Data Center Infrastructure Management Market by Component, Application (Asset Management, Power Monitoring, and Capacity Management), Deployment Model, Data Center Type, Vertical and Region - Global Forecast to 2026

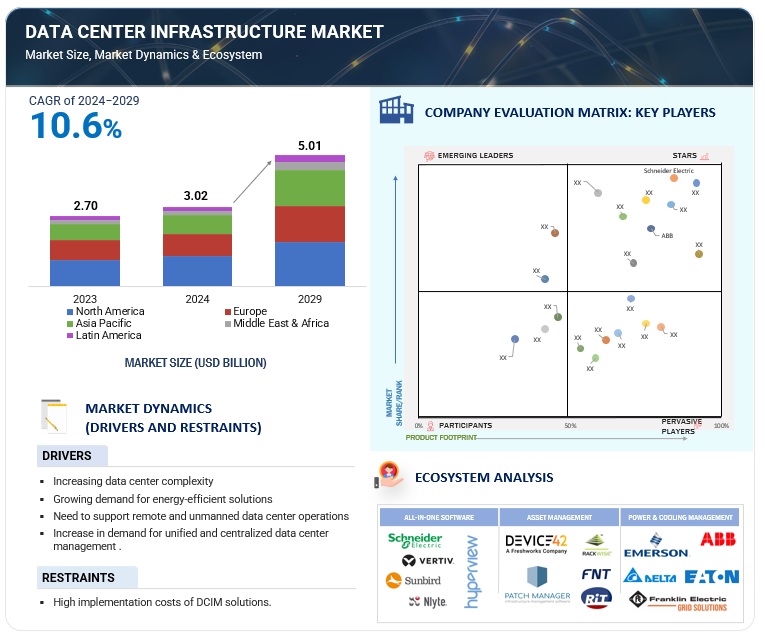

The market for data center infrastructure management is anticipated to expand at a CAGR of 11.2% from USD 1.8 billion in 2021 to USD 3.2 billion by 2026. Gaining end-to-end visibility for predicting capacity requirements, indispensable requirements to improve data center uptime and energy efficiency, the emergence of next-generation dcim offerings, data center optimization initiative mandate to address critical infrastructure inefficiencies, need for integrating monitoring systems with disparate applications and databases for better data accuracy are some of the drivers shaping the DCIM adoption.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Center Infrastructure Management Market Dynamics

Drivers: Gaining end-to-end visibility for predicting capacity requirements

With the growing data center modernization, the need for end-to-end visibility across infrastructure has become the greatest challenge for data center operators. However, the data center industry is undergoing a significant transition with the advent of supplementary and new technologies. DCIM is one such technology that is progressively adopted by data center, IT, and facility operators to gain holistic visibility into critical data center infrastructure information, including operations, configuration, and resource utilization.

Restraints: Complex implementation processes and uncertainty over returns on investments to create reluctance among data center teams

DCIM has evolved as a major infrastructure optimization software. Several organizations have reported successful implementation of DCIM, although the number of failed implementations cannot be overlooked. According to the 2018 survey by Uptime Institute, over 25% of respondents had an unsuccessful deployment, with one-third having no plans to pursue the DCIM technology. One of the major reasons behind the unsuccessful implementations is a substantial gap between what customers expect and DCIM providers deliver. For the data center having different functional domains, the DCIM implementation can be complex.

Challenges: Complexities involved in integrating real-time devices to an operational data center

Most traditional data center equipment, such as UPS, chillers, cooling towers, and Computer Room Air Handlers (CRAHs)/CRACs, lack real-time energy meters and environmental sensors. The DCIM software requires to be connected to sensors and meters for various applications. These applications include monitoring and analysis of power usages and cooling statistics to achieve better power efficiency in real time. Therefore, the vendors face challenges in modifying a traditional data center to integrate real-time devices.

Opportunities: Inclination of organizations for cloud-based deployments to overcome on-premises limitations

Most companies are increasingly distributing their computing resources across a number of environments, including cloud servers, edge data centers , and physical systems. According to the 2018 Voice of the Enterprise: Datacenter Transformation, Budgets, and Outlook survey, 57% of respondents agreed to be utilizing cloud service providers, another 54% owned and operated their data center facilities, and 41% rented space from colocation data center providers. This continuous adoption of the hybrid approach for both agility and 24X7 connectivity has caused an influx in the adoption of Software as a Service (SaaS) offerings.

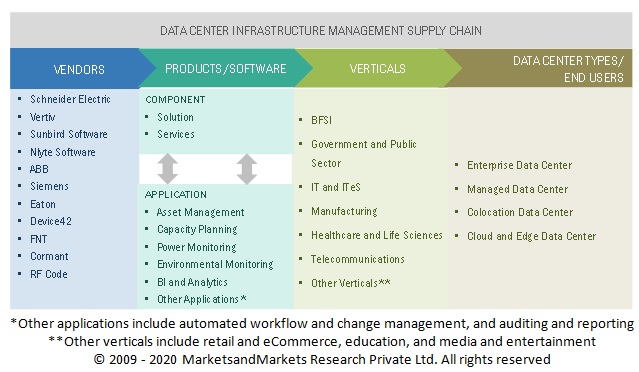

Data Center Infrastructure Management Market Supply Chain

To know about the assumptions considered for the study, download the pdf brochure

Based on application, the asset management segment to be a larger contributor to the data center infrastructure management market growth during the forecast period

According to the International Association for IT Asset Managers, the average organization can expect an error rate of 15% or more when manually tracking IT assets. The manual data entry alone comes with a 10% error rate due to transcription and typographical mistakes. Rackwise, Hyperview, Sunbird Software, and Nlyte Software are some of the vendors that have prominent asset management offerings in the DCIM space. Asset management forms a key component of the DCIM offerings and offers various benefits.

Based on the deployment model, the on-premises segment to be a larger contributor to the DCIM market growth during the forecast period

On-premises DCIM systems play a vital role in organizations. This type of DCIM is based in a physical environment, and it collects information of data centers, which can be used in decision-making processes. On-premises DCIM captures data from sensors across the data center infrastructure. An on-premises DCIM solution offers consistent and secure data collection, reporting, and alerting for an individual environment. The data gives administrators information related to infrastructure availability, airflow, power consumption, temperature, humidity, and security.

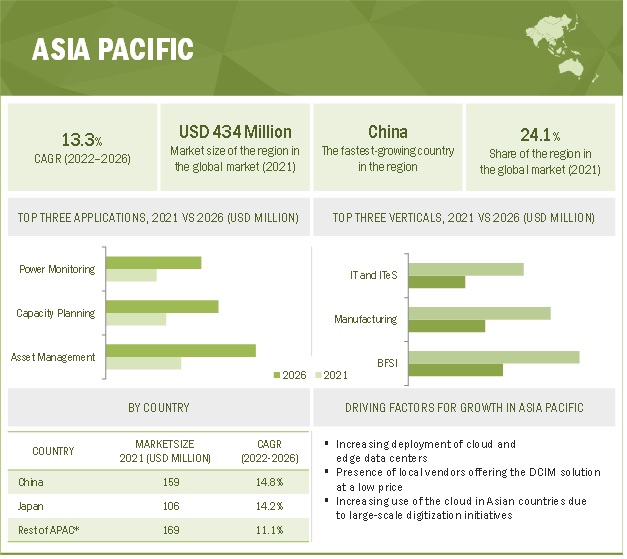

Asia Pacific (APAC) to grow at the highest CAGR during the forecast period

APAC is one of the fastest growing region in the data center infrastructure management market and has witnessed huge investments in data center construction. The major countries, such as China and Japan, are witnessing huge investments in verticals, such as BFSI, retail, healthcare, manufacturing, telecommunications, and IT, which has brought development and economic growth in APAC countries. The spread of internet-enabled devices will continue to increase the demand for data centers in this region. This increase in development has boosted the growth of data center construction in the region, which is expected to boost the adoption of DCIM solution and services. Additionally, as a part of green initiative, the governments across the region are drafting new energy efficiency laws, ranging from carbon emission tax, efficient power usage, and others. Such regulatory requirements are driving the need for using DCIM software to manage data centers.

Key Market Players

The data center infrastructure management market is dominated by companies such as ABB (Switzerland), CommScope (US), Cormant (US), Device42 (US), Eaton ( Ireland), FNT (Germany), Nlyte Software (US), Panduit (US), Rackwise (US), RF Code (US), Schneider Electric (France), Siemens (Germany), Sunbird Software (US), UnityOneCloud (US), and Vertiv (US), and others. These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

The study includes an in-depth competitive analysis of key players in the DCIM market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2026 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, Application, Deployment Model, Data Center Type, Verticals, and Regions |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

ABB (Switzerland), CommScope (US), Cormant (US), Delta Electronics (Taiwan), Device42 (US), Eaton (Ireland), FNT Software (Germany), Graphical Networks (US), GreenField Software (Oman), Huawei (China), Hyperview (Canada), Intel (US), Modius (US), Nlyte Software (US), Optimum Path (US), Panduit (US), Patchmanager (Netherlands), Rackwise (US), RF Code (US), Rittal (Germany), Schneider Electric (France), Siemens (Germany), SolarWinds (US), Sunbird Software (US), UnityOneCloud (US), and Vertiv (US). |

This research report categorizes the data center infrastructure management market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Component:

- Solution

- Services

Based on the Application:

- Asset Management

- Capacity Planning

- Power Monitoring

- Environmental Monitoring

- BI and Analytics

- Others (Automated Workflow and Change Management, and Auditing and Reporting)

Based on the Deployment Model:

- On-premises

- Cloud

Based on the Data Center Type:

- Enterprise Data Center

- Managed Data Center

- Colocation Data Center

- Cloud and Edge Data Center

Based on verticals:

- BFSI

- Government and Public Sector

- IT and ITeS

- Manufacturing

- Healthcare and Life Sciences

- Telecommunications

- Others (Retail and eCommerce, Education, and Media and Entertainment)

Based on Regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- Rest of APAC

-

MEA

- Saudi Arabia

- UAE

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In November 2021, Seimens introduced the open Industrial Edge ecosystem innovative IT platform. This enables and serves scalable deployment of IT technologies and applications in the production environment. This also enables B2B customers to purchase and operate multiple software components all under one single platform.

- In October 2021, Sunbird Software launched a new version of the dcTrack solution. Earlier enterprise-class customers were struggling to manage all their data centers, labs, units, and edge sites remotely, where the first-generation DCIM was sluggish. dcTrack has enhanced the scalability and tool management ability to address these issues.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Data Center Infrastructure Management Market?

The global Data Center Infrastructure Management Market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% during the forecast period, to reach USD 3.2 billion by 2026 from USD 1.8 billion in 2021.

Which region has the highest market share in the DCIM market?

North America and Europe region have the highest market share in the DCIM market, where these two regions together contribute more than half of the global DCIM market in the year 2021.

Which submarkets is expected to witness high adoption in the coming years?

Asset management, power monitoring, and capacity planning are some of the top applications, which have a high demand among data center teams. The high demand is mainly due to a wide range of features these applications offer for managing data center needs.

Who are the major vendors in the DCIM market?

Despite the presence of a large number of vendors, the market is dominated mainly by vendors such as ABB (Switzerland), CommScope (US), Cormant (US), Device42 (US), Eaton (Ireland), FNT Software (Germany), Nlyte Software (US), Panduit (US), Rackwise (US), RF Code (US), Schneider Electric (France), Siemens (Germany), Sunbird Software (US), UnityOneCloud (US), and Vertiv (US).

What are some of the latest trends that will shape the Data Center Infrastructure Management Market in the future?

Emergence of BI and analytics, AI and cloud enabled offerings, which significantly improve the management of data center operations, is expected to shape the market in the coming years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 STUDY OBJECTIVES

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED

1.7 CURRENCY

TABLE 1 USD EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 6 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

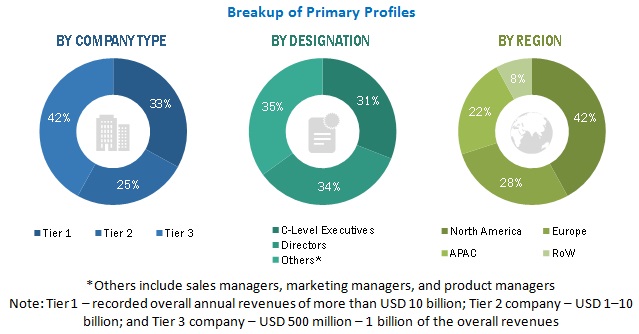

2.1.2.1 Break-up of primary profiles

FIGURE 7 BREAK-UP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): ESTIMATED MARKET SIZE THROUGH VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (SUPPLY SIDE): ESTIMATED MARKET SIZE THROUGH VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM DATA CENTER TYPES

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.5.1 SUPPLY SIDE

FIGURE 13 MARKET PROJECTIONS FROM SUPPLY SIDE

2.5.2 DEMAND SIDE

FIGURE 14 MARKET PROJECTIONS FROM DEMAND SIDE

2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 15 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET: GLOBAL SNAPSHOT

FIGURE 16 TOP GROWING SEGMENTS IN THE MARKET

FIGURE 17 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 18 ENTERPRISE DATA CENTER SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 19 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 20 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET

FIGURE 21 DATA CENTER MODERNIZATION, NEED TO REDUCE DATA CENTER OPERATIONS COST ALONG WITH ENERGY CONSUMPTION, AND THE EMERGENCE OF ARTIFICIAL INTELLIGENCE AND ANALYTICS-ENABLED SOLUTION TO DRIVE THE MARKET GROWTH

4.2 MARKET: BY APPLICATION, 2021 VS 2026

FIGURE 22 ASSET MANAGEMENT SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2021

4.3 MARKET: BY DEPLOYMENT MODEL, 2021 VS 2026

FIGURE 23 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

4.4 MARKET: BY DATA CENTER TYPE, 2021 VS 2026

FIGURE 24 ENTERPRISE DATA CENTER SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2021

4.5 MARKET: BY VERTICAL, 2021 VS 2026

FIGURE 25 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SHARE IN 2021

4.6 MARKET REGIONAL SCENARIO, 2021–2026

FIGURE 26 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 58)

5.1 INTRODUCTION

FIGURE 27 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET

5.1.1 DRIVERS

5.1.1.1 Gaining end-to-end visibility for predicting capacity requirements

5.1.1.2 Indispensable requirements to improve data center uptime and energy efficiency

5.1.1.3 Emergence of next-generation DCIM offerings

5.1.1.4 Data center optimization initiative to mandate to address critical infrastructure inefficiencies

5.1.1.5 Need to integrate monitoring systems with disparate applications and databases for better data accuracy

5.1.2 RESTRAINTS

5.1.2.1 Complex implementation processes and uncertainty over returns on investments to create reluctance among data center teams

5.1.3 OPPORTUNITIES

5.1.3.1 Inclination of organizations for cloud-based deployments to overcome on-premises limitations

5.1.3.2 Rise in the number of data center facilities across geographies

5.1.3.3 Surge in data center workloads during COVID-19 pandemic

5.1.4 CHALLENGES

5.1.4.1 Complexities involved in integrating real-time devices to an operational data center

5.2 COVID-19-DRIVEN MARKET DYNAMICS

5.2.1 DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS AND CHALLENGES

5.3 REGULATIONS

5.3.1 GENERAL DATA PROTECTION REGULATION

5.3.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.3.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.3.4 GRAMM-LEACH-BLILEY ACT

5.3.5 SOC2

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: ELIMINATING MANUAL CALCULATIONS AND METER READINGS TO OPTIMIZE COST

5.4.2 CASE STUDY 2: REDUCING CARBON EMISSION FOOTPRINTS AND POWER USAGES FOR BETTER ENERGY EFFICIENCY

5.4.3 CASE STUDY 3: MONITORING DATA CENTER HEALTH AND CAPACITY FOR OPTIMIZING DATA CENTER OPERATIONS

5.4.4 CASE STUDY 4: BLADE UPS BY EATON PROVED CRUCIAL ASSET FOR A FINANCIAL FIRM

5.4.5 CASE STUDY 5: INTRODUCTION OF DATA CENTER AUTOMATION IN AN EDUCATIONAL INSTITUTION

5.4.6 CASE STUDY 6: ASSISTANCE IN SCALING UP AN EDGE SITE WITHIN A SHORT DURATION

5.4.7 CASE STUDY 7: LOWERING EXTINGUISHING DISCHARGE PROCESS NOISE

5.4.8 CASE STUDY 8: VISUALIZED MANAGEMENT ENHANCES OPERATIONS AND MAINTAINANCE EFFICIENCY

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 28 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET: SUPPLY CHAIN

5.6 ECOSYSTEM

FIGURE 29 MARKET: ECOSYSTEM

5.7 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 DEGREE OF COMPETITION

5.8 TECHNOLOGY ANALYSIS

5.8.1 ARTIFICIAL INTELLIGENCE

5.8.2 ANALYTICS

5.8.3 CLOUD COMPUTING

5.8.4 THREE-DIMENSIONAL AND TWO-DIMENSIONAL VISUALIZATION

5.9 PRICING ANALYSIS

5.10 PATENT ANALYSIS

FIGURE 31 NUMBER OF PATENTS PUBLISHED

FIGURE 32 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 4 TOP TEN PATENT OWNERS (US)

TABLE 5 PATENTS GRANTED TO THE LEADING MARKET PLAYERS IN THE MARKET

6 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY COMPONENT (Page No. - 79)

6.1 INTRODUCTION

FIGURE 33 SOLUTION SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

TABLE 6 MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 7 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTION

TABLE 8 SOLUTION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 9 SOLUTION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 10 SOLUTION: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 11 SOLUTION: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 12 SOLUTION: EUROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 13 SOLUTION: EUROPE DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 14 SOLUTION: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 15 SOLUTION: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 16 SOLUTION: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 17 SOLUTION: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 18 SOLUTION: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 19 SOLUTION: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

6.3 SERVICES

TABLE 20 SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 SERVICES: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 SERVICES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 23 SERVICES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 24 SERVICES: EUROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 25 SERVICES: EUROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 26 SERVICES: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 27 SERVICES: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 28 SERVICES: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 29 SERVICES: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 30 SERVICES: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 31 SERVICES: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

7 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY APPLICATION (Page No. - 91)

7.1 INTRODUCTION

FIGURE 34 ASSET MANAGEMENT SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

7.1.1 APPLICATION: MARKET DRIVERS

7.1.2 APPLICATION: COVID-19 IMPACT

TABLE 32 MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 33 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 ASSET MANAGEMENT

TABLE 34 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 CAPACITY PLANNING

TABLE 36 CAPACITY PLANNING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 CAPACITY PLANNING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 POWER MONITORING

TABLE 38 POWER MONITORING: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 POWER MONITORING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 ENVIRONMENTAL MONITORING

TABLE 40 ENVIRONMENTAL MONITORING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 ENVIRONMENTAL MONITORING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.6 BUSINESS INTELLIGENCE AND ANALYTICS

TABLE 42 BUSINESS INTELLIGENCE AND ANALYTICS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 BUSINESS INTELLIGENCE AND ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.7 OTHER APPLICATIONS

TABLE 44 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 OTHER APPLICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DEPLOYMENT MODEL (Page No. - 101)

8.1 INTRODUCTION

FIGURE 35 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

8.1.1 DEPLOYMENT MODEL: MARKET DRIVERS

8.1.2 DEPLOYMENT MODEL: COVID-19 IMPACT

TABLE 46 MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 47 MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

8.2 ON-PREMISES

TABLE 48 ON-PREMISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 ON-PREMISES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 51 ON-PREMISES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 52 ON-PREMISES: EUROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 53 ON-PREMISES: EUROPE DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 54 ON-PREMISES: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 55 ON-PREMISES: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 56 ON-PREMISES: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 57 ON-PREMISES: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 58 ON-PREMISES: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 59 ON-PREMISES: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

8.3 CLOUD

TABLE 60 CLOUD: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 62 CLOUD: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 63 CLOUD: NORTH AMERICA DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 64 CLOUD: EUROPE MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 65 CLOUD: EUROPE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 66 CLOUD: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 67 CLOUD: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 68 CLOUD: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 69 CLOUD: MIDDLE EAST AND AFRICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 CLOUD: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 71 CLOUD: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DATA CENTER TYPE (Page No. - 112)

9.1 INTRODUCTION

FIGURE 36 ENTERPRISE DATA CENTER SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

9.1.1 DATA CENTER TYPE: MARKET DRIVERS

9.1.2 DATA CENTER TYPE: COVID-19 IMPACT

TABLE 72 MARKET SIZE, BY DATA CENTER TYPE, 2017–2020 (USD MILLION)

TABLE 73 MARKET SIZE, BY DATA CENTER TYPE, 2021–2026 (USD MILLION)

9.2 ENTERPRISE DATA CENTER

TABLE 74 ENTERPRISE DATA CENTER: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 75 ENTERPRISE DATA CENTER: MENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 MANAGED DATA CENTER

TABLE 76 MANAGED DATA CENTER: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 MANAGED DATA CENTER: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 COLOCATION DATA CENTER

TABLE 78 COLOCATION DATA CENTER: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 79 COLOCATION DATA CENTER: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 CLOUD AND EDGE DATA CENTER

TABLE 80 CLOUD AND EDGE DATA CENTER: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 CLOUD AND EDGE DATA CENTER: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY VERTICAL (Page No. - 119)

10.1 INTRODUCTION

FIGURE 37 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

10.1.1 VERTICAL: MARKET DRIVERS

10.1.2 VERTICAL: COVID-19 IMPACT

TABLE 82 MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 83 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 84 BANKING, FINANCIAL SERVICES, AND INSURANCE: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 86 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 87 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 88 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 89 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.3 GOVERNMENT AND PUBLIC SECTOR

TABLE 90 GOVERNMENT AND PUBLIC SECTOR: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 91 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 92 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 93 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 94 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 95 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.4 INFORMATION TECHNOLOGY AND INFORMATION TECHNOLOGY ENABLED SERVICES

TABLE 96 IT AND ITES: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 IT AND ITES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 98 IT AND ITES: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 99 IT AND ITES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 100 IT AND ITES: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 101 IT AND ITES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.5 MANUFACTURING

TABLE 102 MANUFACTURING: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 103 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 104 MANUFACTURING: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 105 MANUFACTURING: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 106 MANUFACTURING: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 107 MANUFACTURING: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.6 HEALTHCARE AND LIFE SCIENCES

TABLE 108 HEALTHCARE AND LIFE SCIENCES: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 109 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 110 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 111 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 112 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 113 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.7 TELECOMMUNICATIONS

TABLE 114 TELECOMMUNICATIONS: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 115 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 116 TELECOMMUNICATIONS: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 117 TELECOMMUNICATIONS: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 118 TELECOMMUNICATIONS: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 119 TELECOMMUNICATIONS: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

10.8 OTHER VERTICALS

TABLE 120 OTHER VERTICALS: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 121 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 122 OTHER VERTICALS: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 123 OTHER VERTICALS: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 124 OTHER VERTICALS: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 125 OTHER VERTICALS: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY REGION (Page No. - 137)

11.1 INTRODUCTION

FIGURE 38 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 126 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 127 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT

11.2.3 NORTH AMERICA: REGULATIONS

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 128 NORTH AMERICA: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 130 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 131 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 132 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 133 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 134 NORTH AMERICA: MARKET SIZE, BY DATA CENTER TYPE, 2017–2020 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET SIZE, BY DATA CENTER TYPE, 2021–2026 (USD MILLION)

TABLE 136 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 138 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 139 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.4 UNITED STATES

TABLE 140 UNITED STATES: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 141 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 142 UNITED STATES: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 143 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.2.5 CANADA

TABLE 144 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 145 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 146 CANADA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 147 CANADA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT

11.3.3 EUROPE: REGULATIONS

TABLE 148 EUROPE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 149 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 150 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 151 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 152 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 153 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 154 EUROPE: MARKET SIZE, BY DATA CENTER TYPE, 2017–2020 (USD MILLION)

TABLE 155 EUROPE: MARKET SIZE, BY DATA CENTER TYPE, 2021–2026 (USD MILLION)

TABLE 156 EUROPE: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 157 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 158 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 159 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 160 UNITED KINGDOM: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 161 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 162 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 163 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.3.5 GERMANY

TABLE 164 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 165 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 166 GERMANY: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 167 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 168 REST OF EUROPE: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 169 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 170 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 171 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT

11.4.3 ASIA PACIFIC: REGULATIONS

FIGURE 40 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 172 ASIA PACIFIC: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE, BY DATA CENTER TYPE, 2017–2020 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET SIZE, BY DATA CENTER TYPE, 2021–2026 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.4 CHINA

TABLE 184 CHINA: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 185 CHINA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 186 CHINA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 187 CHINA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.4.5 JAPAN

TABLE 188 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 189 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 190 JAPAN: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 191 JAPAN: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 192 REST OF ASIA PACIFIC: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 193 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 194 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 195 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: GEMENT MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

11.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

TABLE 196 MIDDLE EAST AND AFRICA: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 197 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 198 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 199 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 200 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 201 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 202 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DATA CENTER TYPE, 2017–2020 (USD MILLION)

TABLE 203 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DATA CENTER TYPE, 2021–2026 (USD MILLION)

TABLE 204 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 205 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 206 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 207 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.4 SAUDI ARABIA

TABLE 208 SAUDI ARABIA: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 209 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 210 SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 211 SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.5 UNITED ARAB EMIRATES

TABLE 212 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 213 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 214 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 215 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 216 REST OF MIDDLE EAST AND AFRICA: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 217 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 218 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 219 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT

11.6.3 LATIN AMERICA: REGULATIONS

TABLE 220 LATIN AMERICA: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 222 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 226 LATIN AMERICA: MARKET SIZE, BY DATA CENTER TYPE, 2017–2020 (USD MILLION)

TABLE 227 LATIN AMERICA: MARKET SIZE, BY DATA CENTER TYPE, 2021–2026 (USD MILLION)

TABLE 228 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 229 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 230 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 231 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.4 BRAZIL

TABLE 232 BRAZIL: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 233 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 234 BRAZIL: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 235 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

11.6.5 REST OF LATIN AMERICA

TABLE 236 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2017–2020 (USD MILLION)

TABLE 237 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 238 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 239 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 182)

12.1 INTRODUCTION

12.2 MARKET EVALUATION FRAMEWORK

FIGURE 41 MARKET EVALUATION FRAMEWORK

12.3 MARKET SHARE OF TOP VENDORS

FIGURE 42 VENDOR MARKET SHARE ANALYSIS

12.4 REVENUE ANALYSIS OF TOP VENDORS

FIGURE 43 REVENUE ANALYSIS

12.5 COMPANY EVALUATION QUADRANT

12.5.1 DEFINITIONS AND METHODOLOGY

TABLE 240 COMPANY EVALUATION QUADRANT: CRITERIA

12.5.2 STAR

12.5.3 EMERGING LEADER

12.5.4 PERVASIVE

12.5.5 PARTICIPANT

TABLE 241 GLOBAL COMPANY FOOTPRINT

TABLE 242 COMPANY SERVICE FOOTPRINT

TABLE 243 COMPANY VERTICAL FOOTPRINT (1/2)

TABLE 244 COMPANY VERTICAL FOOTPRINT (2/2)

TABLE 245 COMPANY REGION FOOTPRINT

FIGURE 44 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

12.6 SME EVALUATION QUADRANT

12.6.1 DEFINITIONS AND METHODOLOGY

TABLE 246 SME EVALUATION QUADRANT: CRITERIA

12.6.2 PROGRESSIVE VENDORS

12.6.3 RESPONSIVE VENDORS

12.6.4 DYNAMIC VENDORS

12.6.5 STARTING BLOCKS

FIGURE 45 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 247 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2019–2021

12.7.2 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 248 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2019–2021

12.7.3 MERGERS AND ACQUISITIONS

TABLE 249 MERGERS AND ACQUISITIONS, 2019–2021

12.7.4 EXPANSIONS

TABLE 250 EXPANSIONS, 2019–2021

13 COMPANY PROFILES (Page No. - 197)

13.1 INTRODUCTION

(Business overview, Solutions offered, Recent developments & MnM View)*

13.2 SCHNEIDER ELECTRIC

TABLE 251 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 46 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 252 SCHNEIDER ELECTRIC: SOLUTIONS OFFERED

TABLE 253 SCHNEIDER ELECTRIC: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET: PRODUCT LAUNCHES AND BUSINESS EXPANSIONS

13.3 VERTIV

TABLE 254 VERTIV: BUSINESS OVERVIEW

FIGURE 47 VERTIV: COMPANY SNAPSHOT

TABLE 255 VERTIV: SOLUTIONS OFFERED

TABLE 256 VERTIV: MARKET: PRODUCT LAUNCHES AND BUSINESS EXPANSIONS

TABLE 257 VERTIV: MARKET: DEALS

13.4 NLYTE SOFTWARE

TABLE 258 NLYTE SOFTWARE: BUSINESS OVERVIEW

TABLE 259 NLYTE SOFTWARE: SOLUTIONS OFFERED

TABLE 260 NLYTE SOFTWARE: MARKET: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

TABLE 261 NLYTE SOFTWARE: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET: DEALS

13.5 SUNBIRD SOFTWARE

TABLE 262 SUNBIRD SOFTWARE: BUSINESS OVERVIEW

TABLE 263 SUNBIRD SOFTWARE: SOLUTIONS OFFERED

TABLE 264 SUNBIRD SOFTWARE: MARKET: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

13.6 ABB

TABLE 265 ABB: BUSINESS OVERVIEW

FIGURE 48 ABB: COMPANY SNAPSHOT

TABLE 266 ABB: SOLUTIONS OFFERED

TABLE 267 ABB: MARKET: DEALS

13.7 SIEMENS

TABLE 268 SIEMENS: BUSINESS OVERVIEW

FIGURE 49 SIEMENS: COMPANY SNAPSHOT

TABLE 269 SIEMENS: SOLUTIONS OFFERED

TABLE 270 SIEMENS: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET: PRODUCT LAUNCHES AND BUSINESS EXPANSIONS

TABLE 271 SIEMENS: MARKET: DEALS

13.8 EATON

TABLE 272 EATON: BUSINESS OVERVIEW

FIGURE 50 EATON: COMPANY SNAPSHOT

TABLE 273 EATON: SOLUTIONS OFFERED

TABLE 274 EATON: MARKET: PRODUCT LAUNCHES AND BUSINESS EXPANSIONS

TABLE 275 EATON: MARKET: DEALS

13.9 UNITYONECLOUD

TABLE 276 UNITYONECLOUD: BUSINESS OVERVIEW

TABLE 277 UNITYONECLOUD: SOLUTIONS OFFERED

13.10 FNT SOFTWARE

TABLE 278 FNT SOFTWARE: BUSINESS OVERVIEW

TABLE 279 FNT SOFTWARE: SOLUTIONS OFFERED

TABLE 280 FNT SOFTWARE: DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET: PRODUCT LAUNCHES AND BUSINESS EXPANSIONS

TABLE 281 FNT SOFTWARE: MARKET: DEALS

13.11 DEVICE42

TABLE 282 DEVICE42: BUSINESS OVERVIEW

TABLE 283 DEVICE42: SOLUTIONS OFFERED

13.12 CORMANT

13.13 RF CODE

13.14 RACKWISE

13.15 PANDUIT

13.16 COMMSCOPE

13.17 DELTA ELECTRONICS

13.18 RITTAL

13.19 HUAWEI

13.20 SOLARWINDS

13.21 MODIUS

13.22 HYPERVIEW

13.23 OPTIMUM PATH

13.24 GRAPHICAL NETWORKS

13.25 PATCH MANAGER

13.26 GREENFIELD SOFTWARE

on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 ADJACENT MARKET (Page No. - 237)

14.1 INTRODUCTION

14.2 DATA CENTER POWER MARKET

TABLE 284 DATA CENTER POWER MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 285 DATA CENTER POWER MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 286 SOLUTIONS: DATA CENTER POWER MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 287 SOLUTIONS: DATA CENTER POWER MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

15 APPENDIX (Page No. - 239)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, data center associations, vendor data sheets, product demos, Cloud Computing Association (CCA), Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to identify and collect information useful for this technical, market-oriented, and commercial study of the data center infrastructure management market. The primary sources were mainly several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

The market size of the companies offering the DCIM solution was based on the secondary data available through paid and unpaid sources, and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; and product data sheets, white papers, journals, and certified publications, and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from DCIM vendors, industry associations, independent consultants, and key opinion leaders.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Data Center Infrastructure Management Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the DCIM market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides in the data center infrastructure management market.

Report Objectives

- To define, segment, and project the global market size of the DCIM market

- To understand the structure of the DCIM market by identifying its various subsegments

- To provide detailed information about the key factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the data center infrastructure management market

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value, with respect to the 5 major regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across key regions

- To analyze the competitive developments, such as expansions and investments, new product launches, mergers and acquisitions, joint ventures, and agreements, in the DCIM market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Center Infrastructure Management Market