Human Capital Management Market by Offering (Software (Core HR, ATS, HR Analytics, and Workforce Management) and Services), Deployment Model, Organization Size, Vertical (BFSI, Manufacturing, IT & Telecom, Government) & Region - Global Forecast to 2029

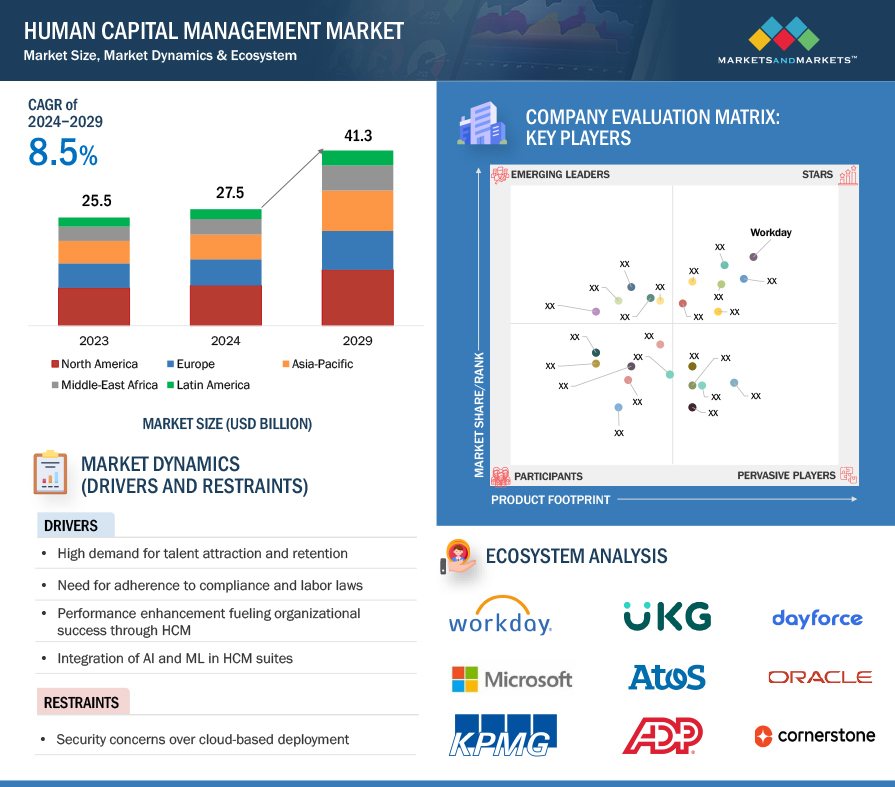

[311 Pages Report] The Human Capital Management (HCM) market is expected to grow from USD 27.5 billion in 2024 to USD 41.3 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period. The rapid advancement of technology, including cloud computing, artificial intelligence (AI), machine learning, and data analytics, has transformed HCM systems. Modern HCM platforms leverage these technologies to automate processes, provide predictive analytics, enhance decision-making, and improve user experiences. As businesses expand globally, the need for effective HCM solutions becomes paramount. Managing a diverse workforce across different geographies, time zones, and cultures requires robust HCM systems that can standardize processes, ensure compliance with local regulations, and facilitate seamless communication and collaboration. Attracting, retaining, and developing top talent is a critical organizational priority. HCM platforms offer advanced talent management functionalities, such as recruitment, onboarding, performance management, learning and development, succession planning, and career development, to support organizations in optimizing their talent strategies.

Data has become a valuable asset for organizations seeking to make informed decisions about their workforce. HCM systems collect and analyze vast amounts of data related to employee demographics, performance, engagement, turnover, and other metrics. By leveraging data analytics and reporting tools, organizations can gain valuable insights into workforce trends, identify areas for improvement, and drive strategic decision-making. An organization's key concern is compliance with labor laws, regulations, and industry standards. HCM systems help organizations stay compliant by automating payroll, benefits administration, time tracking, and reporting processes. They also provide audit trails, documentation, and alerts to ensure adherence to regulatory requirements.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Human Capital Management Market

As per the Global Economic Prospects report of the World Bank, published in June 2022, the compounding effect of the COVID-19 pandemic and the Russian invasion of Ukraine has resulted in a magnified global economic slowdown. Currently, organizations are focusing on the economic downturn and the looming possibility of a recession. As organizations battle rising prices, volatile supply chains, climate issues, talent scarcity, and the ongoing repercussions of the disruption caused by the pandemic, more than half of the executives describe a bleak economic outlook for the next 12–18 months. A wide range of energy-related commodities has witnessed a price surge due to the Ukraine war. Higher energy prices result in lower real incomes, raise production costs, tighten financial conditions, and constrain macroeconomic policies, especially in energy-importing countries. The ICT sector is trading with the onslaught better than other domains. It has been undergoing a transition to next-generation networks (NGN) and converged services. Financial difficulties could transform the sector further by creating new openings for nascent technologies. Businesses are encountering increasing challenges, and several reputable sources of information on economic issues are adjusting their predictions and calling for a worldwide recession. Hence, markets and financial institutions have become more cautious. With the rise in living expenses, there will be an increase in the global recession that would affect overall IT spending. Considering the persistent supply-chain disruption, supply-chain diversification and digitalization are the priorities for most organizations in the coming years. The global recession is expected to increase the demand for automation and cost-saving measures; the leading businesses are expected to turn toward HCM solutions for operational efficiency.

Human Capital Management Market Dynamics

Driver: Requirement for unified HR systems

Transforming the landscape of modern workplaces, Unified HR systems, or integrated HCM platforms are instrumental drivers in the HCM market. These systems consolidate diverse HR processes into a cohesive platform, fostering efficiency, reducing manual work, and improving data accuracy. They ensure consistency and streamline processes by covering the entire employee lifecycle, from recruitment to retirement. Unified HR systems empower organizations with real-time insights for informed decision-making and efficient compliance management. With a user-friendly interface for all HR tasks, these systems enhance the employee experience, contributing to satisfaction and engagement. Scalability, flexibility, and cost-effectiveness further position them as crucial elements driving the evolution of the HCM market.

Restraint: Security concerns over cloud-based deployment

Since most HCM software is hosted on a third party's cloud infrastructure, enterprises are worried about security. Most suppliers provide HCM software on the cloud to use cloud technology advantages, including security, scalability, and lower IT infrastructure costs. Cloud-based software frequently has strong security built in. Data breaches and hacker risks are eliminated. Many companies hesitate to accept HR systems and files, which often contain private employee data. Businesses are, therefore, not prepared to migrate their payroll, administrative, and employee data to the cloud. In the poll conducted by ISG, the most crucial feature companies look for when choosing an HR IT platform is data security. About 72% of enterprises consider data security essential when selecting an on-cloud HCM solution. Therefore, the security issues with cloud-based HCM solutions are anticipated to impede market expansion.

Opportunity: Implementation of remote working models to boost adoption of HCM software

Remote working has presented significant opportunities for HCM software as organizations adapt to a distributed workforce model. According to a 2020 survey, 82% of company leaders plan to permit remote work in some capacity, even after the pandemic subsides. This shift has increased demand for HR tools that efficiently manage remote employees, track their performance, and foster effective communication. HCM software with integrated self-service portals enables remote employees to access important HR information, submit time-off requests, and update personal details from anywhere, fostering a seamless and employee-centric experience. AI-powered analytics in HR software can provide insights into remote employee productivity and engagement, aiding HR professionals in proactively understanding and addressing workforce challenges. With remote work becoming a long-term reality for many businesses, HCM software offers valuable solutions to enhance workforce management and maintain a cohesive and productive workforce, no matter where employees are located.

Challenge: Intricacy of technical integration and high cost of implementation

In HCM, technical integration is a significant challenge for organizations worldwide. The need for meticulous planning and execution arises due to the complexity, cost of implementation, data security, and privacy concerns. The integration process is further complicated by challenges related to interoperability, legacy systems, and user experience. Scalability, change management, and customization dilemmas make the integration process even more complex, highlighting the need for adaptable and user-friendly HCM solutions. As organizations strive to overcome these challenges, seamless technical integration becomes crucial to driving efficiency and maximizing the value of HCM investments.

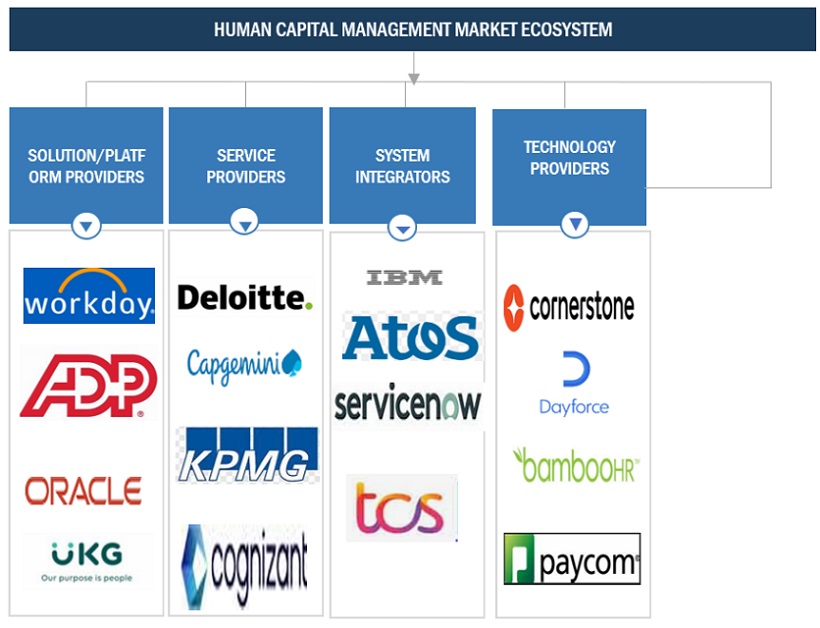

Human Capital Management Market Ecosystem

By Offering, the Software segment will hold the larger market size during the forecast period.

HCM software is a comprehensive digital solution designed to proficiently oversee all facets of human resources throughout the employee lifecycle. With its features and offerings, HCM software optimizes various HR functions, enhancing organizational efficiency and employee satisfaction. From recruitment and onboarding processes to payroll management, benefits administration, and performance evaluation, HCM systems streamline operations and ensure adherence to regulatory requirements. These platforms facilitate talent management initiatives, fostering employee development and succession planning to cultivate a skilled workforce. With specialized solutions tailored to specific industries, such as Rippling for small businesses and Arcoro for construction companies, HCM software caters to diverse organizational needs, offering user-friendly interfaces and cost-effective solutions. HCM software is a pivotal tool in modern HR management, empowering businesses to nurture their human capital and drive sustainable growth effectively.

Based on vertical, the consumer goods & retail vertical will grow at a higher CAGR during the forecast period

Within the consumer goods and retail sector, HCM is instrumental in optimizing workforce performance, enhancing operational efficiency, and delivering exceptional customer experiences. HCM strategies in this industry encompass talent acquisition, development, and retention tailored to the unique demands of the retail environment. Providers like Oracle and Larks offer comprehensive HCM solutions tailored to consumer goods and retail sectors. Oracle Retail's HCM solution enables organizations to manage staff and store associates effectively, from recruitment to retirement, streamlining processes such as talent acquisition, onboarding, workforce planning, payroll, and performance management. Similarly, Larks provides industry-specific HCM solutions designed to optimize workforce performance, enhance employee engagement, and drive operational efficiency in the retail industry. Oracle and Larks empower consumer goods and retail organizations with features like agile workforce planning, talent management, and personalized learning and development initiatives.

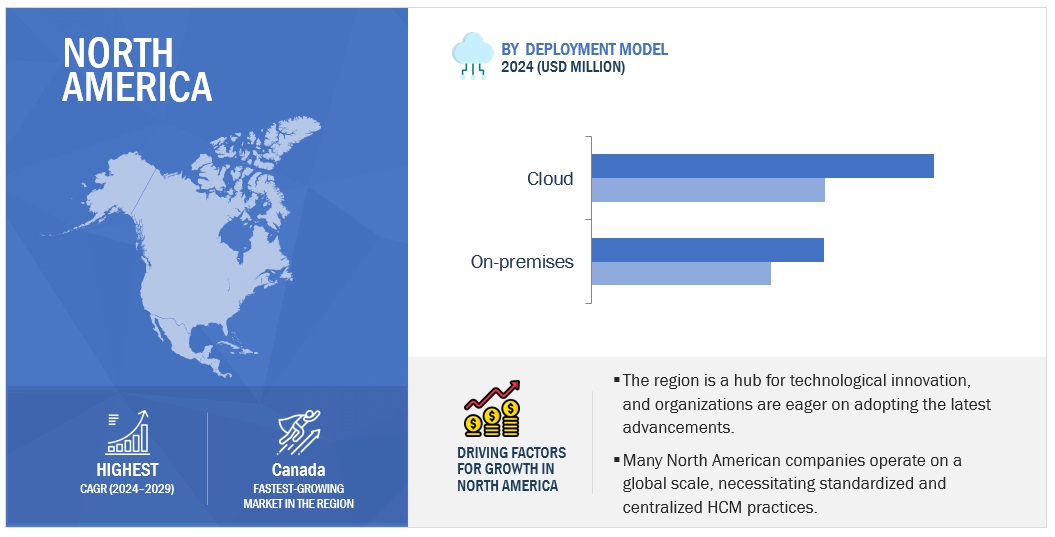

By region, the North American HCM market will hold the most significant size during the forecast period.

The HCM market in North America is experiencing robust growth, driven by the increasing adoption of HCM solutions in HR processes and the rapid advancement of artificial intelligence and information technology. Organizations are investing heavily in digitalizing HR processes to boost productivity, with a growing preference for SaaS delivery models. The focus is on creating flexible digital workplaces, utilizing modern communication tools like social media and video conferencing. Centralizing HR data across branches is becoming imperative, further fueling the expansion of the HCM market in North America. The high cloud adoption rate and integration of advanced technologies to enhance HCM software features drive the global demand for HCM software. The analysis shows that the investments in the HCM space by private equity and venture capital firms would increase and fuel global market growth.

Key Market Players

The Human Capital Management market is dominated by a few globally established players such as Workday (US), UKG (US), Oracle (US), SAP (Germany), Dayforce (US), ADP (US), Paylocity (US), Paycom (US), Cornerstone (US), and Microsoft (US), among others, are the key vendors that secured HCM contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have limited expertise. In the thriving HCM market, the Cloud Adoption Boom is pivotal in reshaping HR practices. For companies leveraging cloud-based solutions, HCM capitalizes on several advantages.

Scope of Report

|

Report Metrics |

Details |

|

Market Size Available For Years |

2019–2029 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Deployment Model, Organization Size, and Vertical |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Workday(US), UKG(US), Oracle (US), SAP(Germany), Dayforce(US), ADP (US), Paylocity(US), Paycom(US), Cornerstone(US), and Microsoft(US). |

This research report categorizes the HCM market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

- Software

- Core HR

- Applicant Tracking System

- HR Analytics

- Workforce Management

- Services

- Professional Services

- Managed Services

By Deployment Model:

- On-Premises

- Hybrid Cloud

By Organization Size:

- Large Enterprises

- Small And Medium-Sized Enterprises

By Vertical:

- BFSI

- Government

- Manufacturing

- IT & Telecom

- Consumer Goods & Retail

- Healthcare & Life Sciences

- Energy & Utilities

- Transportation & Logistics

- Other Verticals

By Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- India

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC

- Saudi Arabia

- UAE

- The rest of the GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

GCC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- Workday launched Manager Insights Hub. The Workday Manager Insights Hub is a new solution designed to enhance the manager experience by providing timely and personalized insights and recommended actions within their workflow. Leveraging AI and ML technologies, it surfaces automated recommendations related to team time off, employee skills, sentiment, goals, and more, empowering managers to make informed decisions and effortlessly facilitate their teams' career growth and development.

- UKG and PayPal collaborated to enable individuals paid through UKG to direct deposit earnings into PayPal Balance accounts, offering flexibility and faster access to wages. This industry-first partnership highlights UKG's commitment to providing people-centric experiences in HR solutions.

- Dayforce acquired Eloomi, a provider of innovative HR solutions. This move would enhance both companies' product and service offerings, leveraging Eloomi's expertise and Dayforce's extensive resources. This deal would offer innovations, including AI Co-pilot, Enhanced Analytics & Reporting, and Social & Communications modules. Despite potential logo changes, Eloomi's dedicated team and customer support will remain unchanged, ensuring a seamless experience for existing clients.

Frequently Asked Questions (FAQ):

What is HCM?

HCM stands for Human Capital Management. HCM refers to the strategic approach to managing employees as assets, focusing on recruiting, hiring, managing, developing, and optimizing human resources to achieve organizational objectives. It encompasses various HR functions and processes aimed at maximizing the value of an organization's workforce.

Which country was the early adopter of HCM solutions?

The US was at the initial stage of HCM solutions.

Which are the key vendors exploring HCM Solutions?

Some of the significant vendors offering HCM solutions across the globe include Workday (US), UKG (US), Oracle (US), SAP (Germany), Dayforce (US), ADP (US), Paylocity (US), Paycom (US), Cornerstone (US), and Microsoft (US).

What is the total CAGR recorded for the HCM market during 2024-2029?

The HCM market will record a CAGR of 8.5% from 2024-2029.

What is the projected market value of the HCM market?

The HCM market will grow from USD 27.5 billion in 2024 to USD 41.3 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 8.5% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

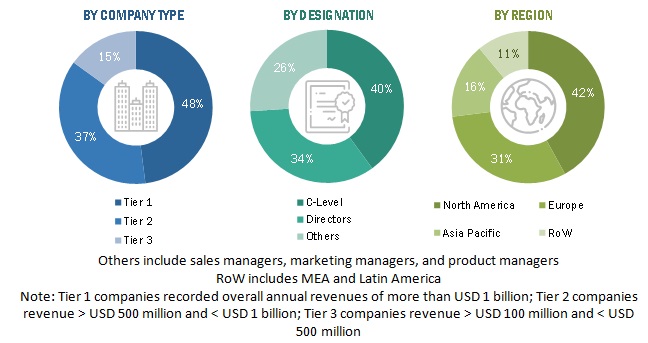

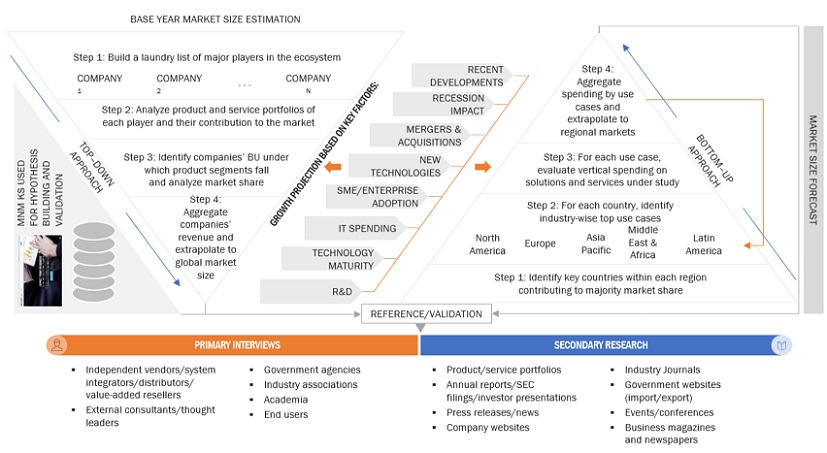

This research study used extensive secondary sources, directories, presentations and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information for the technical, market-oriented, and commercial study of the core HR software market. The primary sources are mainly several industry experts from core and related industries and suppliers, manufacturers, distributors, service providers, technology developers, technologists from companies, and organizations related to all segments of this industry's value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess prospects. The following figure shows the research methodology applied in this report on the HCM market.

The market has been predicted by analyzing the driving factors, such as the emergence of cloud computing, the growing need for cost-effective businesses, and the need for business agility and faster time to market.

Secondary Research

The market for the companies offering HCM software and services was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of the major companies in the ecosystem and rating them according to their performance and quality. In the secondary research process, various sources were referred to to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

We used secondary research to obtain essential information about the industry's supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which we validated from primary sources.

Primary Research

In the primary research process, we interviewed various supply and demand sources to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related vital executives from HCM vendors, industry associations, and independent consultants; and key opinion leaders.

We conducted primary interviews to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various trends related to technology, service type, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using HCM, and digital initiatives project teams, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current use of solutions, which would affect the overall HCM market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We used top-down and bottom-up approaches to estimate and forecast the HCM and other dependent submarkets. We deployed a bottom-up procedure to arrive at the overall market size using the revenues and offerings of key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. We used the overall market size in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

We used top-down and bottom-up approaches to estimate and validate the HCM market and other dependent subsegments.

The research methodology used to estimate the market size included the following details:

- The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research.

- This procedure included studying top market players' annual and financial reports and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

HCM market: Top-down and Bottom-up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakup procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying several factors and trends from the demand and supply sides in the HCM market.

Market Definition

HCM is software and services that manage an enterprise's human resources. These tools cover the entire lifecycle of an employee, from employee onboarding to employee retirement. These tools cover administrative tasks, payroll, benefits, employee productivity, analytics, etc.

As organizations focus on minimizing costs associated with the HR function, HCM software and services are in demand. HCM software and services enable organizations to realize various benefits, such as increased workforce productivity, employee engagement, and reduced cost of HR functions.

Key Stakeholders

- HCM Software and Service Providers

- Technology Service Providers

- Cloud Service Providers (CSPs)

- Government Organizations

- Consultants/Consultancies/Advisory Firms

- Support and Maintenance Service Providers

- Information Technology (IT) Infrastructure Providers

- System Integrators (SIS)

- Regional Associations

- Independent Software Vendors (ISVS)

- Value-added Resellers and Distributors

Report Objectives

- To define, describe, and forecast the global HCM market based on offering deployment model, organization size, vertical, and region

- To forecast the market size of the five major regional segments: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents & innovations, and pricing data related to the HCM market

- To analyze the impact of the recession on offerings, deployment models, organization size, verticals, and regions globally

- To analyze the opportunities in the market for stakeholders and provide details of their competitive landscape for prominent players

- To profile key players in the market and comprehensively analyze their market shares/ranking and core competencies

- To track and analyze competitive developments, such as mergers & acquisitions, new product developments, and partnerships & collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of each company's portfolio.

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Human Capital Management Market