Energy Management Systems Market by Component, Type (Home Energy Management Systems, Building Energy Management Systems, Industrial Energy Management Systems), Deployment, End-User Industry and Region - Global Forecast to 2028

Energy Management Systems Market Size, Share, Growth Report & Forecast

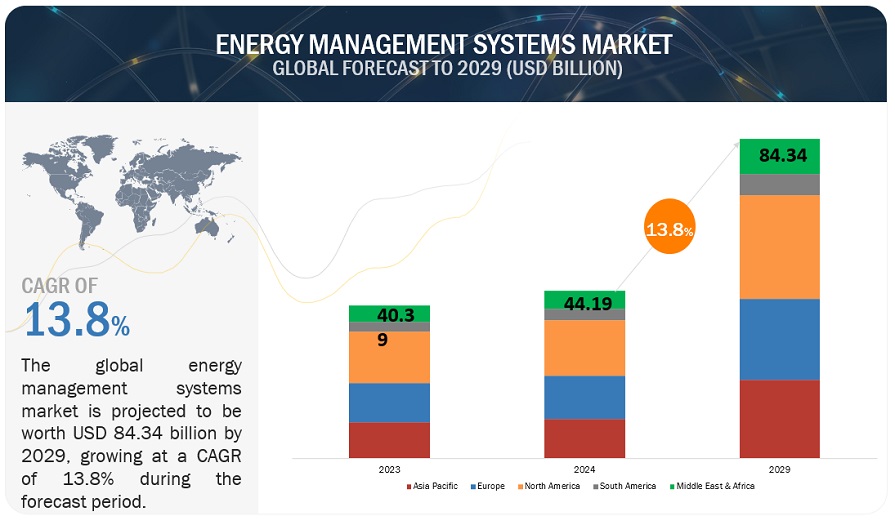

The global energy management systems market in terms of revenue was estimated to be worth $40.7 billion in 2023 and is poised to reach $75.6 billion by 2028, growing at a CAGR of 13.2% from 2023 to 2028.

Several laws and regulations aimed at reducing energy consumption and spreading awareness regarding energy conservation have been enacted by regional governments worldwide. These regulations and policies function as a driving force for the EMS market in application areas such as the industrial, commercial, and residential sectors. Governments across several countries are working toward decarbonization which involves different processes. Due to the high rise in carbon emission rates, many countries have established or have already installed standards and norms about energy consumption and reducing the carbon footprint. Efficient energy consumption is one of the most cost-effective methods for reducing carbon footprints.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Energy Management Systems Market Dynamics

Driver: Government policies to increase energy efficiency and tackle climate change

Energy efficiency is the use of less energy to perform the same task or produce the same result. Energy-efficient homes and buildings use less energy to heat, cool, and run appliances and electronics, and energy-efficient manufacturing facilities use less energy to produce goods. The Go Green initiative is gaining momentum, and organizations are realizing the importance of publicizing their energy conservation initiatives. They gain a competitive edge by positioning themselves as an eco-friendly company, as this helps them gain consumer confidence and community recognition. Many top global companies are now focusing on becoming eco-friendly and have a deep commitment to sustainable energy.

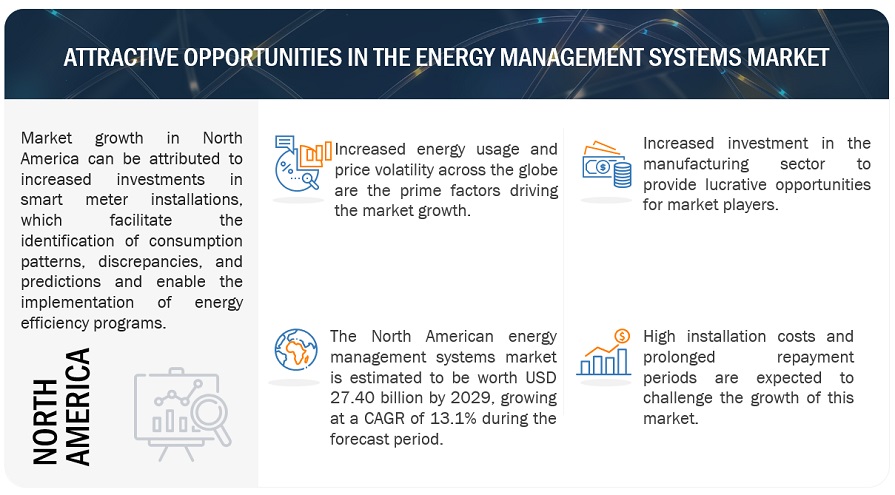

Restraint: High installation costs

Every industry wants a cost cut in its consumption. So, they require energy management systems to monitor the energy consumption of different machines and plants. Although the deployment of energy-efficient solutions and measures leads to substantial cost and energy savings in the long term, it requires sizable initial investments. There could be situations in which industries, companies, and manufacturing units do not have the funds required to undertake the investments in EMS. A lack of understanding of energy efficiency measures could make companies hesitant about investing in projects that do not primarily focus on increasing production capacity and revenue. Typically, companies associate capital investment with company growth and do not link this with energy efficiency projects. Deploying a completely automated and high-tech EMS in buildings or industries requires substantial initial investments.

Opportunity: Growth of urbanization and digitalization

Digital technologies are set to transform the global energy system in the coming decades, making it more connected, reliable, and sustainable. With the help of smart thermostats, the IEA report finds that smart lighting and other digital tools help buildings reduce their energy use by 10% by using real-time data to improve operational efficiency. Meanwhile, massive amounts of data, ubiquitous connectivity, and rapid progress in Artificial Intelligence and machine learning is enabling new applications and business models across the energy system, from autonomous cars and shared mobility to 3D printing and connected appliances. More than 1 billion households and 11 billion smart appliances could participate in interconnected electricity systems by 2040, which is contributed with the help of smart meters and connected devices. This would allow homes to alter when and how much they draw electricity from the grid. Demand-side responses—in building, industry, and transport—could provide 185 GW of flexibility and avoid USD 270 billion of investment in new electricity infrastructure.

Challenge: Lack of awareness in small and medium-sized businesses

The major challenge related to energy efficiency is the lack of awareness among the small and medium-sized businesses operating worldwide. They are hesitant to invest in energy-efficient technologies and are unaware of the policies and benefits they can pursue with the help of energy management systems. The major players are aiming to focus on sustainability and energy efficiency to tackle climate change. However, since most small and medium-sized enterprises are still unaware of the benefits of energy-efficient technologies, they lose out on the cost savings that can be done with the help of energy management systems. Nevertheless, governments are implementing various policies and programs to increase awareness among people regarding energy management.

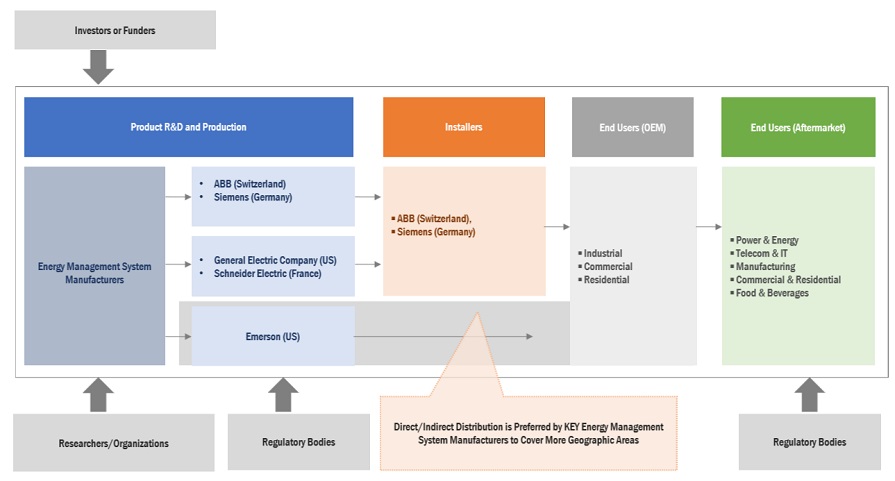

Energy Management Systems Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Energy Management System Market and components. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Eaton (Ireland), ABB (Switzerland), Siemens (Germany), Schneider Electric (France), General Electric (US), and Emerson (US).

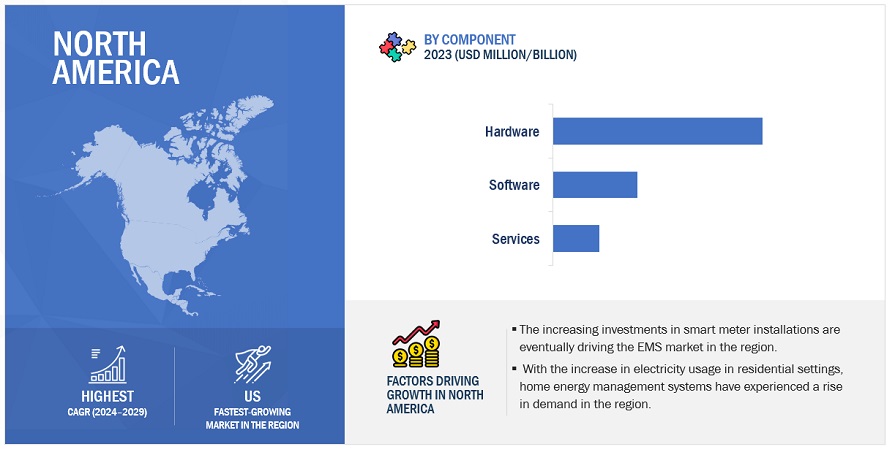

The hardware segment by component holds the largest segment in 2022

A large variety of energy monitoring devices is available, and the market is indicating a potential growth rate. In the past decade, a number of companies have introduced innovative products for the EMS market ranging from basic energy display devices to fully integrated home automated systems with smartphones. But the consumers today are finding challenges in installing, managing, and securing these smart devices, which has come up as one of the major restraining factors for their growth. Therefore, the consumers may interact with suppliers or load-serving entities (LSEs) to facilitate the load management at the supplier side..

BEMS segment by type is estimated to be the second-largest segment for Energy Management Systems Market

Building Energy Management Systems (BEMS) occupied a 14.9% share of the global energy management system market in 2022. Reducing energy waste in buildings and optimizing building operations require access to a diverse and integrated set of data. A BEMS is one of the many tools that can be used to operate buildings more efficiently. Computers and other electronic devices account for about 6% of all building energy use, and the US Energy Information Administration forecasts that energy use in data center servers will increase five-fold by 2040, while energy use in other information technology equipment will more than double. Computer screens, televisions, and other display devices can be major electricity users, and the technology of these devices is changing very rapidly. These can be a driving factor for the market growth of building energy management systems.

On-premises segment by deployment is estimated to be the largest segment for Energy Management Systems Market

Since different servers consume energy at different rates, electricity consumption will be considerable. Many existing on-premise deployments were built at a period when the cloud-based notion was still relatively new. As a result, on-premise servers must be maintained and replaced at some point. Companies/organizations cannot directly migrate to cloud-based choices due to the high initial costs of these systems. This will fuel the market for on-premise energy management system deployment. The retrofitting of existing on-premise servers with significant CAPEX is the driving force behind this market.

Food & beverages segment by end-use industry is estimated to be the third-largest segment for Energy Management Systems Market

Energy Management Systems protect assets such as generators and transformers used in Food & beverages. For food & beverage plants, effective energy management has become a business necessity. Increased competitive pressures, tighter margins, and rising energy costs are forcing manufacturers to alter their historical approach of treating energy usage as an unmanaged business expense. While electricity is the largest energy cost for most food & beverage plants, it also offers the greatest opportunities for savings and can deliver the fastest profit. The food & beverage industry is experiencing an era of unprecedented change, driven by technological advances, new global frameworks, and a supply chain transformation to build resilience and efficiencies across the global food system.

North America is expected to account for largest market size during the forecast period.

Key Market Players

The Market is dominated by a few major players that have a wide regional presence. The major players in the Energy Management Systems Market are ABB (Switzerland), Siemens (Germany), Schneider Electric (France), General Electric (US), and Emerson (US). Between 2019 and 2022, Strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the Market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Component, By Type, By Deployment, By End-use Industry |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

ABB (Switzerland), Siemens (Germany), Schneider Electric (France), General Electric (US), Emerson (US), Cisco Systems, Inc. (US), Honeywell International Inc. (US), Eaton (Ireland), Mitsubishi Electric Corporation (Japan), IBM (US), Hitachi (Japan), Rockwell Automation, Inc. (US), Yokogawa Electric Corporation (Japan), C3 AI (US), Delta Electronics, Inc. (US), Enel X (Italy), Neptune India (India), Weidmuller (Germany), Energy Management Systems, Inc. (US), Distech Controls (Canada) |

This research report categorizes the Energy management systems market based on component, by type, by deployment, by end-use industry, and region.

By Component

- Hardware

- Software

- Services

By Type

- Services

- HEMS

- BEMS

- IEMS

By Deployment

- On-Premise

- Cloud Based

By End-Use Industry

- Power & Energy

- Telecom & IT

- Manufacturing

- Commercial & Residential

- Food & Beverages

- Others

By Region

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In May 2022, General Electric signed a contract to supply energy management systems, medium voltage cubicles, and automation technology, as well as deliver protection, control, and supervision systems for the generating units, GIS substation, and the existing 500 kV transmission lines to upgrade a 14 GW hydropower plant in Brazil.

- In March 2022, Schneider Electric introduced its complete digital solutions with the help of its EcoStruxure platform for building transformation to maximize sustainability and operational efficiency during a building’s life cycle.

- In Oct 2021, Siemens’ Smart Infrastructure acquired French IoT startup Wattsense to expand its offerings within the buildings’ energy management, automation, and French markets.

- In Sept 2021, ABB announced its collaboration with the new Universal 10/4 Residential Storage System powered by Humless’ groundbreaking 48V Universal Energy Management (UEM) and ABB’s UNO-DM-TL-PLUS line of residential inverters.

- In Mar 202, Emerson acquired Verdant, an energy management solution for the hotel and hospitality industries. The addition of Verdant broadens Emerson’s growing energy management and optimization capabilities for residential and commercial applications.

Frequently Asked Questions (FAQ):

What is the market size of the energy management systems market?

The energy management systems market size is projected to grow from USD 40.7 billion in 2023 to USD 75.6 billion by 2028, at a CAGR of 13.2% during the forecast period.

What are the major drivers for Energy Management Systems market?

Smart meters can cut domestic or commercial energy consumption by giving the consumer a lot of useful information. Smart meters give the best home energy management solutions for smart homes using wireless technologies such as (Zigbee or Wi-Fi). Several sensor and actuator-based appliances are commissioned in smart buildings to remotely manage the connection of electrical load based on the consumer choice or utility decisions envisaging the necessity of the smart meter. The increased installation of smart grids and smart meters can drive the market for energy management systems globally.

What is the major restraint for Energy Management Systems market?

Installation of an energy management system requires high investment. Apart from this, the implementation of EMS requires significant investments in time, money, and resources. Energy management can make the difference between profit and loss and establish real competitive enhancements for most companies. No-cost or extremely low-cost operational changes can often save a customer or an industry 10–20% on utility bills. The capital cost programs with payback times of two years or less can often save an additional 20–30%. In many cases, these energy cost control programs will also result in reduced energy consumption and reduced emissions of environmental pollutants. However, the ROI duration is a bit lengthy. The average payback period for EMS solutions is a year, and it could increase accordingly. However, the deployment of these solutions ensures a decline in production costs on a Y-o-Y basis. Extended payback periods can be a restraining factor in the energy management systems market.

Which is the fifth-largest-growing region during the forecasted period in Energy Management Systems Market?

South America accounted for a 6.6% share of the global energy management systems market in 2022. The region has been segmented, by country, into Brazil, Argentina, and the Rest of South America. The scope of Rest of South America includes Ecuador, Bolivia, Uruguay, and Chile.

The South American market is undergoing tremendous economic growth, which has resulted in a high demand for energy and power. The region's electricity and energy consumption patterns are undergoing substantial changes, with an emphasis on energy conservation and efficiency. Energy efficiency reduces reliance on fossil fuels and imports, facilitates the conservation of scarce resources, improves the competitiveness of productive sectors, allows for better resource allocation for infrastructure, and contributes to the resolution of issues such as security and access to energy. This could provide profitable growth prospects for the energy management systems market.

Which is the third-fastest-growing segment, by end-user industry during the forecasted period in Energy Management Systems Market?

The telecom & IT segment, by end-user industry, is projected to hold the highest market share during the forecast period. The demand for computing and data interconnectivity continues to rise, which has increased the size of the data center infrastructure and its energy consumption on a global level. The energy consumption from the telecom industry is also very high. In the telecom industry, the infrastructure providers are required to ensure 24x7 power availability at the base transceiver stations irrespective of the site conditions and grid outages. The telecom and IT companies are evaluating new solutions, alternative energy sources, and energy-efficient telecom equipment. This drives the market for energy management systems, particularly in the telecom industry. Moreover, the telecom industry requires meter data management, which collects, aggregates, and validates data from different sources such as AMR/AMI, databases, and files. This data is then used to produce real-time invoice statements and provides further analysis and forecasting possibilities using a dynamic reporting interface.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

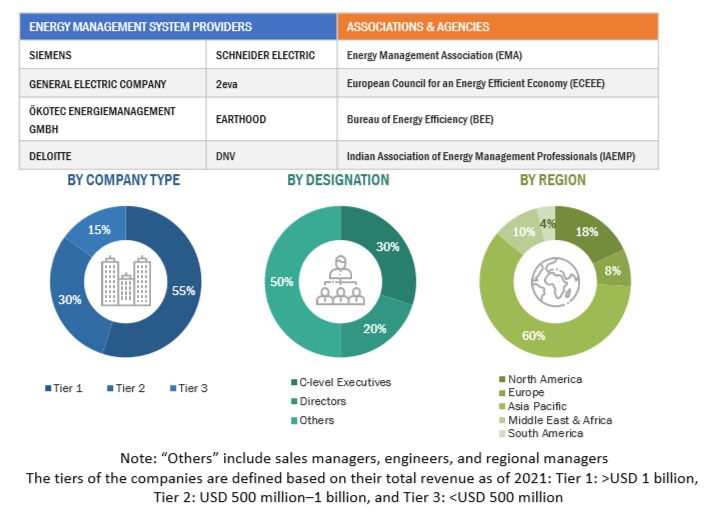

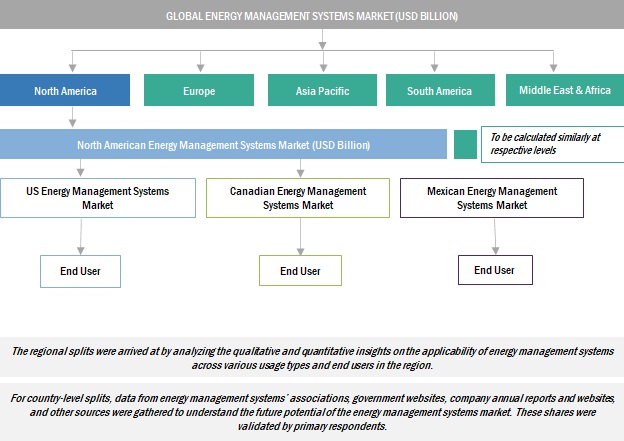

This study involved major activities in estimating the current size of the Energy management systems market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, SMART OFFICES Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global Energy management systems market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

The Energy management system market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by industrial end-users. Moreover, the demand is also fueled by the growing demand of underground distribution systems. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The bottom-up approach has been used to estimate and validate the size of the Energy management system market.

- In this approach, the Energy management systems production statistics for each product type have been considered at a country and regional level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of Energy management systems.

- Several primary interviews have been conducted with key opinion leaders related to Energy management systems development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Energy management systems Market Size: Tow-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market ecosystem.

Market Defenition

An energy management systems (EMS) is a system capable of monitoring, optimizing, maintaining, and generating records of the overall consumption of energy resources by any industry regularly. The data captured via various energy measuring devices are used for trend analysis and annual consumption forecasts.

EMS applications use real-time data such as frequency, actual generation, tie-line load flows, and plant units’ controller status to provide changes to the system. Therefore, an EMS is an integrated software system designed to store energy parameters, analyze and reduce energy consumption, identify areas of wastage, predict electrical system performance, and optimize energy usage to reduce the cost of electrical loads in a premise.

The growth of the market during the forecast period can be attributed to the increasing demand of energy consumption across major countries in North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Key Stakeholders

- EMS vendors

- Energy service providers (private/government)

- Utility platform and analytics vendors

- System design and development vendors

- System integrators/migration service providers

- Consultants/consultancies/advisory firms

- Environmental research institutes

- Private or investor-owned utilities

- Government & research organizations

- State and national regulatory authorities

- Investors/Shareholders

- Investment banks

Objectives of the Study

- To define, describe, and forecast the size of the market by component, by type, by deployment, by end-use industry, and region, in terms of value

- To estimate and forecast the global Energy management system market for various segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), South America, Middle East & Africa, in terms of value and volume

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To provide a detailed overview of the Energy management systems value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the Energy management systems market size in terms of value.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Energy Management Systems Market

How emerging markets offering revenue expansion opportunities in Energy Management Systems Market?

Which end user industry is expected to hold major share of the global Energy Management Systems Market for 2022 to 2027?

During the global Energy Management System (EMS) Market study, we did a separate exercise of deriving revenues for each major vendors for the specific segment and for the specific geographies, for example, IBM’s revenue for big data analytics, energy & utility industry, and UK/Europe/EMEA region. This exercise was done for all public companies and few private companies (which helped us with the specific information). This helped us to derive a portion of the overall market and the overall market was derived based on other data points collected using secondary and primary research.

MnM analyzed analytics vendors’ offerings for Energy Management System (EMS) industry verticals in the energy and utility space. MnM have collected various data points related to the company information from company websites, annual reports, investor presentations, press releases, and news publications. We also have an access to various paid databases including Factiva, OneSource, Hoovers, and Bloomberg, from where we have also collected few relevant data points for each analytics vendor. This helps us understand the revenue breakdown by business segments and geographies.We have collected various data points for the entire industry ecosystem and analyzed various parameters including economic condition, regulations, industry use cases, etc. to understand the adoption trend for this market. Apart from some industry related articles, we have also referred to some government publications and industry journals for collecting data points. After collecting data points for both sides, the industry trend was estimated based on various parameters including IT spending (for some cases, Big Data spending) government regulations, M&A initiatives, recent developments pertaining to the market, R&D expenses, start-up ecosystem/funding, and technology maturity. After analyzing each of these factors, we have applied our statistical market engineering model on these factors to estimate the market size and forecast them. We have also verified our assumptions and estimated through primary research.