Core Materials Market by Type (Foam, Balsa, and Honeycomb), End- use Industry (Wind Energy, Marine, Aerospace & Defense, Automotive & Transportation, Construction & Industrial), and Region - Global Forecast to 2028

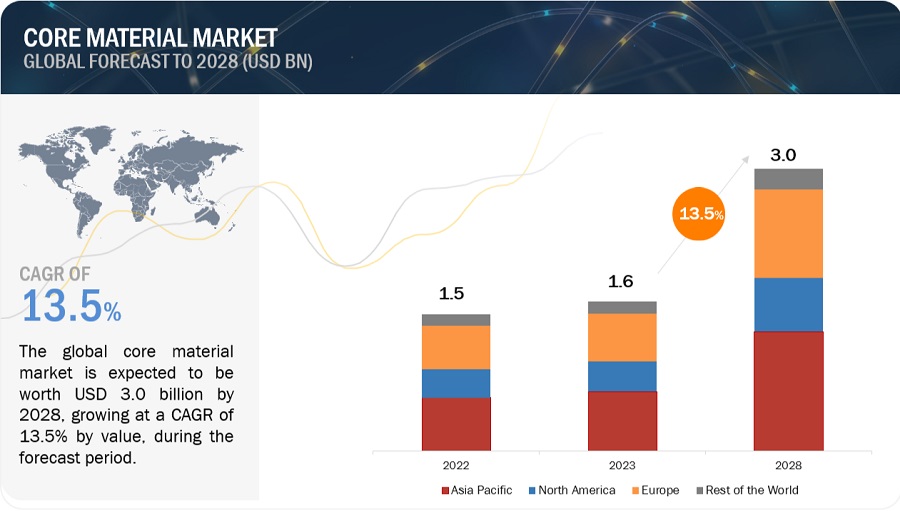

The global core materials market is expected to witness a CAGR of 13.5% between 2023 to 2028. The market size of core materials market is estimated to be USD 1.6 billion in 2023 and is projected to reach USD 3.0 billion by the end of 2028. Sandwich composite systems require core materials because they provide a special blend of stiffness, strength, and lightweight characteristics. Core materials are widely being used in industries like aerospace, wind energy, marine, automotive, construction, and industrial manufacturing as sustainability becomes more and more important. This increase in demand is being driven by the growth of infrastructure, the expansion of renewable energy sources, and technological improvements. Core materials are becoming more and more important in helping businesses fulfill these changing objectives as they look for creative ways to improve performance and efficiency while lowering their environmental effect.

Attractive Opportunities in the Core Materials Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global Core Material Market Dynamics:

Drivers: Demand for core materials in wind turbine blades and solar panels

One major factor propelling the core materials market is the increasing need for these materials in the manufacturing of solar panels and wind turbines. Wind and solar power are becoming more and more essential parts of the world's energy mix as it moves toward renewable energy sources. Both solar panels and wind turbine blades depend heavily on core materials, which offer strength, insulation, and structural support while keeping a thin profile. Core materials are necessary in the wind energy industry to build rotor blades that can endure severe weather and optimize energy collection efficiency. Similar to this, core materials are used in the construction of photovoltaic panels in the solar energy industry to improve efficiency and durability. The demand for core materials is anticipated to increase due to the rapid expansion of wind and solar energy installations worldwide, which is being driven by government incentives and environmental concerns. The importance of core materials in developing renewable energy technologies and addressing the issues of a sustainable future is highlighted by this expanding need.

Restraints: Difficulty in recycling core materials

Core materials are widely used in many different industries, including as the automotive, marine, and aerospace industries. Made up of various constituents, including metals, polymers, and thermoplastics like PVC foam or aramid fiber, these materials are combined to accomplish functionalities. However, the combination of materials with different properties makes it difficult to separate and recycle individual components, which makes recycling composite constructions a difficulty. Furthermore, to form structural components, core materials are frequently laminated or bonded with additional materials using adhesives or resins. This requires the removal of bonding agents, which further complicates the recycling process. The complexity of the recycling process reduces the quality of recovered materials in addition to making it difficult to differentiate essential components from unnecessary ones. As a result, recycling core materials is time-consuming and can be expensive. This limits market potential since end-use industries may choose less expensive and recyclable solutions over more costly and non-recyclable ones.

Opportunities: Growing demand for core materials in medical industry and 3D printing

Durability and good shock absorption capacity are key requirements for lightweight materials used in the sports and medical equipment industries. It is anticipated that as these industries push for innovation while prioritizing performance, safety, and comfort, the need for core materials will rise. Core materials, such as foams, honeycomb structures, and composite materials, provide lightweight building alternatives without sacrificing structural integrity. Lightweight materials are useful in medical applications where comfort and mobility are critical, such as in orthotics, prostheses, and medical equipment. Similar to this, lightweight materials improve performance and lessen athlete fatigue in the sports equipment sector. Core materials are especially well-suited for applications that call for protection against impacts or vibrations, such medical padding, prosthetic limbs, and orthopedic braces that are intended to lessen patient suffering and absorb shocks. This is because of their remarkable shock absorption and impact resistance. Furthermore, core materials are essential to the sports equipment industry because they reduce the chance of damage during sports by offering protection and cushioning in the form of padding, boots, and helmets.

Challenges: Developing low-cost technologies

The affordability of core materials plays a critical role in their adoption across various structural applications. Core materials offer a lot of potential, but it hasn't been fully realized yet. This is mostly because of the high costs of manufacturing, R&D, and longer cycle times. Although there are many known uses in the aerospace, railroad, maritime, and automotive industries, the usage of core materials in a number of other end-use sectors is currently being explored because of financial limitations. The costs associated with developing core materials are frequently high, making the process extremely difficult. Therefore, developing affordable technologies that can enable the use of core materials in sectors where cost concerns are important is the main problem. For instance, Nomex Honeycomb shows promise for a number of uses, but because development is expensive, commercializing these possibilities has not yet been thoroughly investigated.

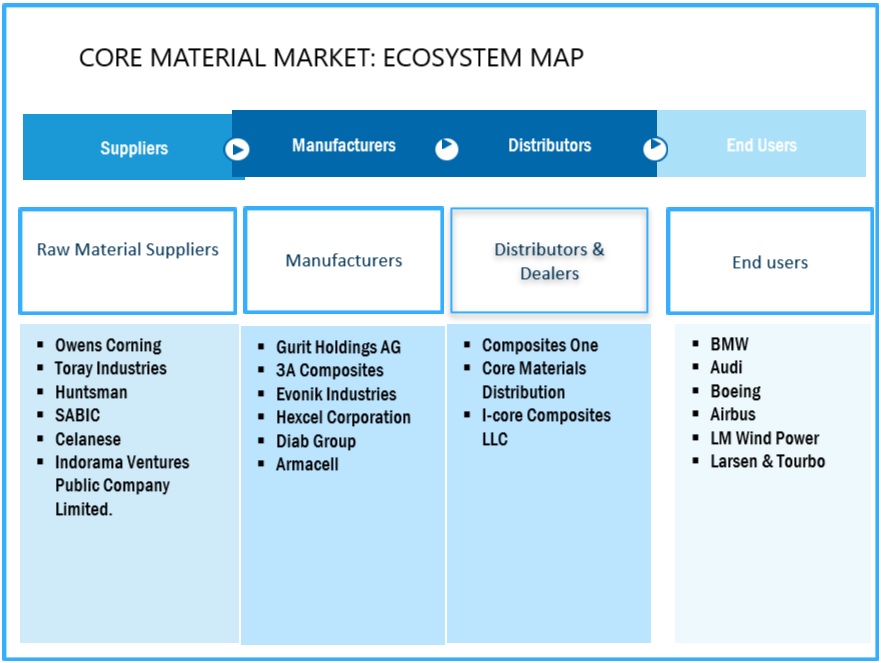

Core Material Market: Ecosystem

The foam core material type segment accounted for the largest share in core materials market, in terms of value and volume.

With the greatest market share compared to its competitors, foam core material leads the core material industry. Foam core material is preferred in many industries due to its cost-effectiveness, durability, and adaptability. In sandwich composite constructions, its ability to offer thickness and high rigidity with little density makes it indispensable. Different varieties of foam, such as PET, PVC, SAN, PMI, and PEI, provide customized solutions to fulfill specific application requirements within this market segment. Foam core material is widely used in applications, such as wind energy blades, wind turbines, nacelles, aerospace interior components, boat hulls, and others. The demand of foam core coming from wind energy sector is the major reason for the high demand of foam core compared to honeycomb and balsa.

The wind energy end-use industry is expected to be the fastest growing industry during the forecast period.

Wind energy stands out as the fastest-growing end-use industry in the core materials market. Wind power becomes increasingly important in creating a sustainable energy environment as the world moves more and more toward renewable energy sources. When creating wind turbine blades, core materials are critical because they give the blades the strength, rigidity, and lightweight qualities that are necessary for maximum performance and longevity. At the same time, governments all over the world are passing laws to encourage the use of renewable energy sources and solve climate change issues, which is driving up investments in wind energy infrastructure. The demand for core materials will undoubtedly increase due to this surge in interest in wind energy installations. As a result, the wind energy industry drives significant expansion in the core materials market, forcing suppliers and manufacturers to meet the rising need for high-performance materials suited to the particular needs of wind energy applications.

Asia Pacific is the largest and the fastest growing regional market during the forecasted period.

Driven by the impressive growth of the wind energy sector, the Asia Pacific region becomes the largest and fastest-growing market in the core materials sector during the projected period. The Asia Pacific area is leading the way in this shift as the world moves more and more toward renewable energy sources, especially wind power. The demand for core materials is rising significantly as a result of the region's governments putting ambitious renewable energy objectives into action and making large investments in wind energy infrastructure. The number of wind farms in China, India, and Japan is increasing, and with it is the demand for core materials for wind turbine blades and related parts. The strong expansion of the wind energy industry has resulted in a corresponding rise in the need for core materials, highlighting the crucial role played by the Asia Pacific region in propelling the core materials market's growth. As the need for high-performance core materials customized to the unique needs of the quickly growing wind energy industry grows, manufacturers and suppliers in the Asia Pacific region are putting more and more effort into meeting this demand, solidifying the region's standing as a major player in the global core materials market.

Increasing number of wind energy installations to boost the market

Accelerating the adoption of renewable energy sources is crucial as the world's capacity to use fossil fuels shrinks. One important renewable energy source that propels the growth of the core material market is wind energy. Wind turbines rely heavily on core materials because they provide outstanding fatigue and corrosion resistance, as well as strengthening the blades. By 2035, renewable energy is expected to generate over 25% of the world's electricity, with wind energy making up a sizable amount of this share, according to the Global Wind Energy Council (GWEC). Due to its affordability in terms of boosting system capacity and lowering CO2 emissions, wind energy is becoming a more and more popular choice for power generation. For example, by 2030, the US government hopes to generate 30 GW of offshore wind energy, which would be enough to power 10 million households sustainably and encourage supply chain investment.

To know about the assumptions considered for the study, download the pdf brochure

Prominent companies in the global core materials market are Diab Group (Sweden), Hexcel Corporation (US), 3A Composites (Switzerland), Euro-Composites S.A. (Luxembourg), Gurit Holding AG (Switzerland), The Gill Corporation (US), Changzhou Tiansheng New Materials Co. Ltd. (China), Plascore Incorporated (US), Armacell International S.A. (Luxembourg), and Evonik Industries AG (Germany). These companies are attempting to establish themselves in the core material market by employing a range of inorganic and organic approaches. The study includes a thorough competitive analysis of these key players in the core materials market, with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Years considered for the study |

2020–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (Kiloton) |

|

Segments |

By Type, End-use Industry, and Region |

|

Regions |

Europe, North America, APAC, and RoW |

|

Companies |

3A Composites (Switzerland), Diab Group (Sweden), Gurit (Switzerland), Hexcel Corporation (US), Armacell International S.A. (Luxembourg), Euro-Composites S.A. (Luxembourg), Changzhou Tiansheng New Materials Co. Ltd. (China), and The Gill Corporation (US). |

This research report categorizes the core materials market based on type, end-use industry, and region.

By Type:

- Foam

- Honeycomb

- Balsa

By End-use Industry:

- Wind Energy

- Aerospace & Defense

- Marine

- Automotive & Transportation

- Construction

- Industrial

- Others (sporting goods and healthcare)

By Region:

- North America

- Europe

- APAC

- RoW

Recent Developments

- In January 2024, Gurit launched two different products. One is Gurit Kerdyn FR+, It is a PET recycled structural foam with Class C – EN13501 test and certification. It has good compressive strength and stiffness and the other one is Balsaflex Lite, which is a next-generation balsa, and PET core material with a novel coating system that reduces resin uptake during infusion processes.

- In October 2023, Gurit announced major long-term supply contracts with two leading OEMs, expected to generate substantial net sales over the contract periods.

- In June 2022, Korean Aerospace Industries (KAI) signed a New Long-Term Contract with The Gill Corporation. The Gill Corporation will supply non-metallic honeycomb products from the El Monte division and metallic honeycomb products from the Maryland division.

- In May 2022, 3A Composites Core Materials acquired SOLVAY’s TegraCore PPSU resin-based foam, which became part of the portfolio under AIREX TegraCore. Both companies agreed to continue their collaboration to further develop AIREX TegraCore.

Frequently Asked Questions (FAQ):

What are the drivers influencing the growth of the core material market?

Demand for core materials in wind turbine blades and solar panels to boost the core materials market.

Which is the largest and the fastest growing country-level market for core material market?

China is the largest and the fastest growing core material market due to high demand coming from wind energy installations.

What are the factors contributing to the final price of core material market?

Raw material plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of core material.

What is the major restraint in the core material market?

Difficulty in recycling of core materials is one of the major restraint for the core materials market.

Which type of core material is expected to register highest CAGR?

Foam core material to register highest CAGR in the market owing to their demand arriving from the wind energy sector.

Who are the major manufacturers?

Diab Group (Sweden), Hexcel Corporation (US), 3A Composites (Switzerland), Euro- Composites S.A. (Luxembourg), Gurit Holding AG (Switzerland), The Gill Corporation (US), Changzhou Tiansheng New Materials Co. Ltd. (China), Plascore Incorporated (US), Armacell International S.A. (Luxembourg), and Evonik Industries AG (Germany). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

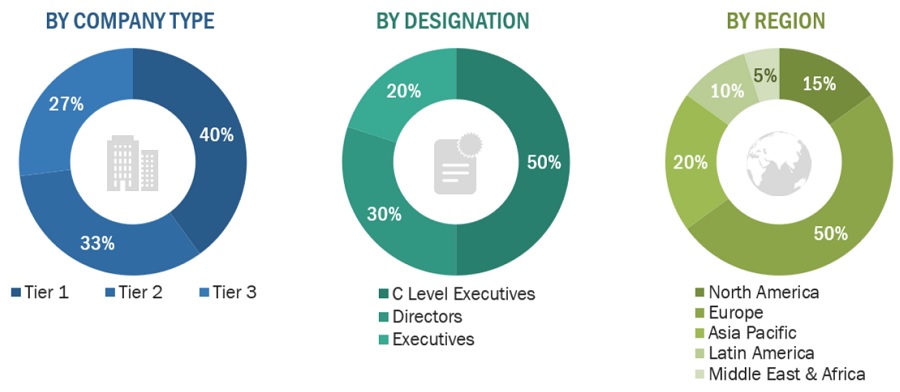

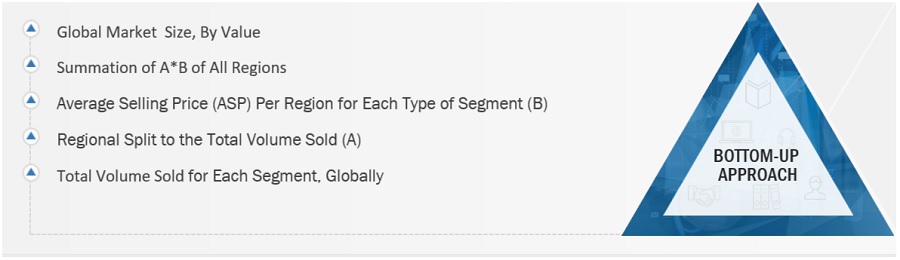

The study involved two major activities in estimating the current size of the core materials market. Exhaustive secondary research was performed to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering core materials and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the core material market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the core material market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from core material industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the core materials, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of core materials and future outlook of their business which will affect the overall market.

Following is the breakdown of primary respondents:

Notes: Tiers of companies are selected based on their ownership and revenues in 2022.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the core material market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations of core materials in different applications at a regional level. Such procurements provide information on the demand aspects of the core materials industry for each application. For each application, all possible segments of the core material market were integrated and mapped.

Core Material Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Core Material Market Size: Top Down Approach

Data Triangulation

After arriving at the overall core materials market size, using the market size estimation processes explained above, the market was split into several segments and sub-segments. In order to complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the wind energy, aerospace & defense, marine, automotive & transportation, and other end-use industries.

Market Definition

The term "core materials" describes a wide variety of materials that are used as essential parts of composite structures in a variety of sectors. These substances function as the inner or central core of sandwich composite structures, offering crucial characteristics including insulation, rigidity, and strength while keeping a thin profile. Core materials, which are commonly classified into categories like foam, balsa wood, and honeycomb structures, are widely used in a variety of industries, including construction, wind energy, aerospace, marine, automotive, and industrial manufacturing. The market for core materials is always changing due to advances in materials science and the increased emphasis on lightweight and sustainable solutions. This is because a variety of end-use sectors are seeing a growing need for high-performance and affordable alternatives.

Key Stakeholders

- Core materials manufacturers and distributors

- Key application segments for composites

- Research and consulting firms

- R&D institutions

- Associations and government institutions

- Environmental support agencies

Report Objectives

- To analyze and forecast the size of the core materials market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on type and end-use industry

- To analyze and project the market based on four regions, namely, Europe, North America, Asia Pacific (APAC), and Rest of World (RoW)

- To strategically analyze the micro markets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC core materials market

- Further breakdown of Rest of Europe core materials market

- Further breakdown of Rest of world core materials market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Core Materials Market

Need core materials market report by end-use industry.