Wireless Broadband in Public Safety Market by Offering (Hardware, Software, Service), Technology (Mobile Wireless Broadband, Fixed Wireless Broadband, Satellite Wireless Broadband), End User, Application and Region - Global Forecast to 2029

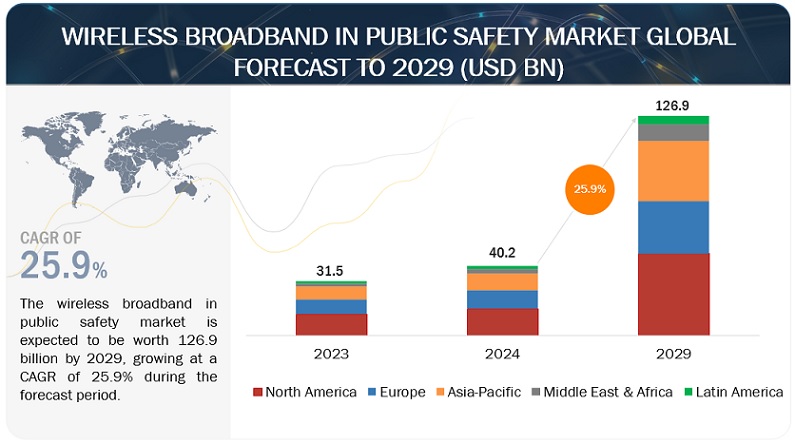

[270 Pages Report] The wireless broadband in public safety market is estimated to be worth USD 40.2 billion in 2024 and is projected to reach USD 126.9 billion by 2029, at a Compound Annual Growth Rate (CAGR) of 25.9% during the forecast period. The wireless broadband in public safety market is expected to surge in the coming years substantially. This growth is fueled by several key trends, such as the rise of connected devices and integrated sensors, the growing focus on public safety and security, the emergence of next-generation technologies, and improved accessibility in remote areas. These factors will combine to create a booming market for wireless broadband, making them an essential tool for public safety providers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Wireless broadband in public safety Market Trends

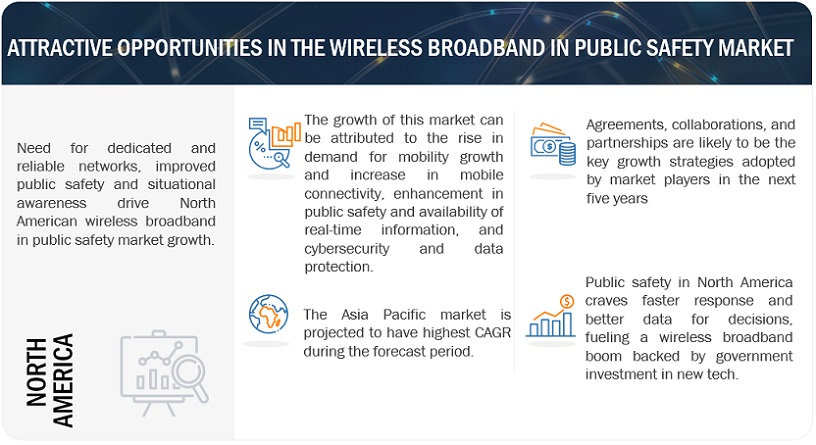

Driver: Mobility growth and increase in mobile connectivity driving the growth of the wireless broadband in public safety market

A significant factor driving the growth of the wireless broadband market in the public safety domain is the combination of rising mobile device usage and increased mobile connectivity. The widespread adoption of smartphones has led to an exponential demand for dependable, high-speed data access, a trend that extends to the range of public safety. This translates to a critical need for first responders, such as firefighters, law enforcement personnel, and emergency medical technicians, to possess constant connectivity. Wireless broadband technology empowers these professionals to maintain communication channels and share vital information in real-time, even in geographically isolated areas or during rapidly evolving emergency situations. For instance, a firefighter receiving live video feeds from within a burning structure, or a police officer on patrol accessing a suspect's background data instantaneously. These represent just a small-scale version of the ways in which robust wireless broadband boosts response times, enhances situational awareness, and ultimately strengthens public safety initiatives.

Restraint: Network congestion in critical situations

Network congestion is a critical constraint specific to the public safety wireless broadband market. During emergencies or large events, a sudden surge in communication demands, combined with outdated infrastructure or insufficient bandwidth, can overwhelm the network. This leads to consequences like delayed response times, dropped calls, and limited access to crucial resources for first responders. Mitigating congestion requires a multi-branched approach that prioritizes critical public safety traffic, invests in network upgrades, utilizes temporary solutions like mobile cell sites, and implements traffic management strategies like throttling. Addressing this challenge through careful planning, technological investment, and traffic management is crucial for ensuring reliable communication and effective emergency response in the public safety sector.

Opportunity: Enhancing next-generation technologies and availability of wireless broadband in rural areas

The development of next-generation technology is of extreme necessity for all regions, especially during post-pandemic times. Since the epidemic, many enterprises have changed their working strategy, and many employees took this opportunity to leave big cities for more rural destinations. This presents a significant economic opportunity for rural communities, but only in those areas that can offer the residents access to robust broadband internet. According to a study by satellite.com, 67% of employees identified that internet availability affects their decisions, and 36% said a lack of access to broadband internet is preventing them from making a move. High-speed internet will be a game-changer for rural economies towards safety since an increase in broadband usage will increase the acceptance rate of public safety applications. According to FCC’s broadband progress report, 19 million Americans still do not have access to wireless broadband. This creates a scale of opportunities for countries across various regions to expand wireless broadband to rural areas to strengthen internet usage for various public safety purposes and can revolutionize emergency response through faster communication and real-time data sharing, improve law enforcement efficiency through data-driven resource allocation and improved officer safety, and strengthen community preparedness by facilitating rapid emergency alerts and public safety education initiatives.

Challenge:Integrating cutting-edge tech with legacy systems creates compatibility hurdles for public safety broadband

Compatibility issues with wireless broadband in the public safety scope arise when new technologies don't integrate seamlessly with older systems. For instance, a police department might want to deploy drones for aerial surveillance but find that their existing network doesn't support the drone's transmission standards. This leads to potentially wasted investment. Additionally, legacy public safety devices like radios may operate on different frequencies and technologies than the broadband network. This incompatibility forces agencies to either replace older infrastructure entirely, incurring substantial costs, or find complicated workarounds that compromise the efficiency of their entire system.

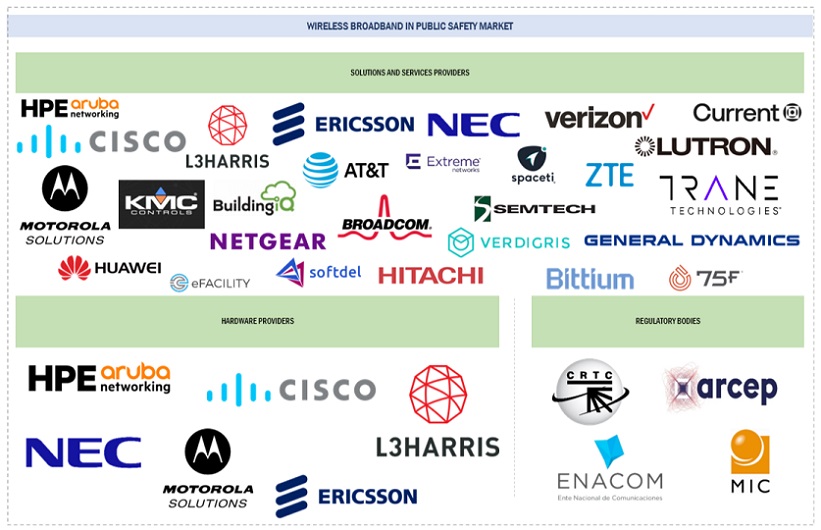

Ecosystem Of Wireless Broadband In Public Safety Market

The prominent players in the wireless broadband in public safety market include AT&T (US), Verizon Communications Inc (US), Cisco Systems, Inc (US), Ericsson (Sweden), Huawei Technologies Co. Ltd (China), Broadcom (US), HPE Aruba Networks (US), Extreme Networks (US), and so on. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies with a well-established geographic footprint.

"By end user, critical infrastructure operators segment to hold the largest market size during the forecast period.”

The critical infrastructure operators segment is estimated to dominate the wireless broadband in public safety market throughout the 2024-2029 forecast period. Reliable and secure communication networks are paramount for critical infrastructure operators, and wireless broadband precisely delivers that. It empowers operators managing power plants, water treatment facilities, and transportation systems to continuously monitor and control critical systems while facilitating seamless emergency response coordination. Furthermore, the increasing adoption of smart grid technologies and Internet of Things (IoT) applications within critical infrastructure sectors necessitates high bandwidth and low latency for effective operation, a capability that wireless broadband inherently possesses. Finally, stricter government regulations mandating the use of advanced communication technologies for public safety are driving wireless broadband integration in critical infrastructure. These regulations demand a level of performance and security that wireless broadband can provide, ensuring compliance for critical infrastructure operators. Consequently, this confluence of factors is expected to generate significant growth in the demand for wireless broadband solutions within the critical infrastructure operator segment over the coming years.

“Video surveillance and monitoring segment is expected to have the fastest growth rate during the forecast period.”

The video surveillance and monitoring segment is projected to exhibit the most rapid growth within the wireless broadband in public safety market during the 2024-2029 forecast period. This surge is attributed to a multitude of factors. Wireless broadband empowers real-time video transmission from public area cameras, enhancing public safety through crime deterrence and swift apprehension. Furthermore, real-time video feeds boost situational awareness for first responders, enabling remote assessment, strategic response planning, and officer safety prioritization during critical situations. Integration with video analytics software fosters automated detection of suspicious activities, optimizing resource allocation and response efficiency. Wireless video surveillance systems are becoming increasingly cost-effective and scalable, making them a suitable solution for budget-conscious public safety agencies seeking to expand their surveillance reach. The expanding trend of urbanization, coupled with escalating public safety concerns, necessitates powerful tools like video surveillance for deterring crime and maintaining order in densely populated areas.

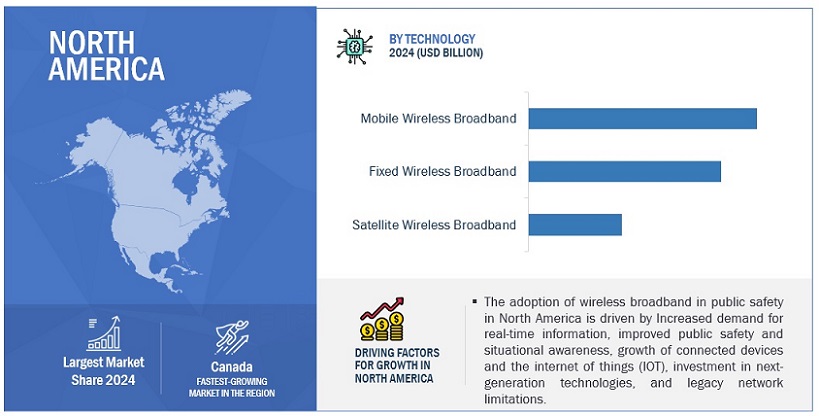

“North America to have the largest market size during the forecast period.”

North America is poised to retain the largest market share in the wireless broadband for public safety market during the 2024-2029 forecast period. This dominance is driven by a confluence of factors, including substantial government funding and initiatives in North America, particularly the US, to foster research and development of new solutions and incentivize public safety agencies' adoption. Secondly, the region boasts a well-developed telecommunications infrastructure, providing a robust foundation for deploying advanced wireless broadband technologies. Thirdly, heightened public safety concerns elevate the demand for advanced communication tools, accelerating the integration of wireless broadband solutions. Fourthly, North America's established industry players drive innovation and facilitate the rapid adoption of new solutions. Finally, a mature regulatory environment ensures system interoperability, fostering seamless communication across public safety agencies.

Market Players:

The major players in the wireless broadband in public safety AT&T (US), Verizon Communications Inc (US), Cisco Systems, Inc (US), Ericsson (Sweden), Huawei Technologies Co. Ltd (China), Broadcom (US), HPE Aruba Networking (US), Extreme Networks (US), Juniper Networks (US), Motorola Solutions (US), NEC Corporation (Japan), Netgear, Inc (US), Semtech Corporation (US), ZTE Corporation (China), General Dynamics Corporation (US), L3Harris Technologies, Inc (US), Bittium Corporation (Finland), Hughes Network Systems, LLC (US), Hytera Communications Corporation (China), Cambium Networks Limited (US), Infinet Wireless (North Holland), Netronics Networks (Canada), Proxim Wireless (US), Radwin (Israel), Aviat Networks, Inc (US), Knightscope (US), Parallel Wireless (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their passenger information system market footprint.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD) Billion |

|

Segments Covered |

By offering (hardware, software, service), technology (mobile wireless broadband, fixed wireless broadband, satellite wireless broadband), end user (first responders, critical infrastructure operators, other end users), application (critical communications, video surveillance and monitoring, automated vehicle tracking, geographic information system, other applications) |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

|

Companies covered |

AT&T(US), Verizon Communications Inc (US), Cisco Systems, Inc (US), Ericsson (Sweden), Huawei Technologies Co. Ltd (China), Broadcom (US), HPE Aruba Networks (US), Extreme Networks (US), Juniper Networks (US), Motorola Solutions (US), NEC Corporation (Japan), Netgear, Inc (US), Semtech Corporation (US), ZTE Corporation (China), General Dynamics Corporation (US), L3Harris Technologies, Inc (US), Bittium Corporation (Finland), Hughes Network Systems, LLC (US), Hytera Communications Corporation (China), Cambium Networks Limited (US), Infinet Wireless (Netherlands), Netronics Networks (Canada), Proxim Wireless (US), Radwin (Israel), Aviat Networks, Inc (US), Knightscope (US), Parallel Wireless (US) |

This research report categorizes the wireless broadband in public safety market to forecast revenues and analyze trends in each of the following submarkets:

Based on offering:

-

Hardware

- Wireless adapter

- Wireless access point

- Repeater and range extender

- Other hardware (amplifiers, antennas, modem, switches, and hubs)

- Software

-

Service

-

Professional services

- Consulting

- Deployment & integration

- Support & maintenance

- Managed services

-

Professional services

Based on technology:

- Mobile wireless broadband

- Fixed wireless broadband

- Satellite wireless broadband

Based on End User

- First responders

- Firefighters

- Law enforcement

- Other first responders (emergency and disaster management units and paramedics)

-

Critical infrastructure operators

- Healthcare and medical facilities

- Transportation providers

- Government agencies

- Other critical infrastructure operators (utilities, communication service providers, and commercial facilities)

- Other end users (community volunteers and public warning system users)

Based on Application

- Critical communications

- Video surveillance and monitoring

- Automated vehicle tracking

- Geographic information system (GIS)

- Other applications (remote collaboration, administrative application, and training & simulation)

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Nordic countries

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East & Africa

- GCC Countries

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In October 2023, Ericsson launched software toolkit for communications service providers (CSPs) to strengthen 5G Standalone network capabilities and enable premium services with differentiated connectivity.

- In July 2022, Huawei introduced the Huawei Router 3B Pro with Wi-Fi-7 capabilities, which can transfer a single file through both 2.4gHz and 5gHz channels to boost speed.

- In June 2022, AT&T launched location-based routing to automatically transmit wireless 9-1-1 calls to the appropriate 9-1-1 call centers on a nationwide basis.

Frequently Asked Questions (FAQ):

What is the definition of wireless broadband in public safety market?

Wireless broadband public safety network delivers seamless communications between public safety agencies, local and state governments, federal agencies, and private companies that respond to incidents and disasters. This network meets the public safety grade operational requirements for reliable and secure communication. It is a platform comprising a wide range of equipment and applications that are technologically advanced. Due to the high-speed transmission of data, voice, and video over the Internet and other networks, wireless broadband is increasingly being used by the public to make use of new services and applications on devices such as laptops, smartphones, and digital tablets. Therefore, its applications have the potential to increase emergency preparedness and response capabilities to meet the needs of emergency responders.

What is the market size of wireless broadband in public safety market?

The wireless broadband in public safety market is estimated at USD 40.2 billion in 2024 to USD 126.9 billion by 2029, at a Compound Annual Growth Rate (CAGR) of 25.9% from 2024 to 2029.

What are the major drivers in the wireless broadband in public safety market?

The major drivers in the wireless broadband in public safety market are the mobility growth and increase in mobile connectivity, enhancement in public safety and availability of real-time information, and cybersecurity and data protection.

Who are the key players operating in the wireless broadband in public safety market?

The key market players profiled in the wireless broadband in public safety market are AT&T(US), Verizon Communications Inc (US), Cisco Systems, Inc (US), Ericsson (Sweden), Huawei Technologies Co. Ltd (China), Broadcom (US), HPE Aruba Networks (US), Extreme Networks (US), Juniper Networks (US), Motorola Solutions (US), NEC Corporation (Japan), Netgear, Inc (US), Semtech Corporation (US), ZTE Corporation (China), General Dynamics Corporation (US), L3Harris Technologies, Inc (US), Bittium Corporation (Finland), Hughes Network Systems, LLC (US), Hytera Communications Corporation (China), Cambium Networks Limited (US), Infinet Wireless (Netherlands), Netronics Networks (Canada), Proxim Wireless (US), Radwin (Israel), Aviat Networks, Inc (US), Knightscope (US), Parallel Wireless (US).

What are the key technology trends prevailing in the wireless broadband in public safety market?

The key technology trends in wireless broadband in public safety include LTE (Long-Term Evolution), Mission-Critical Push-to-Talk (MCPTT), Land Mobile Radio (LMR), 5G, and network slicing. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

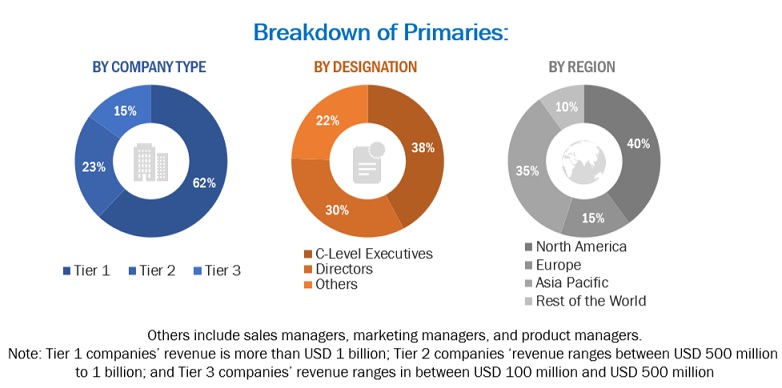

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the wireless broadband in public safety market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering wireless broadband in public safety solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources, as well as by analyzing their product portfolios in the ecosystem of the wireless broadband in public safety market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as Wireless Global Congress 2023, The Public Safety Innovation Summit 2023, 6th IEEE 5G Workshop on First Responder and Tactical Networks 2023 have been referred to for identifying and collecting information for this study on the wireless broadband in public safety market. The secondary sources included annual reports, press releases investor presentations of companies, white papers, journals, and certified publications and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that have been further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from wireless broadband in public safety solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using wireless broadband in public safety solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of wireless broadband in public safety solutions which would impact the overall wireless broadband in public safety market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

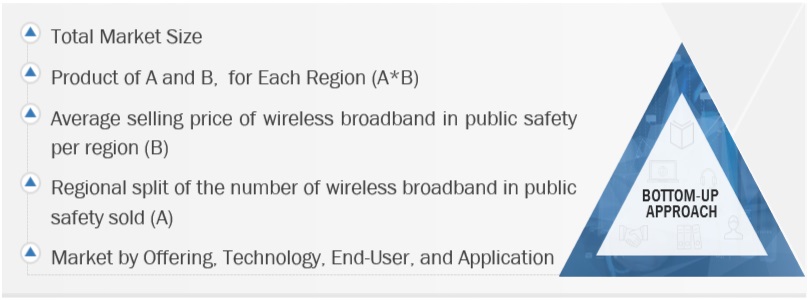

Multiple approaches were adopted to estimate and forecast the size of the wireless broadband in public safety market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of wireless broadband in public safety offerings.

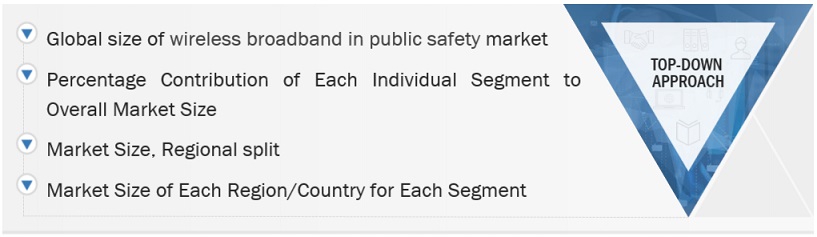

Both top-down and bottom-up approaches were used to estimate and validate the total size of the wireless broadband in public safety market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Wireless broadband in public safety Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Wireless broadband in public safety Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the wireless broadband in public safety market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Wireless broadband public safety network delivers seamless communications between public safety agencies, local and state governments, federal agencies, and private companies that respond to incidents and disasters. This network meets the public safety grade operational requirements for reliable and secure communication. It is a platform comprising a wide range of equipment and applications that are technologically advanced. Due to the high-speed transmission of data, voice, and video over the Internet and other networks, wireless broadband is increasingly being used by the public to use new services and applications on devices such as laptops, smartphones, and digital tablets. Therefore, its applications can potentially increase emergency preparedness and response capabilities to meet the needs of emergency responders.

Key Stakeholders

- Government Bodies and Public Safety Agencies

- IT and Telecommunication Companies

- Network Infrastructure Developers

- Mobile Network Operators

- Software and Hardware Manufacturers

- Communication and Computing Device Manufacturers

- Emergency Public Safety Service Providers

- Chief Information/Technology Officers

- State Broadband Task Force

- Commercial Broadband Vendors

- Urban Area Security Imitative (UASI) Representative

- Regional Interoperability Committees

- Statewide Interoperability Governing Body (SIGB)

- Federal Agencies, especially Federal Emergency Responders

Report Objectives

- To determine, segment, and forecast the wireless broadband in public safety market on the basis of offering, technology, end user, application, and region in terms of value

- To forecast the size of the market segments with respect to 5 main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies2

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and R&D activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle East & Africa market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Wireless Broadband in Public Safety Market

Interested in understanding global and regional market size development for TETRA, Tetrapol and P25 technologies

Interested in understanding market for systems that deliver broadband networking to public safety and disaster relief efforts in the field

Interested in understanding the data sources, methodologies, and assumptions used to generate market size and subsequent forecasts.

Interested in understanding market in volume like million of units, and by unit types (terminals, gateways, eNodeB