Digital Scent Technology Market by Hardware Device (E-Nose, Scent Synthesizers), End-Use Product (Medical Diagnostic Products, Quality Control Products), Application (Medical, Food & Beverages, Military & Defense) and Region - Global Forecast to 2029

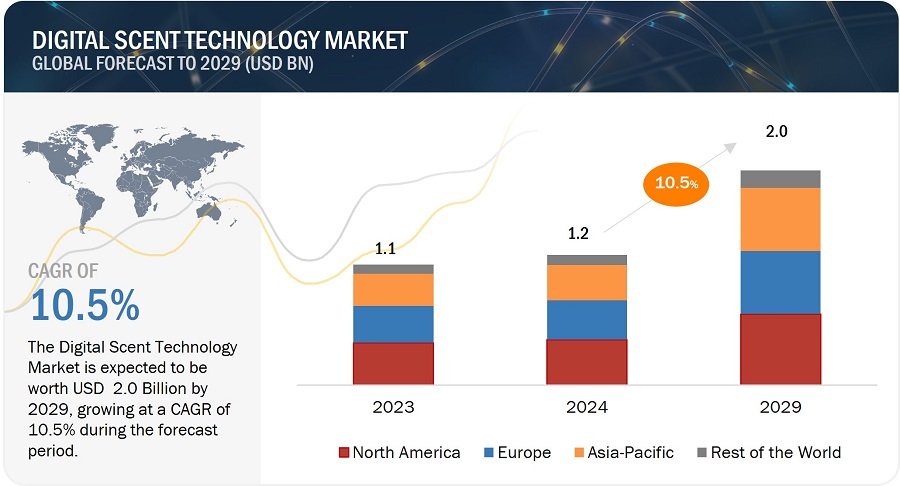

The Digital Scent Technology market was valued at USD 1.2 billion in 2024 and is estimated to reach USD 2.0 billion by 2029, registering a CAGR of 10.5% during the forecast period.

The growth of Digital Scent Technology market is driven by the growing adoption of e-noses in food industry for process monitoring. freshness evaluation, and authenticity assessment, rising adoption of compact, portable, and loT-enabled e-noses, growing deployment of e-nose devices for diagnosing diseases, and integration of e-noses and synthesizers into smart homes.

Digital Scent Technology Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Drivers: Growing adoption of e-noses in food industry for process monitoring freshness evaluation, and authenticity assessment.

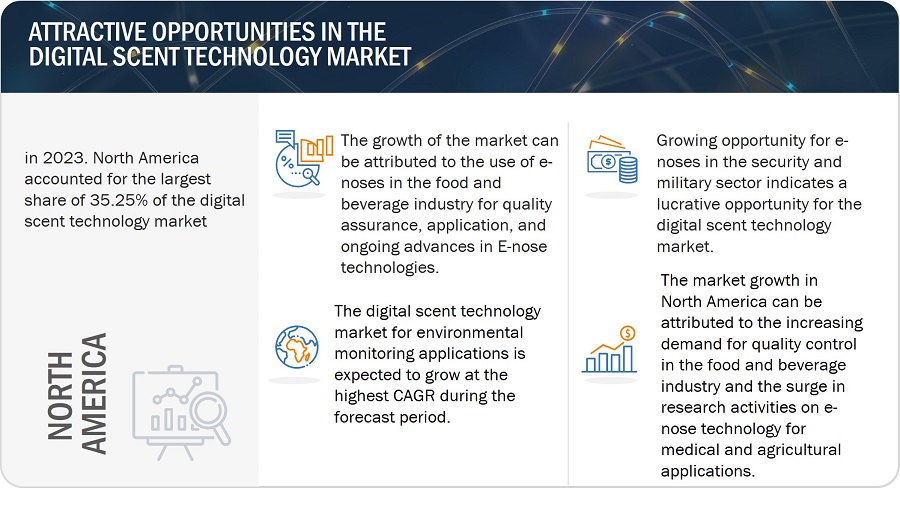

The increasing adoption of e-noses in the food industry for quality assurance significantly propels the growth of the digital scent technology market. E-noses offer benefits such as faster and more objective analysis compared to human inspection, early detection of spoilage and contamination, improved shelf-life management, and streamlined production control. Electronic noses provide a range of significant benefits in the food and beverage industry. They offer a fast and objective method for quality assessment by rapidly analyzing volatile compounds, crucial for maintaining product quality in high-volume production. The high sensitivity of e-noses enables the early detection of spoilage, contamination, and off-flavors, enhancing food safety and quality control.

Restraint: Limited adoption due to high cost of digital scent technology

The high cost of digital scent technology serves as a significant obstacle to its market growth, particularly affecting accessibility for small and medium-sized businesses (SMBs) and individual consumers. This limitation results in a narrowed customer base, hindering industry expansion. The expense associated with the technology holds back innovation, discouraging research and development efforts, especially among smaller players and research institutions. Even larger companies may delay adoption due to a high cost- benefit ratio, prioritizing investments in more established technologies. Market segmentation becomes apparent, with digital scent technology accessible primarily to high-end luxury brands or specific industries like healthcare, further limiting its impact. Scaling challenges arise as the elevated equipment costs make widespread deployment in large spaces or across multiple locations challenging. Despite these obstacles, ongoing efforts in research and development aim to reduce costs through miniaturization and process optimization. Alternative business models, such as subscription-based services and targeted applications with clear returns on investment, are emerging strategies to overcome the cost barrier and facilitate broader adoption of digital scent technology across diverse industries and consumer applications.

Opportunities: Heightened demand to detect explosives in airports and military checkpoints

The integration of e-hoses in security and military sectors offers lucrative opportunities for the digital scent technology market. The heightened demand for explosive detection in airports, border crossings, and military checkpoints, along with improved identification of chemical warfare agents and narcotics, positions E-nose devices as efficient alternatives to traditional methods. Technological advancements such as miniaturization and portability enhance deployment flexibility, while multi-sensor platforms and real-time monitoring strengthen threat detection capabilities. The market's expansion is fueled by collaborations between E-nose developers, government agencies, and security firms, opening avenues for new markets and funding. Successful deployments and international adoption can further drive market growth. Adapting military-grade E-nose technology for civilian applications adds a layer of diversification, spanning environmental monitoring, food safety, and medical diagnostics.

Challenge: Application of hazardous chemicals in scent synthesizers

The digital scent technology market faces significant challenges stemming from the potential health. impacts of hazardous chemicals used in scent synthesizers. Public concern and regulatory hurdles hinder widespread adoption, including consumer apprehension and stringent regulations. Health risks and liability concerns, such as uncertain short-term and long-term health effects and the potential for allergic reactions, further hinder market growth. Additionally, limitations in market reach and ethical considerations, such as concerns about privacy and autonomy, restrict the technology's acceptance. To overcome these challenges, the industry must invest in research, implement safety standards, promote transparency, and focus on ethical applications. By doing so, the digital scent technology market can pave the way for a more sustainable and widely accepted future.

Digital Scent Technology Ecosystem

The market for e-nose segment to hold largest market share during the forecast period.

Electronic noses (e-noses) emulate the human sense of smell using various sensor technologies and have applications in the medical and defense sectors. In the medical sector, they promise rapid, non-destructive disease diagnosis by analyzing breath, urine, or blood samples, enhancing treatment monitoring, and enabling personalized medicine. In April 2023, a mobile e-nose prototype for online breath analysis was introduced. The device, equipped with a gas sensor array featuring eight graphene-based materials, achieved over 80% accuracy in distinguishing respiratory diseases from 401 breath test cases, showcasing its potential for personalized health monitoring. The prototype addressed the need for non-invasive disease diagnosis, emphasizing the importance of timely and correct treatment in respiratory health management.

Smartphones segment to grow at the highest CAGR in the end-use product in the Digital Scent Technology market during the forecast period.

The integration of digital scent technology into smartphones holds immense potential, offering a transformative layer to user experiences. In multimedia it opens doors to enhanced immersion by allowing users to smell movie scenes or experience a racing game's distinctive odors. Personalized notifications take on a new dimension, utilizing scents like coffee or fresh laundry for a more engaging and less intrusive experience. Digital scents also introduce innovative possibilities in marketing, where targeted ads come with a burst of the advertised perfume's scent, creating a sensory and memorable connection with consumers. Beyond entertainment, there are practical applications, such as using digital scents as accessibility tools for the visually impaired or incorporating them into health and wellness apps for managing stress or boosting energy.

Medical segment in application to the highest market share of the Digital Scent Technology market during the forecast period

Digital scent technology is used in the medical segment for clinical diagnosis. Human odor as a result from internal hormonal or metabolic changes, contains a biomarker for various diseases and indicates the physiological status of an individual. The main sources of human odor are saliva, sweat, breath, urine, and skin. Recently, the components of skin emissions, exhaled breath, and urine odor have created attention as diagnostic biomarkers of diseases and disorders, including liver disease, lung cancer, diabetes, asthma, cystic fibrosis, and chronic obstructive pulmonary disease. Volatile organic compounds are the major target for e-noses in medical diagnosis, such as ammonia in individuals with liver disease, acetone for patients with diabetes, and alkanes in patients with lung cancer, pentane in patients with asthma. The e-nose technology has the potential to be operated for diagnosis.

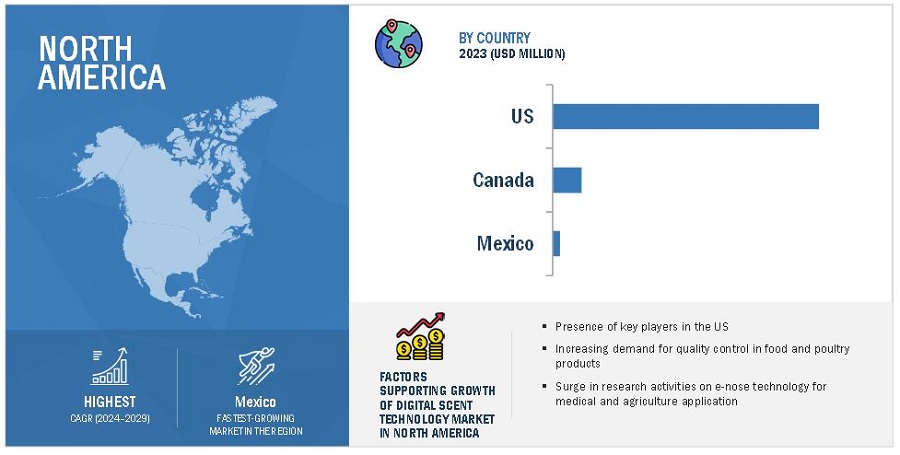

The Digital Scent Technology market in North America is estimated to account for largest share during the forecast period.

Increase in healthcare expenditure in North America has propelled the importance on enhancing patient care, diagnosis, and treatment processes. The integration of digital scent technology and e-noses can offer innovative solutions, particularly in healthcare facilities. The substantial increase in Medicare and Medicaid spending further underscores the government's commitment to healthcare, providing opportunities for technology adoption. Bio-sensing is one of the applications that is being used extensively in the healthcare industry. Biosensors are mainly used in the healthcare industry to recognize and track the physiological processes inside the body. It is used for the critical secondary and tertiary analysis of the physiological mechanisms.

Digital Scent Technology Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major vendors in the Digital Scent Technology companies include Siemens (Germany), Amphenol Corporation (US), Sensirion AG (Switzerland), Honeywell International Inc. (US), Renesas Electronics Corporation (Japan), Envirosuite Ltd (Australia), Alpha MOS (France), Electronic Sensor Technology (US), Aromajoin Corporation (Japan), Figaro Engineering Inc. (US), Bosch Sensortec GmbH (Germany), and Alphasense (UK) among others.

Apart from this, Sensigent LLC (US), AIRSENSE Analytics GmbH (Germany), ScentSational Technologies LLC (UK), Scent Sciences (US), The eNose Company (Netherlands), COMON INVENT B.V. (Netherlands), Aryballe technologies (France), Plasmion (Germany), Noze (Canada), SMELLDECT GmbH (Germany), RoboScientific (UK), AerNos, Inc. (US), CDx, Inc., (subsidiary of MyDx, Inc.) (US), GERSTEL (Germany), Breathomix (Netherlands), Olorama Technology Ltd. (Spain), SmartNanotubes Technologies GmbH (Germany), FlavorActiV. (UK), mui-robotics (Singapore), CROMATOTEC GROUP (France) are among a few emerging companies in the Digital Scent Technology market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020-2029 |

|

Base year |

2023 |

|

Forecast period |

2024-2029 |

|

Segments covered |

Hardware Device, End-Use Product, Application and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major players include Siemens (Germany), |

Digital Scent Technology Market Highlights

This research report categorizes the Digital Scent Technology market hardware device, end-use product, application, and Region.

|

Segment |

Subsegment |

|

By Hardware Device: |

|

|

By End-Use Product: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments

- In March 2023, Siemens (Germany) launched Connect Box, an IoT solution for managing small to mediurn-sized buildings. As part of Siemens Xcelerator, it connected, monitored, and operated buildings, optimizing energy efficiency by up to 30%. With an open digital platforin, Connect Box facilitated easy integration of devices, offering cloud-based access for building management tasks.

- In January 2024, Amphenol Corporation (US) successfully acquired Carlisle Interconnect Technologies (CIT) business from Carlisle Companies Inc. incorporated for USD 2,025 billion in cash. This strategic move aimed to enhance Amphenol's position in harsh environments by interconnecting solutions and catering to commercial air, defense, and industrial markets.

Key Questions Addressed in the Report:

What is the total CAGR expected to be recorded for the Digital Scent Technology market during 2024-2029?

The global Digital Scent Technology market is expected to record a CAGR of 10.5% from 2024-2029.

Which regions are expected to pose significant demand for the Digital Scent Technology market from 2024-2029?

North America & Asia Pacific are expected to pose significant demand from 2024 to 2029. Major economies such as US, Canada, China, Japan, and India are expected to have a high potential for the future growth of the market.

What are the major market opportunities for the Digital Scent Technology market?

Heightened demand to detect explosives in airports and military checkpoints, development of sensitive and durable sensors embedded with Al algorithms, integration of e-nose technology in gaming, and rising popularity of e-nose in AR/VR applications are the significant market opportunities in the Digital Scent Technology market during the forecast period.

Which are the significant players operating in the Digital Scent Technology market?

Key players operating in the Digital Scent Technology market are Siemens (Germany), Amphenol Corporation (US), Sensirion AG (Switzerland), Honeywell International Inc. (US), Renesas Electronics Corporation (Japan), Envirosuite Ltd (Australia), Alpha MOS (France), Electronic Sensor Technology (US), Aromajoin Corporation (Japan), Figaro Engineering Inc. (US), Bosch Sensortec GmbH (Germany), and Alphasense (UK).

What are the major applications of the Digital Scent Technology market?

Food & Beverage, Military & Défense, Medical, Marketing, Environmental Monitoring, Entertainment, and Other Applications are the major applications of Digital Scent Technology market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

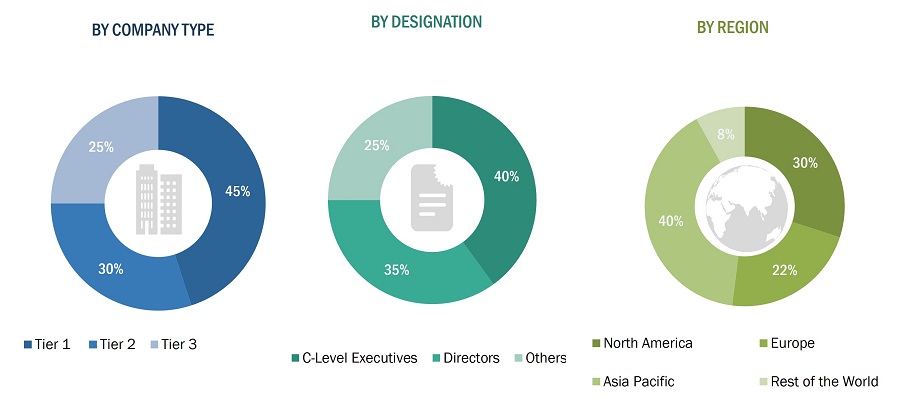

This research study involved the extensive use of secondary sources, directories, and databases (such as annual reports or presentations of companies, industry association publications, directories, technical handbooks, World Economic Outlook (WEO), trade websites, Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the digital scent technology market. Primary sources mainly comprise several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, system providers, technology developers, alliances, and standards and certification organizations related to the various phases of this industry’s value chain. In-depth interviews have been conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess market prospects.

Secondary Research

In secondary research, various sources have been referred to identify and collect information important for this study. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; digital scent technology products-related journals and certified publications; articles by recognized authors; directories; and databases.

Secondary research has been conducted to obtain key information about the industry supply chain, market value chain, total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments from market and technology-oriented perspectives. Data from secondary research has been collected and analyzed to arrive at the overall market size, which has been further validated by primary research.

Primary Research

Extensive primary research was conducted after understanding and analyzing the digital scent technology market through secondary research. Several primary interviews were conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW, which comprises the Middle East, Africa, GCC, and South America. Approximately 25% of the primary interviews were conducted with the demand-side vendors and 75% with the supply-side vendors. This primary data was mainly collected through telephone interviews/web conferences, which comprised 80% of the total primary interviews, questionnaires, and e-mails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses have been carried out on the complete market engineering process to list the key information/insights pertaining to the digital scent technology market.

The key players in the market have been identified through secondary research, and their rankings in the respective regions have been determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players and interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Digital Scent Technology Market: Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall size of the Digital Scent Technology market from the revenues of key players and their share in the market.

Digital Scent Technology Market: Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the size of specific market segments. The bottom-up approach was implemented for the data extracted from secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the bottom-up approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of the data through primaries.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. Where applicable, data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the digital scent technology market has been validated using both top-down and bottom-up approaches.

Market Definition

Digital scent technology involves transmitting, receiving, and perceiving scented digital media through hardware devices like e-noses and scent synthesizers. An e-nose, equipped with an array of gas sensors, is designed to detect various odors, while a scent synthesizer releases scents from electronic devices such as TVs, smartphones, and tablets. This technology finds applications across diverse industries, including military & defense, food & beverage, medical, marketing, entertainment, environmental monitoring, and others like communication, agriculture, public security, transportation, and research and development. Despite its potential, the technology is still in its early stages, requiring dedicated partners and strategic investments to tailor its outcomes for companies aiming to incorporate scent as part of their branding strategy.

The ecosystem of the digital scent technology market encompasses a range of components such as sensors, e-noses, scent synthesizers, cartridges, and software kits. This market exhibits diversity, with numerous companies vying across its value chain to maintain their foothold and expand their market presence. Anticipated to experience notable expansion in the foreseeable future, the digital scent technology market is driven by increasing demand for e-noses in clinical diagnosis applications.

Key Stakeholders

- Original technology designers and suppliers

- Raw material suppliers

- Integrated device manufacturers (IDMs)

- Original device manufacturers (ODMs)

- Digital scent technology original equipment manufacturers (OEMS)

- Process OEMS

- Suppliers and distributors

- System integrators

- Electronic hardware equipment manufacturers

- Assembly and packaging vendors

- Technical universities

- Government research agencies and private research organizations

- Research institutes and organizations

- Market research and consulting firms

- Sensor manufacturers

- Technology investors

- Technology standard organizations, forums, alliances, and associations

Report Objectives

- To describe and forecast the digital scent technology market, in terms of value, by hardware devices, end-use products, and applications.

- To describe and project the digital scent technology market, in terms of value, for four main regions-North America, Europe, Asia Pacific, and RoW.

- To present detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter's Five Forces analysis, and regulations pertaining to the market.

- To offer a comprehensive overview of the value chain of the digital scent technology market ecosystem.

- To critically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

- To assess the opportunities in the market for stakeholders and describe the competitive landscape of the market.

- To analyze competitive developments such as collaborations, agreements, partnerships, product developments, and research and development (R&D) in the market.

- To evaluate the impact of the recession on the digital scent technology market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Scent Technology Market