Anti-Corrosion Coating Market by Type (Epoxy, Polyurethane, Acrylic, Alkyd, Zinc), Technology (Solvent borne, Waterborne, Powder-based), End-Use Industry (Marine, Oil & Gas, Industrial, Infrastructure, Power Generation), & Region - Global Forecast to 2028

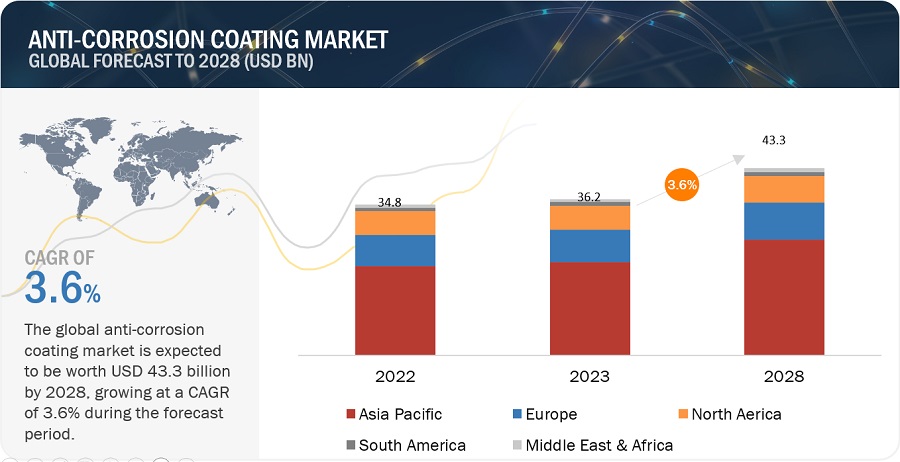

The anti-corrosion coating market is projected to grow from USD 34.8 billion in 2022 to USD 43.3 billion by 2028, at a CAGR of 3.6% between 2023 and 2028. Increasing losses and damage due to corrosion is a major factor behind the growth of the market.

Attractive Opportunities in the anti-corrosion coatings Market

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Anti-corrosion coating Market Dynamics

Drivers: Increasing damage and losses due to corrosion

Corrosion is one of the serious problems in various end-use industries. Corrosion may attack the jacketing, the insulation hardware, or the underlying piping or equipment. The monetary losses caused by corrosion can be very high and directly threaten the well-being of general property and the life of people.

Significant monetary losses must be borne due to rust, corrosion, wear and tear, accidental damages, and other factors affecting the consumption of fixed capital (CFC). These losses lead to economic depreciation and are majorly seen in manufacturing and other industries.

Restraints: Environmental Regulations

Regulations were targeted at limit the volatile organic compounds (VOC) emissions from the coatings. REACH and LEED GreenSeal GC-03 2nd Ed., 1997 specifies that the VOC content in grams per liter (g/L) for anti-corrosion coatings. These regulations pressurized anti-corrosion coatings manufacturers to comply with the standards by reducing the VOC contents while maintaining the quality and performance of these coatings. The regulations have also impacted the price of anti-corrosion coating as the regulations brought a change in the technology which is used for the production of the coatings. Therefore, the regulations present a formidable short-term restraint for the growth of the anti-corrosion coating market.

Opportunities: Demand foe high-efficiency anti-corrosion coatings

Changes in operating circumstances in end-use sectors such as oil and gas and marine have created a demand for anti-corrosion coatings with improved characteristics and efficiency. For example, the rising usage of enhanced oil recovery (EOR) procedures in the oil and gas industry has created a demand for coatings that can withstand high temperatures and pressures while still ensuring long-term structural protection. Demand for high solid anti-corrosion coating from the oil and gas, maritime, and infrastructure industries has also stimulated R&D activity for the development of these coatings, which are appropriate for use in hostile environments. This is a short-term driver of the anti-corrosion coating industry, but it has the potential to become a long-term driver in the future. As a result, the increased demand for high-efficiency anti-corrosion coating is likely to create considerable prospects for market expansion.

Challenges: Entry of local players in the market

The anti-corrosion coating market is dominated by a few major global players. Companies such as PPG Industries (U.S.), AkzoNobel (Netherlands), and Jotun (Norway) lead the market in terms of revenue and product development. The anti-corrosion coating market also comprises a number of small local players such as Diamond Vogel Paints (U.S.) and SK Formulations India Pvt. Ltd. (India) who lacks the financial or technological power to counter the global majors. The local players are slowly gaining an edge through increased R&D initiatives and focus on a limited geographic section. They can identify the needs and demands in the local area and can actively fulfill them with application-specific products. Companies such as Ancatt (U.S.) and Carboline (U.K.) are emerging competitors to the current leading market players.

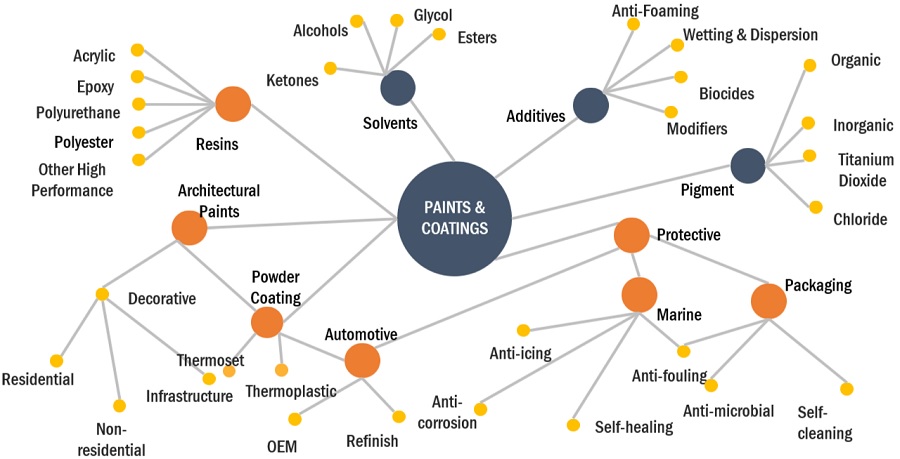

Anti-Corrosion Coating Ecosystem.

The diagram below indicates MnM coverage of the paints & coatings ecosystem. Knowledgestore provides strategic insights on each of the nodes in the ecosystem through a cloud based, highly interactive market intellence platform.

Epoxy by type accounted for the largest growing segment of anti-corrosion coating market

Due to the epoxy's compatibility with other coating materials, the dominance of epoxy anti-corrosion coating is anticipated to persist during the forecast period. Also, it is the most used anti-corrosion coating. Additionally, the demand for epoxy anti-corrosion coating is rising across a range of end-use industries, including marine, infrastructure, oil & gas, and automotive & transportation.

To know about the assumptions considered for the study, download the pdf brochure

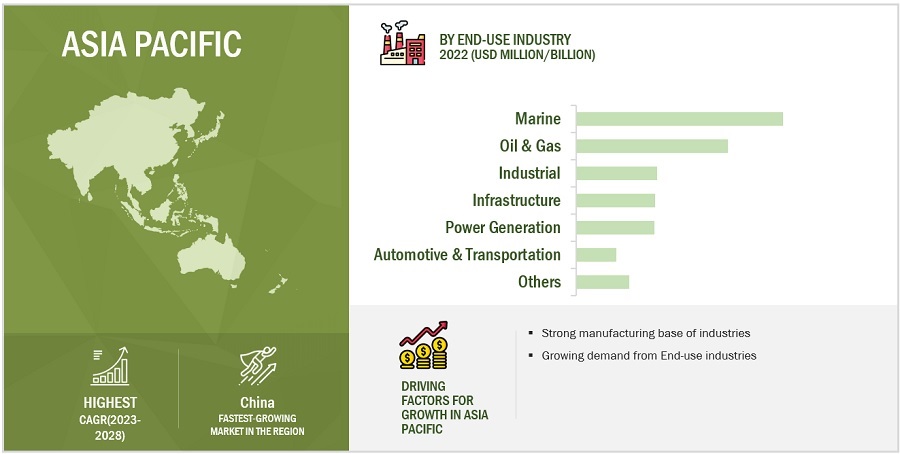

Asia Pacific is the largest growing anti-corrosion coating market.

The Asia Pacific is the largest anti-corrosion coating market, in terms of both, value and volume, and is projected to be the fastest-growing market during the forecast period. Economic development is credited to Asia Pacific, which is followed by major investment in areas such as automotive and transportation, infrastructure, power generation, and industrial. Asia Pacific is the most promising market and will remain such in the foreseeable future. Furthermore, multinational corporations are relocating production facilities to Asia Pacific to take advantage of reduced labour costs and meet local market demand.

Key Market Players

PPG Industries, Inc. (US), AkzoNobel N.V. (Netherlands), The Sherwin-Williams Company (US), Jotun A/S (Norway), Kansai Paints Co., Ltd. (Japan) are the key players in the global anti-corrosion coating market.

PPG Industries, Inc. manufactures and distributes coatings, paints, optical products, and specialty materials. The company operates in two segments, namely, performance coatings, and industrial coatings. The company offers anti-corrosion coatings through the Performance Coatings segment. It also provides industrial and automotive coatings to the manufacturing industries; adhesives and sealants to the automotive industry; metal pretreatments and related chemicals for the industrial & automotive applications; and packaging coatings to aerosol and food & beverage container manufacturers.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered for the study |

2020-2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments |

By Type |

|

Regions covered |

Asia Pacific, Europe, North America, South America, Middle East & Africa |

|

Companies profiled |

PPG Industries, Inc. (US), AkzoNobel N.V. (Netherlands), The Sherwin-Williams Company (US), Jotun A/S (Norway), Kansai Paints Co., Ltd. (Japan). A total of 25 players have been covered. |

This research report categorizes the anti-corrosion coating market based on Type, Technology, End-use Industry, and Region.

By Type:

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc

- Chlorinated Rubber

- Others

By Technology:

- Solvent borne

- Waterborne

- Powder-based coating

- Others

By End-use Industry:

- Marine

- Oil & Gas

- Industrial

- Infrastructure

- Power Generation

- Automotive & Transportation

- Others

By Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In March 2022, PPG has launched AMERLOCK 600 multipurpose epoxy coating for applicators looking for maximum versatility. The AMERLOCK coatings family is known for its excellent corrosion protection in tough environments.

- In February 2021, PPG Industries launched a PPG HI-TEMP 1027 HD corrosion protection coating in North America. The product is used in various sectors including oil & gas, chemical processing, power generation, and industries such as paper mills and steel mills that rely on insulated pipelines.

Frequently Asked Questions (FAQ):

What are the growth driving factors of anti-corrosion coating?

Increasing damage and losses due to corrosion is the major factor for driving anti-corrosion coating market.

What are the major end-use for anti-corrosion coating?

The major end-use industries of anti-corrosion coating are marine, oil & gas, industrial, and infrastructure.

Who are the major manufacturers?

PPG Industries, Inc. (US), AkzoNobel N.V. (Netherlands), The Sherwin-Williams Company (US), Jotun A/S (Norway), Kansai Paints Co., Ltd. (Japan), are some of the leading players operating in the global anti-corrosion coating market.

What are the reasons behind anti-corrosion coating gaining market share?

Anti-corrosion coating are gaining market share due to increasing loses and damage from coreosion.

Which is the largest region in the anti-corrosion coating market?

Asia Pacific is the largest region in anti-corrosion coating market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

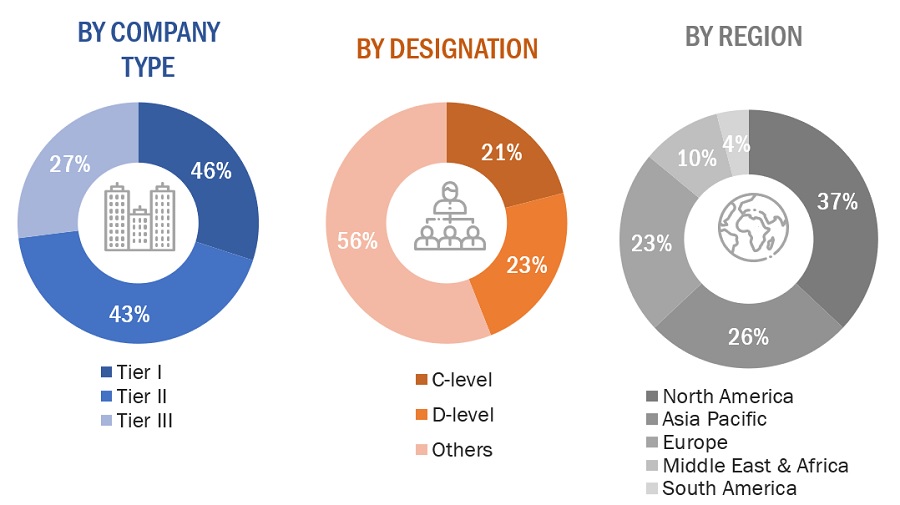

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global anti-corrosion coating market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases & investor presentations of companies, white papers, regulatory bodies, trade directories, certified publications, articles from recognized authors, gold and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain and verify qualitative and quantitative information for this report as well as analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the anti-corrosion coating market. Primary sources from the demand side include experts and key persons from the application segment. Extensive primary research has been conducted after understanding and analyzing the current scenario of the anti-corrosion coatings market through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

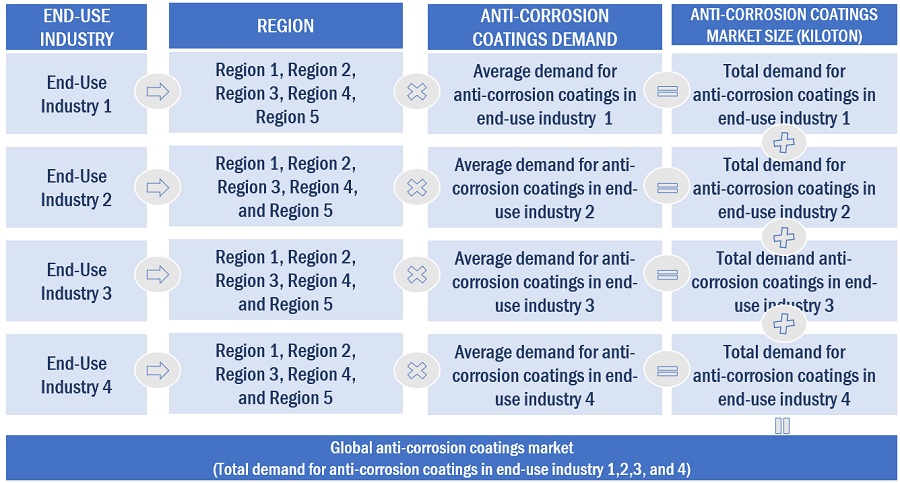

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the anti-corrosion coating market on the basis of different end-use industries and types in each of the regions. The key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that can affect the market have been accounted for in this research study, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Global Anti-Corrosion Coating Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Anti-Corrosion Coating Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market has been validated using both top-down and bottom-up approaches. Then, it has been verified through primary interviews. Hence, for every data segment, there are three sources, one from the top-down approach, second from the bottom-up approach, and third from expert interviews. Only when the values arrived at from the three points match, the data have been assumed correct.

Market Definition.

Anti-corrosion coatings are used for protecting metal, concrete, and other components from degradation caused by moisture, oxidation, and exposure to chemicals and salt water. They are specialized protective coatings used to protect the surfaces by creating a barrier between the surface and the corrosive agents. Anti-corrosion coatings are used to enhance the lifespan and quality of the structure or surface on which they are applied.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, forecast, and analyze anti-corrosion coatings market based on type, technology, and end-use industry in terms of value

- To describe and forecast the size of the market based on five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective countries in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments such as product launches, acquisitions, agreements, and partnerships in the market

Note: 1. Micromarkets are defined as the subsegments of the global anti-corrosion market included in the report.

2. Core competencies of companies are determined in terms of the key developments and strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the anti-corrosion coating market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Anti-Corrosion Coating Market

Key manufacturers their products offered present in the market

Information on forecast of sales of acrylic solvent-borne anti-corrosion coatings with a focus on emerging untapped end-use opportunities in North American market.

Market trends on global anto-corrosion market

General information on Anti-corrosion Coating Market

General information on vacuum pump and measurment, thin film coating, plasma application, semiconductor, LED, OLED, TFT, Solar Cell, Optical coating

Anti-Corrosion Coating Market

General information on Anti-Corrosion Coating Market

Information on anti-corrosion coating market