Electric Heat Tracing Market by Type (Self-regulating, Constant Wattage, Mineral-insulated), Component (Heat Tracing Cables, Control & Monitoring Systems, Thermal Insulation Materials, Power Connection Kits), Vertical - Global Forecast to 2029

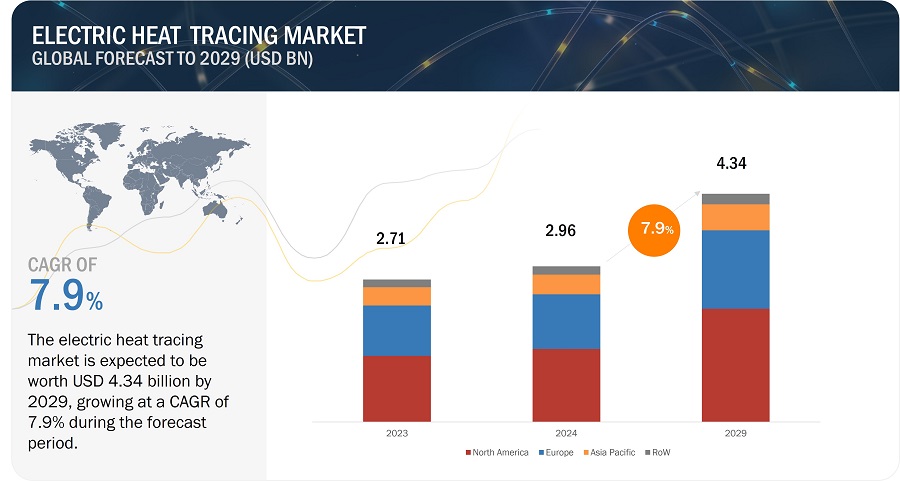

[250 Pages Report] The electric heat tracing market is expected to be valued at USD 2.96 billion in 2024 and is projected to reach USD 4.34 billion by 2029 and grow at a CAGR of 7.9% from 2024 to 2029. The market is experiencing growth driven by a rising inclination toward electric heat tracing systems compared to traditional steam tracing methods. This shift is fueled by an increasing demand for energy-efficient solutions and the cost-effectiveness associated with maintaining electric heat tracing systems. Additionally, there is a notable rise in the adoption of heat tracing systems across various industries, including power plants, offering promising growth opportunities. However, challenges arise from potential issues such as the negative effects of overlapping heating cables and complexities in installing heat tracing systems for large tanks and vessels, presenting obstacles to market expansion.

Electric Heat Tracing Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Electric heat tracing Market Dynamics

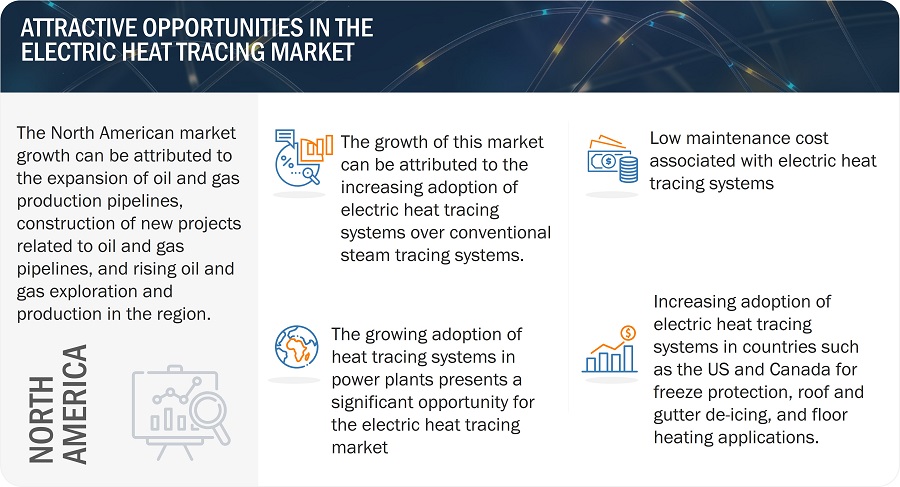

Driver: Increasing adoption of electric heat tracing systems over conventional steam tracing systems in hardware technologies

The increasing adoption of electric heat tracing systems over conventional counterparts in hardware technologies is driven by their superior efficiency and versatility. Electric heat tracing systems offer precise temperature control, ensuring optimal conditions for various industrial processes. Unlike traditional methods, these systems are self-regulating, adjusting heat output according to environmental changes. Additionally, electric heat tracing systems are known for their ease of installation, reducing complexities in hardware setups. This growing preference is fueled by the need for energy-efficient solutions and the desire to enhance overall operational effectiveness in industries relying on hardware technologies.

Restraint: Adverse effects of overlapping heating cables

The electric heat tracing market faces challenges related to the adverse effects of overlapping heating cables, acting as a significant restraint. When heating cables overlap, it can lead to uneven heat distribution and, in some cases, overheating. This not only compromises the effectiveness of the heat tracing system but also poses potential safety risks. Overlapping heating cables may cause damage to the cables themselves, reducing their lifespan and requiring frequent maintenance. In applications where precision and consistency are crucial, such as in industrial processes or critical infrastructure, the negative consequences of cable overlapping can result in operational inefficiencies and increased maintenance costs.

Opportunity: Rising adoption of heat tracing systems in power plants

The growing adoption of heat tracing systems in power plants presents a significant opportunity for the electric heat tracing market. Power plants often require precise temperature control for various processes, including the transportation and handling of fluids, equipment freeze protection, and overall operational efficiency. Electric heat tracing systems offer a reliable and energy-efficient solution for maintaining optimal temperatures in critical areas of power generation facilities. As power generation infrastructures expand and modernize, the demand for heat tracing systems in power plants is expected to rise. This trend not only opens avenues for increased market penetration but also underscores the versatility and adaptability of electric heat tracing technologies across diverse industrial applications, further contributing to the market's growth prospects.

Challenge: Difficulties in installation of heat tracing systems on large tanks and vessels

The installation of heat tracing systems in large tanks and vessels poses challenges for the electric heat tracing market. Large-scale containers present complexities in ensuring uniform heat distribution, and improper installations may result in overlapping heating cables, leading to inefficient performance and potential system failures. Managing the intricate layout of cables to cover extensive surfaces while avoiding interference can be daunting. Additionally, accessing and applying heat tracing in challenging environments, such as those with irregular shapes or limited accessibility, requires specialized expertise.

Electric Heat Tracing Market Ecosystem

The Electric heat tracing market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include nVent Electric plc (UK), Thermon Group Holding, Inc. (US), Spirax-Sarco Engineering plc (UK), NIBE Industrier AB (Sweden), BARTEC Top Holding GmbH (Germany).

Based on the product type, self-regulating heat tracing cables to hold the highest market share during the forecast period

Self-regulating heat tracing cables exhibit high energy efficiency due to their intrinsic self-regulating feature within the tracers. As ambient temperature rises, the resistance of the polymer core of the tracer increases, leading to a reduction in power output. This unique design ensures that the energy output consistently meets the system's requirements. The self-regulating mechanism prevents the generation of excessively high surface temperatures, minimizing the risk of fire hazards, even when handling flammable gases or liquids in the proximity of pipelines. Notably, these systems remain resilient, avoiding overheating or burnout, even in scenarios of self-overlapping cables. The myriad advantages associated with self-regulating cables contribute to their growing adoption across diverse sectors, including oil & gas, chemicals, commercial, and residential applications. These cables find use in various applications, such as freeze protection, process temperature maintenance, roof & gutter de-icing, and floor heating, fostering increased demand throughout the forecast period..

Based on application, the freeze protection and process temperature maintenance to hold the highest market share during the forecast period

Businesses employ pipe-tracing cable systems to mitigate the risk of damage and financial disruptions caused by freezing temperatures. These systems are designed to prevent heat loss from insulated pipes and equipment, safeguarding against frozen pipes and potential compromises in fluid performance. Comprising self-regulating heating cables, thermostats, controllers, sensors, and control panels, these comprehensive solutions address the challenge of freeze protection. Particularly critical for water-based products susceptible to freezing at 0°C (32°F), these solutions ensure optimal temperature control and minimize costly downtime. Renowned for their versatility across industries, heat trace systems provide reliable freeze protection for liquids in pipes across various industrial applications, even in hazardous environments.

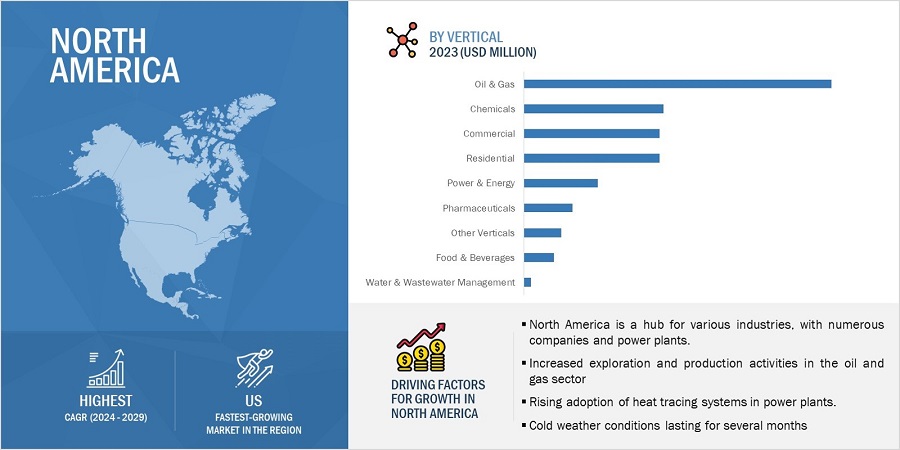

Based on vertical, the oil and gas to hold the highest market share during the forecast period

Oil & Gas vertical in the electric heat tracing market is projected to account for the largest share during the forecast period. The adoption of electric heating in the oil and gas vertical is driven by the need for precise temperature control, ensuring efficient operations, and the growing emphasis on safety, reliability, and energy efficiency in critical processes across the industry. The adoption of electric heating in the oil and gas vertical lies in its ability to offer precise temperature management, which is critical for optimizing various processes. Additionally, the emphasis on safety, reliability, and energy efficiency aligns with industry standards, driving the widespread adoption of electric heating solutions.

Electric heat tracing market in North America to hold the highest market share during the forecast period

The United States commands the electric heat tracing market in North America, propelled by several factors. The market experiences substantial growth due to the demand for dependable freeze protection solutions in regions with harsh winters. Additionally, the ongoing modernization and expansion of critical infrastructure, including oil and gas pipelines, create significant growth prospects. This involves the replacement of outdated systems and accommodation for heightened exploration and production activities. The market's expansion is not limited to the oil and gas sector; there is a notable surge in demand for electric heat tracing systems across diverse industries such as chemicals, commercial, and residential sectors. These comprehensive solutions, integrating self-regulating heating cables with thermostats, controllers, sensors, and control panels, ensure precise temperature control and effectively mitigate costly downtime.

Electric Heat Tracing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The electric heat tracing companies is dominated by players such as market nVent Electric PLC (UK), Thermon Group Holdings (US), Spirax-Sarco Engineering Plc (UK), Nibe Industrier AB (Sweden), Bartec Top Holdings Gmbh(Germany), and others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Type, By Component, By Application, By Region, and By Vertical |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

nVent Electric plc (UK), Thermon Group Holding, Inc. (US), Spirax-Sarco Engineering plc (UK), NIBE Industrier AB (Sweden), BARTEC Top Holding GmbH (Germany), Danfoss (Germany), eltherm GmbH (Germany), Emerson Electric Co. (US), Watlow Electric Manufacturing Company (US), Drexan Energy System, Inc. (Canada) are the major players in the market. (Total 25 players are profiled) |

Electric Heat Tracing Market Highlights

The study categorizes the Electric heat tracing market based on the following segments:

|

Segment |

Subsegment |

|

By Type |

|

|

By Component |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments

- In December 2023, BARTEC introduced the Helos Pro, an advanced heat loss calculation software designed for developing industrial electrical heat tracing systems for pipelines and tanks. The software aims to provide precise heat tracing design, enhancing the efficiency and reliability of heating systems.

- In June 2023, Spirax-Sarco introduced new product named "Turflew Heat Exchanger" as an efficient fluid temperature management solution designed for heating and cooling processes, specifically addressing the needs of managing process water.

Frequently Asked Questions:

What are the major driving factors and opportunities in the electric heat tracing market?

Several key driving factors are propelling the electric heat tracing market and presents abundant opportunities for growth. The increasing adoption of electric heat tracing systems, particularly over traditional methods like steam tracing, is a major driver. The demand for energy-efficient solutions and the cost-effectiveness of maintaining electric heat tracing systems further contribute to market expansion. Opportunities abound with the rising adoption of heat tracing systems in diverse end-user industries and their integration into power plants, offering promising avenues for market players.

Which region is expected to hold the highest market share?

The North American region is expected to hold the highest market share during the forecast period. The market experiences substantial growth due to the demand for dependable freeze protection solutions in regions with harsh winters. Additionally, the ongoing modernization and expansion of critical infrastructure, including oil and gas pipelines, create significant growth prospects. This involves the replacement of outdated systems and accommodation for heightened exploration and production activities. The market's expansion is not limited to the oil and gas sector; there is a notable surge in demand for electric heat tracing systems across diverse industries such as chemicals, commercial, and residential sectors. These comprehensive solutions, integrating self-regulating heating cables with thermostats, controllers, sensors, and control panels, ensure precise temperature control and effectively mitigate costly downtime.

Who are the leading players in the electric heat tracing market?

Companies such as as market nVent Electric PLC (UK), Thermon Group Holdings (US), Spirax-Sarco Engineering Plc (UK), Nibe Industrier AB (Sweden), Bartec Top Holdings Gmbh(Germany), and others are the leading players in the market.

What are some of the technological advancements in the market?

The electric heat tracing market has witnessed significant technological advancements that are transforming the landscape of this heating solution. One notable development is the integration of smart and IoT-enabled features into heat tracing systems. These advancements allow for real-time monitoring, remote control, and data analytics, enhancing overall system efficiency and performance. The incorporation of self-diagnostic capabilities ensures proactive maintenance, reducing downtime and operational disruptions. Moreover, there is a growing trend towards the use of advanced materials and construction techniques, improving the durability and longevity of heat tracing systems. As the industry embraces Industry 4.0 principles, the convergence of electric heat tracing with digital technologies is paving the way for more intelligent, connected, and sustainable solutions, meeting the evolving needs of various industries such as oil & gas, chemicals, and beyond.

What is the impact of the global recession on the market?

The heat tracing industry is poised for negative effects in 2024 due to the looming recession and the surge in inflation. The sector's prosperity is closely tied to the manufacturing and selling of a diverse array of heating systems, including heat trace cables, heat pumps, self-regulating cables, control and monitoring systems, and more. The economic downturn is anticipated to hit the globe, given its status as a lucrative market for numerous providers of heat tracing systems, such as Urecon, Emerson Electric, Nibe Industrier AB, and others. Moreover, the escalating inflation, coupled with rising interest rates and unemployment, is expected to result in diminished consumer and industrial demand for heat tracing system solutions. This, in turn, will impact production and investments across the entire globe. Due to the recession, end-user industries of heat-tracing system solutions, encompassing residential, commercial, oil and gas, and industrial sectors, are likely to exhibit reduced capital expenditure (CAPEX) for the development of heat-tracing system-based solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

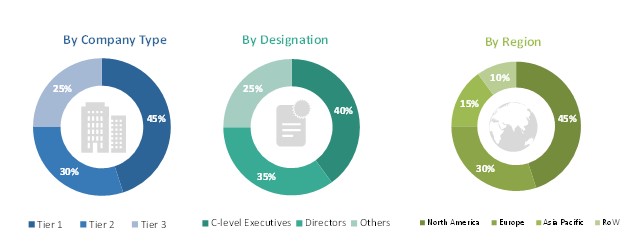

The study involved four major activities in estimating the current size of the electric heat tracing market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

European Committee for Electrotechnical Standardization (CENELEC) |

https://www.cencenelec.eu/ |

|

International Electrotechnical Commission (IEC) |

https://www.iea.org/ |

|

German Institute for Standardization (DIN) |

https://www.din.de/en |

|

International Energy Agency(IEA) |

https://www.iea.org/ |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the electric heat tracing market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the electric heat tracing market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the electric heat tracing market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various verticals using or expected to implement Electric heat tracing systems

- Analyzing each verticals, along with the major related companies and Electric heat tracing system providers

- Estimating the Electric heat tracing market for verticals

- Understanding the demand generated by companies operating across different verticals

- Tracking the ongoing and upcoming implementation of projects based on electric heat tracing technology by vertical and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of Heat tracing products designed and developed vertically. This information would help analyze the breakdown of the scope of work carried out by each major company in the electric heat tracing system market

- Arriving at the market estimates by analyzing electric heat tracing companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various verticals.

- Building and developing the information related to the market revenue generated by key electric heat tracing system manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of Electric heat tracing products in various verticals

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of Electric heat tracing, and the level of solutions offered in verticals

- The impact of the recession on the steps mentioned above has also been considered.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Electric heat tracing refers to a system that uses electrical cables to generate heat for the purpose of maintaining or controlling temperatures in pipelines, tanks, or other equipment. It is commonly employed in industrial, commercial, and residential settings to prevent freezing, maintain process temperatures, or control viscosity in fluids. The system typically involves self-regulating heating cables that automatically adjust their heat output based on ambient conditions, providing an efficient and reliable solution for temperature-related challenges in various applications.

Key Stakeholders

- Component Manufacturers

- End-User Organizations

- System Integrators

- Consumers

- Regulatory Bodies and Compliance Agencies

- Research Institutions

- Distributors and Resellers

- Industry Associations and Organizations

- Investors and Financial Institutions

Report Objectives

- To define, describe, and forecast the electric heat tracing market based on product type, application, by component, vertical, and region.

- To forecast the shipment data of electric heat tracing cables.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as collaborations, partnerships, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the Electric heat tracing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the Electric heat tracing market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Electric heat tracing market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electric Heat Tracing Market

I want to check weather this report includes information on Russia? If yes, then can I buy Russian part - and cost associated with it.