Flame Retardants Market by Type (Aluminum Trihydrate, Antimony Oxide, Brominated), Application (Epoxy, Polyolefin, Unsaturated Polyester), End-Use Industry (Building & Construction, Electronics & Appliances), and Region - Global Forecast to 2028

Updated on : April 05, 2024

Flame Retardants Market

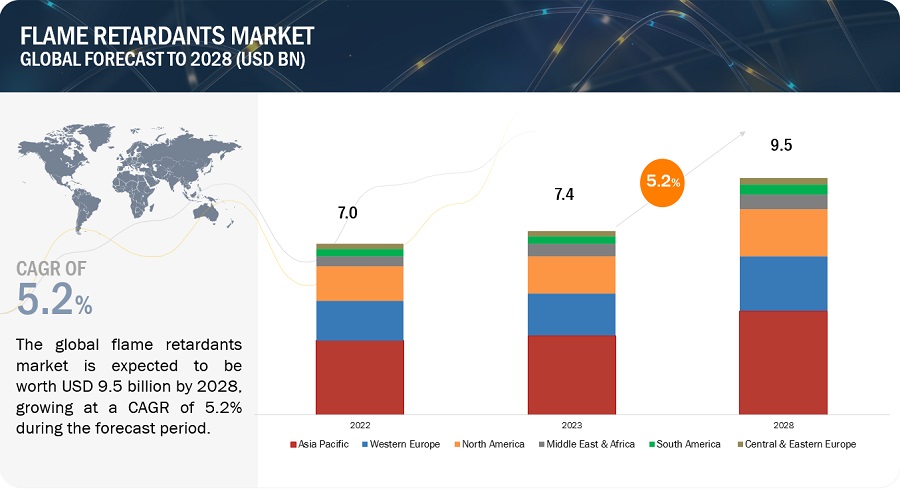

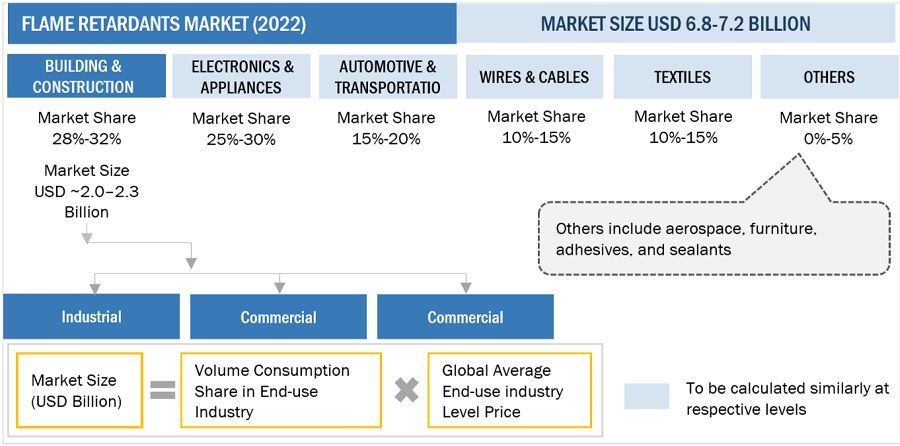

The global flame retardants market was valued at USD 7.0 billion in 2022 and is projected to reach USD 9.5 billion by 2028, growing at 5.2% cagr from 2023 to 2028. Building and construction is one of the major end-use industry of flame retardants. For building projects to be granted licenses and clearances, compliance with fire safety laws is essential. Construction materials need flame retardants in order to meet the local building authorities' fire performance standards. Materials used in constructions are frequently required to meet certain fire safety standards under building and construction rules. Flame retardants are essential to ensure that construction materials, such as insulation, flooring, coatings, and cables, comply with these regulations.

To know about the assumptions considered for the study, Request for Free Sample Report

Flame Retardants Market Dynamics

Driver: Strict fire safety guidelines to increase the demand for flame retardants in various applications

Strict fire safety guidelines and regulations indeed play a significant role in driving the demand for flame retardants across various industries. Government agencies and industry-specific regulatory bodies often establish stringent fire safety guidelines and standards that mandate the use of flame retardants in certain applications. Companies and manufacturers must comply with these requirements to ensure the safety of their products and operations. Building standards and fire safety regulations are particularly important to the construction business. These standards outline the fire performance specifications for building materials, and they usually call for the use of flame-retardant materials in crucial places like wiring, insulation, and structural elements. All these factors drive the market for flame retardants globally.

Restraints : Harmful chemicals used in flame retardants

Traditional flame retardants, especially those using bromine or chlorine, have been linked to threats to the environment and human health. These substances have the ability to accumulate in organisms, remain in the environment, and harm ecosystems. Regulation limits and a move towards more environmentally friendly options have been brought about by worries about these detrimental environmental effects. Some flame retardants have been associated with harmful health effects in people. For instance, several brominated flame retardants have been linked to neurological and developmental issues and are considered endocrine disruptors. Health concerns have prompted calls for the reduction or elimination of these chemicals in consumer products.

Opportunities: Rising demand for wires & cables globally

The demand for wires and cables globally is driven by a wide range of industries and applications. Wires and cables are fundamental components in various sectors, including electrical and electronic equipment, construction, automotive, telecommunications, energy, and manufacturing. Rapid urbanization and infrastructure development projects in emerging economies have led to increased demand for electrical wiring and cabling in buildings, transportation systems, and utilities. With the rise of electric vehicles (EVs) and the expansion of renewable energy systems, there is an increased demand for flame-retardant cables to ensure the safety and reliability of these technologies.

Challenges: Growing emphasis on environmental protection and sustainability

The growing emphasis on environmental protection is indeed a major challenge for the flame retardants market. While flame retardants play a crucial role in fire safety, there are concerns about the environmental and health impacts of certain types of flame retardants. Some traditional flame retardants, particularly those containing bromine or chlorine, can be persistent organic pollutants. These chemicals can persist in the environment, accumulate in ecosystems, and have the potential to disrupt wildlife and ecosystems. Concerns about these environmental impacts have led to regulations and restrictions in various regions. Governments and regulatory bodies in many countries have implemented or strengthened regulations aimed at phasing out or restricting the use of specific harmful flame retardants. These regulations can limit the market for products containing these chemicals.

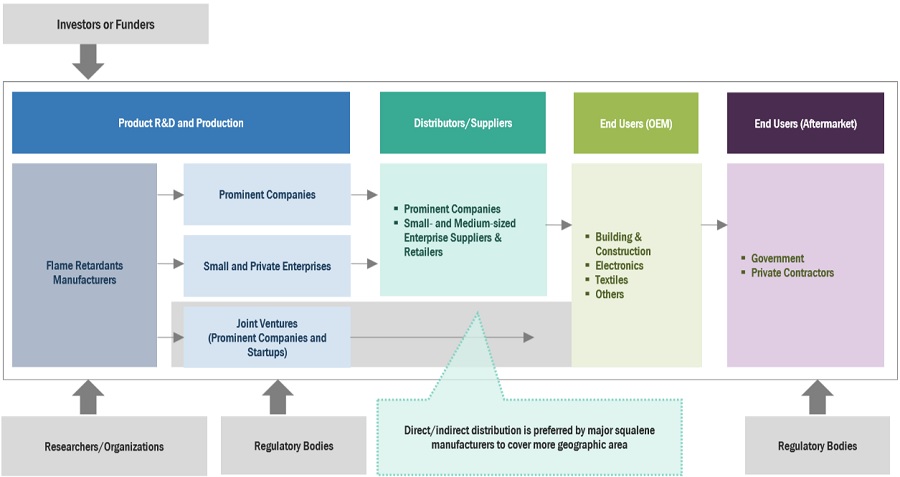

Flame Retardants Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of flame retardants. These companies have been in business for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Prominent companies in this market include Albemarle Corporation (US), Clariant AG (Switzerland), LANXESS AG (Germany), BASF SE (Germany), ICL Group Ltd. (Israel), Nabaltec AG (Germany), Huber Engineered Materials (US), ADEKA Corporation (Japan), Italmatch Chemicals S.p.A. (Italy), and Avient Corporation (US).

Based on type, nitrogen is projected to register highest CAGR, in terms of value, during the forecast period.

The plastics industry is a significant consumer of nitrogen-based flame retardants. These flame retardants are added to polymers, such as polyethylene, polypropylene, and polyurethane, to make plastic products safer by reducing their flammability. Common applications include electronics casings, automotive parts, and construction materials. Nitrogen-based flame retardants are also used in textiles and fabrics to enhance fire resistance. Flame-retardant clothing, upholstery, and curtains are examples of products where these chemicals may be employed to meet fire safety standards.

Based on end-use industry, building & construction was the largest segment for flame retardants market, in terms of value, in 2022.

A wide variety of construction applications, including residential dwellings, apartment buildings, commercial structures, educational institutions, healthcare facilities, and industrial facilities, use flame-retardant materials. While fire safety is a primary concern, there is also a growing emphasis on environmentally friendly flame-retardant options that have minimal environmental and health impacts. These eco-friendly options are gaining importance in the construction industry. The development of more efficient and environmentally friendly flame-retardant formulations for building materials is a goal of ongoing research and development. The performance and safety of building goods are improved overall because to advancements in flame retardant technology.

Based on application, polyolefins was the largest segment for flame retardants market, in terms of value, in 2022.

Flame-retardant polyolefins are used in industrial applications where fire safety is a concern, such as in the manufacturing of machinery and equipment. Flame-retardant polyolefins are utilized in power cables and insulation materials in the energy and utilities sector to guarantee the secure transfer of electricity. Increasing demand for wires & cables end-use industry drives the market for flame retardants in polyolefin application.

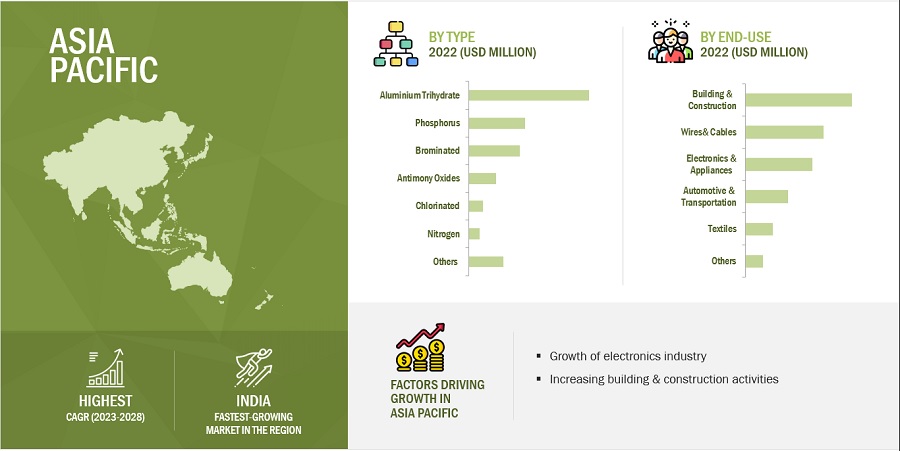

“Asia Pacific accounted for the largest market share for flame retardants market, in terms of value, in 2022”

Stricter safety and environmental standards are being implemented and enforced by governments and regulatory agencies across the Asia Pacific area. Flame retardants are frequently required under these rules in a variety of goods and sectors. Increasing awareness among consumers about fire safety and the potential hazards of non-flame-retardant products has driven the demand for flame-retardant materials in everyday consumer goods. In general, the Asia-Pacific region's fast industrialization, urbanization, and growing emphasis on safety and regulatory compliance across many industries are all intimately related to the region's demand for flame retardants. The demand for flame retardants in the Asia Pacific area is anticipated to stay strong as long as these trends exist.

To know about the assumptions considered for the study, download the pdf brochure

Flame Retardants Market Players

Albemarle Corporation (US), Clariant AG (Switzerland), LANXESS AG (Germany), BASF SE (Germany), ICL Group Ltd. (Israel), Nabaltec AG (Germany), Huber Engineered Materials (US), ADEKA Corporation (Japan), Italmatch Chemicals S.p.A. (Italy), and Avient Corporation (US). among others, these are the key manufacturers that secured major market share in the last few years.

Flame Retardants Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kiloton) and Value (USD Million) |

|

Segments covered |

Type, Application, End-use Industry, and Region |

|

Regions covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The key players profiled in the report include Albemarle Corporation (US), Clariant AG (Switzerland), LANXESS AG (Germany), BASF SE (Germany), ICL Group Ltd. (Israel), Nabaltec AG (Germany), Huber Engineered Materials (US), ADEKA Corporation (Japan), Italmatch Chemicals S.p.A. (Italy), and Avient Corporation (US). among others. |

This report categorizes the global Flame retardants market based on type, application, end-use industry and region.

On the basis of type, the flame retardants market has been segmented as follows:

- Aluminum trihydrate (ATH)

- Antimony Oxide

- Brominated

- Chlorinated

- Phosphorus

- Nitrogen

- Others

On the basis of application, the flame retardants market has been segmented as follows:

- Epoxy

- Polyolefins

- Unsaturated polyesters

- Polyvinyl chloride

- Polyurethane

- ABS & blends

- Polystyrene

- Others

On the basis of end-use industry, the flame retardants market has been segmented as follows:

- Building & Construction

- Electronics & Appliances

- Automotive & Transportation

- Wires & Cables

- Textiles

- Others

On the basis of region, the flame retardants market has been segmented as follows:

- Asia Pacific

- North America

- Western Europe

- Central & Eastern Europe

- Middle East & Arica

- South America

Recent Developments

- In January 2022, Huber Engineered Materials completed the acquisition of MAGNIFIN Magnesiaprodukte GmbH & Co. KG (“MAGNIFIN”). MAGNIFIN’s products are sold globally by Martinswerk GmbH as part of the HEM Fire Retardant Additives (FRA) strategic business unit, which produces a wide range of halogen-free fire retardants, smoke suppressants, and specialty aluminum oxides.

- In January 2020, BASF closed the acquisition of Solvay’s polyamide (PA 6.6) business. The transaction broadened BASF’s polyamide capabilities with innovative products. With the acquisition of Solvay’s polyamide business, BASF had its first Underwriter Laboratories (UL) certified lab in Asia, adding to its existing labs.

- In March 2020, Clariant collaborated with Floreon to expand its high-performance biopolymer applications to additional markets. The companies will work together on a broad range of additives such as stabilizers, flame retardants, and surface aids.

- In December 2021, Nabaltec AG expanded its production capacities for boehmite at the Schwandorf site, Germany, by investing an amount in the mid-double-digit million range. Production output will be more than doubled from 10,000 to 25,000 tons per year. Commissioning is slated for the second half of 2023.

Frequently Asked Questions (FAQ):

Which are the major players in flame retardants market?

The key players profiled in the report include Albemarle Corporation (US), Clariant AG (Switzerland), LANXESS AG (Germany), BASF SE (Germany), ICL Group Ltd. (Israel), Nabaltec AG (Germany), Huber Engineered Materials (US), ADEKA Corporation (Japan), Italmatch Chemicals S.p.A. (Italy), and Avient Corporation (US).

What are the drivers and opportunities for the flame retardants market?

The increasing demand from end-use industries and struct fire safety regulations are the major drives for flame retardants market. Also, demand for wires & cables is expected to create new opportunities for the market.

What are the various strategies key players are focusing within flame retardants market?

New product launches, expansion and partnership are some of the strategies adopted by key players to expand their global presence.

What is the CAGR of the Flame retardants Market?

The market is projected to grow at a CAGR of 5.2%, in terms of value, during the forecast period.

What are the major factors restraining flame retardants market growth during the forecast period?

Volatility in raw material prices and harmful chemical use in flame retardants is expected to restrict the market demand. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

|8 Flame retardants Market, By Application

11 Competitive Landscape

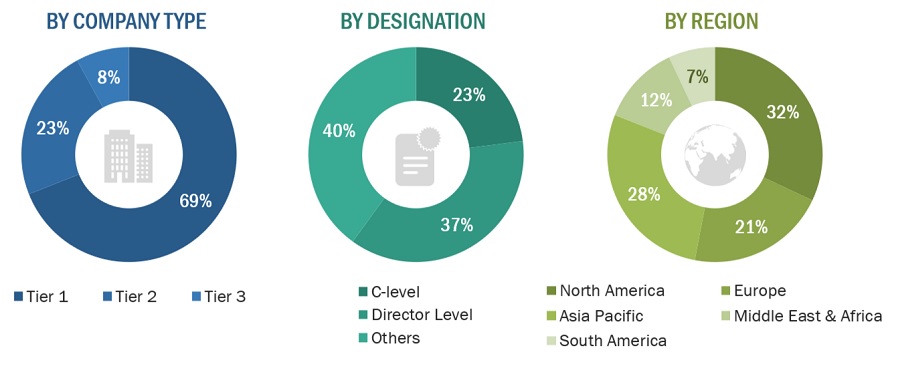

The study involved four major activities in estimating the market size for flame retardants. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Primary Research

The flame retardants market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the building & construction, electronics & appliances, automotive & transportation, wires & cables, textiles and others. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

ICL Group Ltd. |

Senior Manager |

|

Huber Engineered Materials |

Innovation Manager |

|

Nabaltec AG |

Sales Manager |

|

BASF SE |

Production Supervisor |

|

ADEKA Corporation |

Vice-President |

MARKET SIZE ESTIMATION

Both top-down and bottom-up approaches were used to estimate and validate the total size of the flame retardants market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Flame retardants Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Flame retardants Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the flame retardants industry.

Market Definition

Flame retardants are substances or chemicals that are included in a variety of goods to lessen their flammability and delay the spread of fires. They are applied to improve fire safety in a variety of industries and applications. When a substance is exposed to a flame or other heat source, flame retardants either prevent the material from igniting or delay its combustion. The primary purpose of flame retardants is to improve fire safety by reducing the risk of ignition, limiting the spread of flames, and reducing the release of toxic smoke and gases during a fire. They are used to protect people, property, and valuable assets from the devastating effects of fires.

Key Stakeholders

- Flame retardants manufacturers

- Flame retardants suppliers

- Raw material suppliers

- Service providers

- End users, such as building & construction, electronics & appliances, wires & cables, textiles and other companies

- Government bodies

Report Objectives

- To define, describe, and forecast the flame retardants market in terms of value and volume

- To provide detailed information regarding the drivers, opportunities, restraints, and challenges influencing market growth

- To estimate and forecast the market size by type, application, end-use industry, and region

- To forecast the size of the market for five main regions: Western Europe, Central & Eastern Europe, North America, Asia Pacific, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to their growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as deals and expansions, in the market

- To analyze the impact of the recession on the market

- To analyze the impact of COVID-19 on the market and end-use industries

- To strategically profile key players and comprehensively analyze their growth strategies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Flame Retardants Market

Interest in FR applications going into polymer compounding - specifically W&C, construction. Also interested in reports on NHFRs.

Flame retardant supply and demand by region

Market demand, current market trends, and key drivers of flame retardants market

Generic idea on FRs an their uses

Information on global Wire and Cable market for Low Voltage and forFlame retardant cable

Interested in Wire and Cable global market for Low Voltage and forFlame retardant cable (telecom cables and power cables).

Interested in Flame Retardants market with Ceramics segment

Enquiry on dispatch and Research Methodology

Brominated flame retardant contains of polybrominated dibenzo-p-dioxins / dibenzofurans.

Looking for market share of flame retardant

Flame retardant market by type, end-use industry, and global forecast

Information regarding the market size, trends and regulations, and key players in LA.

DecaBDE market

Global forest fire retardants demand

Looking for report on FR market for the U.S. and Canada

Specific information on flame retardant market in US and Canada

Flam retardants market of India

Weather resistant fire retardant gelcoat for Building applications according highest standards such as EN 13501 and ASTM E 84