TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 INDUSTRIAL FILTRATION MARKET SEGMENTATION

1.4 STUDY SCOPE

1.4.1 INCLUSIONS AND EXCLUSIONS

1.4.1.1 Industrial filtration market, by type: Inclusions and exclusions

1.4.1.2 Industrial filtration market, by product: Inclusions and exclusions

1.4.1.3 Industrial filtration market, by filter media: Inclusions and exclusions

1.4.1.4 Industrial filtration market, by industry: Inclusions and exclusions

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 UNIT CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

1.10 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 1 INDUSTRIAL FILTRATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 List of major secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Key industry insights

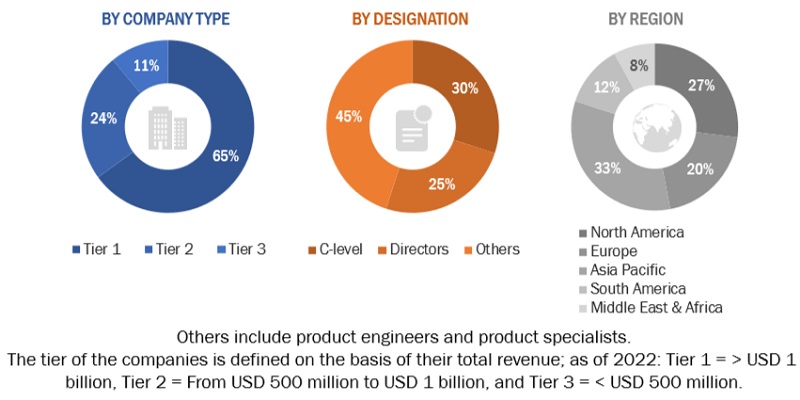

2.1.2.4 Breakdown of primaries

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.3 SCOPE

FIGURE 3 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR INDUSTRIAL FILTRATION PRODUCTS

2.4 MARKET SIZE ESTIMATION METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 DEMAND-SIDE ANALYSIS

TABLE 1 INDUSTRIAL FILTRATION MARKET: INDUSTRY-/COUNTRY-WISE ANALYSIS

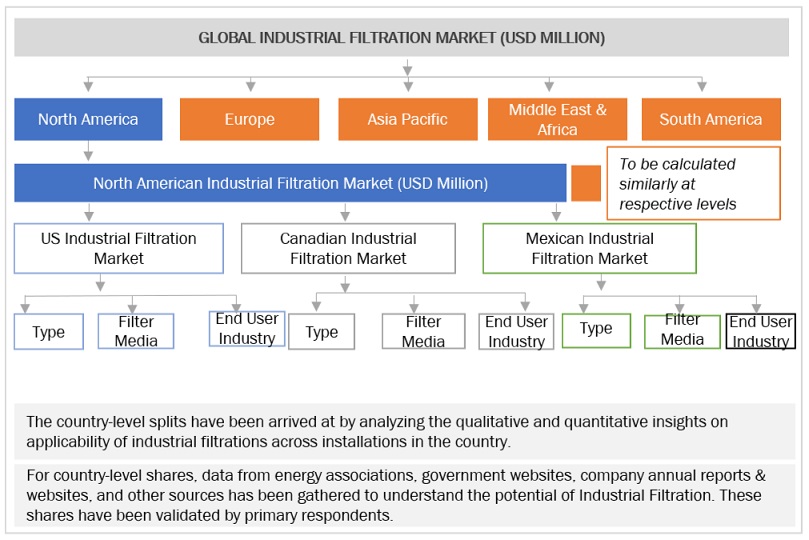

2.4.3.1 Regional analysis

2.4.3.2 Country-level analysis

2.4.3.3 Assumptions for demand-side analysis

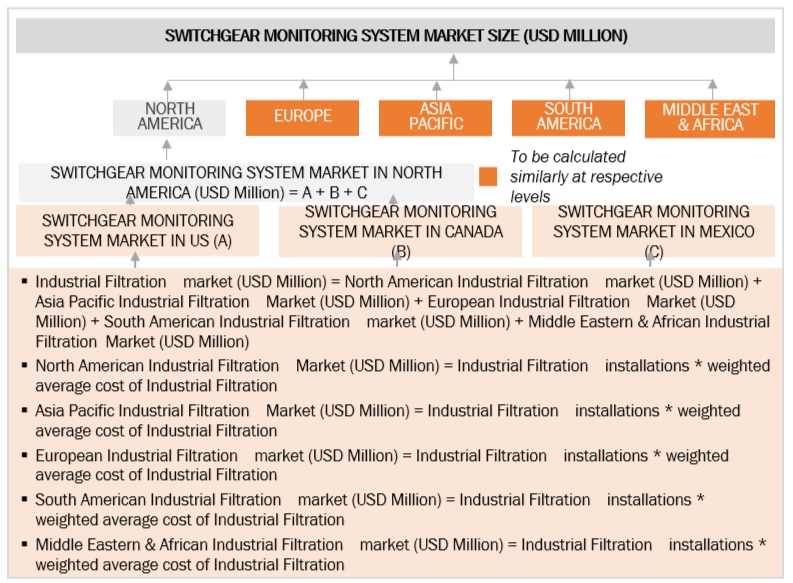

2.4.3.4 Calculations for demand-side analysis

2.4.4 SUPPLY-SIDE ANALYSIS

FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF INDUSTRIAL FILTRATION PRODUCTS

FIGURE 7 INDUSTRIAL FILTRATION MARKET: SUPPLY-SIDE ANALYSIS

2.4.4.1 Assumptions for supply-side analysis

2.4.4.2 Calculations for supply-side analysis

FIGURE 8 COMPANY REVENUE ANALYSIS, 2023

2.4.5 FORECAST

2.5 RISK ASSESSMENT

2.6 RECESSION IMPACT ANALYSIS

2.6.1 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON INDUSTRIAL FILTRATION MARKET

3 EXECUTIVE SUMMARY (Page No. - 64)

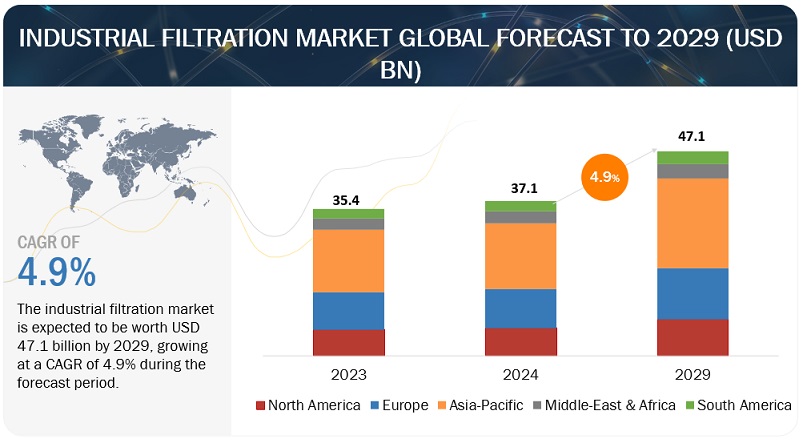

TABLE 2 INDUSTRIAL FILTRATION MARKET SNAPSHOT

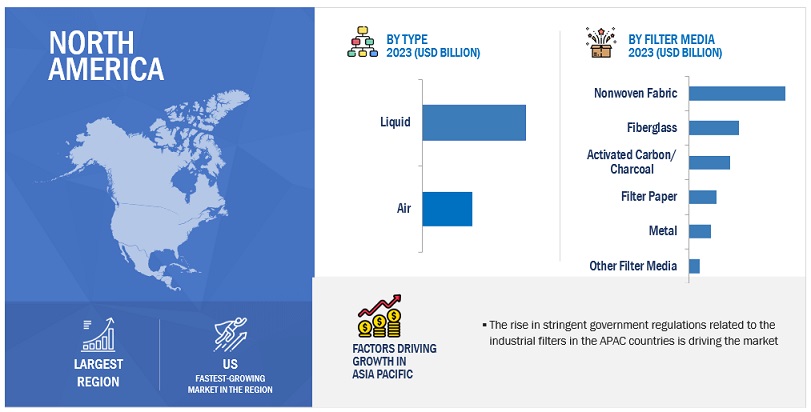

FIGURE 9 NORTH AMERICA DOMINATED INDUSTRIAL FILTRATION MARKET IN 2023

FIGURE 10 LIQUID SEGMENT TO HOLD LARGER SHARE OF INDUSTRIAL FILTRATION MARKET, BY TYPE, IN 2029

FIGURE 11 NONWOVEN FABRIC SEGMENT TO LEAD INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, THROUGHOUT FORECAST PERIOD

FIGURE 12 BAG FILTER SEGMENT TO CAPTURE LARGEST SHARE OF INDUSTRIAL FILTRATION MARKET, BY PRODUCT, IN 2029

FIGURE 13 CHEMICALS & PETROCHEMICALS SEGMENT TO CAPTURE LARGEST SHARE OF INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, IN 2029

4 PREMIUM INSIGHTS (Page No. - 69)

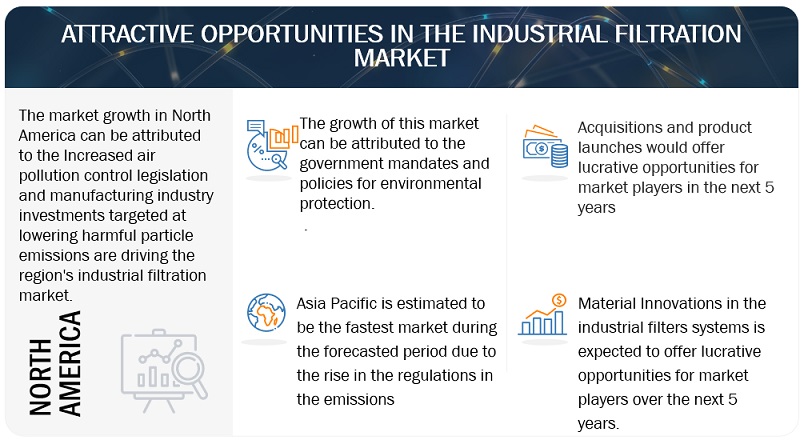

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL FILTRATION MARKET

FIGURE 14 GROWING FOCUS ON PROTECTING HEALTH AND WELL-BEING OF EMPLOYEES IN INDUSTRIAL SETTINGS TO DRIVE MARKET IN COMING YEARS

4.2 INDUSTRIAL FILTRATION MARKET, BY REGION

FIGURE 15 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN INDUSTRIAL FILTRATION MARKET DURING FORECAST PERIOD

4.3 INDUSTRIAL FILTRATION MARKET IN NORTH AMERICA, BY INDUSTRY

FIGURE 16 CHEMICALS & PETROCHEMICALS INDUSTRY AND US DOMINATED NORTH AMERICAN INDUSTRIAL FILTRATION MARKET IN 2023

4.4 INDUSTRIAL FILTRATION MARKET, BY TYPE

FIGURE 17 LIQUID SEGMENT TO HOLD LARGER SHARE OF INDUSTRIAL FILTRATION MARKET IN 2029

4.5 INDUSTRIAL FILTRATION MARKET, BY PRODUCT

FIGURE 18 BAG FILTER SEGMENT TO HOLD MAJORITY OF MARKET SHARE IN 2029

4.6 INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA

FIGURE 19 NONWOVEN FABRIC TO DOMINATE INDUSTRIAL FILTRATION MARKET IN 2029

4.7 INDUSTRIAL FILTRATION MARKET, BY INDUSTRY

FIGURE 20 CHEMICALS & PETROCHEMICALS INDUSTRY TO CAPTURE LARGEST SHARE OF INDUSTRIAL FILTRATION MARKET IN 2029

5 MARKET OVERVIEW (Page No. - 73)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 INDUSTRIAL FILTRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing need to extend service life and improve performance of industrial machinery

FIGURE 22 COSTS RELATED TO DAIRY PLANT EQUIPMENT AFTER PURIFICATION

5.2.1.2 Growing emphasis on maintaining compliance with emission regulations

TABLE 3 ENVIRONMENTAL PROTECTION ACTS AND LAWS

5.2.1.3 Rising investment in refineries and petrochemical infrastructure development

TABLE 4 LIST OF REFINERY AND PETROCHEMICAL INFRASTRUCTURE PROJECTS

FIGURE 23 DISTILLATION CAPACITY ADDITIONS IN EXISTING PROJECTS, BY REGION, 2022–2027

5.2.2 RESTRAINTS

5.2.2.1 Availability of low-cost industrial filtration products in gray markets

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing R&D to reduce industrial machine breakdowns

5.2.3.2 Rapid advancements in filter monitoring technologies

5.2.4 CHALLENGES

5.2.4.1 Frequent replacement and disposal of industrial wastes

5.2.4.2 Difficulties in capturing microscopic contaminants

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 24 INDUSTRIAL FILTRATION MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.4 PRICING ANALYSIS

5.4.1 AVERAGE SELLING PRICE TREND, BY PRODUCT

TABLE 5 AVERAGE SELLING PRICE TREND, BY PRODUCT, 2021–2023 (USD/UNIT)

FIGURE 25 AVERAGE SELLING PRICE TREND, BY PRODUCT, 2021–2023

5.4.2 AVERAGE SELLING PRICE OF INDUSTRIAL FILTRATION PRODUCTS, BY REGION

TABLE 6 AVERAGE SELLING PRICE OF INDUSTRIAL FILTRATION PRODUCTS, BY REGION, 2021–2023 (USD/UNIT)

FIGURE 26 AVERAGE SELLING PRICE OF INDUSTRIAL FILTRATION PRODUCTS, BY REGION, 2021–2023

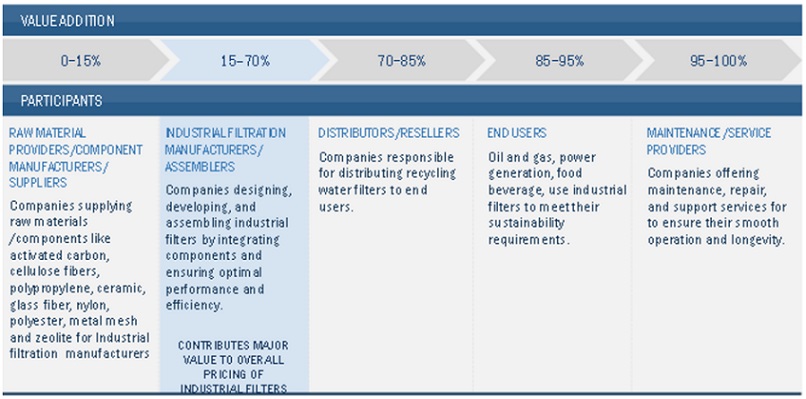

5.5 VALUE CHAIN ANALYSIS

FIGURE 27 INDUSTRIAL FILTRATION MARKET: VALUE CHAIN ANALYSIS

5.5.1 RAW MATERIAL PROVIDERS/COMPONENT MANUFACTURERS/SUPPLIERS

5.5.2 INDUSTRIAL FILTRATION MANUFACTURERS/ASSEMBLERS

5.5.3 DISTRIBUTORS/RESELLERS

5.5.4 END USERS

5.5.5 MAINTENANCE SERVICE PROVIDERS

5.6 ECOSYSTEM ANALYSIS

TABLE 7 ROLE OF COMPANIES IN INDUSTRIAL FILTRATION ECOSYSTEM

FIGURE 28 INDUSTRIAL FILTRATION ECOSYSTEM ANALYSIS

5.7 INVESTMENT AND FUNDING SCENARIO

FIGURE 29 FUNDING SCENARIO FOR TOP PLAYERS

TABLE 8 EATON: FUNDING DETAILS

TABLE 9 CUMMINS: FUNDING DETAILS

TABLE 10 ZWITTERCO: FUNDING DETAILS

5.8 TECHNOLOGY ANALYSIS

5.8.1 KEY TECHNOLOGY

5.8.1.1 Filter media technology

5.8.2 COMPLEMENTARY TECHNOLOGY

5.8.2.1 Internet of Things (IoT)

5.9 PATENT ANALYSIS

FIGURE 30 INDUSTRIAL FILTRATION MARKET: PATENTS APPLIED AND GRANTED, 2013–2022

TABLE 11 INDUSTRIAL FILTRATION MARKET: LIST OF MAJOR PATENTS, 2020–2021

5.10 TRADE ANALYSIS

5.10.1 EXPORT SCENARIO

TABLE 12 EXPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2022 (USD THOUSAND)

FIGURE 31 EXPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2022 (USD THOUSAND)

5.10.2 IMPORT SCENARIO

TABLE 13 IMPORT SCENARIO FOR HS CODE 842199-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2022 (USD THOUSAND)

FIGURE 32 IMPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, 2020–2022 (USD THOUSAND)

5.11 KEY CONFERENCES AND EVENTS, 2024–2025

TABLE 14 INDUSTRIAL FILTRATION MARKET: LIST OF CONFERENCES AND EVENTS, 2024–2025

5.12 TARIFFS, REGULATORY LANDSCAPE, AND STANDARDS

5.12.1 TARIFF RELATED TO INDUSTRIAL FILTRATION PRODUCTS

TABLE 15 INDUSTRIAL FILTRATION MARKET: AVERAGE TARIFF, 2022

5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.3 CODES AND REGULATIONS RELATED TO INDUSTRIAL FILTRATION PRODUCTS

TABLE 22 NORTH AMERICA: CODES AND REGULATIONS

TABLE 23 ASIA PACIFIC: CODES AND REGULATIONS

TABLE 24 GLOBAL: CODES AND REGULATIONS

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 INDUSTRIAL FILTRATION MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 25 INDUSTRIAL FILTRATION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF SUBSTITUTES

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 CASE STUDY ANALYSIS

5.14.1 JONELL SYSTEMS DEVELOPS INDUSTRIAL FILTRATION SOLUTIONS TO ADDRESS SEMI-SOLID CLOGGING ISSUES IN EUROPEAN REFINERY

5.14.2 CAMFIL SIGNS AGREEMENT WITH BORGESIUS BAKERY TO SUPPLY PROSAFE AIR FILTERS TO ENSURE PROCESS SAFETY

5.14.3 FILTRATION GROUP DEVELOPS INDUSTRIAL FILTER CARTRIDGES TO REMOVE FOOD CONTAMINANTS

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

5.15.2 BUYING CRITERIA

FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

TABLE 27 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

6 INDUSTRIAL FILTRATION MARKET, BY TYPE (Page No. - 110)

6.1 INTRODUCTION

FIGURE 36 LIQUID SEGMENT HELD LARGER MARKET SHARE IN 2023

TABLE 28 INDUSTRIAL FILTRATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

TABLE 29 INDUSTRIAL FILTRATION MARKET, BY TYPE, 2023–2029 (USD MILLION)

6.2 LIQUID

6.2.1 INCREASING USE OF STERILE LIQUIDS IN PRODUCT FORMULATION AND BIOLOGICAL PROCESSES IN PHARMACEUTICALS INDUSTRY TO DRIVE MARKET

TABLE 30 LIQUID: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 31 LIQUID: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

TABLE 32 LIQUID: INDUSTRIAL FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 33 LIQUID: INDUSTRIAL FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

6.2.1.1 By technology

6.2.1.1.1 Pressure filtration

6.2.1.1.1.1 High efficiency in removing fine particles and contaminants from liquids to boost demand

TABLE 34 PRESSURE FILTRATION: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 35 PRESSURE FILTRATION: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

6.2.1.1.2 Centrifugal filtration

6.2.1.1.2.1 Focus on reducing environmental impact and conserving resources to encourage adoption

TABLE 36 CENTRIFUGAL FILTRATION: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 37 CENTRIFUGAL FILTRATION: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

6.2.1.1.3 Gravity filtration

6.2.1.1.3.1 Growing adoption by researchers, educators, and practitioners to foster market growth

TABLE 38 GRAVITY FILTRATION: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 39 GRAVITY FILTRATION: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

6.2.1.1.4 Vacuum filtration

6.2.1.1.4.1 Faster filtration rates, increased efficiency, and higher throughput benefits to boost demand

TABLE 40 VACUUM FILTRATION: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 41 VACUUM FILTRATION: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

6.2.1.1.5 Other technologies

TABLE 42 OTHER TECHNOLOGIES: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 43 OTHER TECHNOLOGIES: INDUSTRIAL LIQUID FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

6.3 AIR

6.3.1 GROWING EMPHASIS ON MAINTAINING HYGIENIC ENVIRONMENT AT WORKPLACES TO FUEL MARKET GROWTH

TABLE 44 AIR: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 45 AIR: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

TABLE 46 AIR: INDUSTRIAL FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 47 AIR: INDUSTRIAL FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

6.3.1.1 By technology

6.3.1.1.1 Mechanical

6.3.1.1.1.1 Increasing deployment of HVAC systems and air purifiers in industrial plants to support market growth

TABLE 48 MECHANICAL: INDUSTRIAL AIR FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 49 MECHANICAL: INDUSTRIAL AIR FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

6.3.1.1.2 Electronic

6.3.1.1.2.1 Quiet operation and high efficiency of reusable filters to drive market

TABLE 50 ELECTRONIC: INDUSTRIAL AIR FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 51 ELECTRONIC: INDUSTRIAL AIR FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

6.3.1.1.3 Gas-phase

6.3.1.1.3.1 Need to remove hazardous gases, VOCs, and odors generated by manufacturing processes to boost adoption

TABLE 52 GAS-PHASE: INDUSTRIAL AIR FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 53 GAS-PHASE: INDUSTRIAL AIR FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

7 INDUSTRIAL FILTRATION MARKET, BY PRODUCT (Page No. - 123)

7.1 INTRODUCTION

FIGURE 37 BAG FILTER SEGMENT HELD LARGEST MARKET SHARE IN 2023

TABLE 54 INDUSTRIAL FILTRATION MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

TABLE 55 INDUSTRIAL FILTRATION MARKET, BY PRODUCT, 2023–2029 (USD MILLION)

7.2 FILTER PRESS

7.2.1 FOCUS ON CONSISTENT PRODUCT QUALITY TO DRIVE MARKET

TABLE 56 FILTER PRESS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 57 FILTER PRESS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

7.3 BAG FILTER

7.3.1 CAPABILITY TO HANDLE LARGE VOLUMES OF CONTAMINANTS TO BOOST SEGMENTAL GROWTH

TABLE 58 BAG FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 59 BAG FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

7.4 DRUM FILTER

7.4.1 ABILITY TO PROCESS LARGE VOLUMES OF LIQUID STREAMS EFFICIENTLY AND UNINTERRUPTEDLY TO PROPEL MARKET GROWTH

TABLE 60 DRUM FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 61 DRUM FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

7.5 DEPTH FILTER

7.5.1 NEED TO CAPTURE PARTICLES OF VARIOUS SIZES DURING FILTRATION TO BOOST DEMAND

TABLE 62 DEPTH FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 63 DEPTH FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

7.6 CARTRIDGE FILTER

7.6.1 QUICK AND EASY INSTALLATION AND REPLACEMENT TO FOSTER SEGMENTAL GROWTH

TABLE 64 CARTRIDGE FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 65 CARTRIDGE FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

7.7 HEPA FILTER

7.7.1 NEED TO MAINTAIN HEALTHY AND CLEAN INDOOR ENVIRONMENT TO BOOST DEMAND

TABLE 66 HEPA FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 67 HEPA FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

7.8 ULPA FILTER

7.8.1 STRINGENT REGULATORY REQUIREMENTS FOR CLEANLINESS AND PARTICULATE CONTROL TO BOOST DEMAND

TABLE 68 ULPA FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 69 ULPA FILTER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

7.9 ELECTROSTATIC PRECIPITATOR

7.9.1 POWER GENERATION, CEMENT PRODUCTION, METALLURGY, PULP AND PAPER MANUFACTURING APPLICATIONS TO CONTRIBUTE MOST TO HIGH DEMAND

TABLE 70 ELECTROSTATIC PRECIPITATOR: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 71 ELECTROSTATIC PRECIPITATOR: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

7.10 OTHER PRODUCTS

TABLE 72 OTHER PRODUCTS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 73 OTHER PRODUCTS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

8 INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA (Page No. - 135)

8.1 INTRODUCTION

FIGURE 38 NONWOVEN FABRIC SEGMENT CAPTURED LARGEST MARKET SHARE IN 2023

TABLE 74 INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2020–2022 (USD MILLION)

TABLE 75 INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2023–2029 (USD MILLION)

8.2 ACTIVATED CARBON/CHARCOAL

8.2.1 HIGH POROSITY AND LARGE SURFACE AREA TO BOOST DEMAND

TABLE 76 ACTIVATED CARBON/CHARCOAL: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 77 ACTIVATED CARBON/CHARCOAL: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

8.3 FIBERGLASS

8.3.1 HIGH STRENGTH, EFFICIENCY, AND CORROSION RESISTANCE TO DRIVE MARKET

TABLE 78 FIBERGLASS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 79 FIBERGLASS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

8.4 FILTER PAPER

8.4.1 COST-EFFECTIVENESS, BIODEGRADABILITY, AND HIGH FILTRATION EFFICIENCY TO INCREASE DEMAND

TABLE 80 FILTER PAPER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 81 FILTER PAPER: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

8.5 METAL

8.5.1 REUSABILITY AND HIGH PARTICULATE MATTER CAPTURING ABILITY TO INCREASE ADOPTION

TABLE 82 METAL: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 83 METAL: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

8.6 NONWOVEN FABRIC

8.6.1 HIGH ABSORBENCY, DURABILITY, AND ELASTICITY FEATURES TO BOOST DEMAND

TABLE 84 NONWOVEN FABRIC: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 85 NONWOVEN FABRIC: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

8.7 OTHER FILTER MEDIA

TABLE 86 OTHER FILTER MEDIA: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 87 OTHER FILTER MEDIA: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

9 INDUSTRIAL FILTRATION MARKET, BY INDUSTRY (Page No. - 144)

9.1 INTRODUCTION

FIGURE 39 CHEMICALS & PETROCHEMICALS INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

TABLE 88 INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 89 INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

9.2 FOOD & BEVERAGES

9.2.1 STRONG FOCUS OF FOOD PROCESSING PLANTS ON MAINTAINING PRODUCT QUALITY, SAFETY, AND SHELF LIFE TO DRIVE MARKET

TABLE 90 FOOD & BEVERAGES: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 91 FOOD & BEVERAGES: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

9.3 CHEMICALS & PETROCHEMICALS

9.3.1 STRINGENT REGULATORY REQUIREMENTS FOR PURITY, CONSISTENCY, AND SAFETY OF CHEMICAL AND PETROCHEMICAL PRODUCTS TO BOOST DEMAND

TABLE 92 CHEMICALS & PETROCHEMICALS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 93 CHEMICALS & PETROCHEMICALS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

9.4 OIL & GAS

9.4.1 SURGING NEED TO MAXIMIZE CONTAMINANT REMOVAL AND MINIMIZE MAINTENANCE DOWNTIME TO STIMULATE MARKET GROWTH

TABLE 94 OIL & GAS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 95 OIL & GAS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

9.5 PHARMACEUTICALS

9.5.1 RISING DEMAND FOR REMOVAL OF SUSPENDED PARTICLES AND BACTERIA FROM WATER AND AIR TO DRIVE MARKET

TABLE 96 PHARMACEUTICALS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 97 PHARMACEUTICALS: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

9.6 METALS & MINING

9.6.1 NEED TO IMPROVE PROCESS WATER QUALITY AND MAKE IT SUITABLE FOR REUSE TO BOOST DEMAND

TABLE 98 METALS & MINING: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 99 METALS & MINING: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

9.7 AUTOMOTIVE

9.7.1 ENVIRONMENTAL SUSTAINABILITY INITIATIVES AND INTENSE FOCUS ON HIGH PRODUCT QUALITY TO CONTRIBUTE TO MARKET GROWTH

TABLE 100 AUTOMOTIVE: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 101 AUTOMOTIVE: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

9.8 POWER GENERATION

9.8.1 NEED TO MAINTAIN SUPERIOR PERFORMANCE OF POWER EQUIPMENT TO BOOST DEMAND

TABLE 102 POWER GENERATION: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 103 POWER GENERATION: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

9.9 OTHER INDUSTRIES

TABLE 104 OTHER INDUSTRIES: INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 105 OTHER INDUSTRIES: INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

10 INDUSTRIAL FILTRATION MARKET, BY REGION (Page No. - 155)

10.1 INTRODUCTION

FIGURE 40 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN INDUSTRIAL FILTRATION MARKET DURING FORECAST PERIOD

FIGURE 41 INDUSTRIAL FILTRATION MARKET SHARE, BY REGION, 2023

TABLE 106 INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (USD MILLION)

TABLE 107 INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (USD MILLION)

TABLE 108 INDUSTRIAL FILTRATION MARKET, BY REGION, 2020–2022 (THOUSAND UNITS)

TABLE 109 INDUSTRIAL FILTRATION MARKET, BY REGION, 2023–2029 (THOUSAND UNITS)

10.2 NORTH AMERICA

FIGURE 42 NORTH AMERICA: REGIONAL SNAPSHOT

10.2.1 RECESSION IMPACT: NORTH AMERICA

10.2.2 BY TYPE

TABLE 110 NORTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

TABLE 111 NORTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2023–2029 (USD MILLION)

10.2.2.1 By technology

TABLE 112 NORTH AMERICA: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 113 NORTH AMERICA: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

TABLE 114 NORTH AMERICA: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 115 NORTH AMERICA: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

10.2.3 BY PRODUCT

TABLE 116 NORTH AMERICA: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

TABLE 117 NORTH AMERICA: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2023–2029 (USD MILLION)

10.2.4 BY FILTER MEDIA

TABLE 118 NORTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2020–2022 (USD MILLION)

TABLE 119 NORTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2023–2029 (USD MILLION)

10.2.5 BY INDUSTRY

TABLE 120 NORTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 121 NORTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.2.6 BY COUNTRY

TABLE 122 NORTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

TABLE 123 NORTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

10.2.6.1 US

10.2.6.1.1 Increasing demand for environmentally friendly and operationally safe industrial processes to drive market

TABLE 124 US: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 125 US: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.2.6.2 Canada

10.2.6.2.1 Rising implementation of new projects in oil & gas and mining industries to boost demand

TABLE 126 CANADA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 127 CANADA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.2.6.3 Mexico

10.2.6.3.1 Growing investment in oil & gas sector to create opportunities for providers of industrial filtration products

TABLE 128 MEXICO: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 129 MEXICO: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.3 EUROPE

10.3.1 RECESSION IMPACT: EUROPE

FIGURE 43 EUROPE: REGIONAL SNAPSHOT

10.3.2 BY TYPE

TABLE 130 EUROPE: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

TABLE 131 EUROPE: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2023–2029 (USD MILLION)

10.3.2.1 By technology

TABLE 132 EUROPE: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 133 EUROPE: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

TABLE 134 EUROPE: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 135 EUROPE: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

10.3.3 BY PRODUCT

TABLE 136 EUROPE: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

TABLE 137 EUROPE: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2023–2029 (USD MILLION)

10.3.4 BY FILTER MEDIA

TABLE 138 EUROPE: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2020–2022 (USD MILLION)

TABLE 139 EUROPE: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2023–2029 (USD MILLION)

10.3.5 BY INDUSTRY

TABLE 140 EUROPE: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 141 EUROPE: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.3.6 BY COUNTRY

TABLE 142 EUROPE: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

TABLE 143 EUROPE: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

10.3.6.1 Germany

10.3.6.1.1 Increasing investments in water industry to create potential for industrial filtration products

TABLE 144 GERMANY: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 145 GERMANY: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.3.6.2 UK

10.3.6.2.1 Rapidly growing manufacturing sector to boost demand

TABLE 146 UK: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 147 UK: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.3.6.3 France

10.3.6.3.1 Stringent regulations governing production and quality standards in food & beverages sector to fuel demand

TABLE 148 FRANCE: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 149 FRANCE: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.3.6.4 Italy

10.3.6.4.1 Increasing use of digital technology and IIoT devices in manufacturing sector to support market growth

TABLE 150 ITALY: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 151 ITALY: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.3.6.5 Russia

10.3.6.5.1 Significant demand from mining and water & wastewater treatment sectors to support market growth

TABLE 152 RUSSIA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 153 RUSSIA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.3.6.6 Rest of Europe

TABLE 154 REST OF EUROPE: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 155 REST OF EUROPE: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 RECESSION IMPACT: ASIA PACIFIC

10.4.2 BY TYPE

TABLE 156 ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

TABLE 157 ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2023–2029 (USD MILLION)

10.4.2.1 By technology

TABLE 158 ASIA PACIFIC: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 159 ASIA PACIFIC: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

TABLE 160 ASIA PACIFIC: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 161 ASIA PACIFIC: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

10.4.3 BY PRODUCT

TABLE 162 ASIA PACIFIC: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

TABLE 163 ASIA PACIFIC: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2023–2029 (USD MILLION)

10.4.4 BY FILTER MEDIA

TABLE 164 ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2020–2022 (USD MILLION)

TABLE 165 ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2023–2029 (USD MILLION)

10.4.5 BY INDUSTRY

TABLE 166 ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 167 ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.4.6 BY COUNTRY

TABLE 168 ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

TABLE 169 ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

10.4.6.1 China

10.4.6.1.1 Growing focus on LNG capacity addition to fuel market growth

TABLE 170 CHINA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 171 CHINA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.4.6.2 India

10.4.6.2.1 Government initiatives to diversify investments in manufacturing sector to fuel market growth

TABLE 172 INDIA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 173 INDIA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.4.6.3 Japan

10.4.6.3.1 Rising air pollution concerns to boost demand

TABLE 174 JAPAN: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 175 JAPAN: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.4.6.4 Australia

10.4.6.4.1 Increasing demand for lithium and copper from EV manufacturers to foster market growth

TABLE 176 AUSTRALIA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 177 AUSTRALIA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.4.6.5 South Korea

10.4.6.5.1 Booming chemicals industry to drive adoption of industrial filtration products

TABLE 178 SOUTH KOREA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 179 SOUTH KOREA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.4.6.6 Rest of Asia Pacific

TABLE 180 REST OF ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 181 REST OF ASIA PACIFIC: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 RECESSION IMPACT: MIDDLE EAST & AFRICA

10.5.2 BY TYPE

TABLE 182 MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

TABLE 183 MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2023–2029 (USD MILLION)

10.5.2.1 By technology

TABLE 184 MIDDLE EAST & AFRICA: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

10.5.3 BY PRODUCT

TABLE 188 MIDDLE EAST & AFRICA: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2023–2029 (USD MILLION)

10.5.4 BY FILTER MEDIA

TABLE 190 MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2020–2022 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2023–2029 (USD MILLION)

10.5.5 BY INDUSTRY

TABLE 192 MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.5.6 BY COUNTRY

TABLE 194 MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

TABLE 196 GCC COUNTRIES: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

TABLE 197 GCC COUNTRIES: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

10.5.6.1 GCC countries

10.5.6.1.1 Saudi Arabia

10.5.6.1.1.1 Rising investments in oil & gas and power generation industries to boost demand

TABLE 198 SAUDI ARABIA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 199 SAUDI ARABIA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.5.6.1.2 UAE

10.5.6.1.2.1 Surging demand for oilfields to drive market

TABLE 200 UAE: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 201 UAE: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.5.6.1.3 Rest of GCC countries

TABLE 202 REST OF GCC COUNTRIES: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 203 REST OF GCC COUNTRIES: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.5.6.2 South Africa

10.5.6.2.1 Increasing investments in mining and shale gas resources to fuel market growth

TABLE 204 SOUTH AFRICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 205 SOUTH AFRICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.5.6.3 Rest of Middle East & Africa

TABLE 206 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 207 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 RECESSION IMPACT: SOUTH AMERICA

10.6.2 BY TYPE

TABLE 208 SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2020–2022 (USD MILLION)

TABLE 209 SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY TYPE, 2023–2029 (USD MILLION)

10.6.2.1 By technology

TABLE 210 SOUTH AMERICA: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 211 SOUTH AMERICA: INDUSTRIAL LIQUID FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

TABLE 212 SOUTH AMERICA: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

TABLE 213 SOUTH AMERICA: INDUSTRIAL AIR FILTRATION MARKET, BY TECHNOLOGY, 2023–2029 (USD MILLION)

10.6.3 BY PRODUCT

TABLE 214 SOUTH AMERICA: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2020–2022 (USD MILLION)

TABLE 215 SOUTH AMERICA: INDUSTRIAL AIR FILTRATION MARKET, BY PRODUCT, 2023–2029 (USD MILLION)

10.6.4 BY FILTER MEDIA

TABLE 216 SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2020–2022 (USD MILLION)

TABLE 217 SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY FILTER MEDIA, 2023–2029 (USD MILLION)

10.6.5 BY INDUSTRY

TABLE 218 SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 219 SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.6.6 BY COUNTRY

TABLE 220 SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

TABLE 221 SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

10.6.6.1 Brazil

10.6.6.1.1 Strategic objective to attract new investments in mining industry to contribute to market growth

TABLE 222 BRAZIL: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 223 BRAZIL: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.6.6.2 Argentina

10.6.6.2.1 Increasing investments in water & wastewater treatment plants to boost demand

TABLE 224 ARGENTINA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 225 ARGENTINA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

10.6.6.3 Rest of South America

TABLE 226 REST OF SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2020–2022 (USD MILLION)

TABLE 227 REST OF SOUTH AMERICA: INDUSTRIAL FILTRATION MARKET, BY INDUSTRY, 2023–2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 221)

11.1 INTRODUCTION

11.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021–2023

TABLE 228 INDUSTRIAL FILTRATION MARKET: STRATEGIES ADOPTED BY KEY PLAYERS, 2021–2023

11.3 MARKET SHARE ANALYSIS, 2023

TABLE 229 INDUSTRIAL FILTRATION MARKET: DEGREE OF COMPETITION

FIGURE 44 INDUSTRIAL FILTRATION MARKET SHARE ANALYSIS, 2023

FIGURE 45 REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019–2023

11.3.1 DANAHER CORPORATION

11.3.2 PARKER HANNIFIN CORP

11.3.3 3M

11.3.4 CUMMINS INC.

11.3.5 EATON

11.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 46 INDUSTRIAL FILTRATION MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2023

11.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

11.5.1 TYPE FOOTPRINT

TABLE 230 TYPE FOOTPRINT

11.5.2 REGION FOOTPRINT

TABLE 231 REGION FOOTPRINT

11.5.3 PRODUCT FOOTPRINT

TABLE 232 PRODUCT FOOTPRINT

11.5.4 FILTER MEDIA FOOTPRINT

TABLE 233 FILTER MEDIA FOOTPRINT

11.5.5 INDUSTRY FOOTPRINT

TABLE 234 INDUSTRY FOOTPRINT

11.5.6 OVERALL COMPANY FOOTPRINT

FIGURE 47 OVERALL COMPANY FOOTPRINT

11.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 48 INDUSTRIAL FILTRATION MARKET: COMPANY EVALUATION MATRIX, START-UPS/SMES, 2022

11.7 COMPETITIVE BENCHMARKING: START-UPS/SMES

11.7.1 LIST OF KEY START-UPS/SMES

TABLE 235 INDUSTRIAL FILTRATION MARKET: LIST OF KEY START-UPS/SMES

11.7.2 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 236 INDUSTRIAL FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

11.8 COMPETITIVE SCENARIOS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 237 INDUSTRIAL FILTRATION MARKET: PRODUCT LAUNCHES, JANUARY 2021– SEPTEMBER 2023

11.8.2 EXPANSIONS

TABLE 238 INDUSTRIAL FILTRATION MARKET: EXPANSIONS, JANUARY 2021–DECEMBER 2023

11.9 COMPANY VALUATION AND FINANCIAL METRICS

FIGURE 49 FINANCIAL METRICS

FIGURE 50 COMPANY VALUATION

11.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

FIGURE 51 INDUSTRIAL FILTRATION: BRAND/PRODUCT COMPARISON

12 COMPANY PROFILES (Page No. - 241)

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)*

12.1 KEY PLAYERS

12.1.1 ALFA LAVAL

TABLE 239 ALFA LAVAL: COMPANY OVERVIEW, 2022

FIGURE 52 ALFA LAVAL: COMPANY SNAPSHOT

TABLE 240 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 241 ALFA LAVAL: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

TABLE 242 ALFA LAVAL: EXPANSIONS

12.1.2 CAMFIL

TABLE 243 CAMFIL: COMPANY OVERVIEW, 2022

TABLE 244 CAMFIL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 245 CAMFIL: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

TABLE 246 CAMFIL: DEALS

TABLE 247 CAMFIL: EXPANSIONS

12.1.3 DONALDSON COMPANY, INC.

TABLE 248 DONALDSON COMPANY, INC: COMPANY OVERVIEW 2022

FIGURE 53 DONALDSON COMPANY, INC.: COMPANY SNAPSHOT

TABLE 249 DONALDSON COMPANY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 250 DONALDSON COMPANY, INC.: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

TABLE 251 DONALDSON COMPANY, INC.: DEALS

TABLE 252 DONALDSON COMPANY, INC.: EXPANSIONS

12.1.4 PARKER HANNIFIN CORP

TABLE 253 PARKER HANNIFIN CORP: COMPANY OVERVIEW, 2022

FIGURE 54 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

TABLE 254 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 255 PARKER HANNIFIN CORP: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

12.1.5 CUMMINS INC.

TABLE 256 CUMMINS INC: COMPANY OVERVIEW, 2022

FIGURE 55 CUMMINS INC.: COMPANY SNAPSHOT

TABLE 257 CUMMINS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 258 CUMMINS INC.: DEALS

12.1.6 EATON

TABLE 259 EATON: COMPANY OVERVIEW, 2022

FIGURE 56 EATON: COMPANY SNAPSHOT

TABLE 260 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 261 EATON: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

12.1.7 FILTRATION GROUP

TABLE 262 FILTRATION GROUP: COMPANY OVERVIEW, 2022

TABLE 263 FILTRATION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 264 FILTRATION GROUP: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

TABLE 265 FILTRATION GROUP: DEALS

12.1.8 FREUDENBERG GROUP

TABLE 266 FREUDENBERG GROUP: COMPANY OVERVIEW, 2022

FIGURE 57 FREUDENBERG GROUP: COMPANY SNAPSHOT

TABLE 267 FREUDENBERG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 268 FREUDENBERG GROUP: DEALS

TABLE 269 FREUDENBERG: EXPANSIONS

12.1.9 MANN+HUMMEL

TABLE 270 MANN+HUMMEL: COMPANY OVERVIEW, 2022

FIGURE 58 MANN+HUMMEL: COMPANY SNAPSHOT

TABLE 271 MANN+HUMMEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 272 MANN+HUMMEL: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

TABLE 273 MANN+HUMMEL: DEALS

TABLE 274 MANN+HUMMEL: EXPANSIONS

12.1.10 DANAHER CORPORATION

TABLE 275 DANAHER CORPORATION: COMPANY OVERVIEW, 2022

FIGURE 59 DANAHER CORPORATION: COMPANY SNAPSHOT

TABLE 276 DANAHER CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 277 DANAHER: DEALS

12.1.11 3M

TABLE 278 3M: COMPANY OVERVIEW, 2022

FIGURE 60 3M: COMPANY SNAPSHOT

TABLE 279 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 280 3M: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

TABLE 281 3M: DEALS

TABLE 282 3M: OTHERS

12.1.12 BABCOCK & WILCOX

TABLE 283 BABCOCK & WILCOX: COMPANY OVERVIEW, 2022

FIGURE 61 BABCOCK & WILCOX: COMPANY SNAPSHOT

TABLE 284 BABCOCK & WILCOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 285 BABCOCK & WILCOX: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

12.1.13 W.L. GORE

TABLE 286 W.L. GORE: COMPANY OVERVIEW, 2022

TABLE 287 W.L. GORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 288 W.L. GORE: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

12.1.14 LENNTECH B.V.

TABLE 289 LENNTECH B.V.: COMPANY OVERVIEW, 2022

TABLE 290 LENNTECH B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.15 HENGST SE

TABLE 291 HENGST SE: COMPANY OVERVIEW, 2022

TABLE 292 HENGST SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 293 HENGST SE: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

12.1.16 FLEETLIFE INC.

TABLE 294 FLEETLIFE INC.: COMPANY OVERVIEW, 2022

TABLE 295 FLEETLIFE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 296 FLEETLIFE INC.: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS

*Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 FORAIN ITALIA

12.2.2 EFC FILTRATION B.V.

12.2.3 HYDAC

12.2.4 DRM, DR. MUELLER AG

12.2.5 SHARPLEX FILTERS (INDIA) PVT. LTD.

12.2.6 SULPHERNET

12.2.7 PEARL FILTRATION

12.2.8 SAIFILTER

12.2.9 ANAND FILTERS

13 APPENDIX (Page No. - 297)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Filtration Market