Blood Culture Tests Market Size by Method (Conventional, Automated), Product (Consumables, Instruments), Technology (Culture, Molecular, Proteomics), Application (Bacteremia, Fungemia), End User (Hospitals, Reference Labs) & Region- Global Forecast to 2028

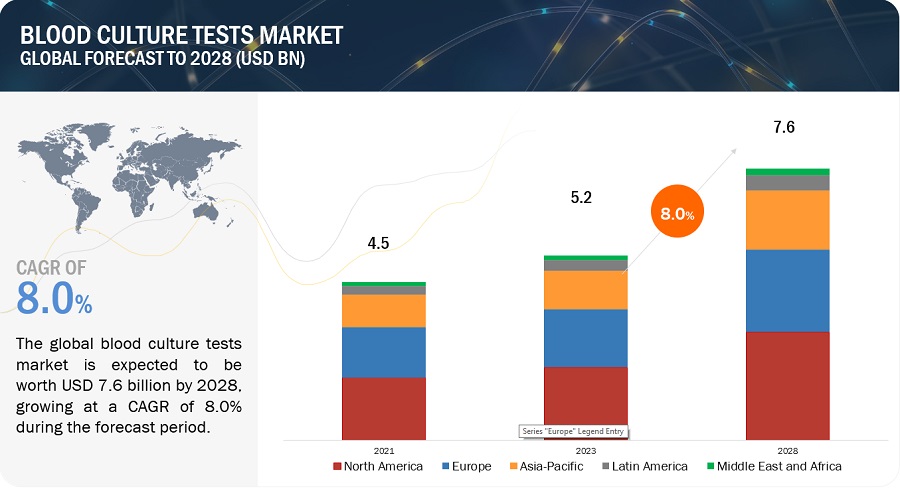

The size of global blood culture tests market in terms of revenue was estimated to be worth $5.2 billion in 2023 and is poised to reach $7.6 billion by 2028, growing at a CAGR of 8.0% from 2023 to 2028. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The expansion of this market is primarily propelled by high incidence of bloodstream infections, growing demand for rapid diagnostic techniques and high prevalence of infectious diseases, rising geriatric population, growing incidence of sepsis cases and high cost treatment. On the other hand, high cost of automated instruments and lack of trained laboratory technicians are expected to restrain the market growth to some extent in the coming years.

Global Blood Culture Tests Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Blood Culture Tests Market Dynamics

Driver: Growing incidence of sepsis cases and high cost of treatment

Sepsis is a medical condition in which the body is prone to severe inflammatory responses to fungal and bacterial infections. Patients with chronic illness, implanted devices, and those with suppressed immune systems are more prone to growing sepsis.

Sepsis is considered a significant global socioeconomic burden as sepsis and septic shock are associated with a high morbidity rate (which may result in a prolonged hospital stay and increase the associated healthcare costs) and mortality rate. According to the Centre of Disease Control and Prevention (CDC), every year in the US, sepsis leads to more deaths than opioid overdoses, prostate cancer and breast cancer combined.

Restraint: Lack of trained laboratory technicians

Advancements in the technology in blood culture tests have increased their adoption among hospital and reference laboratories, which are major end users of these tests. Clinical guidelines and clinician education influence how diagnostic tests are incorporated into clinical practices. For providing improved patient care, it becomes necessary to engage a clinician’s expertise to determine the best diagnostic tests and interpret correct laboratory results. As the level of awareness about the latest technological advancements in blood culture tests is low among technicians (especially in emerging economies), the adoption of advanced technologies is restricted to a great extent. This is limiting the use of best diagnostic practices and restraining the greater uptake of technologically advanced products.

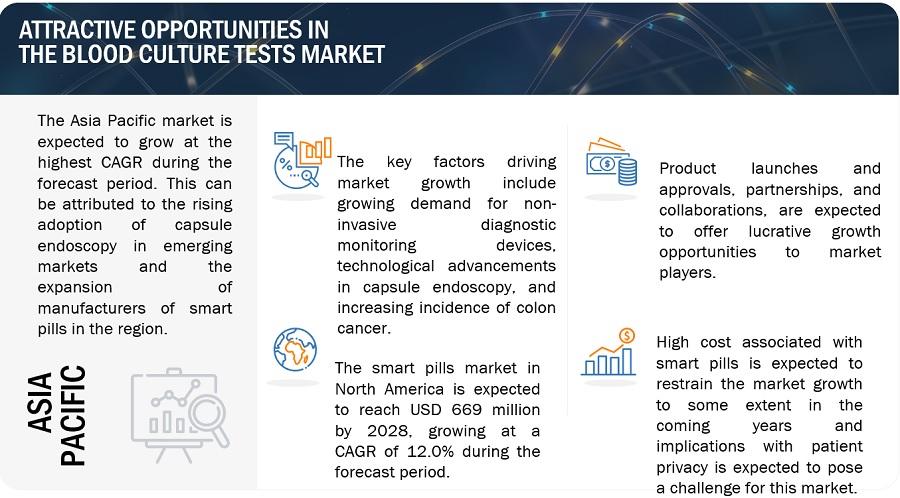

Opportunity: Growth opportunities in emerging economies

Growing countries such as China, India, Brazil, South Korea, Turkey, South Africa and Russia are expected to offer significant growth opportunities to market players during the forecast period. The economic boom over the last few years in these countries is expected to boost the growth of the healthcare sector and create growth opportunities for players operating in the blood culture test market.

Such significant spending will result in the adoption of advanced systems, such as automated blood culture systems, among hospital and reference laboratories in these regions. This, in turn, is expected to provide potential growth opportunities for players operating in the blood culture tests market in the future.

Challenge: Market Cannibalization for conventional products

In recent years, several technologically advanced products that provide enhanced solutions for the detection of microorganisms present in the bloodstream have been launched in the market. These advanced products are expected to cannibalize the market for conventional products, such as microscopes and polystainers, thereby affecting the growth of conventional blood culture testing products. To maintain a competitive position in the market, players need to diversify their product portfolio by adopting new technologies. This will be a challenging task for the market players who have an established portfolio of conventional products to discard all their available products.

Ecosystem Mapping: Blood Culture Tests Market

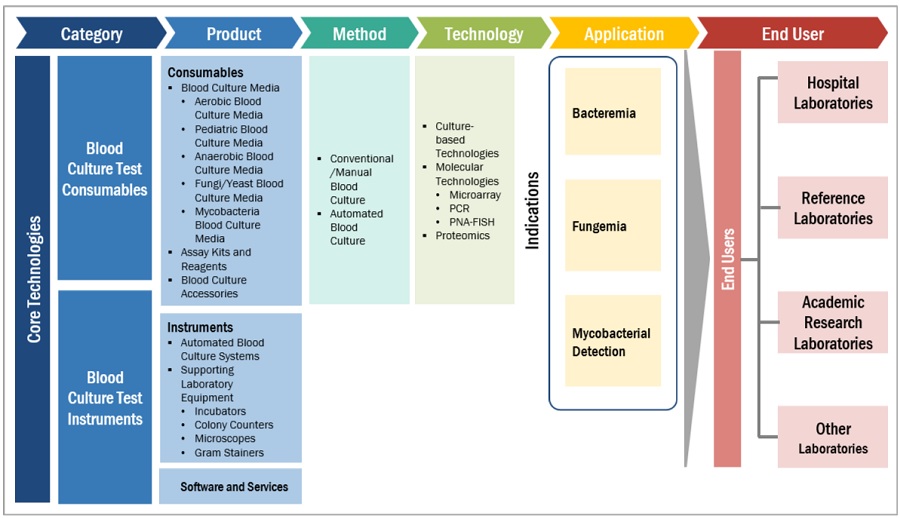

The conventional/manual blood culture segment has accounted for the largest share of the blood culture tests industry during the forecast period.

Based on method, the blood culture tests market is divided into conventional/manual blood culture and automated blood culture methods. The largest share of the market is covered by conventional/manual blood culture methods segment. The large share of this segment can be attributed to ease of using conventional systems. Also, conventional systems do not require the purchase of expensive instruments.

The consumables segment has accounted for the largest share of the blood culture tests industry during the forecast period.

Based on products, the blood culture tests market is segmented into software & services, consumables; and instruments. The largest share of the market is covered by the consumables segment. This is due to the repeated purchase of media for the detection of bacteria, fungi, and yeast.

The culture-based technologies segment has accounted for the largest share of the blood culture tests industry during the forecast period.

Based on technology, the blood culture tests market is segmented into culture-based technologies, molecular technologies, and proteomics. The culture-based technologies segment accounted for the high growth in the global market. The reasons for this are the increasing incidence of sepsis, which demands rapid diagnostic techniques for detecting the presence of bacteria, fungi, and mycobacteria from blood samples.

The bacteremia segment has accounted for the largest share of the blood culture tests industry during the forecast period.

Based on application, the blood culture tests market is divided into bacteremia, fungemia, and mycobacterial detection. Bacteremia segment is accounted for the largest share in the market. The reasons for this are the increasing number of bloodstream infections and the growing number of sepsis cases worldwide.

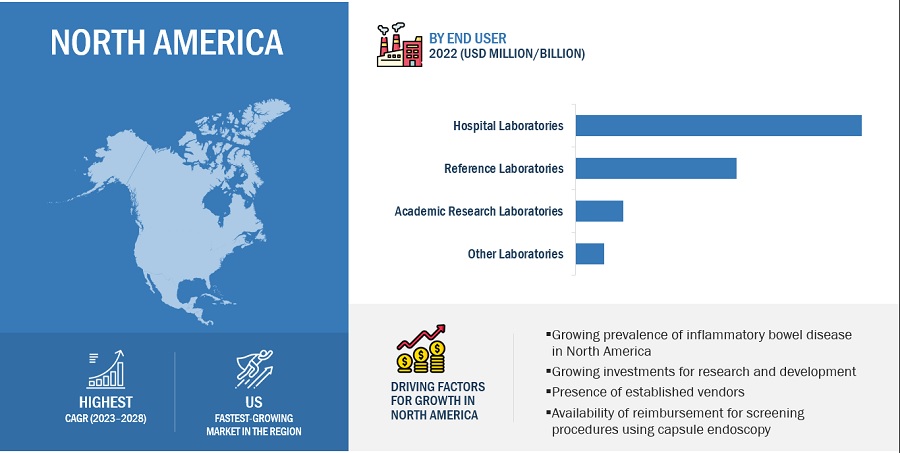

The hospital laboratories segment has accounted for the largest share of the blood culture tests industry during the forecast period.

Based on end users, the blood culture tests market is bifurcated into hospital laboratories, academic research laboratories, reference laboratories, and other laboratories (includes bacteriological laboratories, physician office laboratories (POLs), independent research laboratories and pathology laboratories). The hospital laboratories segment has accounted for the largest share in the global market. The reason for this is the rising number of sepsis cases in emergency departments (EDs), as sepsis is most commonly observed in EDs.

North America accounted for the largest share of the blood culture tests industry.

Based on region, the blood culture tests market is segmented into North America, Europe, the Asia Pacific(APAC), and the Middle East & Africa. North America has accounted for the largest market share. The reasons for this are the significant presence of blood culture test providers, growing product approvals, the increasing incidence of bloodstream infections, high prevalence of infectious diseases and rapidly rising geriatric population.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in blood culture tests market are Biobase Biotech (Jinan) Co., Ltd. (China), Scenker Biological Technology Co., Ltd. (China), Bulldog Bio (England), Anaerobe Systems, Inc. (US), Himedia Laboratories Pvt. Ltd. (India), Autobio Diagnostics Co., Ltd. (China), Axiom Laboratories (India), Iridica (US), Biosystems, Inc (US), BINDER GmBH (Germany), Terumo Corporation (Japan), Becton, Dickinson and Company (US), BioMérieux (France), Thermo Fisher Scientific Inc. (US), Danaher (US), Luminex Corporation (US), Bruker (US), Roche Diagnostics (Switzerland), Mikroscan Technologies, Inc. (US), Labotronics Ltd. (UK), Hardy Diagnostics (US), OpGen, Inc. (US), Meditech Technologies India Private Limited (India), Carl Zeiss AG (Germany) and Nikon Corporation (Japan).

Scope of the Blood Culture Tests Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$5.2 billion |

|

Projected Revenue Size by 2028 |

$7.6 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 8.0% |

|

Market Driver |

Growing incidence of sepsis cases and high cost of treatment |

|

Market Opportunity |

Growth opportunities in emerging economies |

This research report categorizes the blood culture tests market to forecast revenue and analyze trends in each of the following submarkets:

By Method

- Conventional/Manual Methods

- Automated Methods

By Product

-

Consumables

-

Blood Culture Media

- Aerobic Blood Culture Media

- Pediatric Aerobic Blood Culture Media

- Anaerobic Blood Culture Media

- Mycobacterial Blood Culture Media

- Fungi/Yeast Blood Culture Media

- Assay Kits & Reagents

- Blood Culture Accessories

-

Blood Culture Media

-

Instruments

- Automated Blood Culture Systems

-

Supporting Laboratory Equipment

- Incubators

- Colony Counters

- Microscopes

- Gram Stainers

- Software and Services

By Technology

- Culture-Based Technology

-

Molecular Technologies

- Microarrays

- PCR (Polymerase Chain Reaction)

- PNA-FiSH (Peptide Nucleic Acid – Fluroscent in Situ Hybridization)

- Proteomics Technology

By Application

- Bacteremia

- Fungemia

- Mycobacterial Detection

By End User

- Hospital Laboratories

- Reference Laboratories

- Academic Research Laboratories

- Other Laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments of Blood Culture Tests Industry

- In 2023, BioMérieux, announced that it has submitted a 510(k) premarket notification to the US Food and Drug Administration (FDA) for the VITEK REVEAL, formerly known as SPECIFIC REVEALRapid AST System. This rapid, modular, antimicrobial-susceptibility test platform that can deliver actionable results for Gram-negative bacteria directly from positive blood cultures in an average of five and a half hours1 enabling same-day treatment decision-making for patients suffering from bacteremia sepsis.

- In 2023, Bruker introduces fast next-generation MALDI Biotyper IVD Software. The MBT Compass HT IVD software provides a high sample throughput for microbial identification with time-to-result of ~5 minutes for 96 sample spots. Because of a fast sample target exchange, the MBT system can now analyze up to 600 samples per hour, while covering over 4,600 species in the reference library.

- In 2022, BioMérieux, a world leader in the field of in vitro diagnostics, has entered into an agreement to acquire Specific Diagnostics, a privately held US based company that has developed a rapid antimicrobial susceptibility test (AST) system that delivers phenotypic AST directly from positive blood cultures. BioMérieux has held a minority stake in Specific Diagnostics since 2019, and the two companies had signed a co-distribution agreement covering the European market in 2021. With the addition of SPECIFIC REVEAL Rapid AST, the unique and comprehensive BioMérieux Sepsis Solution allows same-day AST results for Gram-negative bacteria to enable more targeted therapy and improve patient outcomes.

- In 2022, Beckman Coulter, partnered with Germany-based company Smart4Diagnostics to close the preanalytical data gap between blood collection and laboratory analysis due to errors that take place before the sample arrives in the laboratory, such as sample collection, patient identification, sample handling, sample transportation, sample loss, etc.

- In 2020, Becton, Dickinson and Company obtained the CE mark approval for the BD Vacutainer UltraTouch Push Button Blood Collection Set (BCS) with Preattached Holder. The one-handed safety activation of the push button allows clinicians to activate the safety mechanism while still attending to the patient and venipuncture site.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global blood culture tests market?

The global blood culture tests market boasts a total revenue value of $7.6 billion by 2028.

What is the estimated growth rate (CAGR) of the global blood culture tests market?

The global blood culture tests market has an estimated compound annual growth rate (CAGR) of 8.0% and a revenue size in the region of $5.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved three major activities in estimating the size of the blood culture tests market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), American Society for Gastrointestinal Endoscopy (ASGE), International Federation of Societies of Endoscopic Surgeons (IFSES), Asia-Pacific Association for Gynecologic Endoscopy and Minimally Invasive Therapy (APAGE), European Society of Gastrointestinal Endoscopy (ESGE), Centers for Disease Control and Prevention (CDC), Organisation for Economic Co-operation and Development (OECD), Food and Drug Administration (FDA), Centers for Disease Control and Prevention (CDC), European Medicines Agency (EMA), Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical decision support system market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

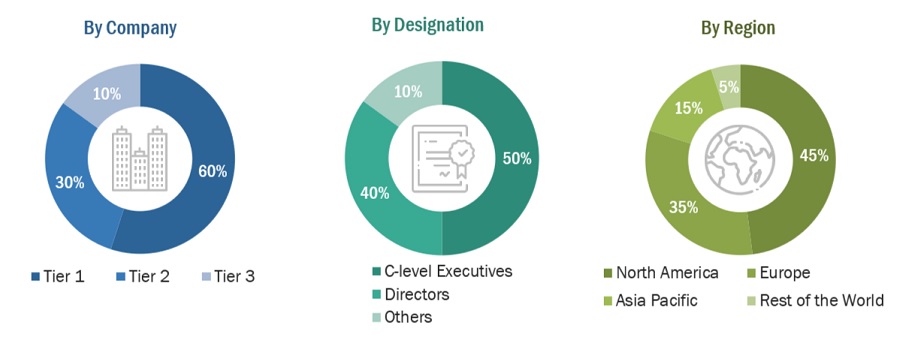

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the blood culture tests market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of Primary Interviews

Note 1: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Bottom-up approaches was used to estimate and validate the total size of the blood culture tests market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Approach 1: Revenue Share Analysis

Revenues of individual companies were gathered from public sources and databases.

Shares of the blood culture tests business of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the blood culture tests business was ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, and geographic reach and strength.

Individual shares or revenue estimates were validated through expert interviews.

The following figure shows an illustrative representation of the overall market size estimation process employed for this study.

To know about the assumptions considered for the study, Request for Free Sample Report

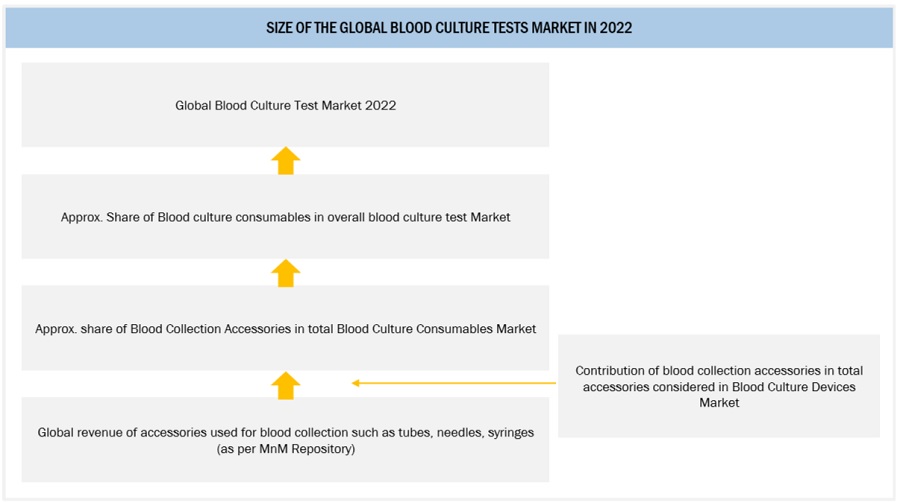

Approach 2: Segmental Extrapolation

Revenue of Accessories such as tubes, needles, and syringes used in blood collection and testing for 2022 was considered referring to the MnM repository.

Considering the contribution of blood collection accessories in the accessories considered for blood culture testing, specific revenue for tubes, needles and syringes (Accessories) was determined.

Estimating the share of blood culture accessories in total blood culture consumables, overall revenue of blood culture consumables was determined for 2022, which was further extrapolated to estimate the global blood culture tests market in 2022.

Segmental EXTRAPOLATION: global blood culture tests market 2022

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the provider, payer, and other industries.

Market Definition

Blood culture testing detects the presence of microbes such as bacteria, yeast, and other microorganisms in a blood specimen. This type of testing determines the nature and severity of blood infections, identifies the causative organisms of blood infections, and helps prevent adverse consequences.

Key Stakeholders

- Molecular diagnostics companies

- Clinical microbiology instrument and consumable manufacturers

- Research and consulting firms

- Clinical diagnostic laboratories

- Healthcare institutions (hospitals, medical schools, group practices, individual surgeons, and governing bodies)

- Medical device vendors/service providers

- Research institutes

- Venture capitalists and investors

Report Objectives

- To define, describe, and forecast the blood culture tests market based on the application,product, method, technology,end user and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges).

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall blood culture tests market.

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, and the Middle East & Africa.

- To strategically analyze the market structure and profile the key players and their core competencies2 in the global blood culture tests market.

- To track and analyze competitive developments such as product launches and approvals, contracts, acquisitions, partnerships, and agreements in the blood culture tests market.

Customization Options

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix: Detailed comparison of the product portfolios of the top companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Blood Culture Tests Market