Cloud-Based Contact Center Market by Component (Solutions and Services), Deployment Mode (Public and Private Cloud), Organization Size, Industry (BFSI, Telecommunications, and Retail and Consumer Goods) and Region - Global Forecast to 2027

Updated on : March 19, 2024

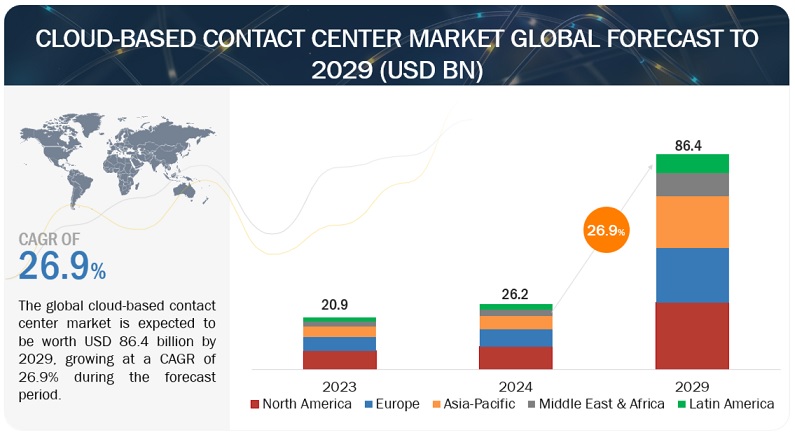

The Cloud-Based Contact Center Market is expected to expand at a compound annual growth rate (CAGR) of 26.1% over the course of the forecast period, from USD 17.1 billion in 2022 to USD 54.7 billion by 2027. The growing need for personalized and streamlined customer interactions is one of the primary factors driving the market growth. Moreover, the increasing popularity of Omnichannel contact centers to improve availability of channels is driving the adoption of Cloud-Based Contact Center solutions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 pandemic has globally changed the dynamics of business operations. Though the COVID-19 outbreak has thrown light on weaknesses in business models across sectors, it has offered several opportunities to leverage cutting-edge technologies, such as AI, ML, and advanced analytics, to transform contact centers in the tough situation to cater to customers and offer the best experiences. According to a survey conducted by one of the leading providers of contact center solutions, during the COVID-19 outbreak, 40-50% of the contact centers have started utilizing call routing via cloud and adopted at least one key application of cloud. In the pandemic, contact centers are proving to be very important as customers prefer online interactions to seek answers to urgent and complex issues. Customers are ranking call support as their initial channel preference for flexible communication.

Cloud-Based Contact Center Market Dynamics

Driver: Better business continuity with cloud-based contact centers

Business continuity is one of the major driving forces for cloud-based contact centers. In on-premises contact centers, hardware failures and disasters come without warning and can have a disastrous impact on companies’ customer data, resulting in downtime, busy signals, and excessive wait time. Cloud-based contact centers are independent of geographic locations, which enables agents, supervisors, and administrators to access them from anywhere through phone and the internet. This makes cloud-based contact centers great disaster recovery/business continuity solutions..

Restraint: Inadequate network bandwidth in emerging economies

With the increased use of internet-based telephone services, many contact centers plan to integrate their communication processes with cloud telephone-based business phone systems. Certain features and services have essentially made cloud-based telephone systems an emerging player in mainlining business communications across the globe. However, with the emergence of cutting-edge technologies in contact center solutions, enterprises face a lack of bandwidth to address some challenges such as poor voice quality in cloud telephone systems, inadequate routers for cloud telephone systems, improperly configured internal networks and security issues. These problems need to be properly taken care of by enterprises while using cloud-based telephone systems and contact centers to efficiently cater to customers.

Opportunity: Shifting focus of enterprises on work from home culture

The COVID-19 outbreak has brought an opportunity to shift business models from the work-from-office to the work-from-home model. When it comes to contact centers, having a permanent model that supports ‘work from home’ agents is one of the important aspects that any organization would have to take care post this pandemic. A distributed work-from-home operating model can be scaled through Contact Center as a Service (CCaaS) strategies. Integrations through cloud telephony can enable direct call routing to traditional mobile phones or smartphone applications, delivering a consistent support platform. This can also provide new communication channels, such as social media, video, and WhatsApp, for enhancing user experiences while complying with risk, governance, security, and compliance mandates that include the Health Insurance Portability and Accountability Act (HIPAA), General Data Protection Regulation (GDPR), Pharmacy Council of India (PCI), and California Consumer Privacy Act (CCPA).

Challenge: Privacy and data security aspects

Contact centers are always at risk as they store a huge amount of crucial customer data. In 2019, fraud attempts against call centers increased. As a result, companies responded with sophisticated tools to identify suspicious calls. According to the 2019 State of Call Center Authentication survey, 54% of respondents want authentication to complete before calls are answered. The validation of calls before they are picked up by IVR or call center agents eliminates the need to authenticate customers on the phone. Longer calls increase the operating costs of call centers. They also frustrate customers, damaging customer experience and overall satisfaction.

Cloud-Based Contact Center Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By Component, the Services segment is expected to account for a higher growth during the forecast period

The services segment is expected to account for a higher growth rate during the forecast period. Clou-based contact center services involve consulting; implementation and integration; and training, support, and maintenance. The services segment plays a vital role in the functionality of a cloud-based contact center solution. The growing deployment of cloud-based contact center solutions is expected to increase the demand for services, such as training, support, and maintenance.

By vertical, the BFSI segment is expected to account for the largest market size during the forecast period

By vertical, the Banking, Financial Services, and Insurance (BFSI) segment is estimated to account for the largest market share. Cloud-based Contact Center solutions provide BFSI organizations the ability to mine customer data that includes transactions, customer activities across banking and financial services, websites, customer queries through multiple channels, and the deep knowledge of prioritized customer segments. With the help of cloud-based solutions, contact center agents can enhance customer experiences through increased speed and better quality of call resolution.

By region, Asia Pacific is expected to record the highest growth during the forecast period

The Asia Pacific region to grow at the highest CAGR during the forecast period. Asia Pacific is increasingly adopting the digitalization trend for several processes in organizations across various industries. The region comprises economies, such as Japan, China, India, ANZ, Indonesia, and the rest of Asia Pacific. Countries in this region are home to many SMEs, and the need for huge investments associated with the deployment of on-premises solutions restricts SMEs from adopting advanced communication technologies. Therefore, the region has a high demand for agile, scalable, and "pay-per-usage" cloud infrastructure. Moreover, companies in the region continue to focus on improving their customer services to drive competitive differentiation and revenue growth. This pushes enterprises to explore hosted and cloud alternatives in place of premises-based systems. Therefore, the increase in the adoption of cloud technologies, coupled with the need to improve customer services, is expected to act as a major factor driving the adoption of cloud-based contact center solutions and services among Asia Pacific enterprises.

Asia Pacific: Cloud-Based Contact Center Market Snapshot

Key Market Players

The report includes the study of key players offering Cloud-Based Contact Center solutions and services. The major vendors in the market include NICE (Israel), Genesys (US), Five9 (US), Vonage (US), Talkdesk (US), 8x8 (US), Cisco (US), Avaya (US), Serenova (US), and Content Guru (US).

The study includes an in-depth competitive analysis of these key players in the Cloud-Based Contact Center market, including their company profiles and strategies undertaken.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Segments covered |

By Component, Deployment Mode, ,Organization size, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa and Latin America |

|

Companies covered |

NICE (Israel), Genesys (US), Five9 (US), Vonage (US), Talkdesk (US), 8x8 (US), Cisco (US), Avaya (US), Serenova (US), Content Guru (US), Alvaria (US), RingCentral (US), Enghouse Interactive (US), 3CLogic (US), Ameyo (India), Twilio (US), Vocalcom (France), Evolve IP (US), Pypestream (US), TechSee (US), AirCall (US), Nubitel (Singapore), JustCall (US), Sentiment Machines (UK) Dialer360 (UK), Servetel (India), NeoDove (India), and Rulai (US). |

This research report categorizes cloud-based contact center market, By Component, Deployment Mode, ,Organization size, Vertical, and Region.

By Component:

-

Solutions

- Omnichannel Routing

- Workforce Engagement Management

- Reporting and Analytics

- Customer Engagement Management

- Other Solutions

-

Services

-

Professional Services

- Training & Consulting

- System integration & implementations

- Support & Maintenance

- Managed Services

-

Professional Services

By Deployment Mode

- Private cloud

- Public cloud

By Organzisation Size

- SMEs

- Large Enterprises

By Verticals

- Banking, Financial Services, And Insurance

- Telecommunications

- IT and Ites

- Government and Public Sector

- retail and consumer goods

- Manufacturing

- energy and utilities

- media and entertainment

- Healthcare and Life Sciences

- Other Verticals

By Region

-

North America

- US

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- ANZ

- Indonesia

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- united arab emirates

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2022, 8x8 launched a new 8x8 Contact Center composed experience transforming the contact center agent role. 8x8 Agent Workspace is a fully browser-based, design-led interface, delivering a tailored and intuitive experience that uniquely blends contact center and unified communications capabilities in a single application

- In March 2022, 8X8 launched the continued global growth and customer adoption of the 8x8 XCaaS solution. 8x8 XCaaS includes an integrated cloud contact center, voice, team chat, video meetings, and CPaaS embeddable APIs capabilities in a single-vendor solution.

- In December 2021, storm SCIM improves administration efficiency for large contact centers, by automating agent provisioning and removing the need to manually add, remove or update users. SCIM gives back valuable work time to administrators by automatically provisioning users, freeing up time to spend on more complex matters. With SCIM, an organization’s provisioning process is completed quickly and securely, creating accounts for new agents right away and removing them for leavers.

- In October 2021, Nice announced the next leap in customer experience (CX) with the introduction of Customer Experience Interactions (CXi), a new framework delivered through a unified suite of applications on the CXone platform. CXi empowers organizations to intelligently meet their customers wherever their journey begins, enables resolution through AI and data-driven self-service, and prepares agents to successfully resolve any customer needs event.

- In October 2021, Talkdesk introduced Talkdesk Insurance Smart Service, an enterprise-grade contact center solution tailor-made to elevate the policyholder and agent experiences. The new solution will provide a better way to alleviate the industries’ most critical customer experience (CX) pain points and expedite claims processing. Combining self-service and agent assist capabilities with artificial intelligence (AI) and out-of-the-box CRM integrations, Insurance Smart Service modernizes the policyholder and agent experience to deliver more convenient, personalized engagements, and faster claims resolution.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Cloud-Based Contact Center market?

The global Cloud-Based Contact Center market is projected to grow from USD 17.1 billion in 2022 to USD 54.7 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 26.1% during the forecast period.

Which are the various region covered in cloud-based contact center market?

The cloud-based contact center market has been segmented into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, and other European countries in the region.

What are the various verticals in cloud-based contact center market?

The cloud-based contact center market, by Vertical, BFSI, Telecommunications, Retail and Consumer Goods, IT and ITeS, Government and Public Sector, Manufacturing, Energy and Utilities, Media and Entertainment, Healthcare and Life Sciences, and Other Verticals.

Who are the major vendors in the Cloud-Based Contact Center market?

The major vendors in the Cloud-Based Contact Center market include NICE (Israel), Genesys (US), Five9 (US), Vonage (US), Talkdesk (US), 8x8 (US), Cisco (US), Avaya (US), Serenova (US), and Content Guru (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 US DOLLAR EXCHANGE RATE, 2019–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 CLOUD-BASED CONTACT CENTER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 1) (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2), BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 3), BOTTOM-UP (DEMAND SIDE): SIZE OF CLOUD-BASED CONTACT CENTER MARKET THROUGH OVERALL CLOUD-BASED CONTACT CENTER SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 7 COMPANY EVALUATION MATRIX: CRITERIA WEIGHT

2.6 COMPETITIVE EVALUATION MATRIX METHODOLOGY FOR SMALL AND MEDIUM-SIZED ENTERPRISES/STARTUPS

FIGURE 8 EVALUATION MATRIX FOR SMALL AND MEDIUM-SIZED ENTERPRISES/STARTUPS/SMES: CRITERIA WEIGHT

2.7 ASSUMPTIONS FOR THE STUDY

2.8 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 4 GLOBAL CLOUD-BASED CONTACT CENTER MARKET AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y%)

FIGURE 9 SOLUTIONS SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

FIGURE 10 LARGE ENTERPRISES SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

FIGURE 11 PUBLIC CLOUD SEGMENT EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE IN 2022

FIGURE 12 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

FIGURE 13 NORTH AMERICA EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 14 INCREASING DEMAND FOR MULTICHANNEL CUSTOMER CONTACTS BOOSTING MARKET GROWTH

4.2 MARKET, BY VERTICAL

FIGURE 15 BFSI SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2022 TO 2027

4.3 MARKET, BY REGION

FIGURE 16 NORTH AMERICA EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

4.4 MARKET, BY SOLUTION AND VERTICAL

FIGURE 17 OMNICHANNEL ROUTING AND BFSI SEGMENTS EXPECTED TO ACCOUNT FOR SIGNIFICANT MARKET SHARES

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 56)

5.1 INTRODUCTION

FIGURE 18 CLOUD-BASED CONTACT CENTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Rising adoption of SMAC technologies

5.1.1.2 Role of social media in cloud-based contact center operations

5.1.1.3 Benefits of SMAC technologies in contact centers

5.1.1.4 Increasing adoption of cloud-based contact centers due to COVID-19

FIGURE 19 IMPACT OF COVID-19 ON CALL CENTER VOLUME

5.1.1.5 Rising number of channels to reach end-customers

5.1.1.6 Growing need for personalized and streamlined customer interactions

5.1.1.7 Faster deployment, scalability, and flexibility of cloud-based contact centers

5.1.1.8 Better business continuity with cloud-based contact centers

5.1.2 RESTRAINTS

5.1.2.1 Inadequate network bandwidth in emerging economies

5.1.2.2 Cyber-attacks impacting business operations

5.1.3 OPPORTUNITIES

5.1.3.1 Enhanced customer experience to increase cloud-based contact center adoption

FIGURE 20 MOST EXCITING BUSINESS OPPORTUNITY

5.1.3.2 Need to analyze audio conversations in real-time

5.1.3.3 Shifting focus of enterprises on work from home culture

5.1.3.4 Implementation of AI, analytics, and NLP capabilities to add value to existing cloud-based contact centers

FIGURE 21 ROLE OF ARTIFICIAL INTELLIGENCE IN CONTACT CENTER TRANSFORMATION

5.1.4 CHALLENGES

5.1.4.1 Privacy and data security aspects

5.1.4.2 Organizational, technical, and operational difficulties while moving contact centers in cloud

5.1.4.3 Integration of mobility with existing capabilities

FIGURE 22 INTEGRATION OF MOBILITY IN EXISTING CAPABILITIES OF CONTACT CENTERS

5.2 COVID-19-DRIVEN MARKET DYNAMICS

5.2.1 DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS AND CHALLENGES

5.3 CLOUD-BASED CONTACT CENTER: EVOLUTION

FIGURE 23 EVOLUTION OF CLOUD-BASED CONTACT CENTER

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: BANKING, FINANCIAL SERVICES, AND INSURANCE

5.4.2 CASE STUDY 2: RETAIL

5.4.3 CASE STUDY 3: HEALTHCARE

5.4.4 CASE STUDY 4: TELECOMMUNICATIONS

5.4.5 CASE STUDY 5: INFORMATION TECHNOLOGY

5.4.6 CASE STUDY 6: GOVERNMENT

5.4.7 CASE STUDY 7: MEDIA AND ENTERTAINMENT

5.4.8 CASE STUDY 8: ENERGY AND UTILITIES

5.4.9 CASE STUDY 9: MANUFACTURING

5.5 CLOUD-BASED CONTACT CENTER MARKET: VALUE CHAIN ANALYSIS

FIGURE 24 MARKET: VALUE CHAIN ANALYSIS

5.6 MARKET ECOSYSTEM

FIGURE 25 MARKET ECOSYSTEM

5.7 MARKET: COVID-19 IMPACT

5.8 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 26 REVENUE SHIFT FOR MARKET

5.9 TECHNOLOGY ANALYSIS

5.9.1 ADVANCED ANALYTICS

5.9.1.1 Data analytics

5.9.1.2 Speech analytics

5.9.1.3 Sentiment analytics

5.9.2 ARTIFICIAL INTELLIGENCE

5.9.2.1 Machine learning

5.9.2.2 Natural language processing

5.10 PRICING ANALYSIS

TABLE 6 CLOUD-BASED CONTACT CENTER MARKET: PRICING MODEL ANALYSIS, 2021

5.11 PATENT ANALYSIS

FIGURE 27 TOP TEN COMPANIES WITH HIGHEST PATENT APPLICATIONS

TABLE 7 TOP TWENTY PATENT OWNERS (US)

FIGURE 28 NUMBER OF PATENTS GRANTED IN A YEAR, 2013–2021

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

6 CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT (Page No. - 80)

6.1 INTRODUCTION

FIGURE 30 SOLUTIONS SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

TABLE 9 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 10 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 31 REPORTING AND ANALYTICS SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 12 MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 13 SOLUTIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 14 SOLUTIONS: CLOUD-BASED CONTACT CENTER MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 OMNICHANNEL ROUTING

6.2.1.1 Digital channels

6.2.1.2 Interactive voice response

6.2.1.3 Automatic call distributors

6.2.1.4 Dialers

6.2.1.5 Virtual agents

TABLE 15 OMNICHANNEL ROUTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 16 OMNICHANNEL ROUTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 WORKFORCE ENGAGEMENT MANAGEMENT

6.2.2.1 Workforce optimization

6.2.2.2 Call recording and quality management

TABLE 17 WORKFORCE ENGAGEMENT MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 18 WORKFORCE ENGAGEMENT MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.3 REPORTING AND ANALYTICS

6.2.3.1 Historical and customized reports

6.2.3.2 Speech analytics

6.2.3.3 Text analytics

TABLE 19 REPORTING AND ANALYTICS: CLOUD-BASED CONTACT CENTER MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 20 REPORTING AND ANALYTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.4 CUSTOMER ENGAGEMENT MANAGEMENT

TABLE 21 CUSTOMER ENGAGEMENT MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 CUSTOMER ENGAGEMENT MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.5 OTHER SOLUTIONS

TABLE 23 OTHER SOLUTIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 OTHER SOLUTIONS: MARKET, BY REGION, 2022–2027(USD MILLION)

6.3 SERVICES

6.3.1 CONSULTING

6.3.2 IMPLEMENTATION AND INTEGRATION

6.3.3 TRAINING AND SUPPORT AND MAINTENANCE

TABLE 25 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 CLOUD-BASED CONTACT CENTER MARKET, BY DEPLOYMENT MODE (Page No. - 96)

7.1 INTRODUCTION

FIGURE 32 PUBLIC CLOUD SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: COVID-19 IMPACT

TABLE 27 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 28 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 PUBLIC CLOUD

TABLE 29 PUBLIC CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 PUBLIC CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 PRIVATE CLOUD

TABLE 31 PRIVATE CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 PRIVATE CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 MARKET, BY ORGANIZATION SIZE (Page No. - 101)

8.1 INTRODUCTION

FIGURE 33 LARGE ENTERPRISES SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

TABLE 33 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 34 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 35 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 37 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 CLOUD-BASED CONTACT CENTER MARKET, BY VERTICAL (Page No. - 106)

9.1 INTRODUCTION

FIGURE 34 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL EXPECTED TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

TABLE 39 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 40 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 41 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 TELECOMMUNICATIONS

TABLE 43 TELECOMMUNICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 TELECOMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 IT AND ITES

TABLE 45 IT AND ITES: CLOUD-BASED CONTACT CENTER MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 IT AND ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 GOVERNMENT AND PUBLIC SECTOR

TABLE 47 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 RETAIL AND CONSUMER GOODS

TABLE 49 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 MANUFACTURING

TABLE 51 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 ENERGY AND UTILITIES

TABLE 53 ENERGY AND UTILITIES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 ENERGY AND UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 MEDIA AND ENTERTAINMENT

TABLE 55 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 HEALTHCARE AND LIFE SCIENCES

TABLE 57 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.11 OTHER VERTICALS

TABLE 59 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 CLOUD-BASED CONTACT CENTER MARKET, BY REGION (Page No. - 122)

10.1 INTRODUCTION

FIGURE 35 ASIA PACIFIC EXPECTED TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

TABLE 61 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 62 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATORY IMPLICATIONS

10.2.4 US SECURITIES AND EXCHANGE COMMISSION

10.2.5 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

10.2.6 CALIFORNIA CONSUMER PRIVACY ACT

10.2.7 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

10.2.8 SARBANES-OXLEY ACT OF 2002

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 63 NORTH AMERICA: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.9 US

TABLE 75 US: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 76 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 77 US: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 78 US: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 79 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 80 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2.10 CANADA

TABLE 81 CANADA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 82 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 83 CANADA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 84 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 85 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 86 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATORY IMPLICATIONS

10.3.4 GENERAL DATA PROTECTION REGULATION

10.3.5 EUROPEAN CYBERSECURITY ACT

TABLE 87 EUROPE: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 90 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 92 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 93 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 94 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 95 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 96 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 97 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 98 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.6 UK

TABLE 99 UK: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 100 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 101 UK: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 102 UK: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 103 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 104 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.7 GERMANY

TABLE 105 GERMANY: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 106 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 107 GERMANY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 108 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 109 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 110 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.8 FRANCE

TABLE 111 FRANCE: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 112 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 113 FRANCE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 114 FRANCE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 115 FRANCE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 116 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.9 REST OF EUROPE

TABLE 117 REST OF EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 118 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 119 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 120 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 121 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 122 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATORY IMPLICATIONS

10.4.4 PERSONAL DATA PROTECTION ACT

10.4.5 SINGAPORE STANDARD SS 564

10.4.6 INTERNET DATA CENTER IN CHINA

FIGURE 37 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 123 ASIA PACIFIC: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.7 CHINA

TABLE 135 CHINA: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 136 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 137 CHINA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 138 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 139 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 140 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.8 JAPAN

TABLE 141 JAPAN: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 142 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 143 JAPAN: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 144 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 145 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 146 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.9 INDIA

TABLE 147 INDIA: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 148 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 149 INDIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 150 INDIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 151 INDIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 152 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.10 AUSTRALIA AND NEW ZEALAND

TABLE 153 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 154 AUSTRALIA AND NEW ZEALAND: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 155 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 156 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 157 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 158 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.11 INDONESIA

TABLE 159 INDONESIA: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 160 INDONESIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 161 INDONESIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 162 INDONESIA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 163 INDONESIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 164 INDONESIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.12 REST OF ASIA PACIFIC

TABLE 165 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 168 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 169 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 170 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA (MEA)

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATORY IMPLICATIONS

10.5.4 PERSONAL DATA PROTECTION LAW

10.5.5 CLOUD COMPUTING REGULATORY FRAMEWORK

TABLE 171 MIDDLE EAST AND AFRICA: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 172 MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 173 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 174 MIDDLE EAST AND AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 175 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 176 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 177 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 178 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.6 SAUDI ARABIA

TABLE 183 SAUDI ARABIA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 184 SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 185 SAUDI ARABIA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 186 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 187 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 188 SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.7 UAE

TABLE 189 UAE: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 190 UAE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 191 UAE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 192 UAE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 193 UAE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 194 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.8 SOUTH AFRICA

TABLE 195 SOUTH AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 196 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 197 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 198 SOUTH AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 199 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 200 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.9 REST OF MIDDLE EAST AND AFRICA

TABLE 201 REST OF MIDDLE EAST AND AFRICA: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 202 REST OF MIDDLE EAST AND AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 203 REST OF MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 204 REST OF MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 205 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 206 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: CLOUD-BASED CONTACT CENTER MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATORY IMPLICATIONS

10.6.4 FEDERAL LAW ON PROTECTION OF PERSONAL DATA HELD BY INDIVIDUALS

TABLE 207 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 212 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 213 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.5 BRAZIL

TABLE 219 BRAZIL: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 220 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 221 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 222 BRAZIL: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 223 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 224 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.6 MEXICO

TABLE 225 MEXICO: CLOUD-BASED CONTACT CENTER MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 226 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 227 MEXICO: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 228 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 229 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 230 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.7 REST OF LATIN AMERICA

TABLE 231 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 232 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 233 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 234 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 235 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 236 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 201)

11.1 KEY PLAYER STRATEGIES

TABLE 237 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN CLOUD-BASED CONTACT CENTER MARKET

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 38 MARKET EVALUATION FRAMEWORK, 2019–2022

11.3 MARKET SHARE ANALYSIS

FIGURE 39 MARKET SHARE ANALYSIS OF COMPANIES IN MARKET, 2022

11.4 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 40 REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019–2021

11.5 COMPANY EVALUATION MATRIX

11.5.1 DEFINITIONS AND METHODOLOGY

TABLE 238 COMPANY EVALUATION MATRIX: CRITERIA AND WEIGHT

11.5.2 STARS

11.5.3 EMERGING LEADERS

11.5.4 PERVASIVE PLAYERS

11.5.5 PARTICIPANTS

FIGURE 41 CLOUD-BASED CONTACT CENTER MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

11.6 EVALUATION MATRIX FOR SMALL AND MEDIUM-SIZED ENTERPRISES/STARTUPS

11.6.1 DEFINITIONS AND METHODOLOGY

TABLE 239 EVALUATION MATRIX FOR SMALL AND MEDIUM-SIZED ENTERPRISES/STARTUPS: CRITERIA WEIGHT

11.6.2 PROGRESSIVE COMPANIES

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

11.6.5 STARTING BLOCKS

FIGURE 42 CLOUD-BASED CONTACT CENTER MARKET (GLOBAL): SME/START-UP EVALUATION MATRIX, 2022

11.7 COMPETITIVE SCENARIO

11.7.1 PRODUCT LAUNCHES

TABLE 240 PRODUCT LAUNCHES, 2019–2022

11.7.2 DEALS

TABLE 241 DEALS, 2018–2022

12 COMPANY PROFILES (Page No. - 226)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Products, Solutions & Services, Recent Developments, MnM View)*

12.2.1 NICE

TABLE 242 NICE: BUSINESS OVERVIEW

FIGURE 43 NICE: COMPANY SNAPSHOT

TABLE 243 NICE: SOLUTIONS OFFERED

TABLE 244 NICE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 245 NICE: DEALS

12.2.2 GENESYS

TABLE 246 GENESYS: BUSINESS OVERVIEW

TABLE 247 GENESYS: SOLUTIONS OFFERED

TABLE 248 GENESYS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 249 GENESYS: DEALS

12.2.3 FIVE9

TABLE 250 FIVE9: BUSINESS OVERVIEW

FIGURE 44 FIVE9: COMPANY SNAPSHOT

TABLE 251 FIVE9: SOLUTIONS OFFERED

TABLE 252 FIVE9: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 253 FIVE9: DEALS

12.2.4 VONAGE

TABLE 254 VONAGE: BUSINESS OVERVIEW

FIGURE 45 VONAGE: COMPANY SNAPSHOT

TABLE 255 VONAGE: SOLUTIONS OFFERED

TABLE 256 VONAGE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 257 VONAGE: DEALS

12.2.5 TALKDESK

TABLE 258 TALKDESK: BUSINESS OVERVIEW

TABLE 259 TALKDESK: SOLUTIONS OFFERED

TABLE 260 TALKDESK: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 261 TALKDESK: DEALS

12.2.6 8X8

TABLE 262 8X8: BUSINESS OVERVIEW

FIGURE 46 8X8: COMPANY SNAPSHOT

TABLE 263 8X8: SOLUTIONS OFFERED

TABLE 264 8X8: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 265 8X8: DEALS

12.2.7 CISCO

TABLE 266 CISCO: BUSINESS OVERVIEW

FIGURE 47 CISCO: COMPANY SNAPSHOT

TABLE 267 CISCO: SOLUTIONS OFFERED

TABLE 268 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 269 CISCO: DEALS

12.2.8 AVAYA

TABLE 270 AVAYA: BUSINESS OVERVIEW

FIGURE 48 AVAYA: COMPANY SNAPSHOT

TABLE 271 AVAYA: SOLUTIONS OFFERED

TABLE 272 AVAYA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 273 AVAYA: DEALS

12.2.9 SERENOVA

TABLE 274 SERENOVA: BUSINESS OVERVIEW

TABLE 275 SERENOVA: SOLUTIONS OFFERED

TABLE 276 SERENOVA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 277 SERENOVA: DEALS

12.2.10 CONTENT GURU

TABLE 278 CONTENT GURU: BUSINESS OVERVIEW

TABLE 279 CONTENT GURU: SOLUTIONS OFFERED

TABLE 280 CONTENT GURU: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 281 CONTENT GURU: DEALS

12.2.11 ALVARIA

12.2.12 RINGCENTRAL

12.2.13 ENGHOUSE INTERACTIVE

12.2.14 3CLOGIC

12.2.15 AMEYO

12.2.16 TWILIO

12.2.17 VOCALCOM

12.2.18 EVOLVE IP

*Details on Business Overview, Products, Solutions & Services, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.3 STARTUP/SME PROFILES

12.3.1 PYPESTREAM

12.3.2 TECHSEE

12.3.3 AIRCALL

12.3.4 SENTIMENT MACHINES

12.3.5 NUBITEL

12.3.6 JUSTCALL

12.3.7 DIALER360

12.3.8 SERVETEL

12.3.9 NEODOVE

12.3.10 RULAI

13 ADJACENT AND RELATED MARKETS (Page No. - 281)

13.1 INTRODUCTION

13.1.1 RELATED MARKETS

13.1.2 LIMITATIONS

13.2 CONTACT CENTER SOFTWARE MARKET

13.2.1 MARKET DEFINITION

13.2.1.1 Contact center software market, by component

TABLE 282 CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 283 CONTACT CENTER SOFTWARE MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 284 SERVICES: CONTACT CENTER SOFTWARE MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 285 SERVICES: CONTACT CENTER SOFTWARE MARKET, BY REGION, 2020–2026 (USD MILLION)

13.2.1.2 Contact center software market, by organization size

TABLE 286 CONTACT CENTER SOFTWARE MARKET, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 287 CONTACT CENTER SOFTWARE MARKET, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

13.2.1.3 Contact center software market, by deployment mode

TABLE 288 CONTACT CENTER SOFTWARE MARKET, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 289 CONTACT CENTER SOFTWARE MARKET, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

13.2.1.4 Contact center software market, by industry

TABLE 290 CONTACT CENTER SOFTWARE MARKET, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 291 CONTACT CENTER SOFTWARE MARKET, BY INDUSTRY, 2020–2026 (USD MILLION)

13.2.1.5 Contact center software market, by region

TABLE 292 CONTACT CENTER SOFTWARE MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 293 CONTACT CENTER SOFTWARE MARKET, BY REGION, 2020–2026 (USD MILLION)

13.3 CONTACT CENTER ANALYTICS MARKET

13.3.1 MARKET DEFINITION

13.3.1.1 Contact center analytics market, by component

TABLE 294 CONTACT CENTER ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 295 CONTACT CENTER ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 296 CONTACT CENTER ANALYTICS MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

TABLE 297 CONTACT CENTER ANALYTICS MARKET, BY SERVICES, 2022–2027 (USD MILLION)

13.3.1.2 Contact center analytics market, by deployment mode

TABLE 298 CONTACT CENTER ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 299 CONTACT CENTER ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

13.3.1.3 Contact center analytics market, by organization size

TABLE 300 CONTACT CENTER ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 301 CONTACT CENTER ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

13.3.1.4 Contact center analytics market, by application

TABLE 302 CONTACT CENTER ANALYTICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 303 CONTACT CENTER ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.3.1.5 Contact center analytics market, by vertical

TABLE 304 CONTACT CENTER ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 305 CONTACT CENTER ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.3.1.6 Contact center analytics market, by region

TABLE 306 CONTACT CENTER ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 307 CONTACT CENTER ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

14 APPENDIX (Page No. - 294)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the cloud-based contact center market. Along with that, a few other market-related sources, such as journals of the Uptime Institute, ResearchGate, Springer, and white papers, were also considered while conducting the extensive secondary research. The primary sources were mainly industry experts from the core and related industries, and preferred system developers, service providers, system integrators, resellers, partners, standards, and certification organizations from companies and organizations related to the various segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of the key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess the prospects. The market has been forecast by analyzing the driving factors, such as the increasing adoption of multiple clouds and rising need to efficiently manage the security and performance of the cloud.

Secondary Research

The market size of companies offering cloud-based contact center solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from secondary sources, such as Contact Center Pipeline, and Artificial Intelligence (AI) for Communications, and related magazines.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information of the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors, from business development, marketing, product development/innovation teams, and related key executives from cloud-based contact center solution vendors, System Integrators (Sis), service providers, industry associations, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the solutions and services, market breakups, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technologies, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs), and installation teams of the governments/end users using cloud-based contact center solutions were interviewed to understand the buyer’s perspective on the suppliers, products, service providers, and their current usage of cloud-based contact center solution and services that would affect the overall cloud-based contact center market.

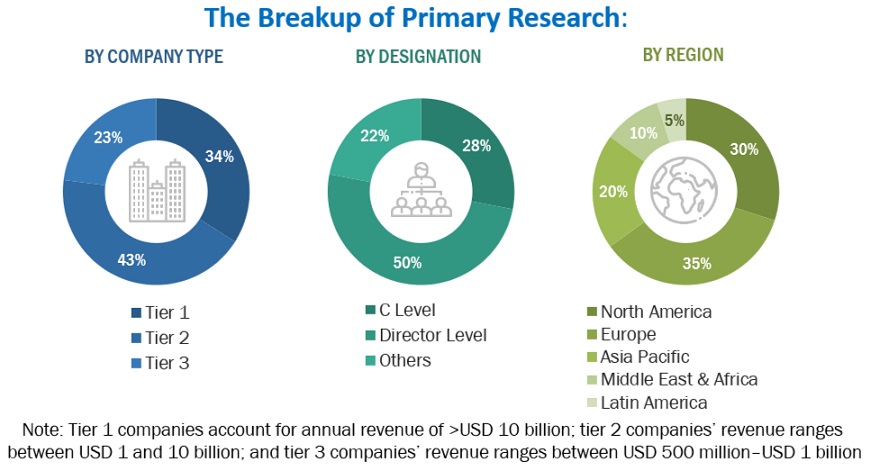

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the cloud-based contact center market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Key market players were not limited to such as NICE (Israel), Genesys (US), Five9 (US), Vonage (US), Talkdesk (US), 8x8 (US), Cisco (US), Avaya (US), Serenova (US), Content Guru (US), Alvaria (US), RingCentral (US), Enghouse Interactive (US), 3CLogic (US), Ameyo (India), Twilio (US), Vocalcom (France), Evolve IP (US), Pypestream (US), TechSee (US), AirCall (US), Nubitel (Singapore), JustCall (US), Sentiment Machines (UK) Dialer360 (UK), Servetel (India), NeoDove (India), and Rulai (US).

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud-Based Contact Center Market

Gather insights into Global Cloud Based Market specifically size of business requiring cloud based contact centre and pricing.

Understand the Cloud Contact Center SaaS growth projections in the UK and Northern Europe.

Interested in BPO market

Understand the Modern Workplace software solutions into Cloud Contact Centre and exploring the markets and Landscapes.

Need insights into Call Center automation and its forecasting.

Gather insights into EU and MEA for a planning business case.