Chromatography Resin Market by type (Natural, Synthetic, Inorganic Media), Technique (Ion Exchange, Affinity, Hydrophobic Interaction, Size Exclusion, Mixed Mode), Application (Pharmaceutical & Biotechnology, FnB), Region - Global Forecasts to 2028

Chromatography Resin Market Overview

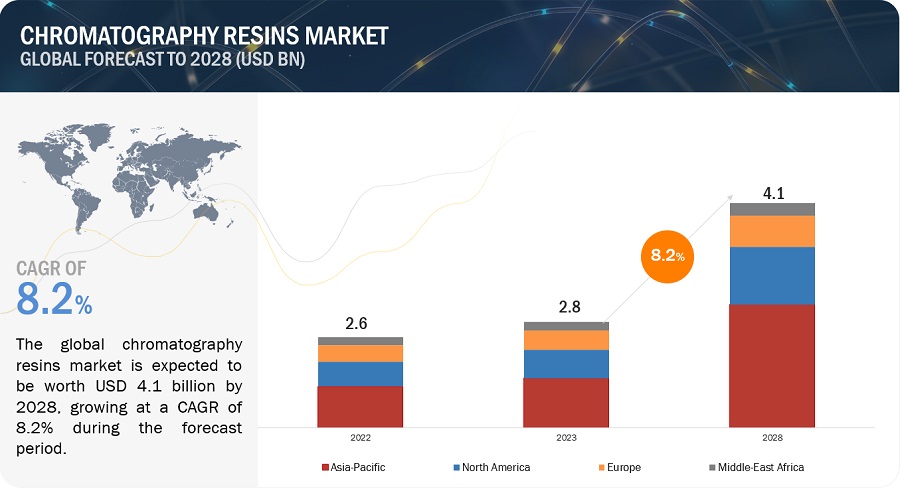

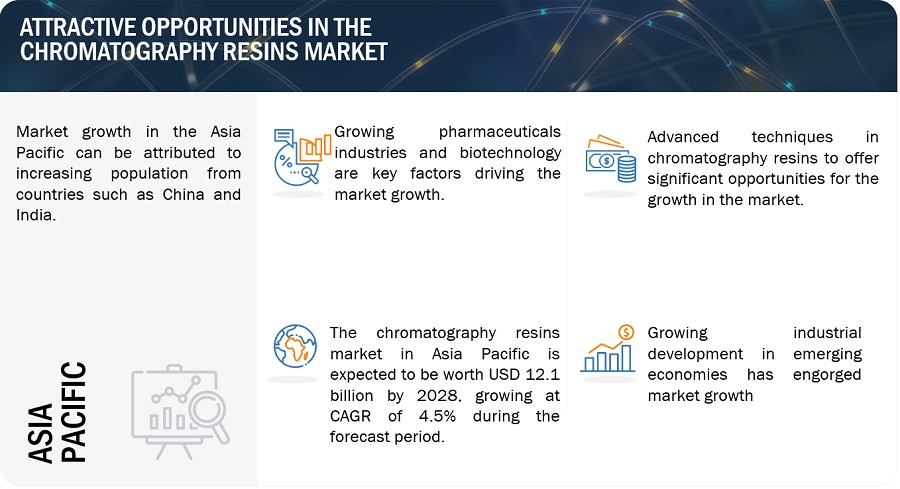

The global chromatography resin market size was valued at USD 2.8 billion in 2023 and is projected to reach USD 4.1 billion by 2028, growing at 8.2% cagr during the forecast period. The market growth of chromatography resins is propelled by two key factors: the rising demand for biosimilars and the continuous expansion of pharmaceutical and biopharmaceutical R&D activities. Particularly, the growing demand for biosimilars in the Asia Pacific region is driving the need for chromatography resins, while further growth is anticipated in the US and Japan. As R&D spending continues to increase, the demand for chromatography resins is expected to grow, with their integral role in various pharmaceutical R&D processes.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing demand for biosimilars

Biosimilars have proven effective in the treatment of various medical conditions such as cancer, rheumatoid arthritis, infectious disorders, psoriasis, anemia, kidney failure, type 1 and type 2 diabetes, post-menopausal osteoporosis, and hormonal disorders. Ongoing research and development efforts are focused on utilizing biosimilars in therapeutic areas, including oncology, autoimmune disorders, diabetes, and hepatitis. Furthermore, there is potential for biosimilars to be developed for other chronic conditions such as meningitis, breast cancer, adult T-cell leukemia, obesity, hypertension, and hepatitis E. The demand for biosimilars continues to rise, and the utilization of chromatography resins is expected to increase accordingly.

Restraint: Shortage of suitably trained professionals

In recent years, the chromatography resin market has witnessed significant technological advancements. However, a pressing challenge in the pharmaceutical industry is the scarcity of skilled professionals who can effectively operate chromatography instruments and perform the necessary techniques. The successful utilization of chromatography equipment demands expertise, hands-on experience, and comprehensive knowledge of various chromatography techniques. This shortage of skilled labor has the potential to impede the growth of the global chromatography resins market. By nurturing a skilled labor force, the chromatography sector can thrive, fueling further advancements and expansion in the market.

Opportunity: Rising demand for chromatography in drug development and omics research

Chromatography is an exceptionally adaptable separation technique that offers extensive availability. During the initial stages of drug discovery, it is crucial to separate numerous closely related compounds that have been synthesized. The identification and assessment of their purity are of utmost importance. Chromatography methods are widely utilized for these purposes. Chromatography instruments find extensive applications in separating, purifying, and analyzing raw materials, Active Pharmaceutical Ingredients (APIs), and excipients. As a result, the growing need for high-quality medications and the implementation of stringent government regulations have led to an increased demand for chromatography resins in several countries.

Challenge: The presence of unconventional technologies in chromatography

There are various alternative techniques available that can serve as substitutes for chromatography, including precipitation, high-resolution ultrafiltration, crystallization, high-pressure refolding, charged ultrafiltration membranes, protein crystallization, capillary electrophoresis, aqueous two-phase extraction, three-phase partitioning, monoliths, and membrane chromatography. These alternative techniques offer distinct advantages, which may pose challenges to the growth of the chromatography resin market. The availability of these alternative methods introduces competition and prompts the industry to continuously innovate and enhance the performance and efficiency of chromatography resin to maintain its market position.

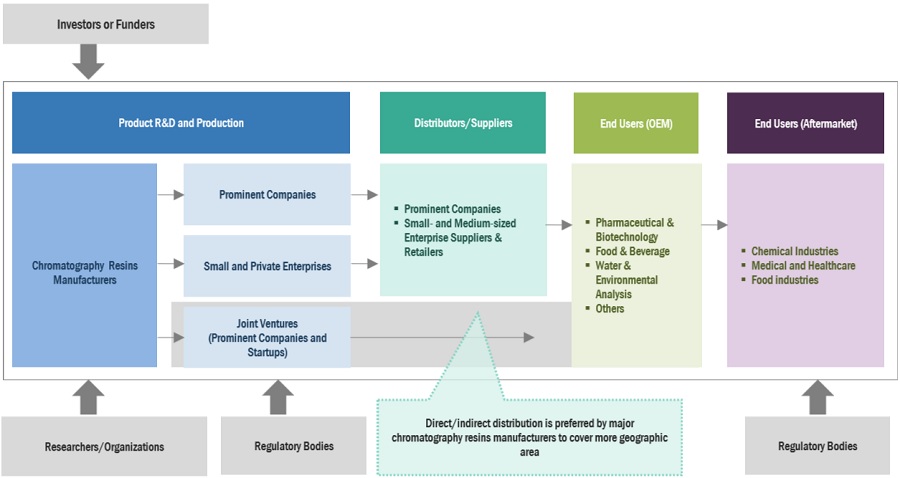

Chromatography resins market ecosystem

Preceding companies in this market include well-established, financially stable chromatography resins. These businesses have been in business for a while and have an extensive range of products, pioneering technologies, and strong international sales and marketing networks. Top companies in this market include Bio-Rad Laboratories Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Tosoh Corporation (Japan), Bio-Works Technologies AB (Sweden), Avantor Performance Materials, Inc. (US), Mitsubishi Chemical Corporation (Japan).

“Synthetic resins are forecasted to be the fastest-growing chromatography resin type between 2023 and 2028.”

The synthetic resins segment is forecasted to exhibit the highest growth rate Between 2023 and 2028. The demand for synthetic resins is primarily fueled by their utilization in ion exchange chromatography. Among synthetic resins, polystyrene divinylbenzene stands out as the most frequently employed type due to its superior performance attributes when compared to natural polymers. The increasing adoption of the IEX technique further contributes to the growing prominence of polystyrene divinyl benzene. This surge in the synthetic resins segment is predominantly driven by the escalating usage of synthetic resins in analytical and laboratory-scale applications.

“Affinity was the largest chromatography technique in 2022 in terms of value.”

The principle of affinity chromatography revolves around the specific affinity between molecules in the mobile phase and ligands attached to the stationary resin. The affinity chromatography resin market segment is anticipated to experience growth due to the increasing need for protein A, which enables convenient and effective antibody purification. Affinity chromatography offers notable benefits, including excellent selectivity, resolution, and capacity in various protein purification processes. One of its advantages lies in leveraging a protein's inherent biological structure or function to facilitate purification. These factors collectively contribute to the rising demand for affinity chromatography techniques.

“Food & Beverages was the second-largest chromatography resin application in 2022 in terms of value.”

Chromatography resin plays a vital role as an analytical technique in food analysis, with its application primarily focused on three areas: assessing the nutritional quality of food, detecting spoilage, and identifying additives in food. The demand for chromatography resin in the food and beverage sector is driven by various factors. These include the rapid advancements in science and technology, the escalating costs of healthcare, the growing consumer preference for natural food products, the evolving lifestyles and dietary choices, and the increasing awareness of the importance of health and wellness. Additionally, the demand for beverages, dairy products, and natural ingredients such as food colors, flavors, flavonoids, and carotenoids further contributes to the need for chromatography resin in the food and beverage industry.

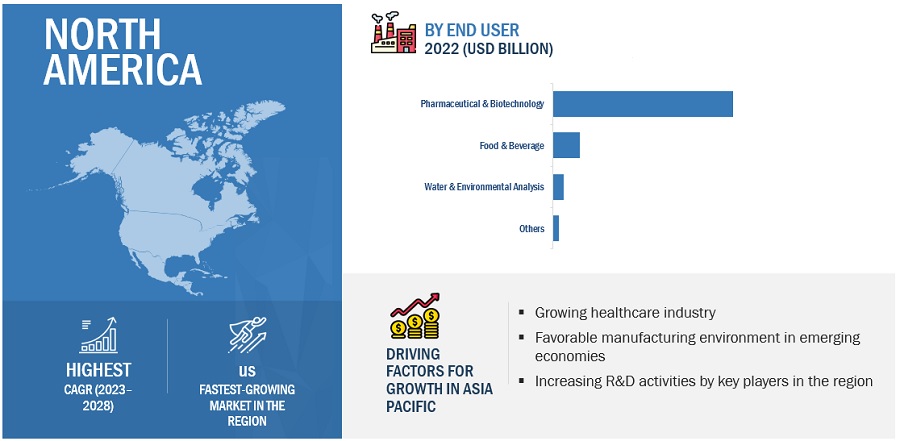

“North America to account for the largest share of the global chromatography resin market during the forecasted period between 2023 and 2028.”

In 2022, North America emerged as the dominant region in the global chromatography resin market, both in terms of volume and value. The United States stands as the leading market for chromatography resin in North America, closely followed by Canada. The strong presence of the therapeutic monoclonal antibody market in North America significantly contributes to the demand for chromatography resin. Moreover, modern chromatographic techniques are increasingly being employed for food analysis and various diagnostic applications in both the US and Canada. North America houses several prominent pharmaceutical companies, many of which have established their research centers in the region. These factors collectively drive the demand for chromatography resin in North America.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The chromatography resin market is dominated by a few globally established players such as Danaher Corporation (US), Bio-Rad Laboratories Inc. (US), Merck KGaA (Germany), Tosoh Corporation (Japan), BioWorks Technologies AB (Sweden), and among others, are the key manufacturers that hold major market share in the last few years. The major focus was given to acquisition, innovation, and new product development due to the changing requirements of users across the world.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (Liters) |

|

Segments Covered |

Type, Technique, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies profiled |

Bio-Rad Laboratories, Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Tosoh Corporation (Japan), Bio-Works Technologies AB (Sweden), Avantor Performance Materials, Inc. (US), Mitsubishi Chemical Corporation (Japan), among others Top 25 major players covered |

This report categorizes the global chromatography resin market based on type, technique, application, and region.

On the basis of type, the chromatography resin market has been segmented as follows:

- Synthetic Resins

- Natural Polymers

- Inorganic Media

On the basis of technique, the chromatography resin market has been segmented as follows:

-

Ion Exchange

- Cation

- Anion

- Affinity

- Size Exclusion

- Hydrophobic Interaction

- Mixed Mode Chromatography Resin Market

- Others

On the basis of application, the chromatography resin market has been segmented as follows:

-

Pharmaceutical & Biotechnology

- Production

- Academics & Research

- Food & Beverage

- Water & Environmental Analysis

- Others

On the basis of region, the chromatography resin market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments:

- In April 2020, Bio-Rad Laboratories, Inc. recently introduced its SARS-CoV-2 Total Ab test, a kit designed for blood-based immunoassays. This test aids in the identification of antibodies developed against SARS-CoV-2, the virus responsible for COVID-19. It has the capability to detect IgG, IgM, and IgA antibodies, offering a more comprehensive approach compared to tests that target a single immunoglobulin. The utilization of multiple immunoglobulins enhances the sensitivity of the assay, providing more accurate results in determining the presence of antibodies against SARS-CoV-2.

- In October 2021, Tosoh Bioscience LLC, a subsidiary of Tosoh Corporation, successfully finalized the acquisition of Semba Biosciences. Semba Biosciences is a renowned pioneer in the development of multi-column chromatography (MCC) instrumentation and technology, specifically for the downstream purification of biologics. This strategic acquisition has enabled Tosoh Biosciences to enhance and broaden its chromatography resin-related business.

- In March 2020, The acquisition of General Electric Company's life sciences division's Biopharma business by Danaher Corporation was successfully concluded. Following the acquisition, the business has been renamed Cytiva and will operate independently as a standalone company within Danaher's life sciences segment.

Frequently Asked Questions (FAQ):

Which is the largest type of chromatography resin market in the year 2022?

In terms of both value and volume in the year 2022,Natural polymers are the largest type of chromatography resin market

Which is the largest application of chromatography resin market?

In terms of both volume and value, Pharmaceuticals & Biotechnology accounts the largest application for chromatography resins market

Which technique of the chromatography resins market will grow during the forecasted period?

Affinity technique will lead the chromatography resins market during the forecasted period.

What is the major factor impacting market growth during the forecast period 2023-2028?

The market growth is primarily due to a shortage of sufficient trained professionals to handle chromatography resin in most countries.

Who are the major players in the chromatography resins market?

The key players profiled in the report include Bio-Rad Laboratories Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Tosoh Corporation (Japan), Bio-Works Technologies AB (Sweden), Avantor Performance Materials, Inc. (US), Mitsubishi Chemical Corporation (Japan). .

What are Chromatography Resins?

Chromatography resins are materials used in chromatographic processes to separate and purify components in a mixture based on their interactions with the resin, facilitating applications in biopharmaceuticals and bioseparations.

What are the types of Chromatography Resins?

The types of chromatography resins include ion exchange resins, affinity resins, hydrophobic interaction resins, and size exclusion resins, each designed for specific separation and purification needs in various chromatographic applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

12 COMPANY PROFILES (Page No. - 223)

The study involved four major activities in estimating the market size of the chromatography resin market. Intensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study involved annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were demonstrated through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The chromatography resin market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of food & beverages, pharmaceuticals & biotechnology, and other industries. The supply side is differentiated by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

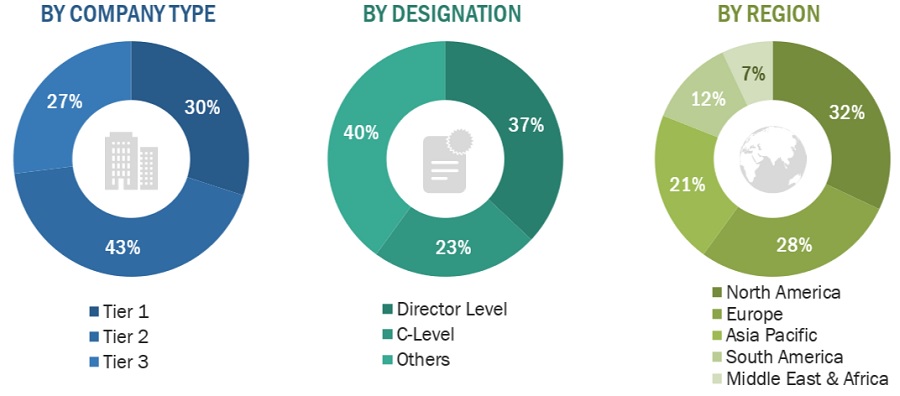

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Danaher Corporation |

Global Strategy & Innovation Manager |

|

Tosoh Corporation |

Technical Sales Manager |

|

Bio-Rad Laboratories, Inc. |

Production Supervisor |

|

Merck KGaA |

Vice-President |

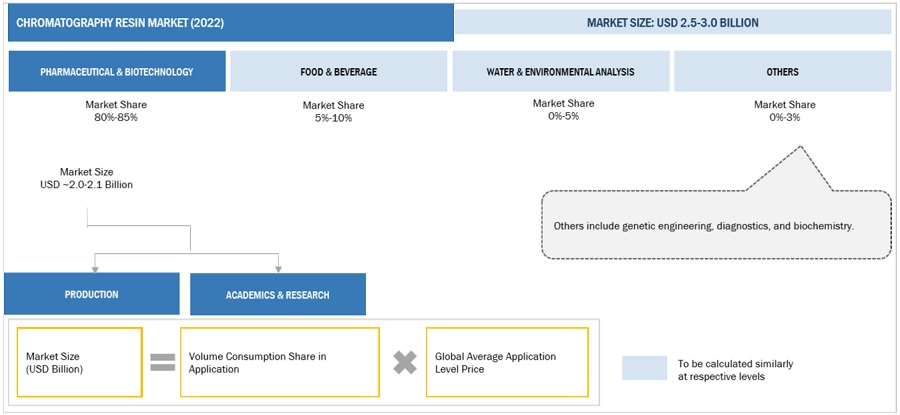

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the chromatography resin market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Chromatography Resins Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Chromatography Resins Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food & beverages, pharmaceuticals & biotechnology industries, among others.

Market Definition

The chromatography resins market refers to the industry involved in the manufacturing, distribution, and utilization of specialized materials known as chromatography resins. These resins play a crucial role in chromatography processes, which are widely applied in scientific and industrial settings to separate and purify different components of a mixture. Chromatography is a technique that utilizes a stationary phase, often in the form of chromatography resins, and a mobile phase (solvent or eluent) to separate individual components based on their distinct interactions. The properties of chromatography resins, including their chemical composition and physical structure, determine the effectiveness of the separation and purification process.

Key Stakeholders

- Chromatography resins manufacturers

- Raw material manufacturers

- Government planning commissions and research organizations

- Industry associations

- End-use industries

- R&D institutions

Report Objectives

- To analyze and forecast the size of the chromatography resin market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the chromatography resin market based on type, technique, and application.

- To forecast the size of the market segments for regions such as North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Chromatography Resin Market