BDaaS Market by Component (Solutions and Services), Organization Size, Deployment Type, Industry Vertical (BFSI, IT and Telecom, Healthcare and Life Sciences, eCommerce and Retail, and Manufacturing), and Region - Global Forecast to 2024

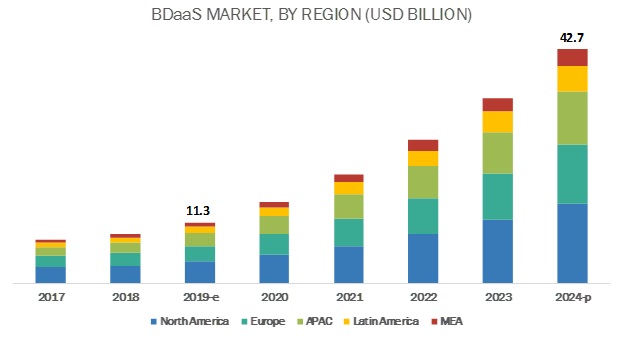

MarketsandMarkets estimates the global Big Data as a Service (BDaaS) market size to grow from USD 11.3 billion in 2019 to USD 42.7 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 30.5% during the forecast period. Factors expected to drive the growth of the BDaaS market include the growing demand in industries to gain actionable insights and growing organizational data across industries due to digitalization and automation of business processes.

Solutions segment to hold a larger market size during the forecast period

The Big Data as a Service market by component includes solutions and services. The solutions segment is estimated to hold a larger market size during the forecast period. Data generated in enterprises across industry verticals is increasing at a rapid rate. This has led to organizations emphasizing on extracting and leveraging insights from the enormous amount of big data generated in various departments to gain a competitive edge. Hence, organizations are looking forward to adopting BDaaS solutions, which facilitate them to collect, store, and analyze the massive volume of data. This is expected to fuel the demand for the BDaaS solutions.

Public cloud to hold the largest market size during the forecast period

Based on deployment type, the BDaaS market has been segmented into public cloud, hybrid cloud, and private cloud. BDaaS solutions enable organizations to lessen the cost of Information Technology (IT) infrastructure, software, storage, and technical staff. These solutions can be deployed on the public, private, and hybrid cloud as per client requirements. The public cloud is expected to hold the largest market size as it offers cost-efficiency to its clients. The private cloud enables organizations to have full control over their systems and data with enhanced security and the hybrid cloud enables organizations to leverage the advantages of both private and public cloud as it offers both cost-efficiency and enhanced security.

Large enterprises to hold a majority of the market share during the forecast period

The adoption of BDaaS solutions among large enterprises is high as in todays highly competitive world, large enterprises leave no stone unturned to capture a higher market share. Generally, these organizations have distributed data scattered over various departments. In order to gain valuable insights out of this clustered data, large enterprises are deploying on-demand services to leverage the benefits of cloud-based analysis of big data. Large enterprises are using cloud-based analytics to combine their external and internal information and to extract valuable insights out of it. Big data analytics provide enterprises with faster access to their data. Hence, they spend significant amounts to become technologically proficient, owing to which the adoption of BDaaS solutions is higher among the large enterprises as compared to Small and Medium-sized Enterprises (SMEs). Large enterprises also spend a significant amount on training workshops and education to enable their employees to effectively leverage the benefits of BDaaS solutions.

North America to account for the largest market size during the forecast period

The global Big Data as a Service market by region covers five major geographic regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period due to the presence of large number of BDaaS vendors. A rising inclination of American companies to leverage advanced technologies, such as advanced analytics, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and cloud to boost the adoption of BDaaS solutions.

Key Market Players

The major players in the BDaaS market are IBM (US), Oracle (US), Microsoft (US), Google (US), AWS (US), SAP (Germany), Teradata (US), SAS (US), Dell Technologies (US), HPE (US), CenturyLink (US), Splunk (US), Cloudera (US), Salesforce (US), Qubole (US), GoodData (US), Hitachi Vantara (US), IRI (US), 1010data (US), and Guavus (US).

The study includes an in-depth competitive analysis of key players in the Big Data as a Service market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component, Deployment Type, Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

IBM (US), Oracle (US), Microsoft (US), Google (US), AWS (US), SAP (Germany), Teradata (US), SAS (US), Dell Technologies (US), HPE (US), CenturyLink (US), Splunk (US), Cloudera (US), Salesforce (US), Qubole (US), GoodData (US), Hitachi Vantara (US), IRI (US), 1010data (US), and Guavus (US). |

This research report categorizes the BDaaS market based on component, deployment type, organization size, industry vertical, and region.

Based on Component:

- Solutions

- Hadoop as a Service (HDaaS)

- Data Analytics as a Service (DAaaS)

- Others*

- Services

Based on Deployment Type:

- Public Cloud

- Hybrid Cloud

- Private Cloud

Based on Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

Based on Industry Vertical:

- Banking, Financial Services and Insurance (BFSI)

- Information Technology (IT) and Telecom

- Healthcare and Life Sciences

- eCommerce and Retail

- Manufacturing

- Media and Entertainment

- Others

Based on Region:

- North America

- United States (US)

- Canada

- Europe

- United Kingdom (UK)

- Rest of Europe

- APAC

- China

- Rest of APAC

- Latin America

- MEA

Recent Developments

- In November 2019, Google partnered with Deloitte. Google Cloud and Deloitte collaborated to offer new solutions and services to help customers solve difficult problems encountered in leveraging the cloud. Google Cloud and Deloitte understand how big data works at scale and customers need for solutions to get the most of the existing data.

- In June 2019, Microsoft partnered with Oracle. The partnership would enable customers to migrate and run mission-critical enterprise workloads across Microsoft Azure and the Oracle Cloud. The partnership would empower enterprises to seamlessly connect Azure services, such as Analytics and AI, with Oracle Cloud services, including Autonomous Database.

Key questions addressed by the report:

- Where would all these developments take the industry in the mid to long term?

- What are the upcoming industry solutions for the Big Data as a Service market?

- Which are the major factors expected to drive the market?

- Which industry vertical would gain the largest market share in the Big Data as a Service (BDaaS) market?

- Which region would offer high growth for vendors in the BDaaS market?

Frequently Asked Questions (FAQ):

What is Big Data as a Service market?

Big Data solutions facilitate the collection, storage and analysis of massive volume, high velocity, and variety of data which is growing exponentially across the globe. BDaaS refers to a wide range of data services hosted on the cloud. BDaaS encompasses Hadoop-as-a-service (HDaaS), Data Analytics as a service (DAaaS) and other (Data-as-a-service and data masking as a service)

What are the major companies in the Big Data as a Service market?

The prominent vendors in the BDaaS market are Google, Microsoft, Amazon Web Services, Oracle, SAP, Teradata, SAS, Dell Technologies, Hewlett Packard Enterprise, Salesforce, Splunk, Cloudera, CenturyLink, Qubole, Hitachi Vantara, IRI, GoodData, 1010data and Guavus

Who are the major adopters of Big Data as a Service market?

The major adopters of BDaaS market are BFSI, IT and telecom, Healthcare and Life Sciences, Ecommerce and Retail, Manufacturing and media. BFSI, IT and telecom and healthcare are the top contributors to the BDaaS market whereas ecommerce and retail is expected to grow the fastest during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Big Data as a Service Market

4.2 North America: Market, By Industry Vertical and Country

4.3 BDaaS Market: Major Regions

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Demand in Industries to Gain Actionable Insights From Big Data

5.2.1.2 Growth in Data Due to Digitization and Automation

5.2.2 Restraints

5.2.2.1 Complexity in Extracting Valuable Insights Out of Humongous Data Source

5.2.3 Opportunities

5.2.3.1 Bdaas Solutions to Enhance Roi and Decision-Making Capabilities

5.2.3.2 Rapid Advancement of Cloud Ai, Ml, Iot, and Advanced Analytics to Boost Opportunities for Bdaas Vendors

5.2.4 Challenges

5.2.4.1 Security and Privacy Concerns

5.2.4.2 Lack of Awareness of Bdaas Solutions and Professional Expertise

6 Big Data as a Service Market, By Component (Page No. - 35)

6.1 Introduction

6.2 Solutions

6.2.1 Hadoop as a Service

6.2.2 Data Analytics as a Service

6.2.3 Others

6.3 Services

7 Big Data as a Service Market, By Organization Size (Page No. - 46)

7.1 Introduction

7.2 Large Enterprises

7.3 Small and Medium-Sized Enterprises

8 Big Data as a Service Market, By Deployment Type (Page No. - 52)

8.1 Introduction

8.2 Public Cloud

8.3 Hybrid Cloud

8.4 Private Cloud

9 Big Data as a Service Market, By Industry Vertical (Page No. - 59)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.3 IT and Telecom

9.4 Healthcare and Life Sciences

9.5 Ecommerce and Retail

9.6 Manufacturing

9.7 Media and Entertainment

9.8 Others

10 Big Data as a Service Market, By Region (Page No. - 68)

10.1 Introduction

10.2 North America

10.2.1 United States

10.2.2 Canada

10.3 Europe

10.3.1 United Kingdom

10.3.2 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 Rest of Asia Pacific

10.5 Latin America

10.6 Middle East and Africa

11 Competitive Landscape (Page No. - 97)

11.1 Introduction

11.2 Competitive Leadership Mapping

11.2.1 Visionary Leaders

11.2.2 Dynamic Differentiators

11.2.3 Innovators

11.2.4 Emerging Companies

12 Company Profiles (Page No. - 99)

12.1 Introduction

12.2 Google

(Business Overview, Solutions and Services Offered, Recent Developments, and SWOT Analysis)*

12.3 Microsoft

12.4 Amazon Web Services

12.5 IBM

12.6 Oracle

12.7 SAP

12.8 Teradata

12.9 SAS

12.10 Dell Technologies

12.11 Hewlett Packard Enterprise

12.12 Salesforce

12.13 Splunk

12.14 Cloudera

12.15 CenturyLink

12.16 Qubole

12.17 Hitachi Vantara

12.18 IRI

12.19 GoodData

12.20 1010data

12.21 Guavus

*Details on Business Overview, Solutions and Services Offered, Recent Developments, and SWOT Analysis Might Not be Captured in Case of Unlisted Companies.

12.22 Right to Win

13 Appendix (Page No. - 130)

13.1 Knowledge Store: Marketsandmarkets Subscription Portal

13.2 Available Customizations

13.3 Related Reports

13.4 Author Details

List of Tables (108 Tables)

Table 1 United States Dollar Exchange Rate, 20162018

Table 2 Factor Analysis

Table 3 Big Data as a Service Market Size, By Component, 20172024 (USD Million)

Table 4 Solutions: BDaaS Market Size, By Type, 20172024 (USD Million)

Table 5 Solutions: Market Size, By Region, 20172024 (USD Million)

Table 6 North America: Solutions Market Size, By Country, 20172024 (USD Million)

Table 7 Europe: Solutions Market Size, By Country, 20172024 (USD Million)

Table 8 Asia Pacific: Solutions Market Size, By Country, 20172024 (USD Million)

Table 9 Hadoop as a Service Market Size, By Region, 20172024 (USD Million)

Table 10 North America: Hadoop as a Service Market Size, By Country, 20172024 (USD Million)

Table 11 Europe: Hadoop as a Service Market Size, By Country, 20172024 (USD Million)

Table 12 Asia Pacific: Hadoop as a Service Market Size, By Country, 20172024 (USD Million)

Table 13 Data Analytics as a Service Market Size, By Region, 20172024 (USD Million)

Table 14 North America: Data Analytics as a Service Market Size, By Country, 20172024 (USD Million)

Table 15 Europe: Data Analytics as a Service Market Size, By Country, 20172024 (USD Million)

Table 16 Asia Pacific: Data Analytics as a Service Market Size, By Country, 20172024 (USD Million)

Table 17 Others Market Size, By Region, 20172024 (USD Million)

Table 18 North America: Others Market Size, By Country, 20172024 (USD Million)

Table 19 Europe: Others Market Size, By Country, 20172024 (USD Million)

Table 20 Asia Pacific: Others Market Size, By Country, 20172024 (USD Million)

Table 21 Services: Big Data as a Service Market Size, By Region, 20172024 (USD Million)

Table 22 North America: Services Market Size, By Country, 20172024 (USD Million)

Table 23 Europe: Services Market Size, By Country, 20172024 (USD Million)

Table 24 Asia Pacific: Services Market Size, By Country, 20172024 (USD Million)

Table 25 BDaaS Market Size, By Organization Size, 20172024 (USD Million)

Table 26 Large Enterprises: Market Size, By Region, 20172024 (USD Million)

Table 27 North America: Large Enterprises Market Size, By Country, 20172024 (USD Million)

Table 28 Europe: Large Enterprises Market Size, By Country, 20172024 (USD Million)

Table 29 Asia Pacific: Large Enterprises Market Size, By Country, 20172024 (USD Million)

Table 30 Small and Medium-Sized Enterprises: Market Size, By Region, 20172024 (USD Million)

Table 31 North America: Small and Medium-Sized Enterprises Market Size, By Country, 20172024 (USD Million)

Table 32 Europe: Small and Medium-Sized Enterprises Market Size, By Country, 20172024 (USD Million)

Table 33 Asia Pacific: Small and Medium-Sized Enterprises Market Size, By Country, 20172024 (USD Million)

Table 34 BDaaS Market Size, By Deployment Type, 20172024 (USD Million)

Table 35 Public Cloud: Big Data as a Service Market Size, By Region, 20172024 (USD Million)

Table 36 North America: Public Cloud Market Size, By Country, 20172024 (USD Million)

Table 37 Europe: Public Cloud Market Size, By Country, 20172024 (USD Million)

Table 38 Asia Pacific: Public Cloud Market Size, By Country, 20172024 (USD Million)

Table 39 Hybrid Cloud: Market Size, By Region, 20172024 (USD Million)

Table 40 North America: Hybrid Cloud Market Size, By Country, 20172024 (USD Million)

Table 41 Europe: Hybrid Cloud Market Size, By Country, 20172024 (USD Million)

Table 42 Asia Pacific: Hybrid Cloud Market Size, By Country, 20172024 (USD Million)

Table 43 Private Cloud: Market Size, By Region, 20172024 (USD Million)

Table 44 North America: Private Cloud Market Size, By Country, 20172024 (USD Million)

Table 45 Europe: Private Cloud Market Size, By Country, 20172024 (USD Million)

Table 46 Asia Pacific: Private Cloud Market Size, By Country, 20172024 (USD Million)

Table 47 Big Data as a Service Market Size, By Industry Vertical, 20172024 (USD Million)

Table 48 Banking, Financial Services, and Insurance: BDaaS Market Size, By Region, 20172024 (USD Million)

Table 49 IT and Telecom: Market Size, By Region, 20172024 (USD Million)

Table 50 Healthcare and Life Sciences: Market Size, By Region, 20172024 (USD Million)

Table 51 Ecommerce and Retail: Market Size, By Region, 20172024 (USD Million)

Table 52 Manufacturing: Market Size, By Region, 20172024 (USD Million)

Table 53 Media and Entertainment: Market Size, By Region, 20172024 (USD Million)

Table 54 Others: Market Size, By Region, 20172024 (USD Million)

Table 55 Big Data as a Service Market Size, By Region, 20172024 (USD Million)

Table 56 North America: BDaaS Market Size, By Component, 20172024 (USD Million)

Table 57 North America: Market Size, By Solution, 20172024 (USD Million)

Table 58 North America: Market Size, By Organization Size, 20172024 (USD Million)

Table 59 North America: Market Size, By Deployment Type, 20172024 (USD Million)

Table 60 North America: Market Size, By Industry Vertical, 20172024 (USD Million)

Table 61 North America: BDaaS Market Size, By Country, 20172024 (USD Million)

Table 62 United States: Market Size, By Component, 20172024 (USD Million)

Table 63 United States: Market Size, By Solution, 20172024 (USD Million)

Table 64 United States: Market Size, By Organization Size, 20172024 (USD Million)

Table 65 United States: Market Size, By Deployment Type, 20172024 (USD Million)

Table 66 Canada: Big Data as a Service Market Size, By Component, 20172024 (USD Million)

Table 67 Canada: Market Size, By Solution, 20172024 (USD Million)

Table 68 Canada: Market Size, By Organization Size, 20172024 (USD Million)

Table 69 Canada: Market Size, By Deployment Type, 20172024 (USD Million)

Table 70 Europe: BDaaS Market Size, By Component, 20172024 (USD Million)

Table 71 Europe: Market Size, By Solution, 20172024 (USD Million)

Table 72 Europe: Market Size, By Organization Size, 20172024 (USD Million)

Table 73 Europe: Market Size, By Deployment Type, 20172024 (USD Million)

Table 74 Europe: Market Size, By Industry Vertical, 20172024 (USD Million)

Table 75 Europe: Market Size, By Country, 20172024 (USD Million)

Table 76 United Kingdom: Big Data as a Service Market Size, By Component, 20172024 (USD Million)

Table 77 United Kingdom: Market Size, By Solution, 20172024 (USD Million)

Table 78 United Kingdom: Market Size, By Organization Size, 20172024 (USD Million)

Table 79 United Kingdom: Market Size, By Deployment Type, 20172024 (USD Million)

Table 80 Rest of Europe: Market Size, By Component, 20172024 (USD Million)

Table 81 Rest of Europe: Market Size, By Solution, 20172024 (USD Million)

Table 82 Rest of Europe: Market Size, By Organization Size, 20172024 (USD Million)

Table 83 Rest of Europe: BDaaS Market Size, By Deployment Type, 20172024 (USD Million)

Table 84 Asia Pacific: Market Size, By Component, 20172024 (USD Million)

Table 85 Asia Pacific: Market Size, By Solution, 20172024 (USD Million)

Table 86 Asia Pacific: Market Size, By Organization Size, 20172024 (USD Million)

Table 87 Asia Pacific: Market Size, By Deployment Type, 20172024 (USD Million)

Table 88 Asia Pacific: Market Size, By Industry Vertical, 20172024 (USD Million)

Table 89 Asia Pacific: Big Data as a Service Market Size, By Country, 20172024 (USD Million)

Table 90 China: Market Size, By Component, 20172024 (USD Million)

Table 91 China: Market Size, By Solution, 20172024 (USD Million)

Table 92 China: Market Size, By Organization Size, 20172024 (USD Million)

Table 93 China: Market Size, By Deployment Type, 20172024 (USD Million)

Table 94 Rest of Asia Pacific: BDaaS Market Size, By Component, 20172024 (USD Million)

Table 95 Rest of Asia Pacific: Market Size, By Solution, 20172024 (USD Million)

Table 96 Rest of Asia Pacific: Market Size, By Organization Size, 20172024 (USD Million)

Table 97 Rest of Asia Pacific: Market Size, By Deployment Type, 20172024 (USD Million)

Table 98 Latin America: Market Size, By Component, 20172024 (USD Million)

Table 99 Latin America: Market Size, By Solution, 20172024 (USD Million)

Table 100 Latin America: Market Size, By Organization Size, 20172024 (USD Million)

Table 101 Latin America: Market Size, By Deployment Type, 20172024 (USD Million)

Table 102 Latin America: Big Data as a Service Market Size, By Industry Vertical, 20172024 (USD Million)

Table 103 Middle East and Africa: Market Size, By Component, 20172024 (USD Million)

Table 104 Middle East and Africa: Market Size, By Solution, 20172024 (USD Million)

Table 105 Middle East and Africa: Market Size, By Organization Size, 20172024 (USD Million)

Table 106 Middle East and Africa: Market Size, By Deployment Type, 20172024 (USD Million)

Table 107 Middle East and Africa: BDaaS Market Size, By Industry Vertical, 20172024 (USD Million)

Table 108 Evaluation Criteria

List of Figures (32 Figures)

Figure 1 Big Data as a Service Market: Research Design

Figure 2 BDaaS Market: Top-Down and Bottom-Up Approaches

Figure 3 Ecommerce and Retail Industry Vertical to Witness the Highest Growth Rate During the Forecast Period

Figure 4 Segments With High Market Shares in the Market in 2019

Figure 5 North America to Account for the Highest Market Share in 2019

Figure 6 Growing Need Among Enterprises to Gain Actionable Big Data Insights to Drive the Market Growth

Figure 7 Banking, Financial Services, and Insurance Industry Vertical and the United States to Account for High Market Shares in 2019

Figure 8 Asia Pacific to Grow at the Highest Growth Rate During the Forecast Period

Figure 9 Drivers, Restraints, Opportunities, and Challenges: BDaaS Market

Figure 10 Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 11 Data Analytics as a Service Segment to Grow at the Highest CAGR During the Forecast Period

Figure 12 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Figure 13 Hybrid Cloud Segment to Grow at the Highest CAGR During the Forecast Period

Figure 14 Ecommerce and Retail Industry Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 15 Asia Pacific to Witness Significant Growth During the Forecast Period

Figure 16 North America: Market Snapshot

Figure 17 Asia Pacific: Market Snapshot

Figure 18 Big Data as a Service Market (Global) Competitive Leadership Mapping, 2019

Figure 19 Google: Company Snapshot

Figure 20 Google: SWOT Analysis

Figure 21 Microsoft: Company Snapshot

Figure 22 Microsoft: SWOT Analysis

Figure 23 AWS: SWOT Analysis

Figure 24 IBM: Company Snapshot

Figure 25 IBM: SWOT Analysis

Figure 26 Oracle: Company Snapshot

Figure 27 Oracle: SWOT Analysis

Figure 28 SAP: Company Snapshot

Figure 29 Teradata: Company Snapshot

Figure 30 SAS: Company Snapshot

Figure 31 Dell Technologies: Company Snapshot

Figure 32 HPE: Company Snapshot

The study involved four major activities in estimating the current size of the global Big Data as a Service (BDaaS) market. An exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total BDaaS market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred for, for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Journal of Big Data, Big Data & Society (BD&S), Big Data and Information Analytics (BDIA), and articles from recognized authors, directories, and databases.

Primary Research

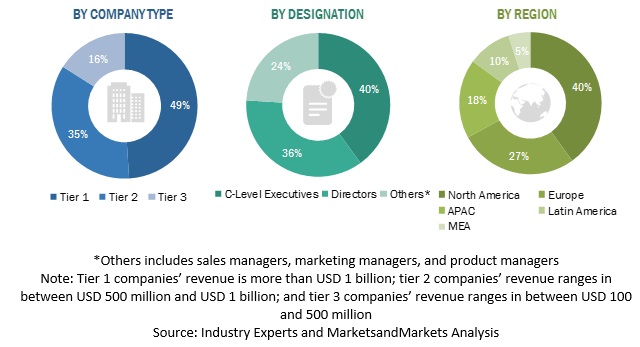

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the BDaaS market along with the associated service providers, and System Integrators (SIs) operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents,

Market Size Estimation

For making market estimates and forecasting the BDaaS market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global BDaaS market using key companies revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the BDaaS market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the BDaaS market by component (solutions and services), deployment type, organization size, industry vertical, and region

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the BDaaS market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the BDaaS market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as new product launches and product enhancements, partnerships, collaborations, and acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in BDaaS Market

Understanding Future Market solutions for the Big Data as a Service Market