Healthcare Business Intelligence (BI) Market by Component (Platform, Software, Service), Function (OLAP, Performance Management), Application (RCM, Inventory, Strategy Analysis), Deployment Model (Cloud, Hybrid) & End User (Payer, Hospital) - Forecast to 2023

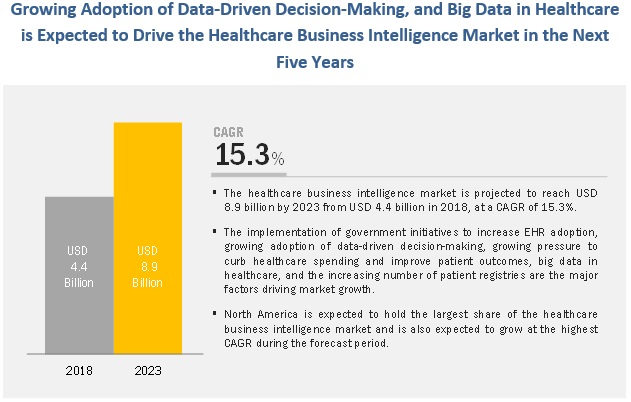

[194 Pages Report] The healthcare business intelligence (BI) market is expected to reach USD 8.9 billion by 2023 from USD 4.4 billion in 2018, at a CAGR of 15.3% during the forecast period. The study involved four major activities to estimate the current size of the market. Exhaustive secondary research was done to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was mainly used to identify and collect information for the extensive, technical, market-oriented, and commercial study of the healthcare business intelligence market. Secondary sources includes directories; databases such as Bloomberg Business, Factiva, and Wall Street Journal; white papers; and annual reports were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

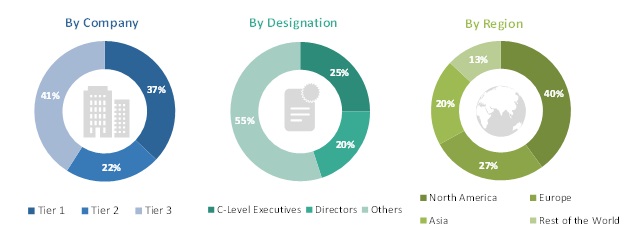

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the healthcare business intelligence market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- Healthcare business intelligence revenue generated by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the market on the basis of component, function, application, deployment model, end user, and region.

- To provide detailed information regarding the factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments in North America, Europe, Asia, and the Rest of the World (RoW)2

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments, such as product launches and enhancements, agreements, partnerships, collaborations, acquisition, and expansions in the healthcare business intelligence market

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component, function, application, deployment model, end user, and region |

|

Geographies covered |

North America, Asia, Europe, and the Rest of the World |

|

Companies covered |

Microsoft (US), IBM (US), Oracle (US), SAP SE (Germany), SAS Institute Inc. (US), Tableau Software (US), MicroStrategy Incorporated (US), QlikTech International AB (US), Information Builders (US), Sisense Inc. (US), Yellowfin BI (Australia), and BOARD International (Switzerland) |

This report categorizes the healthcare business intelligence market into the following segments and subsegments:

On the basis of component, the market has been segmented as follows:

- Platforms

- Software

- Services

On the basis of function, the market has been segmented as follows:

- Query and Reporting

- OLAP and Visualization

- Performance Management

On the basis of Application, the market has been segmented as follows:

-

Financial Analysis

- Claims Processing

- Revenue Cycle Management

- Payment Integrity and Fraud, Waste, & Abuse (FWA)

- Risk Adjustment and Risk Assessment

-

Operational Analysis

- Supply Chain Analysis

- Workforce Analysis

- Strategic Analysis

-

Clinical Analysis

- Quality Improvement and Clinical Benchmarking

- Clinical Decision Support

- Regulatory Reporting and Compliance

- Comparative Analytics/Effectiveness

- Precision Health

On the basis of Deployment model, the market has been segmented as follows:

- On-premise Model

- Cloud-based Model

- Hybrid Model

On the basis of Deployment model, the market has been segmented as follows:

-

Payers

- Private Insurance Companies

- Government Agencies

- Employers and Private Exchanges

-

Providers

- Hospitals, Physician Practices, and IDNS

- Post-acute Care Organizations

- Ambulatory Care Settings

- Other End Users [health information exchanges (HIEs), accountable care organizations (ACOs), managed care organizations (MCOs), and third-party administrators (TPAs)]

On the basis of Region, the market has been segmented as follows:

- North America

- Europe

- Asia

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for this report.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Factors such as the implementation of government initiatives to increase EHR adoption, growing adoption of data-driven decision-making, growing pressure to curb healthcare spending and improve patient outcomes, big data in healthcare, and the increasing number of patient registries are expected to drive the growth of the healthcare business intelligence (BI) market.

Vendors are increasingly delivering BI platforms with high levels of internal platform integration and embedded BI capabilities which is driving the growth of this segment

On the basis of component, the healthcare BI market is segmented into platforms, software, and services. In 2018, the healthcare business intelligence platforms segment are expected to account for the largest share of the market. The large share of this market segment is mainly driven by the increasing requirement for customized BI solutions catering to individual requirements of organizations and allowing them the flexibility to build and integrate BI solutions into existing healthcare business applications for higher efficiency and reduced costs.

OLAP & visualization is expected to account for the largest share of the healthcare business intelligence market in 2018

The market, by function, is segmented into OLAP & visualization, performance management, and query & reporting. In 2018, OLAP & visualization is expected to account for the largest share of the market. OLAP & visualization provides quick insights for decision-making, allows for productivity improvement, and provides competitive advantages; these benefits have supported the growth of this market segment.

The increasingly focusing on cutting costs and implementing practices that will help their operations remain profitable has made financial analysis solutions all the more significant

Based on application, the healthcare business intelligence (BI) market is segmented into clinical analysis, financial analysis, and operational analysis. In 2018, financial analysis segment are expected to account for the largest share of the market. Due to the rising focus of payers on the early detection of fraud and reducing preventable costs, the market for financial analysis is expected to register a significant growth during the forecast period.

On-premise solutions to account for the largest share of the healthcare BI market in 2018

Based on deployment model, the market is segmented into on-premise, hybrid, and cloud-based models. In 2018, on-premise model segment are expected to account for the largest share of the market. This can majorly be attributed to the fact that the on-premise model is more customizable than the other two deployment models.

Payers segment to account for the largest share of the healthcare business intelligence (BI) market in 2018

On the basis of end user, the market is segmented into payers, providers, and other end users. In 2018, the payers segment is expected to account for the largest share of the market. Factors such as rising healthcare costs; the growing need to increase memberships and curb fraudulent claims, optimize provider networks, and reduce operational costs; and increasing competition are compelling healthcare payers to adopt BI solutions.

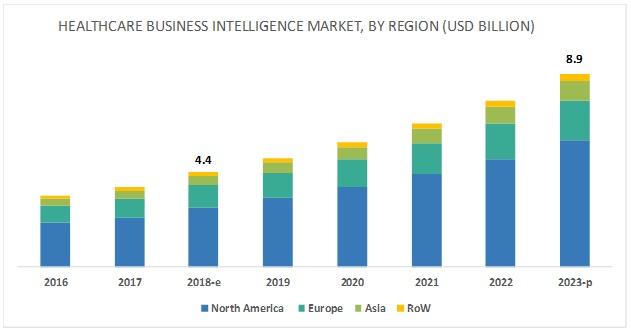

North America is expected to account for the largest market size during the forecast period

The market is dominated by North America, followed by Europe, Asia, and RoW. The market in North America is expected to witness the highest growth during the forecast period. The high growth of the North American market can be attributed to the increasing adoption of healthcare intelligence solutions and services by healthcare providers (especially in the US) to provide better quality care and lower healthcare costs is a major factor driving market growth.

Key players in healthcare business intelligence (BI) market

The market is highly competitive in nature, with several big as well as emerging players. Prominent players in this market include Microsoft (US), IBM (US), Oracle (US), SAP SE (Germany), SAS Institute Inc. (US), Tableau Software (US), MicroStrategy Incorporated (US), QlikTech International AB (US), Information Builders (US), Sisense Inc. (US), Yellowfin BI (Australia), and BOARD International (Switzerland).

IBM is one of the key players in the healthcare BI market and provides a comprehensive range of solutions for this market. IBM is an innovation-centric company; its R&D expenditure has increased substantially in 2017 as compared to 2015. In 2017, it invested 7.3% of its annual revenue in R&D activities. This significant investment allows the company to offer innovative solutions by adopting new product launches. With an aim to increase its footprint in various sectors, IBM has adopted inorganic strategies, such as acquisitions, collaborations, and partnerships.

Recent Developments

- In 2018, Oracle acquired Zenedge (US) to secure critical IT systems deployed via cloud, on-premise, or hybrid hosting environments with the help of Zenedge.

- In 2018, SAS entered into an agreement with Deloitte (Canada) to support their existing strategic alliance that will leverage their combined expertise to introduce lower-risk and higher-quality outcomes in the insurance marketplace.

- In 2017, Microsoft partnered with SAP SE (Germany) to drive more business innovation in the cloud and provide joint support services to ensure the best cloud experience for customers.

Key Questions addressed by the report

- Where will all these developments take the industry in the mid to long term?

- What types of annual and multi-year partnership are healthcare business intelligence companies exploring?

- Which are the key players in the market and how intense is the competition?

- Which are the recent contracts and agreements key players have signed?

- What are the recent trends affecting healthcare BI solution manufacturers and independent service organizations?

Frequently Asked Questions (FAQ):

How big is the Healthcare Business Intelligence (BI) Market ?

Healthcare Business Intelligence (BI) Market worth $8.9 billion by 2023.

What is the growth rate of Healthcare Business Intelligence (BI) Market ?

Healthcare Business Intelligence (BI) Market grows at a CAGR of 15.3% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Healthcare Business Intelligence Market Overview

4.2 Financial Analysis Market, By Type & Region (2018)

4.3 Healthcare Business Intelligence Market, By Component, 2018 vs 2023 (USD Billion)

4.4 Healthcare Business Intelligence Market, By Function, 2018 vs 2023 (USD Billion)

4.5 Healthcare Business Intelligence Market, By Deployment Model, 2018 vs 2023 (USD Billion)

4.6 Healthcare Business Intelligence Market, By End User, 2018 vs 2023 (USD Billion)

4.7 Healthcare Business Intelligence Market: Geographical Snapshot

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Adoption of Data-Driven Decision-Making

5.2.1.2 Implementation of Government Initiatives to Increase EHR Adoption

5.2.1.3 Growing Pressure to Curb Healthcare Spending and Improve Patient Outcomes

5.2.1.4 Big Data in Healthcare

5.2.1.5 Increasing Number of Patient Registries

5.2.2 Restraints

5.2.2.1 Requirement of High Investments

5.2.3 Opportunities

5.2.3.1 Advanced Analytics Enhancing Traditional Bi

5.2.3.2 Growing Demand for Cloud-Based Healthcare BI Solutions

5.2.3.3 Increasing Focus on Value-Based Medicine

5.2.3.4 Use of BI in Precision and Personalized Medicine

5.2.4 Challenges

5.2.4.1 Patient Data Confidentiality

5.2.4.2 Concerns Regarding Inaccurate and Inconsistent Data

6 Healthcare Business Intelligence Market, By Component (Page No. - 52)

6.1 Introduction

6.2 Platforms

6.2.1 Vendors are Increasingly Delivering BI Platforms With High Levels of Internal Platform Integration and Embedded BI Capabilities

6.3 Software

6.3.1 BI Software Plays A Critical Role in Deriving Information That is Instrumental in Driving the Growth of the Healthcare Industry

6.4 Services

6.4.1 Services to Register the Highest Growth Rate During the Forecast Period

7 Healthcare Business Intelligence Market, By Function (Page No. - 57)

7.1 Introduction

7.2 Olap & Visualization

7.2.1 North American Market to Grow at the Highest Rate

7.3 Performance Management

7.3.1 User-Friendliness and Accessibility of Solutions are Current Focus Areas for BI Vendors in This Market Space

7.4 Query and Reporting

7.4.1 Eliminating Manual Reviews and Modernizing Record-Keeping to Drive the Growth of This Segment

8 Healthcare Business Intelligence Market, By Application (Page No. - 62)

8.1 Introduction

8.2 Financial Analysis

8.2.1 Claims Processing

8.2.1.1 Need to Reduce False Claims and Improve Claim Response Times Will Support the Use of Claims Bi

8.2.2 Revenue Cycle Management

8.2.2.1 Healthcare Organizations are Looking to BI for Rcm Applications for Proactive Decision-Making

8.2.3 Payment Integrity and Fraud, Waste, and Abuse

8.2.3.1 BI Enables the Early-Stage Detection of Fraud for Healthcare Payers

8.2.4 Risk Adjustment and Risk Assessment

8.2.4.1 Adjustment and Assessment of Risk Allows for Optimization of Cash Flows and Improved Financial Performance

8.3 Clinical Analysis

8.3.1 Quality Improvement and Clinical Benchmarking

8.3.1.1 Benchmarking Allows for the Identification of the Highest Levels of Performance

8.3.2 Clinical Decision Support

8.3.2.1 Predictive Analytics-Equipped Cds Allows for Specific Data Extrapolation and Guidance

8.3.3 Regulatory Reporting and Compliance

8.3.3.1 Stringent Requirements Have Supported the Need for Compliance Adherence Solutions

8.3.4 Comparative Analytics/Effectiveness

8.3.4.1 Broad Aggregation of Clinical Data Across Stakeholder Purviews Allows for Performance Comparison

8.3.5 Precision Health

8.3.5.1 Government Initiatives Will Create A Demand for Analytical Solutions for Personalized Medicine

8.4 Operational Analysis

8.4.1 Inventory Analysis

8.4.1.1 Supply Chain Expenses Can Be as High as 35–45% of Total Operating Costs

8.4.2 Workforce Analysis

8.4.2.1 Need for Real-Time Resource Demand and Supply Data has Supported the Use of Workforce Analysis

8.4.3 Strategic Analysis

8.4.3.1 BI Tools Leverage Collected Data to Facilitate Strategic Analysis for Goal Adherence and Development

9 Healthcare Business Intelligence Market, By Deployment Model (Page No. - 78)

9.1 Introduction

9.2 On-Premise Model

9.2.1 On-Premise Solutions to Account for the Largest Share of the Healthcare Business Intelligence Market in 2018

9.3 Hybrid Model

9.3.1 in Hybrid Solutions, the Software and Database of Each Client is Stored Separately on A Third-Party Server

9.4 Cloud-Based Model

9.4.1 Cloud-Based Healthcare Business Intelligence Solutions to Register the Highest Growth During the Forecast Period

10 Healthcare Business Intelligence Market, By End User (Page No. - 83)

10.1 Introduction

10.2 Payers

10.2.1 Private Insurance Companies

10.2.1.1 Private Insurance Companies to Account for the Largest Share of the Healthcare BI Payers Market in 2018

10.2.2 Government Agencies

10.2.2.1 Increasing Adoption of Healthcare BI Solutions in Government Agencies is Driving the Growth of This Segment

10.2.3 Employers and Private Exchanges

10.2.3.1 The Growing Private Hies Market Will Provide Significant Growth Opportunities for This Segment

10.3 Providers

10.3.1 Hospitals, Physician Practices, and IDNS

10.3.1.1 Growing Utilization of BI Solutions By Hospitals, Medical Groups, and Physician Practices Will Drive the Growth for This Segment

10.3.2 Post-Acute Care Organizations

10.3.2.1 Maximum Accessibility to All Data Relevant to the Treatment History of Their Patients Will Drive the Growth for This Segment

10.3.3 Ambulatory Care Settings

10.3.3.1 Rising Need to Control the Cost of Healthcare Will Drive the Growth of This Segment

10.4 Other End Users

11 Healthcare Business Intelligence Market, By Region (Page No. - 96)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Rising Healthcare Costs Will Support the Demand for Hcit Solutions in the US

11.2.2 Canada

11.2.2.1 Challenges Affecting the Canadian Healthcare System Include Growing Patient Volumes and Data Management

11.3 Europe

11.3.1 Germany

11.3.1.1 Focus on Big Data Management Will Support Hc BI Implementation in Germany

11.3.2 UK

11.3.2.1 Increasing Venture Capitalist Investments to Improve Healthcare BI in UK Region

11.3.3 France

11.3.3.1 Limited Developments in Hcit and Lack of Awareness Have Resulted in Slow Growth

11.3.4 Rest of Europe

11.4 Asia

11.4.1 Asian Healthcare Systems Will Follow Trends in Developed Countries for the Implementation of Hcit

11.5 RoW

11.5.1 Australia and New Zealand Show High Emr Adoption Rates

12 Competitive Landscape (Page No. - 149)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Situation and Trends

13 Company Profiles (Page No. - 155)

(Business Overview, Products Offered, Recent Developments, MnM View)*

13.1 Microsoft

13.2 IBM

13.3 Oracle

13.4 Sap

13.5 SAS Institute

13.6 Tableau Software

13.7 Microstrategy

13.8 Qlik Technologies

13.9 Information Builders

13.10 Sisense

13.11 Yellowfin International

13.12 Board International

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 187)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (150 Tables)

Table 1 Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 2 Healthcare Business Intelligence Platforms Market, By Region, 2016–2023 (USD Million)

Table 3 Healthcare Business Intelligence Software Market, By Region, 2016–2023 (USD Million)

Table 4 Healthcare Business Intelligence Services Market, By Region, 2016–2023 (USD Million)

Table 5 Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 6 Healthcare Business Intelligence Olap and Visualization Market, By Region, 2016–2023 (USD Million)

Table 7 Healthcare Business Intelligence Performance Management Market, By Region, 2016–2023 (USD Million)

Table 8 Healthcare Business Intelligence Query and Reporting Market, By Region, 2016–2023 (USD Million)

Table 9 Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 10 Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 11 Healthcare Business Intelligence Market for Financial Analysis Applications, By Region, 2016–2023 (USD Million)

Table 12 Claims Processing Market, By Region, 2016–2023 (USD Million)

Table 13 Revenue Cycle Management Market, By Region, 2016–2023 (USD Million)

Table 14 Payment Integrity and Fwa Market, By Region, 2016–2023 (USD Million)

Table 15 Risk Adjustment and Risk Assessment Market, By Region, 2016–2023 (USD Million)

Table 16 Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 17 Healthcare Business Intelligence Market for Clinical Analysis Applications, By Region, 2016–2023 (USD Million)

Table 18 Quality Improvement and Clinical Benchmarking Market, By Region, 2016–2023 (USD Million)

Table 19 Clinical Decision Support Market, By Region, 2016–2023 (USD Million)

Table 20 Regulatory Reporting and Compliance Market, By Region, 2016–2023 (USD Million)

Table 21 Comparative Analytics/Effectiveness Market, By Region, 2016–2023 (USD Million)

Table 22 Precision Health Market, By Region, 2016–2023 (USD Million)

Table 23 Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 24 Healthcare Business Intelligence Market for Operational Analysis Applications, By Region, 2016–2023 (USD Million)

Table 25 Inventory Analysis Market, By Region, 2016–2023 (USD Million)

Table 26 Workforce Analysis Market, By Region, 2016–2023 (USD Million)

Table 27 Strategic Analysis Market, By Region, 2016–2023 (USD Million)

Table 28 Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 29 On-Premise Healthcare Business Intelligence Solutions Market, By Region, 2016–2023 (USD Million)

Table 30 Hybrid Healthcare Business Intelligence Solutions Market, By Region, 2016–2023 (USD Million)

Table 31 Cloud-Based Healthcare Business Intelligence Solutions Market, By Region, 2016–2023 (USD Million)

Table 32 Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 33 Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 34 Healthcare Business Intelligence Market for Payers, By Region, 2016–2023 (USD Million)

Table 35 Healthcare Business Intelligence Market for Private Insurance Companies, By Region, 2016–2023 (USD Million)

Table 36 Healthcare Business Intelligence Market for Government Agencies, By Region, 2016–2023 (USD Million)

Table 37 Healthcare Business Intelligence Market for Employers and Private Exchanges, By Region, 2016–2023 (USD Million)

Table 38 Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 39 Healthcare Business Intelligence Market for Providers, By Region, 2016–2023 (USD Million)

Table 40 Healthcare Business Intelligence Market for Hospitals, Physician Practices, and IDNS, By Region, 2016–2023 (USD Million)

Table 41 Healthcare Business Intelligence Market for Post-Acute Care Organizations, By Region, 2016–2023 (USD Million)

Table 42 Healthcare Business Intelligence Market for Ambulatory Care Settings, By Region, 2016–2023 (USD Million)

Table 43 Healthcare Business Intelligence Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 44 Healthcare Business Intelligence Market, By Region, 2016–2023 (USD Million)

Table 45 North America: Healthcare Business Intelligence Market, By Country, 2016–2023 (USD Million)

Table 46 North America: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 47 North America: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 48 North America: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 49 North America: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 50 North America: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 51 North America: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 52 North America: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 53 North America: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 54 North America: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 55 North America: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 56 US: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 57 US: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 58 US: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 59 US: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 60 US: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 61 US: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 62 US: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 63 US: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 64 US: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 65 US: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 66 Canada: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 67 Canada: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 68 Canada: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 69 Canada: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 70 Canada: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 71 Canada: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 72 Canada: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 73 Canada: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 74 Canada: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 75 Canada: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 76 Europe: Healthcare Business Intelligence Market, By Country, 2016–2023 (USD Million)

Table 77 Europe: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 78 Europe: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 79 Europe: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 80 Europe: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 81 Europe: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 82 Europe: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 83 Europe: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 84 Europe: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 85 Europe: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 86 Europe: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 87 Germany: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 88 Germany: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 89 Germany: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 90 Germany: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 91 Germany: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 92 Germany: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 93 Germany: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 94 Germany: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 95 Germany: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 96 Germany: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 97 UK: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 98 UK: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 99 UK: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 100 UK: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 101 UK: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 102 UK: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 103 UK: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 104 UK: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 105 UK: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 106 UK: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 107 France: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 108 France: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 109 France: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 110 France: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 111 France: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 112 France: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 113 France: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 114 France: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 115 France: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 116 France: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 117 RoE: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 118 RoE: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 119 RoE: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 120 RoE: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 121 RoE: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 122 RoE: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 123 RoE: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 124 RoE: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 125 RoE: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 126 RoE: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 127 Asia: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 128 Asia: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 129 Asia: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 130 Asia: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 131 Asia: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 132 Asia: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 133 Asia: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 134 Asia: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 135 Asia: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 136 Asia: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 137 RoW: Healthcare Business Intelligence Market, By Component, 2016–2023 (USD Million)

Table 138 RoW: Healthcare Business Intelligence Market, By Function, 2016–2023 (USD Million)

Table 139 RoW: Healthcare Business Intelligence Market, By Application, 2016–2023 (USD Million)

Table 140 RoW: Healthcare Business Intelligence Market for Financial Analysis Applications, By Type, 2016–2023 (USD Million)

Table 141 RoW: Healthcare Business Intelligence Market for Clinical Analysis Applications, By Type, 2016–2023 (USD Million)

Table 142 RoW: Healthcare Business Intelligence Market for Operational Analysis Applications, By Type, 2016–2023 (USD Million)

Table 143 RoW: Healthcare Business Intelligence Market, By Deployment Model, 2016–2023 (USD Million)

Table 144 RoW: Healthcare Business Intelligence Market, By End User, 2016–2023 (USD Million)

Table 145 RoW: Healthcare Business Intelligence Market for Payers, By Type, 2016–2023 (USD Million)

Table 146 RoW: Healthcare Business Intelligence Market for Providers, By Type, 2016–2023 (USD Million)

Table 147 Agreements, Partnerships, and Collaborations

Table 148 Product Launches and Enhancements

Table 149 Acquisitions

Table 150 Expansions

List of Figures (40 Figures)

Figure 1 Healthcare Business Intelligence: Market Segmentation

Figure 2 Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Healthcare Business Intelligence Market, By Component, 2018 vs 2023 (USD Billion)

Figure 7 Healthcare Business Intelligence Market, By Function, 2018 vs 2023 (USD Billion)

Figure 8 Healthcare Business Intelligence Market, By Application, 2018 vs 2023 (USD Billion)

Figure 9 Healthcare Business Intelligence Market, By Deployment Model, 2018 vs 2023 (USD Billion)

Figure 10 Healthcare Business Intelligence Market, By End User, 2018 vs 2023 (USD Billion)

Figure 11 Geographical Snapshot of the Healthcare Business Intelligence Market

Figure 12 Big Data in Healthcare is Expected to Drive the Healthcare Business Intelligence Market in the Next Five Years

Figure 13 North America to Dominate the Healthcare Business Intelligence Market for Financial Analysis in 2018

Figure 14 Platforms to Lead the Healthcare Business Intelligence Market in 2023

Figure 15 Performance Management Segment to Register the Highest CAGR During the Forecast Period

Figure 16 Cloud-Based Model Segment to Register the Highest CAGR During the Forecast Period

Figure 17 Payers to Lead the Healthcare Business Intelligence End-User Market During the Study Period

Figure 18 The US to Witness the Highest Growth During the Forecast Period

Figure 19 Healthcare Business Intelligence Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 EHR Adoption Rate Among Healthcare Providers in the US (2013–2017)

Figure 21 Healthcare Spending as A Percentage of GDP, By Country, 2017

Figure 22 Platforms to Dominate the Healthcare Business Intelligence Market During the Forecast Period

Figure 23 Performance Management Segment to Dominate the Healthcare Business Intelligence Market During the Forecast Period

Figure 24 Clinical Analysis Applications Segment to Register the Highest CAGR During the Forecast Period

Figure 25 Cloud-Based Healthcare Business Intelligence Solutions Segment to Register the Highest Growth During the Forecast Period

Figure 26 Payers to Dominate the Healthcare Business Intelligence Market in 2018

Figure 27 North America: Market Snapshot

Figure 28 Europe: Market Snapshot

Figure 29 Asia: Market Snapshot

Figure 30 RoW: Market Snapshot

Figure 31 Key Developments in the Healthcare Business Intelligence Market From 2015 to 2018

Figure 32 Market Evolution Framework

Figure 33 Market Ranking Analysis of Key Healthcare Business Intelligence Solution Providers, 2017

Figure 34 Microsoft: Company Snapshot

Figure 35 IBM: Company Snapshots

Figure 36 Oracle: Company Snapshot

Figure 37 SAP SE: Company Snapshot

Figure 38 SAS Institute: Company Snapshot

Figure 39 Tableau Software: Company Snapshot

Figure 40 Microstrategy: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Business Intelligence (BI) Market