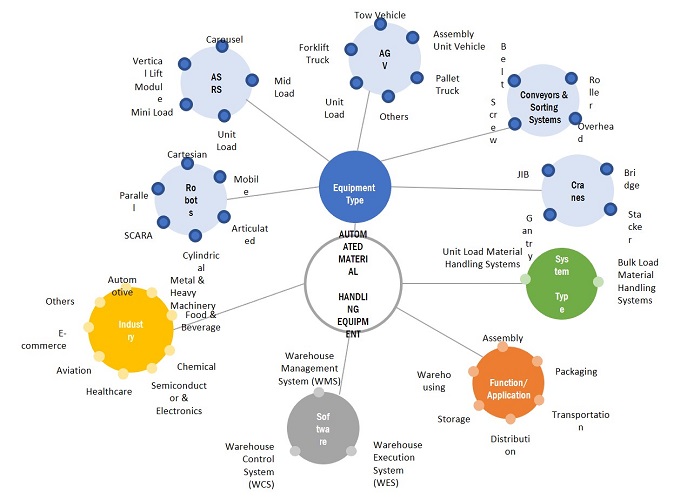

Automated Storage and Retrieval System Market by Function (Storage, Distribution, Assembly), Type (Unit Load, Mini Load, Vertical Lift Module, Carousel, Mid Load), Vertical (Automotive, Food & Beverages, E-Commerce, Retail) - Global Forecast to 2028

ASRS Market

ASRS Market and Top Companies

- Daifuku- Daifuku is involved in consulting, designing, manufacturing, planning and engineering, installation and operation, and after-sales services for logistics systems and material handling equipment. The company’s core businesses comprise factory & distribution automation (FA&DA), e-Factory automation (eFA), automotive factory automation (AFA), airport technologies (ATec), auto washing technologies (AWT), and electronics. The company mainly provides automated storage and retrieval system (ASRS) under the FA&DA business segment.

- Murata Machinery- Murata Machinery is a leading manufacturer of machinery, ranging from industrial machines to office automation products. The company develops, manufactures, and sells products in logistics, automation, clean FA, machine tools, sheet metal machinery, textile machinery, communication equipment, control & sensing, and advanced technology categories. The company provides ASRS in its logistics & automation division. Besides ASRS, the division provides transportation systems, picking systems, sorting systems, and data management systems.

- SSI Schaefer- SSI Schaefer has been recognized as among the world's leading system integrators for all types of automated warehousing and distribution centers. It is a leading provider of intralogistics solutions and products. The company offers product categories such as storage, conveying & transport, picking, handling, and interlinked workstations. SSI Schaefer provides its ASRS products in the storage category. The company has its manufacturing facilities in the US, Mexico, Germany, Austria, Czech Republic, Malaysia, and China, and distribution centers across the world.

- TGW Logistics- TGW Logistics is a supplier of material handling equipment and automated storage and retrieval systems for warehousing, production, picking, and distribution. TGW Logistics is among the leading providers of highly dynamic, automated, and turnkey logistics solutions. The company engineers, produces, and installs material handling solutions in different sizes for various purposes, ranging from conveyor installation to complex distributions centers. The company serves industries such as apparel, grocery, general merchandise, e-commerce & omnichannel, spare parts & components, and 3PL.

- Kardex- The company offers intra-logistic solutions, automated storage solutions, and material handling systems. The company operates through its two independently managed divisions: Kardex Remstar and Kardex Mlog. Kardex Remstar develops and produces shuttles and dynamic storage and retrieval systems; Kardex Mlog provides integrated materials handling systems and automated high bay warehouses. Due to the outbreak of the COVID-19 pandemic, Kardex has made some of its patents free to use in the US and Europe to facilitate rapid restart of production activities. This will help the company keep its financial losses to the minimum.

ASRS Market and Top Industries

Automotive- The automotive industry comprises automotive manufacturers, component providers, and suppliers. These players are striving to bring innovation in the industry with an optimum production plan for manufacturing high-quality automobiles and spare parts. Automotive manufacturing involves manufacturing and assembling activities, which includes a wide variety of spare parts. Suppliers of automotive parts have driven the automotive storage industry to develop innovative new product technologies and enable real-time information to offer excellent order fulfillment in terms of efficient product delivery and quality.

Food & beverages- The food & beverages industry is transforming at a rapid rate owing to changing customer preferences, increasing need for food safety, growing trend of processed food and packaged eatables, and rising number of online food-retailing companies. The industry is constantly under the pressure of meeting the quantitative and qualitative demand of its clients in minimum time. To meet the ever-increasing demand of growing population across the world, food & beverages companies are increasingly adopting automation in food processing, packaging, and storing. Technological advances in cold chain storages and transport, and growing acceptance of frozen foods among consumers are a few of the many factors influencing the growth of the ASRS market. To meet these demands, ASRS is extensively used in food & beverages.

Metals & Heavy Machinery- Metals and heavy machinery implement ASRS in warehouses to facilitate intralogistics movement of heavy goods, which is difficult to be done manually. It is also used for storing a variety of small components that are required on a day-to-day basis to be implemented in larger machines. ASRS is used in production facilities of heavy machinery for assembly and storing function. The demands of this industry are mainly met by unit load ASRS and mini load ASRS.

ASRS Market and Top Types

- Unit Load– Unit load ASRS has a wide range of applications in consumer goods, automotive, publishing, distribution, electronic, food & beverages, pharmaceuticals & medical supplies, retail & apparel, and others. A unit load ASRS offers several benefits; it reduces work-in-progress (WIP) inventory, provides real-time inventory control, improves product quality and productivity, enhances workforce productivity, improves order accuracy and customer services, and ensures high throughput, density storage, and reliability, along with damage-free operations.

- Mini load- A mini load ASRS is generally smaller than a unit load ASRS in terms of material handling capacity. This type of ASRS can handle small loads and can be implemented wherever space is a constraint. Mini load ASRS provides a fast and efficient solution for containers, trays, cases, and bins. Typically, a mini load ASRS has a vertical height of 10–40 feet and is used for storing books and documents, apart from being used in warehouse applications such as kitting, buffering, staging, and sequencing of stock. Mini load ASRSs are easy to integrate into existing automated storage systems.

- VLM- The vertical lift module (VLM) is an enclosed ASRS system that consists of two columns of trays and an inserter/extractor in the center. Based on the input given at the control terminal, the inserter/extractor locates the bin in a particular column of trays and then vertically lifts to the position pulls the entire column, and vertically lowers down the tray to the control terminal. The same procedure is used in reverse order for inserting an item in the VLM. The operator picks or places items from the control terminal. The VLM is designed to deliver stored items to the operator, thereby eliminating walk and search time.

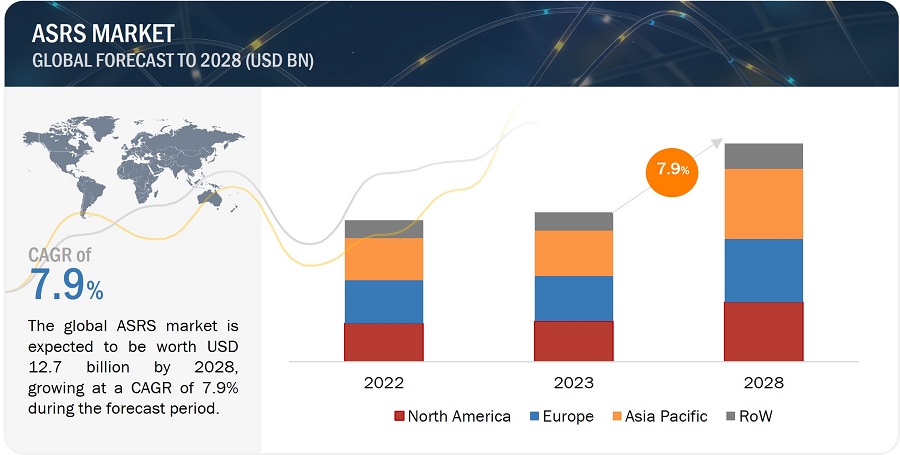

[261 Pages Report] The ASRS market is estimated to be worth USD 8.7 billion in 2023 and is projected to reach USD 12.7 billion by 2028, at a CAGR of 7.9% during the forecast period. The growing demand for ASRS in healthcare, food & beverages, and automotive verticals, coupled with rapid advancements in robotics and artificial intelligence technologies, is contributing to this market growth.

Automated Storage and Retrieval System Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

ASRS Market Trends

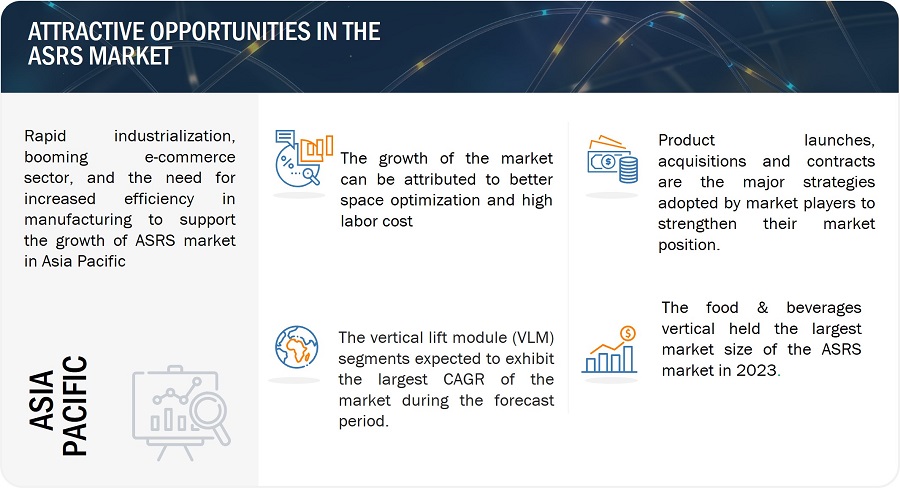

Driver: ASRS demand surges due to better space optimization and high labor costs

Due to the increasing gap between demand and supply, real estate prices are rising in several developed countries such as the US and China. The availability of real estate for warehouses in Europe is almost saturated, and the demand is still rising. Also, developed countries in Asia Pacific and North America must optimize space utilization. This has become imperative considering the ever-growing population and demand for consumer goods. Thus, the issue of warehousing requirements is resolved by adopting ASRS. The ASRS technology provides considerable space savings and can save up to 85% of floor space by removing the wasted aisle space with the utilization of the full ceiling height of the warehousing facility. This technology also offers high-density storage in a compact space, calculates the true cost of storage space, and helps reduce the excessive costs incurred due to manual processing. Different facility centers, warehouses, and distribution centers require labor to carry out logistics and delivery processes. One worker using ASRS can handle the picking assignments of multiple operators in a manual system, reassigning as many as two-thirds of manual picking labor to other, non-picking tasks—without a loss of throughput. Thus, implementing automated storage solutions can compensate for scarce or unreliable labor.

Restraint: High installation and maintenance cost

Implementing ASRS systems requires substantial upfront capital investment, encompassing the cost of equipment, software, infrastructure modifications, and professional installation services. Additionally, ASRS systems require regular maintenance and skilled technicians to ensure their smooth operation, which adds to the long-term operational expenses. These high initial and ongoing costs can deter some businesses, particularly smaller enterprises, from embracing ASRS technology despite its potential benefits, creating a significant restraint in its adoption across industries. Repairing AS/RS equipment requires special expertise, which means that the repairing costs of ASRS may be more than the cost spent on repairing traditional warehouse equipment, such as forklifts or conveyor systems. Therefore, companies implementing AS/RS solutions should consider the cost of downtime and production interruptions in the case of equipment breakdowns. Companies that lack an on-staff maintenance technician experience longer downtimes while waiting for outside technicians to respond. All these factors can incur tremendous costs for companies.

Opportunity: Growing demand for cold chain systems in Asia Pacific

The frozen food market is expected to witness substantial growth in Asia Pacific in the coming years. The increased popularity of chilled and frozen food items in Asia Pacific reflects changing food preferences as consumers become more affluent, leading to the expansion of the infrastructure to support cold chain operations in the region. The growth of the cold chain sector can be largely attributed to globalization, which enables the import and export of perishable foods, technological advancements in cold chain storage and transport, and the growing acceptance of frozen foods among consumers. The latest generation of ASRS provides a uniquely flexible and modular design, with multi-load remote pallet handling capability ideal for deep-freeze warehouse automation at its coldest (−28°C). This type of ASRS allows rapid configuration to fulfill the right storage and retrieval needs for several processes involved in the food & beverages industries. It provides single-deep, double-deep, triple-deep, and multi-deep storage configurations from floor level up to 40 m (131 feet) high, with the flexibility to handle one and multiple loads simultaneously. High-bay deep freeze warehouses are ideal for precisely and efficiently tracking frozen food products because of their highly automated and computer-controlled systems.

Challenge: Rapid technology advancements are resulting as a risk for ASRS systems to become obsolete

Rapid technological advancements do indeed present a potential risk for ASRS (Automated Storage and Retrieval System) systems to become obsolete. As technology evolves at a swift pace, newer and more advanced automation solutions may emerge, offering improved capabilities, efficiency, and cost-effectiveness. This could lead to the depreciation of existing ASRS systems, making it challenging for organizations to keep pace with the latest innovations and potentially rendering their investments outdated. To mitigate this risk, companies must plan for scalability and flexibility in their ASRS implementations, ensuring that they can adapt to and integrate with emerging technologies or consider regular upgrades to stay competitive and maintain system relevance in the fast-evolving industrial landscape.

Market Ecosystem-

ASRS Market: Key Trends

Daifuku Co., Ltd (Japan), Murata Machinery, Ltd. (Japan), SSI SCHAEFER (Germany), TGW Logistics Group GmbH (Austria) and Kardex Holding AG (Switzerland) are the top players in the ASRS market. These ASRS companies boast material handling trends with a comprehensive product portfolio and solid geographic footprint.

Vertical lift module (VLM) type ASRS to grow at the highest CAGR during 2023-2028.

VLM systems offer improved ergonomics and safety, integrating seamlessly with warehouse management systems and providing a competitive edge in today's fast-paced business environment. VLMs maximize the vertical height by utilizing an independent tray storage system to create a dense solution far exceeding traditional storage methods. VLMs are witnessing substantial expansion thanks to their outstanding space utilization, making them a perfect solution for optimizing storage capacity within confined areas. Their capacity to automate inventory control, trim labor expenses, and boost operational efficiency has rendered them extremely appealing to sectors like e-commerce and logistics.

E-commerce vertical to grow at the highest CAGR during forecast period.

The e-commerce vertical has evolved tremendously over the past few years. With the surge in online shopping, there is a critical need for efficient order fulfillment and rapid product delivery. ASRS systems offer a solution by automating warehousing and retrieval processes, reducing errors, and enabling faster order processing. The e-commerce vertical is evolving on a mobile platform as many end users are influenced by it. A person's average screen time on a mobile is the highest among all other screens. Hence, advertising through this medium is beneficial for e-commerce. The development of mobile payments and linking bank accounts with phone numbers have also simplified the buying process for end users.

Asia Pacific is expected to grow at the highest CAGR in the ASRS market during the forecast period.

Asia Pacific’s rapid industrialization, booming e-commerce sector, and the need for increased efficiency in manufacturing and logistics have driven the demand for ASRS technology. Governments and businesses in Asia Pacific are investing heavily in automation to address labor shortages, improve productivity, and reduce operational costs. Additionally, government programs aimed at fostering automation and technological progress are contributing to the expansion of the ASRS market. As businesses in the Asia Pacific region increasingly appreciate the advantages of automation, such as improved operational efficiency, reduced labor expenses, and heightened competitiveness, there is anticipation of significant growth in ASRS adoption in the years ahead.

Automated Storage and Retrieval System Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major companies in the ASRS companies include Daifuku Co., Ltd (Japan), Murata Machinery, Ltd. (Japan), SSI SCHAEFER (Germany), TGW Logistics Group GmbH (Austria) and Kardex Holding AG (Switzerland). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the ASRS market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years Considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Type and Vertical |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Daifuku Co., Ltd. (Japan), Murata Machinery, Ltd. (Japan), SSI SCHAEFER (Germany), TGW Logistics Group GmbH (Austria) and Kardex Holding AG (Switzerland). |

Automated Storage and Retrieval System Market Highlights

In this report, the overall ASRS market has been segmented based on type and region.

|

Segment |

Subsegment |

|

By Type |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments

- In May 2023, The BEUMER Group GmbH & Co. KG acquired Hendrik Group Inc., one of the leading companies for air-supported belt conveyors. With this acquisition the BEUMER Group GmbH & Co. KG is expanding its portfolio in the field of bulk material transport.

- In January 2023, TGW Logistics Group GmbH has partnered with Frisco.pl to build a highly automated fulfillment center in the Polish capital of Warsaw. This project will establish the groundwork for online grocery retailers aiming for dynamic growth in the competitive Polish market in the upcoming years.

- In April 2022, TGW Logistic Group GmbH engineered an energy-efficient and robust sorting solution suitable for diverse applications and industries. At the heart of this system lies the Natrix shoe sorter, which offers three different capacity levels. Its modular design allows for customization to meet the specific requirements of any client.

Frequently Asked Questions:

What is the current size of the global ASRS market?

The ASRS market is estimated to be worth USD 8.7 billion in 2023 and is projected to reach USD 12.7 billion by 2028, at a CAGR of 7.9% during the forecast period.

Who are the global ASRS market winners?

Companies such as Daifuku Co., Ltd (Japan), Murata Machinery, Ltd. (Japan), SSI SCHAEFER (Germany), TGW Logistics Group GmbH (Austria) and Kardex Holding AG (Switzerland) fall under the winners’ category.

Which region is expected to hold the highest share of the ASRS market?

Asia Pacific will dominate the ASRS market in 2028. The rapid growth of the automotive, food & beverages, and healthcare vertical in emerging economies of China, Japan, Australia, and South Korea is expected to boost the ASRS market in the region.

What are the major drivers and opportunities related to the ASRS market?

Surging demand for ASRS in e-commerce and automotive industries and Growing demand for cold chain systems in Asia Pacific are some of the major drivers and opportunities for the ASRS market.

What are the major strategies adopted by ASRS companies?

The agitator companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the ASRS market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

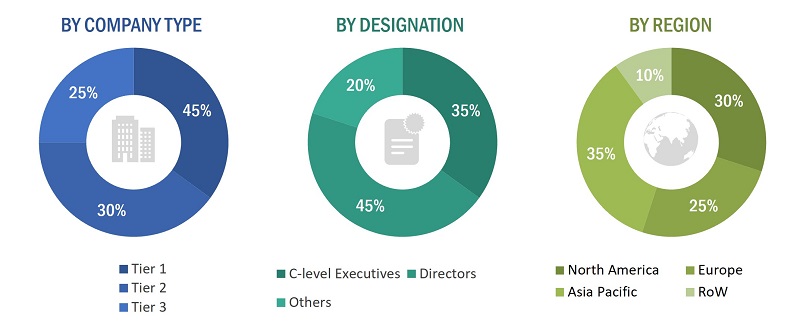

The study involves four major activities that estimate the size of the ASRS market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the ASRS market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research.

Primary Research

In the primary research process, numerous sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from ASRS providers, such as Daifuku Co., Ltd (Japan), Murata Machinery, Ltd. (Japan), SSI SCHAEFER (Germany), TGW Logistics Group GmbH (Austria) and Kardex Holding AG (Switzerland); research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- Market Size Estimation Methodology-Bottom-up approach and Top-down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

An Automated Storage and Retrieval System (ASRS) is a computer-controlled, automated system designed for the efficient storage, retrieval, and management of materials or products within a warehouse or distribution center. ASRS systems use a combination of robotics, conveyors, cranes, and computer software to handle tasks such as storing items in designated locations, retrieving them when needed, and often delivering them to a specific point for further processing or shipping. These systems are known for their ability to optimize space utilization, reduce labor costs, enhance inventory accuracy, and improve overall operational efficiency in various industries, including manufacturing, logistics, and e-commerce.

Stakeholders

- Associations, forums, and alliances related to automated storage and retrieval systems

- Assembly and packaging vendors

- Electronic hardware equipment manufacturers

- End-user industries, such as automotive, chemicals, aviation, electronics & semiconductor, e-commerce, retail, food & beverages, healthcare, and metals and heavy machinery

- Integrated device manufacturers (IDMs)

- Original device manufacturers (ODMs)

- Original equipment manufacturers (OEMs)

- Original technology designers and suppliers

- Raw material suppliers

- Research institutes and organizations

- Standard organizations and regulatory authorities related to the material handling industry

- System integrators

The main objectives of this study are as follows:

- To define, describe, and forecast the global automated storage and retrieval system (ASRS) market based on type, vertical, and region

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the ASRS ecosystem, along with market trends and use cases

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global ASRS market

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the ASRS market

- To benchmark market players using the company evaluation quadrant, which analyzes players based on various parameters within broad business categories and product strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automated Storage and Retrieval System Market