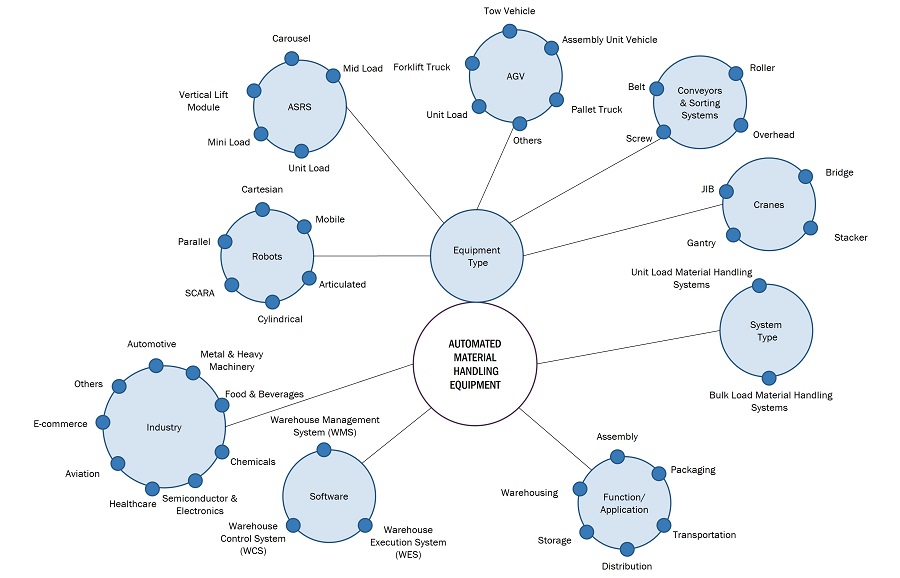

Automated Material Handling Equipment Market Size, Share, Statistics and Industry Growth Analysis Report by Product (Robots, ASRS, Conveyors And Sortation Systems, Cranes, WMS, AGV), System Type (Unit Load, Bulk Load), Industry (Automotive, E-Commerce, Food & Beverage) and Region - Global Forecast to 2028

Automated Material Handling Equipment Market Overview

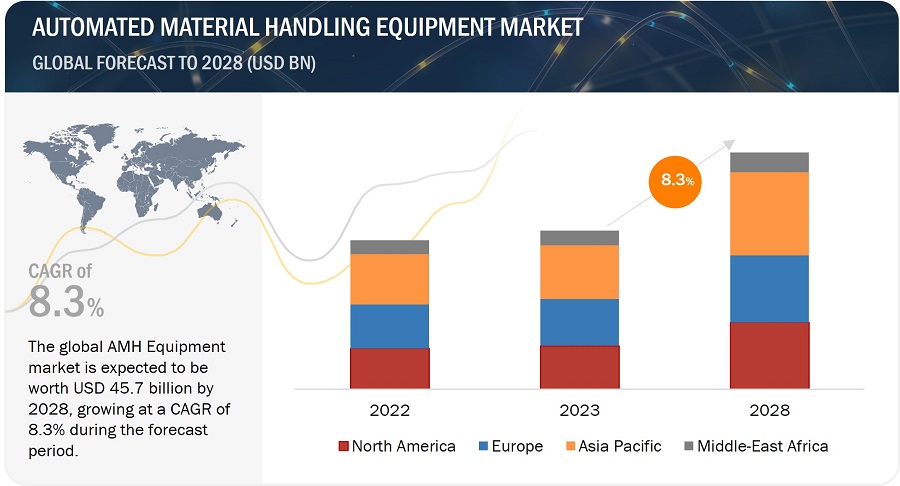

[270 Pages Report] The automated material handling equipment market size is estimated to be worth USD 30.6 billion in 2023 and is projected to reach USD 45.7 billion by 2028, at a CAGR of 8.3% during the forecast period. Increasing demand for automated material handling equipment in e-commerce, 3PL, automotive, and food & beverage industries, and the growing need to improve efficiency, reduce costs, and increase safety in their material handling operations are major factors driving the automated material handling equipment market growth globally.

Automated Material Handling Equipment Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Automated Material Handling Equipment Market Trends

Driver: Rise in demand for automated material handling equipment across diverse industries

Benefits such as low cost of capital, fast return on investment (ROI), and a high degree of possibility of customization encourage manufacturing companies to invest more in factory automation. AMH equipment is used in many industries, such as automotive, chemicals, food & beverages, healthcare, aviation, and metals and heavy machinery. The advantages of this equipment are reduced production time, fewer human errors, increased safety, high-volume production, and increased accuracy and repeatability. The widespread use of AMH equipment, such as automated guided vehicles (AGV), ASRS, conveyors, cranes, and robots, helps fulfill the requirements related to material handling, such as pick and place, storage, retrieval, and transportation. AMH equipment enables just-in-time (JIT) delivery of raw materials, computerized control of received assembled parts, and tracking of articles in factories and storage places. Awareness of these advantages has increased the demand for various AMH products in numerous industries.

Restraint: High integration and switching costs

Companies invest a considerable amount in automating their manufacturing and warehousing facilities. Integrating new AMH equipment with existing equipment attracts a high cost for changing the layout and implementing different software. Moreover, after the successful adoption of automation, manufacturing and warehouse operating companies face another limitation in the form of high switching costs. Most companies —operating their manufacturing units— face problems when switching from one vendor to another, as the switching expense involves changing the software associated with the equipment and the changes needed to be made in facilities while changing the equipment. Therefore, the cost of integration and switching to a different vendor leads to industry reluctance in deploying AMH equipment, thereby hindering widespread adoption.

Opportunity: Substantial industrial growth in emerging economies

Rapid industrialization has resulted in significant investments in infrastructural development in emerging economies such as India, Brazil, Mexico, and Indonesia. This, in turn, attracts global companies to set up their manufacturing plants in these countries. This has created a requirement for advanced and sophisticated warehousing facilities to integrate and manage supply chains. The surge in investments in enhancing the capability of supply chains in emerging economies has opened new growth opportunities for AMH equipment providers.

Challenge: Development of flexible and scalable AMH equipment

With the ever-changing global market scenarios, industries need to adapt to the changes in their operations and processes. Industries such as automotive, electronics, food & beverage, and e-commerce are witnessing significant market developments; hence, they demand flexible and scalable AMH equipment to fulfill their current and future business needs. These needs are related to storage capacity, height limits, control technologies, ease of maintenance, energy efficiency, and ease of integration with existing infrastructure. However, providing a flexible and scalable solution is challenging for suppliers due to constantly changing technologies in the material handling ecosystem.

Market Ecosystem

Automated material handling equipment Market: Key Trends

Daifuku, KION, SSI Schaeffer, Toyota Industries, and Honeywell International are the top five players in the AMH market. These AMH companies boast automated material handling trends with a comprehensive product portfolio and solid geographic footprint.

ASRS accounted for the largest share of the automated material handling equipment market in 2022

ASRS offers benefits such as reduced space and labor utilization, improved supply chain efficiency and productivity, real-time inventory control at a lower cost, error-free fulfillment, and rapid storage and retrieval of items. The deployment of ASRS is increasing as these systems help warehouses and manufacturing companies improve their production capacity and order accuracy. Due to these factors, many warehouses and distribution centers initiated the consolidation of warehouses to align with the needs of their customers, a trend expected to be followed by more warehouse operators. Consolidation of warehouses results in storing many packages in a small space. This would drive the demand for ASRS in automated material handling equipment market.

Unit load material handling equipment to account largest share in the automated material handling equipment market during forecast period.

The unit load material handling systems contributed a larger market share in 2022. Unit load material handling systems will often lead to significant space savings that provide high-density storage, reduce aisle space, and optimize the facility’s vertical height to convert open air to valuable storage space. The increasing demand for automated material handling equipment in the e-commerce industry is expected to fuel the market of unit load material handling systems for the automated material handling equipment market during the forecast period.

The automotive industry to contribute the largest market size in the automated material handling equipment market in 2022.

The automotive industry dominated the automated material handling equipment market, with the highest market size in 2022. Automotive is amongst the most innovative sectors in terms of using automated equipment. The need for constant availability of components and spare parts, just-in-time (JIT) delivery of materials, and reduction in the cost of unproductive labor are driving the growth of the automotive industry segment.

Asia Pacific held the largest share of the automated material handling equipment market in 2022

Asia Pacific contributed the largest market share for automated material handling equipment in 2022. Increasing awareness related to warehouse automation and growing emphasis of the leading economies such as China and Japan on robotics are major factors contributing to the substantial growth of Asia Pacific in the market. The speedy growth of automotive, e-commerce, food & beverage, and healthcare industries in major economies, such as China and Japan, is supporting the growth of automated material handling equipment market in Asia Pacific.

Automated Material Handling Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major AMH companies in the automated material handling equipment market include Daifuku, KION, SSI Schaffer, Toyota Industries, and Honeywell International. These AMH companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the automated material handling equipment market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Segment |

Subsegment |

| Estimated Value | USD 30.6 billion in 2023 |

| Projected Value | USD 45.7 billion by 2028 |

| Growth Rate | CAGR of 8.3% |

|

Years Considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million) |

|

Segments Covered |

Product, System Type, Industry, and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Daifuku (Japan), KION (Germany), SSI Schaefer (Germany), Toyota Industries (Japan), and Honeywell International (US). |

Automated Material Handling Equipment Market Highlights

In this report, the overall automated material handling equipment market has been segmented based on Product, System Type, Industry, and Region.

|

Segment |

Subsegment |

|

By Product |

|

|

By System Type |

|

|

By Vertical |

|

|

By Region |

|

See Also:

- Japan Automated Material Handling Equipment Market to Grow at a CAGR 9.8% from 2023 to 2028

- Germany Automated Material Handling Equipment Market to Grow at a CAGR 8.4% from 2023 to 2028

Recent Developments

- In December 2022, Daifuku announced construction of a new manufacturing plant in Hyderabad, Telangana, India, at its subsidiary Vega Conveyors and Automation Private Limited (Vega).

- In September 2022, Toyota Material Handling Japan, a division of Toyota Industries Corporation, launched an autonomous lift truck featuring AI-based technology that automatically recognizes the location and position of trucks and loads and generates automated travel routes to perform loading operations.

- In January 2022, Schou, the largest Scandinavian retailer of non-food items, commissioned SSI Schaeffer as a general contractor for its new automated logistics center in Kolding, Denmark. The company has been selected because of its flexibility in automated logistics offerings and its solution-based approach.

Frequently Asked Questions (FAQ):

What is the current size of the global automated material handling equipment market?

The automated material handling equipment market is estimated to be worth USD 30 billion in 2023 and is projected to reach USD 45 billion by 2028, at a CAGR of 8.3% during the forecast period. The rising need to move, store, control, and protect materials throughout the manufacturing, warehousing, and distribution process are the major factors driving the automated material handling equipment market growth.

Who are the global automated material handling equipment market winners?

AMH companies such as Daifuku, KION, SSI Schaeffer, Toyota Industries, and Honeywell International fall under the winners’ category.

Which region is expected to hold the highest share of automated material handling equipment market?

Asia Pacific will dominate the automated material handling equipment market in 2028. Countries in Asia Pacific are showing growth in the automotive, e-commerce, chemical, and healthcare industries, which are proposed to be the primary industries for automated material handling equipment and mixing equipment which are some of the major factors driving the automated material handling equipment market growth in the region.

What are the major drivers and opportunities related to the automated material handling equipment market?

Surging demand for automated material handling equipment in the e-commerce industry and potential growth prospectus in the healthcare industry are some of the major drivers and opportunities for AMH companies and the automated material handling equipment market.

What are the major strategies adopted by AMH companies?

The agitator companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the automated material handling equipment market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

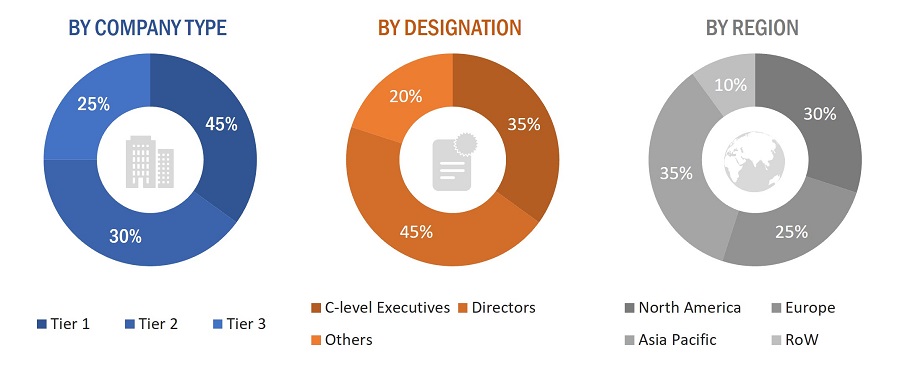

The study involves four major activities that estimate the size of the automated material handling equipment market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the automated material handling equipment market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research.

Primary Research

In the primary research process, numerous sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. Various primary interviews were conducted with several market experts from demand (agriculture and construction companies) and supply sides (automated material handling equipment manufacturers and distributors). Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

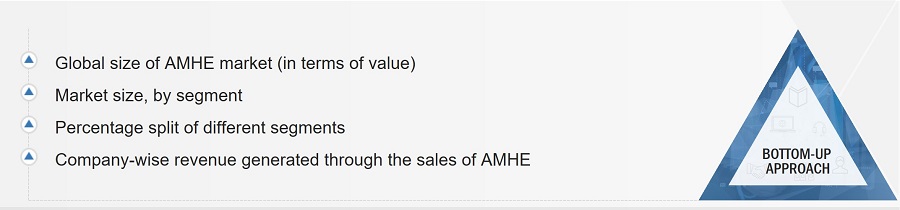

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the automated material handling equipment market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

Automated material handling equipment (AMHE) are integrated system used for material handling and storing during product manufacturing, warehousing, and distribution. These systems also serve the purpose of controlling the flow of materials in a manufacturing facility. The key objective of deploying automated material handling equipment is to ensure that the right materials are safely delivered to the desired destination at the right time and at the minimum cost. Automated material handling equipment includes automated guided vehicles (AGV), automated storage and retrieval systems (ASRS), cranes, robots, warehouse management systems, and conveyors and sortation systems.

Stakeholders

- Integrators of material handling systems

- Warehousing companies

- Government bodies, venture capitalists, and private equity firms

- Manufacturers of AMHE

- Research organizations, forums, alliances, and associations

- Software and service providers

- Components Suppliers

- Venture Capitalists, Private Equity Firms, and Startup Companies

The main objectives of this study are as follows:

- To describe and forecast the automated material handling equipment (AMHE) market, in terms of value, segmented by product, system type, and industry.

- To forecast the market size, in terms of value, for four specific regions—North America, Europe, Asia Pacific, and Rest of the World.

- To describe the software and services provided for automated material handling equipment and outdoor material handling equipment.

- To provide the latest warehousing technology trends impacting the automated material handling equipment market.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market’s growth.

- To analyze the probable impact of the recession on the market in the future.

- To provide a comprehensive overview of the value chain of the AMHE ecosystem.

- To strategically analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the total market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide a detailed market competitive landscape.

Available Customizations:

With the given market data, MarketsandMarkets offer customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automated Material Handling Equipment Market