Feed Phosphates Market by Type (Dicalcium, Monocalcium, Mono-dicalcium, Defluorinated, and Tricalcium), Livestock (Ruminants, Swine, Poultry, and Aquaculture), Form (Powder and Granule), and Region - Global Forecast to 2028

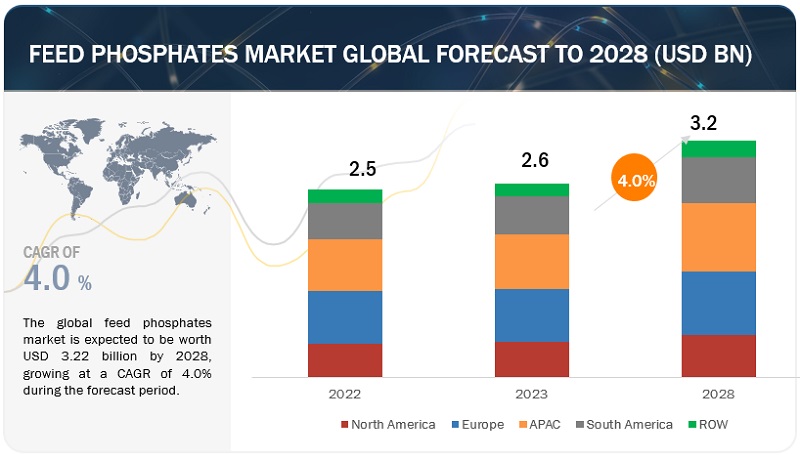

[271 Pages Report] The market for feed phosphates is estimated at USD 2.6 billion in 2023; it is projected to grow at a CAGR of 4.0% to reach USD 3.2 billion by 2028.

The feed phosphates market is experiencing growth due to several factors, including the increasing global demand for animal protein, expansion of livestock production, improved feed efficiency, emphasis on animal health, regulatory backing, technological advancements, rising awareness of animal nutrition, adoption of sustainable farming practices, and ongoing research and development endeavors. As the world's population continues to grow, the demand for animal-based products is expected to rise further, driving the feed phosphates market's expansion in the future.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Feed Phosphates Market Dynamics

Driver: Rise in consumption of meat and dairy products

The demand for meat, eggs, and dairy products in developing countries has also increased significantly over the past few years. According to Organisation for Economic Co-operation and Development (OECD), in 2021, global milk production, comprising approximately 81% cow milk, 15% buffalo milk, and 4% from goats, sheep, and camels combined, increased by 1.1% to reach approximately 887 million metric tonnes (Mt). This growth was primarily fueled by increased output in India and Pakistan, attributed to the expansion of dairy herds and improved availability of fodder, aided by favorable monsoon rains. According to OECD 2021, the per capita consumption of dairy products is projected to rise by 0.4% per year to reach 21.9 kg (milk solids equivalent) by 2031 in high-income countries. According to the same source, in comparison, low-middle-income countries are expected to experience an annual increase of 2.0% to reach 21.2 kg, while low-income countries are anticipated to see a 1.5% annual increase to reach 5.4 kg. Utilizing feed phosphates in dairy cattle diets can lead to improved feed efficiency. The presence of adequate phosphorus and other essential minerals in the feed enhances nutrient absorption and utilization in the rumen and digestive tract. As a result, dairy cows can convert feed into milk more efficiently, reducing wastage and enhancing overall feed efficiency.

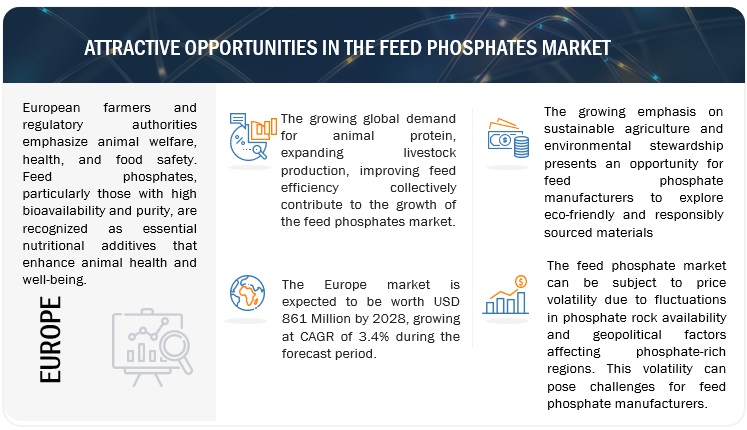

Restraint: Fluctuating prices of phosphate

According to the World Bank, phosphate rock prices are forecasted to increase from USD 91 per MT in 2017 to USD 125 per MT by 2030. As phosphate reserves are depleting, this leads to supply shortages and price volatility, creating challenges for feed phosphate producers to secure stable and sufficient raw materials. Higher production costs are incurred due to the increased expense of extracting and processing the remaining phosphate rock, which are passed on to end-users. The industry has a need to explore alternative phosphate sources and substitutes to mitigate the reliance on traditional reserves. This search for alternatives adds complexity and uncertainty to the market.

Any disruption in the supply chain or production capacity of phosphate rock can lead to price volatility. Geopolitical factors, such as export restrictions, trade disputes, and national policies of countries possessing significant phosphate reserves, can influence global phosphate supply and prices.

Opportunity: Innovation in technology, new raw materials, and production process

Advancements in technology have the power to revolutionize the feed phosphates industry. New extraction techniques, refining processes, and quality control systems can optimize production efficiency, reduce costs, and enhance the overall quality of feed phosphates. For example, innovative technologies such as nanotechnology, microencapsulation, automation, and advanced analytics improves the production yields, increase consistency, and streamline operations.

With advanced technology and improved understanding of animal nutrition, feed manufacturers are developing specialized feed phosphate products for different livestock sectors. This approach optimizes feed efficiency, supports targeted nutrient delivery, and promotes optimal animal health and growth. Innovations in production processes and raw materials help in meeting the evolving regulatory requirements. Compliance with stringent regulations related to quality, safety, and sustainability is crucial for market access and consumer trust. By adopting innovative practices and materials that align with regulatory standards, feed phosphate manufacturers are anticipated to differentiate themselves in the market.

Challenge: Toxicity of feed phosphates

Feed phosphates are a concentrated source of phosphorus, an essential nutrient for animal growth and metabolism. However, excessive intake of phosphorus can disrupt the delicate balance of minerals in an animal's body, particularly the calcium-phosphorus ratio. When the ratio is imbalanced, it is likely lead to health issues such as skeletal abnormalities, mineral deficiencies, or impaired bone development. This highlights the importance of proper formulation and dosage of feed phosphates to prevent phosphorus overdosing. Toxicity also results from mineral imbalances caused by an excessive intake of phosphorus relative to other minerals like calcium, magnesium, and zinc. These minerals play crucial roles in various physiological processes, and disturbances in their balance affect animal health and performance. For example, high phosphorus levels in the diet inhibits calcium absorption and utilization, leading to conditions like metabolic bone disorders or urinary calculi. Contamination of feed phosphates with heavy metals, such as lead, cadmium, mercury, or arsenic, is another concern. These contaminants originate from the phosphate rock used in the production of feed phosphates or from other sources during the manufacturing process. Phosphorus metabolism generates reactive oxygen species (ROS), which, if not properly managed by the animal's antioxidant defenses, leads to oxidative damage to cells and tissues. Prolonged oxidative stress results in inflammation, weakened immune response, and increased susceptibility to diseases. The interactions between feed phosphates and other nutrients in animal diets also influence their potential toxicity. For instance, high levels of dietary phytate, a form of phosphorus found in plant-based feed ingredients, reduces the availability of phosphorus for absorption. This results in phosphorus deficiency and compromised animal health, despite adequate levels of feed phosphates in the diet.

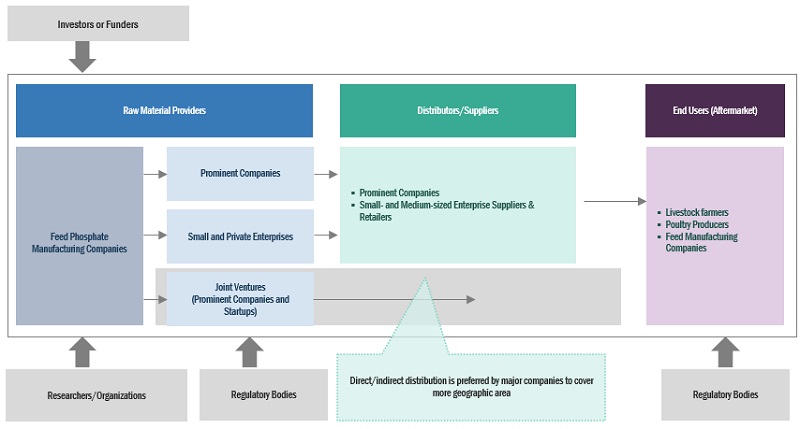

Feed Phosphates Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of feed phosphates market. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Mosiac (US), Nutrien Ltd (Canada), OCP (Morocco), Rotem (Turkey), Eurochem Group (Switzerland), Phosagro (Russia), Fosfitalia Group (Italy), Phosphea (France), YARA (Norway), and J. R. Simplot Company (US).

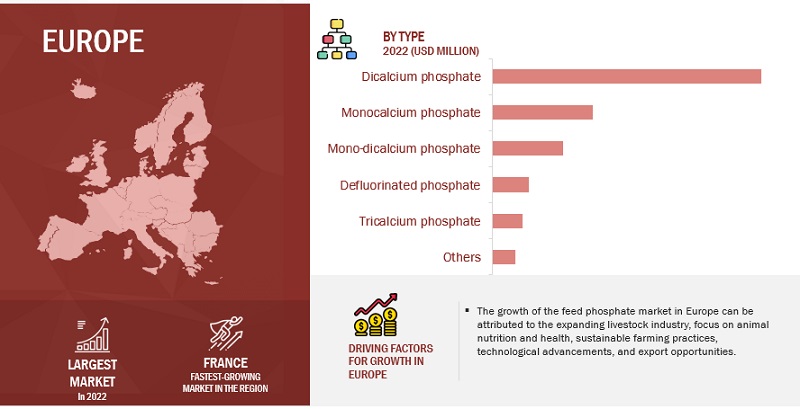

Based on type, dicalcium phosphate is estimated to account for the largest market share of the feed phosphates market

Based on type, dicalcium phosphate (DCP) segment is estimated to account for the largest market share. A proper calcium-to-phosphorus ratio is essential for animal nutrition. DCP provides an ideal balance of these minerals, ensuring that animals receive the right nutrients to support their growth and health. Compared to other feed phosphates, DCP is relatively cost-effective, making it an attractive option for farmers seeking affordable yet high-quality mineral supplements for their animals.

Poultry segment of the feed phosphates market by livestock is projected to witness the highest CAGR during the forecast period.

Based on livestock, the poultry segment estimated to register the highest growth rate between 2023-2028. Feed phosphates, including DCP and MCP, have gained regulatory approval and are widely accepted as safe and effective feed additives for poultry. Compliance with food safety regulations and guidelines encourages the use of feed phosphates in the poultry industry.

Based on form, powder segment is projected to witness the highest CAGR during the forecast period.

Powdered feed phosphates allow for the creation of homogeneous feed formulations. This uniformity is vital for ensuring that all animals in the herd or flock receive the same levels of essential minerals, contributing to uniform and steady development of animals. The use of powdered feed phosphates leads to improved efficiency in feed mills. The ease of mixing and uniform distribution reduces processing time and minimizes losses during manufacturing, contributing to cost savings for feed producers.

The South America market is projected to register a significant CAGR for the feed phosphates market.

The livestock sector of South America has also been witnessing exponential growth over the years owing to the steady demand brought on by the rise in meat consumption and poultry products.

According to OECD-FAO Agricultural Outlook 2021-2030, the export of meat is concentrated, and it is expected that the three leading meat-exporting countries - Brazil, the European Union, and the United States - will maintain a stable combined share of approximately 60% in the global meat exports over the forecast period. In 2021, Brazil, the top poultry meat exporter, is projected to become the largest beef exporter, holding a 22% market share. This rise in meat consumption and growth of the domestic livestock sector are expected to contribute to the growth of the feed phosphates industry.

Key Market Players

The key players in this include Mosiac (US), Nutrien Ltd. (Canada), OCP (Morocco), Rotem (Turkey), Eurochem Group (Switzerland), Phosagro (Russia), Fosfitalia Group (Italy), Phosphea (France), YARA (Norway), and J. R. Simplot Company (US).

These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Feed phosphates Market by Type (Dicalcium phosphate, Monocalcium phosphate, Mono-dicalcium phosphate, Defluorinated phosphate, Tricalcium phosphate, Others), Livestock (Poultry, Swine, Ruminants, Aquaculture and Others) and Form (Powder and Granules) and Region - Global Forecast to 2028 |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

Mosiac (US), Nutrien Ltd (Canada), OCP (Morocco), Rotem (Turkey), Eurochem Group (Switzerland), Phosagro (Russia), Fosfitalia Group (Italy), Phosphea (France), YARA (Norway), and J. R. Simplot Company (US) |

This research report categorizes the feed phosphates market based on by type, livestock, form, and region

Based on type, the feed phosphates market has been segmented as follows:

- Dicalcium phosphate

- Monocalcium phosphate

- Mono-dicalcium phosphate

- Defluorinated phosphate

- Tricalcium phosphate

- Others

Based on livestock, the feed phosphates market has been segmented as follows:

- Poultry

- Swine

- Ruminants

- Aquaculture

- Others

Based on the form, the the feed phosphates market has been segmented as follows:Solid

- Powder

- Granule

Based on the region, the feed phosphates market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In 2023, OCP Group, a prominent global provider of phosphate-based plant and animal nutrition solutions, and Fertinagro Biotech S.L., a major Spanish fertilizer producer, are delighted to announce the successful completion of OCP's acquisition of Global Feed S.L on May 17th, 2023. This acquisition reinforces OCP's dedication to establishing a strong position in the animal nutrition sector, further solidifying its role as a leading player in the industry.

- In 2020, Nutrien Ltd. entered into a definitive agreement to acquire the entire equity of the Tec Agro Group. Tec Agro, a prominent agricultural retailer operating in the state of Goiás, (Brazil) brings nearly 25 years of dedicated service to farmers and operates through eight retail branches. This acquisition of Tec Agro represents a significant advancement in establishing a robust presence within the vital and expanding Brazilian agricultural market.

- In 2018, Mosaic Company acquired the Vale Fertilizantes (a Brazilian fertilizer company that has five phosphate mines), thereby enhancing the company’s market access in the Brazilian feed phosphate market.

Frequently Asked Questions (FAQ):

Which are the major companies in the feed phosphates market? What are their major strategies to strengthen their market presence?

The key players in this includes Mosiac (US), Nutrien Ltd. (Canada), OCP (Morocco), Rotem (Turkey), Eurochem Group (Switzerland), Phosagro (Russia), Fosfitalia Group (Italy), Phosphea (France), YARA (Norway), and J. R. Simplot Company (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What are the drivers and opportunities for the feed phosphates market?

The rising global demand for meat and animal-based products is a significant driver for the feed phosphates market. Feed phosphate manufacturers benefit from expanding their markets globally, as meat production and consumption increase worldwide. Export opportunities arise as countries seek high-quality feed additives to support their growing livestock industries.

Which region is expected to hold the highest market share?

Europe dominated the fed phosphates marketin 2022, showcasing strong demand from feed phosphates market in the region. The growth of the feed phosphate market in Europe is attributed to the expanding livestock industry and focus on animal nutrition and health

Which are the key technology trends prevailing in the feed phosphates market?

Microencapsulation technology is being explored to protect and stabilize feed phosphates from premature degradation during feed processing and storage. This ensures that the phosphorus remains available to the animals over an extended period, optimizing its absorption and utilization.

Nanotechnology is being investigated to improve the delivery and release of feed phosphates in animal feed. Nanoparticle formulations have the potential to enhance the bioavailability of minerals, leading to more efficient nutrient absorption.

What is the total CAGR expected to be recorded for the feed phosphates during 2023-2028?

The CAGR is expected to record a CAGR of 4.0 % from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

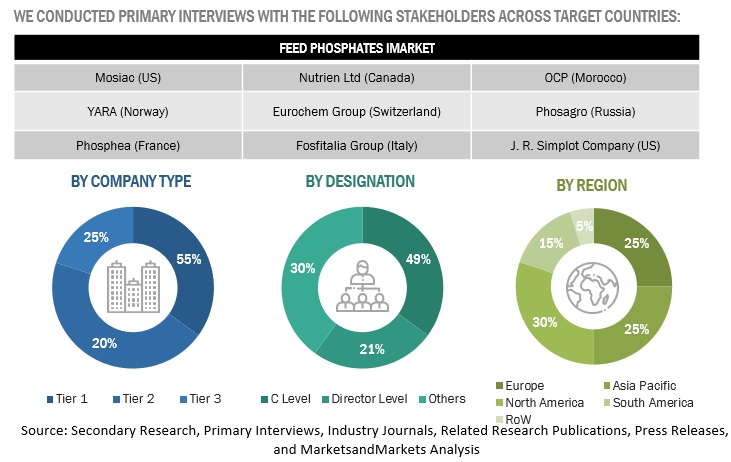

The study involved four major activities in estimating the current size of the feed phosphates market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles from regulatory bodies, trade directories by recognized authors, and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The feed phosphates market includes several stakeholders in the supply chain, including raw material suppliers, feed phosphates manufacturers, and regulatory organizations. Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the livestock sectors. The primary sources from the supply side include key opinion leaders and key manufacturers in the feed phosphates market.

To know about the assumptions considered for the study, download the pdf brochure

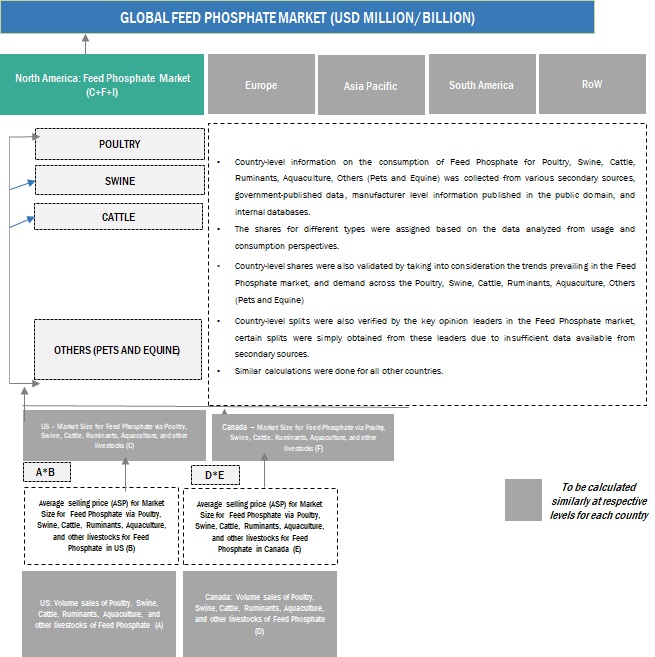

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the feed phosphates market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent markets—the feed additives market and feed binders market—were considered to validate further the market details of feed phosphates.

-

Bottom-up approach:

- The market size was analyzed based on the share of each livestock of feed phosphates and types at regional and country levels. Thus, the global market was estimated with a bottom-up approach at the country level.

- Other factors include demand from consumers for different feed phosphates; pricing trends; adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the feed phosphates market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global feed phosphates market Size: Bottom Up Approach

The bottom-up approach used the data extracted from secondary research to validate the market segment sizes obtained. The approach was employed to determine the overall size of the feed phosphates market in particular regions. Its share in the feed phosphates market at the country and regional levels was validated through primary interviews conducted with suppliers, dealers, and distributors.

To know about the assumptions considered for the study, Request for Free Sample Report

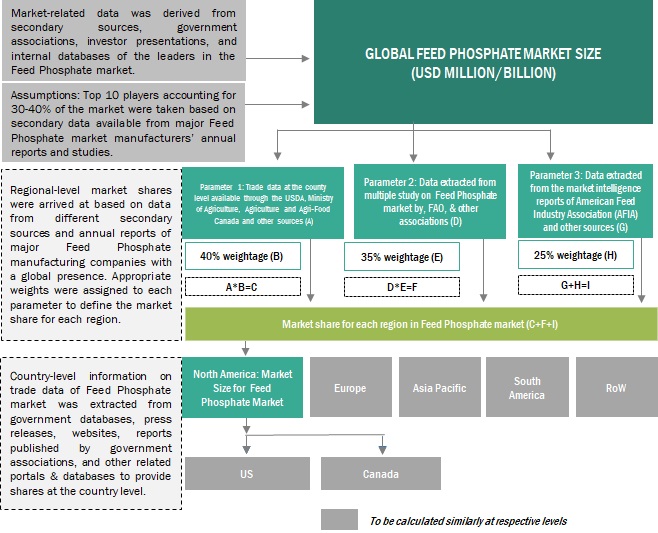

Global feed phosphates market Size: Top Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the segmentation) through percentage splits from secondary and primary research.

The top-down approach used to triangulate the data obtained through this study is explained in the next section:

-

In the global feed phosphates market, related secondary sources su

To know about the assumptions considered for the study, Request for Free Sample Report

ch as World Health Organization (WHO), Food and Agriculture organization (FAO), Association of Poultry Processors and Poultry Trade in the EU (AVEC) and Annual Reports of all major players were considered to arrive at the global market size. - The global number for feed phosphates was arrived upon after giving certain weightage factors for the data obtained from these secondary and primary sources.

- With the data triangulation procedure and data validation through primaries (from both supply and demand sides), the shares and sizes of the regional markets and individual markets were determined and confirmed.

- Data on company revenues, product launches, and global regulations for feed phosphates in the last four years was used to arrive at the country-wise market size. CAGR estimation of type and livestock segments was used and then validated from primary sources.

- feed phosphates market size estimation: top-down approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall feed phosphates market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

According to the Florida Industrial and Phosphate Research Institute, Monocalcium phosphate (MCP) and dicalcium phosphate (DCP) are the primary components of animal feed phosphates. These substances serve as essential ingredients in the production of livestock feed for animals such as cattle, pigs, poultry, and more.

Feed phosphates are defined as inorganic salts of phosphoric acid that are extracted from phosphate rock. These phosphates are an essential nutrient in animal diets, ensuring optimal growth, improving gut functionality, fertility, and aiding bone development. Such feed phosphates are often provided to animals in conjunction with calcium and magnesium, which further aid growth and development in animals.

Key Stakeholders

- Feed manufacturers, processors, traders, and distributors

- Animal husbandry companies

- Large-scale ranches and poultry farms

- R&D institutes

- Regulatory bodies

- Organizations such as the International Feed Industry Federation (IFIF)

- Associations and industry bodies such as The Association of American Feed Control Officials (AAFCO)

- Government agencies and NGOs

- Food safety agencies

- Financial institutions, importers, and exporters of feed phosphate ingredients and sources

- Feed & feed additive manufacturers

- Trade associations and industry bodies

- Importers and exporters of feed and feed additives

Report Objectives

Market Intelligence

- Determining and projecting the size of the feed phosphates market based on by type, livestock, form, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the feed phosphates market

Competitive Intelligence

- Identifying and profiling the key market players in the feed phosphates market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in the feed phosphates market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific feed phosphates market, by key country

- Further breakdown of the Rest of Europe feed phosphates market, by key country

Growth opportunities and latent adjacency in Feed Phosphates Market