Ceramic Sanitary Ware Market by Type (Toilet Sinks/Water Closets, Washbasins, Urinals, Cisterns), Application (Commercial, Residential), Technology (Slip Casting, Pressure Casting, Type Casting, Isostatic Casting), Region - Global Forecast to 2025

Updated on : March 21, 2024

Ceramic Sanitary Ware Market

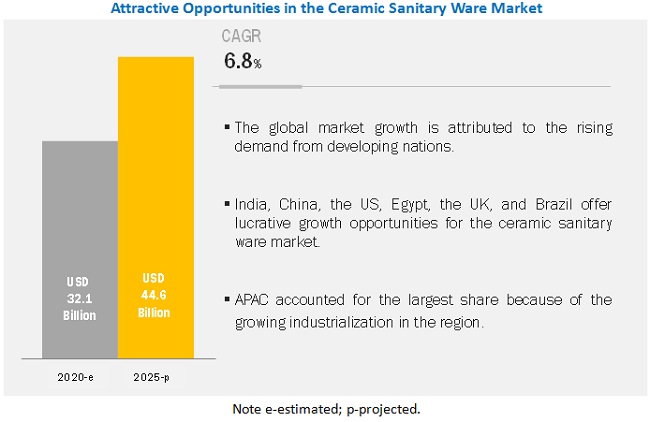

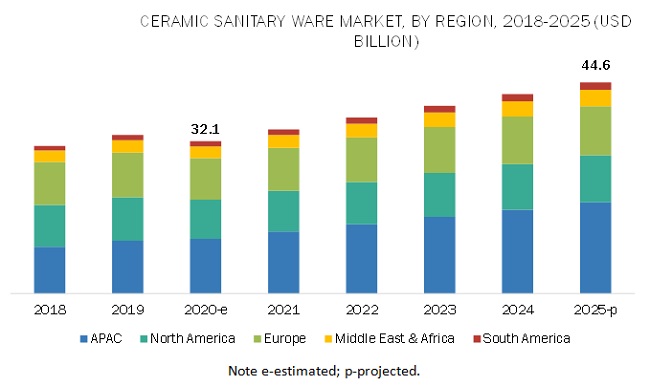

The global ceramic sanitary ware market was valued at USD 32.1 billion in 2020 and is projected to reach USD 44.6 billion by 2025, growing at 6.8% cagr from 2020 to 2025. The initiatives by the governments of developing nations, coupled with the changing lifestyle and purchasing power of the middle-class population across the globe, are driving the ceramic sanitary ware market.

Commercial application is projected to witness faster growth during the forecast period.

Based on application, the ceramic sanitary ware market has been segmented into commercial and residential. The commercial segment is further classified into hospitality, offices, industrial, and institutional & retail. The residential application is also classified into single family and multi family. The commercial segment is projected to register the higher growth in terms of value as well as volume in the global ceramic sanitary ware market. Ceramic sanitary wares used in commercial applications are frequently replaced due to their heavy use. Hence, the demand for ceramic sanitary ware is high in the commercial segment. Hospitality is the largest sub-segment of the ceramic sanitary ware market. The increasing demand for luxurious ceramic sanitary wares in hotels, resorts, and villas is the major factor supporting the growth of the market in the hospitality segment.

The toilet sinks/water closets segment is projected to be the fastest-growing type of the ceramic sanitary ware market during the forecast period.

Toilet sinks/Water closets is expected to be the fastest-growing ceramic sanitary ware segment during the forecast period. Based on type, the most commonly used ceramic sanitary ware is toilet sinks/water closets as it is the most basic sanitary ware. The initiatives by the governments of developing nations to improve access to basic sanitation and maintain hygiene are the key factor for this growth. They have been further classified into once piece, two piece, EWC, wall hung closets, and others. The demand for toilet sinks/water closets ceramic sanitary ware is very high in all the applications.

APAC to account for the largest share of the global ceramic sanitary ware market during the forecast period.

APAC is projected to account for the largest share in the ceramic sanitary ware market during the forecast period, in terms of value. The growing population and infrastructural developments in the region have increased the use of ceramic sanitary ware in various applications. The increasing economic growth, followed by substantial investments in the industrial sector, is fueling the growth of the market.

Due to the economic crisis because of COVID-19, the ceramic sanitary ware market is expected to decline in 2020. Due to the lockdown in most countries across the globe, major construction projects are on hold. These projects are expected to start operating again after the end of the lockdown in respective countries; hence the ongoing and upcoming construction projects are expected to support the market growth during the forecast period.

Ceramic Sanitary Ware Market Players

The key players profiled in the report include Geberit Group (Switzerland), Kohler Co. (US), TOTO Ltd. (Japan), LIXIL Group Corporation (Japan), Roca Sanitario SA (Spain), Villeroy & Boch AG (Germany), RAK Ceramics (UAE), Duravit AG (Germany), Duratex SA (Brazil), and HSIL (India).

LIXIL Group Corporation (Japan) is a leading innovator in the ceramic sanitary ware market. The company has a strong and diversified geographic presence globally. It launched two new bathroom collections under the brand name of INAX at Milan Design Week. This helped the company to meet the increasing demand from the global market.

TOTO Ltd. (Japan) is another leading producer of ceramic sanitary ware, globally. The company focuses on expanding its presence in the emerging markets and maintaining a strong position in the existing ones. It has a significant geographical presence and a strong brand image in the market. TOTO Ltd. launched high-end washlet bidet toilets in the global market. This new product is sold under the brand name of NEOREST NX. This helped the company to attract more customers and capture an additional market share.

Ceramic Sanitary Ware Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 32.1 billion |

|

Revenue Forecast in 2025 |

USD 44.6 billion |

|

CAGR |

6.8% |

|

Years Considered for the study |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million), Volume (Thousand Unit) |

|

Segments covered |

Type, Application, Technology, and Region |

|

Regions covered |

APAC, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

Geberit Group (Switzerland), Kohler Co. (US), TOTO Ltd. (Japan), LIXIL Group Corporation (Japan), Roca Sanitario SA (Spain), Villeroy & Boch AG (Germany), RAK Ceramics (UAE), Duravit AG (Germany), Duratex SA (Brazil), and HSIL (India) |

This report categorizes the global ceramic sanitary ware market based on type, technology, application, and region.

Based on Type:

-

Toilet sinks/Water closets

- One piece

- Two piece

- EWC

- Wall hung closets

- Others

-

Washbasins

- Pedestal

- Wall hung

- Table top

- Corner

- Counter

Based on Technology:

- Slip casting

- Pressure casting

- Tape casting

- Isostatic casting

Based on Application:

-

Commercial

- Hospitality

- Industrial

- Institutional & retail

- Offices

-

Residential

- Single family

- Multi family

Based on Region:

- APAC

- North America

- Europe

- Middle East & Arica

- South America

Latest Developments

- In January 2020, Kohler Co. introduced five new products, which include touchless faucets and touchless toilet technologies, among others. This touchless technology provides flushing with sensors placed near the flush tank. These smart products provide comfort and hygiene to the user.

- In August 2019, Roca Sanitario SA launched a new bathroom collection made from innovative designs. This collection offers sanitary wares in bold colors.

- In September 2018, RAK Ceramics opened a new orientation center in North India for ceramic sanitary ware. This helped the company to strengthen its presence in the Indian ceramic sanitary ware market.

Key Questions addressed by the report

- What are the major developments impacting the market?

- Where will all the developments take the market in the mid-to-long-term?

- What are the upcoming types of ceramic sanitary wares?

- What are the emerging applications of ceramic sanitary ware?

- What are the major factors that are likely to have an impact on the ceramic sanitary ware market growth during the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 BASE NUMBER CALCULATION

2.1.1 CERAMIC SANITARY WARE MARKET: PRIMARY RESEARCH METHODOLOGY

2.1.1.1 Breakdown of Primary Interviews

2.1.2 CERAMIC SANITARY WARE MARKET: RESEARCH METHODOLOGY

2.1.3 MARKET SIZE CALCULATION STEPS FROM SUPPLY SIDE

2.1.4 MARKET SIZE CALCULATION FROM SUPPLY SIDE

2.1.5 KEY MARKET INSIGHTS, BY TYPE

2.2 DATA TRIANGULATION

2.3 MARKET ENGINEERING PROCESS

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 ASSUMPTIONS

2.5 SECONDARY DATA

2.5.1 KEY INDUSTRY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 34)

3.1 CERAMIC SANITARY WARE MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

3.1.1 NON-COVID-19 SCENARIO

3.1.2 OPTIMISTIC SCENARIO

3.1.3 PESSIMISTIC SCENARIO

3.1.4 REALISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 SIGNIFICANT OPPORTUNITIES IN THE CERAMIC SANITARY WARE MARKET

4.2 CERAMIC SANITARY WARE MARKET SIZE, BY REGION

4.3 APAC: CERAMIC SANITARY WARE MARKET, BY TYPE AND COUNTRY

4.4 CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY

4.5 CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION

4.6 CERAMIC SANITARY WARE MARKET ATTRACTIVENESS

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Initiatives taken by the public sector to improve access to proper sanitation

5.2.1.2 Change in lifestyle and increase in purchasing power of middle-class population

5.2.2 RESTRAINTS

5.2.2.1 Fluctuation in housing demand

5.2.2.2 Environmental impact

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements

5.3 SHIFT IN REVENUE STREAMS DUE TO MEGATRENDS IN END-USE INDUSTRIES

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 VALUE CHAIN ANALYSIS

5.6 ECOSYSTEM

5.7 CASE STUDY

5.8 PRICING ANALYSIS

5.9 TECHNOLOGY ANALYSIS

5.10 INDUSTRY OUTLOOK

5.10.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

5.11 ECONOMIC PANDEMIC DUE TO COVID-19

5.11.1 IMPACT OF COVID-19 ON THE CONSTRUCTION INDUSTRY

5.11.1.1 Impact on customers’ output and strategies to resume/improve production

5.11.1.2 Customer’s most impacted regions

5.11.1.3 MnM viewpoint on growth outlook and new market opportunities

5.12 PRE AND POST COVID-19 SCENARIO

5.13 RECOVERY ROAD FOR 2020 & 2021

6 CERAMIC SANITARY WARE MARKET, BY TECHNOLOGY (Page No. - 58)

6.1 INTRODUCTION

6.2 SLIP CASTING

6.2.1 LOW COST AND EASY OPERATIONS TO DRIVE THE MARKET FOR SLIP CASTING

6.3 PRESSURE CASTING

6.3.1 DEMAND FOR LUXURY PRODUCTS TO DRIVE THE MARKET

6.4 TAPE CASTING

6.4.1 HIGH DEGREE OF AUTOMATION AND EFFICIENCY TO DRIVE THE MARKET

6.5 ISOSTATIC CASTING

6.5.1 DEMAND FOR ECO-FRIENDLY TECHNOLOGY TO DRIVE THE MARKET

7 CERAMIC SANITARY WARE MARKET, BY TYPE (Page No. - 67)

7.1 INTRODUCTION

7.2 TOILET SINKS/WATER CLOSETS

7.2.1 ONE PIECE

7.2.1.1 High demand for low water leakage systems is driving the sub-segment

7.2.2 TWO PIECE

7.2.2.1 Low cost of two piece toilet sinks to drive the demand

7.2.3 WALL HUNG CLOSETS

7.2.3.1 Need for less space drives the demand

7.2.4 EUROPEAN WATER CLOSETS (EWC)

7.2.4.1 Low water consumption to drive the demand for EWC

7.2.5 OTHERS

7.3 WASHBASINS

7.3.1 PEDESTAL

7.3.1.1 Demand for luxurious bathroom products to drive the market

7.3.2 WALL HUNG

7.3.2.1 Small and lightweight design to drive the demand

7.3.3 CORNER

7.3.3.1 Compact design to propel the demand

7.3.4 TABLE TOP

7.3.4.1 The demand for high-end products to drive the market

7.3.5 COUNTER

7.3.5.1 Demand for convenient washbasins to drive the market

7.4 URINALS

7.5 CISTERNS

7.6 OTHERS

8 CERAMIC SANITARY WARE MARKET, BY APPLICATION (Page No. - 78)

8.1 INTRODUCTION

8.2 COMMERCIAL

8.2.1 HOSPITALITY

8.2.1.1 Growth in the tourism industry to drive the market

8.2.2 OFFICE

8.2.2.1 Growth in urbanization to drive the market

8.2.3 INSTITUTIONAL & RETAIL

8.2.3.1 Increasing demand from developing nations to drive the market

8.2.4 INDUSTRIAL

8.2.4.1 Rising industrialization to drive the market

8.3 RESIDENTIAL

8.3.1 SINGLE FAMILY

8.3.1.1 Demand from developed nations to support the growth

8.3.2 MULTI FAMILY

8.3.2.1 Growing number of renters and the job portability across the globe to drive the market

9 CERAMIC SANITARY WARE MARKET, BY REGION (Page No. - 85)

9.1 INTRODUCTION

9.2 TRADE STATISTICS

9.3 APAC

9.3.1 IMPACT OF COVID-19 ON APAC CERAMIC SANITARY WARE MARKET

9.3.2 CHINA

9.3.2.1 High economic growth driving the market

9.3.3 JAPAN

9.3.3.1 Strong presence of the key players in the country to drive the market

9.3.4 INDIA

9.3.4.1 Rising domestic demand to drive the market

9.3.5 INDONESIA

9.3.5.1 Growing domestic consumption and FDI to boost the market

9.3.6 THAILAND

9.3.6.1 Government initiatives in the industrial sector to support the growth of the market

9.3.7 SOUTH KOREA

9.3.7.1 Increased importance of hygiene to boost the market

9.3.8 AUSTRALIA

9.3.8.1 Increasing number of commercial construction projects to boost the market

9.3.9 MALAYSIA

9.3.9.1 Growing population and rising income level to boost the market

9.4 NORTH AMERICA

9.4.1 IMPACT OF COVID-19 ON NORTH AMERICAN CERAMIC SANITARY WARE MARKET

9.4.2 US

9.4.2.1 Strong foothold of key players in the country acts as the market driver

9.4.3 CANADA

9.4.3.1 Advanced manufacturing industry to significantly impact the market growth

9.4.4 MEXICO

9.4.4.1 Rising foreign investment to propel the market growth

9.5 EUROPE

9.5.1 IMPACT OF COVID-19 ON THE EUROPEAN CERAMIC SANITARY WARE MARKET

9.5.2 GERMANY

9.5.2.1 Expansion of the manufacturing sector to create favorable conditions for market growth

9.5.3 FRANCE

9.5.3.1 Growth in various industries to increase the demand for ceramic sanitary ware

9.5.4 UK

9.5.4.1 Strong industrial growth to drive the UK ceramic sanitary ware market

9.5.5 ITALY

9.5.5.1 Increasing exports to boost the market

9.5.6 SPAIN

9.5.6.1 Growing industrial sector to drive the market

9.5.7 RUSSIA

9.5.7.1 Rising standard of living to influence the market positively

9.6 MIDDLE EAST & AFRICA

9.6.1 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA CERAMIC SANITARY WARE MARKET

9.6.2 SAUDI ARABIA

9.6.2.1 The country is the second-largest ceramic sanitary ware market in the region

9.6.3 UAE

9.6.3.1 Growth in real estate and infrastructure projects to drive the country’s market

9.6.4 EGYPT

9.6.4.1 High demand from various applications to drive the market

9.6.5 TURKEY

9.6.5.1 Rapid urbanization and improving living standards to propel the market growth

9.7 SOUTH AMERICA

9.7.1 IMPACT OF COVID-19 ON THE SOUTH AMERICAN CERAMIC SANITARY WARE MARKET

9.7.2 BRAZIL

9.7.2.1 The country is the largest ceramic sanitary ware market in South America

9.7.3 ARGENTINA

9.7.3.1 Growing industrialization will drive the market

9.7.4 COLOMBIA

9.7.4.1 Growing population to drive the market

10 COMPETITIVE LANDSCAPE (Page No. - 140)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

10.3 REVENUE ANALYSIS OF KEY MARKET PLAYERS

10.4 COMPETITIVE LEADERSHIP MAPPING, TIER 1 COMPANIES

10.4.1 VISIONARY LEADERS

10.4.2 INNOVATORS

10.5 STRENGTH OF PRODUCT PORTFOLIO

10.6 BUSINESS STRATEGY EXCELLENCE

10.7 COMPETITIVE LEADERSHIP MAPPING (SMALL AND MEDIUM-SIZED ENTERPRISES)

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 STARTING BLOCKS

10.8 STRENGTH OF PRODUCT PORTFOLIO

10.9 BUSINESS STRATEGY EXCELLENCE

10.10 MARKET SHARE ANALYSIS

10.11 COMPETITIVE SCENARIOS

10.11.1 NEW PRODUCT LAUNCH

10.11.2 EXPANSION

11 COMPANY PROFILES (Page No. - 151)

11.1 GEBERIT GROUP

11.1.1 BUSINESS OVERVIEW

11.1.2 PRODUCTS OFFERED

11.1.3 RECENT DEVELOPMENTS

11.1.4 SWOT ANALYSIS

11.1.5 CURRENT FOCUS & STRATEGIES

11.1.6 THREAT FROM COMPETITION

11.1.7 RIGHT TO WIN

11.2 LIXIL GROUP CORPORATION

11.2.1 BUSINESS OVERVIEW

11.2.2 PRODUCTS OFFERED

11.2.3 RECENT DEVELOPMENTS

11.2.4 SWOT ANALYSIS

11.2.5 CURRENT FOCUS AND STRATEGIES

11.2.6 THREAT FROM COMPETITION

11.2.7 RIGHT TO WIN

11.3 VILLEROY & BOCH AG

11.3.1 PRODUCTS OFFERED

11.3.2 SWOT ANALYSIS

11.3.3 CURRENT FOCUS AND STRATEGIES

11.3.4 THREAT FROM COMPETITION

11.3.5 RIGHT TO WIN

11.4 RAK CERAMICS

11.4.1 BUSINESS OVERVIEW

11.4.2 PRODUCTS OFFERED

11.4.3 RECENT DEVELOPMENTS

11.5 TOTO LTD.

11.5.1 BUSINESS OVERVIEW

11.5.2 PRODUCTS OFFERED

11.5.3 RECENT DEVELOPMENTS

11.5.4 SWOT ANALYSIS

11.5.5 CURRENT FOCUS AND STRATEGIES

11.5.6 THREAT FROM COMPETITION

11.5.7 RIGHT TO WIN

11.6 KOHLER CO.

11.6.1 BUSINESS OVERVIEW

11.6.2 PRODUCTS OFFERED

11.6.3 RECENT DEVELOPMENTS

11.7 DURAVIT AG

11.7.1 BUSINESS OVERVIEW

11.7.2 PRODUCTS OFFERED

11.8 HSIL

11.8.1 BUSINESS OVERVIEW

11.8.2 PRODUCTS OFFERED

11.8.3 RECENT DEVELOPMENTS

11.9 DURATEX SA

11.9.1 BUSINESS OVERVIEW

11.9.2 PRODUCTS OFFERED

11.10 ROCA SANITARIO S.A.

11.10.1 BUSINESS OVERVIEW

11.10.2 PRODUCTS OFFERED

11.10.3 RECENT DEVELOPMENTS

11.10.4 SWOT ANALYSIS

11.10.5 CURRENT FOCUS AND STRATEGIES

11.10.6 THREAT FROM COMPETITION

11.10.7 RIGHT TO WIN

11.11 OTHER KEY PLAYERS

11.11.1 LECICO BATHROOMS

11.11.2 ECZACIBASI

11.11.3 SANITA

11.11.4 CATALANO

11.11.5 PORCELANOSA GROUP (NOKEN)

11.11.6 JAQUAR

11.11.7 SAUDI CERAMICS

11.11.8 SHANGHAI AQUACUBIC SANITARY WARE CO., LTD

11.11.9 CERA CERAMICS

11.11.10 EAGLE CERAMICS LIMITED

11.11.11 COTO CERAMICS PVT. LTD.

11.11.12 SANSO SANITARY WARE

11.11.13 SANYO CERAMICS

11.11.14 DEVON & DEVON

11.11.15 CREAVIT

11.11.16 IDEAL STANDARD INTERNATIONAL SA

12 APPENDIX (Page No. - 176)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (124 Tables)

TABLE 1 CERAMIC SANITARY WARE MARKET PRICING ANALYSIS, 2018-2025 (USD/UNIT)

TABLE 2 TRENDS AND FORECAST OF GDP, BY MAJOR COUNTRY, 2017–2024 (USD BILLION)

TABLE 3 CONSTRUCTION COMPANIES’ ANNOUNCEMENTS

TABLE 4 CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 5 CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (THOUSAND UNIT)

TABLE 6 SLIP CAST CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 SLIP CAST CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 8 PRESSURE CAST CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 PRESSURE CAST CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 10 TAPE CAST CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 TAPE CAST CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 12 ISOSTATIC CAST CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 ISOSTATIC CAST CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 14 CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 15 CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND UNIT)

TABLE 16 CERAMIC-BASED TOILET SINKS/WATER CLOSETS SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 CERAMIC-BASED TOILET SINKS/WATER CLOSETS SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 18 CERAMIC-BASED WASHBASINS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 19 CERAMIC-BASED WASHBASINS MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 20 CERAMIC-BASED URINALS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 CERAMIC-BASED URINALS MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 22 CERAMIC-BASED CISTERNS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 CERAMIC-BASED CISTERNS MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 24 CERAMIC-BASED OTHER SANITARY WARES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 CERAMIC-BASED OTHER SANITARY WARES MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 26 CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 27 CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 28 CERAMIC SANITARY WARE MARKET SIZE IN COMMERCIAL APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 CERAMIC SANITARY WARE MARKET SIZE IN COMMERCIAL APPLICATION, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 30 CERAMIC SANITARY WARE MARKET SIZE IN RESIDENTIAL APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 31 CERAMIC SANITARY WARE MARKET SIZE IN RESIDENTIAL APPLICATION, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 32 CERAMIC SANITARY WARE MARKET, IMPORT-EXPORT, 2019

TABLE 33 CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 CERAMIC SANITARY WARE MARKET SIZE, BY REGION, 2018–2025 (THOUSAND UNIT)

TABLE 35 APAC: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 APAC: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNIT)

TABLE 37 APAC: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 38 APAC: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND UNIT)

TABLE 39 APAC: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 40 APAC: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 41 APAC: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 42 APAC: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (THOUSAND UNIT)

TABLE 43 CHINA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 44 CHINA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 45 JAPAN: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 46 JAPAN: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 47 INDIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 48 INDIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 49 INDONESIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 50 INDONESIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 51 THAILAND: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 THAILAND: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 53 SOUTH KOREA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 54 SOUTH KOREA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 55 AUSTRALIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 AUSTRALIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 57 MALAYSIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 MALAYSIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 59 NORTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNIT)

TABLE 61 NORTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 62 NORTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (THOUSAND UNIT)

TABLE 63 NORTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 NORTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND UNIT)

TABLE 65 NORTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 66 NORTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 67 US: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 US: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 69 CANADA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 CANADA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 71 MEXICO: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 72 MEXICO: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 73 EUROPE: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNIT)

TABLE 75 EUROPE: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 76 EUROPE: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (THOUSAND UNIT)

TABLE 77 EUROPE: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 EUROPE: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND UNIT)

TABLE 79 EUROPE: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 80 EUROPE: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 81 GERMANY: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 82 GERMANY: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 83 FRANCE: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 84 FRANCE: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 85 UK: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 86 UK: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 87 ITALY: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 88 ITALY: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 89 SPAIN: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 90 SPAIN: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 91 RUSSIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 92 RUSSIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 93 MIDDLE EAST & AFRICA: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNIT)

TABLE 95 MIDDLE EAST & AFRICA: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (THOUSAND UNIT)

TABLE 97 MIDDLE EAST & AFRICA: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND UNIT)

TABLE 99 MIDDLE EAST & AFRICA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 101 SAUDI ARABIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 102 SAUDI ARABIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 103 UAE: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 104 UAE: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 105 EGYPT: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 106 EGYPT: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 107 TURKEY: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 108 TURKEY: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 109 SOUTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 110 SOUTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND UNIT)

TABLE 111 SOUTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 112 SOUTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY TECHNOLOGY, 2018–2025 (THOUSAND UNIT)

TABLE 113 SOUTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 SOUTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY TYPE, 2018–2025 (THOUSAND UNIT)

TABLE 115 SOUTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 116 SOUTH AMERICA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 117 BRAZIL: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 118 BRAZIL: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 119 ARGENTINA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 120 ARGENTINA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 121 COLOMBIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 122 COLOMBIA: CERAMIC SANITARY WARE MARKET SIZE, BY APPLICATION, 2018–2025 (THOUSAND UNIT)

TABLE 123 NEW PRODUCT LAUNCH, 2016–2020

TABLE 124 EXPANSION, 2016–2020

LIST OF FIGURES (58 Figures)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 CERAMIC SANITARY WARE MARKET: ESTIMATION AND FORECAST

FIGURE 3 CERAMIC SANITARY WARE MARKET: KEY CHALLENGES

FIGURE 4 MARKET SIZE IN TERMS OF REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIO

FIGURE 5 TOILET SINKS/WATER CLOSETS TO BE THE LARGEST TYPE OF CERAMIC SANITARY WARE

FIGURE 6 COMMERCIAL TO BE THE FASTER-GROWING APPLICATION OF CERAMIC SANITARY WARE

FIGURE 7 SLIP CASTING TO BE THE LARGEST TECHNOLOGY FOR CERAMIC SANITARY WARE

FIGURE 8 APAC ACCOUNTED FOR THE LARGEST SHARE IN THE CERAMIC SANITARY WARE MARKET IN 2019

FIGURE 9 HIGH GROWTH IN DEVELOPING ECONOMIES TO DRIVE THE MARKET DURING THE FORECAST PERIOD

FIGURE 10 APAC TO BE THE LARGEST CERAMIC SANITARY WARE MARKET DURING THE FORECAST PERIOD

FIGURE 11 CHINA ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

FIGURE 12 SLIP CASTING TO BE THE LARGEST TECHNOLOGY SEGMENT

FIGURE 13 COMMERCIAL TO BE THE LARGER APPLICATION

FIGURE 14 INDIA TO BE THE FASTEST-GROWING MARKET DURING THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, AND OPPORTUNITIES IN THE CERAMIC SANITARY WARE MARKET

FIGURE 16 CERAMIC SANITARY WARE MARKET: CHANGING REVENUE MIX

FIGURE 17 CERAMIC SANITARY WARE MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 CERAMIC SANITARY WARE MARKET: VALUE CHAIN

FIGURE 19 CERAMIC SANITARY WARE MARKET: ECOSYSTEM

FIGURE 20 MARKET ASSESSMENT OF CERAMIC SANITARY WARE PRODUCTS IN EUROPE

FIGURE 21 GDP GROWTH RATE, BY KEY COUNTRIES, 2020

FIGURE 22 CERAMIC SANITARY WARE MARKET: PRE AND POST COVID-19 SCENARIO

FIGURE 23 SLIP CASTING TO BE THE LARGEST TECHNOLOGY SEGMENT DURING THE FORECAST PERIOD

FIGURE 24 APAC TO BE THE LARGEST MARKET FOR SLIP CASTING TECHNOLOGY

FIGURE 25 EUROPE TO BE THE SECOND-LARGEST MARKET IN PRESSURE CASTING SEGMENT

FIGURE 26 APAC TO SURPASS EUROPE IN THE TAPE CASTING TECHNOLOGY SEGMENT DURING THE FORECAST PERIOD

FIGURE 27 EUROPE TO BE THE SECOND-LARGEST MARKET IN ISOSTATIC CASTING SEGMENT

FIGURE 28 TOILET SINKS/WATER CLOSETS TO BE THE LARGEST TYPE SEGMENT DURING THE FORECAST PERIOD

FIGURE 29 APAC TO BE THE LARGEST CERAMIC-BASED TOILET SINKS/WATER CLOSETS MARKET

FIGURE 30 EUROPE TO BE THE SECOND-LARGEST CERAMIC-BASED WASHBASINS MARKET

FIGURE 31 APAC TO BE THE LARGEST CERAMIC-BASED URINALS MARKET

FIGURE 32 APAC TO BE THE FASTEST-GROWING CERAMIC-BASED CISTERNS MARKET

FIGURE 33 MIDDLE EAST & AFRICA TO BE THE SECOND-FASTEST-GROWING CERAMIC-BASED OTHER SANITARY WARES MARKET

FIGURE 34 COMMERCIAL SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

FIGURE 35 APAC TO BE THE LARGEST CERAMIC SANITARY WARE MARKET IN THE COMMERCIAL APPLICATION

FIGURE 36 APAC TO BE THE FASTEST-GROWING CERAMIC SANITARY WARE MARKET IN THE RESIDENTIAL APPLICATION

FIGURE 37 APAC TO BE THE FASTEST-GROWING CERAMIC SANITARY WARE MARKET

FIGURE 38 APAC: CERAMIC SANITARY WARE MARKET SNAPSHOT

FIGURE 39 NORTH AMERICA: CERAMIC SANITARY WARE MARKET SNAPSHOT

FIGURE 40 EUROPE: CERAMIC SANITARY WARE MARKET SNAPSHOT

FIGURE 41 CERAMIC SANITARY WARE: MARKET EVALUATION FRAMEWORK, 2016-2020

FIGURE 42 CERAMIC SANITARY WARE MARKET: REVENUE OF KEY PLAYERS, 2016-2020

FIGURE 43 CERAMIC SANITARY WARE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 44 CERAMIC SANITARY WARE MARKET (SMALL AND MEDIUM-SIZED ENTERPRISES) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 45 CERAMIC SANITARY WARE MARKET SHARE, BY COMPANY, 2019

FIGURE 46 GEBERIT GROUP: COMPANY SNAPSHOT

FIGURE 47 GEBERIT GROUP: SWOT ANALYSIS

FIGURE 48 LIXIL GROUP CORPORATION: COMPANY SNAPSHOT

FIGURE 49 LIXIL GROUP CORPORATION: SWOT ANALYSIS

FIGURE 50 VILLEROY & BOCH AG: COMPANY SNAPSHOT

FIGURE 51 VILLEROY & BOCH AG: SWOT ANALYSIS

FIGURE 52 RAK CERAMICS: COMPANY SNAPSHOT

FIGURE 53 TOTO LTD.: COMPANY SNAPSHOT

FIGURE 54 TOTO LTD.: SWOT ANALYSIS

FIGURE 55 HSIL: COMPANY SNAPSHOT

FIGURE 56 DURATEX SA: COMPANY SNAPSHOT

FIGURE 57 ROCA SANITARIO S.A.: COMPANY SNAPSHOT

FIGURE 58 ROCA SANITARIO S.A.: SWOT ANALYSIS

The study involved four major activities in estimating the market size for ceramic sanitary ware. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After this, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites, such as Factiva, ICIS, and Bloomberg.

Primary Research

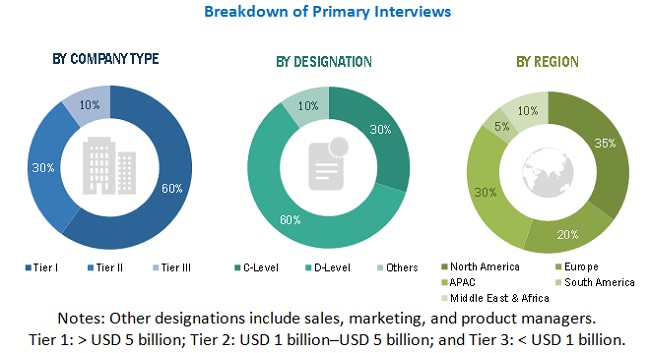

The ceramic sanitary ware market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of residential and commercial construction, among other applications. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The findings of this study were verified through primary research by conducting extensive interviews with key officials, such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ceramic sanitary ware market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in various applications.

Report Objectives

- To analyze and forecast the size of the ceramic sanitary ware market, in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, and opportunities, influencing the growth of the market

- To define, describe, and segment the ceramic sanitary ware market based on type, technology, and application

- To forecast the size of the market segments for regions, such as APAC, North America, Europe, South America, and the Middle East & Africa

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile the key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type or application.

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Ceramic Sanitary Ware Market

Market share (and competitor market share) split between Commercial and Residential. Within Commercial and Residential for China, Vietnam, Indonesia