Automotive HUD Market by Technology (AR-based HUD, Conventional), HUD Type (Combiner, Windshield), Offering (Hardware, Software), Vehicle Class, Level of Autonomy, Dimension Type, Vehicle Type (PC, CV), EV Type and Region - Global Forecast to 2028

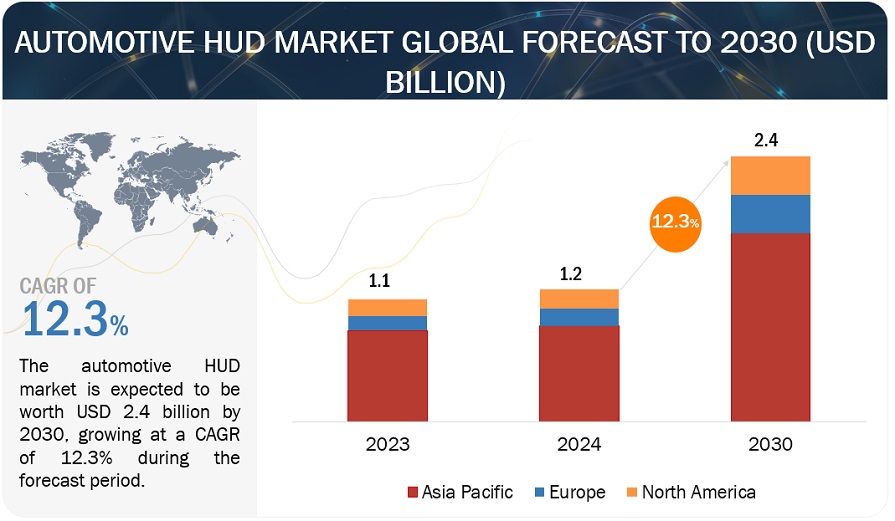

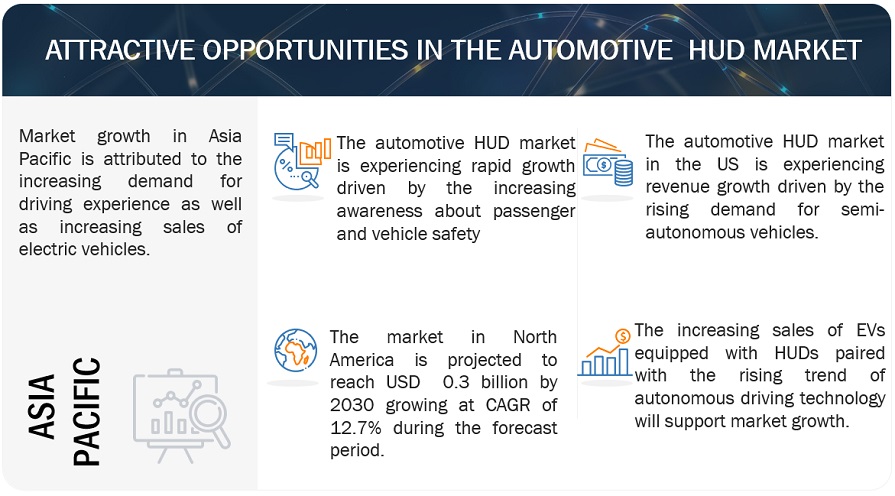

[274 Pages Report] The global automotive HUD market size is projected to grow from USD 1.0 billion in 2023 to USD 2.2 billion by 2028, at a CAGR of 16.6%. Increasing awareness about passenger and vehicle safety, paired with steady growth in luxury and high-end car segments, mainly in emerging markets are anticipated to increase the demand for automotive HUD solutions all over the world. Moreover, increasing penetration of electric vehicles in conjunction with growing demand for semi-autonomous vehicles are also expected to create lucrative opportunities for the automotive HUD market in the coming years globally.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Automotive HUD Market Dynamics:

Driver: Steady growth in demand for luxury and high-end segment cars, mainly in emerging markets

The steady growth in demand for luxury vehicles is anticipated to support the revenue growth of the automotive HUD market during the forecast period. Luxury vehicles have been early adopters of automotive HUD technology. Automotive manufacturers of luxury vehicles have recognized the value of HUDs in providing an enhanced driving experience and have incorporated them into their high-end models. For instance, models such as Audi Q4 e-tron, BMW iX, BMW iX3 (RR), and Mercedes-Benz EQE are equipped with automotive HUDs. Additionally, luxury vehicles often serve as platforms for introducing cutting-edge technologies and features. As a result, automotive HUDs in luxury vehicles have witnessed continuous technological advancements. These advancements include improved display quality, augmented reality features, wider viewing angles, and integration with other advanced systems like night vision and adaptive cruise control. All these aforementioned parameters are expected to support the growth of the automotive HUD market.

Restraint: Requirement for greater space in automotive cockpits

The windshield-projected HUD requires a large amount of space in the cockpit of an automobile. Advanced HUDs such as augmented reality head-up displays (AR HUDs) help make driving more comfortable and safer by superimposing the exterior view of the traffic conditions in front of the vehicle with virtual information (augmentations) for the driver. The reflected information appears to be part of the driving situation itself. The AR-based HUD is gaining significant traction in the global market. At the 1st Automotive Smart Lighting Summit, Huawei Technologies Co., Ltd. (China) announced that multiple models equipped with Huawei’s AR-HUDs will be launched in the year 2023. Simultaneously, the company is also developing next-generation HUD technology and will continue to conduct research in related areas, such as Holographic Optical Elements (HOE) and optical waveguides.

AR HUDs take up substantial space on the dashboard. The hardware associated with full windshield AR HUDs takes up greater automotive cockpit space, which would require re-designing effort by automotive OEMs for automotive cockpit design. Initially, the augmented reality head-up display model developed by Continental AG (Germany) requires more cockpit space, which is typically difficult for the automotive car manufacturers to incorporate. Reducing the size of the augmented reality HUD could impact the augmented image clarity, which in turn would be less legible to the driver/vehicle owner. To make the image projection available precisely in the driver’s field of view or line of sight, iris recognition as well as gesture recognition devices are supposed to be incorporated with the automotive HUD. The large space required for incorporating augmented reality HUD in the automotive cockpit is a major restraint for automotive car manufacturers. Thus, all these aforementioned parameters are expected to hamper the revenue growth of the automotive HUD market to a certain extent.

Opportunity: Increasing demand for semi-autonomous vehicles

The increasing inclination towards semi-autonomous and autonomous vehicles is likely to increase the demand for automotive HUDs. As self-driving technology advances, there is a need to ensure that drivers remain engaged and vigilant in case manual control is required. Automotive HUDs can serve as a vital interface between the vehicle and the driver, displaying critical information about the status of the autonomous system, potential handover requests, or system failures. Thus, integration of HUD technology can contribute to the safe deployment and operation of autonomous vehicles, further boosting the demand for HUDs. All these aforementioned parameters are expected to augment revenue for the automotive HUD market during the forecast period.

Challenge: High cost of advanced head-up display systems

Automotive car manufacturers such as Suzuki Motor Corporation (Japan), Hyundai Motor Company (South Korea), Volkswagen AG (Germany), and Toyota Motor Corporation (Japan) face the challenge of installing automotive HUDs with Augmented Reality (AR) functions in mid-segment cars. In the foreseeable future, these HUD systems are likely to become a standard feature in passenger vehicles across various countries such as US, China, Japan, and Germany, among others. Augmented Reality HUDs with technologically advanced features are valued higher and hence launched in luxury/premium vehicles mostly. The major challenge for automotive manufacturers is to lower the cost of these advanced features to overcome the cost constraint. Owing to the rising competition in the automotive sector, Tier I players are installing innovative displays in automotive cockpit electronics systems. Going forward, automotive car manufacturers are expected to reduce the dashboard electronics and equip vehicles/cars with larger AR displays with integrated ADAS functions in order to have product differentiation as well as brand differentiation. However, as electronic features offered in car impact its overall pricing, automotive OEMs try to buy these advanced systems at the lowest prices. The integration/installation of advanced AR as well as premium automotive interiors at a competitive cost poses a challenge for automotive car manufacturers. The installation of a HUD in a vehicle increases the overall cost of the vehicle. In the current scenario, HUDs are more of a luxury than a common feature, with their prices ranging from USD 30 to USD 1,000. Low-priced HUDs are only featured for navigation. For more advanced features, the price range of the HUDs also increases. The cost difference mostly impacts the sales of the cars, especially in emerging economies where low or mid-range cars are preferred.

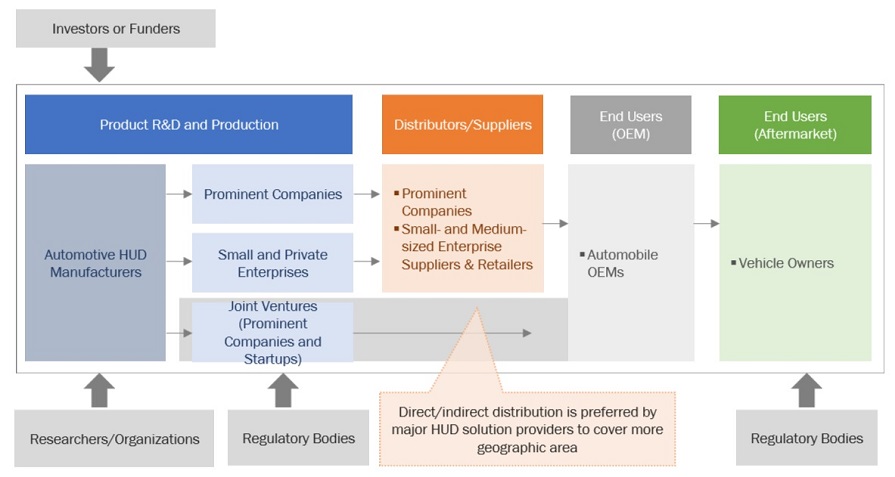

Automotive HUD Market Ecosystem

The ecosystem analysis highlights various players in the automotive HUD ecosystem, which is primarily represented by OEMs, tier 1 integrators/suppliers, tier 2 suppliers, and software providers. Prominent companies in this market include Continental AG (Germany), Foryou Corporation (China), DENSO Corporation (Japan), Yazaki Corporation (Japan), Panasonic Holdings Corporation (Japan), and Nippon Seiki Co., Ltd. (Japan), among others.

Passenger car segment is expected to witness significant growth rate in the global automotive HUD market during the forecast period

The passenger cars segment is expected to dominate the automotive HUD market during the forecast period. This is because of the high sales volume of passenger cars equipped with automotive HUDs. The growing sales of luxury vehicles, increasing purchasing power of consumers, and high demand for convenience features are expected to boost the growth of the passenger vehicles segment of the automotive HUD market.

Leading manufacturers such as BMW AG (Germany), Audi AG (Germany), Geely (China), Great Wall Motor (China), NIO (China), and Hongqi (China) have increasingly adopted HUDs in their vehicles. Companies such as Nippon Seiki Co., Ltd (Japan), Continental AG (Germany), Foryou Corporation (China) Yazaki Corporation (Japan), Panasonic Holdings Corporation (Japan), and WayRay AG (Switzerland), among others, offer automotive HUDs for passenger cars.

ICE vehicles segment is expected to be the largest in automotive HUD market during the forecast period

Rising concerns over safe driving and pedestrian safety are compelling OEMs to incorporate HUD features in modern ICE vehicles. Automotive HUDs help in providing real-time information such as vehicle speed, fuel information, phone calls and messages, and ADAS information. With the rising penetration of ADAS-enabled features and other connected features, the demand for HUD solutions has also increased at a rapid pace in this segment. However, although the demand for electric vehicles is exhibiting exponential growth, the overall sales volume of electric vehicles is still very less compared to ICE-powered vehicles. Hence, ICE vehicles are expected to hold a larger market share. Additionally, increasing adoption of advanced technologies such V2X, ADAS, and other connected features in ICE vehicles is likely to fuel the demand for automotive HUD solutions during the forecast period.

AR-based HUD segment is expected to have significant growth opportunities in automotive HUD market during the forecast period

Increasing advancements in the AR-based HUD segment is expected to be a major revenue opportunity for HUD manufacturers. AR-based HUDs are more interactive and can project complex graphics that correspond to objects in the real world. AR graphics are overlaid onto real-world objects in such a way that the driver can immediately recognize threats and quickly take appropriate actions to avoid them, such as braking for a road obstacle. Such advancements would boost the demand for AR HUDs in the premium vehicles segment during the forecast period. In January 2023, HARMAN International unveiled HARMAN Ready Vision, a set of AR HUD hardware and AR software products to enhance driver safety and awareness. Similarly, in January 2022, Panasonic Corporation of North America, a tier one automotive supplier, unveiled its AR HUD 2.0 at CES 2022. This HUD is patented with eye tracking system (ETS) to enhance the AR experience. Considering the above parameters, the market for AR-based HUDs is likely to gain momentum in the coming years.

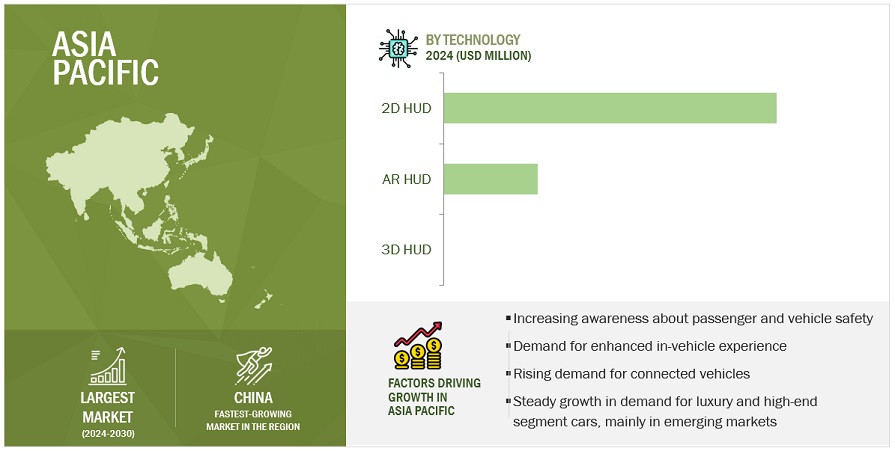

“The Asia pacific automotive HUD market is projected to hold the largest share by 2028.”

Asia Pacific is estimated to be the largest market for automotive HUDs by 2028. In this region, countries such as China, Japan, and South Korea are expected to take the lead in autonomous driving technology in the coming years. Leading automobile manufacturers in this region, such as Toyota, Honda, and Hyundai, have leveraged the advantages of safety systems and made essential safety features a standard across their models. China is expected to be the most influential factor in the Asia Pacific automotive HUD market in terms of value & volume. The large market share of China can also be attributed to the increasing sales of vehicles equipped with HUD technology. For example, Changan Raeton PLUS, Changan CS75, and Haval H6 are some of the models in China equipped with automotive HUDs.

Key Market Players

The global automotive HUD market is dominated by major players such as Nippon Seiki Co. Ltd. (Japan), Continental AG (Germany), DENSO Corporation (Japan), Panasonic Holdings Corporation (Japan), Foryou Corporation (China), Yazaki Corporation (Japan), and Valeo (France), and among others. These companies have secure distribution networks at a global level and offer a wide range of HUD products such as combiner HUDs, and windshield HUDs. The key strategies adopted by these companies to sustain their market position are collaborations, new product developments, acquisitions, etc.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Volume (Thousand Units) & Value (USD Million/Billion) |

|

Segments covered |

HUD Type, Technology, Dimension Type, Sales Channel, Level of Autonomy, Offering, Vehicle Type, Propulsion Type, Electric Vehicle Type, Passenger Car Class, and Region |

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World |

|

Companies Covered |

Nippon Seiki Co. Ltd. (Japan), Continental AG (Germany), DENSO Corporation (Japan), Panasonic Holdings Corporation (Japan), Foryou Corporation (China), Yazaki Corporation (Japan), and Valeo (France). |

This research report categorizes the automotive HUD market based on HUD type, technology, dimension type, passenger car class, vehicle type, electric vehicle type, propulsion type, level of autonomy, sales channel, and region.

Automotive HUD Market, By Technology

- Conventional HUD

- Augmented Reality HUD

Automotive HUD Market, By HUD Type

- Combiner HUD

- Windshield HUD

Automotive HUD Market, By Dimension Type

- 2D-HUD

- 3D-HUD

Automotive HUD Market, By Passenger Car Class

- Economy Cars

- Mid-segment Cars

- Luxury Cars

Automotive HUD Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

Automotive HUD Market, By Electric Vehicle Type

- BEVs

- PHEVs

- HEVs

- FCEVs

Automotive HUD Market, By Propulsion Type

- ICE Vehicles

- Electric Vehicles

Automotive HUD Market, By Level of Autonomy

- Non-autonomous cars

- Semi-autonomous cars

- Autonomous cars

Automotive HUD Market, By Sales Channel

- OE Fitted

- Aftermarket

Automotive HUD Market, By Offering

- Software

- Hardware

Automotive HUD Market, By Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In July 2023, Panasonic Automotive Systems Co., Ltd., a group of Panasonic Holdings Corporation, announced that its intelligent room mirror (electronic mirror) linked with a drive recorder and head-up display (HUD), have been adopted for the new Nissan Serena e-Power. The HUD linked with the mirror uses a 2-megapixel camera and a high-resolution display, as well as proprietary image processing technology, to achieve high-definition images and improved nighttime visibility.

- In February 2023, Huawei Technologies Co., Ltd. announced that Rising Auto, the NEV (New Energy Vehicle) brand of SAIC Motor Corporation Limited (SAIC Motor), will equip its R7 model with Huawei AR HUD (augmented reality head-up display). The innovative AR HUD launched by Huawei will provide R7 users with a smarter, safer, and more convenient mobility experience.

- In January 2023, Continental AG’s Scenic View Head-up Display (HUD) was presented at the CES 2023 and has earned a CES Innovation Award in the Vehicle Tech & Advanced Mobility category for its leading-edge screen technology. This HUD is expected to be launched in the market by 2026.

- In May 2022, Panasonic Automotive Systems Co., Ltd., a group of Panasonic Holdings Corporation, announced that its 11.5-inch wind shield head-up display (WS HUD) has been adopted for Nissan Motor Co., Ltd.’s new Ariya crossover electric vehicle (EV). This is the sixth car model from Nissan to use the WS HUD of Panasonic, following the Skyline, Rogue, Qashqai, Pathfinder, and QX60.

- In October 2021, Nippon Seiki Co., Ltd. supplied its head-up display (HUD) to Geely Automobile’s Lynk & Co brand 09 SUV. The HUD to be installed is a windshield type that projects information such as speed, navigation, etc., onto the windshield of the vehicle.

Frequently Asked Questions (FAQ):

What is the current size of the global automotive HUD market?

The global automotive HUD market is estimated to be USD 1.0 billion in 2023 and projected to reach USD 2.2 billion by 2028.

Who are the winners in the global automotive HUD market?

The automotive HUD market is dominated by global players such as Nippon Seiki Co. Ltd. (Japan), Continental AG (Germany), DENSO Corporation (Japan), Panasonic Holdings Corporation (Japan), and Foryou Corporation (China), among others. These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the automotive HUD market.

What are the new market trends impacting the growth of the automotive HUD market?

Increasing demand for Augmented Reality (AR) based HUDs, and growing sales of luxury vehicles equipped with automotive HUDs are some of the major trends affecting this market.

Which region is expected to be the largest market during the forecast period?

Asia Pacific is anticipated to be the largest market in the automotive HUD market vehicles due to the increasing adoption of ADAS equipped vehicles in this region, and rising adoption of automotive HUDs especially in China.

What is the total CAGR expected to be recorded for the automotive HUD market during 2023-2028?

The CAGR is expected to record a CAGR of 16.6% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities to estimate the current size of the automotive HUD market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used for determining the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study included automotive industry organizations involved with head-up display; publications from government sources [such as country level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), World Bank, CDC, and Eurostat]; corporate filings (annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

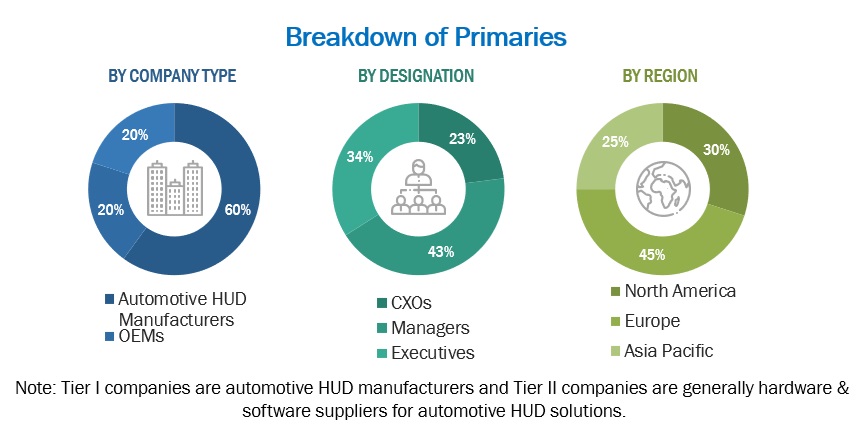

Extensive primary research was conducted after acquiring an understanding of the automotive HUD market through secondary research. Several primary interviews were conducted with market experts from both the demand (OEMs) and supply (automotive HUD manufacturers, and Tier II suppliers) sides across major regions, namely, North America, Europe, and Asia Pacific. Approximately 40% and 60% of primary interviews were conducted from the supply side & industry associations and dealers/distributors, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were considered to provide a holistic viewpoint in this report.

After interacting with industry experts, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from primaries. This, along with the in-house subject matter experts’ opinions, led to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the size of the automotive HUD market. In the bottom-up approach, the number of vehicle production of each vehicle type at the country level was considered. The number was then multiplied with the country-level penetration of HUDs for each vehicle type to determine the market size of automotive HUDs, in terms of volume. The country-level passenger car market was then multiplied with the penetration of vehicle class (economy cars, mid-segment cars, and luxury cars) to determine the market size of automotive HUDs by vehicle class. The country-level market of each vehicle class was then multiplied by the penetration of HUD type to determine the market, by type, in terms of volume. The country-level market size, in terms of volume, of automotive HUDs, by type, was then multiplied by the country-level Average OE Price (AOP) of each HUD type to determine the market of each vehicle class in terms of value. A summation of country-level value for each vehicle class was carried out to determine the country-level market of passenger cars. Further, the AOP of HUD was multiplied by the volume of light commercial vehicle and heavy commercial vehicle markets. Summation of the country-level market for each vehicle, by value, enabled the estimation of the country-level market size, in terms of value. The summation of the country-level market led to the regional market size, and further summation of the regional markets provided the global automotive HUD market size.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Automotive HUD Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size of the global market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedure were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Market Definition

Automotive HUD: As per Continental AG (Germany), the Head-up Display (HUD) shows directly in the line of sight. Drivers get all the important information such as speed, warning signals and indicator arrows for navigation without looking down to the instrument cluster or the secondary display.

Key Stakeholders

- Automobile Manufacturers

- Automotive AR HUD Manufacturers

- Automotive HUD Manufacturers

- Automotive ADAS Manufacturers

- Automotive Component Manufacturers

- Automotive Windshield Display Panel Manufacturers

- Country-level Associations

- Country-level Regulatory Authorities

- Distributors and Suppliers of Automotive Safety and HMI Systems

- EV Manufacturers

- Government Bodies

- GPS Data Providers

- Hardware Manufacturers

- Industry Associations and Experts

- In-vehicle Infotainment System Manufacturers

- Other Automotive Industry Experts

- Raw Material Suppliers for Hardware Systems

- Repair and Maintenance Providers

- Sensor Manufacturers

- Software Providers

- Technology Providers

Report Objectives

- To analyze and forecast the automotive HUD market in terms of value (USD million) & volume (thousand units), from 2018 to 2028

- To segment and forecast the market by value & volume based on region (Asia Pacific, Europe, North America, and Rest of the World)

- To segment and forecast the market, by value & volume, based on HUD type (windshield HUD and combiner HUD)

- To segment and forecast the market, by value & volume, based on technology (conventional HUD and AR-based HUD)

- To segment and forecast the market, by value & volume, based on dimension type (2D HUD and 3D HUD)

- To segment and forecast the market, by value & volume, based on vehicle class (mid-segment cars, luxury cars, and economy cars)

- To segment and forecast the market, by value, based on offering (software, and hardware)

- To segment and forecast the market, by value & volume, based on vehicle type (passenger cars and commercial vehicles)

- To segment and forecast the market, by value & volume, based on level of autonomy (non-autonomous cars, semi-autonomous cars, and autonomous cars)

- To segment and forecast the market, by value & volume, based on propulsion type (ICE vehicles and electric vehicles)

- To segment the market, based on sales channel (OE fitted and aftermarket)

- To segment and forecast the market, by value & volume, based on electric vehicle type (battery electric vehicles [BEVs], fuel cell electric vehicles [FCEVs], hybrid electric vehicles [HEVs], and plug-in hybrid electric vehicles [PHEVs])

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Automotive HUD market, by EV type, at a regional level

- Automotive HUD market, by vehicle autonomy, at a regional level

- Profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automotive HUD Market

for this report (HUD) do you have volume forecast breakdown between OEM preinstalled and aftermarket?