Aerospace and life sciences TIC Market Size, Share, Statistics and Industry Growth Analysis by Sourcing type (In-house and Outsourced services), Service Type (Testing, Inspection and Certification), Application (Aerospace and life sciences) and Region - Forecast to 2025

Updated on : April 07, 2024

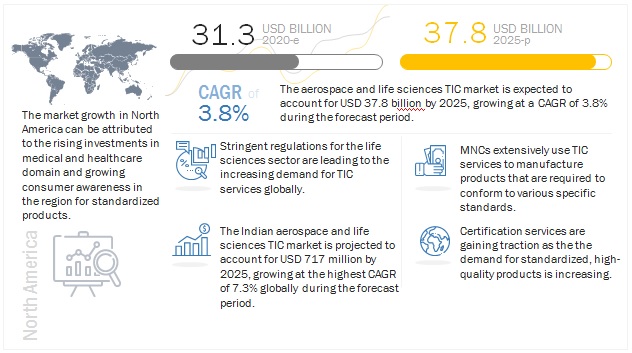

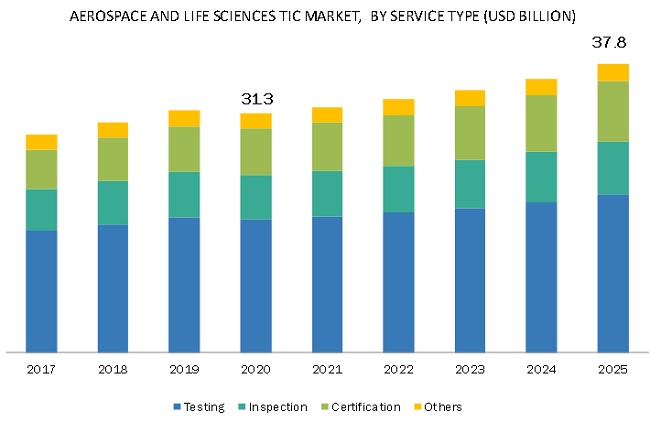

The aerospace and life sciences TIC market size is expected to grow from USD 31.3 billion in 2020 to USD 37.8 billion in 2025, at a CAGR of 3.8%. The primary reasons for this rise in demand are the increasing mandatory certification and amalgamation of new technologies in the manufacturing operations of aerospace and life sciences industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Outsourced services, by scanning type, is expected to grow at the highest CAGR during the forecast period.

With the increase in the global mandates for aerospace components and medical devices, TIC services have to be updated in order to provide accurate results and with no biasness which has led to the increase in the outsourced services.

The market for certification services to grow at highest CAGR in aerospace and life sciences TIC market, by service type, in 2020

The stringent global standards from regulatory organizations like NATA, FDA, WHO etc in aerospace and life sciences has increased the awareness for certification service. It ensures product safety and performance attributes. Certification services mainly include customized audit and certification services with reference to quality, health and safety, environment, and social responsibility. These services aimed at improving business performance.

To know about the assumptions considered for the study, download the pdf brochure

The market for medical application to share the largest market share in 2020

The medical devices application is pull a lot of traction considering the surge in wearable medical devices in both young and aged population, increase in norms of manufacturing of medical devices amidst the pandemic and the necessity demand created by the aged population across the globe.

US, by country, is expected to share the largest market share in 2020.

US is set to witness the largest market share in 2020 due to the numerous manufacturing capabilities of the region. The large aerospace manufacturing companies such as Boeing, Airbus, Lockheed Martin and others have dominated the aerospace market globally. Moreover, the emerging medical devices and manufacturing companies have also helped US to grow and expand in life sciences industry which has resulted in sharing the largest market share in the aerospace and life sciences TIC market.

Top Aerospace and Life Sciences TIC Market Companies - Key Market Players:

Key players in the aerospace and life sciences TIC market include Intertek (UK), SGS (Switzerland), Bureau Veritas (France), Eurofins Scientific (Luxembourg), MISTRAS (US). Intertek is a well-known player for providing innovative and customized TIC solutions in the TIC market. Strong brand name and customer base are among the key factors that resulted in the leading position of SGS in the aerospace and life sciences TIC market. Apart from the strong brand name and customer base, the company has strong R&D capabilities and geographic presence. SGS focuses on strategies such as acquisitions and product launches to strengthen its product portfolio and maintain its position in the aerospace and life sciences TIC market.

Aerospace and life sciences TIC market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 31.3 billion in 2020 |

| Projected Market Size | USD 37.8 billion in 2025 |

| Growth Rate | At CAGR of 3.8% |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

sourcing type, Service type, Application, and region |

|

Regions covered |

North America, Europe, Asia Pacific and Rest of the World |

|

Companies covered |

SGS (Switzerland), Bureau Veritas (France), Intertek (UK), TÜV NORD (Germany), TÜV SUD (Germany), Eurofins Scientific (Luxembourg), TÜV Rheinland (Germany), Applus+ (Spain), Element Material Technology (UK), DNV GL (Norway), UL (US), ALS Ltd. (Australia) and MISTRAS (US) |

This research report categorizes the aerospace and life sciences TIC market based on offering, end-user application, and region.

Aerospace and life sciences TIC MARKET, BY SOURCING TYPE

- In-house services

- Outsourced services

Aerospace and life sciences TIC MARKET, BY SERVICE TYPE

- Testing

- Inspection

- Certification

- Others

Aerospace and life sciences TIC MARKET, BY APPLICATION

- Medical and Life Sciences

- Aerospace

Aerospace and life sciences MARKET, BY GEOGRAPHY

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- Italy

- France

- UK

- Italy

- Norway

- Netherlands

- Rest of Europe

-

Asia Pacific (APAC)

- Japan

- China

- India

- South Korea

- Australia

- Rest of APAC

-

Rest of the World (RoW)

- South America

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- UAE

Recent developments in Aerospace and life sciences TIC Industry :

- Bureau Veritas partnered with Cornis (Paris), a leading provider for blade technology, to offer advanced blade inspection services for wind turbines.

- Intertek partnered with VAKT, a UK-based blockchain platform, which will help Intertek to provide assurance solutions and inspection services seamlessly to its clients.

- Eurofins Scientific acquired Transplant Genomics Inc. to improve its transplantation testing skills, which, in turn, would enhance its diagnostic reliability and reduce the rejection risks.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AEROSPACE AND LIFE SCIENCES TIC MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 LIMITATIONS

TABLE 1 STUDY LIMITATIONS

2.5 RESEARCH ASSUMPTIONS

TABLE 2 ASSUMPTIONS

2.6 COVID-19 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 6 IMPACT OF COVID-19 ON AEROSPACE AND LIFE SCIENCES TIC MARKET

FIGURE 7 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SOURCING TYPE, 2020 & 2025

FIGURE 8 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SERVICE TYPE, 2020 & 2025

FIGURE 9 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY APPLICATION, 2020 & 2025

FIGURE 10 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 MANUFACTURING OF AEROSPACE AND LIFE SCIENCES PRODUCTS REQUIRES ACCURACY DUE TO THEIR CRITICAL NATURE

FIGURE 11 DEVELOPMENT OF NEW TIC SERVICES PORTFOLIO AMIDST COVID-19 TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SOURCING TYPE

FIGURE 12 IN-HOUSE SOURCING TO COMMAND A LARGER MARKER SHARE DURING FORECAST PERIOD

4.3 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SERVICE TYPE

FIGURE 13 TESTING SERVICES TO HOLD LARGEST SHARE OF AEROSPACE AND LIFE SCIENCES TIC MARKET DURING FORECAST PERIOD

4.4 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY TYPE

FIGURE 14 AEROSPACE MANAGEMENT SERVICES TO LEAD AEROSPACE TIC MARKET DUE TO INCREASING ADOPTION OF QUALITY MANAGEMENT AND AUDITING SERVICES

4.5 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY REGION

FIGURE 15 US HELD LARGEST SHARE OF AEROSPACE AND LIFE SCIENCES TIC MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 AEROSPACE AND LIFE SCIENCES TIC MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 17 AEROSPACE AND LIFE SCIENCES TIC MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Adoption of advanced technologies in aerospace and life sciences manufacturing operations

5.2.1.2 Emergence of new TIC services and solutions amidst COVID-19

5.2.2 RESTRAINTS

FIGURE 18 AEROSPACE AND LIFE SCIENCES TIC MARKET RESTRAINTS AND THEIR IMPACT

5.2.2.1 Cascading effect of COVID-19 on TIC industry

5.2.3 OPPORTUNITIES

FIGURE 19 AEROSPACE AND LIFE SCIENCES TIC MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Diversification of businesses due to COVID-19 to generate new revenue pockets

5.2.4 CHALLENGES

FIGURE 20 AEROSPACE AND LIFE SCIENCES TIC MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 Disruptions in supply chains and logistics

5.2.4.2 Lack of skilled workforce

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: AEROSPACE AND LIFE SCIENCES TIC MARKET

5.4 IMPORTANT REGULATIONS FOR AEROSPACE AND LIFE SCIENCES TIC MARKET

5.5 TECHNOLOGY ANALYSIS

5.6 PATENTS

5.6.1 PATENT 1

5.6.2 PATENT 2

5.7 KEY INDUSTRY TRENDS

TABLE 3 MAJOR TRENDS IN AEROSPACE AND LIFE SCIENCES TIC MARKET

5.8 COVID-19 IMPACT ANALYSIS

5.9 IMPACT ON VALUE CHAIN

5.10 IMPACT ON MARKET DYNAMICS

5.10.1 COUNTRY-LEVEL IMPACT ANALYSIS

5.10.1.1 Current scenario

5.10.1.2 Expected impact analysis

5.11 USE CASES

5.11.1 USE CASE 1: LFV

5.11.2 USE CASE 2: LEADING FOOD MANUFACTURER

6 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SOURCING TYPE (Page No. - 61)

6.1 INTRODUCTION

FIGURE 22 IMPACT OF COVID-19 ON AEROSPACE AND LIFE SCIENCES OUTSOURCED TIC SERVICES MARKET

TABLE 4 PRE- AND POST-COVID-19 SCENARIO ANALYSIS: AEROSPACE AND LIFE SCIENCES OUTSOURCED TIC SERVICES MARKET, 2017–2025 (USD BILLION)

FIGURE 23 IN-HOUSE SERVICES TO ACCOUNT FOR LARGER SIZE OF AEROSPACE AND LIFE SCIENCES TIC MARKET IN 2020

TABLE 5 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 6 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SOURCING TYPE, 2020–2025 (USD MILLION)

6.2 IN-HOUSE SERVICES

6.2.1 IN-HOUSE TESTING SERVICES TO CONTINUE TO CAPTURE LARGER MARKET SHARE DURING FORECAST PERIOD

6.3 OUTSOURCED SERVICES

6.3.1 MARKET FOR OUTSOURCED SERVICES TO GROW AT HIGHER CAGR DURING 2020–2025

7 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SERVICE TYPE (Page No. - 65)

7.1 INTRODUCTION

FIGURE 24 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SERVICE TYPE

FIGURE 25 IMPACT OF COVID-19 ON AEROSPACE AND LIFE SCIENCES CERTIFICATION MARKET

TABLE 7 AEROSPACE AND LIFE SCIENCES CERTIFICATION MARKET, 2017–2025 (USD BILLION)

FIGURE 26 TESTING SERVICES TO DOMINATE AEROSPACE AND LIFE SCIENCES TIC MARKET DURING FORECAST PERIOD

TABLE 8 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SERVICE TYPE, 2017–2019 (USD MILLION)

TABLE 9 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY SERVICE TYPE, 2020–2025 (USD MILLION)

7.2 TESTING SERVICES

7.2.1 SAFETY AND SECURITY CONCERNS HAVE LED TO AN INCREASE IN TESTING SERVICES PORTFOLIO OF TIC PLAYERS

7.3 INSPECTION SERVICES

7.3.1 DISRUPTIONS IN TECHNOLOGIES HAVE LED TO INCREASE IN INTRODUCTION AND ADOPTION OF NEW INSPECTION SERVICES

7.4 CERTIFICATION SERVICES

7.4.1 MANDATORY COMPLIANCES FOR AIRCRAFT PARTS AND MEDICAL DEVICES DRIVE CERTIFICATION MARKET

7.5 OTHER SERVICES

7.5.1 COMPREHENSIVE SERVICES PERTAINING TO HEALTH AND HYGIENE ARE CRITICAL TO AEROSPACE AND LIFE SCIENCES SECTORS

8 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY APPLICATION (Page No. - 71)

8.1 INTRODUCTION

FIGURE 27 IMPACT OF COVID-19 ON MEDICAL DEVICES APPLICATION

TABLE 10 PRE- AND POST-COVID-19 SCENARIO ANALYSIS: MEDICAL DEVICES APPLICATION MARKET, 2017–2025 (USD BILLION)

FIGURE 28 MEDICAL DEVICES PLAY A SIGNIFICANT ROLE IN GROWTH OF AEROSPACE AND LIFE SCIENCES TIC MARKET

TABLE 11 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 12 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY TYPE, 2020–2025 (USD MILLION)

8.2 AEROSPACE

8.2.1 FLIGHT TESTS, TRACEABILITY-TO-CERTIFICATION MANAGEMENT, AND CERTIFICATION WITHIN AVIATION MANAGEMENT APPLICATION DRIVE AEROSPACE TIC MARKET

8.2.2 AEROSPACE MANUFACTURING SERVICES

8.2.3 AVIATION MANAGEMENT SERVICES

8.2.4 OTHERS

TABLE 13 AEROSPACE TIC MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 14 AEROSPACE TIC MARKET, BY TYPE, 2020–2025 (USD MILLION)

8.3 MEDICAL & LIFE SCIENCES

8.3.1 DEMAND FOR TIC-APPROVED ADVANCED MEDICAL DEVICES DRIVES GROWTH OF MEDICAL & LIFE SCIENCES APPLICATIONS

8.3.2 MEDICAL DEVICES

8.3.3 HEALTH, BEAUTY, AND WELLNESS

8.3.4 CLINICAL SERVICES

8.3.5 LABORATORY SERVICES

8.3.6 BIOPHARMACEUTICALS AND PHARMACEUTICALS SERVICES

8.3.7 OTHERS

TABLE 15 LIFE SCIENCES TIC MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 16 LIFE SCIENCES TIC MARKET, BY TYPE, 2020–2025 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 81)

9.1 INTRODUCTION

FIGURE 29 GEOGRAPHIC SNAPSHOT: AEROSPACE AND LIFE SCIENCES TIC MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 30 NORTH AMERICA TO HOLD LARGEST SHARE OF AEROSPACE AND LIFE SCIENCES TIC MARKET DURING FORECAST PERIOD

TABLE 17 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 18 AEROSPACE AND LIFE SCIENCES TIC MARKET, BY REGION, 2020–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 31 SNAPSHOT OF AEROSPACE AND LIFE SCIENCES TIC MARKET IN NORTH AMERICA

TABLE 19 AEROSPACE AND LIFE SCIENCES TIC MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 20 AEROSPACE AND LIFE SCIENCES TIC MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 21 AEROSPACE AND LIFE SCIENCES TIC MARKET IN NORTH AMERICA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 22 AEROSPACE AND LIFE SCIENCES TIC MARKET IN NORTH AMERICA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 23 AEROSPACE TIC MARKET IN NORTH AMERICA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 24 AEROSPACE TIC MARKET IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 25 LIFE SCIENCES TIC MARKET IN NORTH AMERICA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 26 LIFE SCIENCES TIC MARKET IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Huge aviation market in country helps US in leading North American aerospace and life sciences TIC market

TABLE 27 AEROSPACE AND LIFE SCIENCES TIC MARKET IN US, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 28 AEROSPACE AND LIFE SCIENCES TIC MARKET IN US, BY SOURCING TYPE, 2020-2025 (USD MILLION)

TABLE 29 AEROSPACE TIC MARKET IN US, BY TYPE, 2017–2019 (USD MILLION)

TABLE 30 AEROSPACE TIC MARKET IN US, BY TYPE, 2020–2025 (USD MILLION)

TABLE 31 LIFE SCIENCES TIC MARKET IN US, BY TYPE, 2017–2019 (USD MILLION)

TABLE 32 LIFE SCIENCES TIC MARKET IN US, BY TYPE, 2020–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 Growing demand for TIC services across aviation components and new testing services in biotechnology drive market in Canada

TABLE 33 AEROSPACE AND LIFE SCIENCES TIC MARKET IN CANADA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 34 AEROSPACE AND LIFE SCIENCES TIC MARKET IN CANADA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 35 AEROSPACE TIC MARKET IN CANADA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 36 AEROSPACE TIC MARKET IN CANADA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 37 LIFE SCIENCES TIC MARKET IN CANADA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 38 LIFE SCIENCES TIC MARKET IN CANADA, BY TYPE, 2020–2025 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Huge potential for growth in medical equipment and aerospace TIC services segments

TABLE 39 AEROSPACE AND LIFE SCIENCES TIC MARKET IN MEXICO, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 40 AEROSPACE AND LIFE SCIENCES TIC MARKET IN MEXICO, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 41 AEROSPACE TIC MARKET IN MEXICO, BY TYPE, 2017–2019 USD MILLION)

TABLE 42 AEROSPACE TIC MARKET IN MEXICO, BY TYPE, 2020–2025 (USD MILLION)

TABLE 43 LIFE SCIENCES TIC MARKET IN MEXICO, BY TYPE, 2017–2019 (USD MILLION)

TABLE 44 LIFE SCIENCES TIC MARKET IN MEXICO, BY TYPE, 2020–2025 (USD MILLION)

9.3 EUROPE

FIGURE 32 SNAPSHOT OF AEROSPACE AND LIFE SCIENCES TIC MARKET IN EUROPE

TABLE 45 AEROSPACE AND LIFE SCIENCES TIC MARKET IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 46 AEROSPACE AND LIFE SCIENCES TIC MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 47 AEROSPACE AND LIFE SCIENCES TIC MARKET IN EUROPE, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 48 AEROSPACE AND LIFE SCIENCES TIC MARKET IN EUROPE, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 49 AEROSPACE TIC MARKET IN EUROPE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 50 AEROSPACE TIC MARKET IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 51 LIFE SCIENCES TIC MARKET IN EUROPE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 52 LIFE SCIENCES TIC MARKET IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Huge R&D centers and awareness for healthcare have driven market for life sciences in Germany

TABLE 53 AEROSPACE AND LIFE SCIENCES TIC MARKET IN GERMANY, BY SOURCING TYPE, 2019–2025 (USD MILLION)

TABLE 54 AEROSPACE AND LIFE SCIENCES TIC MARKET IN GERMANY, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 55 AEROSPACE TIC MARKET IN GERMANY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 56 AEROSPACE TIC MARKET IN GERMANY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 57 LIFE SCIENCES TIC MARKET IN GERMANY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 58 LIFE SCIENCES TIC MARKET IN GERMANY, BY TYPE, 2020–2025 (USD MILLION)

9.3.2 UK

9.3.2.1 Government investments in research and development activities ensure new growth opportunities for aerospace TIC market in UK

TABLE 59 AEROSPACE AND LIFE SCIENCES TIC MARKET IN UK, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 60 AEROSPACE AND LIFE SCIENCES TIC MARKET IN UK, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 61 AEROSPACE TIC MARKET IN UK, BY TYPE, 2017–2019 (USD MILLION)

TABLE 62 AEROSPACE TIC MARKET IN UK, BY TYPE, 2020–2025 (USD MILLION)

TABLE 63 LIFE SCIENCES TIC MARKET IN UK, BY TYPE, 2017–2019 (USD MILLION)

TABLE 64 LIFE SCIENCES TIC MARKET IN UK, BY TYPE, 2020–2025 (USD MILLION)

9.3.3 FRANCE

9.3.3.1 Diversification of businesses has helped France to provide amenities to domestic market

TABLE 65 AEROSPACE AND LIFE SCIENCES TIC MARKET IN FRANCE, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 66 AEROSPACE AND LIFE SCIENCES TIC MARKET IN FRANCE, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 67 AEROSPACE TIC MARKET IN FRANCE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 68 AEROSPACE TIC MARKET IN FRANCE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 69 LIFE SCIENCES TIC MARKET IN FRANCE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 70 LIFE SCIENCES TIC MARKET IN FRANCE, BY TYPE, 2020–2025 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Health, beauty, and wellness segment will drive adoption of TIC services in Italy

TABLE 71 AEROSPACE AND LIFE SCIENCES TIC MARKET IN ITALY, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 72 AEROSPACE AND LIFE SCIENCES TIC MARKET IN ITALY, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 73 AEROSPACE TIC MARKET IN ITALY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 74 AEROSPACE TIC MARKET IN ITALY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 75 LIFE SCIENCES TIC MARKET IN ITALY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 76 LIFE SCIENCES TIC MARKET IN ITALY, BY TYPE, 2020–2025 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Government initiatives to help industries return to normalcy have led to creation of opportunities for TIC players

TABLE 77 AEROSPACE AND LIFE SCIENCES TIC MARKET IN SPAIN, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 78 AEROSPACE AND LIFE SCIENCES TIC MARKET IN SPAIN, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 79 AEROSPACE TIC MARKET IN SPAIN, BY TYPE, 2017–2019 (USD MILLION)

TABLE 80 AEROSPACE TIC MARKET IN SPAIN, BY TYPE, 2020–2025 (USD MILLION)

TABLE 81 LIFE SCIENCES TIC MARKET IN SPAIN, BY TYPE, 2017–2019 (USD MILLION)

TABLE 82 LIFE SCIENCES TIC MARKET IN SPAIN, BY TYPE, 2020–2025 (USD MILLION)

9.3.6 NORWAY

9.3.6.1 COVID-19 pandemic has led to increased opportunities for TIC players in medical and life sciences segments

TABLE 83 AEROSPACE AND LIFE SCIENCES TIC MARKET IN NORWAY, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 84 AEROSPACE AND LIFE SCIENCES TIC MARKET IN NORWAY, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 85 AEROSPACE TIC MARKET IN NORWAY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 86 AEROSPACE TIC MARKET IN NORWAY, BY TYPE, 2020–2025 (USD MILLION)

TABLE 87 LIFE SCIENCES TIC MARKET IN NORWAY, BY TYPE, 2017–2019 (USD MILLION)

TABLE 88 LIFE SCIENCES TIC MARKET IN NORWAY, BY TYPE, 2020–2025 (USD MILLION)

9.3.7 NETHERLANDS

9.3.7.1 Huge manufacturing and MRO capabilities have led to creation of opportunities for TIC service providers

TABLE 89 AEROSPACE AND LIFE SCIENCES TIC MARKET IN NETHERLANDS, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 90 AEROSPACE AND LIFE SCIENCES TIC MARKET IN NETHERLANDS, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 91 AEROSPACE TIC MARKET IN NETHERLANDS, BY TYPE, 2017–2019 (USD MILLION)

TABLE 92 AEROSPACE TIC MARKET IN NETHERLANDS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 93 LIFE SCIENCES TIC MARKET IN NETHERLANDS, BY TYPE, 2017–2019 (USD MILLION)

TABLE 94 LIFE SCIENCES TIC MARKET IN NETHERLANDS, BY TYPE, 2020–2025 (USD MILLION)

9.3.8 REST OF EUROPE (ROE)

TABLE 95 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF EUROPE, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 96 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF EUROPE, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 97 AEROSPACE TIC MARKET IN REST OF EUROPE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 98 AEROSPACE TIC MARKET IN REST OF EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 99 LIFE SCIENCES TIC MARKET IN THE REST OF EUROPE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 100 LIFE SCIENCES TIC MARKET IN THE REST OF EUROPE, BY TYPE, 2020–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 33 SNAPSHOT OF AEROSPACE AND LIFE SCIENCES TIC MARKET IN APAC

TABLE 101 AEROSPACE AND LIFE SCIENCES TIC MARKET IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 102 AEROSPACE AND LIFE SCIENCES TIC MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 103 AEROSPACE AND LIFE SCIENCES TIC MARKET IN APAC, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 104 AEROSPACE AND LIFE SCIENCES TIC MARKET IN APAC, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 105 AEROSPACE TIC MARKET IN APAC, BY TYPE, 2017–2019 (USD MILLION)

TABLE 106 AEROSPACE TIC MARKET IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 107 LIFE SCIENCES TIC MARKET IN APAC, BY TYPE, 2017–2019 (USD MILLION)

TABLE 108 LIFE SCIENCES TIC MARKET IN APAC, BY TYPE, 2020–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Increasing developments in technologies and medical space have encouraged TIC service providers to set up labs in China

TABLE 109 AEROSPACE AND LIFE SCIENCES TIC MARKET IN CHINA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 110 AEROSPACE AND LIFE SCIENCES TIC MARKET IN CHINA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 111 AEROSPACE TIC MARKET IN CHINA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 112 AEROSPACE TIC MARKET IN CHINA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 113 LIFE SCIENCES TIC MARKET IN CHINA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 114 LIFE SCIENCES TIC MARKET IN CHINA, BY TYPE, 2020–2025 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Strong pharmaceuticals research and development infrastructure is driving testing services segment in Japan

TABLE 115 AEROSPACE AND LIFE SCIENCES TIC MARKET IN JAPAN, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 116 AEROSPACE AND LIFE SCIENCES TIC MARKET IN JAPAN, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 117 AEROSPACE TIC MARKET IN JAPAN, BY TYPE, 2017–2019 (USD MILLION)

TABLE 118 AEROSPACE TIC MARKET IN JAPAN, BY TYPE, 2020–2025 (USD MILLION)

TABLE 119 LIFE SCIENCES TIC MARKET IN JAPAN, BY TYPE, 2017–2019 (USD MILLION)

TABLE 120 LIFE SCIENCES TIC MARKET IN JAPAN, BY TYPE, 2020–2025 (USD MILLION)

9.4.3 INDIA

9.4.3.1 Demand for TIC services is increasing due to increasing medical equipment and medicines production, and investments in R&D

TABLE 121 AEROSPACE AND LIFE SCIENCES TIC MARKET IN INDIA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 122 AEROSPACE AND LIFE SCIENCES TIC MARKET IN INDIA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 123 AEROSPACE TIC MARKET IN INDIA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 124 AEROSPACE TIC MARKET IN INDIA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 125 LIFE SCIENCES TIC MARKET IN INDIA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 126 LIFE SCIENCES TIC MARKET IN INDIA, BY TYPE, 2020–2025 (USD MILLION)

9.4.4 SOUTH KOREA

9.4.4.1 Manufacturing and export of medical devices have helped South Korea maintain its global rank

TABLE 127 AEROSPACE AND LIFE SCIENCES TIC MARKET IN SOUTH KOREA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 128 AEROSPACE AND LIFE SCIENCES TIC MARKET IN SOUTH KOREA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 129 AEROSPACE TIC MARKET IN SOUTH KOREA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 130 AEROSPACE TIC MARKET IN SOUTH KOREA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 131 LIFE SCIENCES TIC MARKET IN SOUTH KOREA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 132 LIFE SCIENCES TIC MARKET IN SOUTH KOREA, BY TYPE, 2020–2025 (USD MILLION)

9.4.5 AUSTRALIA

9.4.5.1 Stringent rules and norms in Australia have led to rising standards of medical products across region

TABLE 133 AEROSPACE AND LIFE SCIENCES TIC MARKET IN AUSTRALIA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 134 AEROSPACE AND LIFE SCIENCES TIC MARKET IN AUSTRALIA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 135 AEROSPACE TIC MARKET IN AUSTRALIA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 136 AEROSPACE TIC MARKET IN AUSTRALIA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 137 LIFE SCIENCES TIC MARKET IN AUSTRALIA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 138 LIFE SCIENCES TIC MARKET IN AUSTRALIA, BY TYPE, 2020–2025 (USD MILLION)

9.4.6 REST OF APAC (ROAPAC)

TABLE 139 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF APAC, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 140 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF APAC, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 141 AEROSPACE TIC MARKET IN REST OF APAC, BY TYPE, 2017–2019 (USD MILLION)

TABLE 142 AEROSPACE TIC MARKET IN REST OF APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 143 LIFE SCIENCES TIC MARKET IN REST OF APAC, BY TYPE, 2017–2019 (USD MILLION)

TABLE 144 LIFE SCIENCES TIC MARKET IN REST OF APAC, BY TYPE, 2020–2025 (USD MILLION)

9.5 REST OF THE WORLD

FIGURE 34 SNAPSHOT OF AEROSPACE AND LIFE SCIENCES TIC MARKET IN ROW

TABLE 145 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF THE WORLD, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 146 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF THE WORLD, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 147 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF THE WORLD, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 148 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF THE WORLD, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 149 AEROSPACE TIC MARKET IN REST OF THE WORLD, BY TYPE, 2017–2019 (USD MILLION)

TABLE 150 AEROSPACE TIC MARKET IN REST OF THE WORLD, BY TYPE, 2020–2025 (USD MILLION)

TABLE 151 LIFE SCIENCES TIC MARKET IN REST OF THE WORLD, BY TYPE, 2017–2019 (USD MILLION)

TABLE 152 LIFE SCIENCES TIC MARKET IN REST OF THE WORLD, BY TYPE, 2020–2025 (USD MILLION)

9.5.1 SOUTH AMERICA

9.5.1.1 Regulations for medical devices provide opportunities for TIC companies to set up labs in South America

TABLE 153 AEROSPACE AND LIFE SCIENCES TIC MARKET IN SOUTH AMERICA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 154 AEROSPACE AND LIFE SCIENCES TIC MARKET IN SOUTH AMERICA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 155 AEROSPACE TIC MARKET IN SOUTH AMERICA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 156 AEROSPACE TIC MARKET IN SOUTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 157 LIFE SCIENCES TIC MARKET IN SOUTH AMERICA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 158 LIFE SCIENCES TIC MARKET IN SOUTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

9.5.2 ARGENTINA

9.5.2.1 Liberalization and globalization will fuel demand for TIC services in Argentina

TABLE 159 AEROSPACE AND LIFE SCIENCES TIC MARKET IN ARGENTINA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 160 AEROSPACE AND LIFE SCIENCES TIC MARKET IN ARGENTINA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 161 AEROSPACE TIC MARKET IN ARGENTINA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 162 AEROSPACE TIC MARKET IN ARGENTINA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 163 LIFE SCIENCES TIC MARKET IN ARGENTINA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 164 LIFE SCIENCES TIC MARKET IN ARGENTINA, BY TYPE, 2020–2025 (USD MILLION)

9.5.3 BRAZIL

9.5.3.1 Agreements and partnerships between government and MNCs are helping Brazil to move ahead in global ranks

TABLE 165 AEROSPACE AND LIFE SCIENCES TIC MARKET IN BRAZIL, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 166 AEROSPACE AND LIFE SCIENCES TIC MARKET IN BRAZIL, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 167 AEROSPACE TIC MARKET IN BRAZIL, BY TYPE, 2017–2019 (USD MILLION)

TABLE 168 AEROSPACE TIC MARKET IN BRAZIL, BY TYPE, 2020–2025 (USD MILLION)

TABLE 169 LIFE SCIENCES TIC MARKET IN BRAZIL, BY TYPE, 2017–2019 (USD MILLION)

TABLE 170 LIFE SCIENCES TIC MARKET IN BRAZIL, BY TYPE, 2020–2025 (USD MILLION)

9.5.4 REST OF SOUTH AMERICA

TABLE 171 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF SOUTH AMERICA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 172 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF SOUTH AMERICA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 173 AEROSPACE TIC MARKET IN REST OF SOUTH AMERICA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 174 AEROSPACE TIC MARKET IN REST OF SOUTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 175 LIFE SCIENCES TIC MARKET IN REST OF SOUTH AMERICA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 176 LIFE SCIENCES TIC MARKET IN REST OF SOUTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

9.5.5 MEA

9.5.5.1 Advancements in medical facilities amidst COVID-19 pandemic have increased opportunities for TIC companies

TABLE 177 AEROSPACE AND LIFE SCIENCES TIC MARKET IN MEA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 178 AEROSPACE AND LIFE SCIENCES TIC MARKET IN MEA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 179 AEROSPACE TIC MARKET IN MEA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 180 AEROSPACE TIC MARKET IN MEA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 181 LIFE SCIENCES TIC MARKET IN MEA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 182 LIFE SCIENCES TIC MARKET IN MEA, BY TYPE, 2020–2025 (USD MILLION)

9.5.6 SAUDI ARABIA

9.5.6.1 Stringent regulations pave way for TIC companies in testing and certification services segments

TABLE 183 AEROSPACE AND LIFE SCIENCES TIC MARKET IN SAUDI ARABIA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 184 AEROSPACE AND LIFE SCIENCES TIC MARKET IN SAUDI ARABIA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 185 AEROSPACE TIC MARKET IN SAUDI ARABIA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 186 AEROSPACE TIC MARKET IN SAUDI ARABIA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 187 LIFE SCIENCES TIC MARKET IN SAUDI ARABIA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 188 LIFE SCIENCES TIC MARKET IN SAUDI ARABIA, BY TYPE, 2020–2025 (USD MILLION)

9.5.7 UAE

9.5.7.1 Technological innovations and restructuring of business strategies further open doors for TIC services providers

TABLE 189 AEROSPACE AND LIFE SCIENCES TIC MARKET IN UAE, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 190 AEROSPACE AND LIFE SCIENCES TIC MARKET IN UAE, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 191 AEROSPACE TIC MARKET IN UAE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 192 AEROSPACE TIC MARKET IN UAE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 193 LIFE SCIENCES TIC MARKET IN UAE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 194 LIFE SCIENCES TIC MARKET IN UAE, BY TYPE, 2020–2025 (USD MILLION)

9.5.8 REST OF MIDDLE EAST AND AFRICA

TABLE 195 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF MEA, BY SOURCING TYPE, 2017–2019 (USD MILLION)

TABLE 196 AEROSPACE AND LIFE SCIENCES TIC MARKET IN REST OF MEA, BY SOURCING TYPE, 2020–2025 (USD MILLION)

TABLE 197 AEROSPACE TIC MARKET IN REST OF MEA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 198 AEROSPACE TIC MARKET IN REST OF MEA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 199 LIFE SCIENCES TIC MARKET IN REST OF MEA, BY TYPE, 2017–2019 (USD MILLION)

TABLE 200 LIFE SCIENCES TIC MARKET IN REST OF MEA, BY TYPE, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 161)

10.1 OVERVIEW

10.2 MARKET SHARE ANALYSIS

TABLE 201 AEROSPACE TIC ECOSYSTEM: MARKET SHARE ANALYSIS (2019)

TABLE 202 LIFE SCIENCES TIC ECOSYSTEM: MARKET SHARE ANALYSIS (2019)

10.3 COMPETITIVE LEADERSHIP MAPPING, 2019

10.3.1 VISIONARY LEADERS

10.3.2 DYNAMIC DIFFERENTIATORS

10.3.3 INNOVATORS

10.3.4 EMERGING COMPANIES

FIGURE 35 AEROSPACE AND LIFE SCIENCES TIC MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

10.4 STRENGTH OF SERVICE PORTFOLIO

FIGURE 36 SERVICE PORTFOLIO ANALYSIS OF TOP PLAYERS IN AEROSPACE AND LIFE SCIENCES TESTING, INSPECTION, AND CERTIFICATION MARKET

10.5 BUSINESS STRATEGY EXCELLENCE

FIGURE 37 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN AEROSPACE AND LIFE SCIENCES TESTING, INSPECTION, AND CERTIFICATION MARKET

10.6 COMPETITIVE SITUATION AND TRENDS

10.6.1 EXPANSIONS

TABLE 203 EXPANSIONS, 2019

10.6.2 PRODUCT/SERVICE LAUNCHES AND DEVELOPMENTS

TABLE 204 PRODUCT/SERVICE LAUNCHES AND DEVELOPMENTS, 2019

10.6.3 ACQUISITIONS

TABLE 205 ACQUISITIONS, 2018–2019

10.6.4 AGREEMENTS AND PARTNERSHIPS

TABLE 206 AGREEMENTS AND PARTNERSHIPS, 2019 & 2020

11 COMPANY PROFILES (Page No. - 168)

11.1 INTRODUCTION

(Business overview, Services offered, Recent developments, COVID-19-related recent developments, SWOT analysis, and MnM view)*

11.2 KEY PLAYERS

11.2.1 SGS GROUP

FIGURE 38 SGS GROUP: COMPANY SNAPSHOT

11.2.2 BUREAU VERITAS

FIGURE 39 BUREAU VERITAS SA: COMPANY SNAPSHOT

11.2.3 INTERTEK

FIGURE 40 INTERTEK: COMPANY SNAPSHOT

11.2.4 EUROFINS SCIENTIFIC

FIGURE 41 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

11.2.5 TÜV SÜD

FIGURE 42 TÜV SÜD: COMPANY SNAPSHOT

11.2.6 DNV GL

FIGURE 43 DNV GL: COMPANY SNAPSHOT

11.2.7 TÜV RHEINLAND

FIGURE 44 TÜV RHEINLAND: COMPANY SNAPSHOT

11.2.8 APPLUS+

FIGURE 45 APPLUS+: COMPANY SNAPSHOT

11.2.9 TÜV NORD GROUP

FIGURE 46 TÜV NORD GROUP: COMPANY SNAPSHOT

11.2.10 ELEMENT MATERIALS TECHNOLOGY

11.2.11 ALS LIMITED

FIGURE 47 ALS LIMITED: COMPANY SNAPSHOT

11.2.12 UL LLC

11.2.13 MISTRAS

FIGURE 48 MISTRAS: COMPANY SNAPSHOT

11.3 KEY INNOVATORS

11.3.1 AVOMEEN ANALYTICAL SERVICES

11.3.2 ELEMENT MATERIALS TECHNOLOGY (EXOVA)

11.3.3 ENVIGO

11.3.4 MEDISTRI SA

11.3.5 GATEWAY ANALYTICAL

*Details on Business overview, Services offered, Recent developments, COVID-19-related recent developments, SWOT analysis, and MnM view might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 200)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

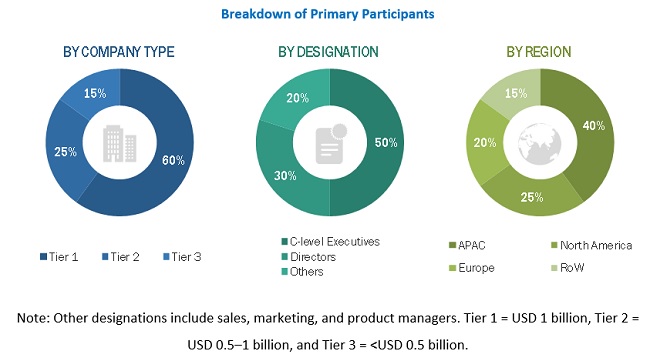

The study involved 4 major activities in estimating the current size of the aerospace and life sciences TIC market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information relevant for this study. These secondary sources include biometric technologies journals, magazines, and IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information pertinent to this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the Europe TIC market. After a complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the Europe TIC market and other dependent submarkets listed in this report.

- Key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures were employed wherever applicable. The data was triangulated by studying various factors and trends identified from both the demand and supply sides—in government, scientific research, healthcare, aerospace, and military & defense verticals.

Report Objectives

The following are the primary objectives of the study:

- To define, describe, and forecast the aerospace and life sciences TIC market based on the sourcing type, service type, application, and region

- To forecast the market size of various segments with respect to global market

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments, such as agreements, contracts, partnerships, acquisitions, and product launches & developments, carried out in the aerospace and life sciences market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Aerospace and life sciences TIC Market