Clinical Decision Support Systems Market Size by Component (Services, Software), Delivery (On-premise, Cloud), Product (Standalone, Integrated), Application (Advanced, Therapeutic, Diagnostic), Interactivity (Active, Passive) & Region - Global Forecast to 2028

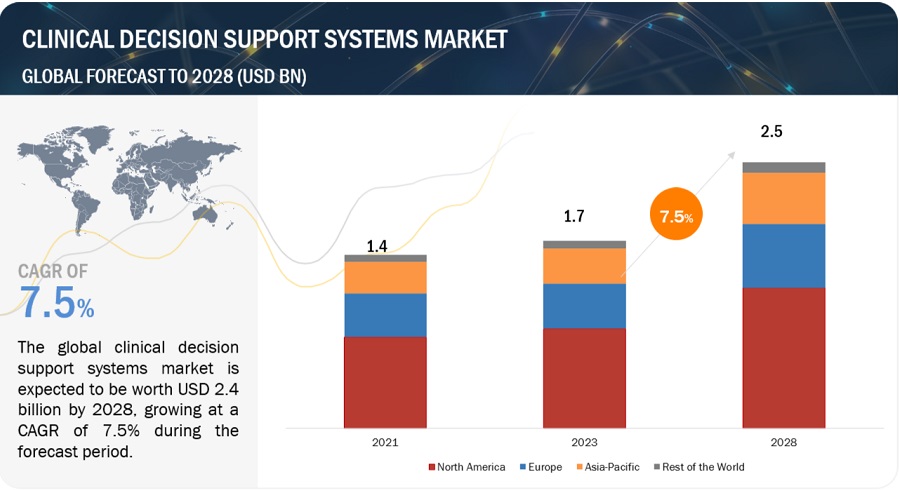

The size of global clinical decision support systems market in terms of revenue was estimated to be worth $1.7 billion in 2023 and is poised to reach $2.5 billion by 2028, growing at a CAGR of 7.5% from 2023 to 2028. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

According to The Office of the National Coordinator for Health Information Technology (ONC), as of 2021, in the US approximately 96 percent of non-federal acute care hospitals and nearly 4 in 5 office-based physicians (78%) have implemented a certified Electronic Health Record (EHR) systems. This marks significant 10-year progress since 2011 when 28% of hospitals and 34% of physicians had adopted an EHR.Additionally factors such as rising adoption of CDSS-enabled EHRs and increasing collaborations and partnerships between stakeholders and several market players. However, requirement of high investments for the implementation of CDSS infrastructure and shortage of skilled IT professionals in the healthcare industry are expected to challenge market growth to a certain extent.

Global Clinical Decision Support Systems Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Clinical Decision Support Systems Market Dynamics

Driver: Implementation of government regulations & initiatives to promote the adoption of HCIT solutions

In December 2021, CMS declared the publication of a Federal Register Notice to formalize its result to exercise enforcement discretion not to take action against certain payer-to-payer data exchange provisions of the May 2020 Interoperability and Patient Access final rule.In 2020, in Europe, EU Health Ministers signed a statement to collaborate and set up an eHealth common area that will permit for the free movement of electronic health records (EHR) across Europe. The statement also calls for eHealth to be an integral part of the Europe 2020 strategy. To push digital health forward, the UK government has pledged USD 347 million to enhance research and development (R&D) and produce novel therapies, devices, and diagnostics. The French government has proposed an investment plan (2022) of ~ USD 686 million, divided into five axes, to accelerate the national digital health strategy as part of the Health Innovation 2030 plan.Such initiatives/regulations are projected to further drive the demand and adoption of EHR, which will influence the adoption of clinical decision support systems (CDSS) in major markets worldwide.

Restraint: Data security concerns related to cloud-based CDSS

A major concern with cloud-based CDSS is that data that is hosted by the vendor is not as safe as its on-premise counterpart. Information related to patient is considered very restricted and a high privacy requirements to be maintained so that this data is available to authorized users only. Patient data through various countries is always under the scanner of legal frameworks, such as the data privacy requirements legislated through HIPAA (Health Insurance Portability and Accountability Act). Similarly, the European Union has the EU Data Protection Regulation in place with implications for guarding sensitive health data.

Opportunity: The growth potential of emerging markets

Several factors, such as the implementation of government initiatives supporting the adoption of HCIT solutions, rising government healthcare expenditure, and the presence of skilled IT experts in emerging markets, are expected to support the market growth for CDSS. Emerging markets across the Asia Pacific, such as India and China, are expected to provide significant growth potential for CDSS companies and stakeholders. Technological advancements are playing a key role as authorities in China are focusing on reforming the country’s healthcare management sector, which is currently facing challenges such as chaotic patient data, underfunded rural health centers, overburdened city hospitals, and a nationwide shortage of doctors.

Challenge: Requirement of high investments for the implementation of CDSS infrastructure

Most healthcare providers have inadequate infrastructure (technology, data, and other resources) to deploy complex healthcare IT solutions. Therefore, to implement CDSS successfully, providers must make further investments in infrastructural development to support IT systems. Investments are required to increase data storage and process capabilities for IT infrastructure. Moreover, the maintenance and software update of these systems may sometimes cost more than the price of the software. Support and maintenance services, which include software upgrades according to changing user requirements, represent a recurring expenditure that may amount to almost 30% of the total cost of ownership.

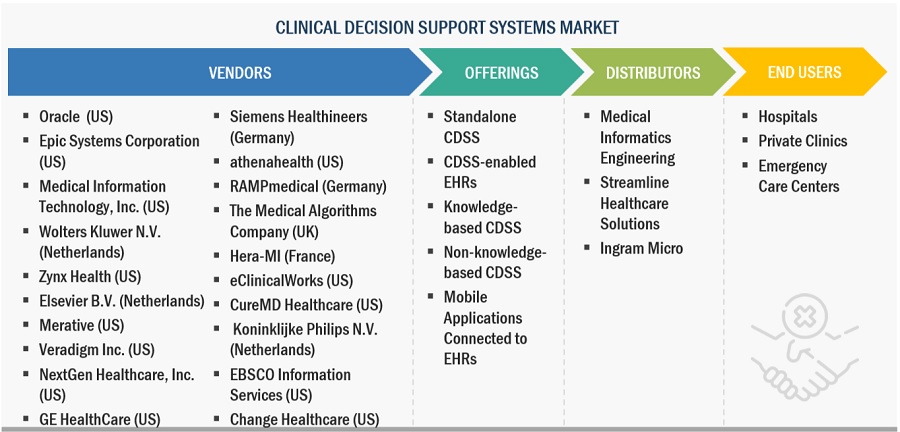

Clinical Decision Support Systems Market Ecosystem Map

By application, conventional CDSS segment accounted for the largest share of the global clinical decision support systems industry during forecast period

Based on application, the clinical decision support systems market is bifurcated into conventional CDSS and advanced CDSS. In 2022, the conventional CDSS segment accounted for the largest share of the market. The largest share of this segment is attributed due to widely adoption of conventional decision support systems by clinicians at the point-of-care to enhance decision-making and reduce medication errors.

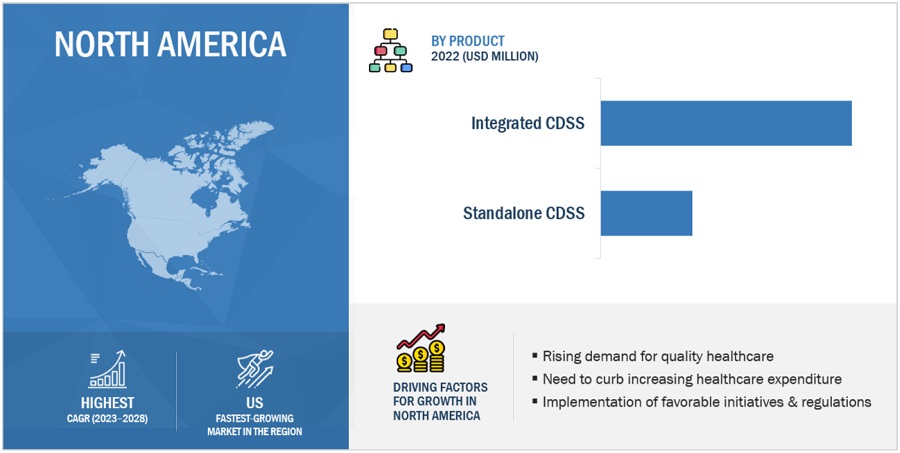

By product, Integrated CDSS segment accounted for the largest share of the global Clinical decision support systems industry in 2022

Based on product, the clinical decision support systems market is bifurcated into integrated CDSS and standalone CDSS. In 2022, the integrated CDSS segment accounted for the largest share of this market. Factors such as growing pressure to cut healthcare costs, the rising geriatric population, and the increasing incidence of chronic disorders are driving the demand for these solutions. Also,healthcare providers widely use integrated CDSS to enhance the quality of care and health outcomes and decrease medication errors.

North America to witness significant growth in the clinical decision support systems industry from 2023 to 2028

Based on region, the clinical decision support systems market is segmented into-North America, Europe, Asia Pacific, and Rest of the World.In 2023, North America projected to lead market share of the market. This can be attributed to the region benefits from the presence of key players, rising significant investments in HCIT solutions, and the growing number of medication errors in the US and Canada.

To know about the assumptions considered for the study, download the pdf brochure

Some of the prominent players operating in the clinical decision support systems market are Wolters Kluwer N.V. (Netherlands), Oracle (US), Merative (US), Change Healthcare (US), Veradigm Inc. (US), athenahealth (US), Epic Systems Corporation (US), Elsevier B.V. (Netherlands), Zynx Health (US), Koninklijke Philips N.V. (Netherlands), Medical Information Technology, Inc. (US), NextGen Healthcare, Inc. (US), CureMD Healthcare (US), Siemens Healthineers (Germany), EBSCO Information Services (US), GE HealthCare (US), eClinicalWorks (US), The Medical Algorithms Company (UK), RAMPmedical (Germany), Hera-MI (France), CareCloud, Inc. (US), VisualDx (US), Premier, Inc. (US), First Databank, Inc. (US), and Strata Decision Technology (US).

Scope of the Clinical Decision Support Systems Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$1.7 billion |

|

Projected Revenue Size by 2028 |

$2.5 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 7.5% |

|

Market Driver |

Implementation of government regulations & initiatives to promote the adoption of HCIT solutions |

|

Market Opportunity |

The growth potential of emerging markets |

The study categorizes the clinical decision support systems market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Integrated CDSS

- Standalone CDSS

By Delivery Mode

- On Premise Mode

- Cloud based Mode

By Model

- Knowledge based CDSS

- Non-Knowledge based CDSS

By Type

- Therapeutic CDSS

- Diagnostic CDSS

By Component

- Services

- Software

- Hardware

By Application

- Advanced CDSS

- Conventional CDSS

By Level of Interactivity Level

- Active CDSS

- Passive CDSS

By Setting

- In Patient

- Ambulatory care settings

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

-

RoW

- Latin America

- Middle East and Africa

Recent Developments of Clinical Decision Support Systems Industry

- In April 2023, Microsoft (US) and Epic Systems Corporation (US) expanded their long-standing strategic collaboration to develop and integrate generative AI into healthcare by combining the scale and power of Azure OpenAI Service with Epic’s industry-leading electronic health record (EHR) software. This co-innovation is focused on delivering a comprehensive array of generative AI- powered solutions integrated with Epic’s EHR to increase productivity, enhance patient care, and improve financial integrity of health systems globally.

- In April 2023, Elsevier B.V. (UK) announced the launch of an upgraded version of its clinical decision support solution, ClinicalKey. This enhanced platform incorporates a comprehensive drug compendium, a cutting-edge mobile application, and seamless integration into Electronic Health Records (EHR). These new features have been strategically designed to offer physicians in the United States and international markets convenient access to reliable and extensive medical content directly at the point of care, speeding up diagnosis and treatment for their patients.

- In February 2023, The province of Nova Scotia, in collaboration with Nova Scotia Health Authority (NSHA) and IWK Health (IWK) entered into a new 10-year agreement has been signed with Oracle (US) to implement an integrated electronic care record across the province for the more than one million Nova Scotians. This technology can help improve the way health professionals use and share patient information.

- In December 2022, athenahealth (US) announced that it had released enhancements to its athenaOne EHR to facilitate immediate administration of COVID-19 vaccines. The rollout includes communications, scheduling, workflow, documentation, and reporting capabilities.

- In April 2022, Change Healthcare (US) launched a new edition of InterQual 2022, the firm’s flagship clinical decision support solution for delivering the latest evidence-based appropriate care.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global clinical decision support systems market?

The global clinical decision support systems market boasts a total revenue value of $2.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global clinical decision support systems market?

The global clinical decision support systems market has an estimated compound annual growth rate (CAGR) of 7.5% and a revenue size in the region of $1.7 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

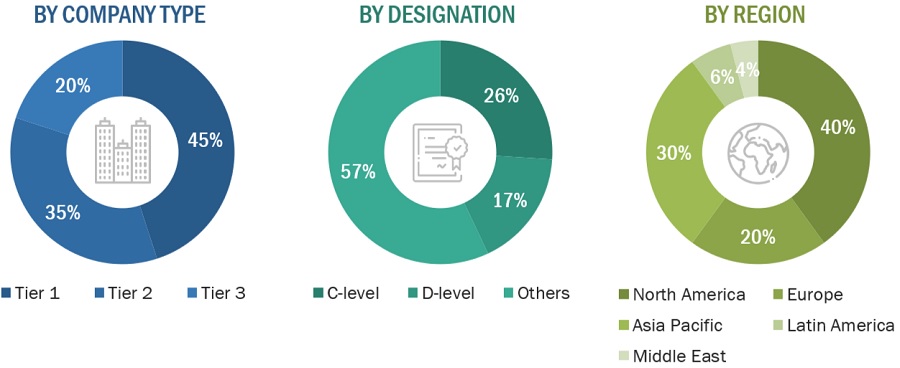

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the clinical decision support systems market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, ATA, AHA and AAHM. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (such as Individual Physicians, Physician Groups, Hospitals, Clinics and Other Healthcare Facilities, Payers- Private and Public Insurance Bodies, Other End Users- Employer Groups and Government Bodies) and supply-side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Note 1: C-level primaries include CEOs, CFOs, and COOs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenues. As of 2022 Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Oracle |

Product Manager |

|

Change Healthcare |

Area Vice President Sales |

|

Merative |

Senior Product Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the CDSS market and various other dependent submarkets. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of CDSS products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Clinical decision support systems Market Size: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the clinical decision support systems market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable.

Market Definition

Clinical decision support systems are designed to aid in clinical decision-making. These healthcare information technology (HCIT) systems provide timely and person-specific information to healthcare providers to make appropriate clinical decisions based on a patient's circumstances. These platforms ensure healthcare professionals provide evidence-based care to their patients.

Key Stakeholders

- Senior Management

- Supply Chain Manager

- Research & Development Team

- Product Manager/Sales Manager

- Hospitals (public and private)

- Ambulatory surgical centers (ASCs)

- Surgeons, physicians, and operating room staff

Report Objectives

- To define, describe, and forecast the global market based on product, component, delivery mode, type, model, application, interactivity level, setting, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions—North America, Europe, the Asia Pacific, and the Rest of the World (Latin America & the Middle East & Africa)

- To strategically analyze the market structure and profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as acquisitions, product launches & enhancements, expansions, agreements, collaborations, and partnerships in the global CDSS market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Decision Support Systems Market

Which segment accounted for the largest market share for the clinical decision support systems market?

Which factors are major growth restraints for the global clinical decision support system market?