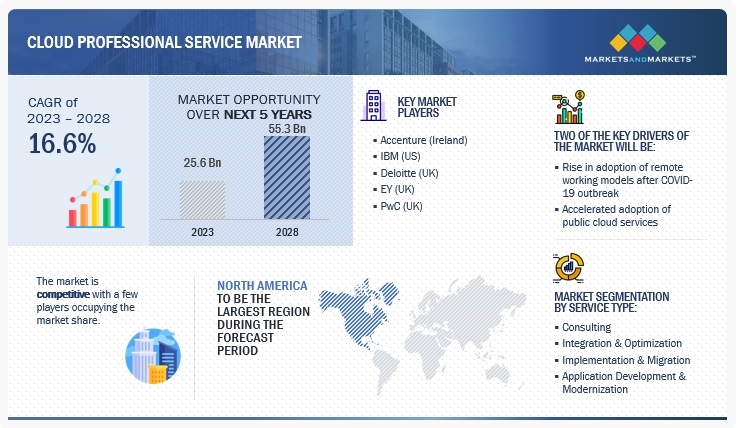

Cloud Professional Services Market by Service Type (Consulting, Application Development & Modernization), Service Model (SaaS, PaaS, IaaS), Deployment Model (Public and Private), Organization Size, Vertical and Region - Global Forecast to 2028

[282 Pages Report] The global Cloud Professional Services market is projected to grow from USD 25.6 billion in 2023 to USD 55.3 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 16.6% during the forecast period. The accelerated adoption of public cloud services is one of the primary factors driving the market growth. Moreover, growing adoption of remote working models with the outbreak of COVID-19 is driving the adoption of Cloud Professional Services.

To know about the assumptions considered for the study, Request for Free Sample Report

Cloud Professional Services Market Dynamics

Driver: Accelerated adoption of public cloud services

Cloud plays an integral role in helping enterprises to sustain despite lockdown scenarios and IT infrastructure inconsistencies, enabling them to innovate faster thereby enhancing speed to market, agility, and responsiveness. In addition, there is an increased openness to adopt hybrid and public cloud models with 68% of the small enterprises preferring public cloud owing to its cost advantages. Another survey conducted by ESG, 59% of organizations indicated spending on public cloud applications would increase in 2023, while 56% reported public cloud infrastructure services spending would go up in 2023.

Restraint: Lack of knowledge and expertise to impact the utilization of cloud professional services among enterprises

Due to the complex nature and the high demand for research, working with the cloud often ends up being a highly tedious task. It requires immense knowledge and wide expertise on the subject. As per the PwC CEO Survey 2020, 77% of CEOs were concerned about the availability of a skilled workforce. The survey also found that those organizations that focused on expanding their employees’ skills were ahead of their peers in many ways and were more confident in their future. Therefore, there is a need for upskilling so that these professionals can easily manage cloud-based applications with a smaller number of issues and ensure enhanced performance and reliability.

Opportunity: Implementation of AI and ML technologies with cloud platforms

Artificial intelligence and machine learning technology are increasingly adopted in various enterprises across the globe. As businesses are focusing on strengthening their digital infrastructure to support remote employees and ensure proper functioning amid the pandemic, many organizations started to believe that AI and ML based cloud applications has potential for supporting large scale data analytics, data insights, and automation of manual tasks. As per the Voice of the Enterprise: AI & Machine Learning Use Cases 2021 study, 95% of organizations stated AI as an important aspect of achieving digital transformation. The AI adoption rate is maximum for enterprises such as communication, over-the-top (OTT) and gaming, technology, and financial services as these organizations focus on improving customer experiences through innovation and automation.

Challenge: Operational challenges with the utilization of multiple clouds

Due to an increase in the options available to the companies, enterprises not only use a single cloud but depend on multiple cloud service providers. Most of these companies use hybrid cloud tactics and close to 84% are dependent on multi-cloud environments. This often ends up being hindered and difficult to manage for the infrastructure team. The process most of the time ends up being highly complex for the IT team due to the differences between multiple cloud providers.

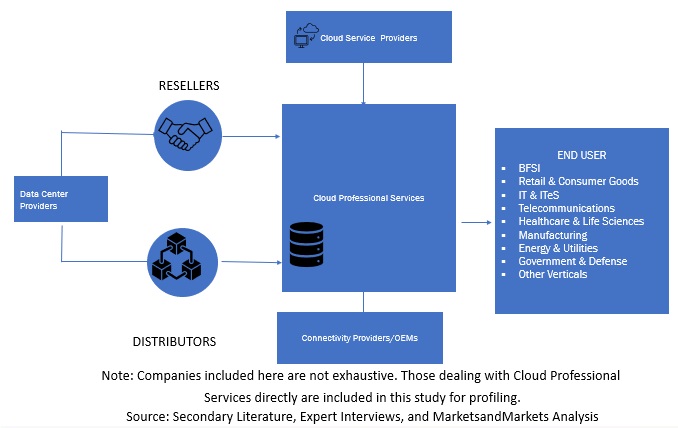

Cloud Professional Services Market Supply Chain

To know about the assumptions considered for the study, download the pdf brochure

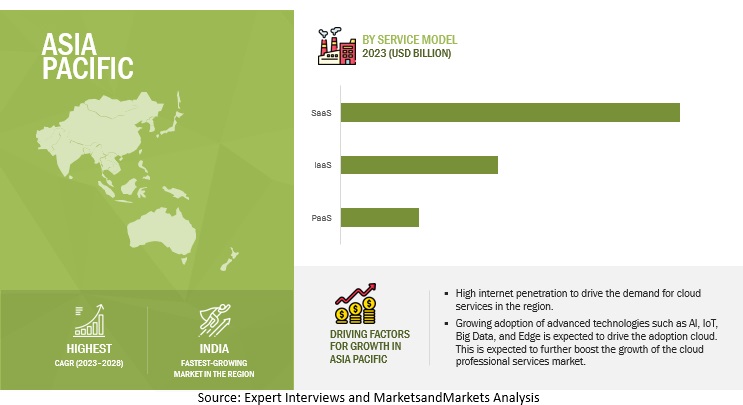

By Service Model, the IaaS segment to grow at a higher CAGR during the forecast period

By Service Model, the IaaS segment is expected to grow at a higher CAGR during the forecast period. Infrastructure-as-a-service model offers compute, memory storage, networking and other related software and hardware as a cloud service replacing the traditional on-premises servers. It provides the end user with flexibility when it comes to hosting custom-built apps or standard software while also providing a general data center for storage.

By deployment model, the public cloud segment is expected to account for the largest market size during the forecast period

The public cloud segment is expected to account for the largest market share among services. The public cloud is defined as computing services offered by third-party providers over the public internet, making them available to anyone who wants to use or purchase them. In the public cloud deployment model, various resources, such as applications, storage, virtual servers, and hardware, are available to clients’ enterprises over the internet. It helps organizations meet their demands for scalability, provides pay per usage pricing strategy and ease of deployment.

By region, Asia Pacific is expected to record the highest growth during the forecast period

The growth of the market in this region is driven by the rising adoption of cloud and mobility trends in countries such as China, India, and Japan. The Asia Pacific region is among the digital hubs of the world, and businesses have been quick to identify the benefits of cloud technology as a facilitator of digital transformation. Well-built ICT infrastructure, strong economies, enterprises’ heavy IT spending, and robust regulatory frameworks are major factors that support the adoption of cloud professional services applications in the region. Various governments in the Asia Pacific are also enhancing cloud adoption through various initiatives. Smart city initiatives will be one of the prime catalysts for adopting public cloud professional services, as government agencies prefer them for transforming their incumbent IT infrastructure. Major players across the region are investing heavily in cloud professional services.

Asia Pacific: Cloud Professional Services Market Snapshot

Key Market Players

The report includes the study of key players offering Cloud Professional Services solutions and services. The major vendors in the market include Accenture (Ireland), IBM (US), Deloitte (UK), EY (UK), PwC (UK), HPE (US), HCLTech (India), Wipro (India), TCS (India), and Capgemini (France).

The study includes an in-depth competitive analysis of these key players in the Cloud Professional Services market, including their company profiles and strategies undertaken.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Service Type, Service Model, Deployment Model, Organization Size, Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors include Accenture (Ireland), IBM (US), Deloitte (UK), EY (UK), PwC (UK), HPE (US), HCLTech (India), Wipro (India), TCS (India), and Capgemini (France) |

This research report categorizes the Cloud Professional Services market to forecast revenues and analyze trends in each of the following subsegments:

By Service Type:

- Consulting

- Integration & Optimization

- Implementation & Migration

- Application Development & Modernization

By Service Model:

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

- Infrastructure as a Service (IaaS)

By Deployment Model:

- Public Cloud

- Private Cloud

By Organization Size:

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Vertical:

- Baanking, Financial Services, and insurance (BFSI)

- Retail & Consumer Goods

- IT & ITeS

- Telecommunications

- Healthcare & Life Sciences

- Manufacturing

- Energy & Utilities

- Government & Defense

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Central & Eastern Europe

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Saudi Arabia

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2023, IBM announced the acquisition of NS1, a network automation SaaS solution provider, to drive agility in hybrid cloud environments.

- In December 2022, EY announced an alliance with Software AG to help organizations to transform by utilizing business process management, IoT, and integration platforms.

- In September 2022, Accenture completed the acquisition of Sentia’s business in the Netherlands, Belgium, and Bulgaria to enhance Accenture’s Cloud First capabilities and provide cloud infrastructure services across public, private, and sovereign cloud environments.

- In September 2022, PwC announced an alliance with HighRadius, a finance software platform, to bring autonomous technology and digital transformation to accounting and finance business processes.

- In December 2021, Deloitte acquired BIAS Corporation, a leader in the Oracle Cloud Infrastructure market, to support Deloitte’s existing portfolio of cloud applications and infrastructure capabilities.

Frequently Asked Questions (FAQ):

How big is the Cloud professional services market?

What is growth rate of the Cloud professional services market?

Who are the key players in Cloud professional services market?

Who will be the leading hub for Cloud professional services market?

What is the Cloud professional services market segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves four major activities in estimating the current size of the Cloud Professional Services market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the Cloud Professional Services market.

Secondary Research

The market size of companies offering Cloud Professional Services solutions and services was arrived at based on the secondary data available through paid and unpaid sources, by analyzing the product portfolios of major companies in the ecosystem, and by rating the companies based on their product capabilities and business strategies.

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, and product data sheets, white papers, journals, certified publications, and articles from recognized authors, government websites, directories, and databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

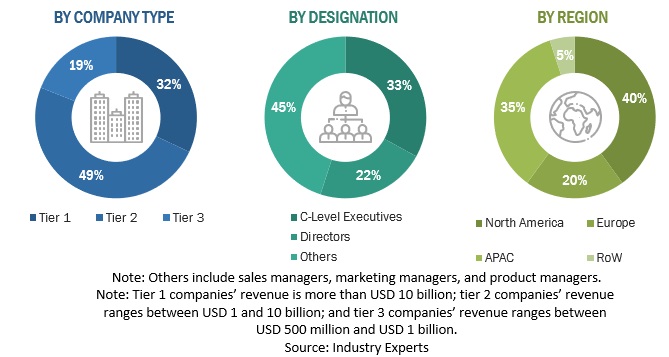

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Cloud Professional Services market.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data of revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs); the installation teams of governments/end users using Cloud Professional Services solutions and services; and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use of solutions solutions affecting the overall Cloud Professional Services market.

Breakup of primary interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the Cloud Professional Services market and various other dependent subsegments. The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in the respective countries were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

In the bottom-up approach, the adoption trend of Cloud Professional Services solutions and services among industry verticals in key countries with respect to regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of Cloud Professional Services solution and services, along with different use cases with respect to their business segments, was identified and extrapolated. Weightage was given to the use cases identified in different solution areas for the calculation. An exhaustive list of all vendors offering solutions and services in the Cloud Professional Services market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with Cloud Professional Services solution and service offerings were considered to evaluate the market size. Each vendor was evaluated based on its solutions and service offerings across verticals. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. Based on these numbers, the region split was determined by primary and secondary sources.

In the top-down approach, an exhaustive list of all vendors in the Cloud Professional Services market was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The market size was estimated from revenues generated by vendors from different Cloud Professional Services solutions and service offerings. Revenue generated from each component (solutions and services) from different vendors was identified with the help of secondary and primary sources and combined to arrive at market size. Further, the procedure included an analysis of the Cloud Professional Services market’s regional penetration. With the data triangulation procedure and data validation through primaries, the exact values of the overall Cloud Professional Services market size and its segments’ market size were determined and confirmed using the study. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Defination

Considering the sources and associations’ views, MarketsandMarkets defines cloud professional services as “a set of practices offered to organizations that plan to implement cloud technologies to drive business operations and improve efficiency. Cloud professional service providers enable businesses to design, implement, and manage cloud systems to improve efficiency, flexibility, and infrastructure scalability. Vendors aid end users in the transition from hardware or on-premises infrastructure to a cloud-based system and help in the optimization of pre-existing cloud systems.”

Key Stakeholders

- Technology service providers

- Cloud service providers (CSPs)

- Colocation providers

- Government organizations

- Networking companies

- Consultants/consultancies/advisory firms

- Support and maintenance service providers

- Telecom service providers

- Information technology (IT) infrastructure providers

- System integrators (SIs)

- Regional associations

- Independent software vendors (ISVs)

- Value-added resellers and distributors.

Report Objectives

- To define, describe, and forecast the global Cloud Professional Services market on the basis of Service Type (Consulting, Integration & Optimization, Implementation & Migration, and Application Development & Modernization), Service Model (PaaS, SaaS, and IaaS), Deployment Model, Organization Size, Vertical, and Region.

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micromarkets1 with respect to growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the Cloud Professional Services market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile key players in the market and comprehensively analyze their market share/ranking and core-competencies2.

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations in the market.

1. Micromarkets are defined as the further segments and subsegments of the market included in the report.

2. Core-competencies of the companies are captured in terms of their key developments and key strategies adopted by them to sustain their position in the market.

Customization Options

Along with the market data, MarketsandMarkets offers customizations as per the company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Professional Services Market