Cloud Content Delivery Network (CDN) Market by Type (Standard/Non-video and Video), Core Solution (Web Performance Optimization, Media Delivery, and Cloud Security), Adjacent Services, Organization Size, Vertical, and Region - Global Forecast to 2021

[159 Pages Report] Cloud Content Delivery Network market to grow from USD 1.81 Billion in 2016 to USD 6.23 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 28.0%. 2015 has been considered as the base year, while the forecast period is 2016-2021.

Objectives of the Study

This report aims to estimate the market size and future growth potential of the cloud CDN market across different segments such as types, core solutions, adjacent services, organization sizes, verticals, and regions. The report aims to analyze each segment with respect to individual growth trends and contribution towards the overall Cloud Content Delivery Network market and to provide detailed information regarding the major factors, which influence the growth of the market (drivers, restraints, opportunities, and industry specific challenges). The aim is to deliver competitive intelligence from market analysis and devise revenue growth strategies from the market size and forecast statistics.

Research Methodology

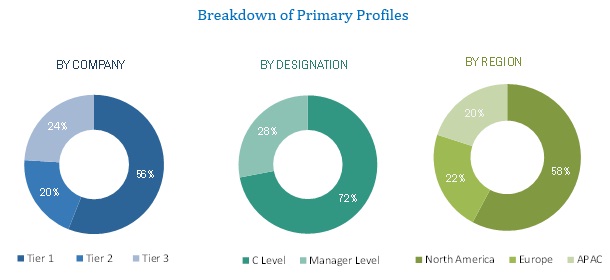

Top-down and bottom-up approaches were used to estimate and validate the size of the global CDN market and to estimate the size of various other dependent subsegments. The key players in the market were identified through secondary research such as Content Delivery Summit, CDN Asia, Streaming Media East, Content Delivery World, and CDN planet and their market shares in respective regions were determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of top market players and extensive interviews for key insights from industry leaders. All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources. All possible parameters that affect the market are covered in this research study, and have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs. The breakdown of profiles of primary discussion with the participants is depicted in the below figure: extensive interviews with key people such as CEOs, VPs, directors, and executives were conducted. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the primary profiles is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the Cloud Content Delivery Network market are Akamai Technologies, Inc. (Cambridge, U.S.), Google, Inc. (California, U.S.), Level 3 Communications (Colorado, U.S.), Limelight Networks, Inc. (Arizona, U.S.), Alcatel – Lucent SA (France), Amazon Web Services, Inc. (Washington, U.S.), Internap Corporation (Georgia, U.S.), Ericsson (Sweden), Verizon Communications, Inc. (New York, U.S.), CDNetworks (Seoul, Korea), Tata Communications (Mumbai and Singapore), and Highwinds (Florida, U.S.). The key innovators identified are Cedexis (U.S.), Incapsula, Inc. (California, U.S.), Fastly, Inc. (U.S.), CacheFly (Chicago, U.S.), MaxCDN (U.S.), CloudFlare, Inc. (U.S.), and Conviva (California, U.S.).

Major Market Developments

- In February 2016, Akamai launched predictive content delivery solutions to provide instant video start-up on mobile devices

- In December 2015, Google launched Alpha Cloud CDN to cater to customers’ CDN requirements and increase the speed of delivery of content

- In July 2017, Level 3 acquired black lotus to increase its product portfolio in network-based detection and mitigation scrubbing solution alongside network routing, rate limiting, and IP filtering abilities

The target audience of the cloud CDN market report includes the following:

- Networking companies

- CCDN providers

- Data center providers

- Cloud Service Providers (CSPs)

- Internet Service Providers (ISPs)

- Telecom providers

- Value Added Resellers (VARs)

- Managed Service Providers (MSPs)

- Hosting vendors

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next 2–5 years for prioritizing their efforts and investments.”

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

The research report categorizes the CDN market to forecast the revenues and analyze the trends in each of the following subsegments:

By Type:

- Standard/Non-Video CDN

- Video CDN

By Core Solution

- Web Performance Optimization

- Media Delivery

- Cloud Security

By Adjacent Service

- Cloud Storage

- Analytics and Monitoring

- Application Program Interface (APIs)

- CDN Network Design

- Support and Maintenance

- Others (Load balancing, access control & authentication, managed Domain Name Server (DNS), Digital Rights Management (DRM), asset monetization, and cache management solutions)

By Organization Size

- Small and Medium Businesses

- Large Enterprises

By Vertical

- Advertising

- Media & Entertainment

- Online gaming

- E-commerce

- Education

- Government

- Healthcare

- Others (BFSI, IT, and Travel & hospitality)

By Region

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East & Africa (MEA)

- Latin America

Critical questions which the report answers

- What are new verticals which the cloud CDN companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Also early buyers will receive 10% customization on the CDN market report or other related report. Under customization, further segmentation of regions into different countries can be provided.

The global Cloud Content Delivery Network market size is expected to grow from USD 1.81 Billion in 2016 to USD 6.23 Billion by 2021, at an estimated Compound Annual Growth Rate (CAGR) of 28.0%. Major factors contributing to the growth of the cloud CDN market are growing rich media file contents, video content, increasing use of connected and smart devices, and proliferation of rich media over social sites.

The cloud CDN market is segmented by type, core solution, adjacent services, organization size, vertical, and region. The cloud CDN market type is primarily dominated by video CDN, and is expected to forecast fastest growing trend in the coming years. This dominance is mainly attributed to proliferation of high quality video contents over the websites and live online videos influencing more and more number of users.

Media delivery cloud CDN core solution held the largest market share, owing to large amount of media contents such as podcasts, live RSS feeds, online videos, and others. However, considering the security threats and cybercrimes over the cloud, cloud security solution is expected to witness fastest growing trend by 2021. The Cloud Content Delivery Network market is expected to forecast the highest growth trend in the online gaming vertical as compared to other industries. This growth is attributed to rising trends in online gaming and e-sports. In order to store and retrieve web content without any lag, the cloud storage adjacent service segment is expected to hold the largest market share as compared to other services

Growing volume of data consumption over internet is a key driver to the growth of the cloud CDN market in media and entertainment and E- commerce verticals

Media and Entertainment

Rising trends in the VoD concept, online audio streaming, podcasts, and live web episodes have boosted the adoption of cloud-based services in order to provide users with un-interrupted access for the data they wish to see. Furthermore, the implementation of cloud CDN plays an active role during peak hours by avoiding data trafficking.

The voluminous increase in the amount of data generated by media and entertainment firms has created a need for reliable CDN solutions. Media production companies, animation companies, TV channel companies, and post-production teams are creating new content at a large scale and delivering to the audiences. Higher resolution imaging standards evolving from HD to 2K and 4K/UHD video quality are creating exponential growth in data sizes. Customers now expect high-quality visualized content on any device with better visibility and without any interruption. The content is delivered to the consumers or the end users in the form of video advertisements and online videos for online campaigns, among others. This factor has provided media companies with a great potential to offer new products, greater reach to their customers, and a higher distinguishing ability. The companies catering to the media and entertainment vertical need to deliver fast, secure, and cloud-based viewing experience to any device and scale to any audience size to gain critical visibility.

E-Commerce

E-commerce websites in the past 5 to 6 years have gained a wide scale popularity as well as customer base as it provides better choices and flexibility to consumers. As the online shopping space is developing, enterprises want to ensure website acceleration along with augmented security functionalities. It has become important for the solution providers to offer an effective web content experience on their websites to the users. The e-tailers need to regularly update their homepage, current content, trends, and improve search engine optimization to offer their customers better visibility. Through cloud-enabled CDN, there has been an easy transmission of data to the end users without latency. E-commerce is gaining wide acceptance across the globe and the e-tailers need to ensure that they provide a high-end shopping experience at anytime, anywhere, and on any device. CDN solutions such as analytics and monitoring enable the providers to keep their customers informed of the latest products and services, further boosting customer relationship. Web performance optimization, transparent caching, cloud storage, and security solutions help in improving the delivery of websites and online applications at high speed on the customer’s devices.

Education

Rising adoption of smart classrooms and education technology has led to growing deployment of cloud CDN solutions across the educational vertical. Furthermore, the deployment of learning management system enabled wide scale implementation of cloud CDN in order to provide users with high quality graphical presentations, video seminars & lectures, infographics, audio streaming, and live RSS feeds.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry trends for cloud CDN?

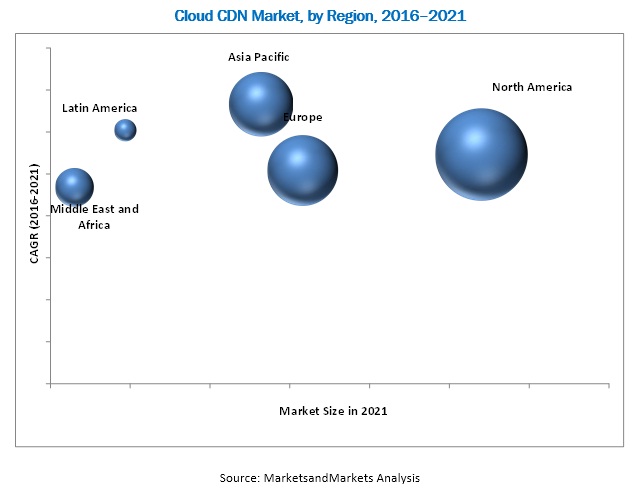

North America is expected to hold the largest market share and dominate the cloud CDN market due to the presence of a large number of CDN vendors, highest internet penetration in the world, large customer base, and its acceptance of technology solutions. However, APAC offers the potential growth opportunities for the cloud CDN market to emerge over the coming years. The key factors driving the growth rate in APAC region are increasing consumption of cloud services, growing penetration of mobile and smartphone devices, and high consumption of video over portable devices. The continuous growth in the integration of various cloud services is further encouraging the overall Cloud Content Delivery Network market to grow.

Latency and connectivity issues are the factors that are majorly restraining the growth of the cloud CDN market.

The major vendors in the Cloud Content Delivery Network market include Akamai Technologies, Inc. (Cambridge, U.S.), Google, Inc. (California, U.S.), Level 3 Communications (Colorado, U.S.), Limelight Networks, Inc. (Arizona, U.S.), Amazon Web Services, Inc. (Washington, U.S.), Alcatel – Lucent SA (France), Internap Corporation (Georgia, U.S.), Verizon Communications, Inc. (New York, U.S.), Ericsson (Sweden), CDNetworks (Seoul, Korea), Tata Communications (Mumbai and Singapore), and Highwinds (Florida, U.S.). The key innovators identified are Cedexis (U.S.), Incapsula, Inc. (California, U.S.), Fastly, Inc. (U.S.), CacheFly (Chicago, U.S.), Conviva (U.S.), MaxCDN (U.S.), and CloudFlare, Inc. (U.S.). These players adopted various strategies, such as mergers, partnerships, collaborations, and new product launches to cater to the needs of the cloud CDN market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Marketscovered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Vendor Dive Matrix Methodology

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Market

4.2 Cloud Content Delivery Network Market, By Region and Top Vertical, 2016

4.3 Lifecycle Analysis, By Region

4.4 Market Investment Scenario

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Type

5.3.2 By Core Solution

5.3.3 By Adjacent Service

5.3.4 By Organization Size

5.3.5 By Vertical

5.3.6 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Implementation of Sanctioned Protocols to Comply With Cloud Storage Regulations

5.4.1.2 Rise in the Number of Transitions Towards Cloud-Based Services

5.4.1.3 Proliferation of Video and Rich Media Over Social Sites

5.4.1.4 Growing Volume of Data Consumption Over Internet

5.4.2 Restraints

5.4.2.1 Continuous Monetization of Websites and Apps

5.4.2.2 Latency Issues

5.4.3 Opportunities

5.4.3.1 Elastic CDN Solution

5.4.3.2 Rise of Mobile CDNs

5.4.4 Challenges

5.4.4.1 Pricing Pressure

6 Industry Trends (Page No. - 45)

6.1 Value Chain Analysis

6.2 Strategic Benchmarking

6.3 Content Delivery Network Key Concepts

6.3.1 Content Types

6.3.1.1 Static Content

6.3.1.2 Streaming Media

6.3.2 Content Delivery Techniques

6.3.2.1 Downloading/Traditional Streaming

6.3.2.2 Adaptive Streaming

6.3.2.3 Http-Based Streaming

7 Cloud Content Delivery Network Market Analysis, By Type (Page No. - 49)

7.1 Introduction

7.2 Standard/Non-Video CDN

7.3 Video CDN

8 Cloud Content Delivery Network Market Analysis, By Core Solution (Page No. - 53)

8.1 Introduction

8.2 Web Performance Optimization

8.3 Media Delivery

8.4 Cloud Security

9 Cloud Content Delivery Network Market Analysis, By Adjacent Service (Page No. - 59)

9.1 Introduction

9.2 Cloud Storage

9.3 Analytics and Monitoring

9.4 Application Programming Interfaces

9.5 CDN Design

9.6 Support and Maintenance

9.7 Others

10 Cloud Content Delivery Network Market Analysis, By Organization Size (Page No. - 66)

10.1 Introduction

10.2 Small and Medium Businesses

10.3 Large Enterprises

11 Cloud Content Delivery Network Market Analysis, By Vertical (Page No. - 70)

11.1 Introduction

11.2 Advertising

11.3 Media and Entertainment

11.4 Online Gaming

11.5 E-Commerce

11.6 Education

11.7 Government

11.8 Healthcare

11.9 Others

12 Geographic Analysis (Page No. - 81)

12.1 Introduction

12.2 North America

12.2.1 United States

12.2.2 Canada

12.3 Europe

12.3.1 United Kingdom

12.3.2 Germany

12.3.3 France

12.3.4 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 South Korea

12.4.4 Rest of Asia-Pacific

12.5 Middle East and Africa

12.5.1 Middle East

12.5.2 Africa

12.6 Latin America

12.6.1 Brazil

12.6.2 Mexico

12.6.3 Rest of Latin America

13 Competitive Landscape (Page No. - 103)

13.1 Vendor Dive Overview

13.2 Cloud CDN: MnM Dive – Vendor Comparison

13.3 Growth Startegies, 2013–2016

13.4 Competitive Situation and Trends

13.4.1 New Product Launches

13.4.2 Agreements, Partnerships, and Collaborations

13.4.3 Mergers and Acquisitions

13.4.4 Integrations and Expansions

14 Company Profiles (Page No. - 114)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.1 Introduction

14.2 Akamai Technologies, Inc.

14.3 Google Inc.

14.4 Level 3 Communications

14.5 Limelight Networks, Inc.

14.6 Amazon Web Services, Inc.

14.7 Alcatel–Lucent Sa

14.8 Ericsson

14.9 Internap Corporation

14.10 Verizon Communications, Inc.

14.11 CDNetworks

14.12 Tata Communications

14.13 Highwinds

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Key Innovators (Page No. - 147)

15.1 Cedexis

15.1.1 Business Overview

15.1.2 Solutions Offered

15.1.3 Key Strategies

15.2 Incapsula, Inc.

15.2.1 Business Overview

15.2.2 Solutions Offered

15.2.3 Key Strategies

15.3 Fastly, Inc.

15.3.1 Business Overview

15.3.2 Solutions Offered

15.3.3 Key Strategies

15.4 Cachefly

15.4.1 Business Overview

15.4.2 Solutions Offered

15.4.3 Key Strategies

15.5 Maxcdn

15.5.1 Business Overview

15.5.2 Solutions Offered

15.6 Cloudflare, Inc.

15.6.1 Business Overview

15.6.2 Products Offered

15.7 Conviva

15.7.1 Business Overview

15.7.2 Products Offered

16 Appendix (Page No. - 152)

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Introducing RT: Real-Time Market Intelligence

16.5 Related Reports

16.6 Author Details

List of Tables (62 Tables)

Table 1 Global Cloud Content Delivery Network Market Size and Growth Rate, 2014–2021 (USD Million, Y-O-Y %)

Table 2 Market Size, By Type, 2014–2021 (USD Million)

Table 3 Standard/Non-Video CDN: Market Size, By Region, 2014–2021 (USD Million)

Table 4 Video CDN: Market Size, By Region, 2014–2021 (USD Million)

Table 5 Cloud Content Delivery Network Market Size, By Core Solution, 2014–2021 (USD Million)

Table 6 Web Performance Optimization: Market Size, By Region, 2014–2021 (USD Million)

Table 7 Media Delivery: Market Size, By Region, 2014–2021 (USD Million)

Table 8 Cloud Security: Market Size, By Region, 2014–2021 (USD Million)

Table 9 Cloud Content Delivery Network Market Size, By Adjacent Service, 2014–2021 (USD Million)

Table 10 Cloud Storage: Content Delivery Network Market Size, By Region, 2014–2021 (USD Million)

Table 11 Analytics and Monitoring: Market Size, By Region, 2014–2021 (USD Million)

Table 12 Application Programming Interfaces: Market Size, By Region, 2014–2021 (USD Million)

Table 13 CDN Design: Market Size, By Region, 2014–2021 (USD Million)

Table 14 Support and Maintenance: Market Size, By Region, 2014–2021 (USD Million)

Table 15 Others: Market Size, By Region, 2014–2021 (USD Million)

Table 16 Cloud Content Delivery Network Market Size, By Organization Size, 2014–2021 (USD Million)

Table 17 Small and Medium Businesses: Market Size, By Region, 2014–2021 (USD Million)

Table 18 Large Enterprises: Market Size, By Region, 2014–2021 (USD Million)

Table 19 Cloud Content Delivery Network Market Size, By Vertical, 2014–2021 (USD Million)

Table 20 Advertising: Market Size, By Region, 2014–2021 (USD Million)

Table 21 Media and Entertainment: Market Size, By Region, 2014–2021 (USD Million)

Table 22 Online Gaming: Market Size, By Region, 2014–2021 (USD Million)

Table 23 E-Commerce: Market Size, By Region, 2014–2021 (USD Million)

Table 24 Education: Market Size, By Region, 2014–2021 (USD Million)

Table 25 Government: Market Size, By Region, 2014–2021 (USD Million)

Table 26 Healthcare: Market Size, By Region, 2014–2021 (USD Million)

Table 27 Others: Market Size, By Region, 2014–2021 (USD Million)

Table 28 Cloud Content Delivery Network Market Size, By Region, 2014–2021 (USD Million)

Table 29 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 30 North America: Market Size, By Type, 2014–2021 (USD Million)

Table 31 North America: Market Size, By Core Solution, 2014–2021 (USD Million)

Table 32 North America: Market Size, By Adjacent Service, 2014–2021 (USD Million)

Table 33 North America: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 34 North America: Market Size, By Vertical, 2014–2021 (USD Million)

Table 35 Europe: Market Size, By Country, 2014–2021 (USD Million)

Table 36 Europe: Market Size, By Type, 2014–2021 (USD Million)

Table 37 Europe: Market Size, By Core Solution, 2014–2021 (USD Million)

Table 38 Europe: Market Size, By Adjacent Service, 2014–2021 (USD Million)

Table 39 Europe: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 40 Europe: Market Size, By Vertical, 2014–2021 (USD Million)

Table 41 Asia-Pacific: Market Size, By Country, 2014–2021 (USD Million)

Table 42 Asia-Pacific: Market Size, By Type, 204–2021 (USD Million)

Table 43 Asia-Pacific: Market Size, By Core Solution, 2014–2021 (USD Million)

Table 44 Asia-Pacific: Market Size, By Adjacent Service, 2014–2021 (USD Million)

Table 45 Asia-Pacific: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 46 Asia-Pacific: Market Size, By Vertical, 2014–2021 (USD Million)

Table 47 Middle East and Africa: Market Size, By Country, 2014–2021 (USD Million)

Table 48 Middle East and Africa: Market Size, By Type, 2014–2021 (USD Million)

Table 49 Middle East and Africa: Market Size, By Core Solution, 2014–2021 (USD Million)

Table 50 Middle East and Africa: Market Size, By Adjacent Service, 2014–2021 (USD Million)

Table 51 Middle East and Africa: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 52 Middle East and Africa: Market Size, By Vertical, 2014–2021 (USD Million)

Table 53 Latin America: Cloud Content Delivery Network Market Size, By Country, 2014–2021 (USD Million)

Table 54 Latin America: Market Size, By Type, 2014–2021 (USD Million)

Table 55 Latin America: Market Size, By Core Solution, 2014–2021 (USD Million)

Table 56 Latin America: Market Size, By Adjacent Service, 2014–2021 (USD Million)

Table 57 Latin America: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 58 Latin America: Market Size, By Vertical, 2014–2021 (USD Million)

Table 59 New Product Launches, 2013–2016

Table 60 Agreements, Partnerships, and Collaborations, 2013–2016

Table 61 Mergers and Acquisitions, 2013–2016

Table 62 Integrations and Expansions, 2013–2016

List of Figures (56 Figures)

Figure 1 Cloud Content Delivery Network Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Global Cloud Content Delivery Network Market Size, 2016–2021 (USD Million)

Figure 8 Market Snapshot, By Type (2016 vs 2021)

Figure 9 Market Snapshot, By Adjacent Service (2016 vs 2021)

Figure 10 North America is Expected to Hold the Largest Market Share in 2016

Figure 11 Lucrative Growth Prospects for Media & Entertainment, Advertising, and E-Commerce Industries

Figure 12 North America and Media and Entertainment to Have the Largest Market Size in 2016

Figure 13 Asia-Pacific is Expected to Be the Most Attractive Market to Invest in During the Forecast Period

Figure 14 Small and Medium Businesses Segment is Expected to Create Huge Market Opportunities in the Cloud Content Delivery Network Market

Figure 15 Evolution of Cloud Content Delivery Network

Figure 16 Market Segmentation By Type

Figure 17 Market Segmentation By Core Solution

Figure 18 Market Segmentation By Adjacent Service

Figure 19 Market Segmentation By Organization Size

Figure 20 Market Segmentation By Vertical

Figure 21 Market Segmentation By Region

Figure 22 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Content Delivery Network Market: Value Chain Analysis

Figure 24 Strategic Benchmarking: Cloud Content Delivery Network Market 2013-2016

Figure 25 Standard Content Delivery Network is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Cloud Security is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 CDN Design is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 Small and Medium Businesses Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Online Gaming Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Asia-Pacific is Expected to Grow at the Highest CAGR From 2016 to 2021

Figure 31 North America Market Snapshot

Figure 32 Asia-Pacific Market Snapshot

Figure 33 Business Strategy Analysis

Figure 34 Product Offerings Analysis

Figure 35 Companies Adopted New Product Launch as the Key Growth Strategy From 2013 to 2016

Figure 36 New Product Launches are Expected to Fuel the Intense Competition in the Cloud Content Delivery Network Market

Figure 37 Battle for Market Share: New Product Launches and Product Enhancements Have Been the Key Growth Strategy for the Market Players

Figure 38 Geographic Revenue Mix of the Top 5 Market Players

Figure 39 Akamai Technologies, Inc.: Company Snapshot

Figure 40 Akamai Technologies, Inc.: SWOT Analysis

Figure 41 Google Inc.: Company Snapshot

Figure 42 Google Inc.: SWOT Analysis

Figure 43 Level 3 Communications: Company Snapshot

Figure 44 Level 3 Communications: SWOT Analysis

Figure 45 Limelight Networks, Inc.: Company Snapshot

Figure 46 Limelight Networks: SWOT Analysis

Figure 47 Amazon Web Services, Inc.: Company Snapshot

Figure 48 Amazon Web Services: SWOT Analysis

Figure 49 Alcatel–Lucent Sa: Company Snapshot

Figure 50 Alcatel–Lucent Sa: SWOT Analysis

Figure 51 Ericsson: Company Snapshot

Figure 52 Ericsson: SWOT Analysis

Figure 53 Internap Corporation: Company Snapshot

Figure 54 Internap Corporation: SWOT Analysis

Figure 55 Verizon Communications, Inc.: Company Snapshot

Figure 56 Tata Communications: Company Snapshot

Growth opportunities and latent adjacency in Cloud Content Delivery Network (CDN) Market