Hot Melt Adhesives Market (HMA Market) by Type (EVA, SBC, MPO, APAO, PA, PO, PU), Application (Packaging Solutions, Nonwoven Hygiene Products, Furniture & Woodwork, Bookbinding) and Region (APAC, Europe, North America, RoW) - Global Forecast (2022 - 2027)

Hot Melt Adhesives Market

The global hot melt adhesives market was valued at USD 9.1 billion in 2022 and is projected to reach USD 11.4 billion by 2027, growing at 4.8% cagr from 2022 to 2027. The packaging solutions, by application type in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for HMA.

Market.jpg)

To know about the assumptions considered for the study, Request for Free Sample Report

Hot Melt Adhesives Market (HMA Market) Dynamics

Drivers: High demand in DIY applications

Hot Melt Adhesives (HMA) can bond to a wide variety of materials and surfaces such as ceramic, fabric, papers, cardboard, metal, and plastics, which makes them suitable for DIY applications. Although DIY is popular in developed economies such as North America and Europe, whereas in emerging markets such as India, UAE, and Turkey it is a relatively new concept. The DIY applications include craft, woodworking, general goods packaging, and others. The stick form of HMA is widely used in these applications because of its ease of use and the availability of HMA guns.

Restraints: Lower thermal resistance of Hot Melt Adhesives (HMA)

HMA are highly effective when the temperature is close to their flow point that makes movement and bonding of the adhesives easy for various applications such as packaging and nonwoven hygiene products. However, they exhibit limitations at high temperatures due to lesser thermal resistance. Thus, they are replaced by solvent and waterborne adhesives for such applications.

Opportunities: Increasing demand of reactive Hot Melt Adhesives (HMA) over traditional adhesives

Reactive hot melt adhesives have low VOC or zero VOC content in comparison to conventional solvent-based products. They do not contain any solvent and have achieved compliance with VOC regulations, thus being more environment-friendly than the conventional alternatives. Currently, the manufacturers are focusing on the use of environment-friendly products, thereby increasing the demand for these adhesives. These adhesives have the ability to eliminate solvents and leverage additional benefits, such as lower labor and energy costs. Reactive hot melt adhesives do not require dryers, which lower energy costs. Their physical properties include flexibility, high strength, and excellent adhesion to a range of substrates, including wood, fabrics, plywood, particleboards, foams, metals, and plastics.

Challenges: Difficulty in usage on hard-to-bond substances

Low surface energy substrates, low porosity or low surface roughness substrates, highly recycled paper stock, and other shiny and coated plastics are hard-to-bond surfaces. These surfaces require cured adhesives for gluing. As HMA are not cured, they take more time to solidify in comparison to other light-cured adhesives such as epoxy adhesives. Thus, HMA are not preferred for hard-to-bond substances. This may result in the use of two-part acrylic-based adhesives as a substitute.

EVA resin accounted for the largest segment of the Hot Melt Adhesives Market (HMA Market) between 2022 and 2027.

EVA is projected to dominate the market during the forecast period. EVA copolymers are used as a base polymer for HMA. EVA is a modified PE or a copolymer of ethylene with vinyl acetate that offers greater flexibility or the ability to withstand adverse temperature changes in comparison to PE. It is manufactured in three grades with varying content of vinyl acetate (VA), namely, 7%–15% VA, 15%–20% VA, and 20%–40% VA.

APAC is the fastest-growing Hot Melt Adhesives Market (HMA Market).

APAC is the largest Hot Melt Adhesives Market (HMA Market) in terms of value and volume and is projected to be the fastest-growing market during the forecast period. The region has witnessed significant economic growth over the last decade. China continues to be an assembly hub for industrial products because of low labor costs. Thus, it consumes large volumes of HMA in appliances, footwear, and wood products, among other applications. Southeast Asian countries, including Vietnam and Cambodia, are witnessing increased adhesive consumption because of growth in footwear manufacturing.

To know about the assumptions considered for the study, download the pdf brochure

Hot Melt Adhesives Market Players

Henkel AG & Co. KGaA (Germany), H.B. Fuller (US), Jowat SE (Germany), 3M (US), and Arkema (Bostik) (France) are the key players in the global Hot Melt Adhesives Market (HMA Market).

Hot Melt Adhesives Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 9.1 billion |

|

Revenue Forecast in 2027 |

USD 11.4 billion |

|

CAGR |

4.8% |

|

Years Considered for the study |

2017-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Resin |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

Henkel AG & Co. KGaA (Germany), H.B. Fuller (US), Jowat SE (Germany), 3M (US), and Arkema (Bostik) (France). A total of 26 players have been covered. |

This research report categorizes the Hot Melt Adhesives Market (HMA Market) based on Resin, Application, and Region.

Hot Melt Adhesives Market By Resin:

- Ethylene-Vinyl Acetate (EVA)

- Styrenic Block Copolymers

- Metallocene PO (mPO)

- Polyamide

- Polyolefins

- Amorphous Poly-alphaolefin (APAO)

- Polyurethane (incl. reactive HMA)

- Others

Hot Melt Adhesives Market By Application:

- Packaging Solutions

- Nonwoven Hygiene Products

- Furniture & Woodwork

- Bookbinding

- Others

Hot Melt Adhesives Market By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In February 2022, Arkema acquired wide range of key technologies and well-known brands of Ashland Performance Adhesives. It is a major player in pressure-sensitive adhesives, particularly decorative, protection, and signage films for automotive and buildings. It also holds leading positions in structural adhesives and offers an extensive range of hot melt adhesives for flexible packaging.

- In September 2021, Jowat launched Jowat-Toptherm 851.99, a hot melt adhesive characterized by a broad spectrum of adhesion and outstanding qualities, coupled with a very low viscosity that allows processing temperatures starting from 99°C (210°F). The low processing temperature makes Jowat-Toptherm 851.99 an exceptional choice for packaging temperature-sensitive products such as confectionery or frozen food.

(FAQ):<Frequently Asked Questions>

How big is the Hot Melt Adhesives Market?

Hot Melt Adhesives Market worth $11.4 Billion by 2027.

What is the growth rate of Hot Melt Adhesives Market?

Hot Melt Adhesives Market grows at a CAGR of 4.8% during the forecast period.

What is the current size of the global Hot Melt Adhesives Market (HMA Market)?

The Hot Melt Adhesives Market (HMA Market) is projected to grow from USD 9.1 Billion in 2022 to USD 11.4 Billion by 2027, at a CAGR of 4.8% between 2022 and 2027.

Who are the major manufacturers?

Henkel AG & Co. KGaA (Germany), H.B. Fuller (US), Jowat SE (Germany), 3M (US), and Arkema (Bostik) (France) are some of the leading players operating in the global HMA market.

Why Hot Melt Adhesives are gaining market share?

The growth of this market is attributed to the growing demand in APAC and the increasing usage of HMA in the packaging applications.

Which is the fastest-growing region in the market?

APAC is projected to be the fastest-growing market for Hot Melt Adhesives Market (HMA Market) during the forecast period. The emerging economies, such as China, India, South Korea, and Southeast Asian countries, are attracting several global players to establish their manufacturing base in APAC. .

What are hot melt adhesives?

Hot melt adhesives are thermoplastic materials that are solid at room temperature but melt into a liquid state when heated, providing a versatile and fast-bonding solution for various applications, such as packaging, woodworking, and product assembly.

What are the types of hot melt adhesives?

The main types of hot melt adhesives include ethylene vinyl acetate (EVA), polyolefin, polyamide, polyester, and reactive polyurethane, each tailored for specific bonding applications in industries such as packaging, automotive, and textiles.

What is the Polyurethane (PU) Hot-Melt Adhesive Market?

The PU hot-melt adhesive market pertains to the industry involved in the production, distribution, and utilization of polyurethane-based hot-melt adhesives, known for their versatile bonding properties in various applications.

What is the PUR hot melt adhesive market?

The PUR (Polyurethane Reactive) hot melt adhesive market refers to the industry focused on the production and distribution of adhesive materials that cure and form strong bonds when exposed to moisture, contributing to versatile bonding solutions.

What is the reactive hot melt adhesives market?

The reactive hot melt adhesives market pertains to the industry focused on adhesive products that undergo chemical reactions upon application, enhancing bonding strength and performance in various sectors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 1 HMA MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.1.2.4 Primary data sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 HMA MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS & LIMITATIONS

TABLE 1 RESEARCH ASSUMPTIONS

TABLE 2 RESEARCH LIMITATIONS

TABLE 3 RISK ANALYSIS

2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.6 PRICING ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 33)

TABLE 4 Hot Melt Adhesives Market SNAPSHOT, 2022 VS. 2027

FIGURE 5 PACKAGING SOLUTIONS APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 6 EVA EMULSION TO BE FASTEST-GROWING RESIN SEGMENT DURING FORECAST PERIOD

FIGURE 7 APAC LED GLOBAL Hot Melt Adhesives Market IN 2021

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE OPPORTUNITIES IN Hot Melt Adhesives Market

FIGURE 8 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 Hot Melt Adhesives Market, BY RESIN TYPE

FIGURE 9 EVA RESIN TO BE LARGEST SEGMENT

4.3 Hot Melt Adhesives Market, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 10 DEVELOPING COUNTRIES TO GROW FASTER THAN DEVELOPED COUNTRIES

4.4 Hot Melt Adhesives Market, BY APPLICATION AND KEY COUNTRIES

FIGURE 11 PACKAGING SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

4.5 Hot Melt Adhesives Market, BY MAJOR COUNTRIES

FIGURE 12 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL MARKET

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN Hot Melt Adhesives Market

5.2.1 DRIVERS

5.2.1.1 Catering to wide range of high growth applications

5.2.1.2 HMA replacing other adhesive technologies

5.2.1.3 High demand in DIY applications

5.2.2 RESTRAINTS

5.2.2.1 Lower thermal resistance of HMA

5.2.3 OPPORTUNITIES

5.2.3.1 Booming packaging and nonwoven applications in Asia Pacific and South America

5.2.3.2 Increasing demand for reactive HMA over traditional adhesives

5.2.4 CHALLENGES

5.2.4.1 Difficulty in usage on hard-to-bond substances

5.2.4.2 Volatility in raw material prices

5.3 PORTER'S FIVE FORCES ANALYSIS

TABLE 5 IMPACT OF PORTER'S FIVE FORCES ANALYSIS ON Hot Melt Adhesives Market

FIGURE 14 PORTER'S FIVE FORCES ANALYSIS: Hot Melt Adhesives Market

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACRO INDICATOR ANALYSIS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

TABLE 6 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE, 2019–2026

5.4.3 TRENDS IN ELECTRONICS INDUSTRY

FIGURE 15 ESTIMATED GROWTH RATES FOR GLOBAL ELECTRONICS INDUSTRY, FROM 2020 TO 2022, BY REGION

5.4.4 TRENDS IN AUTOMOTIVE INDUSTRY

TABLE 7 AUTOMOTIVE INDUSTRY PRODUCTION (2019–2020)

5.4.5 TRENDS IN FOOTWEAR INDUSTRY

FIGURE 16 DISTRIBUTION OF FOOTWEAR PRODUCTION, BY CONTINENT (QUANTITY) 2021

TABLE 8 FOOTWEAR PRODUCTION CONTRIBUTION PERCENTAGE, 2020

5.5 IMPACT OF COVID-19 ON END-USE INDUSTRIES

FIGURE 17 PRE-COVID-19 IMPACT AND POST-COVID-19 IMPACT MARKET SCENARIOS: Hot Melt Adhesives Market

5.6 VALUE CHAIN ANALYSIS

FIGURE 18 HMA: VALUE CHAIN ANALYSIS

FIGURE 19 HMA VALUE CHAIN: PLAYERS AT EACH NODE

5.7 PRICING ANALYSIS

FIGURE 20 AVERAGE PRICE COMPETITIVENESS IN Hot Melt Adhesives Market, BY REGION

5.8 HMA ECOSYSTEM AND INTERCONNECTED MARKET

TABLE 9 Hot Melt Adhesives Market: SUPPLY CHAIN

FIGURE 21 ADHESIVES & SEALANTS: ECOSYSTEM

5.9 YC AND YCC SHIFT

FIGURE 22 CHANGING REVENUE MIX FOR ADHESIVE MARKETS

5.10 TRADE ANALYSIS

TABLE 10 COUNTRY-WISE IMPORT VALUE DATA IN USD BILLION

TABLE 11 COUNTRY-WISE EXPORT VALUE DATA IN USD BILLION

5.11 REGULATIONS

5.11.1 LEED STANDARDS

TABLE 12 ARCHITECTURAL APPLICATIONS

TABLE 13 SPECIALTY APPLICATIONS

TABLE 14 SUBSTRATE-SPECIFIC APPLICATIONS

TABLE 15 SECTOR LIMITS

TABLE 16 SEALANT PRIMERS

5.12 PATENT ANALYSIS

5.12.1 METHODOLOGY

5.12.2 PUBLICATION TRENDS

FIGURE 23 NUMBER OF PATENTS PUBLISHED, 2016–2022

5.12.3 TOP JURISDICTION

FIGURE 24 PATENTS PUBLISHED BY JURISDICTION, 2016–2022

5.12.4 TOP APPLICANTS

FIGURE 25 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2016–2022

TABLE 17 RECENT PATENTS BY OWNERS

5.13 CASE STUDY ANALYSIS

5.14 TECHNOLOGY ANALYSIS

5.15 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 18 Hot Melt Adhesives Market: DETAILED LIST OF CONFERENCES & EVENTS

5.16 TARIFF AND REGULATORY LANDSCAPE

5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 HMA MARKET, BY RESIN TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 26 EVA TO BE LARGEST MARKET SEGMENT (VALUE)

TABLE 21 Hot Melt Adhesives MarketSIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 22 HMA MARKET SIZE, BY RESIN TYPE, 2021–2027 (USD MILLION)

TABLE 23 Hot Melt Adhesives MarketSIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 24 HMA MARKET SIZE, BY RESIN TYPE, 2021–2027 (KILOTON)

6.2 ETHYLENE VINYL ACETATE (EVA)

6.2.1 MODIFIED PE OR A COPOLYMER OF ETHYLENE WITH VINYL ACETATE TO OFFER GREATER FLEXIBILITY

6.3 STYRENIC BLOCK COPOLYMER (SBC)

6.3.1 GOOD HEATING PROPERTIES AND LOW MOISTURE ABSORPTION MAKE IT USEFUL AT HIGHER TEMPERATURES

6.4 METALLOCENE POLYOLEFIN (MPO)

6.4.1 CLEAR, ODORLESS, AND HIGH THERMAL STABILITY MAKE IT SUITABLE FOR COLORLESS APPLICATIONS

6.5 AMORPHOUS POLYALPHAOLEFIN (APAO)

6.5.1 EXTENSIVELY USED FOR MAKING DIFFERENT FORMULATIONS OF ADHESIVES

6.6 POLYOLEFINS

6.6.1 SUPERIOR SEALING ABILITY, HIGH RESISTANCE, AND EXCELLENT OPTICS MAKE THEM FIT FOR PACKAGING APPLICATIONS

6.7 POLYAMIDES

6.7.1 POLYAMIDE-BASED HMA ARE USED FOR MULTIPLE APPLICATIONS

6.8 POLYURETHANE (PUR)

6.8.1 MOISTURE CURED PROPERTY MAKES IT SUITABLE FOR FOOTWEAR, PACKAGING, AND BOOKBINDING APPLICATIONS

6.9 OTHERS

7 HMA MARKET, BY APPLICATION (Page No. - 77)

7.1 INTRODUCTION

FIGURE 27 PACKAGING SOLUTIONS IS LARGEST APPLICATION SEGMENT OF MARKET

TABLE 25 Hot Melt Adhesives MarketSIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 26 HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 27 Hot Melt Adhesives MarketSIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 28 HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

7.2 PACKAGING SOLUTIONS

7.2.1 HIGH DEMAND FOR FLEXIBLE PACKAGING IMPACTS Hot Melt Adhesives Market IN ASIA PACIFIC AND MIDDLE EAST & AFRICA

7.2.1.1 Corrugated boxes and trays

7.2.1.2 Carton and side-seam closures

7.2.1.3 Non-pressure-sensitive labels and marking systems

7.2.1.4 Flexible packaging

7.2.1.5 Others

TABLE 29 Hot Melt Adhesives Market SIZE IN PACKAGING SOLUTIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 HMA MARKET SIZE IN PACKAGING SOLUTIONS, BY REGION, 2021–2027 (USD MILLION)

TABLE 31 Hot Melt Adhesives Market SIZE IN PACKAGING SOLUTIONS, BY REGION, 2017–2020 (KILOTON)

TABLE 32 HMA MARKET SIZE IN PACKAGING SOLUTIONS, BY REGION, 2021–2027 (KILOTON)

7.3 NONWOVEN HYGIENE PRODUCTS

7.3.1 INCREASING HYGIENE AWARENESS AND DEMAND FROM CONSUMERS

7.3.1.1 Baby diapers, nappies, and pants

7.3.1.2 Adult incontinence

7.3.1.3 Feminine care

TABLE 33 Hot Melt Adhesives Market SIZE IN NONWOVEN HYGIENE PRODUCTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 HMA MARKET SIZE IN NONWOVEN HYGIENE PRODUCTS, BY REGION, 2021–2027 (USD MILLION)

TABLE 35 Hot Melt Adhesives Market SIZE IN NONWOVEN HYGIENE PRODUCTS, BY REGION, 2017–2020 (KILOTON)

TABLE 36 HMA MARKET SIZE IN NONWOVEN HYGIENE PRODUCTS, BY REGION, 2021–2027 (KILOTON)

7.4 FURNITURE & WOODWORK

7.4.1 ASIA PACIFIC WOODWORKING INDUSTRY TO INCREASE DEMAND FOR HMA

7.4.1.1 Woodworking

7.4.1.2 Structural and non-structural wood products

TABLE 37 Hot Melt Adhesives Market SIZE IN FURNITURE & WOODWORK, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 HMA MARKET SIZE IN FURNITURE & WOODWORK, BY REGION, 2021–2027 (USD MILLION)

TABLE 39 Hot Melt Adhesives Market SIZE IN FURNITURE & WOODWORK, BY REGION, 2017–2020 (KILOTON)

TABLE 40 HMA MARKET SIZE IN FURNITURE & WOODWORK, BY REGION, 2021–2027 (KILOTON)

7.5 BOOKBINDING

7.5.1 WATER ELIMINATING ADVANTAGE OF HMA MAKES THEM SUI TABLE FOR BOOKBINDING

7.5.1.1 Spine binding

7.5.1.2 Cover page and edge bonding

TABLE 41 Hot Melt Adhesives Market SIZE IN BOOKBINDING, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 HMA MARKET SIZE IN BOOKBINDING, BY REGION, 2021–2027 (USD MILLION)

TABLE 43 Hot Melt Adhesives Market SIZE IN BOOKBINDING, BY REGION, 2017–2020 (KILOTON)

TABLE 44 HMA MARKET SIZE IN BOOKBINDING, BY REGION, 2021–2027 (KILOTON)

7.6 OTHERS

7.6.1 AUTOMOTIVE & TRANSPORT

7.6.2 CONSUMER DIY

7.6.3 FOOTWEAR

7.6.4 ELECTRONICS

TABLE 45 Hot Melt Adhesives Market SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 HMA MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (USD MILLION)

TABLE 47 Hot Melt Adhesives Market SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (KILOTON)

TABLE 48 HMA MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (KILOTON)

8 HMA MARKET, BY REGION (Page No. - 91)

8.1 INTRODUCTION

FIGURE 28 ASIA PACIFIC TO LEAD HMA MARKET BY 2027

TABLE 49 Hot Melt Adhesives Market SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 HMA MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 51 Hot Melt Adhesives Market SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 52 HMA MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

8.2 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: Hot Melt Adhesives Market SNAPSHOT

TABLE 53 ASIA PACIFIC: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 54 ASIA PACIFIC: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 55 ASIA PACIFIC: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 56 ASIA PACIFIC: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2021–2027 (KILOTON)

TABLE 57 ASIA PACIFIC: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 58 ASIA PACIFIC: Hot Melt Adhesives Market SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 59 ASIA PACIFIC: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 60 ASIA PACIFIC: Hot Melt Adhesives Market SIZE, BY COUNTRY, 2021–2027 (KILOTON)

8.2.1 CHINA

8.2.1.1 China is the largest HMA market in Asia Pacific

TABLE 61 CHINA: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 62 CHINA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 63 CHINA: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 64 CHINA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.2.2 JAPAN

8.2.2.1 Infrastructural redevelopment to boost demand

TABLE 65 JAPAN: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 66 JAPAN: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 67 JAPAN: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 68 JAPAN: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.2.3 SOUTH KOREA

8.2.3.1 Growth in automotive industry to fuel demand

TABLE 69 SOUTH KOREA: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 70 SOUTH KOREA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 71 SOUTH KOREA: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 72 SOUTH KOREA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.2.4 INDIA

8.2.4.1 Government’s initiative to boost economy contributes to market growth

TABLE 73 INDIA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 74 INDIA: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 75 INDIA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 76 INDIA: Hot Melt Adhesives Market SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.2.5 MALAYSIA

8.2.5.1 Rebound in automotive industry likely to drive market

TABLE 77 MALAYSIA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 78 MALAYSIA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 79 MALAYSIA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 80 MALAYSIA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.2.6 THAILAND

8.2.6.1 Growth in packaging industry to impact market

TABLE 81 THAILAND: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 82 THAILAND: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 83 THAILAND: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 84 THAILAND: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.2.7 REST OF ASIA PACIFIC

8.3 NORTH AMERICA

FIGURE 30 NORTH AMERICA: HMA MARKET SNAPSHOT

TABLE 85 NORTH AMERICA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 88 NORTH AMERICA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

TABLE 89 NORTH AMERICA: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: HMA MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 91 NORTH AMERICA: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 92 NORTH AMERICA: HMA MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

8.3.1 US

8.3.1.1 Growth in major end-use industries to boost demand

TABLE 93 US: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 94 US: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 95 US: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 96 US: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.3.2 CANADA

8.3.2.1 Automotive sector to play key role in driving HMA demand

TABLE 97 CANADA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 98 CANADA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 99 CANADA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 100 CANADA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.3.3 MEXICO

8.3.3.1 Growth in automotive industry is driving demand for HMA

TABLE 101 MEXICO: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 102 MEXICO: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 103 MEXICO: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 104 MEXICO: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.4 EUROPE

FIGURE 31 EUROPE: HMA MARKET SNAPSHOT

TABLE 105 EUROPE: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 106 EUROPE: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 107 EUROPE: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 108 EUROPE: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

TABLE 109 EUROPE: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 110 EUROPE: HMA MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 111 EUROPE: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 112 EUROPE: HMA MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

8.4.1 GERMANY

8.4.1.1 Various trends in food packaging industry will boost demand

TABLE 113 GERMANY: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 114 GERMANY: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 115 GERMANY: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 116 GERMANY: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.4.2 FRANCE

8.4.2.1 Automotive industry to boost demand for HMA

TABLE 117 FRANCE: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 118 FRANCE: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 119 FRANCE: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 120 FRANCE: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.4.3 ITALY

8.4.3.1 Numerous motor manufacturing companies are shifting their production facilities to Italy, creating growth opportunities

TABLE 121 ITALY: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 122 ITALY: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 123 ITALY: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 124 ITALY: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.4.4 UK

8.4.4.1 Innovative and energy-efficient technology in household appliances to increase demand

TABLE 125 UK: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 126 UK: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 127 UK: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 128 UK: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.4.5 RUSSIA

8.4.5.1 Packaging application will boost demand

TABLE 129 RUSSIA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 130 RUSSIA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 131 RUSSIA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 132 RUSSIA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.4.6 SPAIN

8.4.6.1 Investment in various industries to boost demand

TABLE 133 SPAIN: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 134 SPAIN: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 135 SPAIN: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 136 SPAIN: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.4.7 REST OF EUROPE

8.5 SOUTH AMERICA

TABLE 137 SOUTH AMERICA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 138 SOUTH AMERICA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 139 SOUTH AMERICA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 140 SOUTH AMERICA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

TABLE 141 SOUTH AMERICA: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 142 SOUTH AMERICA: HMA MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 143 SOUTH AMERICA: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 144 SOUTH AMERICA: HMA MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

8.5.1 BRAZIL

8.5.1.1 It is one of the fastest-growing manufacturing hubs globally

TABLE 145 BRAZIL: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 146 BRAZIL: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 147 BRAZIL: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 148 BRAZIL: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.5.2 ARGENTINA

8.5.2.1 Strategic Industrial Plan 2020 supporting HMA market

TABLE 149 ARGENTINA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 150 ARGENTINA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 151 ARGENTINA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 152 ARGENTINA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.5.3 REST OF SOUTH AMERICA

8.6 MIDDLE EAST & AFRICA

TABLE 153 MIDDLE EAST & AFRICA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 156 MIDDLE EAST & AFRICA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

TABLE 157 MIDDLE EAST & AFRICA: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: HMA MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: HMA MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 160 MIDDLE EAST & AFRICA: HMA MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

8.6.1 SAUDI ARABIA

8.6.1.1 Increased local car sales to support market growth

TABLE 161 SAUDI ARABIA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 162 SAUDI ARABIA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 163 SAUDI ARABIA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 164 SAUDI ARABIA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.6.2 UAE

8.6.2.1 Growing building & construction, woodworking, and packaging solution applications will impact market growth

TABLE 165 UAE: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 166 UAE: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 167 UAE: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 168 UAE: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.6.3 SOUTH AFRICA

8.6.3.1 Growing construction and automotive industries will impact market growth

TABLE 169 SOUTH AFRICA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 170 SOUTH AFRICA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

TABLE 171 SOUTH AFRICA: HMA MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 172 SOUTH AFRICA: HMA MARKET SIZE, BY APPLICATION, 2021–2027 (KILOTON)

8.6.4 REST OF THE MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE (Page No. - 150)

9.1 OVERVIEW

9.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY HMA PLAYERS

9.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021

9.2.1 STAR

9.2.2 EMERGING LEADERS

9.2.3 PERVASIVE

9.2.4 EMERGING COMPANIES

FIGURE 32 HMA MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

9.3 STRENGTH OF PRODUCT PORTFOLIO

9.4 COMPETITIVE SCENARIO

TABLE 173 PRODUCT FOOTPRINT OF COMPANIES

TABLE 174 INDUSTRY FOOTPRINT OF COMPANIES

TABLE 175 REGIONAL FOOTPRINT OF COMPANIES

9.5 SME MATRIX, 2021

9.5.1 RESPONSIVE COMPANIES

9.5.2 PROGRESSIVE COMPANIES

9.5.3 STARTING BLOCKS

9.5.4 DYNAMIC COMPANIES

FIGURE 33 HMA MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES’ COMPETITIVE LEADERSHIP MAPPING, 2021

9.6 SME COMPETITIVE BENCHMARKING

FIGURE 34 HMA MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 176 HMA MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

9.7 MARKET SHARE ANALYSIS

FIGURE 35 MARKET SHARE, BY KEY PLAYERS (2021)

9.8 REVENUE ANALYSIS

FIGURE 36 REVENUE ANALYSIS OF TOP PLAYERS, 2016–2021

9.8.1 3M

9.8.2 HENKEL AG

9.8.3 H.B. FULLER

9.8.4 ARKEMA (BOSTIK)

9.9 MARKET RANKING ANALYSIS

TABLE 177 MARKET RANKING ANALYSIS, 2021

9.9.1 COMPETITIVE SITUATION AND TRENDS

TABLE 178 HMA MARKET: PRODUCT LAUNCHES, 2016–2022

TABLE 179 HMA MARKET: DEALS, 2016–2022

10 COMPANY PROFILES (Page No. - 164)

10.1 MAJOR PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

10.1.1 HENKEL AG & CO. KGAA

TABLE 180 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

FIGURE 37 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

TABLE 181 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

TABLE 182 HENKEL AG & CO. KGAA: DEALS

10.1.2 H.B. FULLER COMPANY

TABLE 183 H.B. FULLER COMPANY: COMPANY OVERVIEW

FIGURE 38 H.B. FULLER COMPANY: COMPANY SNAPSHOT

TABLE 184 H.B. FULLER COMPANY: PRODUCT LAUNCHES

TABLE 185 H.B. FULLER COMPANY: DEALS

10.1.3 JOWAT SE

TABLE 186 JOWAT SE: COMPANY OVERVIEW

TABLE 187 JOWAT SE: PRODUCT LAUNCHES

10.1.4 3M

TABLE 188 3M: COMPANY OVERVIEW

FIGURE 39 3M: COMPANY SNAPSHOT

TABLE 189 3M: OTHERS

10.1.5 ARKEMA

TABLE 190 ARKEMA: COMPANY OVERVIEW

FIGURE 40 ARKEMA: COMPANY SNAPSHOT

TABLE 191 ARKEMA: DEALS

10.1.6 DOW INC.

TABLE 192 DOW INC.: COMPANY OVERVIEW

FIGURE 41 DOW INC.: COMPANY SNAPSHOT

10.1.7 TEXYEAR INDUSTRIES INC.

TABLE 193 TEXYEAR INDUSTRIES INC.: COMPANY OVERVIEW

10.1.8 KLEBCHEMIE GMBH & CO. KG

TABLE 194 KLEBCHEMIE GMBH & CO. KG: COMPANY OVERVIEW

10.1.9 SIKA AG

TABLE 195 SIKA AG: COMPANY OVERVIEW

FIGURE 42 SIKA AG: COMPANY SNAPSHOT

TABLE 196 SIKA AG: OTHERS

10.1.10 AVERY DENNISON CORPORATION

TABLE 197 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

FIGURE 43 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

10.1.11 HUNTSMAN CORPORATION

TABLE 198 HUNTSMAN CORPORATION: COMPANY OVERVIEW

FIGURE 44 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

10.1.12 BEARDOW ADAMS (ADHESIVES) LTD.

TABLE 199 BEARDOW ADAMS (ADHESIVES) LTD.: COMPANY OVERVIEW

10.2 OTHER COMPANIES

10.2.1 ADHESIVES DIRECT UK

TABLE 200 ADHESIVES DIRECT UK: COMPANY OVERVIEW

10.2.2 AICA ADTEK SDN BHD

TABLE 201 AICA ADTEK SDN BHD: COMPANY OVERVIEW

10.2.3 BUHNEN GMBH & CO. KG

TABLE 202 BUHNEN GMBH & CO. KG: COMPANY OVERVIEW

10.2.4 CHERNG TAY TECHNOLOGY CO., LTD.

TABLE 203 CHERNG TAY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

10.2.5 CATTIE ADHESIVES

TABLE 204 CATTIE ADHESIVES: COMPANY OVERVIEW

10.2.6 DAUBERT CHEMICAL COMPANY

TABLE 205 DAUBERT CHEMICAL COMPANY: COMPANY OVERVIEW

10.2.7 EVANS ADHESIVE CORPORATION, LTD.

TABLE 206 EVANS ADHESIVE CORPORATION, LTD.: COMPANY OVERVIEW

10.2.8 EVONIK INDUSTRIES AG

TABLE 207 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

10.2.9 HELMITIN ADHESIVES

TABLE 208 HELMITIN ADHESIVES: COMPANY OVERVIEW

10.2.10 KMS ADHESIVES LTD.

TABLE 209 KMS ADHESIVES LTD.: COMPANY OVERVIEW

10.2.11 SANYHOT ADHESIVOS S.A.

TABLE 210 SANYHOT ADHESIVOS S.A.: COMPANY OVERVIEW

10.2.12 SEALOCK LTD.

TABLE 211 SEALOCK LTD.: COMPANY OVERVIEW

10.2.13 TOYOBO CO., LTD.

TABLE 212 TOYOBO CO., LTD.: COMPANY OVERVIEW

10.2.14 WORTHEN INDUSTRIES

TABLE 213 WORTHEN INDUSTRIES: COMPANY OVERVIEW

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

11 ADJACENT & RELATED MARKETS (Page No. - 204)

11.1 INTRODUCTION

11.2 LIMITATIONS

11.3 MS POLYMER ADHESIVES MARKET

11.3.1 MARKET DEFINITION

11.3.2 MARKET OVERVIEW

11.3.3 MS POLYMER ADHESIVES MARKET ANALYSIS, BY TYPE

11.3.3.1 Adhesive

11.3.3.2 Sealant

11.3.4 MS POLYMER ADHESIVES MARKET, BY APPLICATION

TABLE 214 MS POLYMER ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 215 MS POLYMER ADHESIVES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

11.3.5 MS POLYMER ADHESIVES MARKET, BY REGION

TABLE 216 MS POLYMER ADHESIVES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 217 MS POLYMER ADHESIVES MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

12 APPENDIX (Page No. - 208)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHORS DETAILS

The study involves four major activities in estimating the current market size of HMA. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The Hot Melt Adhesives market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in application areas, such as packaging solutions, nonwoven hygiene products, furniture and woodworking, bookbinding, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

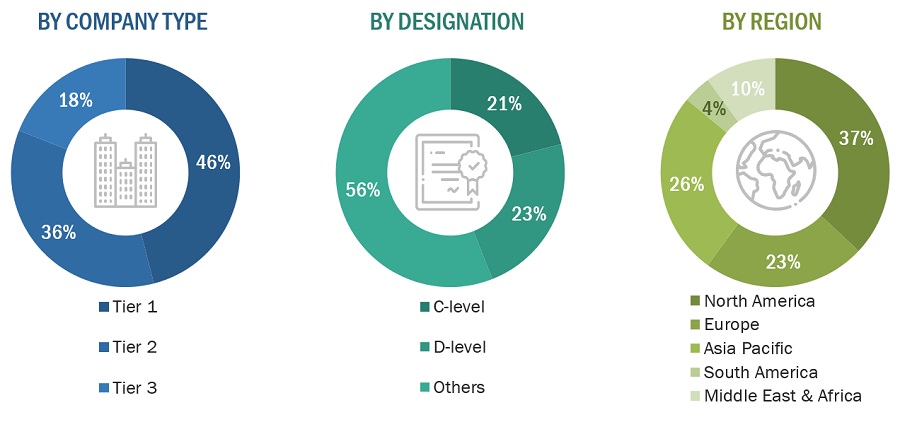

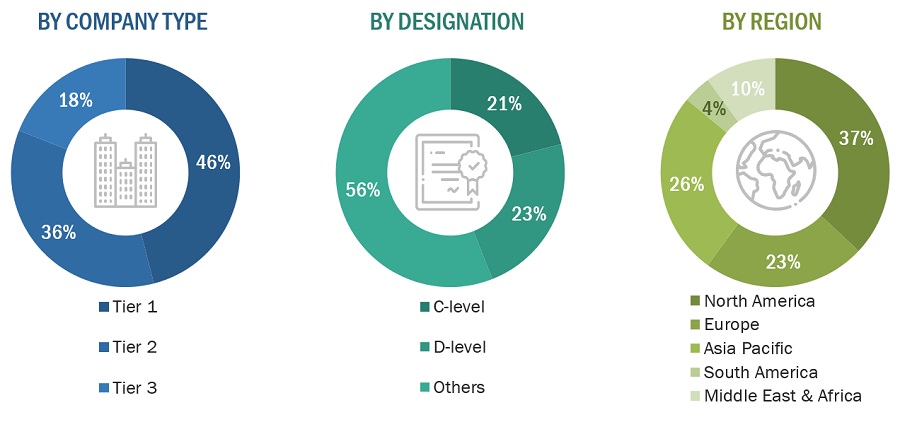

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the HMA market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global HMA Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the Hot Melt Adhesives (HMA) market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the HMA market by resin type, application, and region

- To forecast the HMA market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To strategically analyze micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as acquisitions, new product launches, and expansions, in the HMA market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the HMA market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the HMA market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hot Melt Adhesives Market