Automated Border Control Market by Hardware (Document Authentication System, Biometric Verification System (Facial & Iris Recognition)), Software, Solution Type (Automated Boarding E-gates, Security Checkpoint E-gates, Kiosks) - Global Forecast to 2028

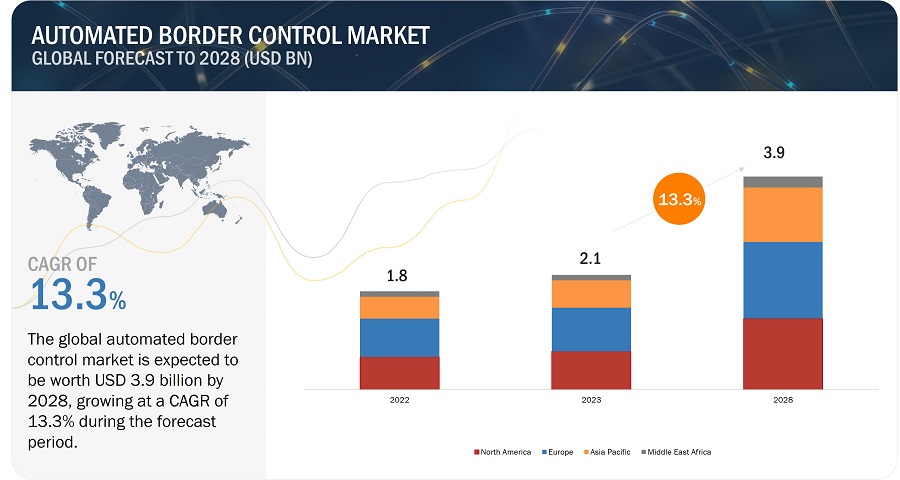

[227 Pages Report] The Global Automated Border Control Market size is expected to grow from USD 2.1 billion in 2023 to USD 3.9 billion by 2028, at a compound annual growth rate (CAGR) of 13.3%.

The rise in the number of international passengers propelled the travel and tourism industry, and growing security concerns at all the ports are the major driving factors for the growth of the automated border control industry. Moreover, the increase in the deployment of digital ID verification systems and the growing incorporation of AI in automated border control systems are some factors that are also expected to drive the growth of the market in the near future.

Automated Border Control Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Automated Border Control Market Dynamics

DRIVER: Rise in number of international passengers to propel travel and tourism industry

The transportation industry plays a major role in the GDP of any country. According to the World Travel & Tourism Council, travel and tourism contributed 6.1% to the global GDP in 2021. The growth of the transportation industry in any country is determined by factors such as the rising tourism industry, economic growth, infrastructure, and per capita income of consumers. Besides, a significant rise in international passenger travel has been observed in recent years. This has resulted in an increase in the demand for effective border control systems. As more people travel across borders, traditional manual border control processes have become overwhelmed, leading to long wait times and decreased efficiency. Hence, border crossings have largely installed ABC systems, i.e., eGates and kiosks, owing to their ability to efficiently handle a large number of travelers compared with border control agents.

RESTRAINT: Lack of security standardization across different systems and countries

Security standard for different countries is determined by the policies formulated by their governments. The policies keep on changing and upgrading as per the requirement of all the regions. For instance, some countries might check goods crossing their border, some might check people, while others may check both depending upon the mode of transport and political situations among the countries. Moreover, the requirement for ABC systems has changed since its inception. The first generation of e-gates was introduced in 2002 and relied on simple barcode scanning technology to authenticate the passport or travel document of the traveler. These systems were limited in their ability to detect fraudulent documents and could be easily bypassed by individuals using fake passports or stolen identities. These systems were defined by each state.

OPPORTUNITY: Growing implementation of digital ID verification systems by governments and transportation organizations

Digital ID verification is becoming increasingly popular due to its convenience, speed, and security, and it is being adopted by a growing number of travelers around the world. As a result, many governments and transportation organizations are investing in ABC systems that incorporate digital ID verification to enhance the travel experience.

Digital ID verification through mobile devices eliminates the need for travelers to carry physical documents and can be completed from anywhere, making the process more convenient. It can incorporate advanced security features, such as biometric authentication and facial recognition technology, to improve the accuracy and effectiveness of border control procedures. Besides, these systems are more cost-effective to implement than traditional border control methods, as they do not require as much specialized hardware or infrastructure.

CHALLENGE: Rising risk of cyberattacks on automated border control systems in transportation industry

ABC systems streamline the process of clearing international travelers through customs and immigration checkpoints. These systems use advanced technologies such as biometrics and machine learning to quickly and accurately authenticate the identities of travelers and determine their eligibility to enter a country. However, cyberattacks on these systems lead to compromise the security and integrity of the entire border control process. Cyberattacks are a major concern in the transportation industry as they involve travelers’ personal data, including their biometrics. Hackers try to access sensitive personal information stored in the eGate systems, such as passport information and biometric data, to use for criminal activities.

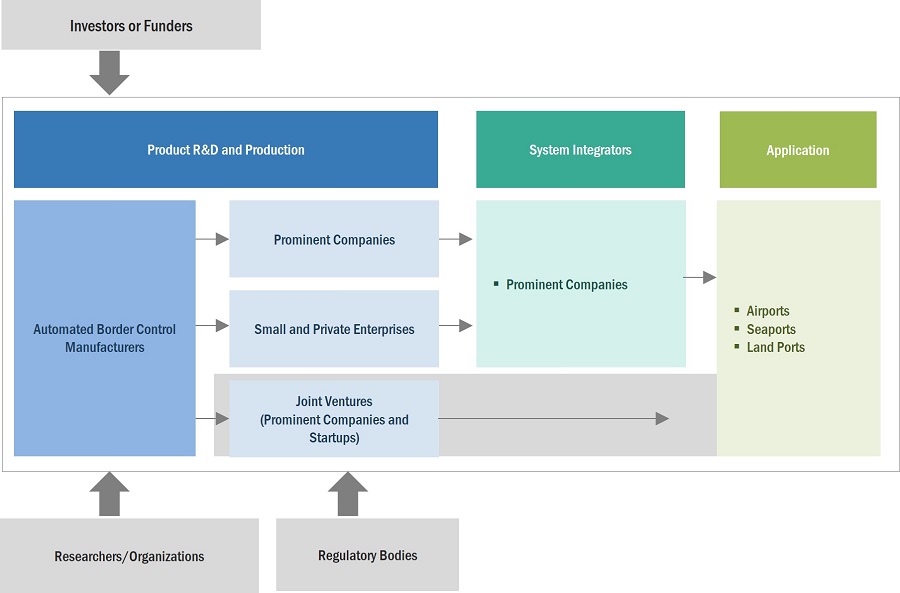

Automated Border Control Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers and providers of automated border control systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Vision-Box (Portugal), SITA (Netherlands), Secunet Security Networks AG (Germany), IDEMIA (France), and Thales (France).

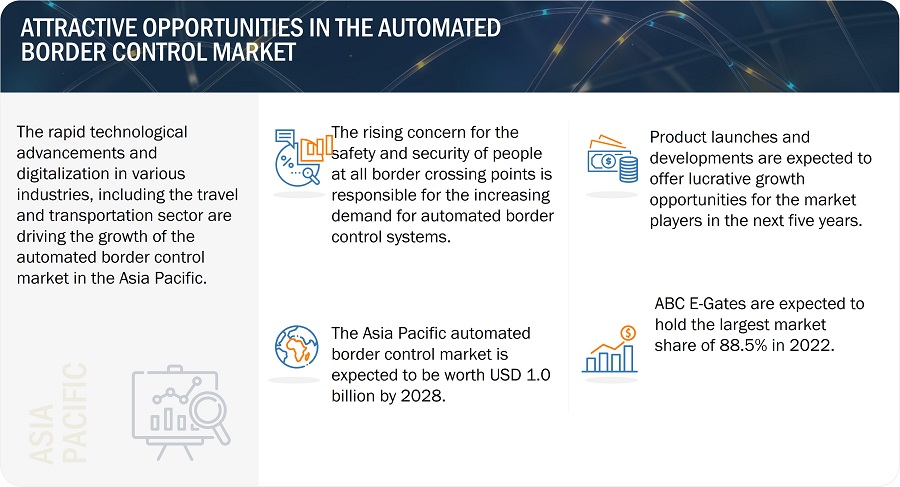

ABC E-Gates is estimated to hold the highest CAGR during the forecast period

Automated border control E-gates are physical gates that travelers walk through, and they use advanced biometric technologies, such as facial recognition, fingerprint scanning, and iris recognition, to verify travelers’ identities. E-gates are typically installed at airports, seaports, and land borders, and they are designed to process large volumes of travelers quickly. In 2022, the ABC E-gates segment held a larger share of the automated border control market. These ABC e-gates are in high demand by applications, such as airports and seaports, as these systems allow border control agencies to process travelers more quickly and efficiently than traditional manual methods and enhance security at the ports. Besides, these systems process a maximum number of passengers without increasing staff costs, which is also responsible for the growth of the segment.

Hardware segment holds the largest share of automated border control in 2022

Hardware plays a crucial role in the development of automated border control systems. In 2022, hardware offerings held a larger share of the automated border control market. The hardware components in the automated border control system have led to the development of more advanced and reliable self-service kiosks and e-gates, which in turn, is driving the demand for advanced hardware components. Besides, the increasing need for biometric verification in the border control process is also responsible for the growth of the segment. Biometric verification is the most accurate and authentic validation technology suggested by transport authorities globally.

Seaports segment to be the second-largest growing segment during the forecast period

Seaports that serve as border crossings for people often have dedicated facilities and processes in place to process the immigration and customs requirements of passengers. These facilities are equipped with checkpoints, counters, and personnel to process the arrival and departure of individuals. Seaports used for border crossing of people implement robust security measures. Hence, automated border control systems are being implemented at seaports to enhance security, streamline operations, and facilitate the movement of goods and passengers. The seaports segment is expected to hold considerable growth of the automated border control market during the forecast period owing to the growing maritime trade, security enhancement requirements, and efficient cargo processing.

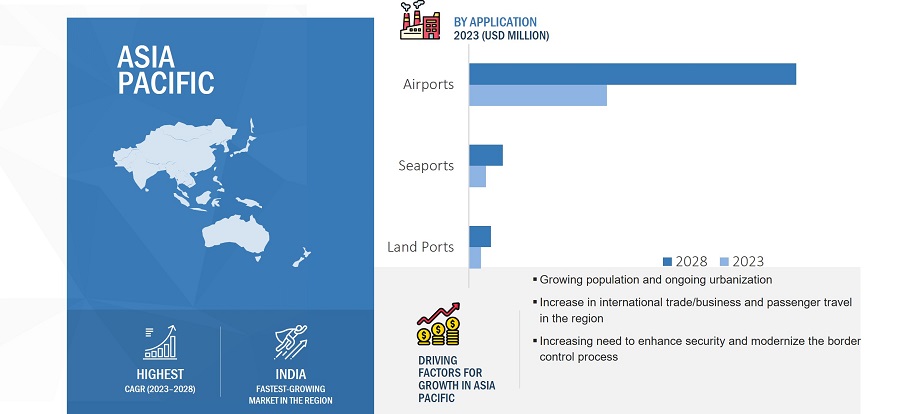

Asia Pacific region is likely to hold the largest growth rate by 2028

Asia Pacific comprises a diverse range of economies with varying levels of development. The region is experiencing a significant increase in air travel, driven by factors such as economic growth, rising incomes, and an expanding middle class. This growth in air travel necessitates the implementation of efficient automated border control systems to handle the rising passenger volumes. Besides, the rapid technological advancements and digitalization in various industries, including the travel and transportation sector, is also significant factor driving the growth of the automated border control market in APAC. This digital transformation has fueled the adoption of automated border control systems as part of a broader effort to modernize and streamline border control processes.

Automated Border Control Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Automated Border Control Companies - Key Market Players

The automated border control companies is dominated by a few globally established players such as Vision-Box (Portugal), SITA (Netherlands), Secunet Security Networks AG (Germany), IDEMIA (France), Thales (France), NEC Corporation (Japan), Indra Sistemas, S.A. (Spain), Gunnebo AB (Sweden), and HID Global Corporation (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Border Crossing Procedure Type, Solution Type, Component, and Application |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

|

Companies Covered |

Major Players: Vision-Box (Portugal), SITA (Netherlands), Secunet Security Networks AG (Germany), IDEMIA (France), Thales (France), NEC Corporation (Japan), Indra Sistemas, S.A. (Spain), Gunnebo AB (Sweden), HID Global Corporation (US), among others - total 25 players have been covered. |

Automated Border Control Market Highlights

This research report segments the automated border control market based on border crossing procedure type, solution type, component, application, and region.

|

Segment |

Subsegment |

|

By Border Crossing Procedure Type: |

|

|

By Solution Type: |

|

|

By Component: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments

- In March 2023, IDEMIA has announced the launch of two contactless biometric devices, namely OneLook Gen 2 and MorphoWave TP. The devices are designed to provide a faster, more secure, and barrier-free biometric verification.

- In February 2023, Frankfurt Airport has team up with SITA and NEC Corporation to introduce a biometric passenger journey by deploying SITA Smart Path which brings a comprehensive biometric passenger processing solution across all terminal and airlines at Frankfurt Airport. The implementation would see additional biometric touchpoints installed by spring 2023.

- In June 2022, Vision-Box unveiled its latest solution namely, Seamless Kiosk – The New Generation of Biometric Technology, which is set to transform the travel experience. This latest solution combines the newest Common Use Self-Service (CUSs) 2.0 platform and border control processing, including Entry/Exit System (EES) requirements.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the automated border control market during 2023-2028?

The global automated border control market is expected to record a CAGR of 13.3% from 2023–2028.

What are the driving factors for the automated border control market?

Rise in number of international passengers to propel travel and tourism industry, and growing security concerns at land ports, airports, and seaports.

Which are the significant players operating in the automated border control market?

Vision-Box (Portugal), SITA (Netherlands), Secunet Security Networks AG (Germany), IDEMIA (France), and Thales (France), are some of the major companies operating in the automated border control market.

Which region will lead the automated border control market in the future?

Asia Pacific is expected to lead the automated border control market during the forecast period.

What is the total market size of the automated border control market in 2022?

The total market size of the automated border control market in 2022 is USD 1.8 billion.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

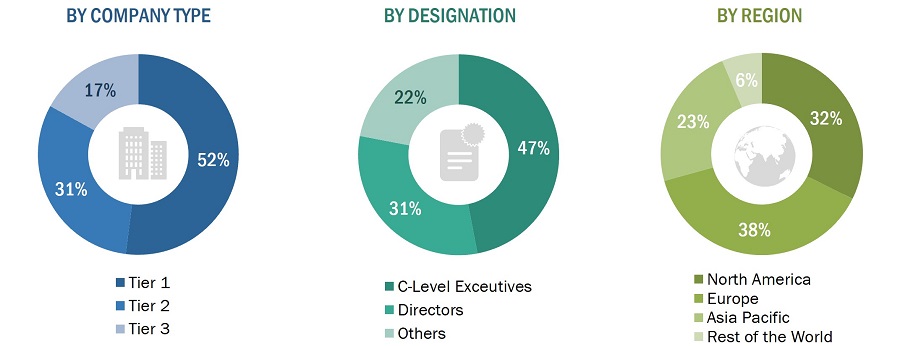

The study involved four major activities in estimating the current size of the automated border control market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information important for the automated border control market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers and certified publications; articles from recognized authors; directories; and databases.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the automated border control market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, for the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate, forecast, and validate the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out to list the key information/insights pertaining to the automated border control market.

Automated Border Control Market: Bottom-Up Approach

- Key players operating in the automated border control market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

Automated Border Control Market: Top-Down Approach

- Focusing on the top-line expenditures and investments made throughout the automated border control system ecosystem for installing new automated border control systems and retrofitting the existing ones.

- Information related to revenues generated by the key developers and providers of automated border control systems has been studied and analyzed.

- Multiple on-field discussions have been carried out with the key opinion leaders of the leading companies involved in developing automated border control systems.

- The geographical split has been estimated using secondary sources based on various factors, such as the number of players in a specific country or region and the type of automated border control systems offered by these players.

Data Triangulation

After arriving at the overall automated border control market size-using the estimation processes explained above-the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the automated border control market.

Market Definition

Automated Border Control (ABC) refers to the use of advanced technologies and automated systems at border checkpoints to facilitate the movement of people across national borders while ensuring border security. ABC systems often use biometric technologies, such as facial recognition and fingerprint scanning, to verify the identity of travelers and determine their eligibility to enter or exit a country. These systems are designed to improve border security by reducing the risk of human errors and fraudulent activities. They also streamline border control processes by allowing passengers to self-process their travel documents and identity verification, which can lead to faster processing times and reduced wait times at border checkpoints. ABC systems can be found at various points of entry, including airports, seaports, and land border crossings.

Key Stakeholders

- Raw material and manufacturing equipment suppliers

- Hardware and software manufacturers for automated border control

- Original equipment manufacturers (OEMs) for card readers and biometrics

- ODM and OEM technology solution providers

- Suppliers and distributors

- System integrators

- Middleware providers

- Assembly, testing, and packaging vendors

- Research institutes and organizations

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- Governments, financial institutions, and regulatory bodies

Report Objectives:

- To describe and forecast the automated border control market in terms of value based on solution type, component, and application.

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of the automated border control ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2 and provide a detailed competitive landscape of the market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of automated border control.

- To analyze competitive strategies, such as product launches and developments, collaborations, agreements, contracts, and partnerships, adopted by key market players in the automated border control market.

- To analyze the probable impact of the recession on the market in the near future

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automated Border Control Market