Hydrogen Storage Market by Storage Form (Physical, Material-Based), Storage Type (Cylinder, Merchant, On-Site, On-board), Application (Chemicals, Oil Refineries, Industrial, Automotive & Transportation, Metalworking), Region - Forecast to 2030

Hydrogen Storage Market

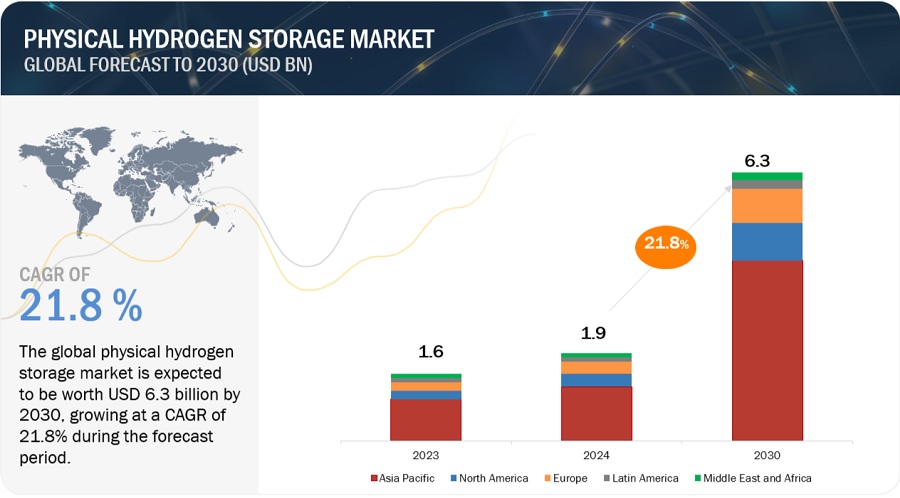

The global hydrogen storage market was valued at USD 1.5 billion in 2023 and is projected to reach USD 6.3 billion by 2030, growing at a cagr 21.5% from 2023 to 2030. The growth of the hydrogen gas industry depends upon safe and efficient storage as well as robust delivery techniques. Hydrogen can be stored in multiple ways. Among all, high-pressure gas cylinders and liquid cryogenic tank methods (known as physical method, when combined) are widely used because of their safe storage ability and reliable operation. Chemi-sorbed hydrogen on materials (also known as metal hydrides or solid storage or material-based storage) is a technique in which hydrogen gas is absorbed on intermetallic hydrides, such as AB5 (LaNi5), AB2 (ZrV2), and A2B (MgNi2), as these metals have the highest volumetric and gravimetric efficiencies, which can be utilized by releasing them on demand from the metal. This storage method is under research and is expected to be totally commercialized in the next 10–15 years.

Attractive Opportunities in the Hydrogen Storage Market

To know about the assumptions considered for the study, Request for Free Sample Report

Hydrogen Storage Market Dynamics

Driver: Rising demand for low-emission fuels is a major driver for market growth

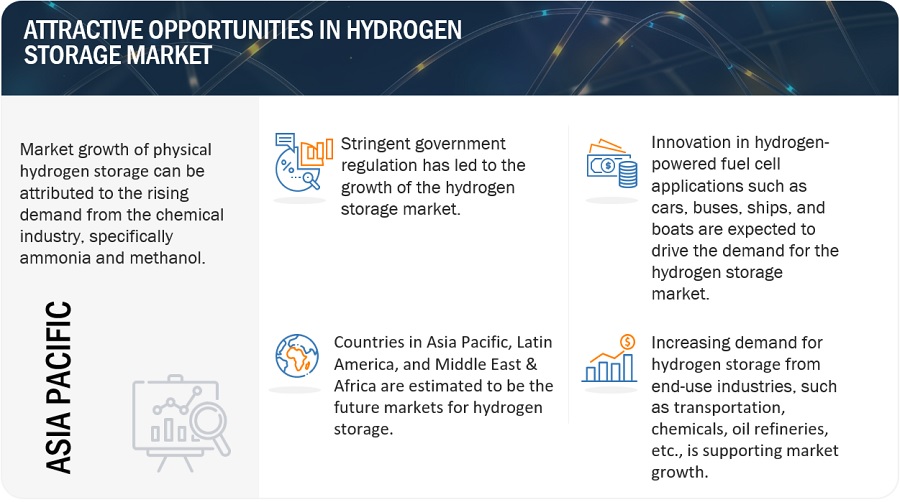

Hydrogen gas is mainly used in oil refineries for the desulfurization of fuels such as gasoline and diesel in transportation applications. Hydrogen demand will increase remarkably with more use of heavier and sour crude oil worldwide. The existing hydrogen generation capacity is insufficient to meet the increasing demand, resulting in the growth of merchant sourcing of the gas. Moreover, tighter environmental regulations on the use of cleaner, low-emission fuels and stringent engine manufacturer specifications are further expected to fuel the demand for hydrogen gas during the forecast period. The European Commission has developed Euro VII standards, which will reduce 4% NOx for cars and 2% NOx for vans and trucks by 2030. India is planning to cut carbon emissions by 1 billion tons by 2030.

Restraint: Limited availability of hydrogen refueling infrastructure in developed economies is a major restraint for market growth

Current hydrogen-powered vehicles are fitted with a 700-bar storage tank, which can go up to 300 miles on a single charge. Refueling at a site takes about 3 minutes, and the tank is filled with 5 kg of hydrogen at a cost of USD 12 per kilogram, providing a mileage of 300-450. Although the technology for hydrogen cars already exists, the infrastructure required to refill the tanks is currently lacking. In 2022, approximately 814 fueling stations were operational globally, with most of them in Asia Pacific. The higher cost of constructing a fueling station (approximately USD 1–2 million) and low confidence among investors concerning the growth of the hydrogen cars market, along with the high cost of cars (between USD 50,000 and USD 70,000), is restraining the Hydrogen Storage Industry growth of fuel cell vehicles. However, developed countries such as the UK, the US, Germany, and France have plans to increase the number of fueling stations gradually, across Europe, with a further decrease in the price involved in operating fueling stations and an increase in profit margins.

Opportunites: New applications for hydrogen-powered fuel cells is a major opportunity for market growth

Hydrogen-powered fuel cells are widely used for transportation. In 2020, 25,932 vehicles, including cars, buses, forklifts, ships & boats, and submarines, among others, were hydrogen-powered, and this number is expected to grow at a very high rate till 2027, driven by an increasing number of fueling stations, tighter regulations on internal combustion engine manufacturers concerning emission control. Fuel cell companies such as Plug Power (US), Ballard Power Systems (Canada), Hydrogenics Corporation (Canada), and SFC Energy AG (Germany) are some of the high-tech companies that develop newer applications for hydrogen-powered fuel cells. Some of these applications include ground support equipment used in airports for material handling, fuel-cell powered bicycles, ships & boats, trams & trains, submarines, and unmanned vehicles. The number of refilling stations is expected to rise during the forecast period due to the development of new end-use applications for hydrogen-powered fuel cells, thereby commercializing hydrogen technology on a large scale.

Challenges: High competition from alternative fuels is a major challenge for market growth

Hydrogen is not the only alternative fuel option that helps in reducing gas emissions. Hydrogen fuel faces stiff competition from biofuels and electric vehicles. In the first quarter of 2022, two million electric cars were sold worldwide (Source: IEA), and this sale is expected to rise significantly during the forecast period. Hydrogen cars have a threat to electric vehicles as both have less impact on the environment. The necessary infrastructure for refueling the tanks is inadequate, restraining market growth. If hydrogen technology does not become more refined globally during the forecast period, it may be substituted by electric cars. Toyota, Hyundai, and Honda have started developing electric vehicles in addition to hydrogen-powered vehicles in case the latter technology gets phased out.

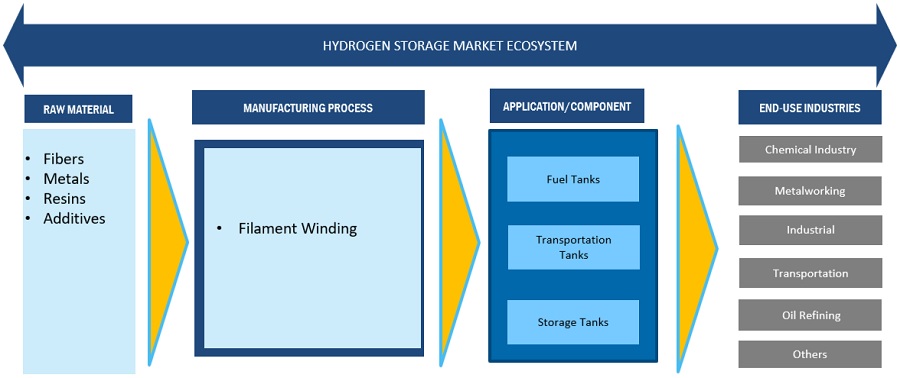

Hydrogen Storage Market Ecosystem

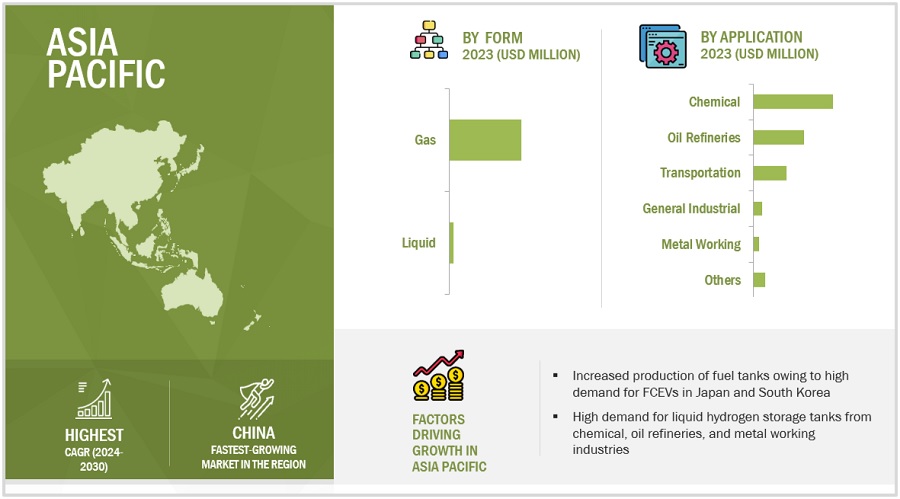

Based on form, gas form is expected to grow with highest CAGR during the forecast period.

The physical hydrogen storage market is dominated by the gas form, as most car manufacturers have opted for storing hydrogen in the gaseous form at high pressure. Transportation is a major end-use industry in the physical hydrogen storage market.

Based on type, cylinder segment led the physical hydrogen storage market, in terms of volume in 2022.

Applications, where hydrogen is required in relatively small quantities at regular intervals, are generally supplied with cylinders and transported by trucks and trailers. Hydrogen is supplied in cylinders, popularly known as cylinder banks. The market of cylinders used for hydrogen storage finds applications in food, metalworking, and electronics. Hydrogen is used in the food industry to convert unhealthy unsaturated fats into saturated oil and fats. It is also used as an element to make hydrogenated vegetable oils such as margarine and butter. In the metalworking industry, hydrogen gas is mixed with argon to create a range of argon/hydrogen shielding gas for tungsten inert gas (TAG) and plasma welding. In electronics, hydrogen gas is used for lithography (gases used for laser operations), purging, and generator cooling.

Based on application, the transportation segment is expected to witness exceptional growth in the physical hydrogen storage market in 2022.

Transportation application is projected to register the highest growth during the forecast period. The primary drivers of physical hydrogen storage market growth in this segment are the demand for hydrogen-powered fuel cell vehicles in European and North American markets due to regulations concerning the reduced use of CO2-emitting cars. Moreover, there have been many innovations recently in hydrogen-powered fuel cell applications which will further boost the demand for hydrogen storage tanks during the forecast period. The transportation fuel cells are expected to grow exceptionally, driven by sustainable innovations in fossil fuel-free energy sources. Automobile companies such as Hyundai (South Korea), Toyota (Japan), Honda (Japan), and Daimler AG (Germany) are developing a combination of hydrogen and electric-powered cars, which will further boost the demand for hydrogen storage tanks during the forecast period. Currently, some of the manufacturers of Class 4 (carbon fiber) transportation tanks are ILJIN (South Korea), Hexagon Lincoln (US), Quantum Fuel Technologies Worldwide Inc. (US) & Luxfer Holdings PLC (UK).

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific to be the fastest-growing region in the physical hydrogen storage market during the forecast period.

Asia Pacific is one of the leading green technology adoption markets to meet government targets for lowering greenhouse gas (GHG) emissions. Japan and South Korea have invested heavily in fuel cell adoption since 2009, owing to the commercial deployment of Japanese fuel cell micro-CHP products. The Roadmap for the Hydrogen Economy of South Korea, published in January 2019, outlines one of the most critical national fuel cell and hydrogen development plans. The Japanese Basic Hydrogen Strategy also lays out a vision for common goals that the public and private sectors should strive for by 2050. Fuel cells have also piqued the interest of India and Malaysia, which have launched exclusive programs to promote them in regional markets. China has also announced a four-year pilot program to support R&D and demonstration of FCEVs in select cities across the country.

Hydrogen Storage Market Players

Some of the key players in the global hydrogen storage market are Air Liquide (France), Worthington Industries, Inc. (US), Luxfer Holdings PLC (UK), Linde plc (Germany), Chart Industries (US), INOXCVA (India), Hexagon Composites ASA (Norway), HBank Technologies Inc. (Taiwan), Pragma Industries (France), Croyolor (France).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the hydrogen storage industry. The study includes an in-depth competitive analysis of these key players in the hydrogen storage market, with their company profiles, recent developments, and key market strategies.

Hydrogen Storage Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 1.5 billion |

|

Revenue Forecast in 2030 |

USD 6.3 billion |

|

CAGR |

21.5% |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Units considered |

Value (USD Billion), Volume (Units) |

|

Segments Covered |

By Form, By Type, By Application, Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa |

|

Companies covered |

Air Liquide (France), Worthington Industries, Inc. (US), Linde plc (Germany), Luxfer Holdings PLC (UK), Hexagon Composites ASA (Norway), Chart Industries (US), INOXCVA (India), HBank Technologies Inc. (Taiwan), Pragma Industries (France), Croyolor (France), and others |

The study categorizes the hydrogen storage market based on form type, type, Application, and Region.

By Form:

- Gas

- Physica

By Type:

- Cylinder

- Merchant/Bulk

- On-site

- On-board

By Application:

- Chemicals

- Oil Refineries

- Metalworking

- Industrial

- Automotive & Transportation

- Others

By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In April 2022, Innovair Group partnered with Worthing Industries Inc. to introduce the best cylinders in Canada.

- In March 2022, Air Liquide and Lotte Chemical has entered into a joint venture to scale up the hydrogen supply chain for mobility markets.

- In July 2021, Luxfer Gas Cylinders, a subsidiary of Luxfer Holdings Inc. and Octopus Hydrogen have partnered to make the goods transportation and aviation industry cleaner and greener.

- In March 2021, Luxfer Holdings Inc. acquired SCI (Structural Composites Industries) business of Worthington Industries Inc. to capitalize the growing hydrogen opportunities. The SCI team will be joining the Gas cylinders team of Luxfer.

- In February 2021, Linde partnered with Hyosung Corporation to develop, own, and operate liquid hydrogen infrastructure in South Korea.

- In February 2021, Worthington released ThermaGuard™ hydrogen cylinders for transporting and storing high-pressure hydrogen gas, meticulously developed using Worthington’s aerospace-grade standards.

Frequently Asked Questions (FAQ):

Which are the major companies in the hydrogen storage market? What are their major strategies to strengthen their market presence?

Some of the major players are Air Liquide (France), Worthington Industries, Inc. (US), Luxfer Holdings PLC (UK), Linde plc (Germany), Chart Industries (US), among others.

What are the opportunities for the hydrogen storage market?

Development of low-weight storage tank for transportation is the one of the major trends in the hydrogen storage market.

What are the factors influencing the growth of the hydrogen storage market?

The rising demand for low-emission fuels, increased hydrogen demand in other applications, and development of hydrogen infrastructure across various countries is driving the growth of the market.

Which is the highest growing country-level market for hydrogen storage?

China is the highest growing country in the hydrogen storage market due to high demand from well-established end-use industries such as automotive & transportation, chemicals and others.

What are the challenges in the hydrogen storage market?

High competition from alternative fuels and Fluctuating oil prices are the major challenge in the hydrogen storage market.

Which type of hydrogen storage is expected to witness highest growth?

On-board is expected to register the highest growth in terms of value and volume, in the hydrogen storage market.

How is the hydrogen storage market aligned?

The market is growing at the fastest pace. It is a potential market and many manufacturers are undertaking business strategies to expand their business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

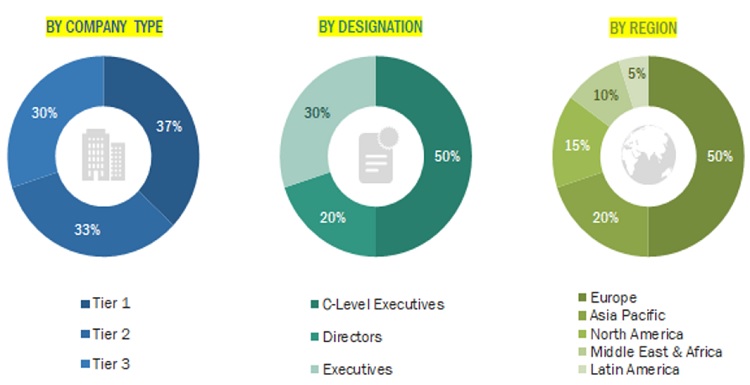

The technical and market-oriented study on the hydrogen storage market extensively used secondary sources, directories, and databases such as Hoovers, Bloomberg, Businessweek, Factiva, World Bank, The World Economic Forum, and IEA to ascertain and collect information. Primary sources included several industry experts from core and related industries, suppliers, manufacturers, distributors, service providers, standards and certification organizations, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the qualitative and quantitative information and assess their prospects.

Secondary Research

Secondary research was done using annual reports, press releases and investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold and silver standard websites, and databases to obtain critical information about the industry’s value chain, total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level and regional markets. It also helped obtain information about the key developments from a market-oriented perspective.

Primary Research

The Hydrogen Storage Industry comprises several stakeholders in the value chain, including raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the demand side included key opinion leaders from various end-use industries of hydrogen storage. In contrast, those from the supply side included experts from companies manufacturing hydrogen storage tanks.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Worthington Industries, Inc. |

Product Development Head |

|

Luxfer Holdings PLC |

CEO & Founder |

|

INOXCVA |

Consultant |

|

Croyolor |

Sales Head |

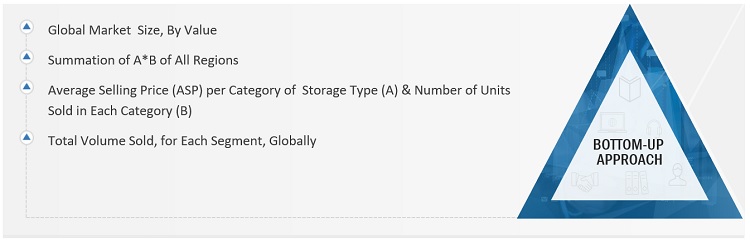

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the hysrogen storage market. Key players in the industry were identified through extensive secondary research. The supply chain of the industry and the market size, in terms of volume, were determined through primary and secondary research. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. The research process included the study of reports, reviews, and newsletters of the key market players and extensive interviews for opinions from leaders such as directors and marketing executives.

Hydrogen Storage Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Hydrogen Storage Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Hydrogen is the lightest and most abundant element in the universe. Hydrogen can be stored in two forms material and physical. The physical form of storage of hydrogen is either in a liquid or gaseous state in high-pressure tanks of 350–700 bars, whereas liquid hydrogen needs to be stored at cryogenic temperatures of −252.8°C. Apart from this, it can also be stored in solid form.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the global hydrogen storage market based on form, type, application, and region.

- To provide detailed information about key factors (drivers, restraints, opportunities, and challenges) influencing market growth.

- To analyze market segments and forecast the market size based on form, type, application, and region.

- To forecast the market size based on North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- This report considers only the physical form of hydrogen storage market by form, by type, by application, and by region; whereas, the market of material-based form of storage has been provided only at the regional level.

- To strategically analyze micromarkets concerning individual growth trends, growth prospects, and contribution to the total market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape.

- To analyze competitive developments in the market, such as new product launches/developments, expansions, mergers & acquisitions, joint ventures, agreements, contracts, and partnerships.

- To profile key players and comprehensively analyze their market shares and core competencies.

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the hydrogen storage market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Hydrogen Storage Market