Animal Wound Care Market by Product (Surgical (Suture, Stapler, Glue), Advanced (Hydrocolloid, Hydrogel Dressing), Traditional (Tape, Dressing), Therapy Device), Animal Type (Cats, Dogs, Horse, Pigs), End User (Hospital, Clinics) & Region - Global Forecast to 2029

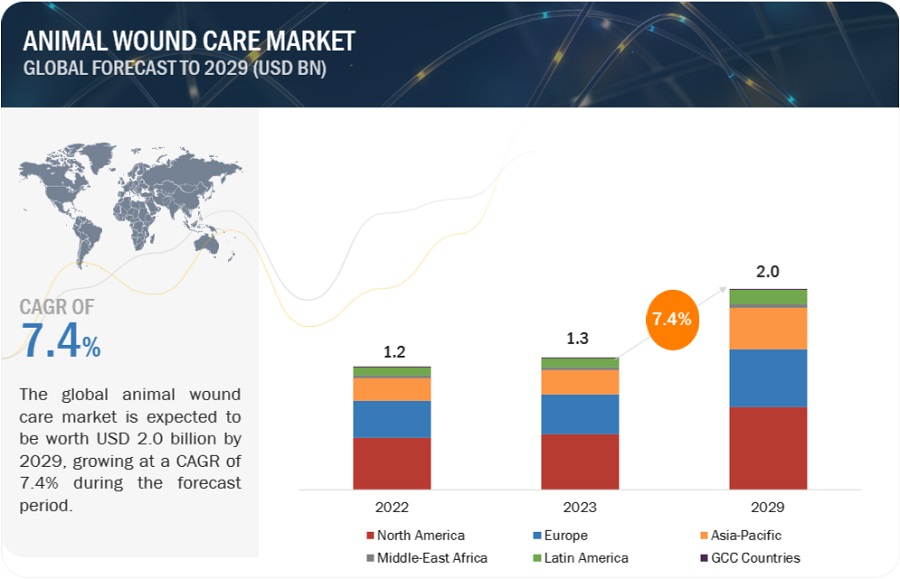

The global animal wound care market in terms of revenue was estimated to be worth $1.3 Billion in 2023 and is poised to reach $2.0 Billion by 2029, growing at a CAGR of 7.4% from 2023 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The increasing adoption of pets, growing veterinary healthcare research, and rising animal healthcare expenditure are driving demand for animal wound care products. As pet owners prioritize their animals' health and well-being, there is a growing demand for innovative wound care products and treatments, driving market growth. However, factors such as the elevated costs of pet care in emerging regions, the animal wound care market through its innovative developments of wound management products has an opportunity to impact animal healthcare and well-being.

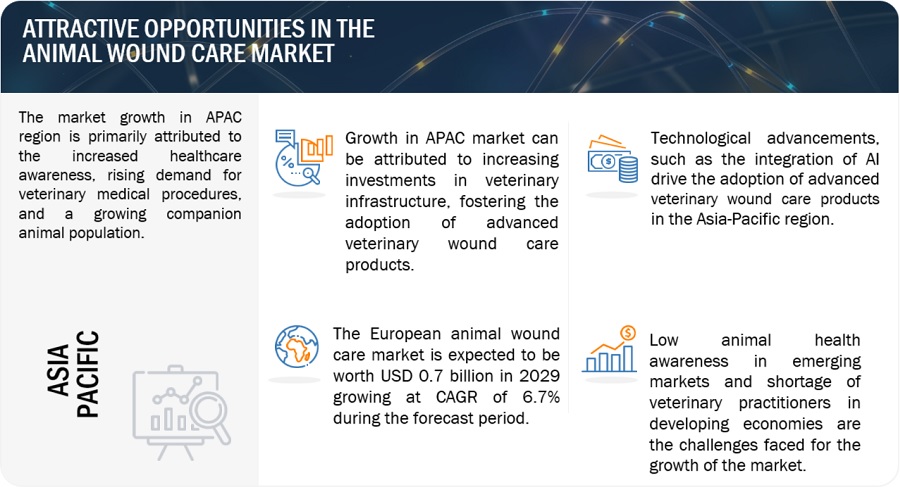

Attractive opportunities in the Animal Wound Care Market

To know about the assumptions considered for the study, Request for Free Sample Report

Animal Wound Care Market Dynamics

Driver: Increasing awareness of animal health

The increasing awareness of animal health has become a pivotal driver in propelling the growth of the animal wound care market. As pet ownership rises and the demand for livestock production surges, there is a growing recognition of the significance of maintaining optimal health in animals. According to the American Veterinary Medical Association (AVMA), the United States alone witnessed a substantial increase in pet ownership, with approximately 70-80 million dogs and 74-96 million cats in households. This surge in animal companionship has led to a heightened emphasis on veterinary care, including the management of wounds and injuries.

Moreover, the World Organization for Animal Health (OIE) highlights the importance of animal health for global food security, emphasizing the need for effective wound care in livestock to ensure sustainable agriculture. The awareness of zoonotic diseases and the interconnectedness of animal and human health further underscore the need for robust animal wound care solutions. The global animal wound care market is witnessing significant developments, with key players investing in research and development. Companies are introducing innovative products, such as advanced wound dressings and healing agents, to address the diverse needs of animals.

The Animal Medicines Australia (AMA) reports an increasing trend in the usage of wound care products, with a notable focus on companion animals. As awareness continues to grow, governments and regulatory bodies are also taking steps to enhance animal health standards, fostering a conducive environment for the expansion of the animal wound care market.

In conclusion, the rise in awareness, coupled with supportive government initiatives and market developments, is driving the animal wound care market to address the evolving health needs of animals worldwide.

Restraint: Rise in expenses associated with pet care

The burgeoning expenses associated with pet care have emerged as a significant impediment to the growth of the animal wound care market. With an increasing number of households considering pets as integral family members, the expenditure on veterinary services, including wound care, has escalated. The American Pet Products Association (APPA) reports a consistent upward trend in pet spending, reaching a staggering USD 99 billion in the United States alone in 2020. This surge in pet care expenses includes veterinary visits, medications, and specialized treatments, placing a financial burden on pet owners. As a result, the willingness or ability of pet owners to invest in high-cost animal wound care products may be constrained. Additionally, the global economic downturns and uncertainties have further exacerbated this issue, impacting household budgets and discretionary spending on non-essential pet care products.

The demand for affordable yet effective wound care solutions is growing, prompting manufacturers to explore cost-effective alternatives without compromising on quality. The challenge is underscored by the fact that, according to the European Pet Food Industry Federation (FEDIAF), Europe witnessed a 30% increase in pet ownership during the COVID-19 pandemic, leading to a surge in veterinary expenses. As pet care costs continue to rise, it poses a hindrance to the animal wound care market's expansion, necessitating strategic pricing and innovative solutions to address the financial constraints faced by pet owners while ensuring optimal care for animal injuries.

In conclusion, the escalating expenses associated with pet care present a formidable challenge for the animal wound care market, necessitating adaptive strategies to navigate the evolving landscape of consumer priorities and financial considerations.

Opportunity: Advancement in wound care medicines

The animal wound care market is experiencing a transformative surge propelled by significant advancements in wound care products, presenting lucrative opportunities for growth. The global push for innovation and research in veterinary medicine is reflected in the development of cutting-edge products designed to address diverse animal wound care needs. According to the European Medicines Agency (EMA), the regulatory body for veterinary medicines, there has been a notable increase in the approval of novel wound care formulations and therapies. Innovations such as advanced wound dressings, tissue engineering products, and bioactive wound care agents are enhancing the efficacy of treatment and expediting the healing process in animals.

The market is witnessing a paradigm shift towards personalized and specialized solutions, with companies investing substantially in research and development. For instance, the U.S. National Institutes of Health (NIH) reports a surge in funding towards veterinary research, including wound care, fostering an environment conducive to breakthroughs. Furthermore, the advent of telemedicine in veterinary services is facilitating access to expert advice on wound care management. This technological integration allows pet owners and livestock producers to seek guidance remotely, contributing to improved overall wound care outcomes. With these advancements, the animal wound care market is poised for expansion as it addresses the evolving needs of a diverse range of animals, from companion pets to livestock, fostering a paradigm of comprehensive and sophisticated wound care solutions that are poised to revolutionize the industry.

Challenge: Limited awareness of animal health in emerging countries

The animal wound care market faces a formidable challenge stemming from the limited awareness of animal health in emerging economies. In regions where economic development is rapidly progressing, there exists a significant gap in knowledge and understanding of proper animal healthcare practices. According to the Food and Agriculture Organization of the United Nations (FAO), many emerging economies witness a surge in livestock populations due to increasing demand for meat and dairy products, yet lack the necessary infrastructure for effective veterinary services. This dearth of awareness is evident in lower rates of vaccination, preventative care, and, notably, in the neglect of proper wound care for animals.

The lack of awareness is compounded by socioeconomic factors, with limited financial resources hindering access to veterinary care and advanced wound care products. In regions like Sub-Saharan Africa and parts of Asia, where livestock farming is a vital economic activity, the absence of comprehensive animal health education perpetuates suboptimal wound care practices, leading to increased morbidity and mortality among animals. Addressing this challenge requires collaborative efforts from governments, NGOs, and industry stakeholders to implement educational programs, enhance veterinary infrastructure, and promote the importance of proper wound care in ensuring the health and productivity of animals in these emerging economies.

As these regions continue to undergo economic development, raising awareness about animal health becomes imperative for the sustainable growth of the animal wound care market, fostering a holistic approach to veterinary care in these evolving economies.

Animal Wound Care Market Ecosystem

Prominent companies in animal wound care market include Elanco Animal Health (US), 3M Company (US), Medtronic PLC (Ireland), B. Braun Melsungen AG (Germany), Virbac (France), Neogen Corporation (US), Jorgen Kruuse A/S (Denmark), Sonoma Pharmaceuticals Inc. (US), Ethicon, Inc. (US), and Dechra Pharmaceuticals (UK), Jazz Medical, LLC (Ireland), Smith & Nephew PLC (UK), Kericure Inc. (US), Advancis Veterinary (UK), and Care-Tech Laboratories, Inc. (US).

The sutures and staplers segment accounted for the largest share of the surgical wound care products market in the animal wound care industry.

The sutures and staplers segment held the largest share of the surgical wound care products market in 2022. This growth is primarily attributed to increasing chronic diseases in animals and the prevalence of veterinary conditions. Sutures and staplers play a crucial role in the animal wound care market by providing effective means for wound closures in veterinary procedures. Sutures are used in various medical treatments that help effective healing by closing wounds. They are especially valuable in surgeries and emergency medicine for animals. Staplers, on the other hand, offer a faster and often more convenient alternative for treating cuts or incisions in veterinary conditions. Sutures and staplers, with their diverse applications and materials suited for different treatments, provide veterinarians with essential tools to ensure effective wound closure and facilitate the healing process in animals.

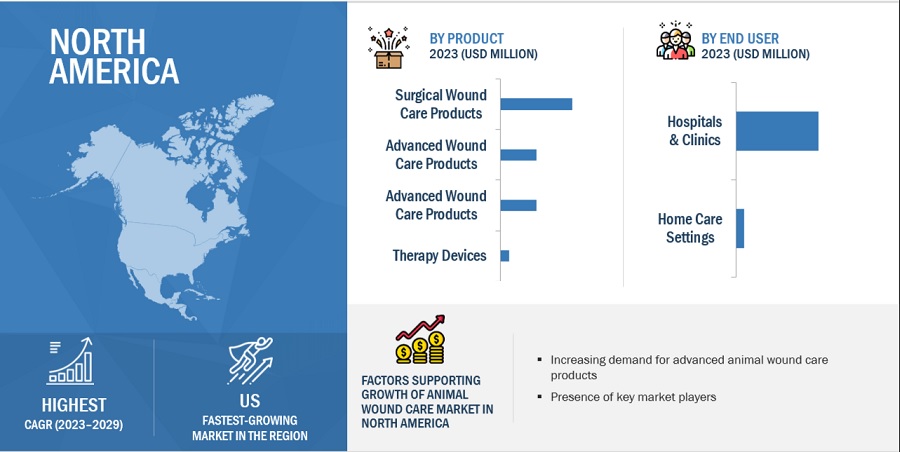

North America is expected to account for the largest share of the animal wound care industry.

North America accounted for the largest share of the animal wound care market in 2022 owing to factors such as government initiatives, higher animal healthcare spending, and growing advances in veterinary healthcare. All these trends are projected to further drive the market growth of global animal wound care products. Moreover, North America's robust research and development activities contribute to innovation in the field of animal wound care market.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the animal wound care market are Elanco Animal Health (US), 3M Company (US), Medtronic PLC (Ireland), B. Braun Melsungen AG (Germany), Virbac (France), Neogen Corporation (US), Jorgen Kruuse A/S (Denmark), Sonoma Pharmaceuticals Inc. (US), Ethicon, Inc. (US), and Dechra Pharmaceuticals (UK). Other players in the animal wound care market are Jazz Medical, LLC (Ireland), Smith & Nephew PLC (UK), Kericure Inc. (US), Advancis Veterinary (UK), Care-Tech Laboratories, Inc. (US). These players include high shares in the market due to strategic mergers, acquisitions, partnerships, and large distribution channels adopted by them. This also leads to an increase in their geographic reach.

Scope of the Animal Wound Care Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1.3 Billion |

|

Projected Revenue by 2029 |

$2.0 Billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 7.4% |

|

Market Driver |

Increasing awareness of animal health |

|

Market Opportunity |

Advancement in wound care medicines |

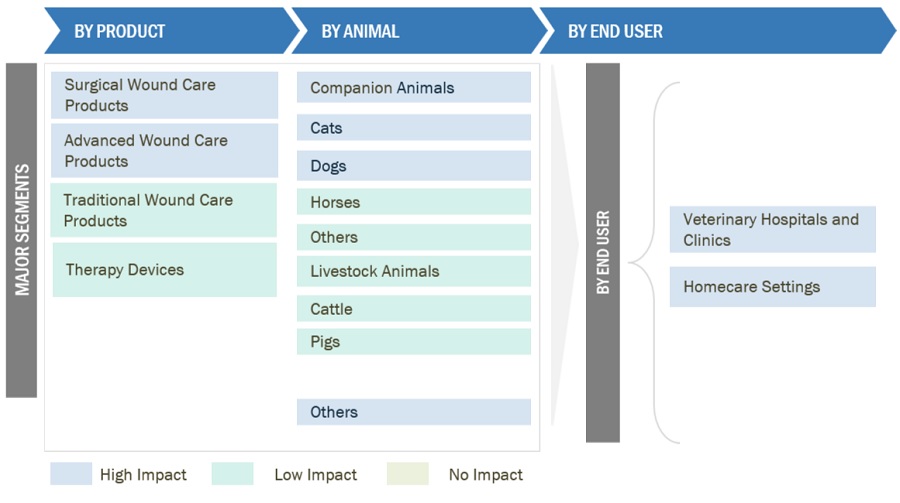

The research report categorizes the animal wound care market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Surgical Wound Care Products

- Sutures And Staplers

- Tissues Adhesives, Sealants, And Glues

-

Advanced Wound Care Products

- Foam Dressings

- Hydrocolloid Dressings

- Film Dressings

- Hydrogel Dressings

- Other Advanced Dressings

-

Traditional Wound Care Products

- Tapes

- Dressings

- Bandages

- Absorbents

- Other Traditional Wound Care Products

- Therapy Devices

By Animal Type

- Companion Animals

- Livestock Animals

By End User

- Hospitals & Clinics

- Home Care Settings

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of LATAM

- Middle East and Africa

- GCC Countries

Recent Developments of Animal Wound Care Industry:

- In January 2023, Elanco acquired Nutriquest U.S. marketed products, inventory, pipeline products, and workforce that helped Elanco to expand its existing nutritional health offerings and explore antibiotic alternatives for swine, poultry, and cattle.

- In March 2022, the Vernacare company acquired Robinson Healthcare for an unclosed sum. This acquisition will help the Group turnover to increase each year.

- In April 2022, the Elanco shifted its assets associated with the microbiome R&D platform to BiomEdit, a newly created biopharmaceutical company. The BiomEdit company majorly focuses on developing solutions and products for animal health.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global animal wound care Market?

The global animal wound care market boasts a total revenue value of $2.0 Billion by 2029.

What is the estimated growth rate (CAGR) of the global animal wound care Market?

The global animal wound care market has an estimated compound annual growth rate (CAGR) of 7.4% and a revenue size in the region of $1.3 Billion in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the animal wound care market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering animal wound care products and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the animal wound care market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the animal wound care market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Latin America, the Middle East & Africa and GCC Countries. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from animal wound care manufacturers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side customers/end users who are using animal wound care products were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of animal wound care products and the future outlook of their business, which will affect the overall market.

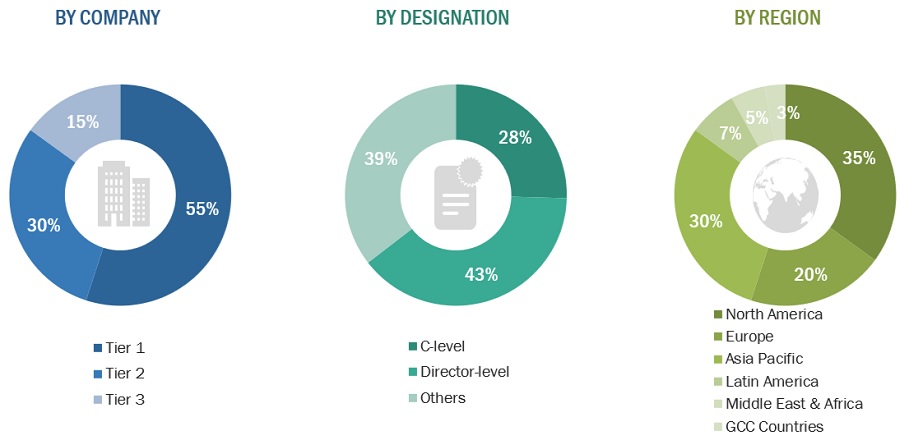

Breakdown of Primary Interviews: Supply-Side Participants, By Company Type, Designation, and Region

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2022: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3=<USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the animal wound care market includes the following details.

The market sizing of the market was undertaken from the global side.

Country-level Analysis: The size of the animal wound care market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products and services in the overall animal wound care market was obtained from secondary data and validated by primary participants to arrive at the total animal wound care market. Primary participants further validated the numbers.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall animal wound care market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Global Animal Wound Care Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Animal wound care market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The animal wound care refers to the industry dedicated to providing products and services for the treatment and management of injuries and wounds in animals. This market encompasses a wide range of veterinary care solutions designed to promote healing, prevent infections, and enhance the overall well-being of animals suffering from wounds or injuries. Key components of the animal wound care market include various wound dressings, bandages, antiseptics, and other therapeutic products tailored for different types of animals, including companion pets, livestock, and wildlife. These products aim to address diverse wound types, such as cuts, abrasions, lacerations, and surgical incisions, across different species..

Key Stakeholders

- Animal wound care products manufacturers

- Animal wound care products distributors

- Animal wound care products associations

- Animal health research & development (R&D) companies

- Pet insurance providers

- Animal hospitals and clinics

- Market research and consulting firms

- Government associations

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the global animal wound care market based on product, animal type, end-user, and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To analyze micro markets with respect to individual growth trends, future prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the animal wound care market with respect to six main regions (along with countries), namely, North America, Europe, Asia Pacific, Latin America, the Middle East and Africa, and GCC countries.

- To profile the key players in the global animal wound care market and comprehensively analyze their core competencies and market shares.

- To track and analyze competitive developments such as acquisitions, product launches, regulatory approvals, and R&D activities of the leading players in the global animal wound care market.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe's animal wound care market into the Netherlands, Austria, Belgium, and others

- Further breakdown of the Rest of Asia Pacific animal wound care market into Singapore, Malaysia, and others

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Animal Wound Care Market