure 40 BASF SE: SWOT Analysis

Figure 41 Clariant AG: Company Snapshot

Figure 42 Clariant AG: SWOT Analysis

Figure 43 Croda: Company Snapshot

Figure 44 Lonza: Company Snapshot

Growth opportunities and latent adjacency in Amphoteric Surfactants Market

Natural betaine market trend and forecast for next five year

Agrochemical application of surfactants, agrochemicals in general, surfactants in general, adjuvants, etc

Information on Global and European Amphoteric and non-ionic Surfactant