Communication Test and Measurement Market by Offering (Hardware, Software, Services), Test Solution, Type of Test (Enterprise Test, Field Network Test, Lab & Manufacturing Test, Network Assurance Test), End User and Region - Global Forecast to 2029

Communication Test and Measurement Market - Size, Growth, Report & Analysis

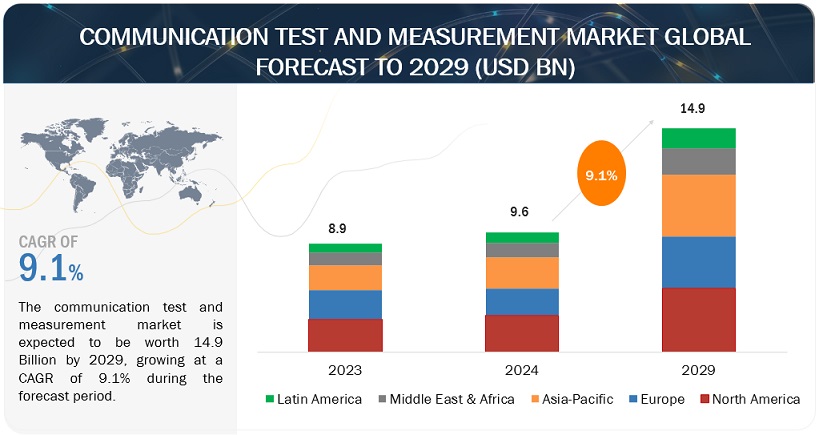

[256 Pages Report] The global Communication Test and Measurement Market size was reached $9.6 billion in 2024 and is anticipated to hit a revenue around $14.9 billion by 2029, at a increasing CAGR of 9.1% during the forecast period. The deployment of next-generation networks, such as 5G and fiber-optic networks, requires specialized test and measurement solutions to validate network performance, optimize infrastructure, and ensure seamless integration with existing systems. With the growing concerns over cybersecurity threats and vulnerabilities in communication networks, there's an increased focus on security testing and monitoring solutions to identify and mitigate potential risks, driving the demand for specialized test and measurement tools in this area. This is driving the adoption of communication test and measurements around the world.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Communication test and measurement market Dynamics

Driver: Rapid technological advancements

The introduction of 5G technology, with its promise of enhanced speeds and connectivity, requires comprehensive testing to validate performance and compatibility. The expansion of the Internet of Things (IoT) introduces diverse communication needs, necessitating thorough evaluations of IoT networks and device interoperability. The integration of artificial intelligence (AI) into communication networks demands testing tools that can assess the impact of AI algorithms on network behavior and reliability. Additionally, the evolution of telecommunication standards, advancements in wireless technologies, and the rise of edge computing contribute to the increasing complexity of communication systems. Quantum communication, next-generation services like AR and VR, and continuous innovations in semiconductor technology further emphasize the critical role of testing solutions. As technology continues its rapid progression, communication test and measurement solutions remain integral in ensuring the seamless performance and reliability of modern communication networks and services.

Restraint: Lack of standardization

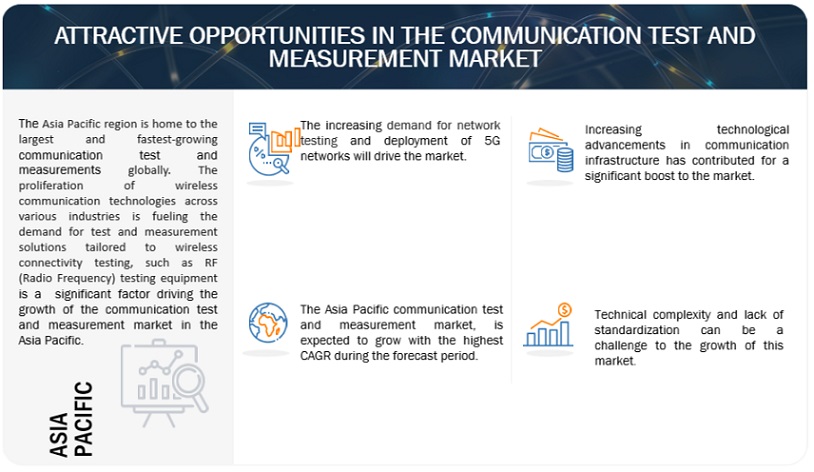

The absence of standardization stands as a formidable challenge within the communication test and measurement market, impeding its seamless evolution and hindering widespread adoption. The lack of uniform testing procedures and methodologies leads to inconsistencies in results across different organizations, making it challenging to compare and interpret findings. Interoperability becomes a major concern as standardized interfaces are essential for the cohesive integration of diverse testing tools with various communication technologies. The complexity of integrating different proprietary solutions and the prevalence of vendor-specific methodologies contribute to a fragmented market, limiting cross-industry compatibility. This absence of common standards also hampers innovation, delaying the development and adoption of cutting-edge technologies in the field. Training and certification processes are further complicated, and ensuring regulatory compliance becomes challenging without universally accepted testing practices. Quality assurance is compromised, impacting the reliability and repeatability of test results. Ultimately, the lack of standardization creates uncertainty, slowing down market growth and hindering the realization of a more interconnected and efficient communication test and measurement industry.

Opportunity: Deployment of 5G networks

The advent of 5G networks offers a pivotal opportunity for the communication test and measurement market, marked by a landscape of increased intricacies and novel requirements. The heightened network complexity of 5G, incorporating features such as massive MIMO and beamforming, creates a demand for specialized testing solutions to accurately validate and optimize performance. The broader spectrum allocation and frequency bands inherent in 5G provide a canvas for test and measurement equipment providers to develop solutions that ensure precision across diverse frequency ranges. The ultra-reliable low latency communication (URLLC) feature and massive Internet of Things (IoT) connectivity open avenues for tailored testing solutions, ensuring stringent performance standards and efficient communication for a vast array of IoT devices. Network slicing, a unique attribute of 5G, prompts the development of testing tools to validate virtualized, independent networks catering to specific use cases. Antenna and beamforming testing, dynamic spectrum sharing verification, and the imperative for security testing in the wake of 5G's integration into critical services all contribute to a rich landscape of opportunities.

Challenge: Security and privacy concerns

In the communication test and measurement market, security and privacy concerns emerge as formidable challenges that demand meticulous attention. The intricacies of handling sensitive information during testing processes, coupled with the necessity for robust encryption techniques, underscore the critical need for safeguarding data privacy and confidentiality. The potential exploitation of vulnerabilities in test interfaces poses a constant threat, requiring the implementation of stringent security measures to thwart unauthorized access to communication networks. Device security is equally paramount, necessitating secure boot processes, firmware integrity checks, and robust authentication mechanisms to prevent unauthorized modifications and ensure that only authorized personnel can access and control the test equipment. Compliance with diverse legal and regulatory frameworks, such as GDPR, adds an additional layer of complexity, compelling industry players to navigate and adhere to specific standards related to data protection and privacy. Implementing secure communication protocols and protecting against eavesdropping are imperative to preserve the integrity and confidentiality of data during transmission. Moreover, ensuring the security of the supply chain, with secure manufacturing processes and continuous monitoring through intrusion detection systems and regular security audits, is essential to fortify the resilience of communication test and measurement solutions against evolving cyber threats.

Communication test and measurement market Ecosystem

Prominent companies in this market have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and marketing networks. Prominent companies in this market include Anritsu (Japan), Fortive (US), EXFO (Canada), Rohde & Schwarz (Germany), Emerson (US), VIAVI Solutions (US), Yokogawa (Japan), Spirent Communications (UK), Keysight Technologies (US), Huawei (China).

Based on type of test, the lab & manufacturing test segment is expected to grow with the highest CAGR during the forecast period

Lab & manufacturing test solutions are used by network equipment manufacturers, mobile device manufacturers, and network operators for all phases of the product lifecycle. These solutions are used for all lab and manufacturing applications, such as optical connectors testing, Reconfigurable Optical Add/Drop Multiplexer (ROADM) component testing, and LTE protocol testing. Laboratories serve as the crucible for innovation, where engineers conduct research, development, and meticulous testing in controlled environments. Here, performance evaluation, protocol compliance, and equipment calibration are meticulously undertaken, providing insights crucial for optimizing system design and ensuring adherence to industry standards. Additionally, simulations enable engineers to model real-world scenarios, offering invaluable insights into system behavior under diverse conditions. Conversely, manufacturing testing focuses on mass production efficiency and quality assurance. Automated test systems streamline the evaluation process, ensuring each device meets specified performance criteria before leaving the production line. These tests, which include functional assessments and RF performance evaluations, serve to uphold product quality and consistency across batches.

By type of test, the field network test segment to hold the largest market size during the forecast period

Field network testing is a pivotal aspect of communication test and measurement, serving various purposes crucial for ensuring network reliability and performance in real-world environments. It encompasses performance verification, troubleshooting, and quality of service evaluation, allowing engineers to validate network throughput, latency, and packet loss while pinpointing and resolving issues promptly. Moreover, it aids in assessing coverage, signal strength, and interoperability, ensuring seamless communication across diverse technologies and vendors. Security assessments are also conducted to identify vulnerabilities and protect against cyber threats, while capacity planning relies on field data to anticipate future network demands and scale infrastructure accordingly. Overall, field network testing plays an indispensable role in optimizing communication networks, safeguarding their integrity, and enhancing the end-user experience.

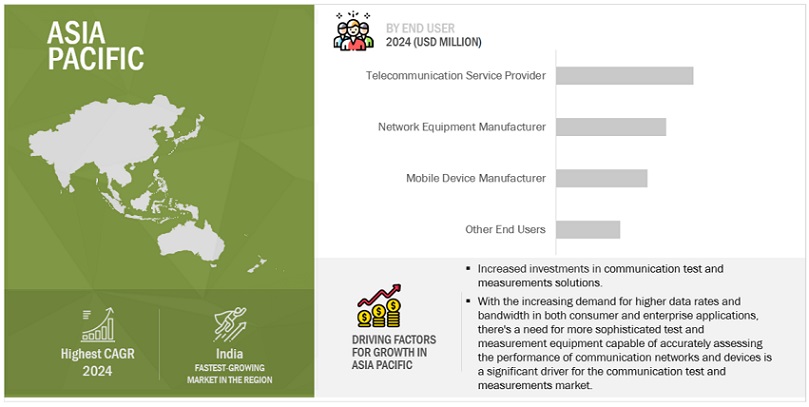

Based on region, Asia Pacific is expected to grow with the highest CAGR during the forecast period

The communication test and measurement market in Asia Pacific has been experiencing significant growth and development. Asia Pacific offers significant growth opportunities for communication test and measurement solutions as end users, such as mobile device manufacturers, count heavily on these solutions to provide their customers with high-quality and high-performing services. Furthermore, increasing penetration of wireless communication standards is boosting their demand in the IT & telecommunications sector. China and India will continue to maintain their supremacy in the communication test and measurement market with the highest number of communication subscribers and a high data usage rate. Major communication test and measurement vendors, such as Yokogawa and Anritsu have a strong presence in this region. These players innovate their offerings in this market.

Market Players:

The major players in the Communication test and measurement market are Keysight Technologies (US), Rohde & Schwarz (Germany), Anritsu (Japan), VIAVI Solutions (US), Yokogawa (Japan). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the communication test and measurement market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Offering (Hardware, Software, Services (Professional Services (Support Services, Consulting Services, Training Services), Managed Services)), Test Solution (Wireline Test Solution, Wireless Test Solution), Type of Test (Enterprise Test, Field Network Test, Lab & Manufacturing Test, Network Assurance Test), End User (Telecommunication Service Provider, Network Equipment Manufacturer, Mobile Device Manufacturer, Other End Users) and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

Anritsu (Japan), Fortive (US), EXFO (Canada), Rohde & Schwarz (Germany), Emerson (US), VIAVI Solutions (US), Yokogawa (Japan), Spirent Communications (UK), Keysight Technologies (US), Huawei (China), Hammer (US), Calnex Solutions (UK), Luna Innovations (US), NetScout (US), Cisco (US), LitePoint (US), SysMech (England), VeEX (US), TEOCO Corporation (US), NetAlly (US), thinkRF (Canada), Kyrio (US), Fastech Telecommunications (India), Eagle Photonics (India), Verkotan (Finland) |

This research report categorizes the communication test and measurement market based on offering, test solution, type of test, end user, and region.

Based on Offering:

- Hardware

- Software

-

Services

-

Professional Services

- Support Services

- Consulting Services

- Training Services

- Managed Services

-

Professional Services

Based on Test Solution:

- Wireline Test Solution

- Wireless Test Solution

Based on Type of Test:

- Enterprise Test

- Field Network Test

- Lab & Manufacturing Test

- Network Assurance Test

Based on End User:

- Telecommunication Service Provider

- Network Equipment Manufacturer

- Mobile Device Manufacturer

- Other End Users

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- UAE

- KSA

- Rest of GCC Countries

- South Africa

- Rest of Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In March 2024, Keysight and ETS-Lindgren jointly developed an over-the-air (OTA) test solution. This solution is specifically for devices that support the narrowband non-terrestrial networks (NB-NTN) technology. This technology enables cellular communications to be deployed through satellite. The solution offers measurement and validation of the transmitter or receiver performance of NB-NTN supporting devices.

- In March 2024, RAPA and Anritsu jointly cooperate in multiple fields to support the development of technologies, such as configuring a test environment capable of validating the candidate frequency bands for B5G/6G, specifically the FR3 (7 GHz to 24 GHz) and the sub-THz band (100 GHz and above), as well as the technical cooperation from proof of concept (PoC) phase.

- In February 2024, Keysight Technologies launched the E7515W UXM Wireless Connectivity Test Platform for Wi-Fi. It is a network emulation system that provides Wi-Fi 7 devices with signaling radio frequency (RF) and throughput testing, that includes 4x4 MIMO 320 MHz bandwidth.

- In February 2024, Anritsu Corporation introduced its new NR Licensed 6GHz Band Measurement MX800010A-014 software for the Radio Communication Test Station MT8000A, which supports RF tests in the 6 GHz band (5.925 GHz to 7.125 GHz) for 5G FR1[*2] devices.

- In February 2024, Anritsu and MediaTek collaborate to verify advanced three uplink transmission (3TX) Technology featured in MediaTek's M80 5G Modem by using Anritsu's MT8000A all-in-one Radio Communication Test Station, providing a flexible test platform for ultrafast, large-capacity 5G communications.

Frequently Asked Questions (FAQ):

What is the definition of the communication test and measurement market?

The communication test and measurement market comprise hardware, software, and services, which are used to test all devices and networks used for communication purposes. It's the process of evaluating and quantifying the performance and quality of communication networks, devices, and systems. Communication test and measurement equipment are used to test both wireless and wired networks. These tests and measurements can apply to various types of networks, including but not limited to, telecommunication networks, mobile networks, internet services, and broadcast networks.

What is the market size of the communication test and measurement market?

The communication test and measurement market size is projected to grow USD 9.6 billion in 2024 to USD 14.9 billion by 2029, at a CAGR of 9.1% during the forecast period.

What are the major drivers in the communication test and measurement market?

The major drivers of the communication test and measurement market are growing demand for network testing, rising demand for automated products and a growing need for communication test and measurement equipment, and rapid technological advancements.

Who are the key players operating in the communication test and measurement market?

The major players in the communication test and measurement market are Anritsu (Japan), Fortive (US), EXFO (Canada), Rohde & Schwarz (Germany), Emerson (US), VIAVI Solutions (US), Yokogawa (Japan), Spirent Communications (UK), Keysight Technologies (US), Huawei (China), Hammer (US), Calnex Solutions (UK), Luna Innovations (US), NetScout (US), Cisco (US), LitePoint (US), SysMech (England), VeEX (US), TEOCO Corporation (US), NetAlly (US), thinkRF (Canada), Kyrio (US), Fastech Telecommunications (India), Eagle Photonics (India), Verkotan (Finland).

What are the opportunities for new market entrants in the communication test and measurement market?

The major opportunities of the communication test and measurement market are deployment of 5G networks, rising demand for bandwidth and traffic inspection, and quantum communication testing. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

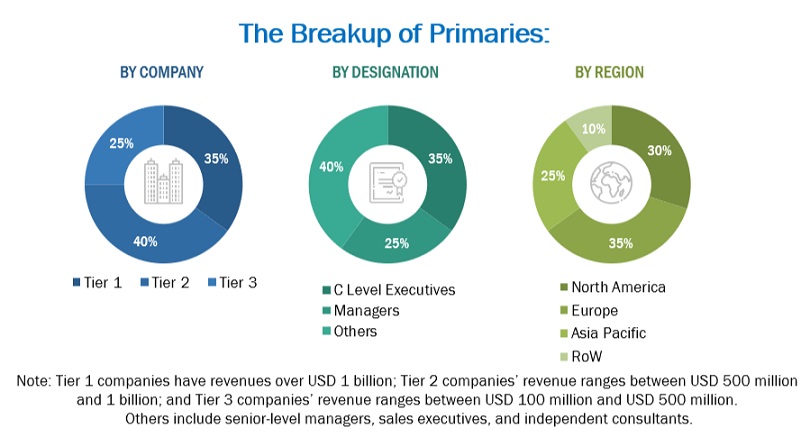

The study involved four major activities in estimating the current size of the global communication test and measurement market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total communication test and measurement market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the communication test and measurement market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

VIAVI Solutions |

Senior Manager |

|

LitePoint |

VP |

|

Spirent Communications |

Business Executive |

Market Size Estimation

For making market estimates and forecasting the communication test and measurement market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global communication test and measurement market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the Communication test and measurement market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Communication test and measurement market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Communication test and measurement market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The communication test and measurement market comprise hardware, software, and services, which are used to test all devices and networks used for communication purposes. It's the process of evaluating and quantifying the performance and quality of communication networks, devices, and systems. Communication test and measurement equipment are used to test both wireless and wired networks. These tests and measurements can apply to various types of networks, including but not limited to, telecommunication networks, mobile networks, internet services, and broadcast networks.

Key Stakeholders

- Communication Service Providers (CSPs)

- Enterprises

- Antenna Manufacturers

- NEMs

- Mobile Device Manufacturers

- Chip Manufacturers

- Network Installation and Maintenance Service Providers

- Wireless Service Providers

- Video Equipment Providers

- Cable Providers

- Suppliers

- Channel Partners

- Government Organizations

- Mobile Network Operators (MNOs)

Report Objectives

- To determine, segment, and forecast the global communication test and measurement market based on offering, test solution, type of test, end user, and region in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the communication test and measurement market.

- To study the complete value chain and related industry segments and perform a value chain analysis of the communication test and measurement market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total communication test and measurement market.

- To analyze the industry trends, patents, and innovations related to the communication test and measurement market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the communication test and measurement market.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Growth opportunities and latent adjacency in Communication Test and Measurement Market

what are the major challenges in Communications Test and Measurement Market