Digital Asset Management Market by Offering (Solutions and Services), Business Function (Marketing & Advertising, Sales & Distribution, Finance & Accounting), Organization Size, Vertical and Region - Global Forecast to 2029

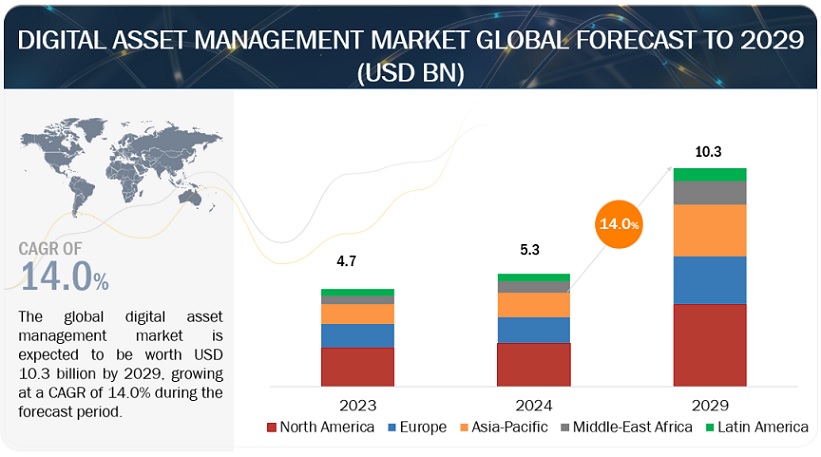

[265 Pages Report] The digital asset management market is expected to grow from USD 5.3 billion in 2024 to USD 10.3 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period. DAM solutions have become indispensable tools for organizations seeking to efficiently manage, distribute, and monetize their digital assets while ensuring brand consistency, regulatory compliance, and collaboration across distributed teams. Organizations across industries are undergoing digital transformation initiatives, leading to a surge in digital content creation, distribution, and consumption. This trend underscores the growing need for robust DAM solutions to centralize and streamline digital asset management processes. In addition, cloud-based DAM solutions are gaining traction due to their scalability, accessibility, and cost-effectiveness. Organizations increasingly migrate from on-premises systems to cloud-based DAM platforms to leverage flexibility, real-time collaboration capabilities, and seamless integration with other cloud services.

Moreover, AI and machine learning technologies are integrated into DAM solutions to automate metadata tagging, content categorization, and content analysis tasks. These capabilities enhance search accuracy, content discovery, and workflow efficiency, driving the adoption of AI-powered DAM solutions. However, organizations face issues such as data security, compliance with regulatory requirements, and integrating DAM solutions with existing workflows and systems. Additionally, the growing volume and variety of digital assets pose challenges regarding metadata management, content governance, and ensuring asset relevancy and accuracy over time. Also, the evolving landscape of digital technologies and changing business needs necessitate continuous adaptation and investment in DAM solutions to remain competitive. Despite these challenges, organizations that successfully implement DAM solutions can gain a competitive edge in managing their digital assets effectively.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Digital Asset Management Market

The combined economic and geopolitical factors, including the COVID-19 pandemic, the Russia-Ukraine war, inflation, and rising interest rates, have impacted the global DAM market. The COVID-19 pandemic precipitated widespread disruptions across industries, prompting organizations to reassess their digital infrastructure and workflows. While sectors such as e-commerce and digital marketing experienced increased demand for DAM solutions to facilitate remote collaboration and content distribution, others faced budget constraints and delayed digital transformation initiatives. The Russia-Ukraine war introduced geopolitical instability and raised concerns about supply chain disruptions and cybersecurity threats, impacting global businesses' access to critical resources and affecting decision-making around DAM investments and partnerships. However, the reduced economic momentum has contributed to alleviating supply chain constraints and mitigating overall cost pressures. This decline has been particularly evident in energy prices, which saw a significant decrease from their peak in 2022 following Russia's invasion of Ukraine. In October 2023, median CPI inflation for G20 countries decreased to 3.9%, marking a notable decrease from its peak of 7.7% in July 2022. Thus, the global DAM market has a moderate impact on the current recession.

Digital Asset Management Market Dynamics

Driver: Emergence of cloud-based delivery options

The emergence of cloud-based delivery options is reshaping the landscape of the global digital asset management (DAM) market, driven by the accelerating adoption of cloud technology across industries. The DAM market has experienced significant growth, with cloud-based DAM providers witnessing a surge in demand for their services. DAM providers such as Adobe Experience Manager Assets, Bynder, and Acquia have reported substantial increases in their customer base and revenue, fueled by the advantages offered by cloud-based DAM solutions. These solutions provide organizations unparalleled scalability, accessibility, and cost-effectiveness, eliminating the need for on-premises infrastructure and enabling seamless collaboration among distributed teams. According to PWC's Cloud Business Survey 2023, 78% of executives said their organizations had adopted the cloud in most businesses. Additionally, cloud-based DAM solutions offer advanced features such as AI-powered tagging, real-time collaboration, and seamless integrations with other cloud-based tools, enhancing productivity and efficiency. As cloud adoption rates grow, businesses will seek agile, cost-effective solutions for managing their digital assets.

Restraint: High cost of implementation of DAM solutions

High implementation costs can be a significant entry barrier for many organizations and small and medium-sized enterprises (SMEs) with limited budgets. These upfront expenses often include software licensing fees, customization costs, and investments in hardware infrastructure. As per Image Relay, the average cost of implementing DAM software is USD 51,999 (hosted) - USD 7 1,746 (non-hosted) in 2022. Due to the rising average pricing, organizations may be reluctant to adopt DAM solutions, opting for cheaper or makeshift alternatives to manage their digital assets; this will likely affect the market growth, limiting DAM vendors' adoption rate and revenue potential. Conversely, offering competitively priced solutions and flexible pricing models can help stimulate market demand by making DAM more accessible to a broader range of businesses. Lowering the barrier to entry through affordable pricing can encourage greater adoption, driving market expansion as more organizations recognize the value proposition of DAM in improving operational efficiency, enhancing brand consistency, and facilitating collaboration.

Opportunity: Emergence of AI to automate business processes

Integrating Artificial Intelligence (AI) into DAM systems transforms business processes by streamlining workflows, enhancing productivity, and optimizing resource allocation. According to Deloitte State of AI in the Enterprise Report, 2022, 94% of business leaders reported that AI is critical for business success over the next five years. Moreover, AI-driven content recommendation engines integrated into DAM systems analyze user behavior and content usage patterns to provide personalized recommendations. For instance, a marketing team can leverage these capabilities to quickly identify the most compelling images or videos for specific campaigns, improving engagement and conversion rates. Adobe's Sensei, an AI and machine learning platform integrated into Adobe Experience Manager Assets, is a prime example of such technology in action. Sensei analyzes user interactions with digital assets to predict future needs and preferences, facilitating more targeted content delivery and driving better business outcomes.

Additionally, AI-powered content analytics tools embedded within DAM systems offer valuable insights into content performance and audience behavior. These tools can analyze engagement levels, sentiment analysis, and content effectiveness across different channels. For instance, Bynder's Advanced Analytics module employs AI algorithms to track how assets are used across different touchpoints and provides actionable insights to optimize content strategy. This data-driven approach enables organizations to make informed decisions, refine their content strategies, and allocate resources more effectively, improving ROI and competitive advantage.

Challenge: Need to ensure security and manage access control

Security and access control present significant challenges in adopting DAM solutions, particularly given the increasing frequency and sophistication of cyber threats. According to the IBM Cost of Data Breach Report 2023, the global average data breach cost was USD 4.4 million in 2023, a 15% increase in the last three years; this highlights the financial risks associated with inadequate security measures. In the context of DAM, ensuring the security of digital assets involves protecting them from unauthorized access, data breaches, and theft; this includes implementing robust access control mechanisms to restrict access to sensitive assets based on user roles and permissions. However, achieving the right balance between security and usability can be challenging. Complex access control policies can hinder productivity, while overly permissive policies can increase the risk of unauthorized access.

Furthermore, managing access control across diverse user groups, departments, and external collaborators can be complex, especially in large organizations with distributed workflows. Additionally, the rise of remote work and the proliferation of mobile devices further complicates access control, as organizations must secure access to digital assets from various endpoints. Ensuring compliance with regulatory requirements such as GDPR, HIPAA, or PCI DSS adds another layer of complexity, as organizations need to implement measures to protect sensitive data and demonstrate compliance through audit trails and reporting capabilities.

Digital Asset Management Market Ecosystem

Based on business functions, the sales & distribution segment will grow at a higher CAGR during the forecast period.

Sales teams rely on various assets such as product images, brochures, presentations, and pricing sheets to effectively communicate with prospects and customers. DAM solutions provide a centralized repository for storing, organizing, and accessing these assets, ensuring easy retrieval and consistent messaging across sales channels. By adopting DAM, sales teams can enhance collaboration and productivity by enabling seamless sharing and customization of sales collateral. As sales teams grow and expand into new markets, they need scalable solutions to accommodate the increasing volume and variety of sales assets. DAM solutions offer flexibility and scalability to support the evolving needs of sales and distribution teams.

Based on vertical, retail & e-commerce segment to grow at a higher CAGR during the forecast period.

In the dynamic landscape of retail & e-commerce, the strategic utilization of DAM solutions has become essential in driving competitive advantage, enhancing customer experiences, and optimizing operational efficiency. Retailers and e-commerce businesses rely on DAM to manage a vast array of digital assets, including product images, videos, marketing materials, and brand assets, which are essential for engaging customers and driving sales. With the exponential growth of online shopping, the demand for visually compelling and consistent content has surged. For instance, leading e-commerce platforms like Amazon and Alibaba leverage DAM solutions to manage their extensive product catalogs comprising millions of images and descriptions. Generic product descriptions fail to engage customers and personalize their experience. DAM allows product assets to be associated with specific customer segments based on demographics or purchase history. For instance, Nike uses DAM to manage personalized product recommendations based on user data. Customers see targeted images and videos showcasing styles they might be interested in. Such instances will drive the adoption of DAM solutions in this sector during the forecast period.

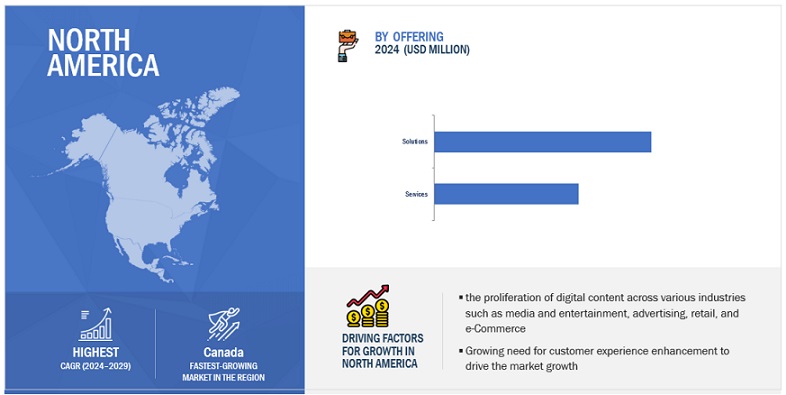

Based on region, North America holds the largest market share during the forecast period.

The robust IT infrastructure in North America is a solid foundation for the accelerating adoption of DAM solutions across various industries. This region boasts a sophisticated technological ecosystem characterized by widespread access to high-speed internet and advanced cloud computing infrastructure, which drives the adoption of DAM platforms. The University of California System implemented a DAM solution to centralize access to educational resources and research materials for its students and faculty across all its campuses; this allows for efficient sharing of knowledge and supports collaboration and innovation within the academic community. Also, the proliferation of social media and the ever-increasing internet penetration have fueled the creation and consumption of digital assets. As per DataReportal, the US had 246.0 million social media users in January 2023, representing 72.5% of the population. Cloud adoption further accelerates this trend, with organizations leveraging scalable infrastructure and remote access capabilities offered by cloud-based DAM platforms. Leading players such as OpenText, Bynder, and Aprimo have witnessed significant uptake in North America, with a notable increase in enterprise subscriptions over the past few years. As companies recognize the importance of centralized asset management for enhancing collaboration, brand consistency, and operational efficiency, the demand for DAM solutions in North America will increase.

Key Market Players

The DAM market is dominated by a few globally established players such as Adobe (US), OpenText (Canada), Cognizant (US), Aprimo (US), Cloudinary (US), Bynder (Netherlands), Hyland (US), Acquia (US), Frontify (Switzerland), Veeva Systems (US), Sitecore (US), Esko (Belgium), Celum (Austria), Photoshelter (US), Wedia (France), Extensis (US), Orange Logic (US), Intelligence Bank (Australia), MarcomCentral (US), Filecamp (Switzerland), Brandfolder (US), Pickit (Sweden), MediaValet (Canada), and Storyteq (Netherlands) among others, are the key vendors that secured DAM contracts in last few years. These vendors have both global and local presence in the DAM market. The DAM market is witnessing significant growth, driven by evolving learning needs, technological advancements, and the increasing adoption of digital learning solutions across various industries. Vendors are focusing on continuous product innovation to differentiate themselves in the market; this includes developing user-friendly interfaces and incorporating advanced features such as AI-driven work order management solutions and mobile-based DAM solutions to offer enhanced customer service

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market Size Available For Years |

2019–2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Business Function, Organization Size, and Vertical |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Adobe (US), OpenText (Canada), Cognizant (US), Aprimo (US), Cloudinary (US), Bynder (Netherlands), Hyland (US), Acquia (US), Frontify (Switzerland), Veeva Systems (US), Sitecore (US), Esko (Belgium), Celum (Austria), Photoshelter (US), Wedia (France), Extensis (US), Orange Logic (US), Intelligence Bank (Australia), MarcomCentral, Filecamp, Brandfolder (US), Pickit (Sweden), MediaValet (Canada), and Storyteq (Netherlands). |

This research report categorizes the digital asset management market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

- Solutions

- On-premises Solutions

- Cloud-based Solutions

- Services

By Business Function:

- Marketing & Advertising

- Finance & Accounting

- Sales & Distribution

- IT & Operations

- Human Resources

- Other Business Functions

By Organization Size:

- Large Enterprises

- SMEs

By Vertical:

- Retail & eCommerce

- BFSI

- Manufacturing

- IT & Telecom

- Media & Entertainment

- Government & Public Sector

- Travel & Hospitality

- Healthcare

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2024, Bynder and Salsify announced a partnership to revolutionize collaboration between creative, digital, and commerce teams. Their joint efforts aim to deliver precise, comprehensive, and engaging product experiences. This partnership establishes a system of record to enhance content distribution across various channels and devices for the timely delivery of relevant content.

- In January 2024, Aprimo announced the launch of Aprimo AI, an artificial intelligence solution for the digital asset management market. The product accelerates content creation, enhances asset discoverability, automates asset management, and ensures brand governance.

- In June 2023, Adobe announced an enhancement to its Asset Experience Manager to simplify content updates for digital properties; this will empower users of all skill levels to create, edit, and publish content seamlessly using tools like Microsoft Word or Google Docs. Enhanced security controls have been introduced to ensure authorized users make changes. The latest offering expands access globally, enabling organizations to deliver personalized experiences faster.

- In January 2023, Cloudinary launched Cloudinary Nexus, an AI-enabled DAM solution for SMEs to assist teams in linking, exploring, and adapting assets and supporting business growth.

- In March 2021, Hyland announced the acquisition of Nuxeo. The acquisition brought the entire Nuxeo business, including its products and technology, under Hyland Nuxeo's enterprise-grade DAM solution, which enhanced Hyland's content services platform by adding robust capabilities.

Frequently Asked Questions (FAQ):

What is a Digital Asset Management?

Digital Asset Management (DAM) refers to the centralized storage, organization, retrieval, and distribution of digital assets. These assets can include images, videos, audio files, documents, presentations, and other digital content. DAM systems provide a structured and efficient way to manage these assets throughout their lifecycle, from creation or acquisition to distribution and archival. Businesses use DAM for various business functions, including sales & distribution, marketing & advertising, human resources, IT & operations, finance & accounting, creative services, customer service, and product management to manage and collaborate digital assets.

Which country was the early adopter of DAM solutions?

The US was at the initial stage of the adoption of DAM solutions.

Which are the key vendors exploring DAM Solutions?

Some of the significant vendors offering DAM solutions across the globe include Adobe (US), OpenText (Canada), Cognizant (US), Aprimo (US), Cloudinary (US), Bynder (Netherlands), Hyland (US), Acquia (US), Frontify (Switzerland), Veeva Systems (US), Sitecore (US), Esko (Belgium), Celum (Austria), Photoshelter (US), Wedia (France), Extensis (US), Orange Logic (US), Intelligence Bank (Australia), MarcomCentral (US), Filecamp(Switzerland), Brandfolder (US), Pickit (Sweden), MediaValet (Canada), and Storyteq (Netherlands).

What is the total CAGR recorded for the DAM market from 2024 to 2029?

The DAM market will record a CAGR of 14.0% from 2024-2029

What is the projected market value of the DAM market?

The DAM market will grow from USD 5.3 billion in 2024 to USD 10.3 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 14.0% during the forecast period.

What are the significant trends in the DAM market?

There is an increasing demand for AI-powered DAM solutions, which leverage machine learning and natural language processing to automate metadata tagging, content recognition, and search optimization, enhancing efficiency and accuracy in content management workflows. Additionally, there's a growing emphasis on cloud-based DAM solutions, enabling seamless collaboration, scalability, and accessibility across distributed teams and global markets. Integration with marketing technology ecosystems is another key trend, as organizations seek to unify DAM with other marketing tools such as CRM platforms, content management systems, and analytics platforms to streamline content creation, distribution, and measurement processes. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

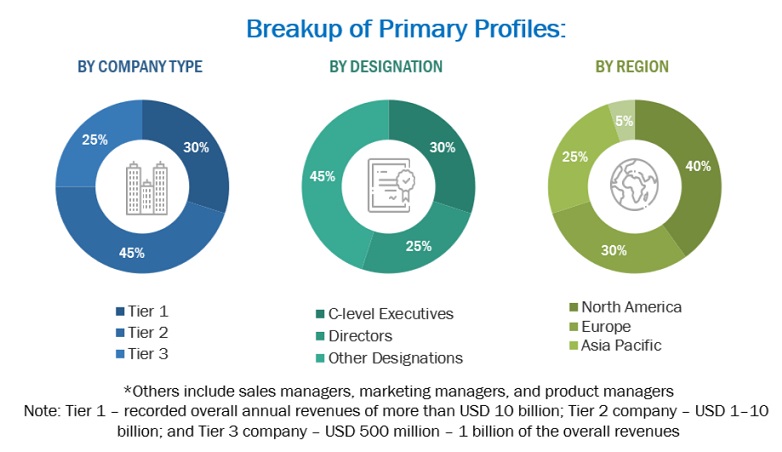

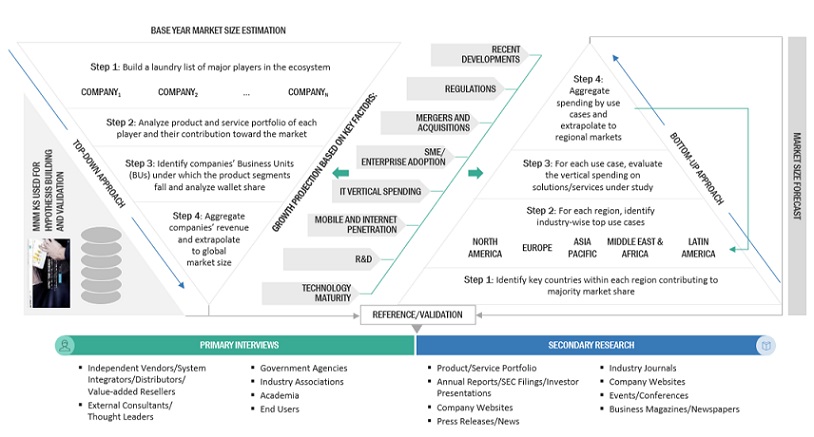

The study involved four major activities in estimating the digital asset management market. We performed extensive secondary research to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, we used the market breakup and data triangulation procedures to estimate the market size of the various segments in the DAM market.

Secondary Research

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. We used these sources to identify and collect valuable information for this technical, market-oriented, and commercial DAM market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the industry's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market's prospects.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various technology trends, segmentation types, industry trends, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs); the installation teams of governments/end users using DAM solutions & services; and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of services, which would affect the overall DAM market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the DAM and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the DAM market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- We identified key players in the market through secondary research. We then determined their revenue contributions in the respective countries through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Digital asset management market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the DAM market's demand and supply sides.

Market Definition

Digital Asset Management (DAM) refers to the centralized storage, organization, retrieval, and distribution of digital assets. These assets can include images, videos, audio files, documents, presentations, and other digital content. DAM systems provide a structured and efficient way to manage these assets throughout their lifecycle, from creation or acquisition to distribution and archival. DAM is utilized for various business functions, including sales & distribution, marketing & advertising, human resources, IT & operations, finance & accounting, creative services, customer service, and product management to manage and collaborate digital assets.

Key Stakeholders

- DAM solution and service providers.

- Consulting service providers and consulting companies

- Government organizations, forums, alliances, and associations

- System integrators (SIs)

- Value-added resellers (VARs)

- Research organizations.

- End users.

Report Objectives

- To define, describe, and forecast the DAM market based on offerings, business functions, organization sizes, verticals, and regions

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the macro and micromarkets1 concerning growth trends, prospects, and their contributions to the overall market

- To analyze the industry trends, patents and innovations, and pricing data related to the DAM market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies across segments and subsegments.

- To track and analyze the competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's product portfolio.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Asset Management Market