Automotive Bearing Market by Bearing type (Ball bearing, Roller bearing and others), Application, Vehicle type (PC, LCV, HCV and Two-wheelers), Region, and by Aftermarket (Region, Vehicle type and Application) - Trends & Forecasts to 2020

[182 Pages Report] This report classifies and defines the global automotive bearing market in terms of volume & value. This report provides comprehensive analysis and insights on the global automotive bearing market for both - qualitative and quantitative. It highlights the potential growth opportunities in the coming years as well as it covers review of the - market drivers, restraints, growth indicators, challenges, legislation trends, market dynamics, competitive landscape, and other key aspects related to the global automotive bearing market. This report also has a section on off-highway vehicle bearing market outlook and what steps are taken by the bearing manufacturers and associations to counter their counterfeit market.

Bearings are used in vehicle types; passenger cars, light commercial vehicles, heavy commercial vehicles, and two-wheelers. Bearings are used for a variety of automotive applications that include wheel hub, interior, engine, and transmission system. The major factors driving the market are increasing production of vehicles, increasing demand from the developing countries, and increasing demand for technologically advanced solutions.

In the coming years, the demands for automotive bearings are estimated to rise in the countries of Asia-Pacific, mainly in China, India, and Japan. Moreover with 1/3rd of the world population in countries of China and India, the demand for vehicles especially passenger cars and two-wheelers are also on the rise, which in turn increases the demand for automotive bearings in these countries. In matured markets like Europe and North America, it is estimated to have a steady growth for automotive bearings. Developing countries like Brazil and South Africa are projected to have a high growth rate.

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

The report covers the automotive bearing market in terms of volume & value. The market size in terms of volume is provided from 2013 to 2020 in units, whereas the value of the market is provided in $million. The global automotive bearing market is broadly classified by geography (Asia-Pacific, Europe, North America, and RoW), by vehicle type (PC, LCV, HCV & Two-Wheelers), by bearing type (Roller bearing, Ball bearing and others), by Aftermarket (by region, by vehicle type and by application).

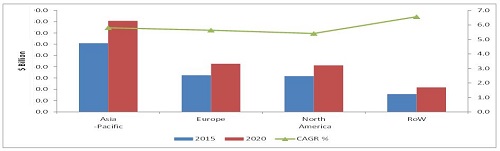

Global Bearing Market, by Region, 2015 vs. 2020 ($Billion)

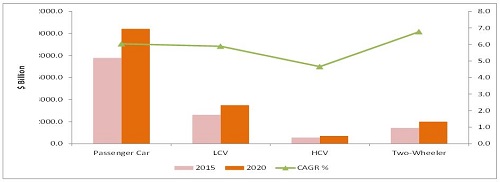

Global Bearing Market, by Vehicle Type, 2015 vs. 2020 ($Billion)

Source: MarketsandMarkets Analysis

The global automotive bearing market, in terms of value, is projected to grow at 186.4 Billion USD and CAGR of 5.8% from 2015 to 2020

In the coming years, the demands for automotive bearings are estimated to be on rise in the countries of Asia-Pacific, mainly in China, India, and Japan. Moreover, with 1/3rd of the world population in countries of China and India, the demand for vehicles, especially passenger cars and two-wheelers are also on the rise, which in turn increases the demand for automotive bearings in these countries. The Asia- Pacific region is projected to grow, in terms of volume, at a CAGR of 6.4%. In the matured markets like Europe and North America, it is expected to have a steady growth for automotive bearings with a same CAGR of 5.8% (2015-2020). Developing countries like Brazil and South Africa are projected to have a high growth rate.

The global automotive bearing market has been broadly classified by geography (Asia-Pacific, Europe, North America, and RoW), by vehicle type (PC, LCV, HCV & Two-Wheelers), by bearing type (Roller bearing, Ball bearing and others), by Aftermarket (by region, by vehicle type and by application).

Bearings are used for a variety of automotive applications that include wheel hub, interior, engine, and transmission system. The major factors driving the market are increasing production of vehicles, increasing demand from the developing countries, and increasing demand for technologically advanced solutions.

This report classifies and defines the global automotive bearing market in terms of volume & value. This report provides comprehensive analysis and insights on the global automotive bearing market for both - qualitative and quantitative. It highlights potential growth opportunities in the coming years as well as it also covers review of the - market drivers, restraints, growth indicators, challenges, legislation trends, market dynamics, competitive landscape, and other key aspects of the global automotive bearing market. This report also has a section on off-highway vehicle bearing market outlook and what steps are taken by the bearing manufacturers and associations to counter the counterfeit market.

Following are few major companies which are into manufacturing of automotive bearings: Timken Co. (U.S.), SKF (Sweden), Shaeffler AG (Germany), JTEKT Corp. (Japan), and NTN Corp. (Japan).

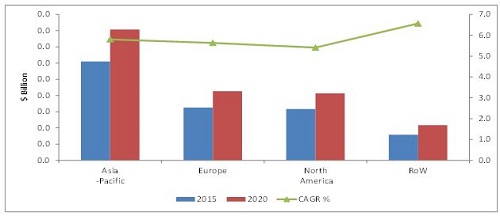

Global Bearing Market, by Region, 2015 vs. 2020 ($Billion)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Markets Covered

1.3 Market Definition

1.4 Market Scope

1.4.1 Years Considered in the Report

1.5 Currency

1.6 Package Size

1.7 Stakeholders

1.8 Limitations

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand Side Analysis

2.4.2.1 Easy Availability

2.4.2.2 Options Available in Terms of Brands & Price

2.4.2.3 Increasing Awareness Regarding Vehicle Maintenance

2.4.2.4 Increasing Miles Driven

2.4.3 Supply Side Analysis

2.4.3.1 Technological Advancements

2.4.3.2 Rise in Raw Material Prices

2.5 Market Size Estimation

2.6 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 34)

4.1 Introduction

4.2 Global Automotive Bearing OEM Market

4.3 Global Automotive Bearing OEM Market Growth (20152020), By Country

4.4 Global Automotive Bearing OEM Market Growth (20152020), By Application

4.5 Global Automotive Bearings Aftermarket Growth (20152020), By Region

4.6 Global Automotive Bearing OEM Market Growth (20152020), By Bearing Type

4.7 Global Two-Wheeler Bearing OEM Market Growth (20152020), By Bearing Type

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Average Age of Vehicles

5.3.1.2 Increasing Vehicle Production

5.3.1.3 Growing Demand for Off-Highway and Two-Wheeler Vehicles

5.3.1.4 E-Tailing

5.3.2 Restraints

5.3.2.1 Counterfeit Automotive Products

5.3.2.2 Increasing Raw Material Prices

5.3.2.3 Longer Lifespan of Bearings Due to Improved Technology

5.3.3 Opportunities

5.3.3.1 Right to Repair Act

5.3.3.2 Private Labelling

5.3.3.3 Advent of More Efficient Materials

5.3.4 Challenge

5.3.4.1 Increasing Participation of OEMs in the Aftermarket

5.4 Porters Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Value Chain Analysis

6 Global Automotive Bearing OEM Market, By Region (Page No. - 52)

6.1 Pest Analysis

6.1.1 Political Factors

6.1.1.1 Europe

6.1.1.2 Asia-Pacific

6.1.1.3 North America

6.1.1.4 Rest of World

6.1.2 Economic Factors

6.1.2.1 Europe

6.1.2.2 Asia-Pacific

6.1.2.3 North America

6.1.2.4 Rest of the World

6.1.3 Social Factors

6.1.3.1 Europe

6.1.3.2 Asia-Pacific

6.1.3.3 North America

6.1.3.4 Rest of the World

6.1.4 Technological Factors

6.1.4.1 Europe

6.1.4.2 Asia-Pacific

6.1.4.3 North America

6.1.4.4 Rest of the World

6.2 Introduction

6.3 Asia-Pacific

6.3.1 China

6.3.2 Japan

6.3.3 India

6.4 Europe

6.4.1 Germany

6.4.2 France

6.5 North America

6.5.1 U.S.

6.5.2 Canada

6.5.3 Mexico

6.6 RoW

6.6.1 Brazil

6.6.2 Russia

7 Global Automotive Bearing OEM Market By Vehicle Type (Page No. - 81)

7.1 Introduction

7.2 Passenger Car

7.3 LCV

7.4 HCV

7.5 Two-Wheeler

8 Global Automotive Bearing OEM Market By Type (Page No. - 89)

8.1 Introduction

8.2 Automotive Bearings, By Type

8.2.1 Ball Bearings

8.2.2 Roller Bearing

8.3 Two-Wheeler Bearing, By Type

9 Global Automotive Bearing Market, By Application (Page No. - 97)

9.1 Introduction

9.2 Automotive Bearing Application

9.2.1 Wheel Hub

9.2.2 Transmission System

9.2.3 Engine

9.2.4 Interior

9.3 Two-Wheeler Bearing Application

10 Global Automotive Bearing Aftermarket, By Region (Page No. - 106)

10.1 Introduction

10.2 Asia-Pacific

10.3 Europe

10.4 North America

10.5 RoW

11 Global Automotive Bearing After-Market, Vehicle Type (Page No. - 113)

11.1 Introduction

12 Global Automotive Bearing Aftermarket, By Application (Page No. - 116)

12.1 Introduction

13 Off-Highway Vehicles, Global Automotive Bearing Market Outlook (Page No. - 119)

14 The Counterfeit Market (Page No. - 123)

15 Competitive Landscape (Page No. - 125)

15.1 Overview

15.2 Market Share Analysis, Global Automotive Bearing Market

15.3 Competitive Situation and Trends

15.4 Battle for Market Share: New Product Launch Was the Key Strategy

15.5 New Product Launches and Developments

15.6 Expansions

15.7 Agreements, Partnerships, Collaborations, Investments, and Joint Ventures

15.8 Mergers and Acquisitions

16 Company Profiles (Page No. - 133)

16.1 Introduction

16.2 Timken Company

16.3 Svenska Kullagerfabriken AB

16.4 Schaeffler AG.

16.5 Jtekt Corporation

16.6 NTN Corporation

16.7 Iljin Bearing Co., Ltd.

16.8 ORS Bearings

16.9 CW Bearing

16.10 C&U Bearing

16.11 RKB Bearings

16.12 RBC Bearings

16.13 Nachi Fujikoshi Corp.

16.14 NSK Ltd.

16.15 Wafangdian Bearing Group Corp

16.16 Minebea Co., Ltd.

16.17 SNL Bearings Ltd.

17 Appendix (Page No. - 177)

17.1 Insights of Industry Experts

17.2 Discussion Guide

17.3 Available Customization

17.4 Introducing RT: Real Time Market Intelligence

17.5 Related Reports

List of Tables (88 Tables)

Table 1 Global: Automotive Bearing OEM Market Size , By Region, 20132020 (Million Units)

Table 2 Global: Automotive Bearing Market Size , By Region, 20132020 ($Billion)

Table 3 Asia-Pacific: Automotive Bearing OEM Market Size, By Country, 20132020 (Million Units)

Table 4 Asia-Pacific: Automotive Bearing OEM Market Size, By Country, 20132020 ($Billion)

Table 5 Asia-Pacific: Automotive Bearing OEM Market Size, By Vehicle Type, 20132020 (Million Units)

Table 6 Asia-Pacific: Automotive Bearing OEM Market Size, By Vehicle Type, 20132020 ($Billion)

Table 7 China: Automotive Bearing OEM Market Size, By Vehicle Type, 20132020 (Million Units)

Table 8 China: Automotive Bearing OEM Market Size, By Vehicle Type, 20132020 ($Billion)

Table 9 Japan: Automotive Bearing OEM Market Size, By Vehicle Type, 20132020 (Million Units)

Table 10 Japan: Automotive Bearing OEM Market Size, By Vehicle Type, 20132020 ($Billion)

Table 11 India: Automotive Bearing OEM Market Size, By Vehicle Type, 20132020 (Million Units)

Table 12 India: Automotive Bearing OEM Market Size, By Vehicle Type, 20132020 ($Billion)

Table 13 Europe: Automotive Bearing OEM Market Size, By Country, 20132020 (Million Units)

Table 14 Europe: Automotive Bearing Market Size, By Country, 20132020 ($Billion)

Table 15 Europe: Automotive Bearing OEM Market Size, By Vehicle Type, 20132020 (Million Units)

Table 16 Europe: Automotive Bearing Market Size, By Vehicle Type, 20132020 ($Billion)

Table 17 Germany: Automotive Bearing Market Size, By Vehicle Type, 20132020 (Million Units)

Table 18 Germany: Market Size, By Vehicle Type, 20132020 ($Billion)

Table 19 France: Automotive Bearing Market Size, By Vehicle Type, 20132020 (Million Units)

Table 20 France: Market Size, By Vehicle Type, 20132020 ($Billion)

Table 21 North America: Automotive Bearing Market Size, By Country, 20132020 (Million Units)

Table 22 North America: Market Size, By Country, 20132020 ($Billion)

Table 23 North America: Automotive Bearing Market Size, By Vehicle Type, 20132020 (Million Units)

Table 24 North America: Market Size, By Vehicle Type, 20132020 ($Billion)

Table 25 U.S.: Automotive Bearing Market Size, By Vehicle Type, 20132020 (Million Units)

Table 26 U.S.: Market Size, By Vehicle Type, 20132020 ($Billion)

Table 27 Canada: Automotive Bearing Market Size, By Vehicle Type, 20132020 (Million Units)

Table 28 Canada: Market Size, By Vehicle Type, 20132020 ($Billion)

Table 29 Mexico: Automotive Bearing Market Size, By Vehicle Type, 20132020 (Million Units)

Table 30 Mexico: Market Size, By Vehicle Type, 20132020 ($Billion)

Table 31 RoW: Automotive Bearing Market Size, By Country, 20132020 (Million Units)

Table 32 RoW: Market Size, By Country, 20132020 ($Billion)

Table 33 RoW: Automotive Bearing Market Size, By Vehicle Type, 20132020 (Million Units)

Table 34 RoW: Market Size, By Vehicle Type, 20132020 ($Billion)

Table 35 Brazil: Automotive Bearing Market Size, By Vehicle Type, 20132020 (Million Units)

Table 36 Brazil: Market Size, By Vehicle Type, 20132020 ($Billion)

Table 37 Russia: Automotive Bearing Market Size, By Vehicle Type, 20132020 (Million Units)

Table 38 Russia: Market Size, By Vehicle Type, 20132020 ($Billion)

Table 39 Global: Automotive Bearing OEM Market Size, By Vehicle Type, 2013-2020 (Million Units)

Table 40 Global: Automotive Bearing OEM Market Size, By Vehicle Type, 2013-2020 ($Billion)

Table 41 Passenger Car Automotive Bearing OEM Market Size, By Region, 2013-2020 (Million Units)

Table 42 Passenger Car: Automotive Bearing OEM Market Size, By Region, 2013-2020 ($Billion)

Table 43 LCV: Automotive Bearing OEM Market Size, By Region, 2013-2020 (Million Units)

Table 44 LCV: Automotive Bearing OEM Market Size, By Region, 2013-2020 ($Billion)

Table 45 HCV: Automotive Bearing OEM Market Size, By Region, 2013-2020 (Million Units)

Table 46 HCV: Automotive Bearing OEM Market Size, By Region, 2013-2020 ($Billion)

Table 47 Two-Wheeler: Automotive Bearing OEM Market Size, By Region, 2013-2020 (Million Units)

Table 48 Two-Wheeler: Automotive Bearing OEM Market Size, By Region, 2013-2020 ($Billion)

Table 49 Automotive Bearings OEM Market Size, By Type, 2013-2020 (Million Units)

Table 50 Automotive Bearings OEM Market Size, By Type, 2013-2020 ($Billion)

Table 51 Automotive Ball Bearing OEM Market Size, By Region, 2013-2020 (Million Units)

Table 52 Automotive Ball Bearing OEM Market Size, By Region, 2013-2020 ($Billion)

Table 53 Automotive Roller Bearing OEM Market Size, By Region, 2013-2020 (Million Units)

Table 54 Automotive Roller Bearing OEM Market Size, By Region, 2013-2020 ($Billion)

Table 55 Two-Wheeler Bearings OEM Market Size, By Type, 20132020 (Million Units)

Table 56 Two-Wheeler Bearings OEM Market Size, By Type, 20132020, ($Billion)

Table 57 Automotive Bearing OEM Market Size, By Application, 20132020 (Million Units)

Table 58 Automotive Bearing OEM Market Size, By Application, 20132020 ($Billion)

Table 59 Automotive Bearings OEM Market in Wheel Hub, By Vehicle Type, 20132020 (Million Units)

Table 60 Automotive Bearings in Wheel Hub, By Vehicle Type, 20132020 ($Billion)

Table 61 Automotive OEM Bearing Market in Transmission System, By Vehicle Type, 20132020 (Million Units)

Table 62 Automotive Bearings in Transmission System, By Vehicle Type, 20132020 ($Billion)

Table 63 Automotive Bearings in Engine, By Vehicle Type, 20132020 (Million Units)

Table 64 Automotive Bearings in Engine, By Vehicle Type, 20132020 ($Billion)

Table 65 Automotive Bearings in Interior, By Vehicle Type, 20132020 (Million Units)

Table 66 Automotive Bearings in Interior, By Vehicle Type, 20132020 ($Billion)

Table 67 Two-Wheeler Bearing OEM Market Size, By Application, 20132020 (Million Units)

Table 68 Two-Wheeler Bearing OEM Market Size, By Application, 20132020 ($Billion)

Table 69 Automotive Bearings Aftermarket Size, By Region, 20132020 (000 Units)

Table 70 Automotive Bearings Aftermarket Size, By Region, 20132020 ($Billion)

Table 71 Asia-Pacific: Automotive Bearings Aftermarket Size, By Country, ( 000 Units)

Table 72 Asia-Pacific: Automotive Bearings Aftermarket Size, By Country, ($Billion)

Table 73 Europe: Automotive Bearings Aftermarket Size, By Country, ( Ooo Units)

Table 74 Europe: Automotive Bearings Aftermarket Size, By Country ($Billion)

Table 75 North America: Automotive Bearings Aftermarket Size, By Country, ( 000 Units)

Table 76 North America Automotive Bearings Aftermarket Size, By Country, ($Billion)

Table 77 RoW: Automotive Bearings Aftermarket Size, By Country, (000 Units)

Table 78 RoW: Automotive Bearings Aftermarket Size, By Country, ($Billion)

Table 79 Global: Automotive Bearing Aftermarket, By Vehicle Type, 20132020 (000 Units)

Table 80 Global: Automotive Bearing Aftermarket, By Vehicle Type, 20132020 ($Billion)

Table 81 Global: Automotive Bearing Aftermarket, By Application, 20132020 (000 Units)

Table 82 Global: Automotive Bearing Aftermarket, By Application, 20132020 ($Billion)

Table 83 Global: Tractor Bearings Market Size , By Region, 20132020 (Million Units)

Table 84 Global: Tractor Bearings Market Size Split , By Application, 20132020 (Million Units)

Table 85 New Product Launches and Developments, 2015

Table 86 Expansions, 20132015

Table 87 Agreements, Partnerships, Collaborations, Investments & Joint Ventures, 20142015

Table 88 Mergers and Acquisitions, 2013-2015

List of Figures (70 Figures)

Figure 1 Research Design

Figure 2 Research Methodology Model

Figure 3 Breakdown of Primary Interviews: By Company Type, By Designation and By Region

Figure 4 Automotive Service Technicians & Motorcycle Mechanics in the U.S.

Figure 5 Fluctuating Steel Prices Over the Years, 2011-2014

Figure 6 Data Triangulation

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Automotive Bearing OEM Market (2015): Asia-Pacific Projected to Have the Largest Market Share

Figure 9 Global Automotive Bearing OEM Market, By Application, 20152020

Figure 10 Two-Wheelers Bearings Market, By Application, 20152020

Figure 11 Global Automotive Bearing Market: Demand for Passenger Car Bearings Segment Estimated to Have the Largest Share in Vehicle Type

Figure 12 Emerging Opportunities in Global Automotive Bearing OEM Market

Figure 13 Regions are Estimated to Witness Stable Growth During the Forecast Period

Figure 14 Global Automotive Bearing OEM Market: Interior Segment has the Fastest Growth Rate

Figure 15 Global Two-Wheeler Bearing OEM Market: Engine Application Segment is Expected to Generate the Highest Revenue

Figure 16 Bearings Aftermarket: North America Region has the Fastest Growth Rate

Figure 17 Ball Bearing Segment Projected to Have the Largest Share in the OEM Market

Figure 18 Ball Bearing Segment is Projected to Have the Largest Share in Two-Wheeler Segment

Figure 19 Global Automotive Bearings OEM Market Segmentation

Figure 20 Increasing Average Age of Vehicles and the Growing Trend of E-Tailing are Expected to Drive the Market

Figure 21 Global Growth in Vehicle Production: Asia-Pacific Region to Hold the Largest Share in 2015

Figure 22 Porters Five Forces Analysis

Figure 23 Value Chain: for Bearing Major Value Addition Takes Place in Manufacturing and Assembly Stage

Figure 24 Value Chain Analysis: Automotive Bearings Aftermarket

Figure 25 Regional Snapshot: Rapid Growing Markets (Russia & India) Emerging as New Hotspots

Figure 26 Asia-Pacific Automotive Bearing OEM Market Snapshot: China Estimated to Capture the Largest Share of Automotive Bearing Market in 2015

Figure 27 China: Rapid Economic Growth & Rapid Urbanization to Drive the Market for Automotive Bearing

Figure 28 Germany to Account for the Largest Share in Automotive Bearing OEM Market in 2015

Figure 29 Passenger Car to Account for the Largest Share in Automotive Bearing OEM Market in Germany

Figure 30 North America: Mexico is the Fastest Growing Automotive Bearing Market

Figure 31 Mexico: The Fastest Growing Segment in Automotive Bearing Market is HCV

Figure 32 RoW Automotive Bearing OEM Market, 2015 vs 2020 ($Billion)

Figure 33 Mexico: the Fastest Growing Segment in Automotive Bearing Market is Two-Wheelers

Figure 34 Global Automotive Bearing OEM Market Growth, 2015-2020

Figure 35 LCV: Most Attractive Vehicle Type Segment for Automotive Bearings

Figure 36 Ball Bearings Hold the Largest Share of the Automotive Bearing Oe Market

Figure 37 Automotive Bearing Market, By Type, 2015 vs 2020

Figure 38 Asia-Pacific Accounts for the Largest Market Share

Figure 39 Automotive Bearing OEM Market Size, By Application

Figure 40 Automotive Bearing Wheel Hub Application, By Vehicle Type

Figure 41 Regional Snapshot (2015): Rapid-Growth Markets Emerging as New Hotspots

Figure 42 Global Automotive Bearing Aftermarket: Passenger Car Segment to Have the Highest Share in 2015

Figure 43 Global Bearing Aftermarket, By Application

Figure 44 Construction Equipment Market Size-Sales , By Region 20132020 (Units)

Figure 45 Companies Adopted Product Innovation as the Key Growth Strategy From 2010 2015

Figure 46 Schaeffler AG Grew at the Fastest Rate From 2009 to 2014

Figure 47 Global Automotive Bearings Market Share, By Key Player, 2014

Figure 48 Region-Wise Revenue Mix of Top Five Market Players

Figure 49 Competitive Benchmarking of Key Market Players: Schaeffler Group Emerged as the Champion Owing to Its Diversified Product Portfolio

Figure 50 Timken Company. : Business Overview

Figure 51 Timken Comapny: SWOT Analysis

Figure 52 Svenska Kullagerfabriken AB: Business Overview

Figure 53 Svenska Kullagerfabriken AB: SWOT Analysis

Figure 54 Schaeffler AG: Business Overview

Figure 55 Schaeffler AG: SWOT Analysis

Figure 56 Jtekt Corporation: Business Overview

Figure 57 Jtekt Corporation: SWOT Analysis

Figure 58 NTN Corporation: Company Snapshot

Figure 59 NTN Corporation.: SWOT Analysis

Figure 60 Iljin Bearing Co., Ltd.: Business Overview

Figure 61 ORS Bearings: Business Overview

Figure 62 CW Bearing: Business Overview

Figure 63 C&U Bearing: Business Overview

Figure 64 RKB Bearings: Company Snapshot

Figure 65 RBC Bearings. : Business Overview

Figure 66 Nachi Fujikoshi: Business Overview

Figure 67 NSK Ltd: Business Overview

Figure 68 Wafangdian Bearing Group Corp.: Business Overview

Figure 69 Minebea Co., Ltd.: Business Overview

Figure 70 SNL Bearings Ltd. : Business Overview

Growth opportunities and latent adjacency in Automotive Bearing Market

This report could be good reference. However we are interested to know assumptions and methodology , prior purchasing full copy of this report.