Data Center Asset Management Market by Component Type (Software, Service, & Hardware), Deployment Type (On-Premise, & Cloud), Service (Consulting, Installation & Support, & Professional), Data Center Type, Vertical and Region - Global Forecast to 2020

[162 Pages Report] The data center asset management market is expected to grow from USD 731.5 Million in 2015 to USD 2.81 Billion by 2020, at a Compound Annual Growth Rate (CAGR) of 30.8% from 2015 to 2020. 2013 has been considered as the historical year and 2014 as the base year for performing the market estimation and forecasting. The exponential growth in the amount of data consumed by various industries, individuals, and organizations has resulted in a swift increase in the demand for data storage. The growing data and storage requirement increases the associated data center assets and costs. In order to minimize the cost associated with the operations of data centers and to maximize profits, various organizations developing more scalable and efficient data center management solutions.

In the present scenario, the global data centers are undergoing through technological transformations and are experiencing significant adoption and they are also expected to experience an exponential growth in the coming years. The global data center asset management market is segmented into various application types across geographical regions such as North America, Europe, APAC, MEA, and Latin America. The market has also been segmented into diverse industry verticals which include BFSI, IT and telecom, government and public sector, healthcare, energy, and other verticals.

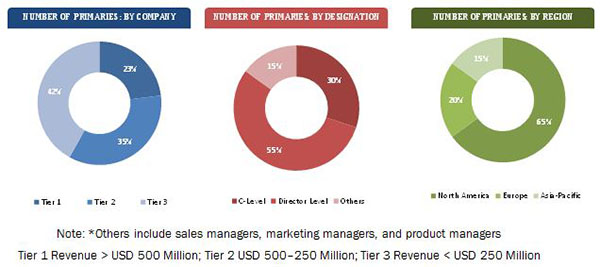

Top-down and bottom-up approaches were used to estimate and validate the size of the global data center asset management market and to estimate the size of various other dependent submarkets in the overall market. The research methodology used to estimate the market size includes the following details: Key players in the market were identified through secondary research and their market shares in respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The data center asset management ecosystem comprises of data center asset management vendors such as Schneider Electric, HP, Emerson Network Power, IBM, Raritan, CA Technologies, Fieldview Solutions, BMC Software, INC., and Huawei among various others. A few small and medium-sized companies such as Modius, Inc., AssetPoint, Inc., DCIM Solutions, AlphaPoint Technologies, and others provide comparatively narrower, yet locally effective solution portfolio and distribution networks in the data center asset management ecosystem. These vendors provide innovative asset management solutions and services to end users in various industrial verticals, including IT and telecom, BFSI, government and public, healthcare, energy, manufacturing, media and entertainment, and others. During the forecast period, the data center asset management market also presents a potential opportunity for various data center hardware, infrastructure vendors, and operators in the data center industry.

Target audience

- Data center solution vendors

- Support infrastructure equipment providers

- Component providers

- Service providers

- System integrators

- Cloud storage providers

- Colocation providers

The data center asset management market report is broadly segmented into following components, data center types, services, deployment types, verticals, and regions.

Global Market by Component

- Software

- Services

- Hardware

Global Market by Deployment type

- On-Premise

- Cloud

Global Market by Data Center Type

- Mid-size data center

- Enterprise data center

- Large data center

Global Market by Service

- Consulting

- Installation & support

- Professional

Global Market by Vertical

- BFSI

- Telecom and IT

- Government

- Energy

- Healthcare

- Manufacturing

- Media and entertainment

- Others

Global Market by Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the rest of Asia-Pacific data center asset management market into South Korea, Australia, and New Zealand, and others

- Further breakdown of the Latin American market into Brazil, Argentina, and rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The increased overhead costs and complexities in managing data centers have given way to the adoption of data center asset management solutions, thereby aiding companies in cutting down their time, Operational Expenditure (OPEX), and Capital Expenditure (CAPEX), and empowering them with better inventory management and resource planning. The data center asset management market is estimated to grow from USD 731.5 Million and projected to be of USD 2.81 Billion by 2020, at a Compound Annual Growth Rate (CAGR) of 30.89% during the forecast period. The increasing number of data centers with requirement of storage facilities and associated data center assets is driving the growth of the data center asset management market.

The global data center asset management report quantifies the market for software, hardware solution, and service. The end users have started transforming from traditional practices of maintaining assets list by adopting data center asset management solutions that provide real-time asset tracking, thereby reducing time and cost of tracking and managing data center assets. The data center asset management software solution market is expected to register a significant growth rate in the coming years as these solutions assist managers and professionals in gaining control of their data centers. In terms of the service market, professional services show great opportunities and are projected to grow at the highest CAGR by 2020.

Tracking and maintaining data center assets is becoming more complex where data center asset management solutions simplify the management of assets, ensuring optimal utilization of all resources in data centers. The data center asset management market by deployment type includes on-premises and cloud. The cloud deployment type shows great potentials during the forecast period as it simplifies the management of multi-data centers.

The data center asset management market is thriving, and in the next five years it will present huge potential opportunity in the software solutions and services. The report provides detailed insights into the global data center asset management which is segmented by component type, by deployment type, by service, by data center type, by vertical, and by region. The market has been segmented into diverse industry verticals including IT and telecom; Banking, Financial Services, and Insurance (BFSI); government and public; healthcare; energy; manufacturing; media and entertainment; and other verticals.

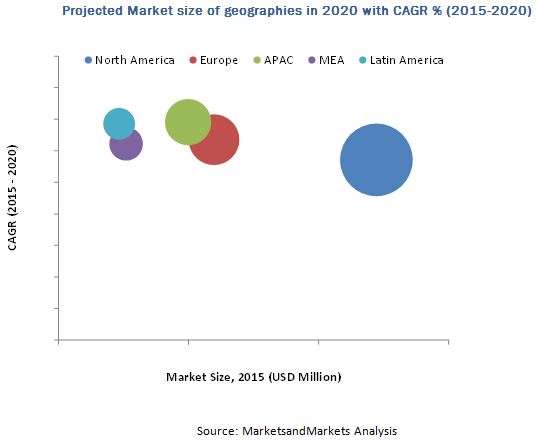

The report covers all the major aspects of the data center asset management market and provides an in-depth analysis across the regions of North America, Europe, APAC, MEA, and Latin America. North America is expected to hold the largest market share, whereas the APAC region is projected to have great opportunities in this market, growing at the highest percentage of CAGR by 2020, due to the developing infrastructure and increasing number of data centers in this region.

Though the users are quite reluctant towards changing the existing traditional data center management practices, the time and cost-saving benefits of data center asset management solutions support the adoption rate, which is expected to increase in the next five years. Few of the major vendors providing data center asset management solutions and services are HP, IBM, Schneider Electric SE, Emerson Network Power, Nlyte Software, Optimum Path, Inc., Raritan, CA Technologies, FieldView Solutions, Inc., Huawei Technologies Co. Ltd., and others. These players are adopting various strategies such as new product developments, partnerships, and business expansions to cater to the needs of the market.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Market Opportunities

4.2 Data Center Asset Management Market: By Component Type

4.3 Market Share of Top Three Components and Regions

4.4 Data Center Asset Management Size of Regions (2015 and 2020)

4.5 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Need for Real-Time Monitoring, Control, and Management

5.4.1.2 Improved Energy Efficiency

5.4.1.3 Enhanced Planning and Manageability

5.4.2 Restraints

5.4.2.1 High Initial Investment Costs

5.4.2.2 Reluctance in Changing Existing Management Practices

5.4.3 Opportunities

5.4.3.1 Increasing Number of Data Centers

5.4.4 Challenges

5.4.4.1 Lack of Awareness About Data Center Asset Management Solutions and Their Benefits

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Supply-Side Analysis

6.3 Strategic Overview

6.3.1 Innovation and Product Enhancements

6.3.2 Collaborations and Partnerships

6.4 Technology, Trends, and Standards

6.4.1 Introduction

6.4.2 Infrastructure Standards and Guidelines for Data Center

6.4.2.1 American National Standards Institute (ANSI)

6.4.2.2 Telecommunication Industry Association (TIA)

6.4.2.3 Canadian Standards Association (CSA)

6.4.2.4 Factory Mutual (FM) Approved

6.4.2.5 Health Insurance Portability and Accountability Act of 1996 (HIPAA)

6.4.2.6 Made in Usa (For U.S. Region)

6.4.2.7 National Electrical Manufacturers Association (NEMA)

6.4.2.8 Underwriters Laboratory (UL)

7 Data Center Asset Management Market, By Component Type (Page No. - 48)

7.1 Introduction

7.2 Software

7.3 Service

7.4 Hardware

8 Market Analysis, By Deployment Type (Page No. - 54)

8.1 Introduction

8.2 On-Premises

8.3 Cloud

9 Market By Service (Page No. - 59)

9.1 Introduction

9.2 Consulting Service

9.3 Installation and Support Service

9.4 Professional Service

10 Market By Data Center Type (Page No. - 65)

10.1 Introduction

10.2 Midsize Data Center

10.3 Enterprise Data Center

10.4 Large Data Center

11 Data Center Asset Management Market Analysis, By Vertical (Page No. - 71)

11.1 Introduction

11.2 Telecom and IT

11.3 Banking, Financial Services, and Insurance (BFSI)

11.4 Government and Public

11.5 Healthcare

11.6 Energy

11.7 Manufacturing

11.8 Media and Entertainment

11.9 Others

12 Geographic Analysis (Page No. - 82)

12.1 Introduction

12.2 North America

12.2.1 The U.S.

12.3 Europe

12.3.1 The U.K

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 107)

13.1 Overview

13.2 Competitive Situation and Trends

13.2.1 New Product Launches/Enhancements

13.2.2 Partnerships, Agreements, and Collaborations

13.2.3 Business Expansions

14 Company Profiles (Page No. - 115)

14.1 HP Inc.

14.1.1 Business Overview

14.1.2 Products and Solutions Offered

14.1.3 Recent Developments

14.1.4 MnM View

14.1.4.1 SWOT Analysis

14.1.4.2 Key Strategies

14.2 IBM

14.2.1 Business Overview

14.2.2 Products Offered

14.2.3 Recent Developments

14.2.4 MnM View

14.2.4.1 SWOT Analysis

14.2.4.2 Key Strategies

14.3 Schneider Electric Se

14.3.1 Business Overview

14.3.2 Products and Services Offered

14.3.3 Recent Developments

14.3.4 MnM View

14.3.4.1 SWOT Analysis

14.3.4.2 Key Strategies

14.4 Emerson Network Power

14.4.1 Business Overview

14.4.2 Products and Services Offered

14.4.3 Recent Developments

14.4.4 MnM View

14.4.4.1 SWOT Analysis

14.4.4.2 Key Strategies

14.5 Nlyte Software

14.5.1 Business Overview

14.5.2 Products and Services Offered

14.5.3 Recent Developments

14.5.1 MnM View

14.5.1.1 SWOT Analysis

14.5.1.2 Key Strategies

14.6 Optimum Path, Inc.

14.6.1 Business Overview

14.6.2 Products Offered

14.6.3 Recent Developments

14.6.4 MnM View

14.6.4.1 Key Strategies

14.7 Raritan

14.7.1 Business Overview

14.7.2 Solutions and Services Offered

14.7.3 Recent Developments

14.7.4 MnM View

14.7.4.1 Key Strategies

14.8 CA Technologies, Inc.

14.8.1 Business Overview

14.8.2 Solutions and Services Offered

14.8.3 Recent Developments

14.8.4 MnM View

14.8.4.1 Key Strategies

14.9 Fieldview Solutions, Inc.

14.9.1 Business Overview

14.9.2 Products and Services Offered

14.9.3 Recent Developments

14.9.4 MnM View

14.9.4.1 Key Strategies

14.10 Huawei Technologies Co. Ltd.

14.10.1 Business Overview

14.10.2 Products and Services Offered

14.10.3 Recent Developments

14.10.4 MnM View

14.10.4.1 Key Strategies

15 Apendix (Page No. - 150)

15.1 Insights of Industry Experts

15.2 Recent Developments

15.3 Discussion Guide

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

List of Tables (67 Tables)

Table 1 Market Assumptions

Table 2 Data Center Asset Management Market Size and Growth Rate, 20132020 (USD Million, Y-O-Y %)

Table 3 Global Data Center Asset Management Market Size, By Component Type, 20132020 (USD Million)

Table 4 Software: Market Size, By Region, 20132020 (USD Million)

Table 5 Service: Market Size, By Region, 20132020 (USD Million)

Table 6 Hardware: Market Size, By Region, 20132020 (USD Million)

Table 7 Data Center Asset Management Market Size, By Deployment Type, 20132020 (USD Million)

Table 8 On-Premises: Market Size, By Region, 20132020 (USD Million)

Table 9 Cloud Deployment: Market Size, By Region, 20132020 (USD Million)

Table 10 Global Data Center Asset Management Market Size, By Service, 20132020 (USD Million)

Table 11 Consulting Service: Market Size, By Region, 20132020 (USD Million)

Table 12 Installation and Support Service: Market Size, By Region, 20132020 (USD Million)

Table 13 Professional Service: Market Size, By Region, 20132020 (USD Million)

Table 14 Global Data Center Asset Management Market Size, By Data Center Type, 20132020 (USD Million)

Table 15 Midsize Data Center: Market Size, By Region, 20132020 (USD Million)

Table 16 Enterprise Data Center: Market Size, By Region, 20132020 (USD Million)

Table 17 Large Data Center: Market Size, By Region, 20132020 (USD Million)

Table 18 Global Data Center Asset Management Market Size, By Vertical, 20132020 (USD Million)

Table 19 Telecom and IT: Market Size, By Region, 20132020 (USD Million)

Table 20 BFSI: Market Size, By Region, 20132020 (USD Million)

Table 21 Government and Public: Market Size, By Region, 20132020 (USD Million)

Table 22 Healthcare: Market Size, By Region, 20132020 (USD Million)

Table 23 Energy: Market Size, By Region, 20132020 (USD Million)

Table 24 Manufacturing: Market Size, By Region, 20132020 (USD Million)

Table 25 Media and Entertainment: Market Size, By Region, 20132020 (USD Million)

Table 26 Others: Data Center Asset Management Market Size, By Region, 20132020 (USD Million)

Table 27 Global Data Center Asset Management Market Size, By Region, 20132020 (USD Million)

Table 28 North America: Market Size, By Component Type, 20132020 (USD Million)

Table 29 North America: Market Size, By Deployment Type, 20132020 (USD Million)

Table 30 North America: Market Size, By Service, 20132020 (USD Million)

Table 31 North America: Market Size, By Data Center Type, 20132020 (USD Million)

Table 32 North America: Market Size, By Vertical, 20132020 (USD Million)

Table 33 The U.S.: Market Size, By Component Type, 20132020 (USD Million)

Table 34 The U.S.: Market Size, By Deployment Type, 20132020 (USD Million)

Table 35 The U.S.: Market Size, By Service, 20132020 (USD Million)

Table 36 The U.S.: Market Size, By Data Center Type, 20132020 (USD Million)

Table 37 The U.S.: Market Size, By Vertical, 20132020 (USD Million)

Table 38 Europe: Market Size, By Component Type, 20132020 (USD Million)

Table 39 Europe: Market Size, By Deployment Type, 20132020 (USD Million)

Table 40 Europe: Market Size, By Service, 20132020 (USD Million)

Table 41 Europe: Market Size, By Data Center Type, 20132020 (USD Million)

Table 42 Europe: Market Size, By Vertical, 20132020 (USD Million)

Table 43 The UK: Market Size, By Component Type, 20132020 (USD Million)

Table 44 The UK: Market Size, By Deployment Type, 20132020 (USD Million)

Table 45 The UK: Market Size, By Service, 20132020 (USD Million)

Table 46 The UK: Market Size, By Data Center Type, 20132020 (USD Million)

Table 47 The UK: Market Size, By Vertical, 20132020 (USD Million)

Table 48 Asia-Pacific: Market Size, By Component Type, 20132020 (USD Million)

Table 49 Asia-Pacific: Market Size, By Deployment Type, 20132020 (USD Million)

Table 50 Asia-Pacific: Market Size, By Service, 20132020 (USD Million)

Table 51 Asia-Pacific: Market Size, By Data Center Type, 20132020 (USD Million)

Table 52 Asia-Pacific: Market Size, By Vertical, 20132020 (USD Million)

Table 53 Middle East and Africa: Market Size, By Component Type, 20132020 (USD Million)

Table 54 Middle East and Africa: Market Size, By Deployment Type, 20132020 (USD Million)

Table 55 Middle East and Africa: Market Size, By Service, 20132020 (USD Million)

Table 56 Middle East and Africa: Market Size, By Data Center Type, 20132020 (USD Million)

Table 57 Middle East and Africa: Market Size, By Vertical, 20132020 (USD Million)

Table 58 Latin America: Market Size, By Component Type, 20132020 (USD Million)

Table 59 Latin America: Market Size, By Deployment Type, 20132020 (USD Million)

Table 60 Latin America: Market Size, By Service, 20132020 (USD Million)

Table 61 Latin America: Market Size, By Data Center Type, 20132020 (USD Million)

Table 62 Latin America: Market Size, By Vertical, 20132020 (USD Million)

Table 63 New Product Launches, 20132015

Table 64 Partnerships, Collaborations and Agreements, 2013 2015

Table 65 Business Expansions, 20132015

Table 66 New Product Launches, 20132015

Table 67 Partnerships, Collaborations and Agreements, 2013 2015

List of Figures (45 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Data Center Asset Management Software Market is Expected to Hold Large Market Size During the Forecast Period

Figure 7 Top Segments in Terms of Market Share for the Data Center Asset Management Market

Figure 8 North America is Expected to Hold the Largest Market Share in 2015

Figure 9 Growth Trend of the Data Center Asset Management Market

Figure 10 Software Component is Expected to Hold the Largest Share in the Data Center Asset Management Market Throughout the Forecast Period

Figure 11 Tnorth America is Expected to Hold the Largest Market Share in the Data Center Asset Management Market

Figure 12 Asia-Pacific is Expected to Register the Highest CAGR in the Data Center Asset Management Market During the Forecast Period

Figure 13 Geographic Lifecycle Analysis (2015): Asia-Pacific Market is Expected to Be in the High Growth Phase in the Coming Years

Figure 14 The Evolution of Data Center Asset Management Market

Figure 15 Data Center Asset Management: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Supply-Side Analysis

Figure 17 Strategic Benchmarking: Product Innovation and Enhancements

Figure 18 Strategic Benchmarking: Partnerships and Collaborations

Figure 19 More Than Half of the Data Center Asset Management Market is Dominated By Software Solutions

Figure 20 On-Premises Market to Dominate Data Center Asset Management During the Forecast Period

Figure 21 Installation and Support is Expected to Hold the Major Share in the Service Market

Figure 22 Enterprise Data Center Type is Expected to Register the Highest Market Share During the Forecast Period

Figure 23 IT and Telecom Vertical is Expected to Dominate the Data Center Asset Management Market During the Forecast Period

Figure 24 Geographic Snapshot (2015 - 2020): APAC is Emerging as A New Hotspot

Figure 25 North America is Expected to Dominate the Data Center Asset Management Market During the Forecast Period of 20152020

Figure 26 North America Market: Snapshot

Figure 27 Asia-Pacific Market: Snapshot

Figure 28 New Product Launches and Enhancements Were the Key Growth Strategies During the Years 2013 - 2015

Figure 29 Market Evaluation Framework

Figure 30 Battle for Market Share: Market Players Adopted New Product Launches and Enhancements as the Key Strategy

Figure 31 HP Inc.: Company Snapshot

Figure 32 HP Inc: SWOT Analysis

Figure 33 IBM: Company Snapshot

Figure 34 IBM: SWOT Analysis

Figure 35 Schneider Electric Se: Company Snapshot

Figure 36 Schneider Electric: SWOT Analysis

Figure 37 Emerson: Company Snapshot

Figure 38 Emerson Network Power: SWOT Analysis

Figure 39 Nlyte Software: Company Snapshot

Figure 40 Nlyte Software: SWOT Analysis

Figure 41 Optimum Path, Inc.: Company Snapshot

Figure 42 Raritan: Company Snapshot

Figure 43 CA Technologies: Company Snapshot

Figure 44 Fieldview Solutions, Inc.: Company Snapshot

Figure 45 Huawei: Company Snapshot

Growth opportunities and latent adjacency in Data Center Asset Management Market