Humanized Mouse and Rat Model Market by Type (Genetic Models, Cell-based Models (CD34, BLT, PMC), Rat Models), Application (Oncology, Immunology, Neuroscience, Toxicology, Infectious Diseases), End User (Pharma, Biotech) & Region - Global Forecast to 2028

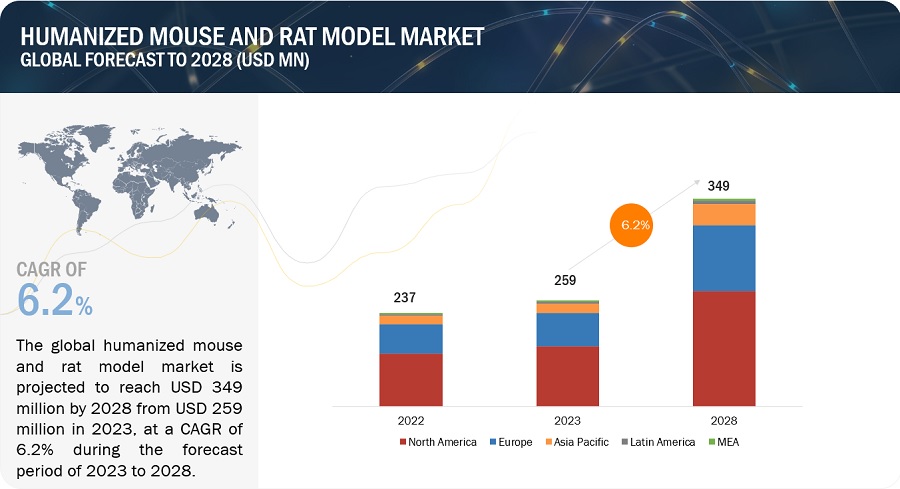

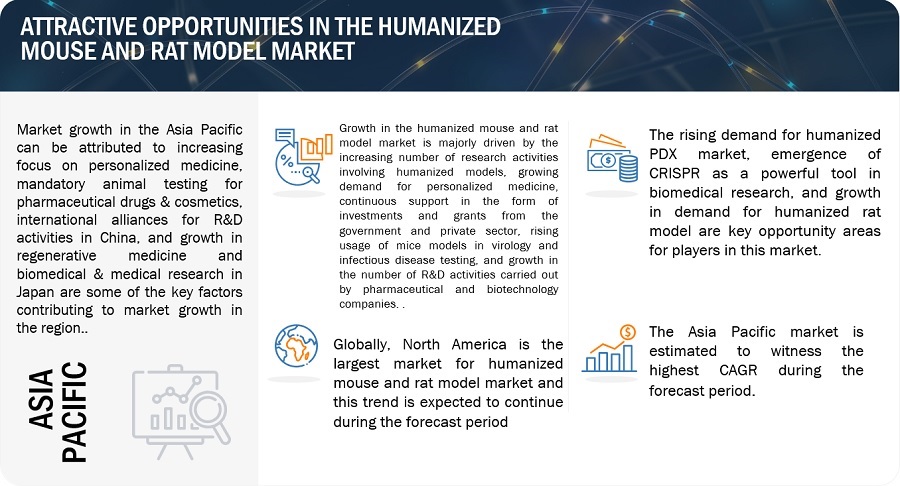

The global humanized mouse and rat model market in terms of revenue was estimated to be worth $259 million in 2023 and is poised to reach $349 million by 2028, growing at a CAGR of 6.2% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in the humanized mouse and rat model market is majorly driven by the rising use of humanized models in drug discovery research, rising demand for personalized medicine, government-funded initiatives for cancer research, increasing R&D activities in pharmaceutical & biotechnology industry. However, the high cost of custom humanized models, and regulatory compliance for ethical use of animal mode are expected to restrain the growth of this market during the forecast period. Some of the marsket challenges include limitations of humanized mouse models and alternative methods for animal testing. Additionally, growing demand for humanized mouse models, preference for humanized PDX models, and emergence of CRISPR in biomedical research are expected to serve as lucrative market opportunities.

Attractive Opportunities in humanized mouse and rat model Market

To know about the assumptions considered for the study, Request for Free Sample Report

Humanized Mouse and Rat Model Market Dynamics

DRIVER: Rising use of humanized models in drug discovery research

Disease models reflect human physiology and are used for more accurate non-clinical studies and drug discovery, the demand for humanized mouse and rat models is expected to be high among researchers. Demand for humanized mouse models is increasing in immuno-oncology research, attributed to an increase in the number of research studies validating their efficacy. Next-generation humanized mouse models are being developed to gain a better understanding of the development of adaptive immunity and human innate. The development and use of novel humanized mouse platforms is set to accelerate oncology research. This has propelled market players to create a portfolio suitable for different research applications. For instance, THE JACKSON LABORATORY (US) offers Humanized CD34+ mice (hu-CD34) platform for in vivo analysis efficacy and safety of novel therapies that modulate the immune system. Also, genOway (France) offers established humanized models for allergy and inflammation studies mouse suitable to assess in vivo efficacy and safety of therapeutic candidates/ biologics.

RESTRAINTS: High cost of custom humanized models

Humanized models are created with the engraftment of human cells, genes, or tissues into an immunodeficient mouse or rat. It is then harvested, fragmented, and implanted again in a larger set of models treated with various drugs and drug combinations. Considering the cost of creating and maintaining these models, coupled with the requirement of expensive drugs in these models, these experiments can cost thousands of dollars, even in the case of a single patient. Humanized mouse and rat models must be housed in exceptionally protective conditions and may require a special maintenance regimen. Often, mice production is lengthy and, in some cases, restricted by patents. These are the major factors limiting the wider adoption of humanized models across the globe.

OPPORTUNITY: Growing demand for humanized rat models

The demand for humanized rat models is increasing worldwide as they are important tools for conducting preclinical research. These models are developed by the engraftment of human cells or tissues, leading to the expression of human proteins in rats. Humanized rats are increasingly being developed and used as models for biomedical research applications, such as cancer, infectious diseases, HIV/AIDS, and hepatitis. The growing need to efficiently identify the actual effects of drugs on humans as well as to study human-specific infections, therapies, and immune responses are the major factors supporting the use and development of humanized rat models. This is considered an opportunity area in the market.

Also, advancements in genetic techniques for the development of genetically modified rats have driven the adoption of rats as models for studying human diseases. The increased availability of knockout rats, mutant rats, and embryonic stem cell lines makes them the preferred animals for studying various human diseases.

CHALLENGE: Alternatives for animal testing

The development of efficient and reliable alternatives to animal testing is posing major challenges to the growth of the global humanized mouse and rat model market. The increasing pressure from animal rights activists is compelling research institutes and companies to seek options to minimize the use of animals in research activities. In December 2022, the US Food and Drug Administration (FDA) announced the exemption of animal testing in drug discovery & development. Since this law is not implemented clearly yet, the impact of it remains unclear. This law has opened new avenues for companies developing alternatives such as organoids, spheroids, and 3D cell culture, thus expecting to pose a challenge to market growth.

Humanized Mouse and Rat Model Market Ecosystem

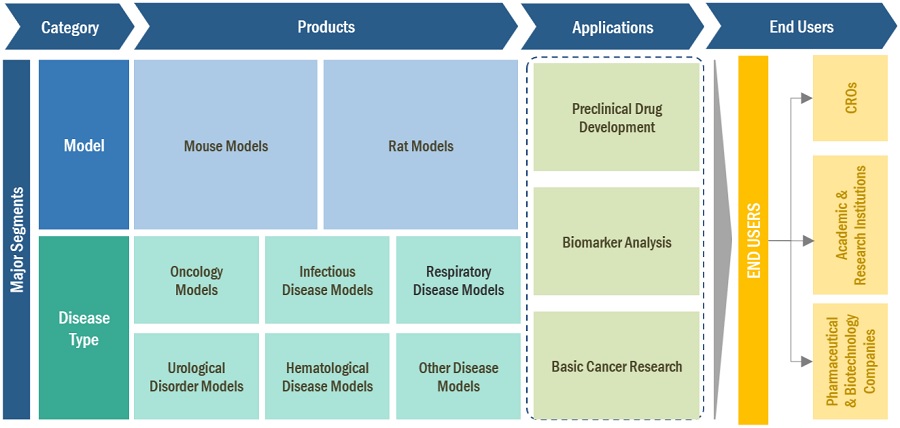

The market ecosystem comprises of product providers and end users such as Pharmaceutical & Biotechnology companies, Academic & Research Institutes, and CROs & CDMOs. The suppliers for Humanized Mouse and Rat Model provide these research models for applications such as Preclinical Drug Development, Biomarker Analysis, Cancer research, among others. Overall, the market ecosystem for humanized mouse and rat models is a complex and dynamic network of different players, all working together to advance biomedical research and to develop new and better therapies for human diseases.

The prominent players in the global humanized mouse and rat model market include Charles River Laboratories (US), THE JACKSON LABORATORY (JAX) (US), Taconic Biosciences, Inc. (US), Crown Biosciences (US), Champions Oncology, Inc. (US), Hera BioLabs (US), genOway (France), Inotiv (US), Vitalstar Biotechnology (China), Ingenious Targeting Laboratory (US), TRANS GENIC (Japan), Harbour Antibodies BV (Netherlands), Oncodesign (France), Pharmatest Services (Finland), Ozgene Pty Ltd. (Australia), TransCure bioServices (France), Cyagen Biosciences (US), Aragen Life Sciences Ltd. (India), GemPharmatech (China), and Biocytogen (US).

Ecosystem Analysis: Humanized Mouse and Rat Model Market

Source: Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis

Based on type, CD34 humanized mouse model segment accounted for the largest share of the humanized mouse and rat model industry in 2022

Based on type, the humanized mouse and rat model market has been segmented into humanized mouse models and humanized rat models. Humanized mouse models are segmented into genetic models and cell-based models. Cell-based models are further segmented into CD34 models, BLT models, and PBMC models. CD34 humanized mouse models garnered largest share in the market in 2022. CD34 mouse models are used as in vivo platforms for analyzing the safety and effectiveness of potential new drugs that can modulate the immune system. Additionally, these models are used for long-term studies in immuno-oncology, infectious diseases, and graft-versus-host disease. For example, NSG-engrafted models offer the longest research span, over 12 months, with a functional human immune system displaying T-cell-dependent inflammatory responses with no donor cell immune reactivity towards the host.

Based on application, oncology segment accounted for the largest market share of the humanized mouse and rat model industry

Based on application, the humanized mouse and rat model market is segmented into oncology, immunology and infectious diseases, neuroscience, hematopoiesis, toxicology, and other applications. The oncology segment accounted for the largest share of the humanized mouse and rat model market in 2022. The growth of this segment can be attributed to the growing number of cancer research programs in academic & research institutes and favorable support by governments for cancer research. For instance, in January 2023, researchers from Brigham and Women’s Hospital developed a new cell therapy for eliminating tumors; the cell therapy would act as a cancer vaccine to prevent tumors from reoccurring. Scientists recently tested the latest treatment in a mouse model of glioblastoma. Similarly, in October 2022, Yale School of Medicine developed its first humanized mouse model to study neutrophils in vivo. The team is working on putting tumors in humanized mice models and learning the effect.

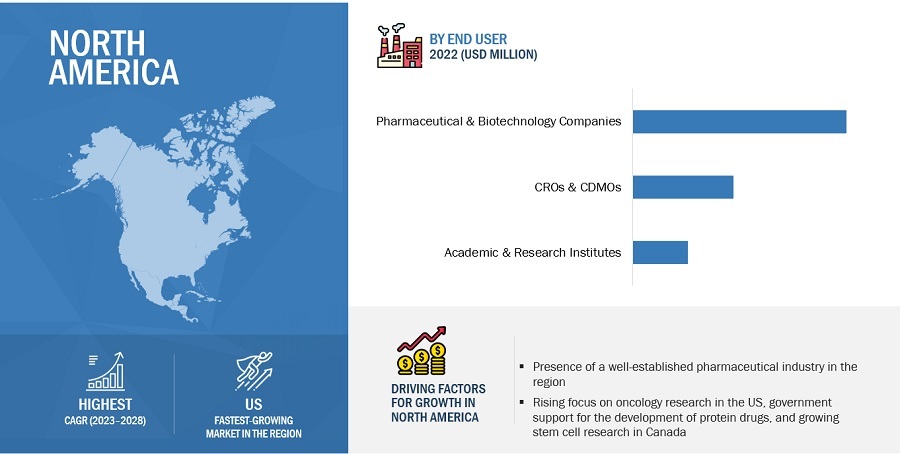

Based on end users, pharmaceutical & biotechnology companies segment accounted for the largest market share of the humanized mouse and rat model industry

Based on end user, the humanized mouse and rat model market has been segmented into pharmaceutical and biotechnology companies, CROs & CDMOs, and academic & research institutes. The pharmaceutical and biotechnology companies segment accounted for the largest share of the humanized mouse and rat model market in 2022. Factors such as the rising expenditure for innovative drug development and the growing preference for personalized medicine are expected to support the growth of the pharmaceutical & biotechnology companies segment.

The North American market is projected to contribute the largest share for the humanized mouse and rat model industry

The global humanized mouse and rat model market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America is the largest regional market for humanized mouse and rat model market in 2022, while Europe is the second-largest market. US has emerged as the key revenue contributor to this region. The large share of the market is primarily driven by the rising funding for life sciences research and growing research on mAbs and biosimilars. The growing incidence of cancer is also expected to support market growth. According to the American Cancer Society, over 1.9 million new cancer cases will be diagnosed in the US in 2023.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the global humanized mouse and rat model market include Charles River Laboratories (US), THE JACKSON LABORATORY (JAX) (US), Taconic Biosciences, Inc. (US), Crown Biosciences (US), Champions Oncology, Inc. (US), Hera BioLabs (US), genOway (France), Inotiv (US), Vitalstar Biotechnology (China), Ingenious Targeting Laboratory (US), TRANS GENIC (Japan), Harbour Antibodies BV (Netherlands), Oncodesign (France), Pharmatest Services (Finland), Ozgene Pty Ltd. (Australia), TransCure bioServices (France), Cyagen Biosciences (US), Aragen Life Sciences Ltd. (India), GemPharmatech (China), and Biocytogen (US).

Scope of the Humanized Mouse and Rat Model Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$259 million |

|

Projected Revenue by 2028 |

$349 million |

|

Revenue Rate |

Poised to Grow at a CAGR of 6.2% |

|

Market Driver |

Rising use of humanized models in drug discovery research |

|

Market Opportunity |

Growing demand for humanized rat models |

This report categorizes the humanized mouse and rat model market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Humanized Mouse Model

- Genetic Humanized Mouse Models

- Cell-Based based Humanized Mouse Model

- CD34 Humanized Mouse Models

- PBMC Humanized Mouse Models

- BLT Humanized Mouse Models

- Humanized Rat Model

By Application

- Oncology

- Immunology and Infectious Diseases

- Neuroscience

- Toxicology

- Hematopoiesis

- Other Applications

By End User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations and Contract Development & Manufacturing Organizations (CROs & CDMOs)

- Academic & Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific (RoAPAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Recent Developments of Humanized Mouse and Rat Model Industry

- In January 2022, Taconic Biosciences, Inc. (US) launched the huNOG-EXL EA (early access) humanized immune system (HIS) mouse.

- In October 2021, The Jackson Laboratory (US) acquired RMS Business of Charles River Laboratories Japan, Inc. (Japan) which is Charles River Laboratories Japan’s Research Models & Services (RMS) business as a wholly-owned subsidiary.

- In September 2021, Biocytogen (US) collaborated with Envigo (US) in order to support the research applications of the triple immunodeficient B-NDG mouse. Envigo is the exclusive provider of B-NDG mice in the US, Europe, and certain APAC regions.

- In March 2021, Charles River Laboratories International, Inc. (US) acquired Cognate BioServices, Inc. (US) a cell and gene therapy contract development and manufacturing organization (CDMO) offering comprehensive manufacturing solutions for cell therapies. The acquisition expanded Charles River's broad capabilities across the major CDMO platforms for cell and gene therapies.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the humanized mouse and rat model market?

The humanized mouse and rat model market boasts a total revenue value of $349 million by 2028.

What is the estimated growth rate (CAGR) of the humanized mouse and rat model market?

The global humanized mouse and rat model market has an estimated compound annual growth rate (CAGR) of 6.2% and a revenue size in the region of $259 million in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

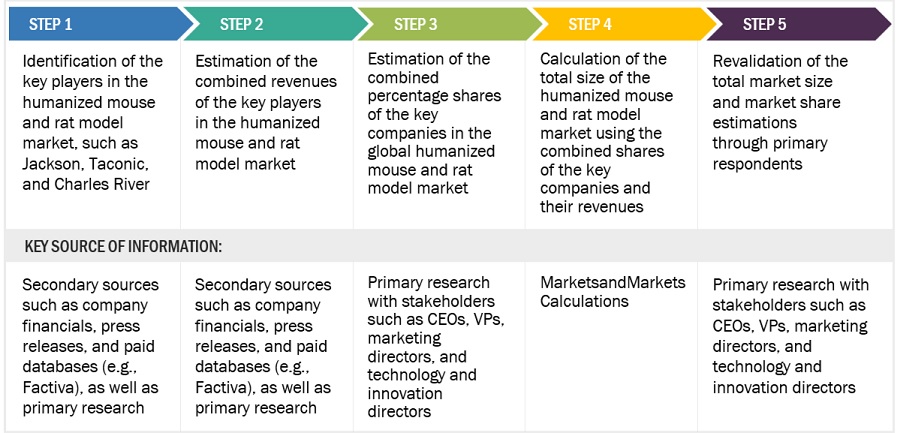

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global humanized mouse and rat model market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

This research study involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, Companies’ House documents, investor presentations, and SEC filings of companies. The secondary sources referred to for this research study include publications from government sources, such as the American Association for Cancer Research, American Association for Laboratory Animal Science, European Society for Medical Oncology, European Association for Cancer Research, Federation for Laboratory Animal Science Associations, Alzheimer's Association, European Animal Research Association (EARA), Humanized Mouse Resource (HMR), National Center for Biotechnology Information (NCBI), and Association for Assessment and Accreditation of Laboratory Animal Care International (AAALAC). Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the humanized mouse and rat model market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. Secondary data was collected and analyzed to arrive at the overall size of the global humanized mouse and rat model market, which was validated through primary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the humanized mouse and rat model market. The primary sources from the demand side included industry experts, purchase & sales managers, doctors, and personnel from research organizations. Primary research was conducted to validate the market segmentation, identify key players in the market, and as well as gather insights on key industry trends and key market dynamics.

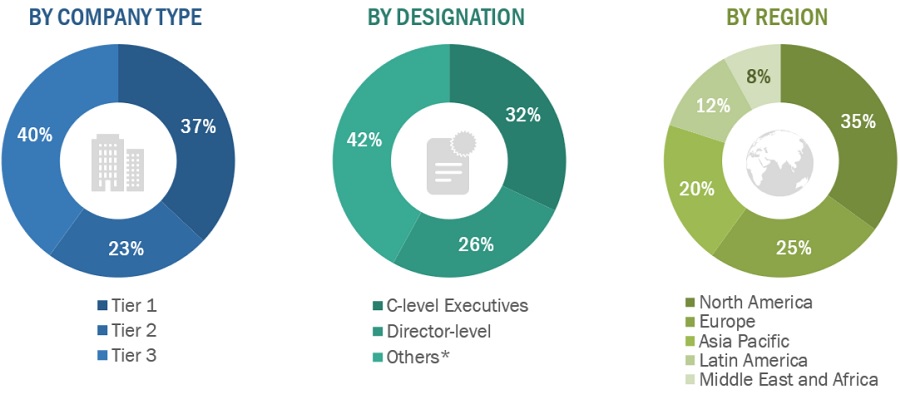

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

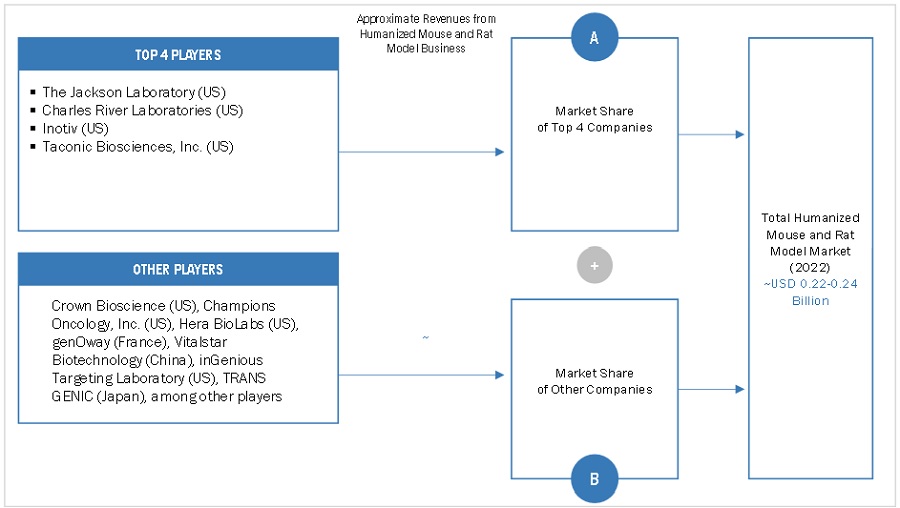

Top-down and bottom-up approaches were used to estimate and validate the size of the global market and various other dependent submarkets. The following paragraph and figure shows an illustrative representation of the overall market size estimation process employed for this study.

Approach 1: Supply Side Analysis

- The global humanized mouse and rat model market size was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of the market segments. Further splits were applied to arrive at the size of each subsegment. These percentage splits were validated by primary participants.

- The country-level market sizes obtained from annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for North America. By adding up the market sizes for all regions, the global humanized mouse and rat model market was derived.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the market size, the total humanized mouse and rat model market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, in order to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition:

A humanized mouse or rat model is an organism that has been genetically engineered to study immune responses to drugs or identify potential disease targets. Humanized mouse and rat models are widely used as research models to study human diseases and human genes. Researchers in academia and industry, as well as clinicians, use humanized mouse and rat models extensively in their research works. Humanized mouse and rat models are beneficial tools for immuno-oncology and infectious disease research. They have improved the ability to predict human responses to new therapeutics in clinical development.

Key Stakeholders

- Research and consulting firms

- Biopharmaceutical manufacturers

- Pharmaceutical manufacturers

- Mouse model and service companies

- Government and private research institutes

- Manufacturers and suppliers of animal care products

- Clinical research organizations (CROs)

- Academic and research institutes

- Venture capitalists

- Animal care associations

- Public and private animal health agencies

Report Objectives

- To define, describe, and forecast the humanized mouse and rat model market by type, application, end user, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges).

- To strategically analyze the micro markets with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific (APAC), Latin America, and the Middle East & Africa.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as acquisitions, collaborations, and product launches in the humanized mouse and rat model market.

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the RoE humanized mouse and rat model market, by country

- Further breakdown of the RoAPAC humanized mouse and rat model market, by country

- Further breakdown of the RoLA and MEA humanized mouse and rat model markets, by country

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Segment Analysis

- Further breakdown of the application segment as per the product portfolio of prominent players operating in the market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Humanized Mouse and Rat Model Market