Industrial Communication Market by Components (Switches, Gateways, Power Supply Devices, Router & WAP, Communication Interface & Protocol Converters, Controllers), Software, Services, Communication Protocol, Vertical and Region - Global Forecast to 2028

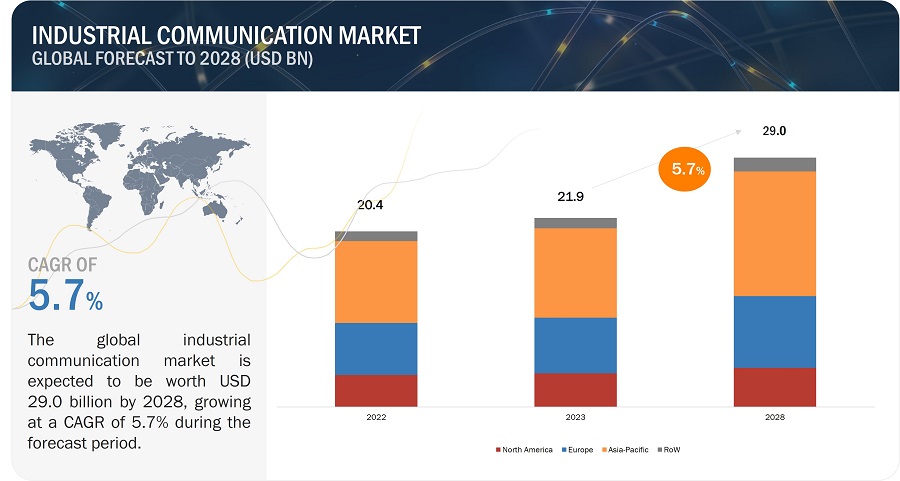

[241 Pages Report] The industrial communication market is projected to grow from USD 21.9 billion in 2023 to USD 29.0 billion by 2028; it is expected to grow at a CAGR of 5.7% from 2023 to 2028. Initiatives undertaken by governments of different countries to promote the adoption of industrial automation, the growing need for scalable, faster, reliable, and interoperable communication protocols, increasing use of machine-to-machine communication technology, and increasing use of digital twin to safely monitor smart manufacturing operations are among the factors driving the growth of industrial communication market.

Industrial Communication Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Communication Market Dynamics

Driver: Increasing use of machine-to-machine communication technology

Better connectivity for smooth communication and low power requirements are the key reasons for the increased adoption of new machine-to-machine (M2M) technologies. To achieve effective M2M communication, the existing capacity of mobile networks must be able to handle billions of nodes that are expected to be deployed in the next couple of years. Currently, the network capacity is not capable of handling M2M and human-based communications, as well as their different communication patterns, including latency time. For this reason, a next-level cellular network for mobile communication featuring hyper-connectivity and larger bandwidth (e.g., 5G) is required. The M2M communication technology will be widely used in the coming years in heavy manufacturing industries and process industries (e.g., food industry) to increase the efficiency of different processes and reduce human intervention for machines.

M2M technology has opened new avenues for the industrial communication market. It enables enterprises to improve their productivity and safety in work environments, thus allowing them to attain better efficiencies. Such benefits of M2M communication are expected to further drive the industrial communication market.

Restraint: Absence of standardization in industrial communication protocols and interfaces

Industrial equipment or devices communicate through various interfaces, technologies, and protocols. The lack of standardization in these communication interfaces and protocols may result in the misrepresentation of data. The lack of standardization complicates the integration of systems and hinders the use of plug-and-play features for unrelated systems. For instance, most equipment manufacturers use their proprietary interface protocols to communicate with their devices, which results in communication challenges for the devices developed by other manufacturers.

Opportunity: Upsurge in demand for wireless networks

The rapid growth in the demand for wireless technologies, such as Bluetooth Smart, WirelessHART, WLAN, and Zigbee, is opening new growth opportunities for the industrial communication market, mainly for the oil & gas, electronics, and energy & power generation industries. Zigbee helps drive the market for low-cost wireless network solutions. The Zigbee IEEE 802.15.4 technology has been adopted by many organizations worldwide. Similarly, WirelessHART-enabled communication is becoming one of the most widely used options for signal transmission in process industries using HART communication. WLAN (IEEE 802.11) is used for high-performance infrastructure networks that are also suitable for industrial applications. Advancements in wireless communication technologies, especially cellular technologies, are helping various industries to monitor their assets across the world. These technologies enable efficient and universal communication for all industrial applications. In process and infrastructure applications, industrial wireless systems simplify the process of recording data from remote stations and field devices, which would otherwise be inaccessible for accomplishing the process. The speed and simplicity of the installation of wireless networks have also made them popular among industries, as they can be deployed to facilitate M2M communication even under extreme environments. All these factors have contributed to the growth of the market for wireless technologies for industrial communication, especially in highly industrialized regions, and are expected to drive the overall market in the coming years.

Challenge: Harsh field site conditions such as high-voltage transients, severe shocks and vibrations, and extremely high temperatures

Industrial communication technology is increasingly being deployed at remote field locations. Remote field locations are more prone to the effects of unfavorable and harsh conditions, such as high-voltage transients, shocks and vibrations, and extremely high temperatures. High voltage transients result from electrostatic discharge (ESD), surge, burst, electrical fast transients (EFT), and lightning strikes. Industrial switches should be capable of preventing high-voltage transients by providing high electromagnetic protection. Shock and vibration in machinery can separate networking wires meant for long-term exposure to shock and vibration, eventually resulting in electrical shorts, broken solder joints, loose printed circuit board (PCB) components, PCB delamination, and cracked device housings. Moreover, remote onsite locations may not have air conditioning; this raises the demand for switches with high-temperature tolerance and optimal heat dissipation to keep the switch lifecycle intact. Therefore, there is a requirement for robust industrial communication equipment to withstand harsh conditions.

Services offerings to witness highest CAGR during the forecast period

There is a growing requirement for services pertaining to industrial communication. Various services are provided by industrial communication market players, which can meet the application-specific needs of end users. Service providers provide customized network design and other related services, such as long-term maintenance contracts of installations, to cater to clients with specific requirements. They also provide remote support services for networks and can solve or manage network problems remotely. Companies such as Siemens and General Electric provide a separate services portfolio for this market.

Pharmaceutical and medical devices to witness highest CAGR during the forecast period

The pharmaceutical industry is evolving with the adoption of automation and sensing technologies. A pharmaceutical company generally has different plants or units for various processes, such as manufacturing and packaging. Chemical plants process various medicines, and the manufacturing and packaging plants pack these medicines into capsules and bottles. However, there must be proper communication between these units to ensure efficient production. Companies such as Rockwell Automation provide communication solutions for gaining real-time access and extended enterprise visibility into vital manufacturing data. This can enable businesses to improve their processes and provide organizations with better access to real-time production information. It also helps improve supply chain integration across a pharma facility.

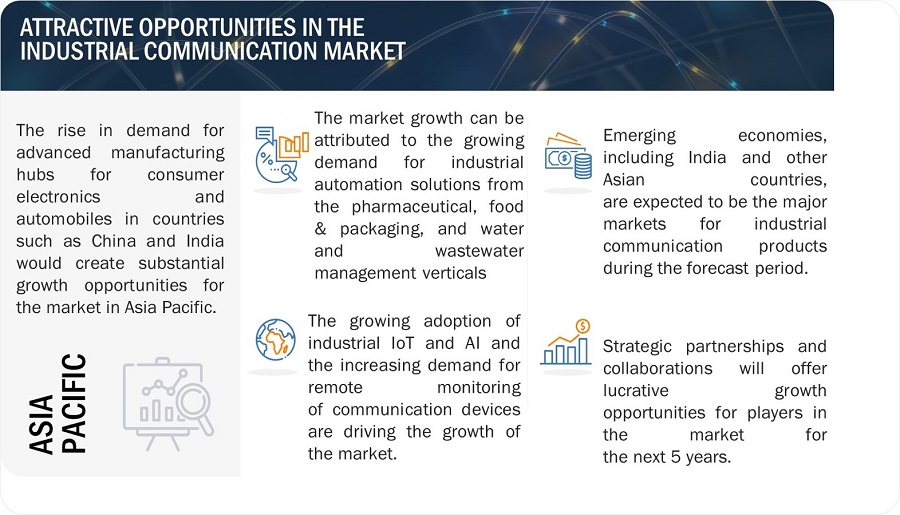

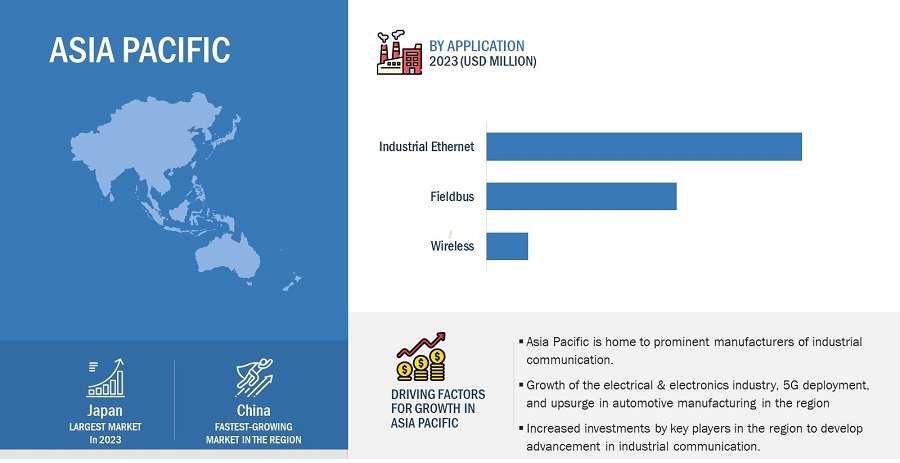

Asia Pacific to witness highest CAGR during forecast period

Asia Pacific is currently the largest manufacturing hub for automotive and electronics companies. The manufacturing companies in Asia Pacific extensively adopt the smart factory concept for implementing advanced manufacturing technologies on the factory floor. This innovative concept has transformed the manufacturing sector in Asia Pacific and has increased the implementation of smart automation in factories. The growing acceptance of Industrial Revolution 4.0 in Asia Pacific is among the factors driving the growth of the industrial communication market in this region. Furthermore, an increase in factory automation in various industries to integrate wireless networking technologies for reliable and fast machine-to-machine communications led to the growth of the industrial communication market in Asia Pacific.

Industrial Communication Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the industrial communication companies include Cisco Systems, Inc. (US), Siemens (Germany), Rockwell Automation (US), OMRON Corporation (Japan), Moxa Inc. (Taiwan), Huawei Technologies Co., Ltd. (China), SICK AG (Germany), Schneider Electric (France), ABB (Switzerland), Belden Inc. (US), GE (France), Advantech Co., Ltd (Taiwan), FANUC CORPORATION (Japan), Bosch Rexroth AG (Germany), AAEON Technology Inc. (Taiwan), HMS Networks (Sweden), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), Ericsson (Sweden), Hans Turck GmbH & Co. KG (Germany), ACS Motion Control (Israel), Eaton (Ireland), Beckhoff Automation (Germany), Hitachi, Ltd. (Japan). These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Estimated Market Size | USD 21.9 billion in 2023 |

| Projected Market Size | USD 29.0 billion by 2028 |

| Growth Rate | CAGR of 5.7% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Offering, By Communication Protocol, By Vertical, By Geography |

|

Geographies Covered |

South America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Cisco Systems, Inc. (US), Siemens (Germany), Rockwell Automation (US), OMRON Corporation (Japan), Moxa Inc. (Taiwan), Huawei Technologies Co., Ltd. (China), SICK AG (Germany), Schneider Electric (France), ABB (Switzerland), Belden Inc. (US), GE (France), Advantech Co., Ltd (Taiwan), FANUC CORPORATION (Japan), Bosch Rexroth AG (Germany), AAEON Technology Inc. (Taiwan), HMS Networks (Sweden), Honeywell International Inc. (US), Mitsubishi Electric Corporation (Japan), Ericsson (Sweden), Hans Turck GmbH & Co. KG (Germany), ACS Motion Control (Israel), Eaton (Ireland), Beckhoff Automation (Germany), and Hitachi, Ltd. (Japan) |

Industrial Communication Market Highlights

This research report categorizes the industrial communication market based on by offering, by communication protocol, by vertical, and by region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Communication Protocol |

|

|

By Vertical |

|

|

By Geography |

|

Recent Developments

- In February 2023, Cisco Systems, Inc.has launched Meraki’s first 5G Cellular Gateways for fixed wireless access (FWA). The Cisco Meraki MG51 and MG51E cellular gateways provide a 5G powered, cloud first way of doing Wide Area Networking (WAN).

- In April 2023, The Simatic S7-1500V is an expansion of Simatic Portfolio which meets special market requirements such as virtual hosting of PLC computing.

- In December 2022, Rockwell Automation launched FactoryTalk Logix Echo streamlines the emulator process by allowing users to download straight to FactoryTalk Logix Echo without any adjustments. It provides the quick system performance, large capacity, and optimized productivity that a control system needs. ControlLogix 5580 controllers are multi-discipline controllers that may control distinct, motion, process, and safety applications.

- In October 2022, for the first time in the United States, OMRON Corporation showcased their IoT Gateways. These capture correct data, link to the cloud reliably, and develop solutions to extend automation in our daily life.The company has created several lineups and hardware/software platforms that allow clients to quickly and freely customize features, resulting in faster and easier creation of IoT solutions.

- In October 2022, Moxa, Inc launched the EDR-G9010 Series which is a secure router that includes a firewall, NAT, VPN, and a switch. With the inclusion of IDS/IPS, the EDR-G9010 Series is transformed into an industrial next-generation firewall, complete with risk detection and prevention features to defend critical infrastructure from cybersecurity assaults.

Frequently Asked Questions (FAQ):

What is the current size of the Global industrial communication market?

The industrial communication market is projected to grow from USD 21.9 billion in 2023 to USD 29.0 billion by 2028; it is expected to grow at a CAGR of 5.7% from 2023 to 2028.

Who are the winners in the global industrial communication market?

Companies including Cisco Systems, Inc (US), Siemens (Germany), Rockwell Automation (US), OMRON Corporation (Japan), Moxa Inc. (Taiwan) are the winners in the industrial communication market.

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the industrial communication market during the forecast period. Growing demand in electrical & electronics industry and the presence of established industrial communication component manufacturers are the major factors contributing to the market growth in Asia Pacific.

What are the major drivers related to the industrial communication market?

The growing need for scalable, faster, reliable, and interoperable communication protocols, increasing use of digital twin to safely monitor smart manufacturing operations, initiatives undertaken by governments of different countries to promote the adoption of industrial automation, and increasing use of machine-to-machine communication technology.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the industrial communication market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

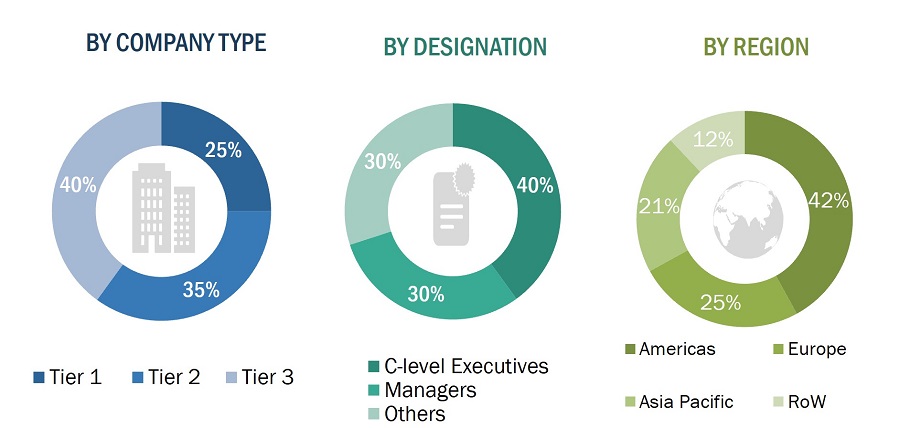

The study involved four major activities in estimating the size of the industrial communication market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering industrial communication components, software, and services have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; IoT technologies journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases.

Secondary research has been mainly conducted to obtain critical information about the value chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated by primary research.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the industrial communication market through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand and supply sides across 4 major regions: North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews have been conducted with the demand side, while 75% have been conducted with the supply side. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews. Questionnaires and e-mails have also been used to collect data.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the industrial communication market.

- Identifying end users that are either using or are expected to use industrial communications

- Tracking leading companies and other key manufacturers operating across various sectors

- Deriving the size of the industrial communication market through the data sanity method; analyzing revenues of more than 25 key providers through their annual reports and press releases; and summing them up to estimate the overall market size

- Understanding and analyzing Y-o-Y projections to derive the projected market values of each type, media, and industry; initially, the Y-o-Y projections showed a moderate growth till 2019. However, with the unfolding of the impact of the COVID-19, the industrial communication market witnessed a slight downfall in 2020 but made a significant recovery in FY 2021/2022. The market is expected to witness a steady increase in its growth thereafter, considering the surging demand for industrial communication from different end users

- Carrying out the market trend analysis to obtain the CAGR of the industrial communication market by understanding the industry penetration rate and analyzing the demand and supply of industrial communication in different industries

- Assigning a percentage to the overall revenue or, in a few cases, to segmental revenues of each company to derive their revenues from the sales of industrial communications. This percentage for each company was assigned based on their product portfolios and the range of their industrial communication offerings

- Verifying and crosschecking estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operation managers, and with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources such as annual reports, press releases, white papers, and databases

- Tracking the ongoing projects and identifying the upcoming industrial communication implementation projects by companies, and forecasting the market size based on these developments and other critical parameters

Data Triangulation

After arriving at the overall size of the industrial communication market from the estimation process explained earlier, the global market was split into several segments and subsegments. Where applicable, data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Industrial communication combines components, software, and standard protocols, allowing man-to-machine and machine-to-machine communications across various industries. Efficient, reliable, and secure industrial communications help improve operational efficiency and reduce the overall operating costs of industries. Industrial communication plays a significant role in oil & gas, electronics, automotive, power generation, and several other sectors.

Key Stakeholders

- Raw materials, testing and processing equipment vendors, services providers, distributors, and suppliers of industrial communication devices

- Research organizations

- Original equipment manufacturers (OEMs)

- Technology standards organizations, forums, alliances, and associations

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- Industries willing to know more about the industrial communication market and the latest trends

Report Objectives

- To define, describe, and forecast the industrial communication market, by offering, communication protocol, and vertical, in terms of value

- To describe and forecast the market size, by region, for North America, Europe, Asia Pacific (Asia Pacific), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To describe the industrial communication value chain

- To analyze opportunities in the market for stakeholders and describe the competitive landscape of the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as product developments/launches, expansions, and acquisitions in the market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Communication Market

I am Interested in undertanding the total global industrial communications market in terms of volume and size. I am also interested in understanding the competitive landscape of market players for the industrial communication market and the key strategies adopted by them in this market.

I am interested in understanding the market for industrial communication in Europe. Also, I would like to know more about the industrial communication equipment market for specific countries in Europe and if these include communication protocol.

I am looking for in-depth analysis on the industrial communication market. Can you help me with the scope of the industrial communication market? I would like to know more about the segments covered in the report. I would also like to understand the research methodology used to arrive at the market size.

We would like to understand the ecosystem for the industrial communication market and the major product offerings of leading players in this market, along with the key strategies adopted by them. I am also looking for some use cases specific to industrial ethernet.

I would like to know the overall scope of the industrial communication market report in terms of the industries covered and the type of components, software, and services that are included in the report. Also, I would like to know if metal is included in the mining sector, and, if not, can you provide market sizing for the steel and metal industry?