Biopreservation Market Size by Type (Media (Sera), Equipment (Thawing Equipment, Alarms, Freezers)), Biospecimen (Human Tissue, Stem Cells, Organs), Application (Therapeutic, Research, Clinical Trials), End User (Hospitals, Biobank) & Region - Global Forecast to 2025

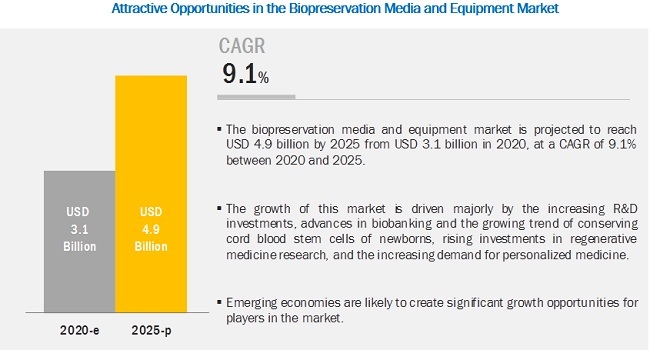

The global size of biopreservation market in terms of revenue was estimated to be worth USD 3.1 billion in 2020 and is poised to reach USD 4.9 billion by 2025, growing at a CAGR of 9.1% from 2020 to 2025. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The growth of this market is driven majorly by the increasing R&D investments, advances in biobanking and the growing trend of conserving cord blood stem cells of newborns, rising investments in regenerative medicine research, and the increasing demand for personalized medicine. Emerging economies are likely to create significant growth opportunities for players in the market. However, the high cost of biopreservation equipment will challenge market growth.

Therapeutic applications held the largest share of the biopreservation industry, by application

Based on application, the biopreservation market is segmented into Therapeutic applications, Research applications, Clinical trials and other applications. Therapeutic applications accounted for the largest share of this market in 2019. The growth of this segment is attributed to the advancements in the fields of regenerative medicine and personalized medicine and increasing trend of cord blood banking. The large share of this segment can be attributed to advancements in treatment techniques, and high prevalence of chronic diseases across the globe.

The Asia Pacific biopreservation industry is expected to grow at the highest CAGR during the forecast period

The Asia Pacific is expected to grow at the highest rate in the biopreservation market. The major factors driving the growth of this market include increasing public and private investments in life sciences research, growing number of biobanks and research centers and high prevalence of chronic diseases.

The prominent players in the biopreservation market include Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), and Avantor, Inc. (US), ThermoGenesis Holdings, Inc. (US), Bio-Techne Corporation (US), BioLife Solutions, Inc. (US), Exact Sciences Corporation (US), Worthington Industries, Inc. (US), and Chart Industries, Inc. (US).

Thermo Fisher Scientific Inc. is the largest player in the market. The large share of this company can be attributed to its strong suite of biopreservation media and equipment products. Owing to its strong sales and distribution network, the company has a significant global footprint. Additionally, the large number of production sites give it a competitive advantage over other players in the market.

The company focuses on product launches in order to create a strong foothold in the market. In 2018, Thermo Fisher Scientific Inc. launched the Gibco BenchStable Media, which provides more sustainable packaging for cell culture compared to sustainable media. The company further intends to strengthen its presence in this market by investing in R&D. Its extensive R&D activities enable it to increase its depth of capabilities in biopreservation media and equipment solutions and services and to provide innovative products and services in the market space.

Scope of the Biopreservation Industry:

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$3.1 billion |

|

Estimated Value by 2025 |

$4.9 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 9.1% |

|

Market Driver |

Advances in biobanking and the growing trend of conserving cord blood stem cells of newborns |

|

Market Opportunity |

Growing number of research studies in the field of biopreservation |

The research report categorizes the biopreservation market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Biopreservation Media

- Nutrient Media

- Sera

- Growth Factors & Supplements

-

Biospecimen Equipment

- Temperature Control Systems

- Freezers

- Cryogenic Storage Systems

- Thawing Equipment

-

Refrigerators

- Accessories

- Alarms & Monitoring systems

- Incubators

- Centrifuges

- Other Equipment

By Biospecimen

- Human Tissue Samples

- Organs

- Stem Cells

- Other Biospecimens

By Application

- Therapeutic Applications

- Research Applications

- Clinical Trials

- Other Applications

By End User

- Biobanks

- Gene Banks

- Hospitals

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia - Pacific

- China

- Japan

- India

- Australia

- RoAPAC

-

Rest of World

- Latin America

- Middle East & Africa

Recent Developments of Biopreservation Industry

- In 2020, Thermo Fisher Scientific Inc. launched Gibco BenchStable Media for market.

- In 2020, Merck announced plans for the construction of a new biotech development facility in Switzerland. The company will be investing USD 282.5 million for this purpose. This facility is going to strengthen company’s presence in market.

- In 2020, Merck announced its plans to establish a Sustainability Centre in Dubai. The center comprises diverse programs that address and accelerate solutions for sustainable challenges through the application of advanced science and technology.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global biopreservation market?

The global biopreservation market boasts a total revenue value of $4.9 billion by 2025.

What is the estimated growth rate (CAGR) of the global biopreservation market?

The global biopreservation market has an estimated compound annual growth rate (CAGR) of 9.1% and a revenue size in the region of $3.1 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary sources

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 BIOPRESERVATION INDUSTRY SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 5 ILLUSTRATIVE EXAMPLE OF THERMO FISHER SCIENTIFIC

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 7 BIOPRESERVATION MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 BIOPRESERVATION MEDIA MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 9 BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2020 VS. 2025 (USD MILLION)

FIGURE 11 BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 12 BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE BIOPRESERVATION MARKET

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 BIOPRESERVATION MARKET OVERVIEW

FIGURE 14 INCREASING DEMAND FOR PERSONALIZED MEDICINE TO SUPPORT MARKET GROWTH

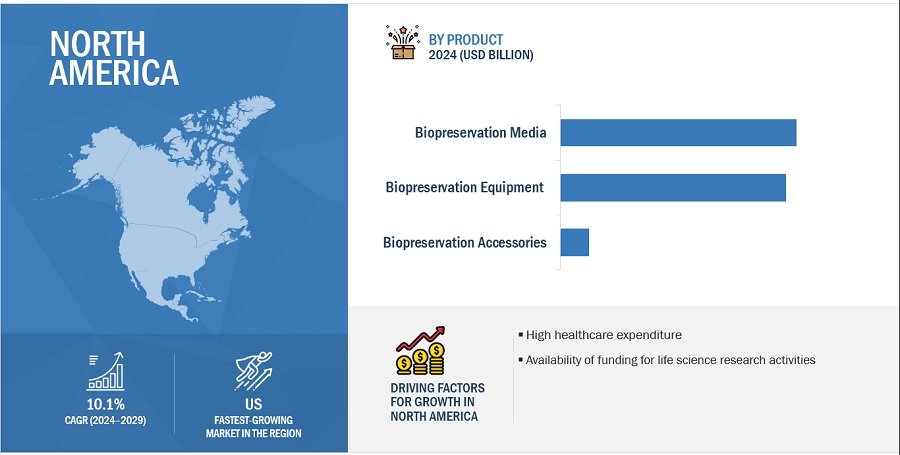

4.2 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY TYPE (2019)

FIGURE 15 BIOPRESERVATION MEDIA SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2019

4.3 BIOPRESERVATION MEDIA & EQUIPMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 ASIA PACIFIC MARKET TO REGISTER THE HIGHEST GROWTH IN THE BIOPRESERVATION MEDIA & EQUIPMENT MARKET FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 BIOPRESERVATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing R&D investments

5.2.1.2 Advances in biobanking and the growing trend of conserving cord blood stem cells of newborns

TABLE 1 COUNTRY-WISE DATA FOR THE PERCENTAGE OF BIRTHS BANKING CORD BLOOD (2019)

5.2.1.3 Rising investments in regenerative medicine research

TABLE 2 FUNDING FOR REGENERATIVE MEDICINE RESEARCH BY NIH UNDER THE 21ST CENTURY ACT

5.2.1.4 Increasing demand for personalized medicine

5.2.2 RESTRAINTS

5.2.2.1 High cost of advanced techniques

5.2.2.2 Stability issues due to tissue injury during freezing and thawing

5.2.3 OPPORTUNITIES

5.2.3.1 Asia offers significant growth opportunities

FIGURE 18 GROWTH IN HEALTHCARE EXPENDITURE IN SOUTHEAST ASIA AND WESTERN PACIFIC REGIONS

5.2.3.2 Rising demand for organ transplants

5.2.3.3 Growing number of research studies in the field of biopreservation

FIGURE 19 RESEARCH PAPERS PUBLISHED, 2010-2019

5.2.4 CHALLENGES

5.2.4.1 Increasing demand for room temperature storage technologies

5.2.4.2 Disruption of research activities and clinical trials due to the COVID-19 pandemic

6 BIOPRESERVATION MARKET, BY TYPE (Page No. - 63)

6.1 INTRODUCTION

TABLE 3 BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

6.2 BIOPRESERVATION MEDIA

TABLE 4 BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 5 BIOPRESERVATION MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 NORTH AMERICA: BIOPRESERVATION MEDIA MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 7 EUROPE: BIOPRESERVATION MEDIA MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 8 ASIA PACIFIC: BIOPRESERVATION MEDIA MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 9 ROW: BIOPRESERVATION MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.1 NUTRIENT MEDIA

6.2.1.1 Nutrient media is the largest and fastest-growing segment of the biopreservation media segment

TABLE 10 BIOPRESERVATION NUTRIENT MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 NORTH AMERICA: BIOPRESERVATION NUTRIENT MEDIA MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 EUROPE: BIOPRESERVATION NUTRIENT MEDIA MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 13 ASIA PACIFIC: BIOPRESERVATION NUTRIENT MEDIA MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 ROW: BIOPRESERVATION NUTRIENT MEDIA MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2 SERA

6.2.2.1 Sera is used for the cryopreservation of biologics at -80° to -196°C

TABLE 15 BIOPRESERVATION SERA MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 NORTH AMERICA: BIOPRESERVATION SERA MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 EUROPE: BIOPRESERVATION SERA MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 ASIA PACIFIC: BIOPRESERVATION SERA MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 19 ROW: BIOPRESERVATION SERA MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.3 GROWTH FACTORS & SUPPLEMENTS

6.2.3.1 Growth factors & supplements are used to improve cell viability and utility

TABLE 20 BIOPRESERVATION GROWTH FACTORS & SUPPLEMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 NORTH AMERICA: BIOPRESERVATION GROWTH FACTORS & SUPPLEMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 22 EUROPE: BIOPRESERVATION GROWTH FACTORS & SUPPLEMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 ASIA PACIFIC: BIOPRESERVATION GROWTH FACTORS & SUPPLEMENTS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 24 ROW: BIOPRESERVATION GROWTH FACTORS & SUPPLEMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 BIOPRESERVATION EQUIPMENT

TABLE 25 BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 26 BIOPRESERVATION EQUIPMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 NORTH AMERICA: BIOPRESERVATION INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 28 EUROPE: BIOPRESERVATION EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 29 ASIA PACIFIC: BIOPRESERVATION INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 ROW: BIOPRESERVATION EQUIPMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.1 TEMPERATURE CONTROL SYSTEMS

TABLE 31 BIOPRESERVATION TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 32 BIOPRESERVATION TEMPERATURE CONTROL SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: BIOPRESERVATION TEMPERATURE CONTROL SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 EUROPE: BIOPRESERVATION TEMPERATURE CONTROL SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 ASIA PACIFIC: BIOPRESERVATION TEMPERATURE CONTROL SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 ROW: BIOPRESERVATION TEMPERATURE CONTROL SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.1.1 Freezers

6.3.1.1.1 Freezers segment accounted for the largest share of the temperature control systems market

TABLE 37 BIOPRESERVATION FREEZERS MARKET, BY REGION, 2018–2025(USD MILLION)

TABLE 38 NORTH AMERICA: BIOPRESERVATION FREEZERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 EUROPE: BIOPRESERVATION FREEZERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 ASIA PACIFIC: BIOPRESERVATION FREEZERS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 41 ROW: BIOPRESERVATION FREEZERS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.1.2 Cryogenic storage systems

6.3.1.2.1 Cryogenic storage systems are used for the storage of samples below -130°C

TABLE 42 BIOPRESERVATION CRYOGENIC STORAGE SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: BIOPRESERVATION CRYOGENIC STORAGE SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 EUROPE: BIOPRESERVATION CRYOGENIC STORAGE SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 ASIA PACIFIC: BIOPRESERVATION CRYOGENIC STORAGE SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 46 ROW: BIOPRESERVATION CRYOGENIC STORAGE SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.1.3 Thawing equipment

6.3.1.3.1 Rapid thawing is essential for the ideal preservation of cells

TABLE 47 BIOPRESERVATION THAWING EQUIPMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: BIOPRESERVATION THAWING EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: BIOPRESERVATION THAWING EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 ASIA PACIFIC: BIOPRESERVATION THAWING EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 ROW: BIOPRESERVATION THAWING EQUIPMENT MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.1.4 Refrigerators

6.3.1.4.1 Refrigerators are used for the storage of samples at a constant temperature

TABLE 52 BIOPRESERVATION REFRIGERATORS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: BIOPRESERVATION REFRIGERATORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 54 EUROPE: BIOPRESERVATION REFRIGERATORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 ASIA PACIFIC: BIOPRESERVATION REFRIGERATORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 56 ROW: BIOPRESERVATION REFRIGERATORS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.2 ACCESSORIES

6.3.2.1 Accessories are indispensable and integral components for any biopreservation procedure

TABLE 57 BIOPRESERVATION ACCESSORIES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 58 NORTH AMERICA: BIOPRESERVATION ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 EUROPE: BIOPRESERVATION ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 ASIA PACIFIC: BIOPRESERVATION ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 ROW: BIOPRESERVATION ACCESSORIES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.3 ALARMS & MONITORING SYSTEMS

6.3.3.1 Alarms & monitoring systems help scrutinize the proper functioning of biopreservation equipment

TABLE 62 BIOPRESERVATION ALARMS & MONITORING SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: BIOPRESERVATION ALARMS & MONITORING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 64 EUROPE: BIOPRESERVATION ALARMS & MONITORING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 ASIA PACIFIC: BIOPRESERVATION ALARMS & MONITORING SYSTEMS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 66 ROW: BIOPRESERVATION ALARMS & MONITORING SYSTEMS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.4 INCUBATORS

6.3.4.1 Incubators help to maintain a favorable environment for cell growth

TABLE 67 BIOPRESERVATION INCUBATORS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 68 NORTH AMERICA: BIOPRESERVATION INCUBATORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: BIOPRESERVATION INCUBATORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 70 ASIA PACIFIC: BIOPRESERVATION INCUBATORS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 71 ROW: BIOPRESERVATION INCUBATORS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.5 CENTRIFUGES

6.3.5.1 Centrifuges are used for isolating and separating suspensions and immiscible liquids

TABLE 72 BIOPRESERVATION CENTRIFUGES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: BIOPRESERVATION CENTRIFUGES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: BIOPRESERVATION CENTRIFUGES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: BIOPRESERVATION CENTRIFUGES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 76 ROW: BIOPRESERVATION CENTRIFUGES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3.6 OTHER EQUIPMENT

TABLE 77 BIOPRESERVATION MARKET FOR OTHER EQUIPMENT, BY REGION, 2018–2025 (USD MILLION)

TABLE 78 NORTH AMERICA: BIOPRESERVATION MARKET FOR OTHER EQUIPMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 79 EUROPE: BIOPRESERVATION MARKET FOR OTHER EQUIPMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 80 ASIA PACIFIC: BIOPRESERVATION MARKET FOR OTHER EQUIPMENT, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 81 ROW: BIOPRESERVATION MARKET FOR OTHER EQUIPMENT, BY REGION, 2018–2025 (USD MILLION)

7 BIOPRESERVATION MARKET, BY BIOSPECIMEN (Page No. - 96)

7.1 INTRODUCTION

TABLE 82 BIOPRESERVATION MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

7.2 HUMAN TISSUE SAMPLES

7.2.1 HUMAN TISSUE SAMPLES SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

TABLE 83 BIOPRESERVATION MARKET FOR HUMAN TISSUE SAMPLES, BY REGION, 2018–2025 (USD MILLION)

TABLE 84 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR HUMAN TISSUE SAMPLES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 85 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR HUMAN TISSUE SAMPLES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 86 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR HUMAN TISSUE SAMPLES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 87 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR HUMAN TISSUE SAMPLES, BY REGION, 2018–2025 (USD MILLION)

7.3 ORGANS

7.3.1 INCREASING NUMBER OF ORGAN TRANSPLANTS WILL DRIVE MARKET GROWTH

FIGURE 20 ORGAN TRANSPLANTATION PROCEDURES PERFORMED WORLDWIDE, BY ORGAN TYPE (2017)

TABLE 88 BIOPRESERVATION MARKET FOR ORGANS, BY REGION, 2018–2025 (USD MILLION)

TABLE 89 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR ORGANS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 90 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR ORGANS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 91 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR ORGANS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 92 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR ORGANS, BY REGION, 2018–2025 (USD MILLION)

7.4 STEM CELLS

7.4.1 ADVANCEMENTS IN THE FIELD OF STEM CELL THERAPY TO SUPPORT MARKET GROWTH

TABLE 93 BIOPRESERVATION MARKET FOR STEM CELLS, BY REGION, 2018–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR STEM CELLS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 95 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR STEM CELLS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 96 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR STEM CELLS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 97 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR STEM CELLS, BY REGION, 2018–2025 (USD MILLION)

7.5 OTHER BIOSPECIMENS

TABLE 98 BIOPRESERVATION MARKET FOR OTHER BIOSPECIMENS, BY REGION, 2018–2025 (USD MILLION)

TABLE 99 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER BIOSPECIMENS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 100 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER BIOSPECIMENS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER BIOSPECIMENS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 102 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER BIOSPECIMENS, BY REGION, 2018–2025 (USD MILLION)

8 BIOPRESERVATION MARKET, BY APPLICATION (Page No. - 106)

8.1 INTRODUCTION

TABLE 103 BIOPRESERVATION MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

8.2 THERAPEUTIC APPLICATIONS

8.2.1 INCREASING UTILIZATION OF STEM CELLS FOR THE TREATMENT OF DISEASES IS DRIVING MARKET GROWTH

TABLE 104 BIOPRESERVATION MARKET FOR THERAPEUTIC APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 105 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR THERAPEUTIC APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 106 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR THERAPEUTIC APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 107 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR THERAPEUTIC APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 108 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR THERAPEUTIC APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

8.3 RESEARCH APPLICATIONS

8.3.1 GOVERNMENT INITIATIVES WILL SUPPORT THE GROWTH OF THIS APPLICATION SEGMENT

TABLE 109 BIOPRESERVATION MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 110 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 111 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 112 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 113 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

8.4 CLINICAL TRIALS

8.4.1 GROWING NUMBER OF CLINICAL TRIALS IN THE ASIA PACIFIC REGION TO SUPPORT MARKET GROWTH

TABLE 114 BIOPRESERVATION MARKET FOR CLINICAL TRIALS, BY REGION, 2018–2025 (USD MILLION)

TABLE 115 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR CLINICAL TRIALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 116 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR CLINICAL TRIALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 117 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR CLINICAL TRIALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 118 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR CLINICAL TRIALS, BY REGION, 2018–2025 (USD MILLION)

8.5 OTHER APPLICATIONS

TABLE 119 BIOPRESERVATION MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 120 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 121 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 122 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 123 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

9 BIOPRESERVATION MARKET, BY END USER (Page No. - 116)

9.1 INTRODUCTION

TABLE 124 BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

9.2 BIOBANKS

9.2.1 INCREASING RESEARCH IN THE FIELD OF PERSONALISED MEDICINE WILL DRIVE MARKET GROWTH

TABLE 125 BIOPRESERVATION MARKET FOR BIOBANKS, BY REGION, 2018–2025 (USD MILLION)

TABLE 126 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR BIOBANKS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 127 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR BIOBANKS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 128 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR BIOBANKS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 129 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR BIOBANKS, BY REGION, 2018–2025 (USD MILLION)

9.3 GENE BANKS

9.3.1 GROWING NUMBER OF GENE BANKS TO SUPPORT MARKET GROWTH

TABLE 130 BIOPRESERVATION MARKET FOR GENE BANKS, BY REGION, 2018–2025 (USD MILLION)

TABLE 131 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR GENE BANKS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 132 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR GENE BANKS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 133 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR GENE BANKS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 134 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR GENE BANKS, BY REGION, 2018–2025 (USD MILLION)

9.4 HOSPITALS

9.4.1 GROWING NUMBER OF ORGAN TRANSPLANT PROCEDURES TO SUPPORT MARKET GROWTH

TABLE 135 BIOPRESERVATION MARKET FOR HOSPITALS, BY REGION, 2018–2025 (USD MILLION)

TABLE 136 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 137 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 138 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 139 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR HOSPITALS, BY REGION, 2018–2025 (USD MILLION)

9.5 OTHER END USERS

TABLE 140 BIOPRESERVATION MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

TABLE 141 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 142 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 143 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 144 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

10 BIOPRESERVATION MARKET, BY REGION (Page No. - 126)

10.1 INTRODUCTION

TABLE 145 BIOPRESERVATION MARKET, BY REGION, 2018–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: BIOPRESERVATION MARKET SNAPSHOT

TABLE 146 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 147 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 148 NORTH AMERICA: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 149 NORTH AMERICA: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 150 NORTH AMERICA: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 151 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 152 NORTH AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 153 NORTH AMERICA: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.2.1 US

10.2.1.1 The US dominates the global biopreservation media and equipment market

TABLE 154 US: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 155 US: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 156 US: BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 157 US: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 158 US: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 159 US: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 160 US: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Government funding for research and innovation to support market growth

TABLE 161 CANADA: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 162 CANADA: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 163 CANADA: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 164 CANADA: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 165 CANADA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 166 CANADA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 167 CANADA: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3 EUROPE

TABLE 168 EUROPE: BIOPRESERVATION MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 169 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 170 EUROPE: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 171 EUROPE: BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 172 EUROPE: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 173 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 174 EUROPE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 175 EUROPE: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Germany is the largest market for biopreservation media and equipment in Europe

TABLE 176 GERMANY: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 177 GERMANY: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 178 GERMANY: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 179 GERMANY: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 180 GERMANY: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 181 GERMANY: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 182 GERMANY: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Advances in research activities are supporting market growth

TABLE 183 FRANCE: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 184 FRANCE: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 185 FRANCE: BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 186 FRANCE: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 187 FRANCE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 188 FRANCE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 189 FRANCE: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.3 UK

10.3.3.1 High R&D expenditure to drive the biopreservation media and equipment market in the UK

TABLE 190 UK: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 191 UK: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 192 UK: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 193 UK: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 194 UK: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 195 UK: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 196 UK: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Growth in this market is driven by an increase in life sciences research projects

TABLE 197 ITALY: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 198 ITALY: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 199 ITALY: BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 200 ITALY: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 201 ITALY: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 202 ITALY: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 203 ITALY: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Spain has an established network of research centers, universities, and hospitals

FIGURE 22 ORGAN DONATIONS IN SPAIN (2017)

TABLE 204 SPAIN: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 205 SPAIN: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 206 SPAIN: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 207 SPAIN: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 208 SPAIN: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 209 SPAIN: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 210 SPAIN: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.6 REST OF EUROPE (ROE)

TABLE 211 ROE: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 212 ROE: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 213 ROE: BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 214 ROE: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 215 ROE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 216 ROE: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 217 ROE: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: BIOPRESERVATION MARKET SNAPSHOT

TABLE 218 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 219 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 220 ASIA PACIFIC: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 221 ASIA PACIFIC: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 222 ASIA PACIFIC: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 223 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 224 ASIA PACIFIC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 225 ASIA PACIFIC: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing life sciences research to support market growth

TABLE 226 CHINA: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 227 CHINA: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 228 CHINA: BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 229 CHINA: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 230 CHINA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 231 CHINA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 232 CHINA: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Government initiatives to support market growth in Japan

TABLE 233 JAPAN: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 234 JAPAN: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 235 JAPAN: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 236 JAPAN: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 237 JAPAN: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 238 JAPAN: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 239 JAPAN: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Increasing investments in research activities to support market growth

TABLE 240 INDIA: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 241 INDIA: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 242 INDIA: BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 243 INDIA: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 244 INDIA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 245 INDIA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 246 INDIA: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Increasing investments in research activities to offer significant growth opportunities for market players in Australia

TABLE 247 AUSTRALIA: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 248 AUSTRALIA: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 249 AUSTRALIA: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 250 AUSTRALIA: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 251 AUSTRALIA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 252 AUSTRALIA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 253 AUSTRALIA: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC (ROAPAC)

TABLE 254 ROAPAC: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 255 ROAPAC: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 256 ROAPAC: BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 257 ROAPAC: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 258 ROAPAC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 259 ROAPAC: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 260 ROAPAC: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

TABLE 261 ROW: BIOPRESERVATION MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 262 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 263 ROW: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 264 ROW: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 265 ROW: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 266 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 267 ROW: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 268 ROW: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.5.1 LATIN AMERICA

10.5.1.1 Increasing research in the field of stem cell to support market growth in Latin America

TABLE 269 LATIN AMERICA: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 270 LATIN AMERICA: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 271 LATIN AMERICA: BIOPRESERVATION INDUSTRY, BY TYPE, 2018–2025 (USD MILLION)

TABLE 272 LATIN AMERICA: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 273 LATIN AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 274 LATIN AMERICA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 275 LATIN AMERICA: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Government investments in the healthcare sector and growing biotechnology industry to drive market growth in the region

TABLE 276 MEA: BIOPRESERVATION MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 277 MEA: BIOPRESERVATION MEDIA MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 278 MEA: BIOPRESERVATION EQUIPMENT MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 279 MEA: TEMPERATURE CONTROL SYSTEMS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 280 MEA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY BIOSPECIMEN, 2018–2025 (USD MILLION)

TABLE 281 MEA: BIOPRESERVATION MEDIA & EQUIPMENT MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 282 MEA: BIOPRESERVATION MARKET, BY END USER, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 183)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 24 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCHES IS THE MAJOR STRATEGY ADOPTED BY KEY MARKET PLAYERS

11.3 MARKET SHARE ANALYSIS

FIGURE 25 BIOPRESERVATION MARKET RANKING IN 2019

11.4 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET) (2019)

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

11.4.4 EMERGING COMPANIES

FIGURE 26 COMPETITIVE LEADERSHIP MAPPING: BIOPRESERVATION MARKET

11.5 KEY DEVELOPMENTS IN THE BIOPRESERVATION MARKET

11.5.1 KEY AGREEMENTS

TABLE 283 AGREEMENTS (2017–2020)

11.5.2 KEY PRODUCT LAUNCHES

TABLE 284 PRODUCT LAUNCHES (2017–2020)

11.5.3 KEY ACQUISITIONS

TABLE 285 ACQUISITIONS (2017–2020)

11.5.4 KEY EXPANSIONS

TABLE 286 EXPANSIONS (2017–2020)

12 COMPANY PROFILES (Page No. - 189)

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1 THERMO FISHER SCIENTIFIC, INC.

FIGURE 27 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2019)

12.2 MERCK KGAA

FIGURE 28 MERCK KGAA: COMPANY SNAPSHOT (2019)

12.3 AVANTOR, INC.

FIGURE 29 AVANTOR, INC.: COMPANY SNAPSHOT (2019)

12.4 THERMOGENESIS HOLDINGS, INC.

FIGURE 30 THERMOGENESIS HOLDINGS, INC.: COMPANY SNAPSHOT (2019)

12.5 BIO-TECHNE CORPORATION

FIGURE 31 BIO-TECHNE CORPORATION: COMPANY SNAPSHOT (2019)

12.6 BIOLIFE SOLUTIONS, INC.

FIGURE 32 BIOLIFE SOLUTIONS, INC.: COMPANY SNAPSHOT (2018)

12.7 EXACT SCIENCES CORPORATION

FIGURE 33 EXACT SCIENCES CORPORATION: COMPANY SNAPSHOT (2019)

12.8 WORTHINGTON INDUSTRIES, INC.

FIGURE 34 WORTHINGTON INDUSTRIES, INC.: COMPANY SNAPSHOT (2019)

12.9 CHART INDUSTRIES, INC.

FIGURE 35 CHART INDUSTRIES, INC.: COMPANY SNAPSHOT (2019)

12.10 SO-LOW ENVIRONMENTAL EQUIPMENT CO., INC.

12.11 PRINCETON CRYOTECH, INC.

12.12 BIOCISION, LLC.

12.13 SHANGHAI GENEXT MEDICAL TECHNOLOGY CO., LTD.

12.14 PHC HOLDINGS CORPORATION

12.15 HELMER SCIENTIFIC, INC.

12.16 ARCTIKO

12.17 NIPPON GENETICS EUROPE

12.18 STEMCELL TECHNOLOGIES, INC.

12.19 AMS BIOTECHNOLOGY (AMSBIO)

12.20 OPS DIAGNOSTICS

*Business Overview, Products Offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 224)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

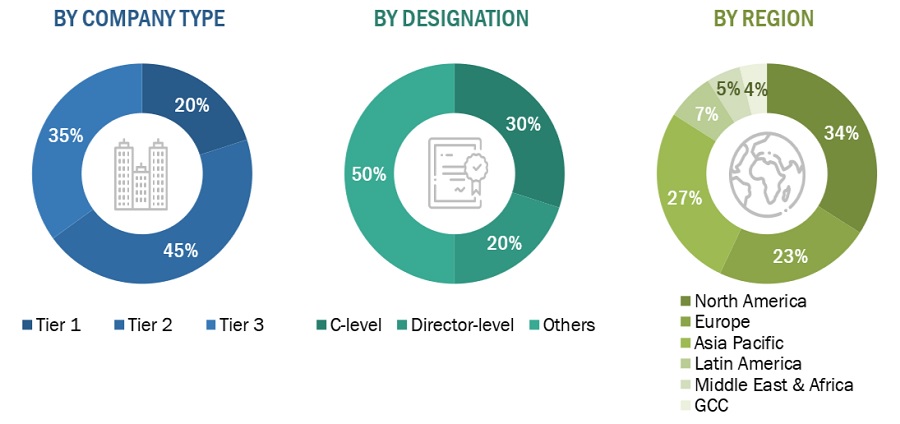

The biopreservation media and equipment market study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the biopreservation media and equipment market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the biopreservation media and equipment market. Primary sources from the demand side included industry experts, such as researchers & scientists. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The biopreservation media and equipment market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by technology, application, and region).

Data Triangulation

After arriving at the market size, the biopreservation media and equipment market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments.

Objectives of the Study

- To define, describe, and forecast the biopreservation media and equipment market on the basis of system type, product, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast revenue of the market segments with respect to four main regional segments, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their market shares and core competencies3 in terms of market developments and growth strategies

- To track and analyze competitive developments such as agreements, partnerships, expansions, acquisitions, and product launches in the biopreservation media and equipment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Biopreservation Market